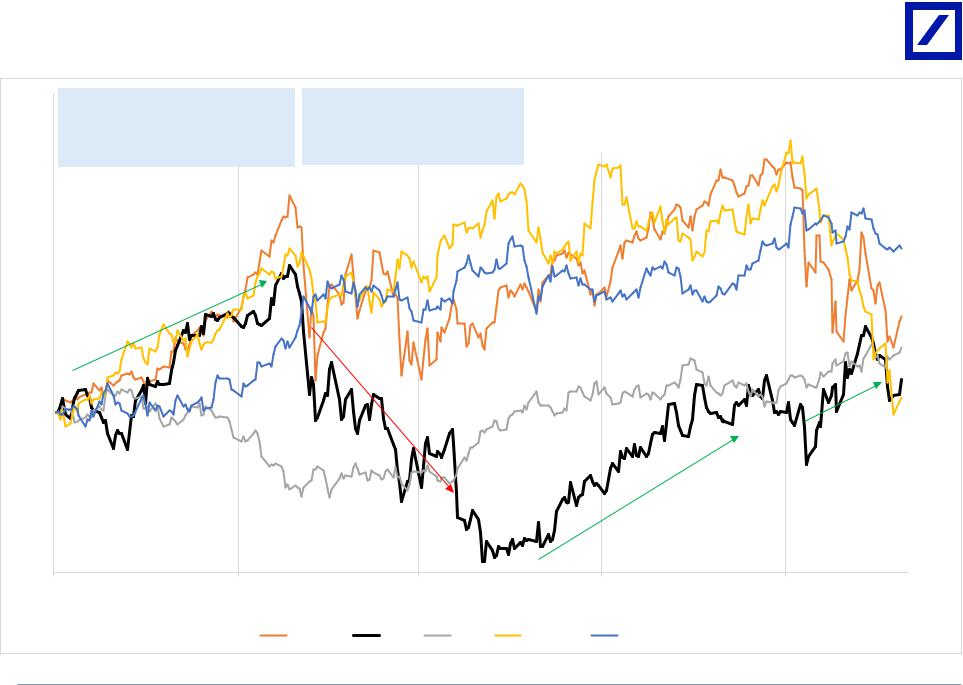

- •Looking back, 2018 has been a volatile year for the market and for CPG

- •Unprecedented strategic actions and external events have exacerbated this volatility

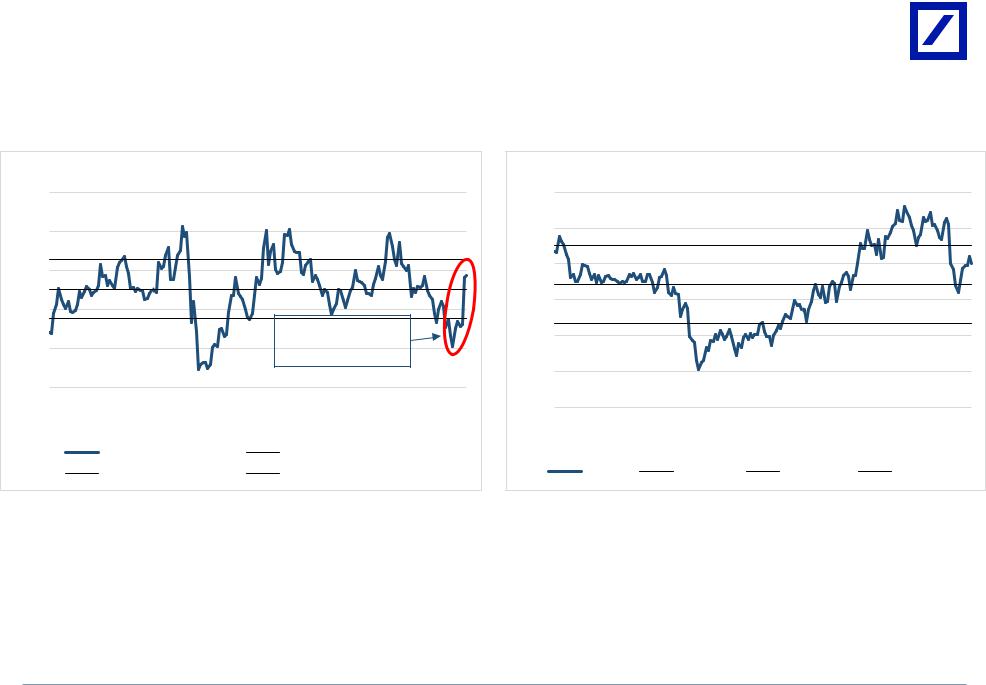

- •In general, relative CPG multiples have climbed sharply into year-end (given macro concerns, pricing optimism) after reaching their lowest point since 2009 in May 2018

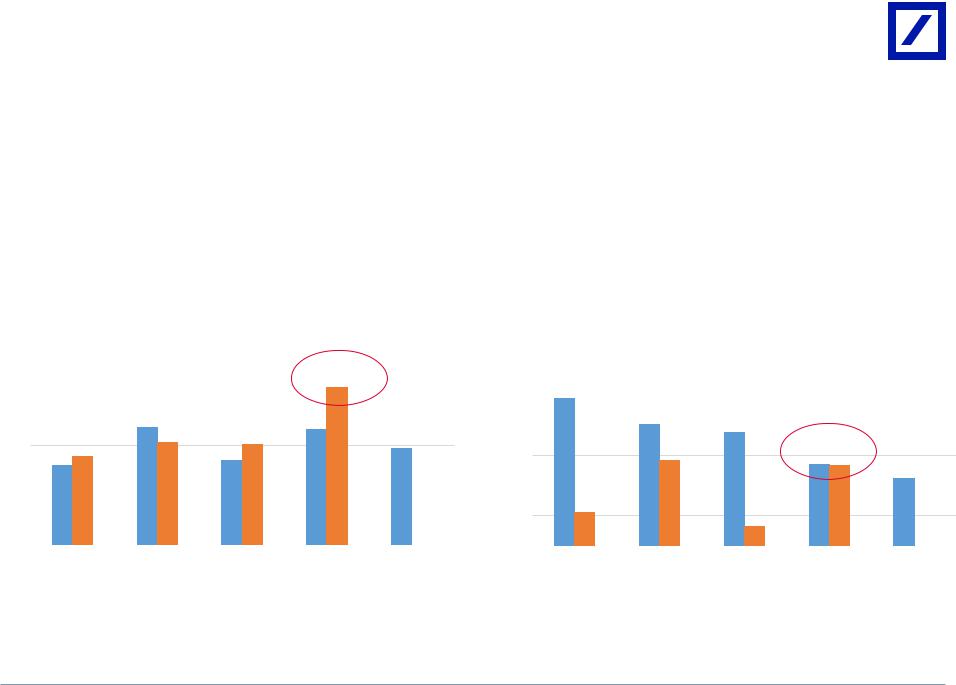

- •Improving organic growth trends (led by US strength, especially in HPC) have helped justify this recent CPG multiple expansion

- •While gross margins have continued to miss expectations, improving price (and more recently the decline in oil) have fuelled hope of stabilizing/expanding margins in 2019

- •Within HPC, Beverages & Tobacco, EPS estimates have broadly declined since February; however, stock performance has been more diverse

- •Especially most recently, leverage has become a burden

- •Mirroring the broader market, CPG “Growth” names have lost their luster

- •So, where do we go from here? Fundamentally, on top-line...

- •DB Beverages, Tobacco, and HPC Coverage

- •Consumer Staples one of the most expensive sectors on absolute and relative terms vs. history

2019 Set-up

vk.com/id446425943 |

|

|

|

|

Deutsche Bank |

|

|

|

|

Research |

|

|

|

|

Europe |

|

Industry |

|

Date |

|

|

|||

North America |

|

2019 Set-up |

|

28 November 2018 |

Global |

|

|

|

|

Consumer |

|

|

|

Industry Update |

Global Consumer |

|

|

|

|

Research |

|

|

|

|

|

|

|

|

|

Underappreciated Risks in the Risk-O

Trade

Amidst market volatility and an increasing bid for defensive names, we take a step back and look at what happened in 2018, as well as where we think the world of Staples may be headed in 2019. See enclosed a slide deck expanding upon our views.

While we understand the market's current defensive bias, we see it containing underappreciated risks

2018 has been a volatile and di cult-to-navigate year for CPG investors, with numerous corporate actions (accelerated M&A, multiple CEO changes, ongoing activism) combined with rapidly changing market leanings (from pro-growth optimism early in the year to fears of economic slowing more recently) making stock picking challenging. Most companies in our coverage have seen EPS/EBIT estimates revised downward since the start of the year, and yet certain stocks (e.g., CLX, CHD) have meaningfully outperformed and are up over 40% o of their intra-year lows. In fact, while HPC and Beverage stocks have performed roughly in line with the S&P 500 year-to-date, they have outperformed the market by roughly 15% over the past six months—almost entirely on the basis of multiple expansion. In general, as we show on Slide 8 of the enclosed deck:

■"Simple/clean" stories have disproportionately worked (e.g., KO, PG, CLX, CHD)

■"Growth" names, despite generally positive fundamentals, have struggled to gain traction given fears of future deceleration (e.g., EL, MNST, STZ, BF.B)

Steve Powers Research Analyst +212-250-5480

Faiza Alwy Research Analyst +1-212-250-7611

Christopher Barnes, CFA Research Associate +1-212-454-0778

Katy Ansel Research Associate +1-212-250-1027

■"Complicated" stories (especially those with elevated leverage or weak fundamentals) have definitively underperformed—being viewed more as "value traps" than "value opportunities" (e.g., TAP, MO, ENR, EPC, COTY, NWL, SPB)

At present, given the market's defensive bias, enthusiasm over better-than- expected top-line momentum coming out of CY3Q, and newfound optimism over future gross margin stability/expansion, Consumer Staples (especially HPC/ Beverages) has rapidly become one of the most expensive sectors in the market (see Figure 1 and Slide 21 in enclosed deck).

Looking forward to 2019, while we acknowledge the factors that have led us here, and while we remain cognizant of further potential downside to risk assets

Deutsche Bank Securities Inc. |

Distributed on: 28/11/2018 09:36:10 GMT |

Deutsche Bank does and seeks to do business with companies covered in its research reports. Thus, investors should be aware that the firm may have a conflict of interest that could a ect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. DISCLOSURES AND ANALYST CERTIFICATIONS ARE LOCATED IN APPENDIX 1. MCI (P) 091/04/2018.

7T2se3r0Ot6kwoPa

vk.com/id446425943

28 November 2018

Global Consumer Research 2019 Set-up

(and relative upside to Staples) should recession fears build, we remain more optimistic on the ability of global demand to persist, and thus more cautious on the ability of CPG stocks to over-deliver vs. expectations (particularly within HPC).

From here, we see four broad scenarios playing out for the sector (See Slide 16 in enclosed slide deck):

1.DB Base Case: Economic growth slows less than feared, while CPG fundamentals underwhelm relative to now-elevated expectations (we assign 50% probability)—In this scenario, the US/global economy proves more resilient than feared (perhaps aided by more nuanced/ more accommodating Fed Policy and/or a thawing of global trade and geopolitical tension1), while CPG fundamentals broadly fall short of expectations (e.g., stagnating or faltering organic growth, commodity re-inflation, unrealized pricing power vs. retailers/consumers, and/or FX pressure). In such a scenario, selective stock-picking will be paramount, with a slight bias from here towards "growth" over "safety" (see below).

2.Current Market Base Case: Economic growth slows (more or less in line with the market's current bias), CPG fundamentals hold up/ improve (25% probability)—In this scenario, perceived macro headwinds pressure economic growth (and with it more cyclical sectors), while CPG companies are able to outperform given more stable late-cycle fundamentals, aided additionally by recent pricing & cost deflation (helping to rebuild margins). In this scenario, CPG "growth" stocks would face more challenges, and the market's current leaning towards "safer" names (e.g., PG, CLX, CHD) may have more merit.

3.Recession Scenario: Recession fears build, defensive bid persists unabated (15% probability)—In this scenario, macro risks continue to stoke fears (e.g., trade wars, excessive interest rate hikes, Brexit, etc.), amplifying the market's desire to simply “de-risk” and pursue safety. While most bearish for the market at large (and growth-oriented stocks within our coverage), such a scenario might prove most bullish for CPG stocks broadly (on a relative, though likely not absolute basis).

4.Growth Scenario: Economic growth proves resilient, risk appetite fully reemerges (10% probability)—In this scenario, recent macro apprehensions prove merely a “correction” in an otherwise-sustained bull market. While CPG fundamentals would also likely benefit from such an outcome, core CPG assets would likely disproportionately underperform as the market "re-risks" in pursuit of growth (favoring, within our coverage, names like EL, and MNST).

Industry Valuation and Risks: For US HPC, Beverage, and Tobacco companies, we derive our price targets using a DCF methodology (7%-12% WACC, 0%-3% terminal growth). Upside risks include better-than-expected top-line growth, cost savings, M&A, or value-additive capital deployment. Downside risks include material changes in macroeconomic trends, interest rates, and/or credit conditions, increase competitive and promotional activity, and/or persistent commodity inflation

1Noting that comments made by Fed Chairman Powell later today and/or coming out of the G20 this weekend could be important in this context

Page 2 |

Deutsche Bank Securities Inc. |

vk.com/id446425943

28 November 2018

Global Consumer Research 2019 Set-up

Top Picks exiting 2018

Given the risk/reward distribution associated with the above scenario, we maintain our current positioning – biased slightly towards secular growth and quality over "safety," cyclicals, and self-help.

Top Core CPG Holdings: KO, IFF

■KO remains our top pick among core CPG, as we see KO's growth investments as well-placed, and the system's pricing power able to o set commodity inflation over time. See also "Marching Along" (10/30/18).

■While IFF remains to us a growth company (5%+ volume growth) — tied to the stable core of CPG where growth is scarce — driven by consumer tailwinds around health & wellness, convenience, and the increasing popularity of smaller local/regional brands, we see it as a core CPG holding likely to work in most macro scenarios. While there is much skepticism around the integration of Frutarom, we view IFF as hyperfocused on this and executing on a smooth transition. We still see upside potential to $200 over the next three years, and are encouraged by recent management commentary regarding early cross-selling wins.

Top Growth Picks: MNST, STZ, EL

■For MNST, we see outsized +HSD-DD top-line growth as sustainable in the near-term, margins well positioned to stabilize behind recent price increases, and recent market concerns over new competition (Bang, Coca-Cola Energy) as exaggerated—noting that (i) MNST's valuation compares favorably with many other CPG players o ering far less (and/or more expensive) growth, (ii) MNST itself is a likely buyer of its own stock, with current Board authorization of ~$700M in repurchases, and (iii) KO too could easily opt to increase its existing MNST stake (either as a matter of strategy, or tactically on any pullback that it sees as overdone).

■For STZ, while we acknowledge recent overhangs caused by an unexpected CEO change, insider selling, early fits and starts in Canada post recreational cannabis legalization, and fears over of a potential slowing in core Beer volume/profit growth, we see such concerns as more than priced in below $200. While STZ has perhaps become a "show me" stock again, we seek highly favorable risk/reward to the extent the company can simply deliver on its FY19 commitments and guide in line with FY20 Street expectations.

■For EL, it's still (nearly) all about China. However, following strong FY1Q results and seemingly conservative full-year guidance (i.e., guidance that already allows for China slowing), we now see EL as increasingly wellplaced to beat 2Q expectations and raise FY19 guidance alongside its results in February, or at its subsequent Investor Day on March 6.

Top Value Picks: MO, TAP

■While MO will likely face an enduring overhang given the FDA's recent e orts to eliminate menthol cigarettes from the market, we see underappreciated upside to the extent that either (i) announced e-vapor limitations spur a near-term lift in combustible volumes, (ii) e-vapor limitations ultimately expand and become more all-encompassing, (iii)

Deutsche Bank Securities Inc. |

Page 3 |

vk.com/id446425943

28 November 2018

Global Consumer Research 2019 Set-up

MO's pending IQOS PMTA/MRTP applications are approved and IQOS achieves commercial success, (iv) menthol/nicotine reduction regulation is prolonged or made less absolute, and/or (iv) MO is able to consolidate combustible share in a non-menthol world given Marlboro's leading non-menthol brand equity. We also see MO's dividend as safe (current dividend yield = 6%), its credit rating (A3/A-/A-) secure, and balance sheet as advantaged vs. peers (just over 1x net debt/EBITDA)—providing the company with strategic optionality with which to potentially diversify.

■While work remains to be done in the US, TAP has so far convincingly rea rmed its 2018 FCF guidance ($1.5B +/- 10%), and maintained its commitment to deleveraging to 3.75x by mid-FY19 (at which time it plans to reinstitute a dividend payout ratio target in the range of 20-25% of EBITDA)—each aided by accelerated cost savings likely to flow over the balance of 2018/19, and likely favorable STW vs. STR shipment timing in 1H19. Our $1.5 billion FY19 FCF estimate implies an ~11% FCF yield on today's market cap—compelling to the extent that such FCF remains a stable annuity stream into the future (as is our base case).

Maintain cautious stance of PEP and HPC names

We continue to remain more cautious on PEP (new CEO, lingering NAB investment needs) and core HPC names (e.g., PG, CL, and Sell-rated KMB, CLX, CHD). While recent top-line results have been solid (especially at PG, CLX, CHD) and incremental pricing/lower oil prices do raise prospects of margin stabilization/expansion in 2019, we (a) caution against extrapolating top-line strength indefinitely, (b) are mindful that other costs (e.g., pulp, natural gas) remain inflationary, with any outsized deflationary benefits likely to be ultimately returned to the consumer in the form of price rollbacks/promotions, and (c) note that recent stock performance already reflects a portion of these benefits— meaning that risks from here could easily skew to the downside (See slides 11-14 in enclosed slide deck).

Figure 1: CPG (especially HPC/Beverages) has rapidly become one of the most expensive sectors in the market

Sector/Subsector P/E (NTM) Multiples Relative to the S&P500

1.40x |

1.20x |

1.00x |

0.80x |

0.60x |

0.40x |

0.20x |

0.00x |

Current Sector/Subsector Relative P/E (NTM) vs. |

LTM Average |

15% |

10% |

5% |

0% |

(5%) |

(10%) |

(15%) |

(20%) |

(25%) |

Source: FactSet, Deutsche Bank analysis

Page 4 |

Deutsche Bank Securities Inc. |

vk.com/id446425943

Looking back, 2018 has been a volatile year for the market and for CPG

120% |

|

|

|

|

|

4Q17-Jan '18, false hope (?): |

Feb-May '18, fundamental/macro woes: |

Jun-Sep '18, flight to safety: |

160% |

||

|

|

Oct '18 onwards: building |

|||

|

• Companies seem to embrace new calls to |

• Rates & Oil continue higher, pressuring |

• Rates & Oil stall amidst trade disputes |

|

market apprehension |

|

action |

4Q17 /1Q18 margins |

• Management teams express confidence in pricing |

|

causes defensives to |

|

• Tax reform appears to provide EPS |

• Retailer pressure / cost inflation retake |

• 2Q18 results: stable fundamentals |

|

outperform |

|

lift/funding source |

mgmt/ investor focus |

|

|

|

|

|

|

|

115% |

|

|

|

|

145% |

110% |

|

|

|

|

130% |

105% |

|

|

|

|

115% |

100% |

|

|

|

|

100% |

95% |

|

|

|

|

85% |

90% |

|

|

|

|

70% |

Oct 17 |

Jan 18 |

|

Apr 18 |

Jul 18 |

Oct 18 |

|

S&P 500 |

CPG |

USD |

Oil (RHS) |

US 10-Yr (RHS) |

Source: FactSet, Deutsche Bank analysis |

Note: Indexed Price Change since 10/2/2017 |

Deutsche Bank |

Steve Powers | (+1) 212 250-5480 | stephen.powers@db.com |

|

Research |

Faiza Alwy | (+1) 212 250-7611 | faiza.alwy@db.com |

1 |

vk.com/id446425943

Unprecedented strategic actions and external events have exacerbated this volatility

Sell-side |

• BUFF sale to General Mills |

|

M&A |

• DPS sale to JAB |

|

|

||

Buy-side |

• ENR/SPB; STZ/WEED; PEP/SODA; |

|

M&A |

KO/Costa; KO/BODYARMOR; |

|

CLX/Nutranext; IFF/FRUT |

||

CEO |

• PEP; STZ; KMB; COTY; SPB; BFb; |

|

Changes |

COTT |

|

|

||

Tariffs |

• BFb; EL; NWL; SPB |

|

FDA |

• JUUL; Menthol cigarettes |

|

Actions |

||

|

||

Activism |

• PG; NWL |

Source: FactSet, Company filings, Deutsche Bank analysis

16-Jan |

Energizer acquisitions of Spectrum batteries |

|

|

29-Jan |

DPS acquisition by JAB/Keurig |

9-Feb |

Newell activism + subsequent divestitures |

|

|

23-Feb |

Acquisition of Blue Buffalo by General Mills |

12-Mar |

CLX acquisition of Nutranext |

|

|

24-Apr |

FDA Actions amidst the rise of JUUL |

26-Apr |

Spectrum Brands CEO replaced |

|

|

6-May |

IFF acquisition of Frutarom |

29-May |

Brown-Forman CEO transition |

|

|

1-Jul |

Retaliatory tariffs by EU, Mexico, China |

2-Aug |

COT CEO transition |

|

|

6-Aug |

PEP CEO transition |

14-Aug |

KO acquisition of BODYARMOR |

|

|

15-Aug |

STZ investment in WEED |

20-Aug |

PEP acquisition of SodaStream |

|

|

31-Aug |

KO acquisition of Costa Coffee |

12-Sep |

FDA calls youth vaping an epidemic |

|

|

17-Oct |

STZ CEO transition |

22-Oct |

KMB CEO transition |

|

|

12-Nov |

COTY CEO replaced |

15-Nov |

Energizer acquisition of Spectrum auto care |

|

|

15-Nov |

FDA announces intention to ban menthol cigarettes |

|

|

Deutsche Bank |

Steve Powers | (+1) 212 250-5480 | stephen.powers@db.com |

|

Research |

Faiza Alwy | (+1) 212 250-7611 | faiza.alwy@db.com |

2 |

vk.com/id446425943

In general, relative CPG multiples have climbed sharply into year-end (given macro concerns, pricing optimism) after reaching their lowest point since 2009 in May 2018

Consumer Staples vs. S&P500 - P/E (NTM)

1.40x |

|

|

|

|

|

|

|

1.30x |

|

|

|

|

|

|

|

1.20x |

|

|

|

|

|

|

|

1.10x |

|

|

|

|

|

|

|

|

|

|

|

|

Low point in relative |

|

|

1.00x |

|

|

|

|

valuation since 2009 |

|

|

0.90x |

|

|

|

|

|

|

|

Dec 03 |

Dec 05 |

Dec 07 |

Dec 09 |

Dec 11 |

Dec 13 |

Dec 15 |

Dec 17 |

|

SP477 relative to S&P500 |

|

15-yr Avg |

|

|

||

|

+1 STDEV |

|

|

-1 STDEV |

|

|

|

|

|

Consumer Staples - P/E (NTM) |

|

|

|||

22.0x |

|

|

|

|

|

|

|

20.0x |

|

|

|

|

|

|

|

18.0x |

|

|

|

|

|

|

|

16.0x |

|

|

|

|

|

|

|

14.0x |

|

|

|

|

|

|

|

12.0x |

|

|

|

|

|

|

|

10.0x |

|

|

|

|

|

|

|

Dec 03 |

Dec 05 |

Dec 07 |

Dec 09 |

Dec 11 |

Dec 13 |

Dec 15 |

Dec 17 |

|

SP477 |

|

15-yr Avg |

|

+1 STDEV |

|

-1 STDEV |

Through May 2018, cost inflation and a reluctance/inability to take pricing led to the erosion of the CPG valuation premium

But positive pricing commentary (in some categories) since and global growth fears have led to a rebound in CPG stock performance and relative CPG valuations

Source: FactSet, Deutsche Bank analysis

Deutsche Bank |

Steve Powers | (+1) 212 250-5480 | stephen.powers@db.com |

|

Research |

Faiza Alwy | (+1) 212 250-7611 | faiza.alwy@db.com |

3 |

vk.com/id446425943

Improving organic growth trends (led by US strength, especially in HPC) have helped justify this recent CPG multiple expansion

Relative to expectations, organic growth trends have improved since 1Q across Beverages and HPC, making it easier to stomach the elevated multiples at which CPG companies now trade

Easing retailer pressure, notably in the US, has ushered in new confidence and determination to take price to allay input inflation

|

Average Beverages Reported Organic Growth vs. Expectations |

|

|

|

|

Average HPC Reported Organic Growth vs. Expectations |

|

|

|||||||||||||

9.0% |

|

|

|

|

|

|

|

|

|

|

|

3.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

209 bps |

|

|

|

|

|

|

|

|

|

|

|

|||

8.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.0% |

|

|

|

|

|

|

|

|

|

|

|

2.0% |

|

|

|

|

|

|

|

|

|

46 bps |

-73 bps |

77 bps |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

5.0% |

|

|

|

|

|

|

-59 bps |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

1.5% |

|

-2 bps |

|

|

|||||||

4.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.0% |

|

|

|

|

|

|

|

|

|

|

|

1.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-190 bps |

|

|

|

|

|

|

|

|

|||

2.0% |

|

|

|

|

|

|

|

|

|

|

|

0.5% |

|

|

-157 bps |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

1.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.0% |

|

|

|

|

|

|

|

|

|

|

|

0.0% |

|

|

|

|

|

|

|

|

|

4Q17 |

1Q18 |

2Q18 |

3Q18 |

4Q18E |

|

4Q17 |

1Q18 |

2Q18 |

3Q18 |

4Q18E |

|

||||||||||

|

|

|

|

|

|||||||||||||||||

|

|

|

|

Consensus |

|

Actual |

|

|

|

|

|

|

|

|

Consensus |

|

Actual |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: FactSet, Company filings, Deutsche Bank analysis. Beverages includes CCEP, KO, MNST, PEP, STZ, and TAP. HPC includes CHD, CL, CLX, EPC, KMB, and PG.

Deutsche Bank |

Steve Powers | (+1) 212 250-5480 | stephen.powers@db.com |

|

Research |

Faiza Alwy | (+1) 212 250-7611 | faiza.alwy@db.com |

4 |