JPM_Europe Year Ahead 2019_watermark

.pdf

vk.com/id446425943

vk.com/id446425943

Mislav Matejka, CFA (44-20) 7134-9741

mislav.matejka@jpmorgan.com

No recession likely in 2019. Upside for equities not yet exhausted.

In contrast to our cautious EM call for 2018, we are bullish on EM for next year.

The consensus concerns over

China, Fed, trade and stronger

USD may not materialize.

Remain OW US vs Europe

Cyclicals have opened up a gap with bond yields. Upgrading Energy and US Banks.

Europe Equity Research

03 December 2018

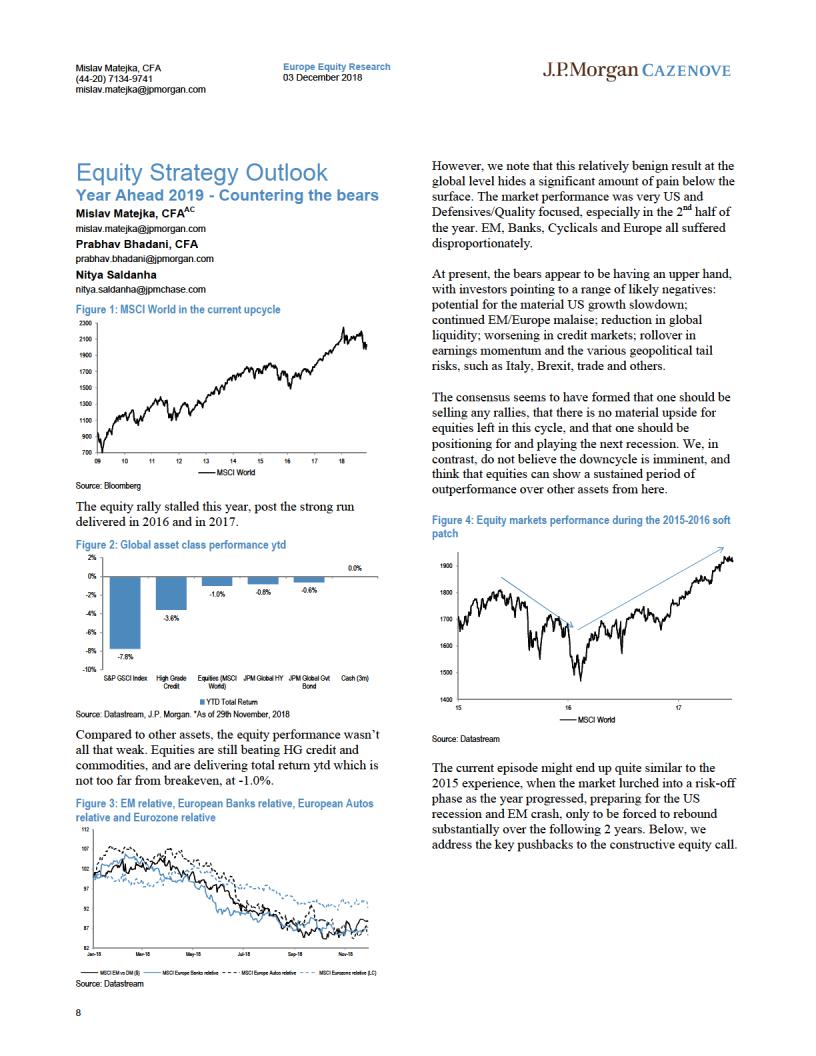

Investment Summary

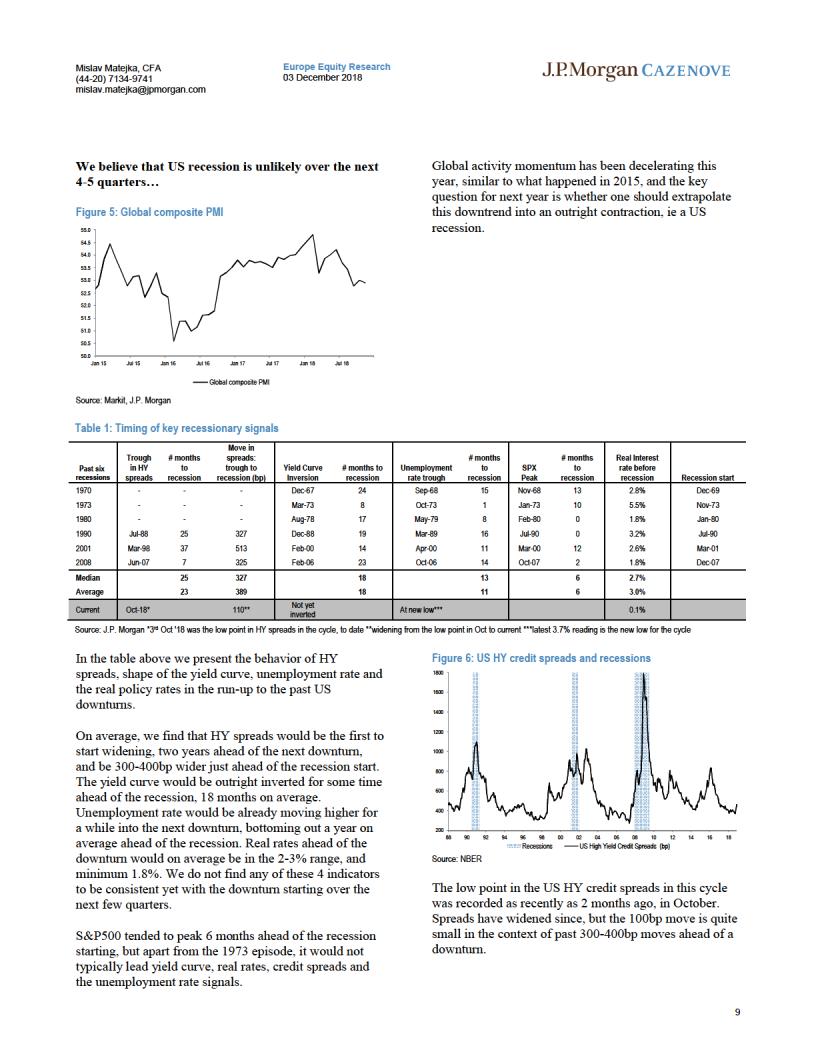

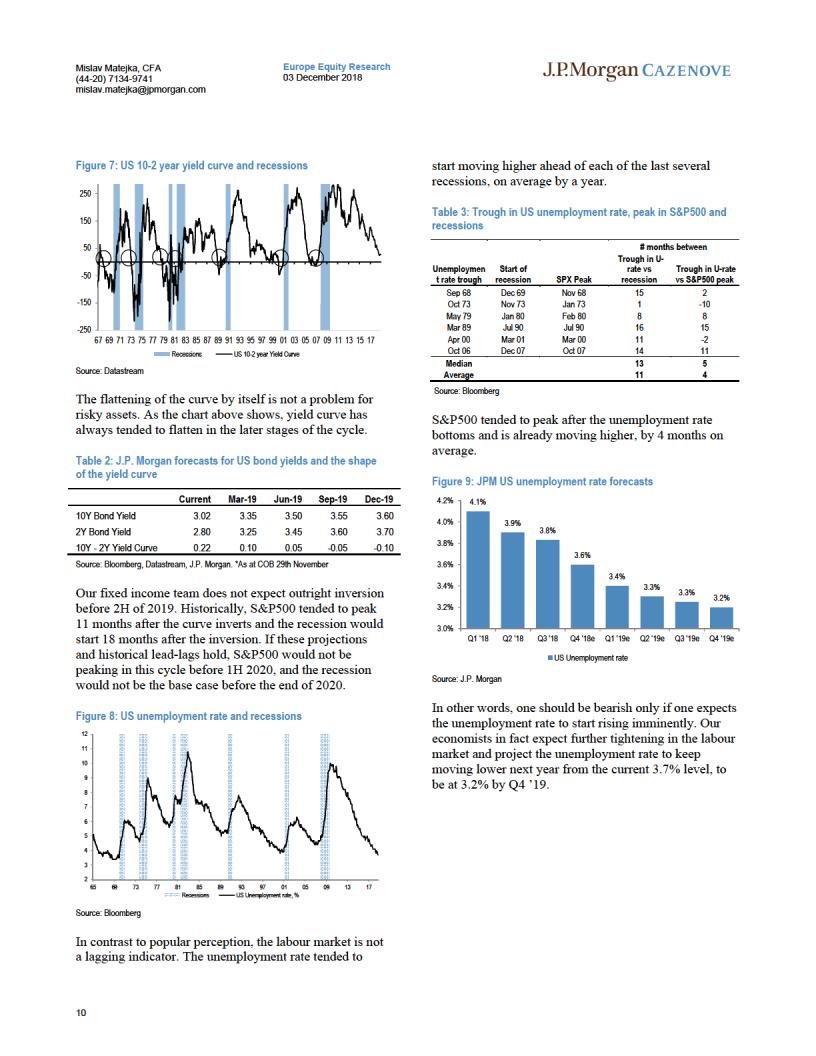

As 2018 progressed, a number of consensus calls got unstuck, such as bullishness on EM, bearishness on USD, complacency over the Fed and over trade, as well as the belief in the synchronized global recovery. Entering 2019, we think one should be contrarian again to prevailing consensus views. We don’t agree that the US/global recession is inevitable over the next 1-2 years and that there is only downside left for equities. In our view, before this cycle is finished, equities can still deliver a period of significant outperformance vs fixed income. We believe earnings will grow in 2019, not too far away from consensus projections of 8-10%, and that bond yields should move higher. Many see higher yields hurting P/Es, but equity multiples are already below their long-term averages, with MSCI World trading at 14.5x forward P/E, outright 7% lower than 30 year typical.

With respect to Emerging Markets, entering 2018 we had a non-consensus cautious call on EM and we worried about the stronger USD. The consensus was bullish on China entering the year, but currently many we speak to believe that China stimulus will not be effective in stabilizing growth. We disagree. We think one should be buying into EM now, and believe that the peaking in US-RoW growth differential might constrain the USD. Specifically, EM equities are currently trading even cheaper than at the low point in ’15-’16, when China appeared even worse than currently.

On trade, while entering 2018 the issue wasn’t on anybody's radar, now most think that it can only get worse. We believe the potential for a compromise is higher than this, as the US equities are not decoupling anymore from global equities. With respect to the Fed, entering 2018 the consensus was relaxed, but currently many think Fed will stay hawkish no matter what. The increasingly consensus view became that the Fed keeps tightening "until something breaks”. We, in contrast, think that the Fed will be much more sensitive to market imbalances and growth concerns, opening the potential for a dovish surprise.

Regionally, we remain OW US vs Europe, despite an already significant US outperformance. For the potential regional switch, we are monitoring Italy, which needs to improve in order for Eurozone to have a chance of leading. Japan looks attractively priced, but its earnings outlook doesn’t appear appealing (N). We stay UW UK equities, as even if/when the Brexit deal is signed off, the resulting strength of the GBP might take away the upside from equities. We reiterate our upgrade of EM from summer.

Sectorwise, while our cover chart in 2018 Year Ahead argued that Cyclicals are expensively priced, for the 2019 Year Ahead we highlight that Cyclicals have decoupled from bond yields – see bottom chart. We are in particular bullish on Miners, and take advantage of the recent selloff to upgrade Energy to OW, while locking in profits on our Utilities OW. We remain unexcited by European Banks, but think US Banks could start performing better. We stay OW Tech as we believe the sentiment is now too bearish on the sector’s earnings prospects, and buybacks remain strong.

2

vk.com/id446425943

Mislav Matejka, CFA (44-20) 7134-9741

mislav.matejka@jpmorgan.com

Europe Equity Research

03 December 2018

Table of Contents |

|

Investment Summary ............................................................... |

2 |

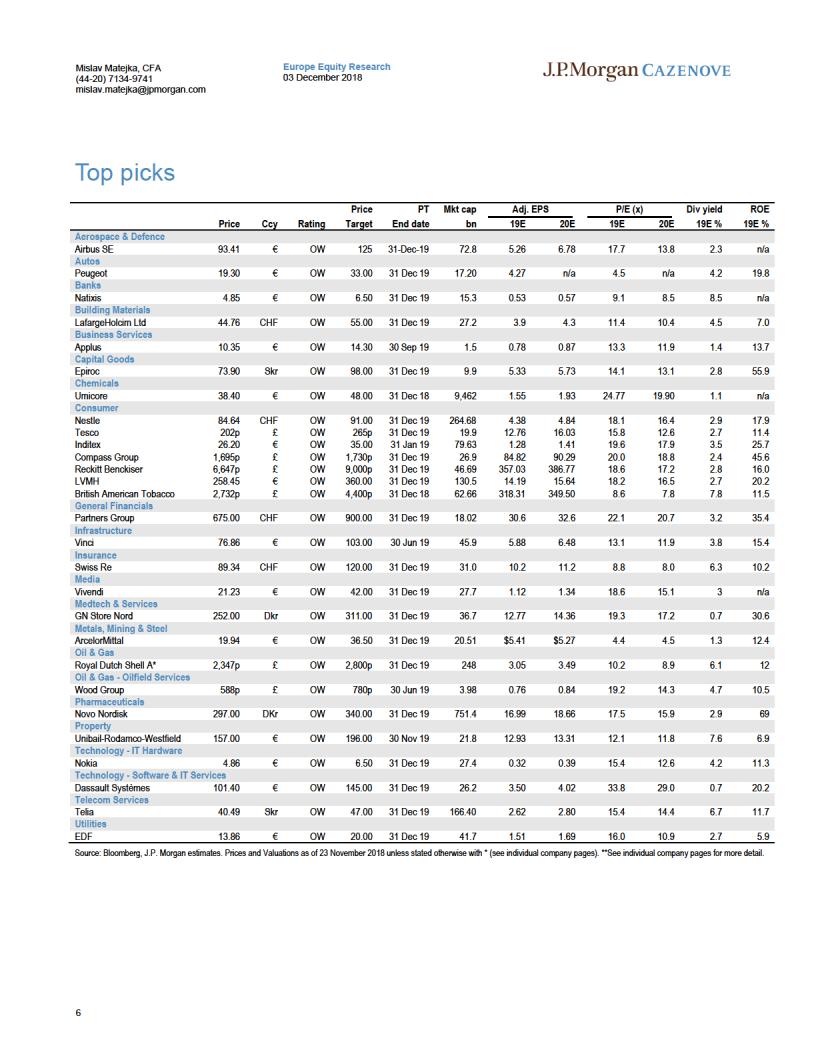

Top picks................................................................................... |

6 |

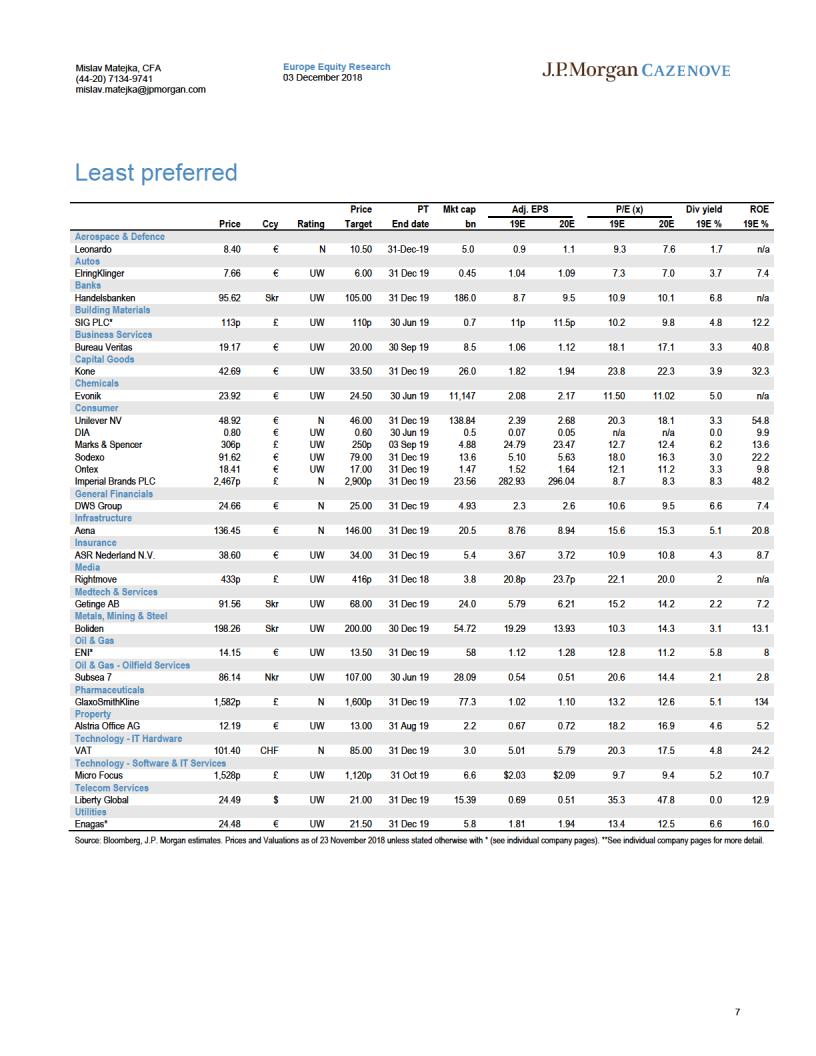

Least preferred ......................................................................... |

7 |

Economic Outlook 2019......................................................... |

47 |

Euro Area Rates Outlook ....................................................... |

52 |

Credit Strategy Outlook ......................................................... |

58 |

Global FX Outlook 2019 ......................................................... |

66 |

Small/Mid-Cap Strategy Outlook........................................... |

71 |

CEEMEA Strategy Outlook .................................................... |

80 |

Sector outlooks, top picks and least preferred.................... |

83 |

Aerospace & Defence............................................................. |

84 |

Top pick – Airbus SE ......................................................... |

85 |

Least preferred – Leonardo............................................... |

85 |

Autos ....................................................................................... |

86 |

Top pick – Peugeot ............................................................ |

87 |

Least preferred – ElringKlinger......................................... |

87 |

Banks....................................................................................... |

88 |

Top pick – Natixis............................................................... |

89 |

Least preferred – Handelsbanken..................................... |

89 |

Building Materials................................................................... |

90 |

Top pick – LafargeHolcim Ltd ........................................... |

91 |

Least preferred – SIG PLC................................................. |

91 |

Business Services.................................................................. |

92 |

Top pick – Applus .............................................................. |

93 |

Least preferred – Bureau Veritas...................................... |

93 |

Capital Goods ......................................................................... |

94 |

Top pick – Epiroc ............................................................... |

95 |

Least preferred – Kone Corporation................................. |

95 |

Chemicals ............................................................................... |

96 |

Top pick – Umicore ............................................................ |

97 |

Least preferred – Evonik ................................................... |

97 |

3

vk.com/id446425943

Mislav Matejka, CFA (44-20) 7134-9741

mislav.matejka@jpmorgan.com

Europe Equity Research

03 December 2018

Consumer - Food Producers ................................................. |

98 |

Top pick – Nestle................................................................ |

99 |

Least preferred – Unilever NV ........................................... |

99 |

Consumer - Food Retailing.................................................. |

100 |

Top pick – Tesco .............................................................. |

101 |

Least preferred – DIA ....................................................... |

101 |

Consumer - General Retail .................................................. |

102 |

Top pick – Inditex............................................................. |

103 |

Least preferred – Marks & Spencer ................................ |

103 |

Consumer - Hotels & Leisure .............................................. |

104 |

Top pick – Compass Group............................................. |

105 |

Least preferred – Sodexo ................................................ |

105 |

Consumer - Household & Personal Care ........................... |

106 |

Top pick – Reckitt Benckiser .......................................... |

107 |

Least preferred – Ontex ................................................... |

107 |

Consumer - Luxury Goods .................................................. |

108 |

Top pick – LVMH .............................................................. |

109 |

Consumer – Tobacco ........................................................... |

110 |

Top pick – British American Tobacco ............................ |

111 |

Least preferred – Imperial Brands PLC .......................... |

111 |

General Financials................................................................ |

112 |

Top pick – Partners Group .............................................. |

113 |

Least preferred – DWS Group ......................................... |

113 |

Infrastructure ........................................................................ |

114 |

Top pick – Vinci................................................................ |

115 |

Least preferred – Aena .................................................... |

115 |

Insurance .............................................................................. |

116 |

Top pick – Swiss Re......................................................... |

117 |

Least preferred – ASR Nederland N.V. ........................... |

117 |

Media ..................................................................................... |

118 |

Top pick – Vivendi............................................................ |

119 |

Least preferred – Rightmove........................................... |

119 |

4

vk.com/id446425943

Mislav Matejka, CFA (44-20) 7134-9741

mislav.matejka@jpmorgan.com

Europe Equity Research

03 December 2018

Medtech & Services.............................................................. |

120 |

Top pick – GN Store Nord................................................ |

121 |

Least preferred – Getinge AB.......................................... |

121 |

Metals, Mining & Steel.......................................................... |

122 |

Top pick – ArcelorMittal................................................... |

123 |

Least preferred – Boliden ................................................ |

123 |

Oil & Gas ............................................................................... |

124 |

Top pick – Royal Dutch Shell A....................................... |

125 |

Least preferred – ENI ....................................................... |

125 |

Oil & Gas - Oilfield Services ................................................ |

126 |

Top pick – Wood Group................................................... |

127 |

Least preferred – Subsea 7 ............................................. |

127 |

Pharmaceuticals................................................................... |

128 |

Top pick – Novo Nordisk ................................................. |

129 |

Least preferred – GlaxoSmithKline................................. |

129 |

Property................................................................................. |

130 |

Top pick – Unibail-Rodamco-Westfield .......................... |

131 |

Least preferred – Alstria Office AG................................. |

131 |

Technology - IT Hardware.................................................... |

132 |

Top pick – Nokia............................................................... |

133 |

Least preferred – VAT ...................................................... |

133 |

Technology - Software & IT Services.................................. |

134 |

Top pick – Dassault Systèmes........................................ |

135 |

Least preferred – Micro Focus ........................................ |

135 |

Telecom Services ................................................................. |

136 |

Top pick – Telia ................................................................ |

137 |

Least preferred – Liberty Global ..................................... |

137 |

Utilities .................................................................................. |

138 |

Top pick – EDF ................................................................. |

139 |

Least preferred – Enagas ................................................ |

139 |

Investment Thesis, Valuation and Risks ............................ |

140 |

The legal entity for all analysts within this publication is J.P. Morgan Securities plc unless stated otherwise.

5

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943