CFA Level 1 (2009) - 2

.pdf

Srudy Session 5 Cross-Reference to CFA Institute Assigned Reading #20 - MonoPQlistic Competition and Oligopoly

KEy CONCEPTS

LOS 20.a

MOllopolisric comperirion is characterized by a large number of independent sellers, low barriers ro enrry. difTerenriared products, and firms rhar compere on rhe basis of price, qualiry. and markering.

Oligopoly is a marker srfLlcrure characrerized by a small number of sellers, inrerdependence among compcrirors (decisions made by one firm affecr rhe demand, price. and profir of orhers in rhe indusrry), significanr barriers [Q emry rhar ofren include large economies of scale, and producrs rhar may be similar or differenriared.

LOS 20.b

Firms ill JIIollopolisric compcririon maximizc profirs by producing rhe quantirv where marginal revellue eqll;ds l1lar~in,11 cost, and h\ charging rhe price frol11 rhe dem;lnd

'.'lH\'l,

Long-rull economic profir is zero under monopolisric comperirion because barriers ro cntn' arc lo\\" and nC\\' firms ",ill C::llrcr rhe market if exisring firms are earning economic proht,\,

iDS 20,,-

I'rodllcr innovarion and developmenr, adwnising, and branding are necessar}' for firms in monopolisric comperjrioll. To judge wherher monopolistic comperirion is efficienr. rhe cosr of rhese aeri\'iries musr be weighed againsr rhe benehrs rhey produce for consumers.

lDS 20.d

The kinked demand model of oligopoly is based on an assumprion rhar each firm hclie\'es a price decrease will be marched by comperitors, while a price increase wilJ nor, rhar is. demand is more elasric in response ((J a price increase than to a price decrease.

The dominanr firm model of oligopoly is based on an assumprion thar one firm is rhe low-cosr producer in rhe industry and rhus has rhe abiliry to effecrively ser rhe marker price, which higher-cosr producers then rake as given.

Prisoners' Dilemma is a rheorerical game thar illustrares rhar rhe besr course of acrion for an oligopoh' firm rhat has emered inro an agreement wirh anorher firm ro restricr rheir indi\idllal outputs is [() cheat 011 rhe agreemenr ;ll1d produce more rhan the agreed-upon

alllOlliH.

©2008 Kaplan Schweser |

Page III |

Study Session 5

Cross-Reference to CFA Institute Assigned Reading #20 - Monopolistic Competition and Oligopoly

CONCEPT CHECKERS

1.A characteristic of monopolistic competition is:

A.differentiated products.

B.high barriers to entry and exit.

e.a single seller with no competition.

2.The demand for products from monopolistic competitors is elastic due to:

A.high barriers to entry.

B.the availability of many close substitutes.

e.the availability of many complementary goods.

3.Which of the following is least likely a feature that monopolistic competition and perfect competition have in common?

A.Output occurs where MR = Me.

B.Zero economic profits in the long run.

C.Extensive advertising to differentiate producrs.

4.An oligopolistic industry has:

A.few barriers to entry.

B.few economies of scale.

e.a great deal of interdependence among firms.

5.Consider a firm in an oligopoly market that believes the demand curve for its product is more elastic above a certain price than below this price. This belief fits most closely to which of the following models?

A.Dominant firm model.

B.Kinked demand model.

e. Variable elasticity model.

6.Consider an agreement between France and Germany that will restrict wine production so that maximum economic profit can be realized. The possible outcomes of the agreement are presented in the table below.

|

|

Germany complies |

Germany defaults |

||

|

|

|

|

|

|

France complies |

France gets €8 |

billion |

France gets €2 billion |

||

|

|

Germany gets € |

8 billion |

Germany gets €10 billion |

|

France defaults |

France gets € 10 billion |

France gets €4 |

billion |

||

|

|

Germany gets €2 billion |

Germany gets € |

4 billion |

|

|

|

||||

|

|

|

|

|

|

Based on the game theory framework, the most likely strategy followed by the tWO countries with respect to whether they comply with or default on the agreement will be:

A.both countries will default.

B.both countries will comply.

C. one country will default and the other will comply.

)age 112 |

©2008 Kaplan Schweser |

Srudy Session 5

Cross-Reference to CFA Institute Assigned Reading #20 - Monopolistic Competition and Oligopoly

ANSWERS - CONCEPT CHECKERS

I. |

A |

Differenriared producrs are a key characterisric of monopolisric comperirion . |

.., |

B |

Thc demand for producrs from firms compering in monopolisric comperjrion is elasric |

|

|

due ro rhe availabiliry of many close subsrirures. If a firm incrcases irs producr price, ir |

|

|

will lose cusromers ro firms selling subsrirurc producrs ar lowcr priccs. |

3.C The only irem lisred in rhe question rhar mono polis ric compcrjrion and perfecr comperirion do nor have in common is rhe use of adverrising ro differenriare rheir producrs.

4.C An oligopolisric indusrry has a grear deal of inrerdependcnce among firms. One firm's pricing decisions or adverrising acriviries will affecr rhc orher firms.

'i. B |

The kinked dcmand model assumes rhat each firm in a market helieves that a[ some |

|

|

price, demand is morc elasric tor a price increase: than for a PfiCC dccrc.lse. |

|

(), ;\ |

The solulion ft)J the game I., |

tor e.lch ILHion is tll pursue the SlfJtcg\ [hat i,s hL·st. gi\'cn |

|

rhe srratcgl' rhal is pursuc,1 h |

the orher narion. |

Given riLl( German)' complics wirh rhe agreemcnr: France will get €H billion if it complies, bur € J 0 billion if jr defaulrs. Thercfore France should defaulr.

Civcn that German;' dcfaulrs: France will gel (2 hillion ii it complies. hUI f'l billion if Il defaub. Therefore france should default.

Because France is bencr off in cirher case by defaulting. hance will defaulr. Germany will follow rhe same logic and reach rhe same conclusion,

©2008 Kaplan Schweser |

Page 113 |

The following is a review of the Economics principles designed to address the learning outcome statements set forth by CFA Institute@. This topic is also covered in:

MARKETS FOR FACTORS OF PRODUCTION

Study Session ')

EXAM Focus

Here, you want ro gain an understanding of how the demand for inputs ro production is determined and which facrors influence the elasticity of demand for inputs, especially labor. The second key ropic is how the market for financial capital establishes the price (inrerest rate) for financial cafJital

and the facrors that influence the supply of and demand for financial capital. Finally, you should gain an understanding of two components of the paymcnrs ro producrive resources, opporrunity cost ;ll1d economic renr.

" .", |

- |

"I' |

I |

J |

J f |

\ |

/-' |

(', . ,II I; , : |

:'. f,-' |

~ ] ,;~: |

".:;P alii |

W 1Y |

unU::I1C |

,li' ~'11~ |

.actors |

0, procll.:;:uon IS Cd leC! ll(::rr\T" |

|

demand, differentiate between marginal revenue and marginal revenue produG (Iv) R!' I, and describe how the M P,P determines the demand for labor and the

The demand for a productive resource depends on the demand for the final goods that It is bein~ used ro prodll..:e. Thus, demand for a factor of prc::J.uction is a derived demand

The marginal product of a resource is the additional outpur of a final product produced b:-'using one more unit of a productive input (resource) and holding the quantities of other inputs constanr. This is measured in output units and is sometimes called the marginal physical product of the resource. The marginal revenue is the addition ro

rotal revenue from selling one more unit of outpur. For a price taker, marginal revenue is equal ro price. For a producer facing a downward sloping demand curve, marginal revenue is less thall price, since price musr be reduced in order to sell additional unirs or outpur.

The marginal revenue product (MRP) is the addition ro total revenue gained by selling the marginal product (additional output) from employing one more unir of a productive resource. The interpretation of MRP is that it i~ the addition to roral revenue from selling the additional output produced by using one more unit of a productive input, holding the quantities of other inputs constant.

The MRP is downward sloping in any range of output for which diminishing

marginal returns are realized from using additional units of a productive resource. This downward-sloping MRP curve is in fact the firm's shorr-run demand curve for the productive resource or input, as illustrated in Figure 1. This is true of any productive input, of which labor is one.

Page 114 |

©2008 Kaplan Schweser |

Srudy Session 5

Cross-Reference to CFA Institute Assigned Reading #21 - Markets for Factors of Production

Figure 1: Marginal Revenue Product (Demand for a Productive Resource)

Marginal Revenue

Product (Price)

Quanrity

The inruition here is thar a profir-maximizing firm will be willing to pay an amounr for one more unir of labor (e.g., one more employee day) equal to the addition to roral revenue from employing thal addirional bbor in the producrion process and selling the

rewlrins addirional ourput. The condition for maximizing profirs wirh respecr [0 hiring addirional unirs of !.thor is (() l"()(1tinuc In add addirionalunirs of labor unril:

Ivl RP Labor = prict'LJhor

Once this condirion is mer, ar an\' kvel of producrion rhar emploved Jess labor (holding other inputs consrant). rhere would he additional profirs [() be made. Onc more unir of labor would cosr less than the value of rhe addirional ourput from hiring an addirional unit oflabor (the MRPLahor)' For additional unirs of labor beyond rhe amount thar sarisfies MRP[ .a I = price[ hor ,each unir of labor costs more than the additional revenue gained from the outpur of that unit of labor. Thus, rhe MRP of labor derermines the equilibrium wage rate, the highest price a firm will pay to hire an addirional unit of labor.

So we can say that a profit-maximizing firm will use additional units of a productive resource as long as its MRP is greater than its price. This supporrs the conclusion that the MRP curve is a firm's shorr-run demand curve for a productive resource (shorr-run, because quantities of orher factors are held fixed).

LOS 21.b: Describe the factors that cause changes in the demand for labor and the factors that determine the elasticity of the demand for labor.

Now thar we understand how a profit-maximizing firm determines the optimal quantity of an input to employ, we can examine the factors that will influence the firm's demand for labor.

An increase (decrease) in the price of the firm's output will increase (decrease) the demand for labor. An increase in the product price will increase the firm's marginal revenue, which increases the MRP of labor, increasing the demand for labor at each wage level, i.e., the demand curve for labor (the MRP curve) shifts upward. A decrease in the price of the firm's output will have the opposite effect. by the same logic.

The effect on the demand for labor of a change in the price of another factor of production will depend on whether that factor is a complement to labor or a substitute

©2008 Kaplan Schweser |

Page 115 |

Srudy Session 5

Cross-Reference to CFA Institute Assigned Reading #21 - Markets for Factors of Production

for it. The decrease in the price of computers over time has decreased the demand for many types of labor for which a computer is a substitute (e.g., customer service

personnel). The demand for IT professionals, however, has increased tremendously, since they arc a complement to computers in the production of the final good.

This example also illustrates the effect of technological improvements on the demand for labor. Demand for some types of labor has increased and the demand for other types of labor has decreased. Over time, the effect of technological improvements has been

a net increase in the demand for labor. A rising real wage rate (wage ratc adjusted for inflation) over time has provided evidence of this.

Elasticity of Demand for Labor

The demand for labor, like other types of demand, is more clastic in the long run than in the short run. This is simphbecause wc defin<:' the short run in produCtion

period owr which the qU.!TItilies of other faclOrs of produClion are: tlxed. If the wage Lite' rises. \\'C will see ;\ greater decreasc in the Cjuanrit\, oC labor cmpj()\'cd \\·hen the timl can substitute: (dem;lnd) other fac[(lrs of production for bbor (e.g .. get morc aUlomaled machinery).

The elasticity ofbhor will be gre:ltcr for firms with production processes thal are more labor-intensive. A warehouse operation tint relies heavily on m.anpower w fill :lnd ship orders will have a relatively clastic demand for labor because labor represents :I brge proportion of the total cost of the SL,vicc it provides. For an airline, on the other hanei. Lbor COSts represent a much smaller prnportion of rotal costs. We would expect the airline's demand for pilots to he much less clastic than a warehouse operation's demand for workers.

A third facror affecting the elasticity of demand for labor is the degree to which labor and capital can be substituted. While airplanes may, one day, have the technology to Ay themselves, pilots are actually quite difficult to replace with automation (as are flight attendants). In contrast, warehouse operations and manufacturing assembly plants ha\'c found many wa.vs ro substitute capital for lahor through aULUmarion and robotics. The elasticity of demand for assembly workers is much more elastic than the demand for airline pilots and flight attendants as a result of this difference in the opportunities to substitute capital for labor in production.

LOS 2I.c: Describe the factors determining the supply of labor. including the substitution and income effects, and discuss the factors rebrcd fl,· change~ in th~' sllpnh' 0\ labor, including capita! aCCllnllllatiOli,

Each individual decides whether, and how much, to work. Typically, labor has disurility; people generally prefer less work (and more leisure). Employers must offer a wage rate high enough that workers give up leisure time in favor of employment.

Wages, then, are the opportunity cost of leisure. The higher the wage rate, the more hours of leisure a worker will forego and the more hours of labor he will supply. This is

Page 116 |

©2008 Kaplan Schweser |

Scudy Session 5

Cross-Reference to CFA Institute Assigned Reading #21 - Markets for Factors of Production

the substitution effect in labor supply: workers substitute labor for leisure to the extent that the wage rate is high enough to give them an incentive to do so.

At some point, however, an individual reaches a maximum amount of labor that he is willing to offer for any wage. JUSt as labor has disutility, leisure has a positive value. As a worker's income increases, his demand for the things he values also increases, and leisure is one of those things. Thus an income effect limits how much labor a worker is willing to substitute for leisure. For the labor market as a whole, the substitution effect causes the labor supply curve to slope upward, but the income effect makes the curve "bend backward" at some (maximum) quantity of labor supplied.

Factors other than the wage rate that affect the supply of labor (shift the labor supply curve) include the size ~fthe adult poplilatio1l' and capital accumulatio1l in items that increase productivity in the home so that a greater proportion of adults choose to work outside the home.

|

, |

I |

|

|

":~1(' |

::! " |

'nOJH)ps:,'~'·,. |

;) <,: ( '.;! !: |

()f{(~:'~ |

;;n |

efficient |

Labor unions arc organized so that workers can bargain for wages and other aspects of

employment as a group. a process called collective bargaining. OnL: way this is to simpl" restrict suppl~' by refusing to work (striking) until the employer agrees to the

new higher wage rate. This is illustr3ted in Figure 2. Supply of labor curve So represents [he supply of labor without union bargaining. With collective bargaining the union ma~' shift [he supply curve to 5 I'The result is that the wage rises from We: to W L" but fewer workers are employed (QL'instead of the competitive result,

Figure 2: Supply of Labor Restricted by Unionization

Wage

Quantiry

of Labor

In addition to restricting supply through collective bargaining, unions attempt to increase the demand for the labor of [heir members in various ways. By increasing the demand for union labor, unions can reduce the decline in the quantity of union labor employed caused by the increase in the union wage rate.

One way to increase the demand for the labor of union members is to increase the marginal product of their members through additional training.

©2008 Kaplan Schweser |

Page 117 |

Study Session 5

Cross-Reference to CFA Institutet\ssigned Reading #21 - Markets for Factors of Production

Two other ways to increase the demand for union labor are based on increasing the demand for products made by union workers. Advertisements that encourage people to buy products labeled as made by unionized employees are an example of this strategy. Another strategy is to influence trade restrictions on imported goods. Restrictions on imported steel, for example, increase the demand for domestically produced stee!, which increases the demand for unionized steel workers.

Other strategies for increasing the demand for union labor are based on reducing the supply (increasing the price) of substitutes for union labor. Unions attempt to get increases in the minimum wage rate for unskilled workers, since unskilled labor may be a substitute for skilled union labor. An increase in the price of a substitute productive resource (input) will increase the demand for a productive resource. Political activity centered on restricting immigrant or guest foreign workers will have the same effect, since less skilled immigrant labor is also seen as a substitute for skilled union labor.

Monopsony refers to a situarion where the buvcr of a good or producrive inpul h~b market power. a situarion opposite to thar of monopoly. where rhe selkr has marker powcr. If an emplover pa\'~ a single wage: rare:. increasing rhis wage in orckr to hire additional workers meam that all workers receivt rl1e increased wage. The result of rhis is that rhe addition to roral COSl associated wirh hiring an additional worker is more that simply the (increased) wage for the additional worker. An employer that is the only major employer in a geographic area can face labor suppJy and associated marginal costs of hiring additional workers illustrated in figure 3. A monopsonist employer wili hire fewer workers. Q,\:, compared to the competitive level of employmenr. Qc The employer hires worker~: up ro the point where rhe marginal COSt of hiring an addition .• : worker is equal ro the additional worker's MRP, but pays only the wage necessary ro hire rhat quantity of workers. 'W',\\. Compared to the competitive equilibrium. this is inefficient and results in a deadweight loss from underemploymenr, since the marginal revenue product of an additional worker is greater than the wage rate.

Figure 3: Monopsony in the Market for Labor

Wage

Marginal Cost of

Additional Labor

Supply of labor

We: ------- ...... |

-.----- ... ----- |

Demand for Labor

(MRP)

Qc |

Quantity of Labor |

If workers are unionized and bargain collectively (as a monopoly supplier) and the employer represenrs a significant portion of the local demand for labor (acts as a monopsonist), the actual wage rate and employment level will be the result of bargaining between the company and the union. The wage rate will likely be somewhere between the (roo high) wage resulting from the union's reduction in the supply oflabor and the

Page 118 |

©2008 Kaplan Schweser |

Study Session 5

Cross-Reference to CFA Institute Assigned Reading #21 - Markets for Factors of Production

wage rate (roo low) that would result if workers did not negoriare collectively and the employer paid the monopsony wage.

LOS 21.e: Differentiate between physical capital and financial capital, and explain the rdation between the demand for physical capital and the demand for financial capital.

Physical capital is rhe physical assers of a firm, including property, plant, and |

|

equipment, as well as its inventory of finished goods and goods in process, The greater |

|

the demand for physical capital, the greater the demand for the financial capital (money |

|

raised rhrough issuing securities) necessary to purchase rhe physical capital. |

|

A firm employs physical capiral as a facror of producrion oecause it is necessary to |

|

produce rhe firm's ourpur and meet customer orders. We can rhink, in a simple sense, |

|

of t\\'O primar~' |

flC(ors of' production: labor and physical cq)itaJ (p<"ople. and machines |

and goods), In |

this senst'. just as a profit-maximizing firm c(luates rhe J\IR.PI.d"l! to the |

\\"~lge |

rate, it |

\\'ill also eqluLc'the |

!\!I\l'" |

,[(l thc C(LSl |

OrCl!)!ul. Since rhe' I)J"odlluion |

|||

... |

|

|

'-,.lpn.l! |

|

|

Ii, acrualh' a future f\1RP. The |

||

of caniraJ as,C:l, dlmcs o\'erman\' !JtTioJs, the MRP( |

~,I ~11 |

|

||||||

t |

|

" |

|

|

1.\ |

• |

||

vallie to the firm of the assers' producrion is rhe pre.l"eJIt /I,z/ur of its furure MRP. |

||||||||

The cost of ca~)iral rclcl"anr to thi, dl'Cision |

is the cosr of rhe funds |

that rhe firm musr |

||||||

raise |

to bu\' 11lwsical capiral. Just |

rhink of the MRP ,· , |

|

I as the retUfl1~ 0\'<:1'time (in |

||||

|

, |

, |

|

l ,ap"o |

|

|

||

percenrage terms) on the funds necessary to purchase additional physical capital. Viewed

in this \va\', we can sa," rhat the furure |

MRP ' , |

I must equal rhe interesr rate rhe firm |

, . |

.apHO |

|

|

c |

|

must pay to raise the financial capital in order to maximize profits.

LOS 21.f: Explain the factors that influence the demand and !iUpply of capital.

Similar to the demand for labor, the demand for capital will be a downward sloping curve derived from its MRP curve. A profit-maximizing firm will employ additional physical capiral until its )\tfRP is equal ro its cost, the interest rart: rhat rhe firm must pay on the funds (financial capital) necessary ro purchase the physical capital. At higher (lower) inrerest rates, firms will demand less (more) capiral, borh physical and financial.

ProftHO I' 5 Note: This conccpt i.r illtroduccd here but is co/lcrcd ill more detail in tlJ(' COIjJoratc F/llrlllCC topic rev/eli', Czpital bud,e:et/lIg is thr proass ofchoosillg OJl~)' thosrfirlll illI1estl7lCIlts(or {I'hich the rctunl 011 capital il7/lc.l"tl//elll iJ greater thall thtfirm:r rO.l"t o(ill/Jestl17m{ filllds,

We need to add one additional point here to account for an imponalH difference berween the MRP of capital and the MRP of labor. The addirional OUtput from employing an additional unit of labor is produced ar the rime that the labor is employed. With physical capiral-a bulldozer, for example-the additional output will come over many periods inro the future. For this reason, it is actually the present value of the future MRP of capital that will determine the return on a current investment in (physical) capiral assets. In any event, the demand for financial capital will be a downward sloping function of the interest rate (the cosr of flnancial capita!),

©2008 Kaplan 'schweser |

Page] ]9 |

Study Session 5

Cross-Reference to CFA Institute Assigned Reading #21 - Markets for Faccors of Production

Professor's Note: We saw the concept ofnet present vaLue ofan investment in

~Quarztitative Methods and we wiLL see exampLes ofdiscounting the vaLue ofthe

~fitture output ofan asset to evaLuate an investment opportunity in Corporate Finance.

Now that we have explained that the demand for financial capital is derived from the present value of MRP of physical capital in production, we can turn our attention to the supply of financial capital. Since the in terest rate is the price of capital, the supply curve will be an upward sloping function of interest rates. The suppliers of capital are savers, and they have the choice of consuming now or saving to consume later. Three primary factors influence savings and the supply of financial capital: interest rates, current incomes, and expected future incomes.

•At higher rates of interest, individuals are willing to save more because they will receive greater future amounts. Savers will save more (forego more consumption now) if they can consume 10 0/lJ more next year than if they are ooh· rewarded with

2(70 more consumption next year for foregoing consumption now.

Ilh:reases in currelH income induct individuals to save more (incrcase the SLIppl>: ()~ capital). while decreases in current income have the opposite effecL

If expected future incomes increase, individuah' willingness to trade current consumption for future consumption wilJ decrease. Workers anticipating a declinc in their incomes in retiremeI1l arc motivated to save more now to smooth out their consumption over time. The~' will save more now (consume less) so that they caD consume more in the future when their incomes are lower. College students are

in the opposite situation and save little (or go into debt) in anticipation of rising incomes in the future. We can say that, in general, an increase (decrease) in expected future incomes will decrease (increase) the current supply of capital. Change.~ in current income and expected future income will shift the supply of capi taJ curve; that is, at each interest rate, more or less capital will be supplied.

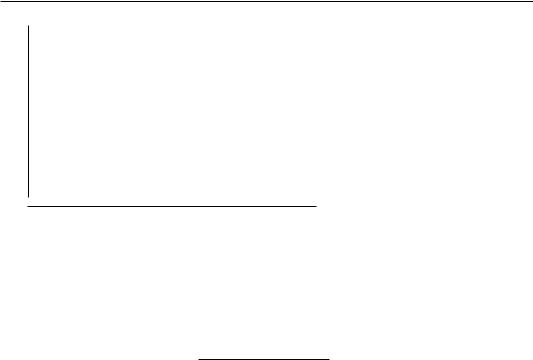

Equilibrium in the capital market determines interest rates. The interest rate where the quantity of capital supplied equals the quantity of capital demanded is the equilibrium (market) interest rate. Capital market equilibrium is illustrated in Figure 4.

Figure 4: Capital Market Equilibrium

Jmerest Ra tc |

:~uppl)' o{ |

|

Financial Capiral |

Demand for

Financial Capital

Quantity of

Q |

Financial Capital |

|

Page 120 |

©2008 Kaplan Schweser |