586

.pdf9)Do auditors study and evaluate the accounting system and the internal accounting control during the audit? Do they rely on internal controls?

10)What are the most critical elements in the auditor’s judgement?

11)Do all audits end up in the approval of the financial statements? Why do auditors sometimes disclaim or qualify their opinions?

12)Who has the right to act as an auditor?

4.Identify the main ideas of the text. Present the summary of it. Use the following phrases:

• I’d like to give a brief overview of …;

• Turning to …;

• A case in point is …;

• I’d like to highlight the fact that …;

• Moreover, …;

• And to complete the picture …;

• Although …, we must bear in mind …;

• All in all…;

• Basically …;

• So, to go over the main points again ….

VOCABULARY PRACTICE

Give derivatives of the following verbs using suffixes:

adjective |

noun |

verb |

noun |

||

reliable |

|

compl |

|

||

|

|

|

y |

|

|

accurate |

|

evalua |

|

||

|

|

||||

|

|

|

te |

|

|

complete |

|

depen |

|

||

|

|

||||

|

|

|

d |

|

|

confiden |

|

create |

|

||

|

|

||||

t |

|

|

|

|

|

correct |

|

concl |

|

||

|

|

||||

|

|

|

ude |

|

|

objective |

|

measu |

|

||

|

|

||||

|

|

|

re |

|

|

consisten |

|

exami |

|

||

|

|

||||

t |

|

ne |

|

||

|

|

|

|

|

|

2. (a) Think of the nouns that are often used with the following verbs.

to complete, to perform, to misstate, to omit, to approve, to audit, to conduct, to examine, to prepare, to carry out, to obtain

Make your own sentences.

(b) Think of the verbs that are most commonly used with.

opinion, audit, auditor’s report, internal controls, substantive testing, payments, evidence

Make your own sentences.

3. Match the verbs from (A) with the nouns from (B) below.

|

A |

|

B |

1) |

to share |

a) |

certificate |

2) |

to take |

b) |

assumption |

3) |

to foster |

c) |

responsibility |

4) |

to seek |

d) |

faults |

5) |

to submit |

e) |

services |

6) |

to give |

f) |

advice |

7) |

to make |

g) |

point of view |

8) |

to obtain |

h) |

evidence |

9) |

to find |

i) |

standards |

10) to render |

j) |

financial statements |

|

4. Fill in the blanks using the phrases in the box.

evidence gathering |

independent auditor |

accounting principles |

generally accepted |

prior periods |

financial disclosure |

internal control |

applied consistently |

|

|

The Auditing Framework

When the 1)_____________ begins an audit assignment, he assumes that the 2)____________ system of the enterprise is appropriate and effective; generally accepted 3)_________________ have been applied in all accounting processes underlying the financial principles; the 4)_______________ accounting principles utilized have been 5)______________ between the current and 6)_________________; there is an adequate amount of informative 7)________________ in the financial statements and footnotes. 8)_______________ and its evaluation enable the auditors to reject or confirm these a priori assumption. We are thus in a position to define the main responsibility of auditors:

AUDITORS: Professional accountants whose main duty is to prepare a report for shareholders stating whether, in their opinion, the financial statements of a business show true and fair view of financial position and performance

5. Match the job titles (1-4) with the descriptions (a-d).

1) |

bookkeepers |

a) |

company employees who check the financial statements |

2) |

accountants |

b) |

expert accountants working for independent firms who review |

|

|

companies' financial statements and accounting records |

|

3) |

internal auditors |

c) |

people who prepare financial statements |

4) |

external auditors |

d) |

people who prepare a company's day-to-day accounts |

6. Match the nouns in the box with the verbs below to make word combinations. Some words can be used twice.

accounts |

procedures |

opinions |

systems of control |

regulations |

policies |

stock take |

advice |

laws |

|

|

|

check |

______________ |

examine |

_____________ |

|

______________ |

_____________ |

|||

|

|

|||

|

______________ |

|

|

|

______________ |

|

_______________ |

comply with |

______________ |

give |

_______________ |

|

______________ |

|

|

7. Fill in the missing prepositional phrases in the following sentences. Choose from the box.

agree with |

blame for caused by |

difference between in |

|

line |

|

with insist on |

reason for refer to |

responsible for suspi- |

|

cious of |

|

|

|

|

1)The auditor discovered that there was a _______________ the cash book and the bank balance.

2)If the entries in the accounts are not clear, he can ______________ the original invoices.

3)You must _______________ an official signature on all large orders.

4)The auditor must check that the records are ________________ the company requirements.

5)The auditor must ask the _______________ any large discounts or allowances.

6)The auditor is _______________ checking the reason for any changes in the accounts.

7)The authorities will _____________ the auditor _____ any mistakes in the accounts.

8)The auditor must check that the purchase invoices ______________ the entries in the Purchases Journal.

9)The auditor should be _______________ any short-cut methods of correcting errors.

10)Mistakes may be _______________ the wrong steps used in the original accounting process.

8. Match the following terms (1–14) with the correct definition (a-n) on the right and write your answers in the grid below.

1) |

statutory audit |

|

a) |

official document stating the internal rules of the |

|

|||||||||||||

|

|

|

|

|

|

|

|

company |

|

|

|

|

|

|

|

|||

2) |

continuous audit |

|

b) |

following one after the other without a break |

|

|||||||||||||

3) |

Memorandum of Association |

|

c) |

this checks that controls are operating effectively |

|

|||||||||||||

4) |

Articles of Association |

|

d) |

required by law |

|

|

|

|

|

|

|

|||||||

5) |

walk through test |

|

e) |

money received from one debtor is wrongly recorded |

||||||||||||||

|

|

|

|

|

|

|

|

to another |

|

|

|

|

|

|

|

|||

6) |

compliance test |

|

f) |

regulates the company's relationship with the public |

||||||||||||||

|

|

|

|

|

|

|

g) |

testing a small number of representative items |

|

|||||||||

7) |

substantive test |

|

h) |

carried out all the time |

|

|

|

|

|

|

|

|||||||

8) |

teeming and lading |

|

i) |

following documents or transactions through the sys- |

||||||||||||||

9) |

auditor |

|

|

tem |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

j) |

piece of work you are given to do |

|

|

|

|

|

|||||

10) prior period |

|

k) |

careful study of all the details |

|

|

|

|

|

||||||||||

11) audit assignment |

|

l) |

accountant who examines a firm’s accounts |

|

|

|

||||||||||||

12) corroborate |

|

m) previous length of time |

|

|

|

|

|

|

|

|||||||||

13) statistical sampling |

|

n) |

make sure it's true with more information |

|

|

|

||||||||||||

14) consecutive numbers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

1 |

|

2 |

|

3 |

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Read the following text and fill each gap with a suitable word.

internal auditors systems of control accuracy recommend

controllers evaluate comply with examination

Internal auditing

After bookkeepers complete their accounts, and accountants prepare their financial statements, these are checked by 1) internal auditors. An internal audit is an 2)______________ of a company's accounts by its own internal auditors or 3)_______________. They 4)______________ the 5)______________ or correctness of the accounts, and check for errors. They make sure that the accounts 6)________________, or follow, established policies, procedures, standards, laws and regulations. The internal auditors also check the company's 7)_______________, related to recording transactions, valuing assets and so on. They check to see that these are adequate or sufficient and, if necessary, 8)______________ changes to existing policies and procedures.

10. Read the text and:

(a) number the following words or expressions with their underlined equivalents.

accuracy (1) |

determine |

shareholders |

Annual Meeting MeetinGeneral |

deviations |

implemented |

board of directors |

directives |

subsidiaries |

checking |

external |

a synonym |

deficiencies |

ratified |

standard operating proce- |

|

dures |

|

|

transnational corporations |

|

|

|

|

The traditional definition of auditing is a review and an evaluation of financial records by a second set of accountants. An internal audit is a control by a company's own accountants, checking for completeness, (1) exactness and reliability. Among other things, internal auditors are looking for (2) departures from a firm's (3) established methods for recording business transactions. In most countries, the law requires all firms to have their accounts audited by an outside company. An (4) independent audit is thus a review of financial statements and accounting records by an accountant not belonging to the firm. The auditors have to (5) judge whether the accounts give what in Britain is known as a «true and fair view» and in the US as a «fair presentation» of the company's [corporation's] financial position. Auditors are appointed by a company's (6) most senior executives and advisors, whose choice has to be (7) approved by the (8) owners of the company's equity at the company's (9) yearly assembly. Auditors write an official audit report. They may also address a «management letter» to the directors, outlining (10) inadequacies and recommending improved operating procedures. This leads to the more recent use of the word «audit» as (11) an equivalent term for «control»: (12) multinational companies, for example, might undertake inventory, marketing and technical audits. Auditing in this sense means (13) verifying that general management (14) instructions are being (15) executed in branches, (16) companies which they control, etc.

(b)add appropriate words to these phrases:

1)Auditors _____________ companies' accounts.

2)Accounts have to ______________ a fair presentation.

3)Auditors write a ______________.

4)It's the directors who _____________ the auditors.

5)Auditors sometimes ______________ better accounting procedures.

6)Using external auditors is a _____________requirement.

11. Translate the following definitions of the economic terms relating to audit.

Auditor — ревизор, сотрудник аудиторской фирмы, контролирующий и анализирующий финансовую деятельность предприятий, а также дающий заключение по годовым бухгалтерским отчетам и балансам;

External audit — проверка годовой отчетности организации независимым квалифицированным специалистом (аудиторской службой, аудитором), который должен определить степень достоверности и правдивости информации, содержащейся в бухгалтерской отчетности и ее соответствие требованиям закона;

Internal audit — проверка годовой отчетности организации внутренним аудитором или специально подготовленным служащим организации с целью информирования менеджмента об эффективности и надежности применяемых компанией систем и выработки рекомендаций по их улучшению;

Inaudit — хозрасчетное акционерное общество, задачей которого является консультирование отечественных и иностранных партнеров совместных предприятий и осуществление контроля за бухгалтерским учетом и финансовой отчетностью совместных предприятий;

Accounting — функциональная сфера бизнеса, связанная со сбором, обработкой, классифицированием, анализом и оформлением различных видов финансовой информации;

Auditor’sopinion—заключениеназначенныхаудиторов о проверке отчетности организации; Reporting — периодическое составление предприятиями, организациями отчетов о своей деятельности,

представляемыхв государственные органы.

12. Make a free translation of the following extract from Russian into English.

Аудиторское заключение

Цель аудитора подтвердить правильность бухгалтерской отчетности, И собственникам и кредиторам важно знать: можно ли доверять числам, с которыми их знакомит администрация предприятия.

У аудитора почти никогда не может быть точного убеждения в том, что отчетность составлена правильно, и поэтому заключение аудитора имеет своим следствием только мнение, имеющее ту или иную степень убедительности.

Результаты аудиторской проверки, так называемое мнение аудитора, представляется в форме аудиторского заключения — документа, имеющего юридическое значение для всех юридических и физических лиц, органов государственной власти и управления, органов местного управления и судебных органов. Аудиторское заключение составляется для пользователей (учреждений, акционеров, банков, потенциальных инвесторов, поставщиков

ипокупателей), которых интересуют данные экономического субъекта, гарантии полноты

иправильности годового отчета.

Вотличие от аудиторского отчета, аудиторское заключение составляется в краткой форме, должно быть четким и содержать недвусмысленное описание результатов проверки. В нем должны быть сделаны точно обоснованные выводы о достоверности бухгалтерской отчетности, ее соответствия действующему законодательству и типовым положениям по вопросам организации и ведения бухгалтерского учета.

Выделяют четыре вида аудиторского заключения: безусловно положительное, условно положительное, отрицательное и отказ от выражения мнения.

К аудиторскому заключению должна быть приложена бухгалтерская отчетность хозяйствующего субъекта, в отношении которой проводился аудит.

Заключение аудитора должно состоять из трех частей: вводной, аналитической и итоговой.

После подписания заключения и предоставления его заинтересованным пользователям аудитор не несет ответственности за имевшие место события.

За правильность своего мнения, за степень найденной очевидности, аудитор несет ответственность, оговоренную в договоре с клиентом. Так как всегда есть сомнение в правильности бухгалтерской отчетности, которую предоставляет администрация, то появление посредника в лице аудитора становится необходимым, именно он может подтвердить, что эта отчетность составлена правильно или, что более точно, достаточно правильно. Отсюда возникает неизбежность возникновения аудита как гаранта рыночных отношений.

SUPPLEMENTARY READING PRACTICE

1.Scan the text, single out the main facts and present them in a short review.

Describe the two main functions of auditing;

Discuss how public accountants (auditors) and government auditors perform these functions;

Explain the importance of internal auditing.

Audit is an examination of the records and reports of an enterprise by accounting specialists other than those responsible for their preparation. Public auditing by independent accountants has acquired professional status and become increasingly common with the rise of large business units and the separation of ownership from control. The public accountant performs tests to determine whether the management’s statements were prepared in accordance with acceptable accounting principles and fairly present the firm’s financial position and operating results. Such independent evaluations of management reports are of interest to actual and prospective shareholders, bankers, suppliers, lessors, and government agencies. Generally speaking, auditing has two functions: to reveal undesirable practices and, as far as possible, to prevent their recurring in the future. A relatively new type of auditing is internal auditing. It is

designed to evaluate the effectiveness of a business’s accounting system. Perhaps the most familiar type of auditing is the administrative audit, or pre-audit, in which individual vouchers, invoices or other documents are investigated for accuracy and proper authorization before they are paid or entered in the books.

In English-speaking countries, public auditors are usually certified, and high standards of professional qualification are encouraged.

Most countries have specific agencies or departments charged with the auditing of their public accounts.

Taxpayers in all countries are interested in the sound management of the collected revenue, they also want to know whether or not the executive branch of government is complying with the law, especially in the area of public finance.

Government auditors are working for sound, economical and efficient financial management, addressing the key problems in the field of public sector auditing, like strengthening the institutions that oversee financial management, changes in the scope and methodology of government auditing, ability to conduct performance audits in public enterprises, strengthening internal auditing in spending units, ex-post external audits of government activities, budget efficiency problems, performance of expenditure programmes.

The advantages accruing from an audit are obvious, taking into account the complexity of present-day commerce and business.

2. Read the dialogue, translate the Russian remarks into English and act the dialogue out. Fo- As far as we know, you are Russia’s leading provider of accounting and con-

reigner: sulting services. The history of your firm mirrors the changes that have taken place in Russia over the recent years.

|

Да, вы правы. Наша фирма была основана еще в 1989 году. Все эти годы |

|

нам пришлось упорно работать, так как мы начинали практически с нуля. А |

Rus- |

сейчас мы активно сотрудничаем с Большой Шестеркой, крупнейшие пред- |

sian: |

ставители нашего бизнеса обращаются к нам за помощью и советом. |

|

What services do you provide? |

Мы предоставляем широкий перечень услуг: от услуг в области бухучета и аудита до услуг в области финансового менеджмента и налогообложения. Главным является проведение аудиторских проверок и подтверждение фи-

F:нансовой отчетности.

R:Who are your clients?

Нашими клиентами являются компании всех форм организации бизнеса, работающие во всех секторах нашей экономики, включая транспорт, торговлю и банковскую деятельность.

F:

We in the UK believe that if auditors are to play their role in economy they

R:must be independent. What are your fundamental principles?

Мы полностью разделяем вашу точку зрения в отношении независимости аудиторов, кроме того, мы уделяем большое внимание повышению их профессионального уровня.

F:

Are there any professional organizations of auditors in Russia?

Да, у нас существуют различные профессиональные организации, помо-

R:гающие аудиторским фирмам решать различные вопросы, включая повыше-

ние квалификации, лицензирование и т. п.

Thank you for the opportunity to learn something about auditing in Russia.

F:

R:

F:

3. Read the text and:

(а) fill each gap with a suitable word from the box;

free |

proper |

standards |

audit (2) |

opinion (2) |

preparing responsi- |

performed |

management |

statements |

bilities |

accordance |

view |

|

|

|

|

Independent Auditors’ Report to the Board of Directors and Shareholders

We have audited the consolidated balance sheets of the Company and Subsidiaries at December 31, 2006 and 2007 and the related consolidated statements of income, shareholders’ equity and cash flows for each of the years in the period ended December 31, 2007.

Respective 1) ___________ of directors and auditors are as follows: the company directors are responsible for the preparation of financial 2)__________; our responsibility is to form an independent 3)________ based on our audit or these statements and to report our opinion to you.

Basis of Opinion. We conducted our 4) ____________ in accordance with generally accepted auditing 5)_____________. Our audit includes examination, on a test basis, of evidence relevant to the amounts and disclosures in the financial statements. It also includes an assessment of the significant estimates and judgements made by the 6)______________ in the preparation of the financial statements, and of whether the accounting policies are appropriate to the company’s circumstances, consistently applied and adequately disclosed.

We planned and 7)____________ our audit so as to obtain all the information and explanations which we considered 8)___________ in order to provide us with sufficient evidence to give reasonable assurance that the financial statements are 9)___________ from material misstatements, whether caused by fraud or other irregularity or error. In 10)___________ our opinion we also evaluated the overall adequacy of the presentation of information in the financial statements. We believe that our 11)_____________ provides a reasonable basis for our opinion.

Opinion. In our 12)____________ the financial statements referred to above give a true and fair 13)___________ of the consolidated financial position of _____ Company and Subsidiaries at December 31, (year) and have been properly prepared in 14)____________ with generally accepted accounting principles and the Company Act 1985.

Words you may need:

disclosure n — отражение, раскрытие (информации в финансовой отчетности)

fraud n — обман, мошенничество

(b) sum up the text in 5–7 sentences and present your summary.

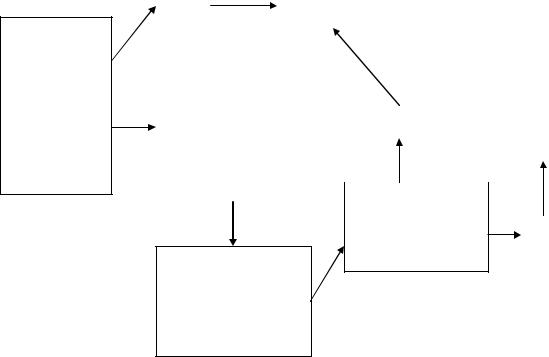

4. Read the text and with the help of the scheme below give a short presentation on the work of the external auditor.

External auditing

Public companies have to submit their financial statements to external auditors — independent auditors who do not work for the company. The auditors have to give an opinion about whether the financial statements represent a true and fair view of the company's financial situation and results.

During the audit, the external auditors examine the company's systems of internal control, to see whether transactions have been recorded correctly. They check whether the assets mentioned on the balance sheet actually exist, and whether their valuation is correct. For example, they usually check that some of the debtors recorded on the balance sheet are genuine. They also check the annual stock take — the count of all the goods held ready for sale. They always look for any unusual items in the company's account books or statements.

Until recently, the big auditing firms also offered consulting services to the companies whose accounts they audited, giving them advice about business planning, strategy and restructuring. But after a number of big financial scandals, most accounting firms separated their auditing and consulting divisions, because an auditor who is also getting paid to advise a client is no longer totally independent.

Words you may need:

genuine (adj) — подлинный, неподдельный, настоящий stock take — инвентаризация

Are control systems adequate, according to external auditors? Have accounting principles been applied correctly?

|

|

|

Auditors |

|

|

|

Auditors produce a |

|

|||||

|

|

|

produce an audit |

|

|

|

qualified report, |

|

|||||

Yes |

|

|

|

report. |

|

|

|

stating that the |

|

||||

|

|

|

|

|

|

|

|

|

financial statements |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

do not give an |

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

entirely true and fair |

|

||

|

|

|

|

|

|

|

|

|

|

view and there are |

|

||

|

|

|

|

|

|

|

|

|

|

some problems. |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No – Auditors find |

|

|

|

|

|

|

|

|

|

|

|

||

irregularities: systems are |

|

|

|

|

|

|

|

|

|

||||

|

|

|

Yes |

|

|

|

|

|

|

||||

not adequate, principles |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

haven’t been applied |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

correctly or consistently. |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Does the company |

|

|

|

|

||||

|

|

|

|

|

follow the advice given |

|

|

|

|

||||

|

|

|

|

|

in the management |

|

|

No |

|

||||

|

|

|

|

|

letter? |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Auditors write a management letter to directors or senior managers explaining what needs to be changed.

5. Read the document below and discuss the results of the audit in Open Joint-Stock Company «Russian Railways» for the financial year 2006.

Independent Auditors' Report

To the Shareholders of Open Joint Stock Company «Russian Railways»

We have audited the accompanying consolidated financial statements of JSC «Russian Railways» and its subsidiaries (hereinafter referred to as «the Company»), which comprise the consolidated balance sheet as of 31 December 2006, and the consolidated statement of income, consolidated statement of cash flows and consolidated statement of changes in equity for the year then ended, and a summary of significant accounting policies and other explanatory notes.

Management Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with International Financial Reporting Standards. This responsibility includes: designing, implementing and maintaining internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error; selecting and applying appropriate accounting policies; and making accounting estimates that are reasonable in the circumstances.

Auditors' Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with International Standards on Auditing.

Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditors' judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Basis for Qualified Opinion

(i) As discussed in Note 2 to the consolidated financial statements, in accordance with the Company's accounting policy, subsequent to initial recognition, property, plant and equipment are carried at revalued amounts being their fair values at the date of the revaluation less any subsequent accumulated depreciation and impairment loss. In accordance with the requirements of International Accounting Standard 16 «Property, Plant and Equipment» («IAS 16»), as amended, revaluations should be made with sufficient regularity such that the carrying amount of property, plant and equipment does not differ materially from that which would be determined using fair value at the balance sheet date.

The Company completed revaluation of one category of property, plant and equipment as of 1 January 2004 and reported the effects of such revaluation by adjusting corresponding information in the consolidated financial statements. The last revaluation of the Company's other categories of property, plant and equipment was performed as of 31 December 1998.

Therefore, we were unable to determine whether the carrying value of such other categories of property, plant and equipment of 1,068,481 and 898,713 millions of rubles as of 31 December 2006 and 2005, respectively, complies with the requirement referred to above. Similarly, we could not determine whether the impairment reserves provided by the Company, are adequate to reflect the value