posobie

.pdfdeductions. If the machine is financed with a loan, the interest component of a payment is also tax deductible. In addition, the purchaser can expense up to $250,000 of property on federal income tax returns. If this expensing option has not been used by other capital purchases, it can be deducted in the first year of ownership. It can be claimed only during the first year of ownership and the amount claimed is not available for subsequent depreciation. Variable costs such as labor, fuel, and repairs as well as insurance payments are also tax deductible expenses.

1.Answer the following questions:

1)What is a typical method to obtain machinery services for most farm operators?

2)What alternative options to obtain machinery services are considered in the text?

3)What is the critical issue in efficient production?

4)What is the largest single production expense for many farms?

5)What concerns does a farmer consider when entering into a lease?

6)When are miscellaneous expenses incurred in the case of lease?

7)What can significantly affect a farmer’s borrowing capacity?

8)What type of agreement is custom hire?

2.Translate the sentences with the words in bold type.

3.Compile a table comprising characteristics of all options to obtain machinery services.

Option |

Ownership |

Payment |

Additional |

Replacement |

|

|

period |

payments |

|

|

|

|

|

|

Purchase |

|

|

|

|

|

|

|

|

|

Rent |

|

|

|

|

|

|

|

|

|

Custom hire |

|

|

|

|

|

|

|

|

|

Lease |

|

|

|

|

|

|

|

|

|

Rollover |

|

|

|

|

|

|

|

|

|

|

|

71 |

|

|

2.Are these sentences true or false? Correct false sentences.

1)Equipment leases affect a business’s balance sheet differently than ownership does.

2)Customers consider different options for obtaining machinery services.

3)Rental arrangement is a traditional method of obtaining machinery.

4)Financial institutions supply additional financing in the form of equipment leases.

5)Equipment purchasing permits control of productive assets without ownership.

6)Equipment leases typically provide control of the equipment for less than year.

7)The person who owns equipment being leased to another is called the lessee.

8)Custom hire payments are deductible.

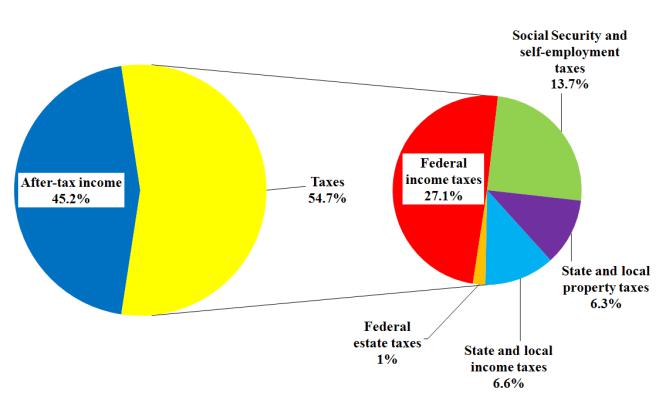

VII. Analyze Figure 2. Make assumptions about American farm taxation. Do you know about the taxes and tax liabilities in Russia? What kind of taxes is definitely absent in Russia?

Figure 2. Tax shares of the total gross income in the US farming

72

VIII.Read the text. What is the main idea of the text? Describe the taxation

process.

Text V. Taxation in the USA

Today, the American tax system can be likened to a perpetual motion machine. While most Americans tend to only think about the tax system and the Internal Revenue Service (IRS) as the month of April approaches, it's actually a never-ending process. Let's take a look inside the tax system and examine its various steps. For our purposes, a good way to explain how the system works is to watch one American income earner – let's call him Joe – as he goes through a year of the American tax process. The tax process begins when Joe starts his new job. He and his employer agree on his compensation, which will be figured into his gross income at the end of the year. One of the first things he has to do when he's hired is to fill out all of his tax forms, including a W-4 form. The W-4 form lists all of Joe's withholding allowance information, such as his number of dependents and child care expenses. The information on this form tells your employer just how much money it needs to withhold from your paycheck for federal income tax. The IRS says that you should check this form each year, as your tax situation may change from year to year. Start by assessing gross income, which includes work income, interest income, pension and annuities. Subtract any adjustments (examples: alimony, retirement plans, interest penalty on early withdrawal of savings, tax on self-employment, moving expenses, education loan interest paid). The difference is the adjusted gross income (AGI). Once the AGI is calculated, there are two choices: either subtract a standard deduction, or subtract itemized deductions, whichever is greater. Itemized deductions might include, but aren't limited to, some medical and dental expenses, charitable contributions, interest on home mortgages, state and local taxes and casualty loss. Next, subtract personal exemptions to end up with taxable income.

Go to the IRS tax tables if taxable income is less than $100,000, or to the IRS tax rate schedules if it's more than $100,000. This is where it gets a little complicated, because the United States uses a marginal tax rate system. There are six tax

73

brackets: 10 percent, 15 percent, 25 percent, 28 percent, 33 percent and 35 percent. How the tax rate works depends on income and marital status.

From your gross tax liability, subtract any credits. Credits may include such items as child care. The difference is the net tax, which is how much to pay or how much of a refund to expect.

At the end of each pay period, Joe's company takes the withheld money, along with all of withheld tax money from all of its employees, and deposits the money in a Federal Reserve Bank. This is how the government maintains a steady stream of income while also drawing interest on your tax dollars.

1.Find the English equivalents to the following words: налогообложение,

налогоплательщик, иждивенец, алименты, здравоохранение,

зарплата, средства к существованию, детализированный,

реконструкция, прибыль (с капитала).

2.Provide the definitions of the given terms.

Term |

Definition |

Income-earner

Compensation

Tax form

Dependent

Withhold

Paycheck

Annuities

Alimony

3.How many key sums should every taxpayer calculate?

4.Make up your own sentences with the words in bold type.

74

IX. Look through the text. Translate the words in bold type. Name the text.

Text VI. __________

Failure to take the tax into account when making your estimated tax payments could result in a substantial penalty. At the very least, you'll have a big surprise when you file your 1040 in April. There are plenty of pointers that many taxpayers overlook.

If you're a sole proprietor or a partner, you're not considered to be an employee. You get no W-2 and nothing is withheld from your pay for FICA or medicare taxes. If you're an employee, 7.65% is withheld from your pay. In order to collect a similar amount for social security and medicare, a sole proprietor has to pay 15.3% of his self-employment income.

Employers make regular deposits of FICA and other withheld taxes to the IRS. Individual taxpayers who owe the self-employment tax are responsible for paying the FICA and medicare taxes directly to the IRS. That's done through quarterly estimated tax payments. For most taxpayers that's April 15, June 15, September 15, and January 15. There's no separate return. Instead, when you file your individual income tax return you must complete Schedule SE (Self-Employment Tax) to compute the tax and report the liability on the back of Form 1040. The selfemployment tax is added to your individual income tax. Estimated tax payments and withholdings are credited against your total tax liability.

You're subject to the tax if you were self-employed and your net earnings from that source were $400 or more. (You're considered self-employed if you carry on a trade or business either as a sole proprietor or partner in a partnership.) You don't have to be in business on a full-time basis. Part-time work also qualifies.

A trade or business is generally an activity carried on for a livelihood or in a good faith attempt to make a profit. While this depends heavily on the facts and circumstances, the IRS wins most of the cases on this issue. There have been a few situations where a taxpayer was able to show he wasn't in a trade or business, but don't count on being able to do so. You might be able to show that, for example, you

grow fruit for your own consumption. You've done so for a number of years and

75

never sold any. Because of crop losses by others in your area, you can sell enough one year to show a small profit. In subsequent years you don't sell any of your crop. You might be exempt. Get good advice if you're going to make such a claim.

As discussed, you pay the self-employment tax along with your estimated individual income taxes during the year. The law doesn't make a distinction. That is, your income tax and self-employment tax are added together and treated as one. That is, you can usually avoid a penalty if you pay in at least as much as your prior years' liability. You may be able to reduce your estimated payments by annualizing your income and making payments based on your actual income during the year.

1.Answer the questions:

1)Why is it so important to understand the self-employment tax?

2)In what case is nothing withheld from the payment?

3)In what cases are you subject to the self-employment tax?

4)When could the taxpayer show that he wasn’t in a trade or business?

5)How could a taxpayer reduce his estimated payments?

2.Explain the following numbers: 7.65%; 400; 1040; 15; 15.5%.

3.Make an annotation of the text.

X. Translate the text into English.

Text VII. Гослизинг по-казахски

«Казагрофинанс» - казахский аналог российского «Росагролизинга».

Особенности казахского агролизинга в том, что компания обязана возвращать средства в бюджет и, следовательно, требовать их с заемщиков. Крестьяне,

привыкшие к субсидиям, не всегда даже довольны льготами. Но тем не менее за три года работы «Казагрофинанс» передал в лизинг техники на сумму 11,3

млрд тенге. Сельскохозяйственная техника в Казахстане изношена более чем на

80%. Механизм, с помощью которого правительство собирается обновить парк сельхозтехники, – гослизинг.

Перед госагролизингом стоят две противоречивые задачи: помочь

сельхозпроизводителям обновить парк сельхозтехники на максимально

76

льготных условиях и вернуть в республиканский бюджет в полном объеме деньги, взятые в кредит. Причем если обязательства перед бюджетом по возврату денег не будут исполнены, лизинговая программа Минсельхоза окажется дискредитирована. Поэтому для «Казагрофинанса» важно было продумать обеспечение. По опыту ежегодно 20–25% платежей идет за счет вторичных источников.

За три года работы «Казагрофинанс» передал в лизинг техники на сумму

11,3 млрд тенге, заключил около 600 договоров лизинга. На лизинг сельхозтехники в этом году государство выделило 3,2 млрд тенге. Но спрос на лизинг сельхозтехники намного превышает возможности бюджета.

Многие сельхозпроизводители ожидают от государства субсидий.

Поэтому не всегда довольны даже теми льготными условиями финансирования,

которые им предлагают, хотя лучших им не может предложить на казахском рынке ни одна другая лизинговая компания: ставка 5% (у коммерческих компаний – 17–20%), срок – семь лет, авансовый платеж в размере 10%,

ежегодное погашение основного долга (либо осенью – до 10 ноября, после уборки урожая, либо весной – до 10 марта, т. е. когда устанавливается максимальная цена на зерно), обеспеченность сделки в размере 25%.

Вознаграждение выплачивается ежеквартально, чтобы было ясно, как идут дела у хозяйства-заемщика: факт неоплаты говорит, что следует принять какие-то меры.

Хозяйствам в Казахстане, в основном занимающимся зернопро-

изводством, нужна прежде всего зерноуборочная техника. Спросом пользуются по-прежнему комбайны российского производства. «Нивами» интересуются западноказахстанский, восточноказахстанский и Павлодарский регионы, «Енисеями» – североказахстанский и Акмолинский. На технику западного производства также есть спрос, но не такой, как на российскую. «Казагрофинанс» приобрел 630 зерноуборочных комбайнов «Джон Дир» с

пропускной способностью 9–11 кг/с, но окупились они за счет сравнительно небольшой остаточной стоимости (приобретены по цене 70 000 долл.). Хотя в

целом приобретение новой западной техники в лизинг в Казахстане многим

77

пока не по карману. Возможно, она опережает российскую технику по многим показателям, но не по соотношению «цена – качество». К тому же ремонт российской техники механизаторы могут производить сами, в то время как для ремонта западной нужны специалисты и запчасти, которые не всегда можно найти на рынке.

XI. Prepare the presentation on one of the following topics:

1.Farm costs in Russia.

2.Leasing in Russia.

3.Taxation of farmers in Russia.

78

References

1.Ricketts C. Introduction to Agribusiness. - Thomson Delmar Learning, 2001.

2.Ricketts C., Ricketts K. Agribusiness Fundamentals and Application. - Delmar Cengage Learning, 2008.

3. 2012 |

USDA |

Agricultural |

Census |

Publications. |

http://www.agcensus.usda.gov/Publications/2012/#full_report

4.Российский агробизнес становится все более привлекательным для инвестиций. http://www.businesspress.ru/newspaper/article_mid_44_aid_105501.html

5.Nakkiran S. Cooperatives in agribusiness. - Discovery Publishing Pvt. Ltd, 2012.

6.Hyde J. Agribusiness Planning: Providing Direction for Agricultural Firms. Pubs.cas.psu.edu/freepubs/pdfs/ua371.pdf

7.Dalsted N.L., Gutierrez P.H. Partial Budgeting. – Colorado State University, 2012.

8.Edwards W. Estimating Farm Machinery Costs. http://www.extension.iastate.edu/agdm/crops/html/a3-29.html

9.Massey R. Leasing Farm Equipment. – University of Missouri, 2010.

10.Income Tax in the USA. http://stuff.dewsoftoverseas.com/bincometax.htm

11.Self-Employment Tax // Department of the Treasury Internal revenue Service, #533, 2013.

12.McEoven R.A. Farm income taxation. - Texas Agricultural Extension service, 2008.

79

Учебное издание

Кулешов Александр Владимирович Горохова Анна Михайловна

ПРОФЕССИОНАЛЬНАЯ КОММУНИКАЦИЯ НА АНГЛИЙСКОМ ЯЗЫКЕ ДЛЯ ЭКОНОМИЧЕСКИХ СПЕЦИАЛЬНОСТЕЙ

Практикум

Часть 1

Техн. редактор Т.Б. Самсонова Подписано к печати 01.06.2015. Формат 60 84/16.

Уч.-изд. л. 4,12. Печ. л. 5,0. Тираж 300 экз. Заказ № 02.

Отпечатано в информационно-издательском отделе ВНИИГиМ имени А.Н. Костякова 127550, Москва, ул. Б. Академическая, д. 44, корп. 2

80