GS Europe Banks_watermark

.pdf

vk.com/id446425943

16 November 2018 | 12:14AM GMT

Europe Banks

“Brexit disagreement” hits UK bank shares, but systemic risk low

An (reasonably) orderly sell-off of UK banks

The domestic UK banks sold off sharply yesterday

(November 15), falling by ~7% on average, as the fallout

from “Brexit disagreement” continued. In comparison to the

first trading day following the Brexit referendum, the sell-off

is (i) less pronounced (down 5-10% vs 20%) and (ii) limited

to UK (and heavily UK exposed) banks. In contrast, European

banks were broadly unchanged.

Liquidity risk indicators stable ...

For the current situation to deteriorate sharply, we believe

equity market nervousness would need to spread to funding

markets. Thus far there appears no evidence of this:

short-term GBP funding showed limited strain, as 3m GBP

LIBOR remains stable, ~10 bp above 3m GBP OIS vs the

Feb-12 peak of 60 bp and 25bp post Brexit vote. Similarly,

US$/GBP xccy basis swap is flat vs a 20bp increase post

Brexit vote.

... and backstops are in place

Even in the event where the (currently stable) situation in

bank funding markets deteriorates sharply, we note that

today: (1) banks are stronger; (2) the “crisis backstops” – put in place to deal with the 2008/9 financial crisis and the € sovereign crisis – remain in place, and finally (3) at extremis, the Bank of England could choose to offer additional liquidity (as following the Brexit vote), based on banks’ sizeable pools of collateral pre-cleared with the BoE. Combined, the overall picture is reassuring, in our view.

Mid-term revenue and profitability risks for UK banks rise

Our economists argue (here) that the political reaction to

the Withdrawal Agreement has increased the risk of a

disorderly Brexit. The next key hurdle is the ratification of

the Withdrawal agreement by the House of Commons. If

voted down, our economists believe this could lead to (i) a

subsequent attempt to pass an amended Withdrawal

agreement, (ii) a second referendum, or (iii) a “no deal” cliff

edge departure. For UK exposed banks, we view this as a

clearly incremental negative, as it can affect the outlook

through volumes, margins and credit losses. Our

Conviction List is positioned for this - our sole “UK bank”

on the CL is STAN (Buy), alongside 4 eurozone banks. We

are Sell rated on Lloyds.

Jernej Omahen

+44(20)7774-6324 | jernej.omahen@gs.com Goldman Sachs International

Martin Leitgeb, CFA

+44(20)7552-1406 | martin.leitgeb@gs.com Goldman Sachs International

Markus Pops

+44(20)7774-1771 | markus.pops@gs.com Goldman Sachs International

Marco Di Matteo

+44(20)7552-9363 | marco.dimatteo@gs.com Goldman Sachs International

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S.

vk.com/id446425943

Goldman Sachs

Europe Banks

(1) Money markets: Limited evidence of funding strain in €, US$ or £

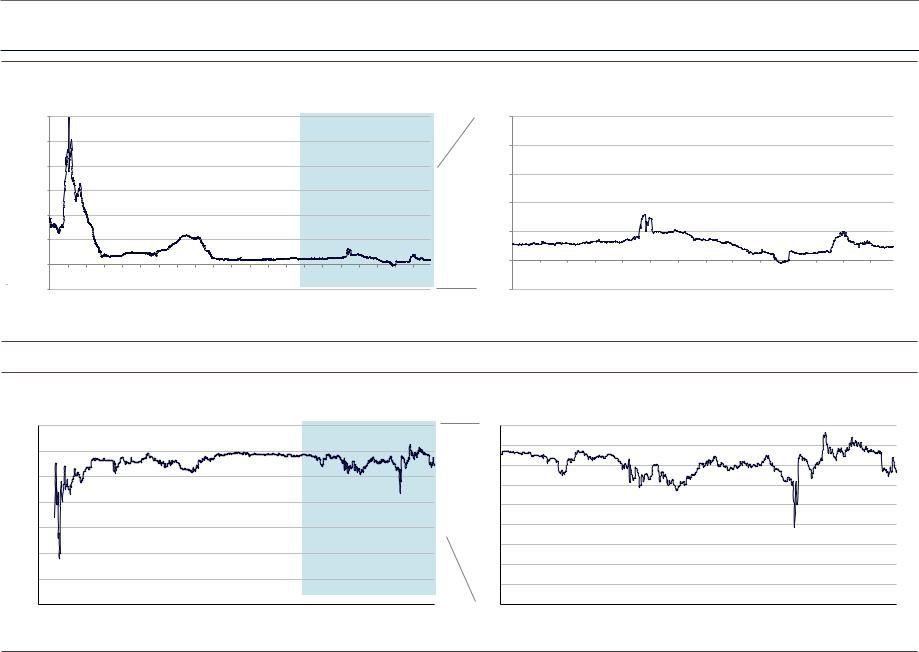

Exhibit 1: GBP risk remains well below previous crisis levels…

3-month GBP LIBOR – 3-month GBP OIS

3.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-0.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

08 May |

08 Nov |

09 May |

09 Nov |

10 May |

10 Nov |

11 May |

11 Nov |

12 May |

12 Nov |

13 May |

13 Nov |

14 May |

14 Nov |

15 May |

15 Nov |

16 May |

16 Nov |

17 May |

17 Nov |

18 May |

1.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

0.80% |

|

|

|

|

|

|

|

|

|

|

|

|

|

0.60% |

|

|

|

|

|

|

|

|

|

|

|

|

|

0.40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

0.20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

0.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

-0.20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

15 May |

15 Aug |

15 Nov |

16 Feb |

16 May |

16 Aug |

16 Nov |

17 Feb |

17 May |

17 Aug |

17 Nov |

18 Feb |

18 May |

18 Aug |

Source: Datastream

Exhibit 2: … with no pressure implied by the $/£ cross-currency swap

US$/£ cross-currency swap (3 months), bp

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-160 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

08-May |

08-Nov |

09-May |

09-Nov |

10-May |

10-Nov |

11-May |

11-Nov |

12-May |

12-Nov |

13-May |

13-Nov |

14-May |

14-Nov |

15-May |

15-Nov |

16-May |

16-Nov |

17-May |

17-Nov |

18-May |

18-Nov |

15-May |

15-Aug |

15-Nov |

16-Feb |

16-May |

16-Aug |

16-Nov |

17-Feb |

17-May |

17-Aug |

17-Nov |

18-Feb |

18-May |

18-Aug |

18-Nov |

Source: SecDv

16 November 2018 |

2 |

vk.com/id446425943

Goldman Sachs

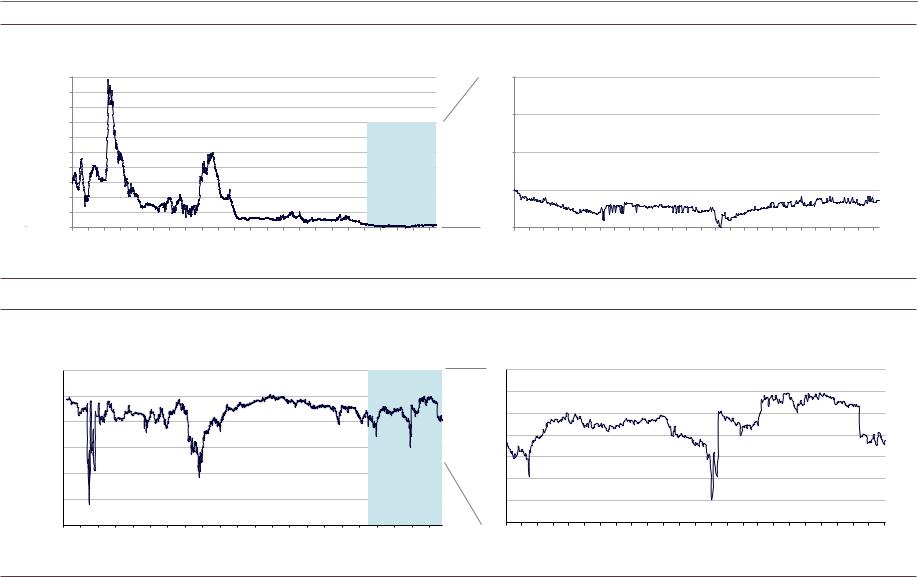

Exhibit 3: Euribor - OIS spread remains at historical lows...

3-month EURIBOR - 3-month OIS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.0% |

Mar 08 |

|

Mar 09 |

|

Mar 10 |

|

Mar 11 |

|

Mar 12 |

|

Mar 13 |

|

Mar 14 |

|

Mar 15 |

|

Mar 16 |

|

Mar 17 |

|

Mar 18 |

|

Sep 07 |

Sep 08 |

Sep 09 |

Sep 10 |

Sep 11 |

Sep 12 |

Sep 13 |

Sep 14 |

Sep 15 |

Sep 16 |

Sep 17 |

Sep 18 |

|||||||||||

Source: Datastream

Exhibit 4: EUR/US$ x-ccy basis swaps have seen an uptick, though far from crisis levels

US$/€ cross-currency swap (3-months), bp

50

0

-50

-100

-150

-200

-250

Jan-08 |

Jul-08 |

Jan-09 |

Jul-09 |

Jan-10 |

Jul-10 |

Jan-11 |

Jul-11 |

Jan-12 |

Jul-12 |

Jan-13 |

Jul-13 |

Jan-14 |

Jul-14 |

Jan-15 |

Jul-15 |

Jan-16 |

Jul-16 |

Jan-17 |

Jul-17 |

Jan-18 |

Jul-18 |

Source: Bloomberg

Europe Banks

0.20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.15% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.05% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.00% |

Nov 16 |

Dec 16 |

Jan 17 |

Feb 17 |

Mar 17 |

Apr 17 |

May 17 |

Jun 17 |

|

Aug 17 |

Sep 17 |

|

Nov 17 |

Dec 17 |

Jan 18 |

Feb 18 |

Mar 18 |

Apr 18 |

May 18 |

Jun 18 |

|

Aug 18 |

Sep 18 |

|

Nov 18 |

Oct 16 |

Jul 17 |

Oct 17 |

Jul 18 |

Oct 18 |

20

0

-20

-40

-60

-80

-100

-120

Nov-16 |

Dec-16 |

Jan-17 |

Feb-17 Mar-17 |

Apr-17 |

May-17 |

Jun-17 |

Jul-17 |

Aug-17 |

Sep-17 Oct-17 |

Nov-17 |

Dec-17 |

Jan-18 |

Feb-18 Mar-18 |

Apr-18 |

May-18 |

Jun-18 |

Jul-18 |

Aug-18 |

Sep-18 |

Oct-18 |

Nov-18 |

16 November 2018 |

3 |

vk.com/id446425943

Goldman Sachs

(2) UK backstops: Ample Bank of England facilities available

Europe Banks

An important element guaranteeing stability are the central bank backstops.The Bank of England created a set of facilities at the height of the financial crisis to provide ample liquidity to the UK banking system.The currently available facilities comprise regular market operations (OSF, DWF, ILTR) as well as non-standard measures such as US$ repo, contingent term repo facility and emergency liquidity assistance. Around the Brexit referendum, it has broadened its offering, by (i) increasing the frequency of its ILTR facility (from monthly to weekly) and (ii) launching the term funding scheme, under which banks borrowed over £120bn on a four year term.

In a first reaction to the outcome of the referendum on Britain’s EU membership, BoE governor Mark Carney highlighted that “as a backstop, and to support the functioning of markets, the Bank of England stands ready to provide more than £250 bn of additional funds through its normal facilities”.This figure relates to pre-positioned collateral (net of applicable haircuts) that major banks have with the Bank of England.

So far, the Bank of England has not reiterated this comment; however, we note that in essence the same facilities remain in place and available.

Exhibit 5: The BoE has in the past extended significant liquidity support to the banking system through both regular operations...

Total amounts outstanding of index-linked term repos (ILTRs, £ bn)

£200 bn

£160 bn

£120 bn

£80 bn

£40 bn

£0 bn

Exhibit 6: ...and other non-standard measures

Total amounts outstanding of Contingent Term Repo Facility (CTRF), US$ Repo facility and Emergency Liquidity Assistance (ELA) - £ bn

£80 bn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£60 bn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£40 bn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£20 bn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£0 bn |

Dec-06 |

|

Dec-07 |

|

Dec-08 |

|

Dec-09 |

|

Dec-10 |

|

Dec-11 |

|

Dec-12 |

|

Dec-13 |

|

Dec-14 |

|

Dec-15 |

|

Dec-16 |

|

Dec-17 |

|

Jun-06 |

Jun-07 |

Jun-08 |

Jun-09 |

Jun-10 |

Jun-11 |

Jun-12 |

Jun-13 |

Jun-14 |

Jun-15 |

Jun-16 |

Jun-17 |

Jun-18 |

Source: Bank of England, Goldman Sachs Global Investment Research |

Source: Bank of England, Goldman Sachs Global Investment Research |

16 November 2018 |

4 |

vk.com/id446425943

Goldman Sachs

Europe Banks

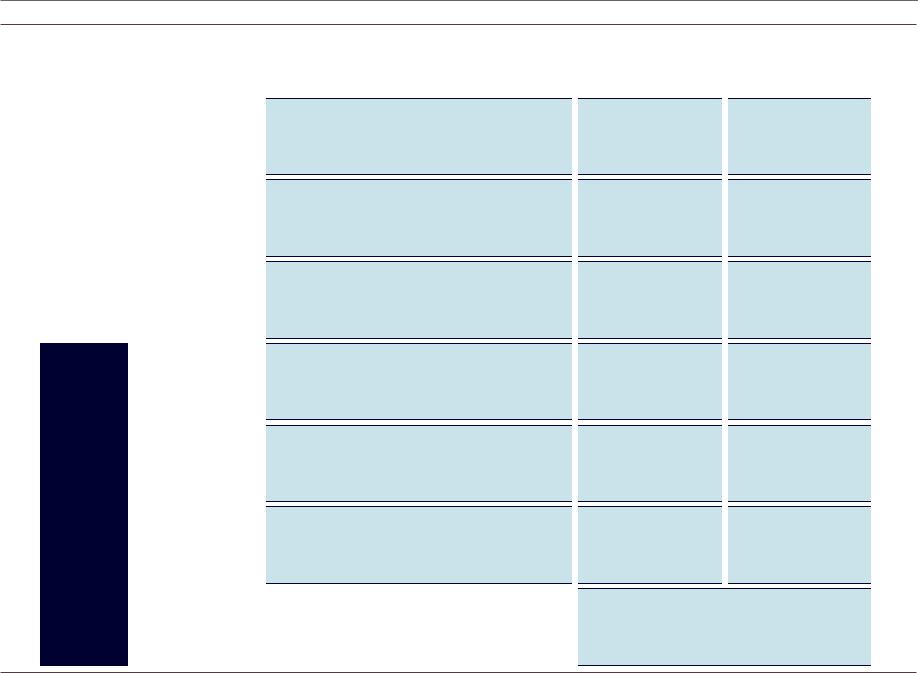

Exhibit 7: A number of Bank of England liquidity facilities are in place in case market liquidity were to dry up

Bank of England open market operations, including marginal rate and frequency

%

rate

|

|

OSF |

|

Operational |

|

|

|

Standing |

|

|

|

|

|

Facilities |

Regular Open |

|

|

|

|

|

|

|

|

|

|

|

|

Discount |

|

Market |

|

DWF |

|

Window |

Operations |

|

|

|

Facility |

|

|

|

|

|

|

|

|

|

|

|

|

ILTRs |

|

Indexed |

|

|

|

Long-term |

|

|

|

|

|

Repo |

|

|

|

|

|

|

|

|

|

|

|

|

US$ Repo |

|

US Dollar |

|

|

|

Repo |

|

|

|

|

|

Operations |

|

|

|

|

|

|

|

|

|

|

|

|

CTRF |

|

Contingent |

|

|

|

Term Repo |

|

|

|

|

|

Facility |

Non-Standard |

|

|

|

|

Policy |

|

|

|

|

|

|

|

||

Measures |

|

|

|

|

|

|

TFS |

|

Term |

|

|

|

Funding |

|

|

|

|

|

Scheme |

|

|

|

|

|

Overnight liquidity operations in £

1-month liquidity operations in £

6-month liquidity operations in £

1-week liquidity operations in US$

Contingency liquidity operations activated in response to exceptional (actual or prospective) market-wide stress

4 year term funding to support pass through of the BoE base rate cut

100 bps

Up to 5% of eligible liabilities (higher thereafter):

25 - 75 bps (Collateral-dependent)

Auction-determined and

collateral dependent

Applicable rate announced by the Bank prior to each auction

Auction determined spread over Bank Rate

Base rate + 0 - 25bps depending on net lending

Frequency

On demand

On demand

Monthly

Weekly

Triggered by the Bank

Closed February 2018

ELA |

|

Emergency |

|

Liquidity support operations outside the Bank’s published |

|

Liquidity |

|

framework. Provided when authorised or directed by HM Treasury |

|

|

|

Assistance |

|

to firms that are at risk, but are judged to be solvent. |

|

|

|

|

|

ELA terms are not established in advance; determined to meet the particular circumstances for which it is being used.

Source: Bank of England

16 November 2018 |

5 |

vk.com/id446425943

Goldman Sachs

Operational Standing Facilities (OSF)

Europe Banks

nPurpose: The OSFs have two roles: (i) providing an arbitrage mechanism to prevent money market rates moving far away from the Bank Rate and (ii) providing a means for firms to manage unexpected payment shocks (arising due to technical problems either in their own systems or market-wide infrastructure).

nEligible Participants: Banks, building societies, broker-dealers and central counterparties.

nEligible Collateral: Level A.

nOperation: The operational standing lending facility allows participating institutions to borrow reserves directly from the Bank on a bilateral basis throughout each business day.

nMaturity: The operational standing lending facility is an overnight lending transaction.

nFees: Institutions borrowing from the lending facility are currently required to pay a 25 bp premium over Bank Rate.

nDisclosure: The average daily amount outstanding in the OSFs during each maintenance period (typically 1 month) is published on the third Wednesday of the following maintenance period.

Discount Window Facility (DWF)

nPurpose: The DWF is aimed at institutions experiencing a firm-specific or market-wide shock.

nEligible Participants: Banks, building societies, broker-dealers and central counterparties.

nEligible Collateral: Level A, Level B and Level C (banks, building societies and broker dealers only).

nOperation: The DWF is a bilateral on-demand facility that allows institutions to borrow gilts in return for less liquid collateral in potentially large size and for a variable term, thereby allowing participants to perform a liquidity upgrade of their collateral. Participants can then raise cash by lending the gilts in the market (or by using them as collateral in the ILTR). If government bond repo markets fail to function properly, the Bank may lend (sterling) cash instead of gilts.

nMaturity: 30 days for banks, building societies and broker-dealers, 5 days for central counterparties. All drawings are repayable at any point and participants can apply to roll drawings in order to fulfill longer temporary liquidity needs.

nFees: Fees are fixed for drawings up to 5% of a firm’s eligible liabilities and are dependent on the collateral used: Level A

– 25 bp, Level B – 50 bp, Level C – 75 bp. The average cost of borrowing between 5% and 15% of eligible liabilities rises thereafter.

nDisclosure: DWF usage is disclosed averaged across counterparties and over a calendar quarter. The data is released with a significant lag in order to ensure that any drawing should have ended before data on it are published: data on the

16 November 2018 |

6 |

vk.com/id446425943 |

Europe Banks |

|

Goldman Sachs |

||

|

|

average amount lent during each calendar quarter are published on the first Tuesday following the final working day of the |

|

|

calendar quarter five quarters ahead. |

Indexed Long-Term Repo (ILTR)

nPurpose: The Bank’s market-wide ILTR operations are aimed at institutions with a predictable need for liquid assets.

nEligible Participants: Banks, building societies and broker-dealers.

nEligible Collateral: Level A, Level B and Level C.

nOperation: ILTR operations are conducted through an auction process, whereby participants bid for a nominal amount with a spread to Bank Rate against a specific collateral set. There is no restriction on the aggregate value of bids that can be submitted. In terms of the supply of funds, the Bank is able to increase the amount of funds available if the pattern of bids observed in the auction suggests greater demand.

nMaturity: ILTR funds typically have a 6-month maturity.

nFees: ILTR auctions use a ‘uniform price’ format, where every successful bidder pays the ‘clearing spread’ for borrowing against a specific collateral set.

nDisclosure: The Bank publishes the aggregate amount of funds allocated under any ILTR operation later the same day.

US$ Repo Operations

nPurpose: The Bank’s US dollar repo operations were originally introduced in co-ordination with other central banks in September 2008, in order to provide short-term US dollar liquidity at a time of elevated pressures in US dollar short-term funding markets. These operations are facilitated by a reciprocal swap agreement the Bank has with the Federal Reserve.

nEligible Participants: Banks, building societies and broker-dealers.

nEligible Collateral: Level A, Level B and Level C.

nOperation: The Bank announces the rate applicable for any US$ repo operation before inviting bids from participants. There is no maximum bid size and no limit on the amount of US$ repo funding that is provided.

nMaturity: US$ repo operations are for a 1-week fixed term.

nFees: The applicable rate for any US$ repo operation is set by the Bank prior to the operation.

nDisclosure: The Bank publishes the results of US$ repo operations later the same day.

ContingentTerm Repo Facility (CTRF)

16 November 2018 |

7 |

vk.com/id446425943

Goldman Sachs

Europe Banks

nPurpose: The CTRF allows the Bank to provide flexible liquidity in response to actual or prospective market-wide stress of an exceptional nature.

nEligible Participants: Banks, building societies and broker-dealers.

nEligible Collateral: Level A, Level B and Level C.

nOperation: The CTRF uses a similar auction process to the ILTR, with participants bidding for a nominal amount with a spread to Bank Rate.

nMaturity: The precise term(s) of CTRF funds offered is at the discretion of the Bank when it decides to conduct a CTRF operation.

nFees: Again, as in the case of ILTR auctions, the CTRF uses a ‘uniform price’ format, where every successful bidder pays the ‘clearing spread’.

nDisclosure: The Bank publishes the aggregate amount of funds allocated under any CTRF operation later the same day.

Emergency Liquidity Assistance (ELA)

During the 2008 crisis, the Bank of England provided a significant amount of liquidity support covertly to both HBOS and RBS. As pointed out in Ian Plenderleith’s ‘Review of the Bank of England’s provision of Emergency Liquidity Assistance in 2008-09’, the evolution of the bank’s sterling monetary framework (in particular the DWF) means that there is now a much reduced space in which ELA might be needed (however such situations do still exist).

nPurpose: The purpose of ELA is to provide liquidity support for a short period of time to systemic institutions that are judged to be fundamentally solvent and have a credible path to exit from such measures (i.e. repay the ELA).

nEligible Participants: Banks, building societies and broker-dealers that are judged to be systemic, solvent and have a credible path to exit ELA support.

nEligible Collateral: By the nature of ELA support, collateral used is likely to be outside of the standard sets of eligible collateral available for the other operations (in particular the DWF). An example is the use of unsecuritised loans as collateral for ELA in 2008, when they were not accepted for the Bank’s other market operations.

nOperation: The decision as to whether to extend ELA and the manner in which this is done will be ultimately decided by the Bank of England and the Treasury, following bilateral discussions with the institution(s) concerned.

nMaturity: Again this will depend on the precise circumstances of ELA support. In 2008, the sterling ELA facilities had terms of one month, but were renewable on a rolling 14-day basis.

16 November 2018 |

8 |

vk.com/id446425943 |

Europe Banks |

|

Goldman Sachs |

||

|

|

n Fees: The fee charged will vary depending on the particular circumstances of ELA support. In general, it should be high |

|

|

(in order to minimise moral hazard), but not so high as to accentuate the pressures that ELA seeks to alleviate. In the |

|

|

case of HBOS and RBS the fee was 200 bp. |

|

|

n Disclosure: In 2008, the provision of ELA support was not disclosed until many months later. Disclosure concerns are |

|

|

likely to be dependent on the particular environment in which ELA may be extended, with a key concern being that any |

|

|

market stress the institution faces is not exacerbated by the disclosure of ELA support. |

16 November 2018 |

9 |

vk.com/id446425943

Goldman Sachs

Europe Banks

(3) ECB (or €) backstops: Ample funding, full allotment / fixed rate in regular intervals

The financial market tensions that Euro area banks experienced since 2007 called for exceptional actions by the ECB regarding liquidity provisions. Regular market operations (1-week MRO and 3-month LTRO) have been complemented by non-standard monetary policy measures, including 3-year LTRO (now expired), US$ MRO and two series of TLTROS (targeted LTROs) aimed at improving bank lending. Ultimately, national central banks can extend emergency liquidity assistance to solvent financial institutions.

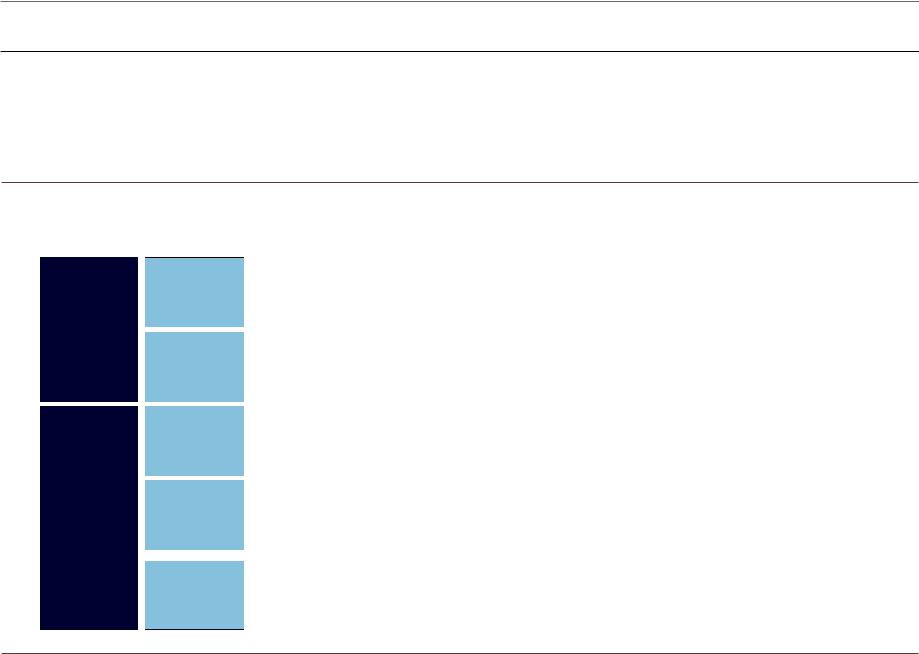

Exhibit 8: ECB regular market operations have been complemented by non-standard policy measures in recent years

Eurosystem open market operations, including marginal rate and allotted amount

Regular Open

Market

Operations

Non-Standard

Monetary Policy

Measures

MRO

LTRO

$ MRO

TLTRO II (targeted)

ELA

|

% |

|

|

Allotted |

|

|

|

rate |

Amount |

||

|

|

|

|

|

|

1-week liquidity operations in € |

|

0 bps |

|

|

€ 6.7 bn |

|

|

|

|

|

|

|

|

|

|

|

|

3-months liquidity operations in € |

|

0 bps |

|

|

€ 4.2 bn |

|

|

|

|

|

|

|

|

|

|

|

|

1-week liquidity operations in US$ |

|

271 bps |

|

|

$ 0.06 bn |

|

|

|

|

|

|

|

|

|

|

|

|

Series of targeted longer-term refinancing operations (TLTROs) of 4 years |

|

-40 - 0 bps |

|

|

|

aimed at improving banks lending to the Euro area non-financial private sector, |

|

|

|

€ 724 bn |

|

excluding retail mortgage lending. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision of central bank credit by Eurosystem national central bank (NCB) to a |

|

Not disclosed |

|

||

solvent financial institution that is facing temporary liquidity problems. Extension |

|

|

|||

of ELA liquidity may be subject to the ECB’s approval. |

|

|

|

|

|

|

|

|

|

|

|

TLTRO 2 auctions have ended, maturities until 2021

Source: ECB

16 November 2018 |

<0 |