Madhani М. Resource Based View (RBV) of Competitive Advantage An Overview

.pdf

1

Resource Based View (RBV) of

Competitive Advantage

An Overview

Pankaj M Madhani

The Resource Based View (RBV) analyzes and interprets internal resources of the organizations and emphasizes resources and capabilities in formulating strategy to achieve sustainable competitive advantages. Resources may be considered as inputs that enable firms to carry out their activities. Internal resources and capabilities determine strategic choices made by firms while competing in their external business environment. Firm’s abilities also allow some firms to add value in customer value chain, develop new products or expand in new marketplace. The RBV draws upon the resources and capabilities that reside within the organization in order to develop sustainable competitive advantages. According to RBV, not all the resources of firm will be strategic and hence, sources of competitive advantage. Competitive advantage occurs only when there is a situation of resource heterogeneity and resource immobility.

© The Icfai University Press. All rights reserved.

Electronic copy available at: http://ssrn.com/abstract=1578704

4 RESOURCE BASED VIEW: CONCEPTS AND PRACTICES

Introduction

Resource Based View (RBV) analyzes and interprets resources of the organizations to understand how organizations achieve sustainable competitive advantage. The RBV focuses on the concept of difficult-to-imitate attributes of the firm as sources of superior performance and competitive advantage (Barney, 1986; Hamel and Prahalad, 1996). Resources that cannot be easily transferred or purchased, that require an extended learning curve or a major change in the organization climate and culture, are more likely to be unique to the organization and, therefore, more difficult to imitate by competitors. According to Conner, performance variance between firms depends on its possession of unique inputs and capabilities (1991).

Example

Honda, the world’s largest engine manufacturer is following a RBV strategy. Honda built its business strategy around the firm’s strength, capability and expertise in building petrol-based engines. Honda initially started with small clip-on engines for bicycles then moved to two wheelers such as scooters and motorbikes, marine engines, generators, lawn and garden equipment, and cars (Honda and Acura automobiles) and even jet planes. Each of these products competes in quite different product verticals, but leverages a unique resource and capability of Honda to build world class petrol-based engines.

Origin of RBV

The RBV takes an ‘inside-out’ view or firm-specific perspective on why organizations succeed or fail in the market place (Dicksen, 1996). Resources that are valuable, rare, inimitable and non substitutable (Barney, 1991) make it possible for businesses to develop and maintain competitive advantages, to utilize these resources and competitive advantages for superior performance (Collis and Montgomery, 1995; Grant, 1991; Wernerfelt, 1984).

According to RBV, an organization can be considered as a collection of physical resources, human resources and organizational resources (Barney, 1991; Amit and Shoemaker, 1993). Resources of organizations that are valuable, rare, imperfectly imitable and imperfectly substitutable are main source of sustainable competitive advantage for sustained superior performance (Barney, 1991).

Electronic copy available at: http://ssrn.com/abstract=1578704

Resource Based View (RBV) of Competitive Advantage: An Overview |

5 |

A resource must fulfill ‘VRIN’ criteria in order to provide competitive advantage and sustainable performance. A ‘VRIN’ criterion is explained below.

1.Valuable (V): Resources are valuable if it provides strategic value to the firm. Resources provide value if it helps firms in exploiting market opportunities or helps in reducing market threats. There is no advantage of possessing a resource if it does not add or enhance value of the firm;

2.Rare (R): Resources must be difficult to find among the existing and potential competitors of the firm. Hence resources must be rare or unique to offer competitive advantages. Resources that are possessed by a several firms in the market place cannot provide competitive advantage, as they cannot design and execute a unique business strategy in comparison with other competitors;

3.Imperfect Imitability (I): Imperfect imitability means making copy or imitate the resources will not be feasible. Bottlenecks for imperfect imitability can be many viz., difficulties in acquiring resource, ambiguous relationship between capability and competitive advantage or complexity of resources. Resources can be basis of sustained competitive advantage only if firms that do not hold these resources cannot acquire them;

4.Non-Substitutability (N): Non-substitutability of resources implies that resources can’t be substituted by another alternative resource. Here, competitor can’t achieve same performance by replacing resources with other alternative resources.

According to Barney valuable resource ‘must enable a firm to do things and behave in ways that lead to high sales, low costs, high margins, or in others ways add financial value to the firm’ (1986, 658). Barney also emphasized that ‘resources are valuable when they enable a firm to conceive of or implement strategies that improve its efficiency and effectiveness’ (1991, 105). RBV helps managers of firms to understand why competences can be perceived as a firms’ most important asset and, at the same time, to appreciate how those assets can be used to improve business performance. RBV of the firm accepts that attributes related to past experiences, organizational culture and competences are critical for the success of the firm (Campbell and Luchs, 1997; Hamel and Prahalad, 1996). Table 1 provides brief outline of prior work on RBV.

6 RESOURCE BASED VIEW: CONCEPTS AND PRACTICES

|

Table 1: Prior Work on the RBV |

||

|

Authors (year) |

Major Contribution |

|

|

|

|

|

|

Penrose (1959) |

Emphasizes the internal resources of a firm. A |

|

|

|

firm's growth is based on a firm's resources and |

|

|

|

limited by managerial resources |

|

|

|

|

|

|

Andrews (1971) |

Emphasizes management of internal resources |

|

|

|

|

|

|

Lippman and Rumelt (1982) |

Sustained competitive advantage results from rich |

|

|

|

connections between uniqueness and causal |

|

|

|

ambiguity |

|

|

|

|

|

|

Wernerfelt (1984) |

Firms as bundles of resources |

|

|

|

|

|

|

Rumelt (1984) |

Strategic theory of the firm based on the idea of |

|

|

|

firms as resource bundles |

|

|

|

|

|

|

Barney (1986) |

Characteristics of the factors market determine |

|

|

|

possibilities for a firm to earn rents |

|

|

|

|

|

|

Rumelt (1987) |

Firms as rent-seekers. The importance of isolating |

|

|

|

mechanisms to earn rents |

|

|

Rumelt (1987), Dierickx and Cool (1989) |

Summary article on imitability barriers (e.g., causal |

|

|

|

ambiguity and isolating mechanisms like asset |

|

|

|

interconnectedness, asset stock efficiencies, etc.) |

|

|

|

that impede (or make very costly) imitation from |

|

|

|

other competitors |

|

|

|

|

|

|

Day and Wensley (1988), Aaker (1989), |

Strategic formulation models that have firm |

|

|

Grant (1991), Wernerfelt (1989) |

resources as the central concept and as the sources |

|

|

|

of sustainable competitive advantage |

|

|

|

|

|

|

Prahalad and Hamel (1990) |

Core-competencies as the drivers of corporate |

|

|

|

strategy and diversification. Business should |

|

|

|

exploit and leverage core competencies. |

|

|

|

Corporations should diversify in related businesses |

|

|

|

which can make use and enhance the core |

|

|

|

competences of the organization |

|

Contd...

|

Resource Based View (RBV) of Competitive Advantage: An Overview |

7 |

||

|

|

|

|

|

|

Contd... |

|

|

|

|

Hansen and Wernerfelt (1989), |

Empirical studies that support the hypothesis that |

|

|

|

Rumelt (1991) |

firm-specific resources or organizational factors are |

|

|

|

|

more important than industry variables for |

||

|

|

explaining firm superior performance |

|

|

|

|

|

|

|

|

Barney (1991) |

Key strategic resources can be sources of strategic |

|

|

|

|

competitive advantage if they are scarce, difficult to |

|

|

|

|

imitate, non-substitutable, and valuable |

|

|

|

|

|

|

|

|

Conner (1991) |

Comparison of the resource based theory of the |

|

|

|

|

firm with other strategic approaches derived from |

|

|

|

|

economics. Clarification of assumptions of the |

|

|

|

|

resource based theory and its implication for rent |

|

|

|

|

earning strategies |

|

|

|

|

|

|

|

|

Peteraf (1993) |

An integrative resource based framework for |

|

|

|

|

strategic competitive advantage. Proposes that |

|

|

|

|

firms obtain superior performance, by earning rents |

|

|

|

|

from scarce and efficient resources and/or form |

|

|

|

|

market power in the product markets |

|

|

|

|

|

|

|

|

Day (1994) |

Capabilities framework of strategic competitive |

|

|

|

|

advantage. Distinguishes between outside-in, |

|

|

|

|

spanning and inside-out capabilities |

|

|

|

|

|

|

|

|

Collis and Montgomery (1995) |

Managerially-oriented review of the RBV |

|

|

|

Grant (1996) |

Knowledge based view develops considering |

|

|

|

|

knowledge as the key or strategic asset of firms |

|

|

|

|

|

|

|

|

Teece, Pisano, and Shuen (1997) |

Dynamic capabilities as sources of competitive |

|

|

|

|

advantage |

|

|

|

|

|

|

|

Adapted from Olavarrieta & Ellinger, 1997; Mahoney, 2004.

Resource Based View: Types of Resources and Capabilities

According to RBV, resources can be broadly defined to include assets, organizational processes, firm attributes, information, or knowledge controlled by the firm which can be used to conceive of and implement their strategies (Learned, Christensen, Andrews and Guth, 1969; Daft, 1983; Barney, 1991;

8 RESOURCE BASED VIEW: CONCEPTS AND PRACTICES

Mata et al., 1995). Examples of resources are brand names, technological abilities, efficient procedures, among others (Wernerfelt, 1984; Olavarrieta and Ellinger, 1997; Spanos and Lioukas, 2001). Other researchers have classified different resources as tangible and intangible (Itami and Roehl, 1987; Hall, 1992; Hall, 1993). When identifying resources, several researchers have grouped specific types of resources that may enable firms to conceive and implement value creating business strategies (e.g., Hitt and Ireland, 1985; Grant, 1991; Amit and Schoemaker, 1993; Black and Boal, 1994; Bogaert, Maertens and Van Cauwenbergh, 1994; Wade and Hulland, 2004).

Barney (1991) categorises three types of resources:

1.Physical capital resources (physical, technological, plant and equipment),

2.Human capital resources (training, experience, insights), and

3.Organizational capital resources (formal structure).

Brumagim (1994) presents a hierarchy of resources with four different levels of corporate resources;

1.Production/maintenance resources (considered the most basic or lowest level),

2.Administrative resources,

3.Organizational learning resources, and

4.Strategic vision resources (considered the most advanced or the highest level).

All firms possess a wide spectrum of resources and capabilities. For better understanding of resources it is necessary to distinguish such varied resources. One useful approach for such classification is to group resources in two categories viz., tangible resources and intangible resources (Table 2).

Identification of Resources and Capabilities for Sustainable Competitive Advantages

The RBV has been useful in identifying the basis by which the resources and capabilities of a firm serve as sources of sustained competitive advantage (e.g.,

|

|

Resource Based View (RBV) of Competitive Advantage: An Overview |

9 |

|||

|

|

|

|

|

|

|

|

|

Table 2: Types of Resources and Capabilities |

|

|

||

|

|

|

|

|

|

|

|

|

Tangible Resources and Capabilities |

Examples |

|

|

|

|

|

|

|

|

|

|

|

|

Financial |

– |

Ability to generate internal funds |

|

|

|

|

|

– Ability to raise external capital |

|

|

|

|

|

|

|

|

|

|

|

|

Physical |

– |

Location of plants, machines, offices, and their |

||

|

|

|

|

geographic locations |

|

|

|

|

|

– Access to raw materials and distribution channels |

|

|

|

|

|

|

|

|

||

|

|

Technological |

– |

Possession of patents, trademarks, copyrights, and |

||

|

|

|

|

trade secrets |

|

|

|

|

|

|

|

|

|

|

|

Organizational |

– |

Formal planning, command, and control Systems |

|

|

|

|

|

– |

Integrated management information systems |

|

|

|

|

Intangible resources and capabilities |

Examples |

|

|

|

|

|

|

|

|

|

|

|

|

Human |

– |

Managerial talents? |

|

|

|

|

|

– |

Organizational culture |

|

|

|

|

|

|

|

|

|

|

|

Innovation |

– |

Research and development (R & D) capabilities to |

||

|

|

|

|

innovate new product, process and services |

|

|

|

|

|

– Capacities for organizational innovation and change |

|||

|

|

|

|

|

||

|

|

Reputational |

– |

Perceptions of product quality, durability, and |

||

|

|

|

|

reliability among customers |

|

|

|

|

|

– |

Successful product branding and positioning with |

||

|

|

|

|

satisfied and loyal customer base |

|

|

|

|

|

– Reputation as a good employer |

|

|

|

|

|

|

– Reputation as a socially responsible corporate |

|||

|

|

|

|

citizen. |

|

|

Adapted from (1) J. Barney, 1991, Firm resources and sustained competitive advantage, Journal of Management, 17: 101; (2) R. Hall, 1992, The strategic analysis of intangible resources, Strategic Management Journal, 13: 135-144.

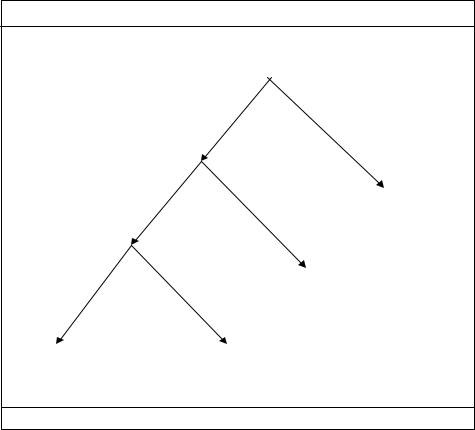

Wernerfelt, 1984; Barney, 1991; Peteraf, 1993). As such, resources and capabilities are fundamental underpinnings of any source of advantage (Rumelt, Schendel and Teece, 1991). Valuable resources are termed strategic assets (Barney, 1991; Amit and Schoemaker, 1993). The RBV asserts that ownership and control of strategic assets determines which organizations will earn superior profits and enjoy a position of competitive advantage over others. Three major questions are asked of resources to identify the impact they have:

10RESOURCE BASED VIEW: CONCEPTS AND PRACTICES

1.Is the resource or capability valuable?

2.Is it heterogeneously distributed across competing firms?

3.Is it imperfectly mobile?

As shown in Figure 1, it is only when the three questions are confirmed that a sustained competitive advantage is likely to be gained.

Figure 1: Identification of Resources and Capabilities

Is a resource or capability valuable?

|

|

|

|

|

Yes |

|

N o |

|

|

|

|

|

|

|

|

|

Is it heterogeneously |

|

|

|

|||

|

distributed across |

|

|

|

|||

|

competing firms? |

|

|

|

|||

|

|

|

|

|

|

||

|

|

Y e s |

|

|

N o |

Competitive |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Disadvantage |

Is it |

|

|

|

||||

imperfectly |

|

|

|

||||

mobile? |

|

|

|

||||

|

|

|

N o |

|

|

Competitive |

|

Yes |

|

|

|||||

|

|

|

|

|

Parity |

||

Sustained |

Temporary |

Competitive |

Competitive |

Advantage |

Advantage |

Adapted from Mata et al., 1995.

The question of a resource’s value is generally confirmed in two ways. First, if a resource is used to reduce a firm’s cost it can be seen as valuable (low cost resources). Second, if a resource is used to increase a firm’s revenue it can be seen as valuable (differentiated resources). As such, valuable resources may be used to implement new strategies to improve efficiency and effectiveness (Barney, 1991), improve customer satisfaction (Bogner and Thomas, 1994; Verdin and

Resource Based View (RBV) of Competitive Advantage: An Overview |

11 |

Williamson, 1994), or reduce cost (in relation to competitors) (Barney, 1986; Peteraf, 1993). In essence, a resource is valuable if it helps an organization to improve its performance relative to their competitors. If the resource meets these conditions the second question is examined. If not, and the resource is exploited, at worst, a competitive disadvantage may be gained – this is because the resource is not valuable to the organization.

The second question regarding the distribution of a resource examines whether the given valuable resource is freely available. If the resource is freely available to all firms, then a competitive parity may be gained, allowing the firm to have the same resources as its competitors. However, if it is not freely available (heterogeneously distributed), then the resource may be a source of competitive advantage (given the third question). While some firms may enjoy resource based advantages (due to their resource base) others will be in a position of resource based disadvantage (Michalisin et al., 1997). Put another way, the resource heterogeneity implies that firms have varying capabilities. Therefore, firms with marginal resources can expect to breakeven, while firms with superior resources should expect to earn rents (Peteraf, 1993). The differences in firm resource endowments can be attributed to several factors: the time the firm enters the marketplace, different sets of knowledge, products and systems of learning, as well as decisions made over time (Helfat, 2000).

The third and final question measures the degree of competitive advantage which may be gained from the given resource. This is achieved by questioning the mobility or inimitability of a resource. If the resource is perfectly mobile then the resource is likely to be only a source of temporary competitive advantage, at best (Mata et al., 1995). This temporary nature is attributed to the advantage because the resource could, due to its mobile nature, change hands. Michalisin et al., (1997) states that since a firm’s advantage is based on a firm having strategic assets that are superior to one’s competitors, therefore, the ability to sustain the advantage is a function of the heterogeneity of such resources.

Barney (1991) defines sustained competitive advantage as a non-duplicatable advantage. This follows from Lippman and Rumelt’s (1982) and Rumelt’s (1984) definitions that outline a sustained competitive advantage as an advantage that

12 RESOURCE BASED VIEW: CONCEPTS AND PRACTICES

continues to hold after efforts of others to duplicate the advantage have ceased (Barney, 1991). Barney’s (1991) definition of sustained competitive advantage does not mean it will last forever. Rather, it suggests that it will not be competed away or easily duplicated by the efforts of others (Barney, 1991). Barney states that sustained advantages may be challenged when unanticipated changes in the economic structure of an industry occur. Such unanticipated changes therefore, can make what was a source of sustained advantage no longer a source of advantage. Rumelt and Wensley (1981), and Barney (1997) call these unanticipated changes ‘Schumpeterian Shocks’. Therefore, a firm enjoying a sustained competitive advantage when faced with a Schumpeterian Shock may experience a major shift in the nature of competition and any sources of sustained competitive advantage may be nullified. A sustained competitive advantage may only be made when resources are strategic and valuable, are heterogeneously distributed and imperfectly mobile and firms should sustain the advantage notwithstanding periods of Schumpeterian Shock.

Resource Based View (RBV) Vs. Market Based View (MBV)

The resource based view (RBV) is a way of viewing the firm and consecutively of imminent strategy. The RBV was popularized by Hamel and Prahalad in their book Competing for the Future (1996). RBV considers the firm as a bundle of resources. These resources, and the way that they are combined, make firms different from one another and in turn allow a firm gain competitive advantage. This concept of RBV is quite different from the traditional Market Based View (MBV). According to MBV perspective, firms are considered as fairly homogenous and driving force for market competition is branding and positioning efforts of competing firms. Further, according to MBV, identifying alternative market as characterized by Michael Porter’s five forces model is major strategic issue. MBV does not take into account whether firm is in position to exploit available market opportunity i.e., whether firms have enough resource and capabilities to compete in the marketplace.

RBV in Changing Environment: Dynamic Capabilities

As market is dynamic, firm’s resources also need to change over a period of time to make them relevant to changing market condition. This perspective is based