JPM_European Best Equity Ideas_watermark

.pdf

vk.com/id446425943

European Best Equity Ideas

Europe Equity Research

15 November 2018

|

|

|

P/E |

|

Top OW |

Price |

PT |

FY18E |

FY19E |

Allianz |

€193.64 |

€222 |

10.9x |

9.8x |

Anglo American |

1657.2p |

2100p |

10.5x |

9.3x |

ArcelorMittal |

€21.57 |

€36.5 |

4.7x |

4.5x |

ASML |

€153.52 |

€200 |

25.6x |

20.4x |

AstraZeneca |

6311p |

6500p |

23.9x |

22.0x |

AVEVA |

2642p |

3150p |

19.0x |

31.4x |

BT Group |

252.3p |

290p |

8.8x |

9.6x |

CaixaBank |

€3.711 |

€4.75 |

9.9x |

8.4x |

Capgemini |

€107.15 |

€135 |

18.0x |

15.7x |

Compass Group |

1566p |

1730p |

20.3x |

18.7x |

EDF |

€15.54 |

€20 |

26.1x |

17.9x |

Engie |

€12.545 |

€19.5 |

12.9x |

11.9x |

Euronext |

€54 |

€65 |

15.9x |

15.3x |

Experian plc |

1873.5p |

2000p |

26.1x |

24.3x |

GN Store Nord |

Dkr279.3 |

Dkr365 |

25.7x |

21.1x |

LafargeHolcim |

SF46.7 |

SF55 |

13.2x |

11.9x |

Linde |

US$156.93 US$185 |

26.5x |

21.5x |

|

Melrose |

177.1p |

285p |

15.6x |

13.0x |

Nestle |

SF84.76 |

SF91 |

21.4x |

19.3x |

Nokia |

€5.204 |

€6.5 |

23.4x |

18.3x |

Peugeot |

€20.64 |

€33 |

6.3x |

4.8x |

Puma |

€446 |

€550 |

34.4x |

26.0x |

Reckitt Benckiser |

6236p |

9000p |

19.1x |

17.5x |

Roche |

SF251.7 |

SF300 |

14.1x |

13.8x |

Royal Dutch Shell B |

2429p |

3250p |

11.7x |

8.3x |

Safran |

€112.9 |

€135 |

23.9x |

18.9x |

Schneider Electric |

€63.76 |

€77 |

13.4x |

12.4x |

Tesco |

214.2p |

265p |

20.5x |

16.8x |

Ubisoft |

€72.22 |

€130 |

40.1x |

22.8x |

Wood Group |

650.2p |

780p |

13.9x |

11.1x |

P/E

Top UW |

Price |

PT |

FY18E |

FY19E |

Evonik |

€27.09 |

€24.5 |

10.9x |

13.0x |

Getinge AB |

Skr83.28 |

Skr68 |

15.2x |

14.4x |

Hargreaves Lansdown |

1918p |

1750p |

38.7x |

34.0x |

JUST EAT |

561p |

742p |

29.7x |

27.6x |

Kingfisher |

245.6p |

240p |

11.3x |

12.0x |

Kone Corporation |

€43.97 |

€33.5 |

25.5x |

24.2x |

Marks & Spencer |

302p |

250p |

10.8x |

12.2x |

Sainsbury |

315.8p |

260p |

16.5x |

15.5x |

Rightmove |

445p |

415.8p |

24.4x |

21.4x |

Rolls-Royce |

821.2p |

840p |

61.0x |

27.2x |

Royal Mail Group |

340p |

340.73p |

7.5x |

13.0x |

Straumann |

SF671.5 |

SF612 |

38.8x |

32.6x |

Telefonica |

€7.516 |

€6.2 |

10.6x |

10.4x |

TOTAL |

€49.51 |

€54 |

10.3x |

8.3x |

|

|

|

|

|

Adds |

Drop |

|

|

|

OW – BT Group, Roche, Safran, |

OW – Vinci, Airbus, Jeronimo Martins, |

|||

LafargeHolcim, AVEVA, ASML, Experian |

SAP, STMicroelectronics, Applus |

|||

UW – Straumann |

UW – Terna |

|

|

|

Source: Bloomberg, J.P. Morgan estimates

All prices as at cob 13th November 2018

Sunil Garg

Head of International Equity Research (44-20) 7742-9816 sunil.garg@jpmorgan.com

Alex Rushing

Deputy Head of European Equity Research (44-20) 7742-4656 alex.rushing@jpmorgan.com

See the end pages of this presentation for analyst certification and important disclosures, including non-US analyst disclosures.

J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

vk.com/id446425943

Macro Strategy

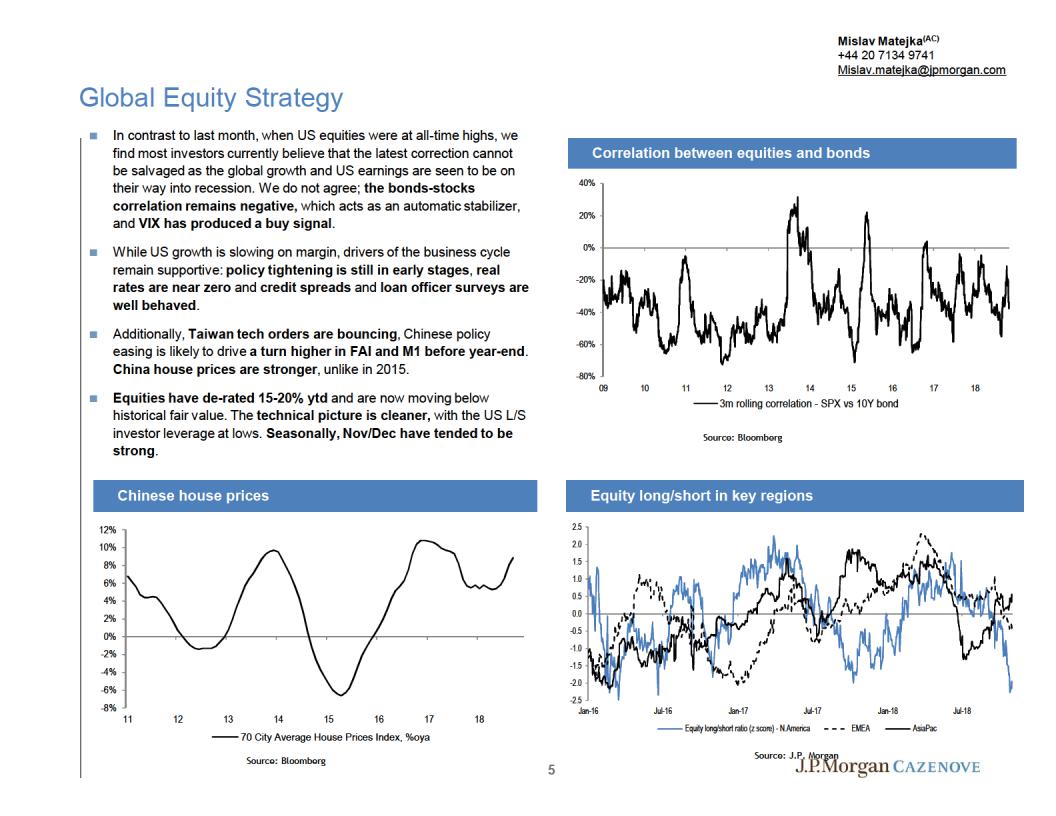

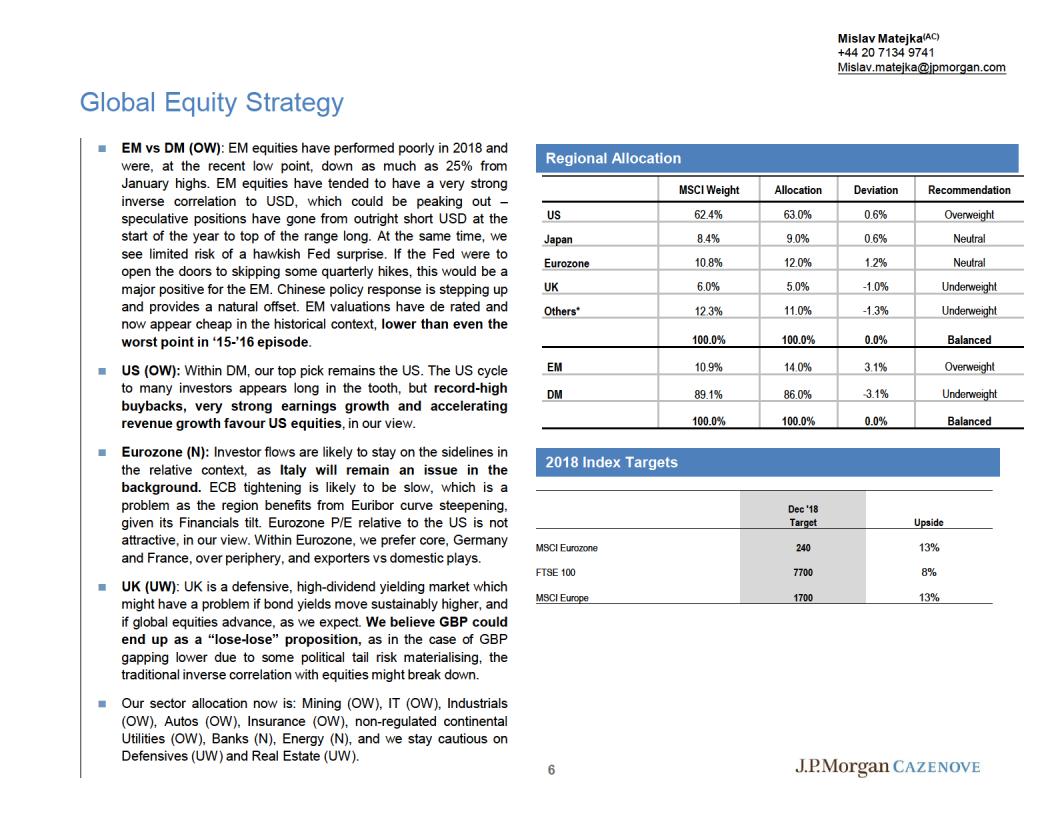

While recession fears mount, the drivers of the business cycle remain supportive. Equities have de-rated and are below fair value. VIX “BUY” signal. Countries: (OW) US and EM over DM. (N) Japan & Eurozone – Dax bias. Remain (UW) UK. Cyclicals vs Defensive bias. Sectors: Autos, Industrials, Technology & UtilitiesPower (OW) vs UW on Real Estate, Healthcare & Consumer Staples . Neutral Financials, Cyclicals & Energy.

Quant Strategy

Euro QMI “Slowdown” phase suggests dispersion to remain elevated & Slowdown is at risk of morphing into contraction. We favour Quality over Value & specifically high Quality, Momentum, Growth over Value and high Risk.

SMID Strategy

Remain cautious, start positioning for a slowdown. OW Switzerland and UW Germany & France. US (UW), Latam (OW), AsiaX (OW) . Focus on High FCF Yld/ Low ND/EBITDA .

Industrials

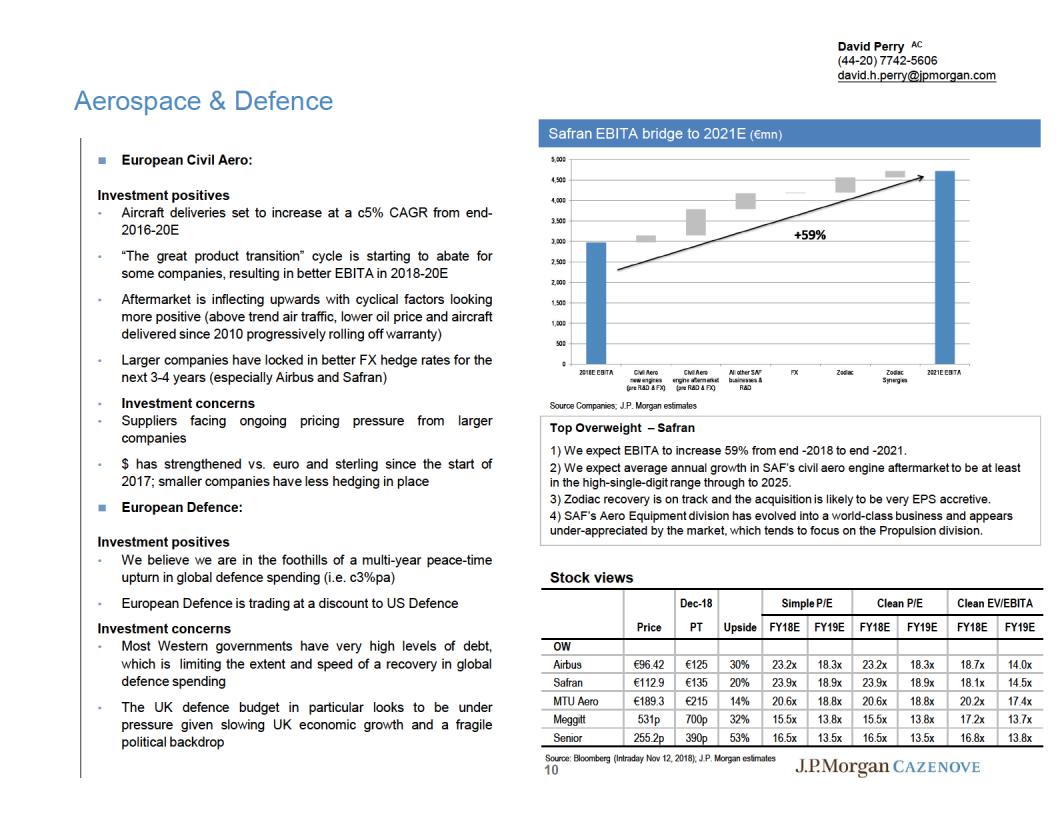

Aerospace/Defence – Bias to Civil: Aircraft deliveries set to increase at a c5% CAGR from end-2016-20E and Aftermarket is inflecting upwards. $ tailwind and FX locked in for next 3-4 yrs.

Autos – While overall demand remains positive in 2018, WLTP certification, 2020 Co2 emissions targets & trade tariff tensions continue to weigh on the sector. Increasingly discounted & positioned for a year-end rally.

Capital Goods – PMIs continue to weaken and shares have derated. Final demand has been weaker and inventories have not improved post a period of de-stocking. While shares have corrected they are by no means discounting a sustained contraction.

Building Mat/Construction – Our DM vs EM bias is starting to moderate given the underperformance of EM. We retain our +ve infra over airport bias though infra is facing tougher comps and we expect slower traffic growth. We remain +vely selective in UK homebuilders w/ focus on self-driven +ve EPS momentum .

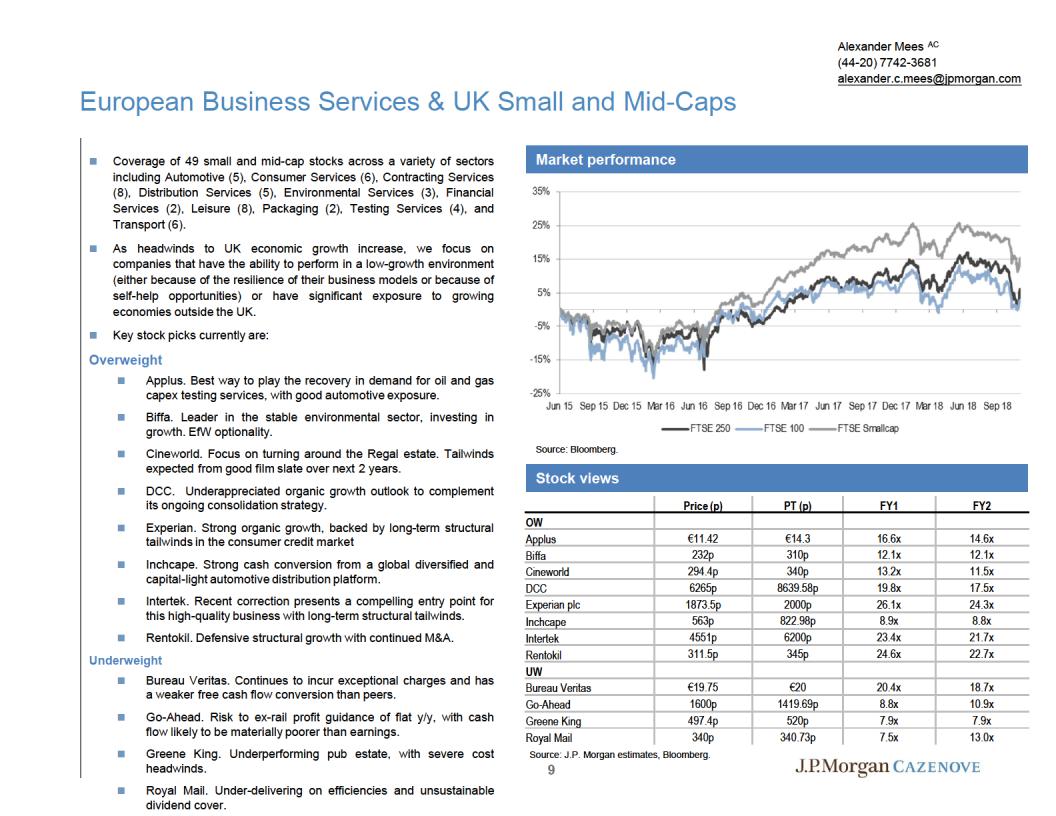

Business Services – Stock-specific Cos w/ ability to perform in a low -growth environment or to growing economies outside the UK.

Summary

Chemicals – In Jan, we took a more cautious approach to stock selection which coincided w/ a broader sector de-rating given macro and sector-specific concerns. Q3 only served to reinforce our

defensive bias .

Consumer

General Retail – Space rollout +ve for European Retail, while UK retail remains fundamentally challenged given consumer confidence.

Food/HPC – After years of modest growth, we expect sector LFL to improve to 3.5% ’18. Q2 saw +ve pricing vs vols. Good margin progression and expected to improve in 2H. Stock-specific growth & execution aided by investor activism .

Food Retail/Hotels/Leisure – Food retail remains expensive and challenged. Contract Catering & Concessions look structurally +ve. European Hotels RevPar is still 21% below ‘07 peak.

Luxury goods – Demand remains strong, and while H2 comps are

tough, we see FY c7-8% org sales growth. The relative outperformance between products & companies has widened. Pricing power and brand momentum remain the focus.

Tobacco – Higher volume declines in combustibles yet pricing/mix

remains strong. Regulatory backdrop continues to weigh on sector.

Commodities

Oil & Gas – JPM LT ‘21 oil price forecast $60bbl. Co LT industrial outlook intact despite portfolio & fiscal restructuring. Key will be transition from defensive to offensive agenda => max cash return w/out compromising LT portfolio growth.

E&P & Services – Global capex spend set to improve 9% in ‘19 y/y w/ increasing MENA spend; hence bias to onshore MENA exposure.

Metals & Mining/Steel – Shares discounting global growth

slowdown. Shares typically trade 30% > higher at this point in the cycle. Commodity prices supportive and cash generation driving excess capital returns.

Financials

Banks – We retain our barbell focus split between high-yielding quality stocks and high-beta So. European banks. Asset gathering businesses are attractive having de-rated. While EPS upside for the sector appears limited, we believe any re-rating will be a function of either rates or a reduction in sovereign risk.

Insurance – Strong solvency & cap generation the key driver w/ duration of cash returns underappreciated. Sector shift towards fee based / capital light or underwriting-based businesses models.

Gen Financials – While Asset mgrs. have de-rated, headwinds persist in fees/regulation/flows; hence, bias to alternatives. Servicers concern on pricing, country risk and rising leverage is capping interest. Exchanges should be buoyed by increased volatility and volumes in the 2H.

Property – We continue to favour Continental Europe over UK given more attractive growth & valuations. UK SMID “structural”

winners are fully priced.

TMT

Telecom – Overwhelmed w/ debt and addicted to dividends. Telcos are the most leveraged sector in Europe. And failing to capitalise on the greatest structural growth story of our time (data).

Media – We look for 7% avg EPS growth in ‘18 and view an avg 5% Equity FCF yield as attractive. Expect structural growth stories to attract a premium while improved Ad momentum needed to alleviate structural concerns.

Technology – Global growth/trade war and DRAM price headwinds have driven a de-rating. Semi metrics remain intact w/ inventories still subdued. Software & Services benefiting from strong digital, cloud, cyber , big data & AI secular trends. +ve Hardware – w/ 5G commercial rollouts better than consensus expect & operating

leverage underappreciated. Payments secular growth remains attractive.

Healthcare

Pharma/BioTech – Consensus looks to have finally rebased. Sector more attractive given mkt cycle concerns. SMidCaps & Biotech bias over large caps becoming less obvious.

MedTech/Services – Secular demographic trends support volume, EPS growth. Focused on stock-specific growth and restructuring

opportunities

Utilities

Utilities – our sector bias is to 1) stocks likely to benefit from higher CO2 prices following reform of the EU ETS; 2) special situations such as M&A and restructuring; and 3) stocks trading at a deep discount due to political and/or regulatory cycle risks.

vk.com/id446425943

Sector coverage

Global Equity Strategy Mislav Matejka, CFA

(44-20) 7134-9741 mislav.matejka@jpmorgan.com

Equity Quantitative Strategy

Khuram Chaudhry

(44-20) 7134-6297 khuram.chaudhry@jpmorgan.com

SMid-Cap Equity Strategy Eduardo Lecubarri

(44-20) 7134-5916 eduardo.lecubarri@jpmorgan.com

Aerospace & Defence David H Perry, CFA

(44-20) 7742-5606 david.h.perry@jpmorgan.com

Autos

Jose M Asumendi

(44-20) 7742-5315 jose.m.asumendi@jpmorgan.com

Banks

Kian Abouhossein

(44-20) 7134-4575 kian.abouhossein@jpmorgan.com

Banks Raul Sinha

(44-20) 7742-2190 raul.sinha@jpmorgan.com

UK Homebuilders Emily Biddulph

(44-20) 7134-5906 emily.biddulph@jpmorgan.com

Construction, Building Materials & Infrastructure Elodie Rall

(44-20) 7134-5911 elodie.rall@jpmorgan.com

Capital Goods

Andreas Willi

(44-20) 7134-4569 andreas.p.willi@jpmorgan.com

Chemicals

Alberto Lopez Rueda

(44-20) 7134-6909

alberto lopezrueda@jpmorgan.com

Consumer Staples Celine Pannuti, CFA

(44-20) 7134-7123 celine.pannuti@jpmorgan.com

Food retail, Hotels/Leisure Borja Olcese

(44-20) 7742-7170 borja.olcese@jpmorgan.com

General Financials Gurjit S Kambo, CFA

(44-20) 7742-0719 gurjit.s.kambo@jpmorgan.com

General Retail Georgina Johanan

(44-20) 7134-5791 georgina.s.johanan@jpmorgan.com

General Retail Chiara Battistini

(44-20) 7134-5417 chiara.x.battistini@jpmorgan.com

3

Insurance

Michael Huttner, CFA

(44-20) 7134-4572 michael.huttner@jpmorgan.com

Insurance

Ashik Musaddi, CFA

(44-20) 7134-4708 ashik.x.musaddi@jpmorgan.com

Luxury Goods Melanie A Flouquet

(39-02) 8895-2133 melanie.a.flouquet@jpmorgan.com

Media

Daniel Kerven

(44-20) 7134-3057 daniel.kerven@jpmorgan.com

Medtech & Services David Adlington

(44-20) 7134-5828 david.adlington@jpmorgan.com

Metals & Mining

Dominic O’Kane

(44-20) 7742-6729 dominic.j.okane@jpmorgan.com

Oil & Gas Christyan F Malek

(44-20) 7134-9188 christyan.f.malek@jpmorgan.com

Oil Field Services/E&P James Thompson

(44-20) 7134-5942 james.a.thompson1@jpmorgan.com

Pharmaceuticals/Biotech Richard Vosser

(44-20) 7742-6652 richard.vosser@jpmorgan.com

Pharmaceuticals/Biotech James D Gordon

(44-20) 7742-6654 james.d.gordon@jpmorgan.com

Property

Tim Leckie, CFA

(44-20) 7134-4477 timothy.leckie@jpmorgan.com

Semiconductors, Hardware Sandeep S Deshpande

(44-20) 7134-5276 sandeep.s.deshpande@jpmorgan.com

Technology - Software & IT Services

Stacy Pollard

(44-20) 7134-5420 stacy.pollard@jpmorgan.com

Telecom Services Akhil Dattani

(44-20) 7134-4725 akhil.dattani@jpmorgan.com

European Business Service & UK SMid Alexander Mees

(44-20) 7742-3681 Alexander.c.mees@jpmorgan.com

Utilities Javier Garrido

(34-91) 516-1557 javier.x.garrido@jpmorgan.com

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943

Small/Mid-Cap Strategy

Last month saw SMid-Caps feeling the pressure of rising geo-political risk, evidence of an ongoing slowdown in economic momentum, and mounting worries about inflation and interest rates. With SMid indices being down YTD, we reiterate our non-consensus cautious stance, reinforcing our belief that 2018 is a year to start positioning our portfolios for more trying times.

How To Position?

By Mkt Cap: We remain OW SMid vs Large across Pan-Europe as it benefits from a long list of structural tailwinds with empirical evidence showing it doesn’t pay to trade them around recessions.

By Style: Remain OW high FCF Yld stories with solid balance sheets, a trade that delivered alpha last month in UK & Europe.

By Country: We remain OW SMid in Ireland vs the UK as it offers a better growth/value proposition in any Brexit scenario. We remain OW Switzerland and UW Germany and France (a trade that continues to deliver alpha), with Switzerland a relative safe haven in this late stage of cycle (limited currency risk, low-cost leverage, welcoming attitude towards foreign capital, superior growth/valuation proposition and higher exposure to faster growing GEM).

By Sector: We continue to side against the YTD bullish consensus view on Financials and cyclicals, in general, which continue to underperform.

Outside of Europe: 1) Remain OW SMid vs Large worldwide (SMid is not underperforming by much). 2) Remain OW Asia ex-J (recent correction offering a better entry point into a superior structural growth equation, trading at a discount to US valuations with a less leveraged B/S), UW US (facing tough comps in 2019, the least accommodative monetary policy and trading at a premium to SMid worldwide), OW LatAm (much appears discounted already), and OW Japan (value play with no corporate debt, benefiting from the stronger US$). 3) Remain OW High FCF Yld / low ND/EBITDA, which continues to outperform YTD in most regions.

Stocks: Top picks from our model portfolio at this juncture are Petrofac, Vectura, ASTM, Maire Tecnimont, the Norwegian Sparebanks (Nord & SMN), and outside Europe: Antero Midstream, Jazz, MRV Engenharia.

Eduardo Lecubarri AC

(44-20) 7134-5916 eduardo.lecubarri@jpmorgan.com

JPM's Small/Mid Cap Views in 3 Minutes (Click HERE or on Video)

TOP PICKS — Model portfolio

INVESTMENT OPPORTUNITIES

|

|

UK |

|

Cont. Europe |

|

RoW |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Arrow Global |

|

Petrofac |

|

Aperam |

Sonova |

Antero Midstream |

MRV Engenharia |

||||||

|

Cineworld |

|

Smiths Group |

|

ASTM |

Sparebank 1 Nord |

Estacio |

Nongshim |

||||||

|

Inchcape |

|

Vectura |

|

Cairo Comm. |

|

Sparebank 1 SMN |

Globaltrans |

|

Pax Global |

|

|||

|

M elrose |

|

|

|

GN Store |

Spie |

Jazz |

Qiwi |

||||||

|

|

|

|

|

M aire Tecnimont |

|

William Demant |

|

Johnson Electric |

|

Sao M artinho |

|

||

|

|

|

|

|

Scandi. Tobacco |

Zardoya |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKS TO AVOID

|

UK |

|

|

|

Cont. Europe |

|

RoW |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hays |

|

Rightmove |

|

Lanxess |

|

TAG Immobilien |

|

Sunstone Hotel |

|

|||||

Pagegroup |

|

|

|

|

Rational |

|

|

Wallenstam |

|

|

|

|

|

|

8

vk.com/id446425943

vk.com/id446425943