CFA Level 1 (2009) - 5

.pdf

Study Scssion 17

Cross-Reference to CFA Instimte Assigned Reading #70 - Option Markets and Contracts

As indicatcd in Figure 2, the expiration date payoff to the owner is either zero or the amount that the option is in the mOI1l:Y. For a call option writer (seller), rhe payoff is either zero or min us the amount iI' is in the money. There are no posi tive payoffs for an option writer. The option writer receives the premium and takes on the obligation to pay whatever the call owner gains.

With reference to Figure 2, you should make the following observations:

• |

The payoff (0 a long call position (the solid line) is a flat line which angles upward |

|

|

to |

the right at a 45 degree angle from the strike price, X. |

• |

The payoff to the writer of a call (dotted line), is a Rat line which angles downward |

|

|

to |

the right at a 45 degree angle from the strike price, X. |

•Options are a zero-sum game. If you add the long call option's payoff to the short option's payoff, you will get a net payoff of zero.

•At a stock price of $55, the payoff to the long is $5, which is a $5 loss to the short.

Similar to our payoff diagram for a call option, Figure 3 illustrates the at-expiration payoff values for a put option. As indicated here, if the price of the srock is less (han the strike price, the put owner will exercise the option and receive (X - S). If the price of the stock is grearer than or equal to the strike price, the put holder will let the pur option expire and get nothing (0). At a stock price of $40, the payoff on a long put is $10; the seller of the put (the shan) would have a negative payoff since he must buy the stock at $50 and receive stock worth $40.

Figure 3: Put Option Payoff Diagram

Value

x

$10

o

|

|

|

|

• (0 0): |

|

|

|

|

|

•• ~ I |

|

|

|

,, |

|

...'" |

|

-$10 |

|

, |

.' |

|

|

-----------~.~ |

|

|

|

||

..' .,...' |

0··· ) |

|

|

||

|

|

|

|||

-x " Short put: |

|

|

|

||

|

|

|

|

|

Srock price |

|

|

|

|

|

|

|

|

$40 |

X = $50 |

||

The time value of an option is the amount by which the option premium exceeds the intrinsic value and is sometimes called rhe speculative value of the option. This relationship can be written as:

option value = intrinsic value + time value

Page 200 |

©2008 Kaplan Schweser |

Study Sessioll 17

Cross-Reference to CFA Institute Assigned Reading #70 - Option Markets and Contracts

For European options, however, the minima are not so obvious because these options arc not exercisable immediately. To determine the lower bounds for European options, we can examine the value of a porrfolio in which the option is combined with a long or shorr position in the srock and a pure discount bond.

h)l'a l:.'lIropean call option, construct the following portfolio:

1\ long at-the-money European call option with exercise price X, expiring at timc t = T.

A long discount bond priced to yield the risk-free rate that pays X at option expIratIOn.

•A short position in one share of the underlying srock priced at So = X.

The current value of this portfolio is Co - So + X / (1 + RFRyr.

I\t expiration time, t = T, this portfolio will pay cT -- Sr + X. That is, we will collect

cr |

= Max[O, Sr - X] on the call option, pay 5r to cover our short srock position, and |

coHect X from the maturing bond. |

|

|

If Sr ?:: X, the call is in-the-money, and the portfolio will have a 'Lem payoff because |

|

the call pays Sr ~ X, the bond pays +X, and we pay -5T to cover our shorr position. |

• |

That is, the time t = T payoff is: 51' - X + X - S1' = o. |

If X > 5r the call is out-of-the-money, and the portfolio has a positive payoff equal |

|

|

to X - 5T because the call value, cT, is zero, we colleer X on the bond, and pay -ST |

|

to cover the short position. So, the time t = T payoff is: 0 + X - Sr = X - 51' |

Note that no matter whether the option expires in-the-money, at-the-money, at out-of- the-money, the porrfolio value will be equal to or greater than zero. We will never have to make a payment.

To prevent arbitrage, any portfolio that has no possibility of a negative payoff cannot have a negative value. Thus, we can state the value of the porrfolio at time t = 0 as:

Co - 50 + X / (1 + RFR)l'2: 0

which allows us to concl ude that:

Combining this result with the earlier minimum on the call value of zero, we can write:

Note that X / (I + RFR)T is the present value of a pure discount bond with a face value of X.

Based on these results, we can now state the lower bound for the price of an American call as:

©2008 Kaplan Schweser |

Page 203 |

Study Session 17

Cross-Reference to CFA Institute Assigned Reading #70 - Option Markets and Contracts

How can we say this? This conclusion follows from the following two facts:

I

1.The early exercise feature on an American call makes it worth at least as much as an equivalent European call (i.e., C[?: c[).

2.The lower bound for the value of a European call is equal ro or greater than the

theoretical lower bound for an American call. for example, max[O, 50 - X /( 1 +

RFR)T] ?' max[O, 50 - X] I.

Professor's Note: Don't get bogged down here. we just use the fact that an American call is worth at let/st as much as a European calf to claim that the lower bound un an American calf is at least as much as the lower bound on a European call.

Derive the minimum value of a European put option by forming the following portfolio at time t = 0:

A long at-the-money European put option with exercise price X, expiring at t = T. A shorr position on a risk-free bond priced at X / (l + RFR)T. This is the same as borrowing an amount equal to X / (l + RFR)T.

A long position in a share of the underlying srock priced at So.

At expiration time t =T, this porrfolio will pay PT + 5T - X. That is, we will collect PI

= Max[O, X - 5T ] on the put option, receive 5 T from the srock, and pay -x on the bond issue (loan).

If 5T > X, the payoff will equal: PT + 5T - X = 5T - X.

If ST ~ X, the payoff will be zero.

Again, a no-arbitrage argument can be made that the portfolio value must be zero or greater, since there are no negative payoffs to the portfolio.

At time t = 0, this condition can be written as:

and rearranged to state the minimum value for a European put option at time t = 0 as:

Po ?: X / (l + RFR)T - 50

We have now established the minimum bound on the price of a European put option as:

Po ?' Max[O, X / (l + RFR)T - 50]

Page 204 |

©2008 Kaplan Schweser |

Study Session 17

Cross-Reference to CFA Institute Assigned Reading #70 - Option Markets and Contracts

Professor's Note: Notice that the lower bound on a European put is below thrlt of rill AmericrllI put option (i.e., max!O, X - Sol). This is becrluse when it's in the money, the Americrln put option CrlU be exenised immediately for rI paJloffof

X - So'

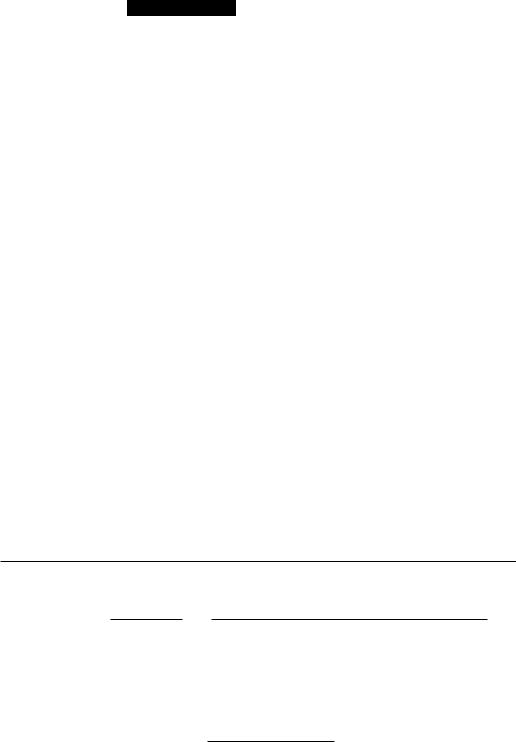

Figure 5 summarizes what we now know regarding the boundary prices for American and European options at any time t prior to expiration at time t = T.

Figure 5: Lower and Upper Bounds for Options

Optiun |

|

|

|

Minimum Value |

Maximum Vtdue |

|||

|

|

|

|

|

|

|

|

|

European call |

c, |

;:::: |

max[O, 51 - |

X / (1 |

+ RFR)TI] |

s, |

||

American call |

C |

T |

;:::: |

maxlO, S, - |

X / (l |

+ RFR)T-ljJ |

S |

|

|

|

|

|

|

|

1 |

|

|

European pur |

1\ ;:::: maxlO, X / (l + RFR)T-,- S,J |

X/(I,RFRf1-, |

||||||

American put |

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

~c~j Professor's Note: For the exam, know the price limits in Figure 5. You wi!! not be "'<j:/ asked to daive them, but you may be expected to use them.

Example: Minimum prices for American vs. European puts

Compute the lowest possible price for 4-month American and European 65 puts on a stock that is trading at 63 when the risk-free rate is 5%.

Answer:

American put: Po;::: max [0, X - So] = max[0,2] = $2

European put: Po ;::: max [0, X / (l + RFR)T - So] = max[O, 65/ 1.05°·333 - 63] =

$0.95

Example: Minimum prices for American vs. European calls

Compute the lowest possible price for 3-month American and European 65 calls 011 a stock that is trading at 68 when the risk-free rate is 5%.

Answer: |

|

|

Co;::: max [0, So - X / (I |

+ RFR)T] = max[O, 68 - |

65/ 1.05°·25] = $3.79 |

co;::: max [0, So - X / (1 |

+ RFR)T] = max[O, 68 - |

65/ 1.05°·25] = $3.79 |

©2008 Kaplan Schweser |

. Page 205 |

Srudy Session 17

Cross-Reference to CFA Institute Assigned Reading #70 - Option Markets and Contracts

LOS 70.i: Explain how option prices are affected by the exercise price and the time to expiration.

The result we arc aftcr here is a simple and somewhat imuitive one. Th;ll is, given

two PUlS Lhat are identical in all respects except exercise price, the onc with the highcr exercise price will havc at Icast as much valuc as the onc with thc lowcr exercise price. This is because the untlnlying srock can be sold at a higher price. Similarly, given two calls thaL arc idclHiClI in every respect except exercise pricc, thc onc with the lower exercise price will have at least as much value as the one with the higher exercise price. This is because the underlying srock can be purchased at a lower price.

Professors Note: Jlle deri1Jation ofthIS resuLt is iI/eluded here aLthough it is not cxplicitLy I'cqllil'tc1 by the IDS.

The method here, for both puts and calls, is LO combine two opLions with differem exercise prices into a porrfolio and examinc the porrfolio payoffs at expiration for the three possible sLOck price ranges. We use the fact that a porrfolio with no possibility of a negative payoff cannot have a negative value to establish the pricing relations for options with differing times to expiration.

For X J < X2 , consider a portfolio at time t that holds the following positions:

c/X j ) = a long call with an. exercise price of XI

c, (X 2) = a shon call wi th an exercise price of X 2

The three expiration date (t = T) conditions and payoffs that need to be considered here are summarized in Figure 6.

Figure 6: Exercise Price vs. Call Price

Expiration Date

Condition

51 ~ Xl

Xl < ST < X2

X2 ~ ST

Option Value |

Portfolio Payoff |

cT(X 1) = cT(X 2) = 0 |

0 |

cT(X I ) =ST - XI |

ST - Xl> 0 |

cT (X2) = 0 |

|

cT(X 1) = ST - XI |

(ST - XI) - (ST - X2) |

c.r(X2) = ST - X2 |

= X 2 - Xl> 0 |

With no negative payoffs at expiration, the currenr portfolio of co(X j ) - |

cO(X2) must |

|||

have a value greater than or equal ro zero, and we have proven that cO(X |

) |

~ c (X |

). |

|

|

1 |

O |

2 |

|

Page 206 |

©2008 Kaplan Schweser |

Study Session 17

Cross-Reference to CFA Institute Assigned Reading #70 - Option Markets and Contracts

Similarly, consider a ponfolio shan a put with exercise price XI and long a put with exercise price X 2 , where XI < Xl" The expiration date payoffs that we need to consider arc summarized in Figure 7.

l~igure 7: Exercise Price ys. Put Price

-------- -- ------ - ---- --- ... _.._ --

|

F,pi/"{/tilill j)"Ii' |

|

Opt iOIl V"!1I1' |

l'ortj(dill j'tlJ,o/I |

||||||

|

Cli ne/it illII |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

||

|

X.'> Sr > XI |

PT(X I ) = 0 |

|

|

|

|

X 2 .. ST> 0 |

|||

|

|

PT(X2) = X2 - |

SI |

|

|

|

||||

|

XI:> ST |

PT(X\) = XI - |

SI |

(X 2 .- ST) ... (X lSI) |

||||||

|

|

PT(X ) = X |

2 |

-- 51 |

=X 2 -X j >O |

|||||

|

|

2 |

|

|

|

|

|

|

||

Here again, wirh no negative payoff, at expirarion, the currcnt portfolio of |

||||||||||

Po(X]) - Po(X\) |

must have a value greater than or equal to I.no, which proves that |

|||||||||

Po(X2) 2 Po(X j ). |

|

|

|

|

|

|

|

|||

In summary, we have shown that, all else being equal:

•Call prices arc inversc!y related lO exercise prices .

•Put prices arc directly related to exercise price .

In general, a longer time to expiration will increase an option's value. For far our-of-the- money oprions, the extra time may have no effect, hut we can say the longer-term option will be no less valu:1ble that the shoner-term option.

The case that doesn't fit this pattern is the European pur. Recall th:1t the minimum vallie of an in-the-money European put at any time t prior to expiration is X I (l + RFR)f-l-

5(' While longer time to expiration increases option value through increased volatility, it decreases the present value of any option payoff at expiration. For this reason, we cannot state positively that the value of a longer European put will be greater than the value of a shorrer-term pur.

If volatility is high and the discount rate low, the extra time value will he the dominant facror and the longer-term put will be more valuable. Low volatility and high interest rates have the opposite effect and the value of a longer-term in-the-money put option can be less than the value of a sharrer-term put option.

LOS 70.j: Ex.plain put-call parit)' for European options, and rdate put-call parit)' to arbitrage and the construction of synthetic options.

Qur derivation of put-call parity is based on the payoffs of two porrfolio combin:nions,

a fiduciary call and a protective pur.

©2008 Kaplan Schweser |

Page 207 |

Study Session 17

Cross-Reference to CFA Institute Assigned Reading #70 - Option Markets.and Contracts

Afiduriary call is a combination of a pure-discount, riskless bond that pays X at maturity and a call with exercise price X. The payoff for a fiduciary call at expiration is X when I the call is out of the money. and X + (S - X) = S when the call is in the mOlley.

A protective put is a share of srock rogether with a put option on the srock. The expiration date payoff for a protective put is (X - S) + S = X when the pm is in the money, and 5 when the pm is out of the mOl1ey.

ProftSJor's Note: When working with put-call parity, it is important to note that the exercise prices on the put and the call and the face value ofthe riskless bond arc all equal to X.

When the pur is in the money, the call is out of the money, and both portfolios pay X at explratlon.

Similarly, when the put is out of the money and the call is in the money, both portfolios pay 5 at expiration.

Put-call parity holds that portfolios with identical payoffs must sell for the same price ro prevent arbitrage. We can express the put-call parity relationship as:

c + X / (1 + RFR)T = S + p

Equivalencies for each of the individual securities in the put-call parity relationship can be expressed as:

S = c - |

p + X / (l |

+ RFRfJ' |

P = c - |

S + X / (1 + RFR)T |

|

c= S + p-X/ (l |

+ RFR)T |

|

X I (1 + RFR)T = S + p - c

The single securities on the left-hand side of the equations all have exactly the same payoffs as the portfolios on the right-hand side. The portfolios on the right-hand side are the "synthetic" equivalents of the securities on the left. Note that the options must be European-style and the puts and calls must have the same exercise price for these relations to hold.

For example, to synthetically produce the payoff for a long position in a share of stock, you use the relationship:

S = c - p + X / (l + RFR)T

This means that the payoff on a long stock can be synthetically created with a long call, a short put, and a long position in a risk-free discount bond.

The other securities in the put-call parity relationship can be constructed in a similar manner.

Page 208 |

©2008 Kaplan Schweser |

Srudy Session 17

Cross-Reference to CFA Institute Assigned Reading #70 - Option Markets and Contracts

Professor's Note: After expressing the put-call pllrity relationship in terms ofthe security y011 want to synthetically create, the sign on the individual securities will indicate whether yOlt need a long pOJ"ition (+ sign) or a short position (- sign) in the respective securities.

Example: Call option valuation using put-call parity

Suppose that the current stoc~,.pric~$~;!¥~l~~.~.l}'<;r~e is 5%. Yo~ ha.ve found a quote for a 3-month put oPt)J)ItAItAee21CrrRri~et'on~.The put pnce IS

but due to light tradin~in th~-d~erions, tflhe W1Mo1it~~tefor the

3-month, $50 call. Estimate ei¥l.d~~~~6~sJ.ycalloption.

-'-.....,,--

--I JI • I.

Answer: |

- r- .... |

__ .......... |

~. |

|

|

|

aearranging put-call parity, we find that the caU price is:

call = put +stock - |

present value(X) |

|

call = $1.50 +$52 - |

$50 |

= $4.11 |

025 |

||

|

1.05 . |

|

This means that if a 3-month, $50 call is available, it should be priced at $4.11 per share.

Contrast American options with European options in terms of the lower bounds on option prices and the possibility of early exercise.

Earlier we established that American caI1s on non-dividend-paying stocks are worth at least as much as European calls, which means that the lower bound on the price of both types of options is max [0, St - X J (l + RFR)T-tJ. If exercised, an American call wil! pay St - X, which is less than its minimum value of St - X J (l + RFR)T-t. Thus, there is no reason for early exercise ofan American call option on stocks with no dividends.

For American caU options on dividend-paying stocks, the argument presented above against early exercise does not necessarily apply. Keeping in mind that options are not typical1y adjusted for dividends, it may be advantageous to exercise an American call prior to the stock's ex-dividend date, particularly if the dividend is expected to significantly decrease the price of the stock.

For American put options, early exercise may be warranted if the company that issued the underlying stock is in bankruptcy so that its stock price is zero. It is better to get X now than at expiration. Similarly, a very low stock price might also make an American put "worth more dead than alive."

©2008 Kaplan Schweser |

Page 20~ |

Study Session 17

Cross-Reference to CFA Ins~itute Assigned Reading #70 - Option Markets and Contracts

LOS 70.1: Explain how cash £lows on the underlying asset affect put-call parity and the lower bounds of option prices. I

If rhe asset has positive cash flows ovn the period or the option, the cost of the asset

is less by the prescnr value of the cash flows. You can think of buying a srock for Sand simultaneously borrowing the present value of the cash Hows, PVCI' . The cash Aow(s) will provide the payoff of the loan(s), and the \oan(s) will reduce the net cost of the asset to S - PVCF . Therefore, for assets with positive cash Haws over the term of the option, we can substitute this (lower) net cost, S - PYCF 'for S in the lower bound conditions and in all the parity relations.

The lower bounds for European options at time too °can be expressed as:

Cu ?:: max [0, So -- PVCI' - |

X / (l |

+ RFR) TJ, and |

|||||

Po?:: |

. |

[0, X / (I |

- |

|

T |

- |

(So - PVCI,)J |

nux |

+ RFR) |

|

|||||

The put-call parity rdations can be adjusted to account for asset cash Hows in the same manner. That is:

(So - PVC/J = C - P + X / (I + RFR)T, and

C + X / (l + RFR)T = (So - PVuJ + P

LOS 70.m: Indicate the directional effect of an interest rate change or volatility change on an option's price.

When inrerest rates increase, rhe value of a call option increases and the value of a put option decreases (holding the price of the underlying security constant). This general result may nor apply to interest rate options or to bond or T·bill options, where a change in the risk-free rate may affect rhe value of the underlying asset.

The no-arbitrage relations for purs and calls make these statemenrs obvious:

c = S + P - X / (l + RFR)T

P = C - S + X / (l + RFR)T

Here we can see that an increase in RFR decreases X / (1 + RFR)T. This wiJl have the effeer of increasing the value of the call, and decreasing the value of the put. A decrease in interest rates will decrease the value of a call option and increase the value of a put option.

~Professor's Note: Admittedly, this is a partial analysis of these equations, but it

~does give the right directions for the effects ofinterest rate changes and will help you remember them ifthis relation is tested on the exam.

Greater volatility in the value of an asset or interest rate underlying an option contract increases the values of both puts and calls (and caps and Roars). The reason is that options are "one-sided." Since an option's value falls no lower than zero when it expires out of the money, the increased upside potential (with no greater downside risk) from increased volatility, increases the option's value.

Page 210 |

©2008 Kaplan Schwescr |

Study Session 17

Cross-Reference to CFA Institute Assigned Reading #70 - Option Markets and Contracts

... ' . - '-

:)illY CONCEPTS |

" |

' |

|

(;... ~ " |

. |

' . . '" |

... |

lOS 70.a

American options can be exercised at any time up to the option's expiration dare.

European options can be exercised only at the option's expiration date.

Moneyness for puts and calls is determined by the difference between the strike price (X) and the market price of the underlying srock (S):

MONf)'NfSJ |

Cd! OptiON |

flllt Option |

|||

In tht: money |

S>X |

S<X |

|||

At the money |

S=X |

S= X |

|||

Out or the money |

S<X |

S > X |

|||

---- |

|

|

|

|

|

|

|

|

|

|

|

Exchange-traded options are standardized, regulated, and backed by a clearinghouse. Over-the-counter options are largely unregulated custom options that have counterparty risk.

lOS 70.h

Options are available on financial securities, futures contracts, interest rates, and commodities.

I OS lOt

Interest rate option payoffs are the difference between the market and strike rates, adjusted for the loan period, multiplied by the principal amount.

At expiration, an interest rate call receives a payment when the reference rate is above the strike rate, and an interest rate put receives a payment when the reference rate is below the strike rate.

An FRA can be replicated with two interest rate options: a long call and a shorr put.

LOS 70.d

Interest rate caps put a maximum (upper limit) on the payments on a floating-rate loan and are equivalent (from the borrower's perspective) to a series of long interest rate calls at the cap ratc.

Interest rate floors put a minimum (lower limit) on the payments on a floating-rate loan and are equivalent (from the borrower's perspective) to a serics of short interest rate puts at the Roor rate.

An in tcrest ra te collar combines a cap and a floor. A borrower can create a collar on a

Roating-rate loan by buying a cap and selling a floor.

©2008 Kaplan Schweser |

Page 211 |