JPM European Media Internet 2019 Outlook_watermark

.pdf

vk.com/id446425943 |

Europe Equity Research |

|

10 December 2018 |

Corrected Note (See page 81 for details)

European Media & Internet

2019 Outlook: Safety first in turbulent times

Over the past year the JPM Media & Internet universe (-2%) outperformed the market (-10%) with a re-rating of quality growth more than offsetting downgrades & de-rating of value & lower quality cyclical names. We assume a macro slowdown in 2019 & expect European ad growth to slow from 2.6% to 1.8%. Our stock selection draws heavily on MediaScreen. We are currently in the “slowdown” of the investment cycle but could move to “contraction” in the coming weeks - we favour stocks that rank well across both phases. Key picks: RELX, VIV, eOne, & INF (OW from N). Key UWs: AutoTrader, RMV & Mset (UW from N). We also d/g RTL & TL5 to Neutral. See pg 15.

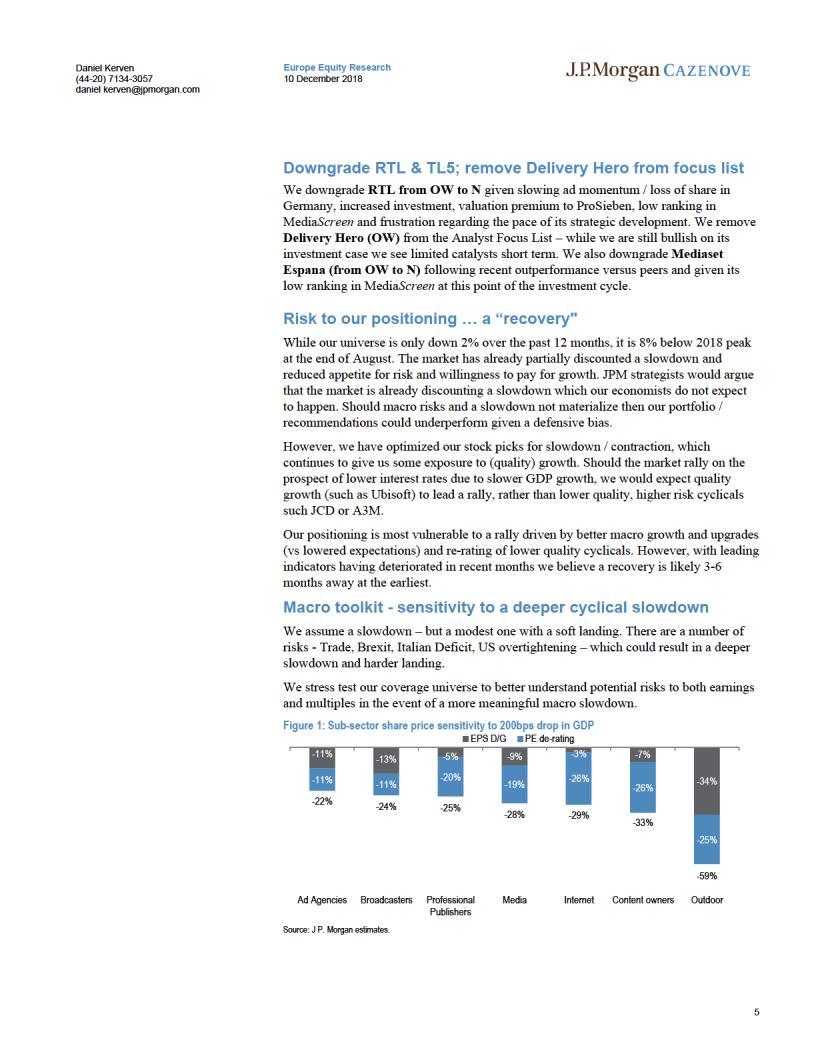

Macro slowdown with soft landing: While our economists expect robust growth they suggest risks are to the downside. Given a deteriorating OECD lead indicator we assume c.0.5% slower economic growth in 2019 / 20 & standardize our forecasts around this assumption. See pg 26.

MediaScreen is our quant overlay that tailors the JPM style framework to the media sector. We believe it is a powerful tool to aid stock selection (L/S portfolio +38% in ‘18). Our key picks (pg 15) are drawn from stocks that rank well in the “slowdown” & “contraction” with a bias to large cap, low risk names that offer defensive, quality growth at a reasonable price. Pg 12.

Where can we be wrong … a recovery: The market has already partially discounted a macro slowdown & a reduced appetite for growth / risk. Should a slowdown not materialise then our portfolio would underperform given our defensive bias and upgrades / re-rating of lower quality, higher risk cyclical stocks. We should remain well positioned for a rally driven by lower bond yields given our preference for quality growth. See pg 5.

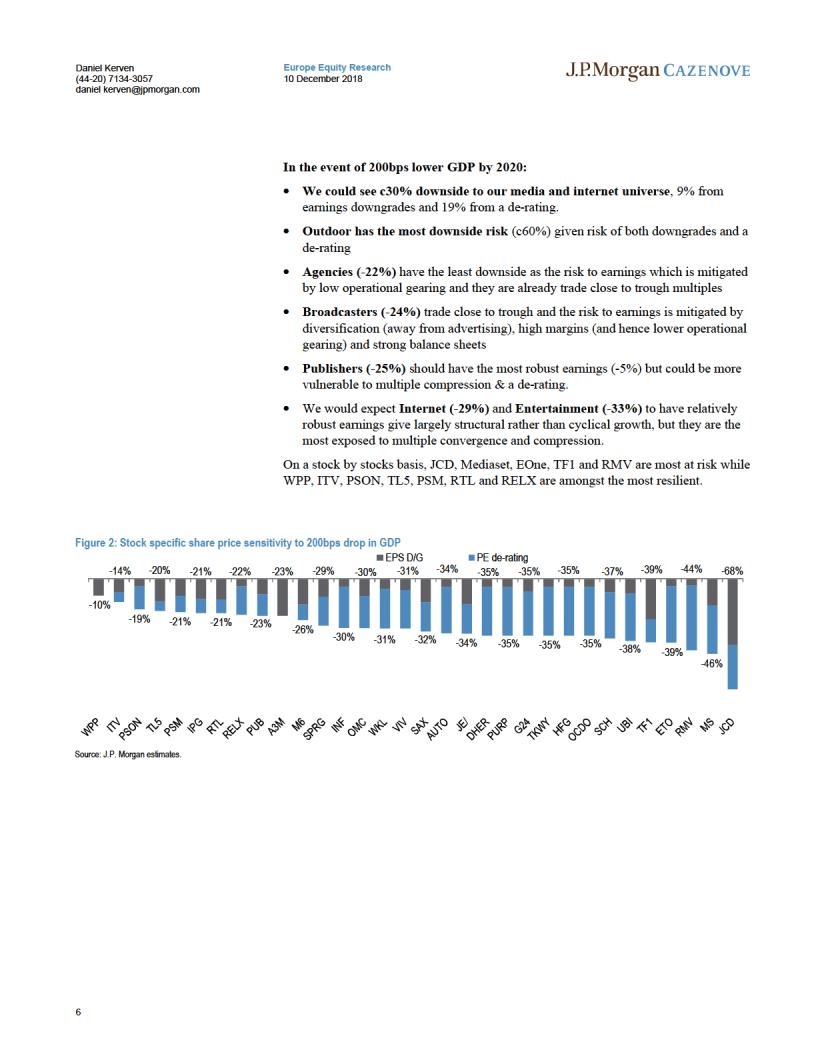

Macro toolkit – sensitivity to a deeper slowdown: We stress test our coverage universe for a deeper slowdown & a harder landing, considering the risk to earnings and valuation in the event of 2% lower GDP by 2020. We could see 30% downside risk to share prices, 10% from earnings downgrades & 20% from a de-rating, with outdoor most at risk. See pg 34.

European Media & Internet Daniel Kerven AC

(44-20) 7134-3057 daniel.kerven@jpmorgan.com Bloomberg JPMA KERVEN <GO>

Marcus Diebel AC

(44 20) 7742-4447 marcus.diebel@jpmorgan.com Bloomberg JPMA DIEBEL <GO>

Marc de Barbuat Duplessis

(44-20) 3493-7568 marc.debarbuatduplessis@jpmorgan.com

Meera Bava

(44-20) 7134-3602 meera.bava@jpmorgan.com J.P. Morgan Securities plc

For Specialist Sales advice, please contact:

Jack Atherton

(44-20) 7134 2486

jack atherton@jpmorgan.com

Table 1: Key picks / Least preferred

|

Analyst |

Price |

Reco |

PT |

Up- / |

|

Downside |

||||

|

|

|

|

|

|

Key picks |

|

|

|

|

|

VIV |

D.Kerven |

€21.1 |

OW |

€40.0 |

90% |

ETO |

M.Diebel |

353p |

OW |

572p |

62% |

INF |

M.Diebel |

663p |

OW |

812p |

23% |

RELX |

D.Kerven |

1,586p |

OW |

1,840p |

16% |

Least preferred

|

selective approach given style / cyclical headwinds. European Agencies are |

Source: J.P. Morgan estimates. |

|

|

||||

MS |

D.Kerven |

€2.6 |

UW |

€2.0 |

-23% |

|||

now turnaround stories while Publishers offer defensive growth given the |

||||||||

provision of “must have” data, information & events. Internet offers |

||||||||

structural growth underpinned by shifts in consumption. See pg 20. |

||||||||

Sub-sector views: Music is the best content story in media. Video Games |

AUTO |

M.Diebel |

418p |

UW |

328p |

-22% |

||

|

are transformed by digital & connectivity. We are structurally constructive |

RMV |

M.Diebel |

444p |

UW |

402p |

-9% |

|

|

on Outdoor, & more controversially, on Broadcasters, but maintain a |

|

|

|

|

|

|

|

Brexit adds a layer of uncertainty. A smooth Brexit transition would be positive for domestic names - ITV would likely offer the greatest upside given its gearing to advertising. A stronger pound would be a headwind for international names. While there are clearly tail risks, our economists’ believe a negotiated deal / no Brexit is the most likely scenario.

See page 81 for analyst certification and important disclosures, including non-US analyst disclosures.

J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

www.jpmorganmarkets.com

vk.com/id446425943

vk.com/id446425943

Daniel Kerven |

Europe Equity Research |

(44-20) 7134-3057 |

10 December 2018 |

daniel kerven@jpmorgan.com |

|

Table of Contents |

|

Valuation ................................................................................... |

2 |

Cautious approach into 2019................................................... |

4 |

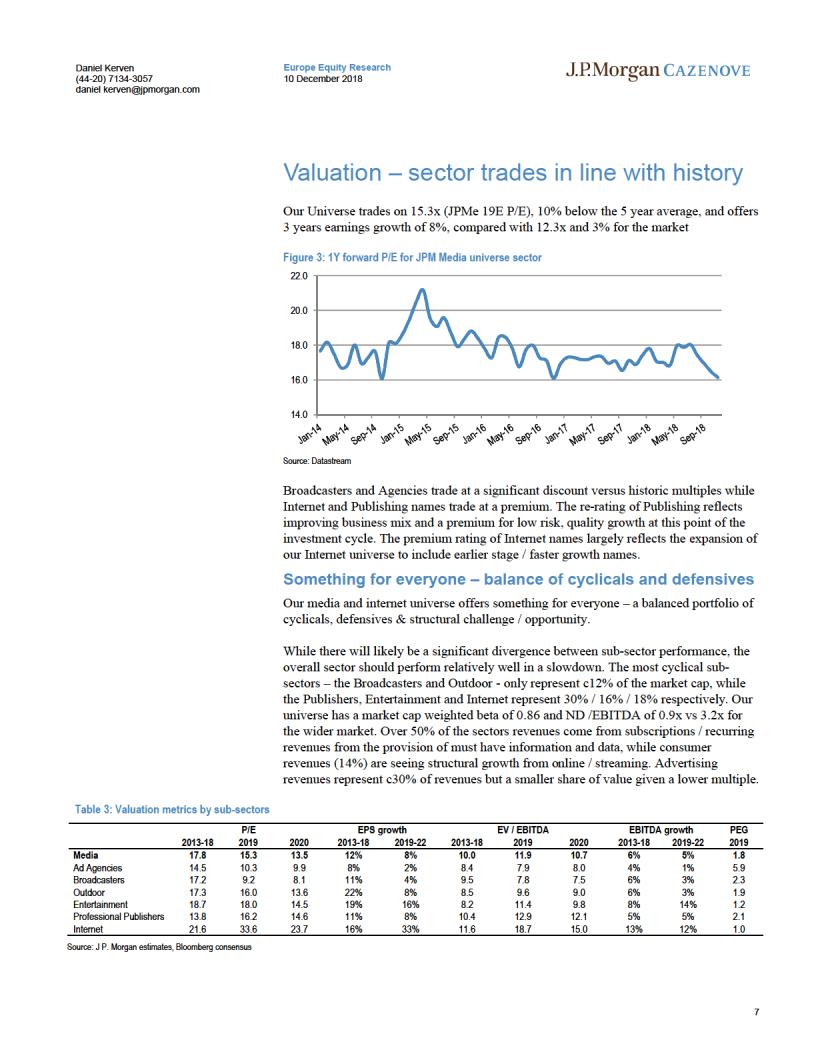

Valuation – sector trades in line with history......................... |

7 |

Media Screen and our positioning for 2019 (base case)..... |

11 |

MediaScreen – a Platform for Performance ......................... |

12 |

Key picks reflect cautious view............................................. |

15 |

Key Underweights .................................................................. |

17 |

Other recommendation changes........................................... |

19 |

Fundamental views by sub-sector ........................................ |

20 |

Sector performance and advertising .................................... |

23 |

JPM universe outperformed in 2018..................................... |

24 |

Macro assumptions for 2019 ................................................. |

26 |

Advertising Forecasts............................................................ |

27 |

Organic Growth, Margins and EPS ....................................... |

29 |

Balance Sheets are in good shape ....................................... |

31 |

Stress testing our coverage universe for a macro shock... |

33 |

Media Sensitivity to a deeper slowdown .............................. |

34 |

Assessing the risk of further multiple contraction.............. |

37 |

Aggregating our thoughts - a recession scenario already |

|

priced in for some .................................................................. |

42 |

Appendix - Introducing MediaScreen ................................... |

44 |

Company financials................................................................ |

47 |

3

vk.com/id446425943

Daniel Kerven |

Europe Equity Research |

(44-20) 7134-3057 |

10 December 2018 |

daniel kerven@jpmorgan.com |

|

Cautious approach into 2019

Optimize for “slowdown / contraction”

Our economists assume relatively robust global macro growth of c3% in 2019. However, they expect US growth to slow and suggest risks are skewed to the downside in Europe. Given a deterioration in leading macro indicators our forecasts are struck on the basis of c50 basis points slower GDP growth than that assumed by our economists. We forecast European ad growth to slow from +2.6% in 2018 to +1.8% in 2019, below the c2.7% growth suggested by GroupM and Zenith.

We use MediaScreen, our quant overlay that tailors the JPM Cycle investing framework to the media sector, to help inform our stock selection. We are currently in the “slowdown” phase of the investment cycle, but could well transition to “contraction” in the coming months. Our key buy / sells for 2019 are largely those names that scan well in both the "slowdown" and “contraction” – broadly large cap stocks that offer defensive, quality growth at a reasonable valuation.

Table 2: Top picks / Least preferred: JPM Media & Internet high conviction calls

|

Analyst |

Current price |

Rating Old |

Rating New |

PT Old |

PT New |

Up- / Downside |

Top picks |

|

|

|

|

|

|

|

Vivendi |

Daniel Kerven |

21.1 |

OW |

OW |

42.0 |

40.0 |

89.6% |

Entertainment One |

Marcus Diebel |

353 |

OW |

OW |

572 |

572 |

62.1% |

Informa |

Marcus Diebel |

663 |

N |

OW |

812 |

812 |

22.5% |

RELX PLC |

Daniel Kerven |

1,586 |

OW |

OW |

1,875 |

1,840 |

16.1% |

Least preferred |

|

|

|

|

|

|

|

Auto Trader |

Marcus Diebel |

418 |

UW |

UW |

328 |

328 |

-21.5% |

Rightmove |

Marcus Diebel |

444 |

UW |

UW |

402 |

402 |

-9.4% |

Mediaset |

Daniel Kerven |

2.6 |

N |

UW |

3.1 |

2.0 |

-22.8% |

Source: J.P. Morgan estimates. Bloomberg prices as at 06/12/18 close.

Top picks: RELX, Informa, Vivendi and EOne

1) RELX (OW) offers defensive, compounding growth at a reasonable valuation; 2) Vivendi (OW) is a play on music, which we see as the best content story in Media; 3) Informa (OW from N) offers cheap, low risk quality – we would expect Informa to be resilient in a shallow slowdown given its geographic diversification, “must attend” events & a significant element of subscription / recurring revenue; 4) Entertainment One (OW) benefits from the increasing demand for audio-visual content, the global monetization of family, limited cyclical exposure and potential upside from M&A.

Least preferred: AutoTrader, Rightmove and Mediaset

1) Mediaset (UW from N) has outperformed peers despite advertising downgrades, a step down in Italian PMI’s, significant cuts to our 2019 GDP growth & Italian deficit risks. We see scope for downgrades given Mediaset’s dependence on advertising revenues, high operational gearing and modest financial leverage. We also see scope for a de-rating with Mediaset trading on 15x 2019 NOPAT, a 40% premium to peers. Mediaset is lowly ranked in MediaScreen during the slowdown and contraction. 2) AutoTrader (UW) and 3) Rightmove (UW) which both trade on high valuations relatively to their growth. We also see earnings risk in a weak UK macro environment and from rising competition that is likely to lead to increased investment / reduced pricing power. Both stocks don’t scan particularly poorly in MediaScreen given their resilient earnings momentum in the past – however, we believe that they will be less resilient / more cyclical in the future.

4

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943

Daniel Kerven |

Europe Equity Research |

(44-20) 7134-3057 |

10 December 2018 |

daniel kerven@jpmorgan.com |

|

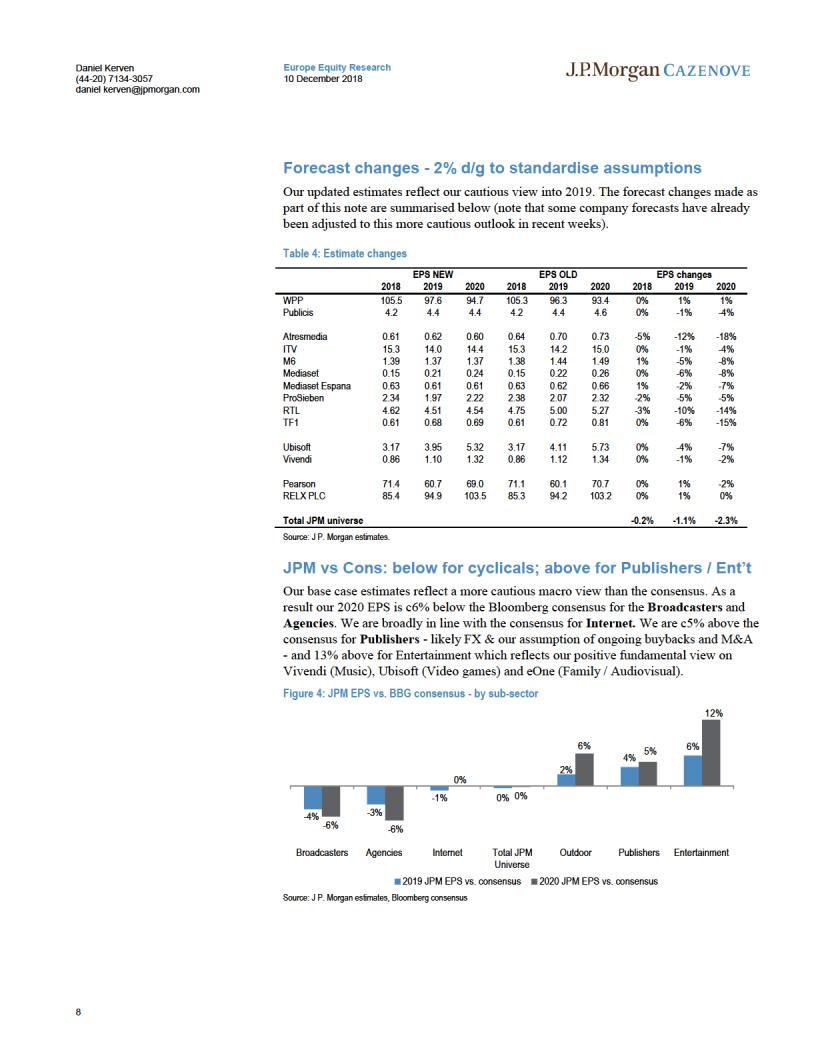

Table 5: JPM estimates vs. BBG consensus

In local currency (m)

|

|

2019 Sales |

|

|

2020 Sales |

|

|

2019 EPS |

|

|

2020 EPS |

|

|

JPM |

Cons. |

vs. Cons. |

JPM |

Cons. |

vs. Cons. |

JPM |

Cons. |

vs. Cons. |

JPM |

Cons. |

vs. Cons. |

Publicis |

9,610 |

9,567 |

0% |

9,770 |

9,958 |

-2% |

4.39 |

4.82 |

-9% |

4.42 |

5.11 |

-13% |

WPP |

12,775 |

15,458 |

-17% |

11,011 |

15,847 |

-31% |

97.6 |

105.5 |

-7% |

94.7 |

109.5 |

-13% |

Atresmedia |

1,045 |

1,056 |

-1% |

1,047 |

1,066 |

-2% |

0.62 |

0.59 |

5% |

0.60 |

0.59 |

1% |

ITV |

3,346 |

3,304 |

1% |

3,442 |

3,412 |

1% |

14.0 |

14.4 |

-3% |

14.4 |

15.7 |

-8% |

M6 |

1,387 |

1,460 |

-5% |

1,390 |

1,478 |

-6% |

1.39 |

1.40 |

-1% |

1.46 |

1.44 |

1% |

Mediaset |

3,049 |

3,141 |

-3% |

3,056 |

3,161 |

-3% |

0.21 |

0.22 |

-5% |

0.24 |

0.26 |

-6% |

Mediaset Espana |

985 |

989 |

0% |

986 |

996 |

-1% |

0.58 |

0.59 |

-1% |

0.59 |

0.58 |

1% |

ProSieben |

4,151 |

4,177 |

-1% |

4,330 |

4,371 |

-1% |

1.97 |

2.08 |

-6% |

2.22 |

2.25 |

-1% |

RTL |

6,630 |

6,704 |

-1% |

6,809 |

6,894 |

-1% |

4.51 |

4.71 |

-4% |

4.54 |

4.85 |

-6% |

TF1 |

2,296 |

2,343 |

-2% |

2,319 |

2,382 |

-3% |

0.68 |

0.86 |

-21% |

0.69 |

0.92 |

-25% |

JCDecaux |

3,952 |

3,919 |

1% |

4,120 |

4,043 |

2% |

1.28 |

1.30 |

-2% |

1.47 |

1.45 |

1% |

Stroer |

1,731 |

1,728 |

0% |

1,841 |

1,834 |

0% |

4.27 |

3.99 |

7% |

4.83 |

4.30 |

12% |

Entertainment One |

1,108 |

1,132 |

-2% |

1,226 |

1,232 |

0% |

24.7 |

24.5 |

1% |

29.1 |

27.2 |

7% |

Ubisoft |

2,185 |

2,078 |

5% |

2,491 |

2,307 |

8% |

3.16 |

2.95 |

7% |

3.99 |

3.51 |

14% |

Vivendi |

14,540 |

14,641 |

-1% |

15,396 |

15,246 |

1% |

1.10 |

1.05 |

6% |

1.32 |

1.17 |

13% |

Informa |

2,875 |

2,875 |

0% |

2,969 |

2,977 |

0% |

52.4 |

52.2 |

0% |

55.3 |

55.7 |

-1% |

Pearson |

4,378 |

4,178 |

5% |

4,424 |

4,177 |

6% |

60.7 |

56.9 |

7% |

69.0 |

63.4 |

9% |

RELX PLC |

8,121 |

7,793 |

4% |

8,550 |

8,142 |

5% |

94.9 |

90.9 |

4% |

103.5 |

97.9 |

6% |

Wolters Kluwer |

4,510 |

4,505 |

0% |

4,716 |

4,704 |

0% |

2.70 |

2.64 |

2% |

2.95 |

2.85 |

3% |

Axel Springer |

3,348 |

3,311 |

1% |

3,490 |

3,432 |

2% |

3.16 |

3.24 |

-2% |

3.52 |

3.63 |

-3% |

Auto Trader |

350 |

350 |

0% |

373 |

374 |

0% |

19.5 |

19.6 |

-1% |

22.0 |

22.1 |

-1% |

Delivery Hero |

1,101 |

1,103 |

0% |

1,462 |

1,503 |

-3% |

-0.83 |

-0.97 |

-15% |

-0.11 |

-0.20 |

-47% |

JUST EAT |

1,042 |

961 |

8% |

1,198 |

1,157 |

4% |

19.9 |

21.7 |

-8% |

23.9 |

29.2 |

-18% |

Purplebricks |

172 |

166 |

3% |

282 |

250 |

13% |

-8.6 |

-9.5 |

-9% |

2.1 |

-2.6 |

-181% |

Rightmove |

290 |

289 |

1% |

313 |

311 |

1% |

19.7 |

19.5 |

1% |

20.3 |

21.7 |

-6% |

Schibsted (A) |

19,606 |

19,158 |

2% |

20,951 |

20,443 |

2% |

8.28 |

8.61 |

-4% |

10.89 |

11.11 |

-2% |

Scout24 |

623 |

622 |

0% |

703 |

689 |

2% |

2.02 |

1.83 |

10% |

2.37 |

2.09 |

13% |

Takeaway.com |

314 |

322 |

-2% |

385 |

398 |

-3% |

0.26 |

0.00 |

na |

1.35 |

0.82 |

64% |

HelloFresh |

1,599 |

1,567 |

2% |

1,925 |

1,856 |

4% |

-0.17 |

-0.15 |

11% |

0.09 |

0.22 |

-61% |

Ocado |

1,835 |

1,840 |

0% |

2,923 |

2,145 |

36% |

1.2 |

-1.0 |

-221% |

6.4 |

1.6 |

298% |

Source: J.P. Morgan estimates, Bloomberg consensus. We note that several businesses in the Internet sector are at a tipping point in terms of profitability and small differences in absolute numbers have a significant impact on relative percentage deviation.

9

vk.com/id446425943

Daniel Kerven |

Europe Equity Research |

(44-20) 7134-3057 |

10 December 2018 |

daniel kerven@jpmorgan.com |

|

Page left blank intentionally

10