MailYandex-230119(2)_watermark

.pdf

vk.com/id446425943

Yandex and Mail Group

Strong topand bottom-line outlook

Our investment case for Mail Group (Mail) is based on the assumption that: 1) its core social networking and gaming businesses can maintain strong top-line growth and high profitability; and 2) material value can be created both organically and via M&A in its O2O services, with the spin-off of e-commerce assets a potential positive catalyst this year. We maintain our BUY rating with a $31/share TP (down from $36/share on model adjustments). We assume Yandex’ core advertising business outlook is also strong. Yandex.Taxi’s ridesharing business has turned profitable and newsflow around Uber’s IPO could be positive for shares in Yandex. Consequently, we upgrade our rating to HOLD and raise our TP to $32/share (previously $29/share).

Concerns around increased competition for VK overdone

Many investors remain concerned that the popularity of VK (Mail’s social media platform) could be negatively affected by the likes of WhatsApp, Instagram and

YouTube. However, VK’s app usage has not changed significantly over the past couple of years. VK remains under-monetised and we think top-line growth can remain strong in 2019. In games, visibility around medium-term profitability is an issue, but given the level of scepticism we would rather be cautiously optimistic.

Delivery Club and AliExpress could be valuable assets

We believe the market’s focus on near-term profitability at Delivery Club is shortsighted, as the business could be highly profitable over the medium term. Mail’s stake in AliExpress Russia could also see material upside. We are more sceptical about

Youla and Citimobil, but we were also quite sceptical on Pandao, and Mail’s deal with

AliExpress showed that the company knows how to create value.

Yandex’s core business prospects look good

Given Yandex’s historically weak position on mobile, we were concerned that mobile’s growing popularity could negatively impact its overall search share. However, the mandatory requirement to give users a choice of search engine has been a major game changer for Yandex on Android, and it now looks well positioned to maintain its overall leadership longer term, we believe.

Uber’s potential IPO can be a positive catalyst for Yandex

Yandex.Taxi’s popularity continues to grow, and more importantly, the business has significantly reduced losses over the past year. Competition is unlikely to disappear and there is little visibility on long-term profitability. However, the good results suggest we were too negative previously. According to press reports, Uber plans an IPO in 2019, with a potential valuation of up to $120bn. This sounds aggressive vs its last private round valuation of c. $70bn, but a $70bn-120bn range would imply a c. $3.7- 6.4bn valuation for 100% of Yandex.Taxi, on our estimates. While still mindful of the concerns around the taxi aggregator business model, we believe IPO-related newsflow is likely to be positive for shares in Yandex.

Sector update

Equity Research 23 January 2019

Media

Russia

David Ferguson +7 (495) 641-4189

DFerguson@rencap.com

Kirill Panarin

+7 (495) 258-7770 x4009 KPanarin@rencap.com

Summary sector ratings and TPs

Mail Group

Bloomberg |

MAIL LI |

TP, $/share |

31 |

Previous TP, $ |

36 |

Current price, $ |

25.4 |

Upside potential, % |

22.0 |

Rating |

BUY |

|

|

Yandex |

|

Bloomberg |

YNDX US |

TP, $/share |

32 |

Previous TP, $ |

29 |

Current price, $ |

30.8 |

Upside potential, % |

3.9 |

Rating |

HOLD |

Previous rating |

Sell |

Prices in this report are as of market close on 21 January 2019

Source: Bloomberg, Renaissance Capital estimates

Figure 1: Price performance – 52 weeks, $

MAIL LI

45 |

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

15 |

Feb-18 |

Mar-18 |

Apr-18 |

May-18 |

|

Jul-18 |

|

|

Oct-18 |

|

|

|

Jan-18 |

Jun-18 |

Aug-18 |

Sep-18 |

Nov-18 |

Dec-18 |

Jan-19 |

Source: Bloomberg

Figure 2: Price performance – 52 weeks, $

YNDX US

50 |

|

|

|

|

|

|

|

|

|

|

|

|

45 |

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

Mar-18 |

|

|

|

Jul-18 |

|

|

|

|

|

|

Jan-18 |

Feb-18 |

Apr-18 |

May-18 |

Jun-18 |

Aug-18 |

Sep-18 |

Oct-18 |

Nov-18 |

Dec-18 |

Jan-19 |

Source: Bloomberg

Important disclosures are found at the Disclosures Appendix. Communicated by Renaissance Securities (Cyprus) Limited, regulated by the Cyprus Securities & Exchange Commission, which together with non-US affiliates operates outside of the USA under the brand name of Renaissance Capital.

vk.com/id446425943

Contents

Investment summary |

3 |

4 |

|

Ad outlook for VK remains promising |

4 |

Games – growth remains strong, profitability has likely bottomed |

8 |

Delivery Club – competition vs Yandex.Foods negative for near-term margin |

|

but good for long-term revenue potential |

10 |

AliExpress is the dominant platform in cross-border e-commerce |

12 |

We remain sceptical on the outlook for Youla and Citimobil but we were |

|

negative about Pandao and got that wrong |

14 |

O2O spin-off should help crystallise value |

16 |

Financials and valuation |

17 |

Yandex |

18 |

Yandex has gone through the market transition to mobile with no significant |

|

share loss |

18 |

Solid performance for Yandex.Taxi, Uber IPO likely to be a positive catalyst |

21 |

Russia’s e-commerce market still highly fragmented; Beru gaining traction |

23 |

Financials and valuation |

28 |

Disclosures appendix |

30 |

Renaissance Capital

23 January 2019

Media

2

vk.com/id446425943

Investment summary

Mail Group: Our investment case for Mail is based on the assumption that: 1) its core social networking and gaming businesses can continue to see strong top-line growth and high profitability; and 2) material value can be created both organically and via M&A in its O2O services. The planned spin-off of Mail’s e-commerce assets in 2019 should remind the market of the core’s financials, while the scaling of its O2O assets could provide multiple positive share price catalysts. The combination of no new corporate governance concerns with a stable board and controlling shareholder structure could also help revive investor interest, in our view. We reduce our TP to $31/share (from $36/share) on adjustments to our model and maintain our BUY rating.

Many investors remain concerned that VK’s popularity and monetisation could be negatively affected by the likes of Facebook, WhatsApp, Instagram and YouTube. However, VK’s app usage has not changed significantly over the past couple of years, despite competitors gaining traction. In fact, given meaningful growth in the user base of alternative messengers, we believe there has been a shift in time spent on VK from nonmonetised messaging towards monetised services. With VK significantly under-monetised vs international peers, we believe top-line growth can remain strong in 2019. In games, key titles continued to do well in 4Q18. Visibility on medium-term profitability is an issue and Mail’s games business could surprise on both the upside and downside in 2019; however, given the level of scepticism in the market currently, we would rather be cautiously optimistic, at least for now.

Among its O2O businesses, we believe Delivery Club and AliExpress have the most potential to increase in value. Delivery Club is growing fast, but break-even has been delayed. We believe the market’s focus on near-term profitability and competition from Yandex is short sighted, and that Delivery Club could be highly profitable over the medium term. Mail’s stake in AliExpress Russia could also see material upside from our current $450mn estimate on a three-to-five-year view. We are more sceptical about the monetisation potential of Youla and Citimobil, but we were also quite sceptical on Pandao and Mail’s deal with AliExpress showed that there are different routes to create value.

Yandex: As with Mail, we assume a strong outlook for Yandex’s core search business. In its O2O businesses, Yandex Taxi’s ride-sharing business has turned profitable and its financials could continue to improve quickly. Uncertainty around Yandex’s future control structure needs to be resolved, but on balance results should remain strong in 2019. Consequently, we upgrade our rating to HOLD with a $32/share TP (from $29/share).

Over the past few years, the Russian search market has transitioned from desktop to mobile, with mobile accounting for the majority of searches last year. Given Yandex’s historically weak position on mobile we were concerned that the growing popularity of mobile could negatively impact its overall search share, leading to deteriorating monetisation. However, the mandatory requirement to give users a choice of search engine for the widget and even Chrome browser, regardless of which apps are preinstalled, has been a major game changer for Yandex on Android and it now appears well-positioned to maintain its overall leadership longer term.

Yandex.Taxi’ has made impressive progress over the past two years. Its popularity continues to grow, and more importantly, the business has managed to significantly reduce losses over the past year. Competition is unlikely to disappear and there is very little visibility on long-term profitability; however, given the good results it appears we were too negative previously. According to press reports, Uber plans an IPO in 2019, with a potential valuation of up to $120bn. This sounds aggressive vs its last private round valuation of c. $70bn, but somewhere between $70bn and $120bn is probably reasonable. Applying the same GMV multiple range to Yandex.Taxi’s 2018 GMV would imply a c. $3.7-6.4bn valuation for 100% of the company, on our estimates. While we are mindful of some of the concerns around Uber and Yandex.Taxi’s business model, for shares in Yandex we would rather have a positive bias around this newsflow.

Renaissance Capital

23 January 2019

Media

3

vk.com/id446425943

Ad outlook for VK remains promising

Renaissance Capital

23 January 2019

Media

VK’s usage remains stable despite competition, with new products helping engagement

Competition for users’ time has grown significantly over the past five years, with multiple media platforms gaining traction in Russia. Unsurprisingly, many investors remain concerned that VK’s popularity and monetisation potential could be negatively affected by the likes of Facebook, WhatsApp, Instagram and YouTube. We believe these concerns are overdone.

VK remains one of the most popular social media platforms in Russia by audience, engagement and time spent, according to Mail. Its app usage has been stable over the past 18 months despite competitors gaining traction. This is important and, in our view, has been achieved via various product initiatives and new functions, be it longreads, podcasts, live streams or classifieds integration. This is an ongoing process and in the near term we expect the introduction of O2O-type services and the integration of AliExpress to be popular enhancements to VK.

Regarding competition:

▪While VK’s overall app usage has not changed significantly over the past couple of years, in our view there has been an important change in how it is used. Given meaningful growth in the user base of alternative messengers (WhatsApp, Viber and Telegram), there has likely been a shift in time spent on VK from nonmonetised messaging towards monetised services such as newsfeeds or watching videos.

▪We believe the only platform that is comparable to VK in terms of audience, engagement and monetisation potential is YouTube, which is usually preinstalled on mobile handsets and is now similar to VK in terms of active users and time spent, based on SimilarWeb data.

▪VK has also been successful in popularising its video services, achieving 13.5bn video views per month by mid-2018. At the same time, video remains the toughest area of competition for Mail, in our view. If VK managed to outperform YouTube in terms of popularity, it would make a meaningful difference to VK’s future revenue potential, as the importance of the online video ad market continues to grow.

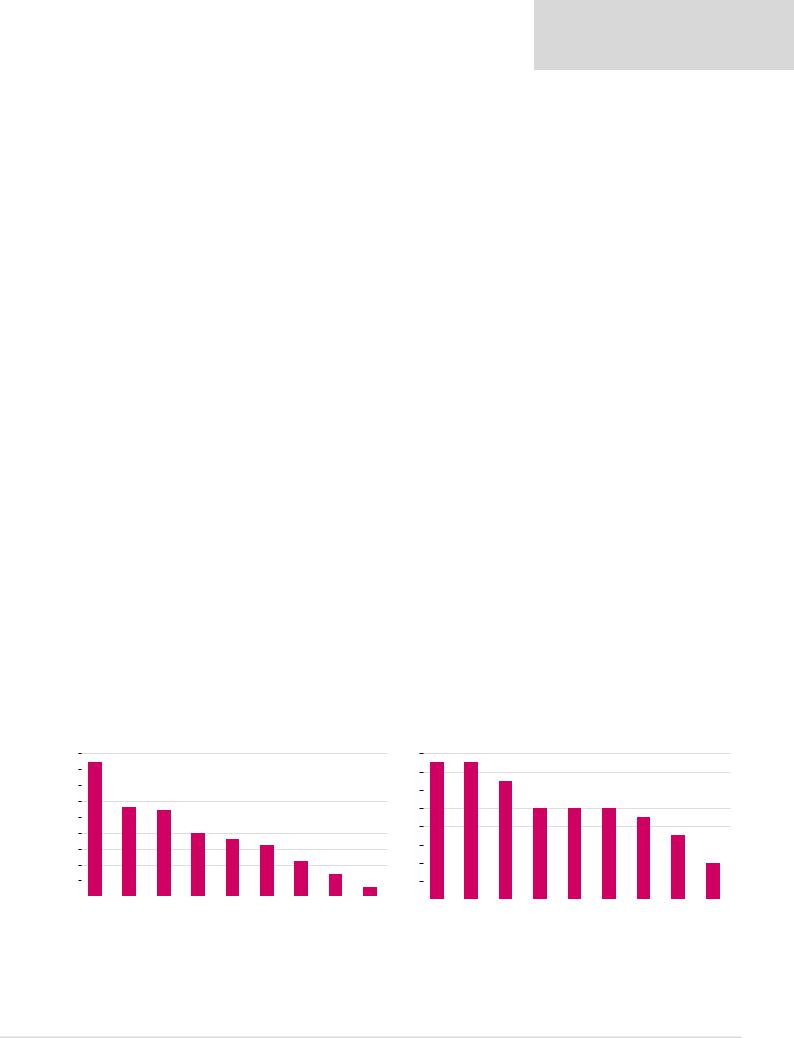

Figure 3: According to Mail, VK remains the leading social platform in Russia in |

Figure 4: …and engagement (days per month) |

|

|

|

|

|

|||||||||||||||

terms of average daily reach (%)… |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

45 |

42 |

|

|

|

|

|

|

|

|

|

16 |

15 |

15 |

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

14 |

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

30 |

|

27 |

|

|

|

|

|

|

|

|

|

|

10 |

10 |

10 |

9 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|||

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

18 |

|

|

|

|

|

8 |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

20 |

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

||

15 |

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

4 |

|

|||

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

||||

10 |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

5 |

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

0 |

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

VK |

YouTube |

What's up |

Viber |

OK |

Telegram |

|

|

|

|

|

|

|

|

|

|

||||||

VK |

What's up |

Viber |

YouTube |

|

OK |

||||||||||||||||

|

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

Source: Company data |

|

|

|

|

|

|

|

|

Source: Company name |

||||

4

vk.com/id446425943

Renaissance Capital

23 January 2019

Media

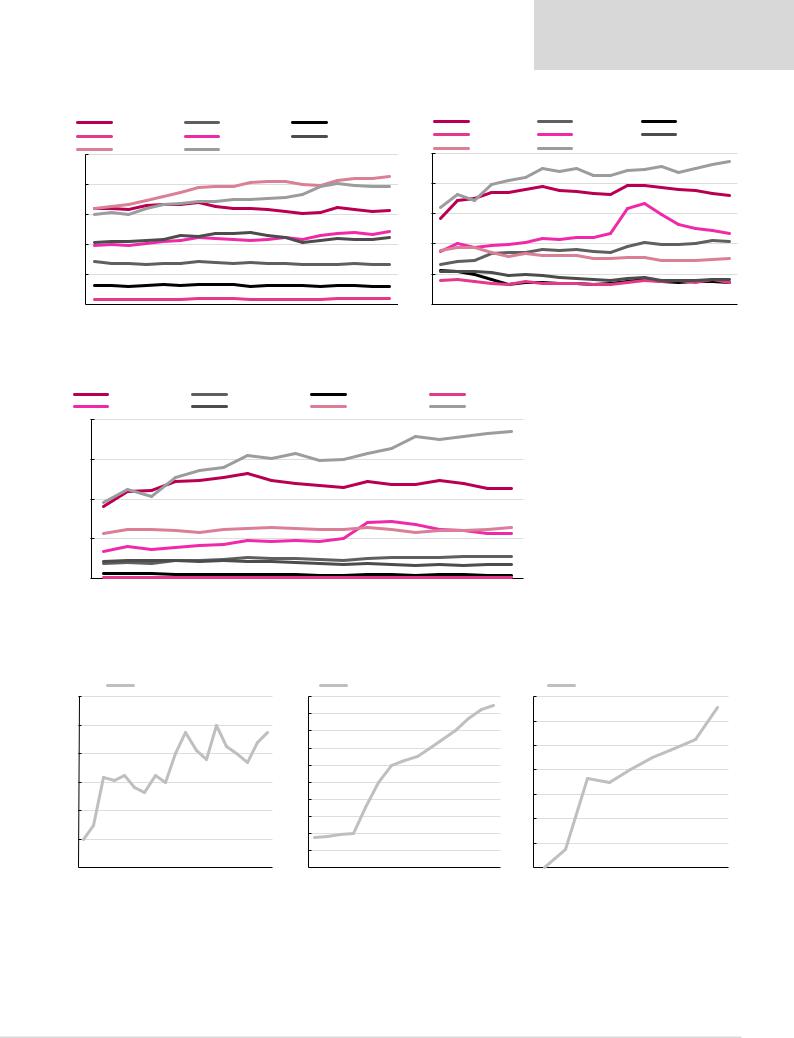

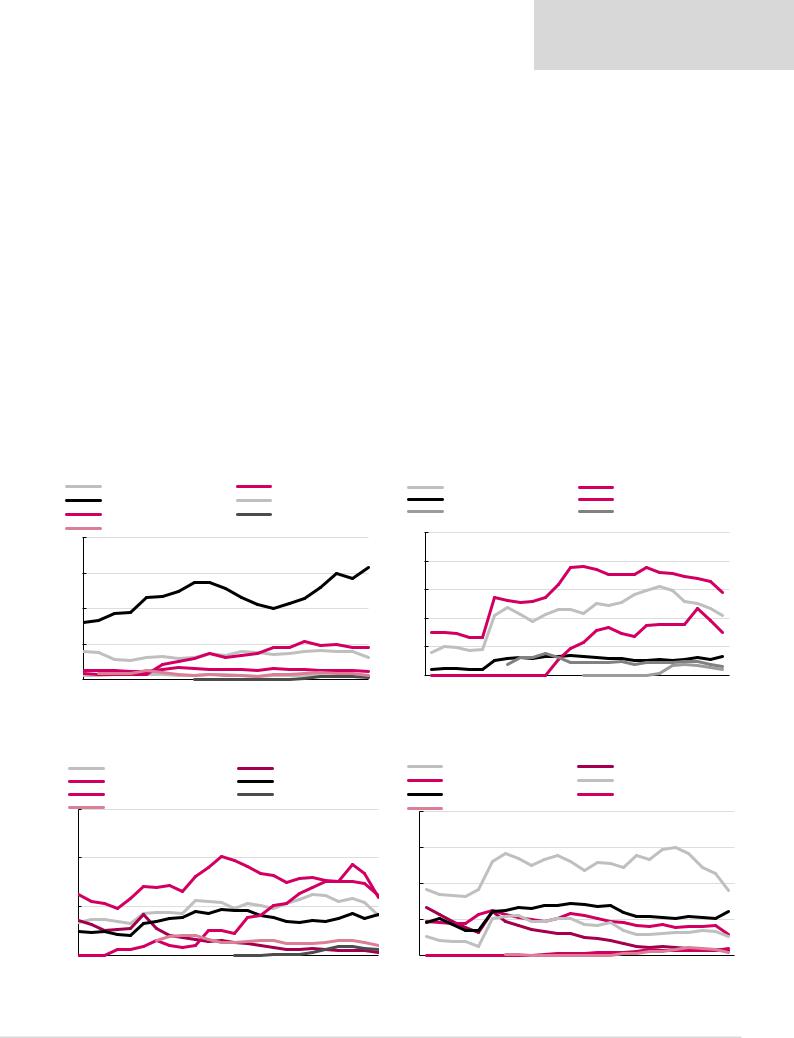

Figure 5: According to SimilarWeb, VK’s user base has been broadly stable in the Figure 6: …and average daily time spent has increased slightly, min… past 18 months despite growing competition (Android app DAU, mn)…

|

VK |

|

OK |

|

||

|

FB Messenger |

|

|

Viber |

|

|

25.0 |

|

YouTube |

|

|

100.0 |

|

|

|

|

|

|

||

20.0 |

|

|

|

|

|

80.0 |

15.0 |

|

|

|

|

|

60.0 |

10.0 |

|

|

|

|

|

40.0 |

5.0 |

|

|

|

|

|

20.0 |

0.0 |

|

|

|

|

|

0.0 |

Jul-17 |

Sep-17 Nov-17 |

Jan-18 |

Mar-18 May-18 |

Jul-18 |

Sep-18 |

Nov-18 |

|

VK |

|

OK |

|

|

|

FB Messenger |

|

|

Viber |

|

|

|

YouTube |

|

|

|

Jul-17 |

Sep-17 Nov-17 |

Jan-18 |

Mar-18 May-18 |

Jul-18 |

Sep-18 Nov-18 |

Source: SimilarWeb |

Source: SimilarWeb |

Figure 7: …as has the total time spent on the platform, although YouTube is now leading (mn min)

VK |

|

|

OK |

|

|

FB Messenger |

||

|

Viber |

|

|

YouTube |

||||

2,000 |

|

|

|

|

|

|

|

|

1,500 |

|

|

|

|

|

|

|

|

1,000 |

|

|

|

|

|

|

|

|

500 |

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

Jul-17 |

Sep-17 |

Nov-17 |

Jan-18 |

Mar-18 |

May-18 |

Jul-18 |

Sep-18 |

Nov-18 |

Source: SimilarWeb

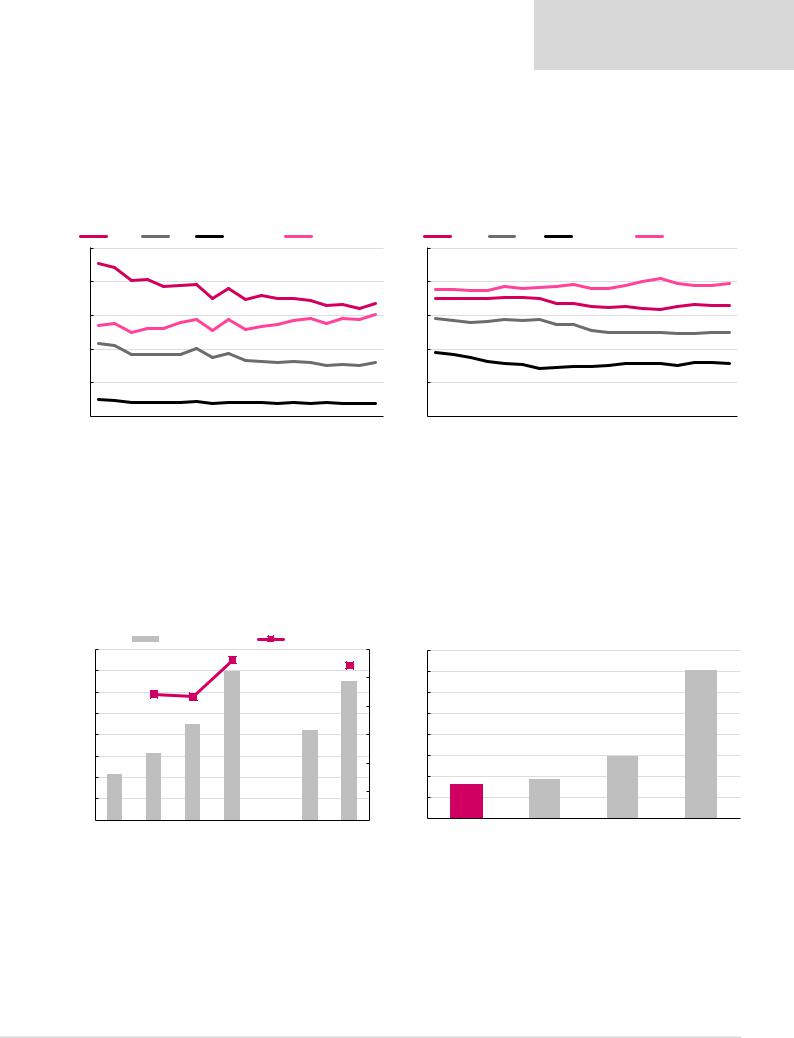

Figure 8: User engagement on VK has been supported Figure 9: …music subscriptions… |

Figure 10: …and longreads |

by product initiatives including video… |

|

Video views per month, bn

16

14

12

10

8

6

4

Jan-17 May-17 Sep-17 Jan-18 May-18

VK App + Boom subscriptions, mn

2 |

|

|

|

14 |

1.8 |

|

|

|

12 |

1.6 |

|

|

|

|

|

|

|

|

|

1.4 |

|

|

|

10 |

1.2 |

|

|

|

8 |

|

|

|

|

|

1 |

|

|

|

|

0.8 |

|

|

|

6 |

|

|

|

|

|

0.6 |

|

|

|

4 |

0.4 |

|

|

|

2 |

0.2 |

|

|

|

|

|

|

|

|

|

0 |

|

|

|

0 |

Jul-17 |

Oct-17 |

Jan-18 |

Apr-18 |

Jul-18 |

Source: Company data |

Source: Company data |

Longreads Daily Active Users, mn

Dec-17 |

Feb-18 |

Apr-18 |

Jun-18 |

Aug-18 |

Source: Company data

5

vk.com/id446425943

Renaissance Capital

23 January 2019

Media

VK’s desktop usage declining gradually but still relevant

VK’s web usage continues to decline as people access its app more frequently, and this trend is likely to continue. That said, with 1.7bn monthly visits and an average visit duration of 16 minutes, VK’s web version remains highly popular, with video-watching on desktops an important driver of engagement.

Figure 11: VK web’s usage has been declining (monthly visits, mn)… |

Figure 12: …but remains significant with watching videos on desktop popular |

|

(average visit duration, min) |

vk.com |

ok.ru |

facebook.com |

|

YouTube.com |

|

2,500 |

|

|

|

|

25.0 |

2,000 |

|

|

|

|

20.0 |

1,500 |

|

|

|

|

15.0 |

1,000 |

|

|

|

|

10.0 |

500 |

|

|

|

|

5.0 |

0 |

|

|

|

|

0.0 |

Jul-17 |

Sep-17 Nov-17 Jan-18 |

Mar-18 May-18 |

Jul-18 |

Sep-18 Nov-18 |

|

|

vk.com |

ok.ru |

facebook.com |

|

YouTube.com |

Jul-17 |

Sep-17 |

Nov-17 Jan-18 |

Mar-18 May-18 |

Jul-18 |

Sep-18 Nov-18 |

Source: SimilarWeb |

Source: SimilarWeb |

VK remains relatively under-monetised

VK has delivered impressive top-line performance since being acquired by Mail, with revenue up by around 45-50% every year and on track to more than quadruple in 2018 vs 2014 (and double vs 2016). Nevertheless, VK remains significantly under-monetised vs Facebook in North America and vs WeChat in China in terms of revenue per active user; hence, we believe the medium-term growth outlook for VK is still strong.

Figure 13: VK’s revenue is on track to double in 2018 vs 2016… |

|

Figure 14: …but it remains relatively under-monetised |

|

||||||

|

VK revenue, RUBmn |

Growth, % |

|

|

Adj. revenue/MAU, $ |

|

|||

16,000 |

|

|

|

|

60% |

16.0 |

|

|

|

14,000 |

|

|

|

|

50% |

14.0 |

|

|

|

12,000 |

|

|

|

|

|

12.0 |

|

|

|

10,000 |

|

|

|

|

40% |

10.0 |

|

|

|

8,000 |

|

|

|

|

30% |

8.0 |

|

|

|

6,000 |

|

|

|

|

20% |

6.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

4,000 |

|

|

|

|

|

4.0 |

|

|

|

2,000 |

|

|

|

|

10% |

2.0 |

|

|

|

|

|

|

|

|

|

|

|

||

0 |

|

|

|

|

0% |

0.0 |

|

|

|

2014 |

2015 |

2016 |

2017 |

9M17 |

9M18 |

VK |

OK |

FB North America |

|

|

|

|

|

|

|

Note: Revenue/MAU is adjusted for GDP per capita in different countries. |

|

||

|

|

|

|

|

Source: Company data |

|

|

Source: Company data, Renaissance Capital estimates |

|

6

vk.com/id446425943

Renaissance Capital

23 January 2019

Media

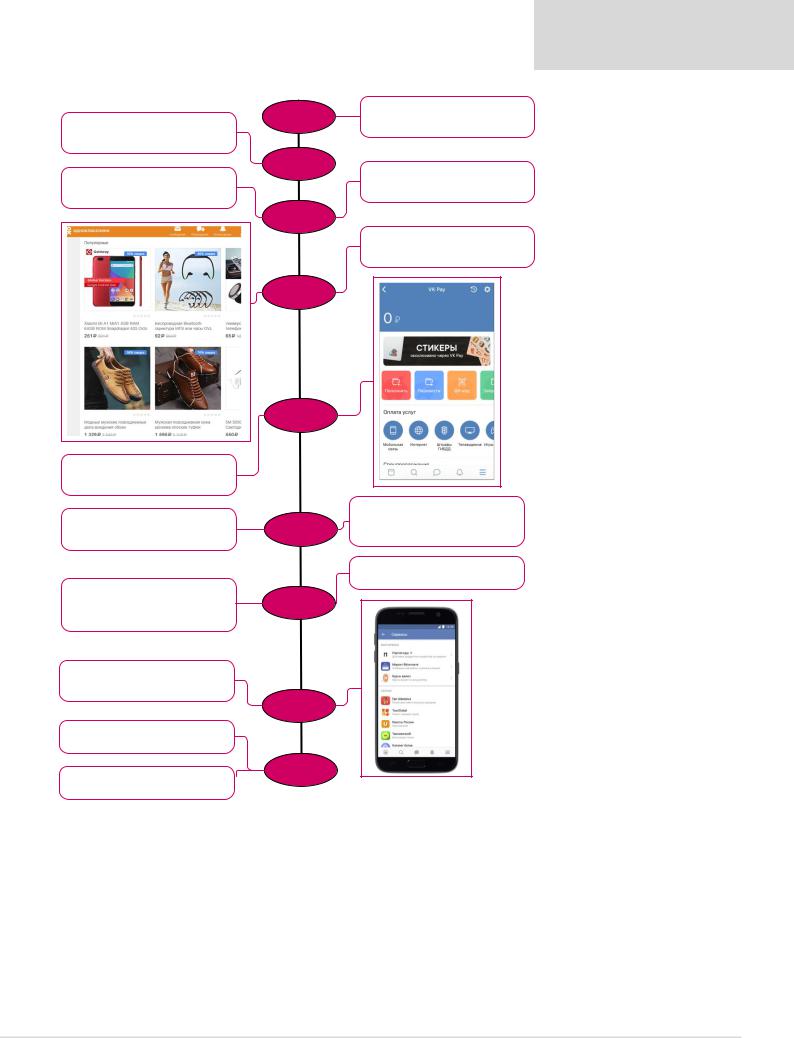

Figure 15: VK is constantly introducing new product and monetisation initiatives

VK launched rewarded video format for games monetisation

Mail announced launching contextual advertising on its major platforms, including VK, OK and Youla

VK started testing VK Pay payment platform, allowing money transfers, utilities and other payments

The number of active paid and trial subscriptions to VK, OK and the BOOM app s music services exceeded 1.5mn

Collection of application possibility to get information about users, who click a link and provide them with application form for orders, requests, workshops

Introduction of Services using it users can directly order Taxi, buy tickets, buy some goods

Launch of special podcasts platform

New privacy settings, possibility to close profile

Oct-17

Nov-17

Apr-18

Apr-18

Mar-18

Jun-18

July-18

Aug-18

Sep-18

VK started music monetisation via limiting the time of free background music listening to 30 min a day

VK introduced secure voice and video calls for iOS and Android

OK launched an e-shop of Chinese goods on its platform based on Mail s Pandao

VK announced plans to monetise stories in the newsfeeds via advertising

Possibility of articles monetization is introduced for groups

Source: Mail.ru, press coverage, VK

7

vk.com/id446425943

Renaissance Capital

23 January 2019

Media

Games – growth remains strong, profitability has likely bottomed

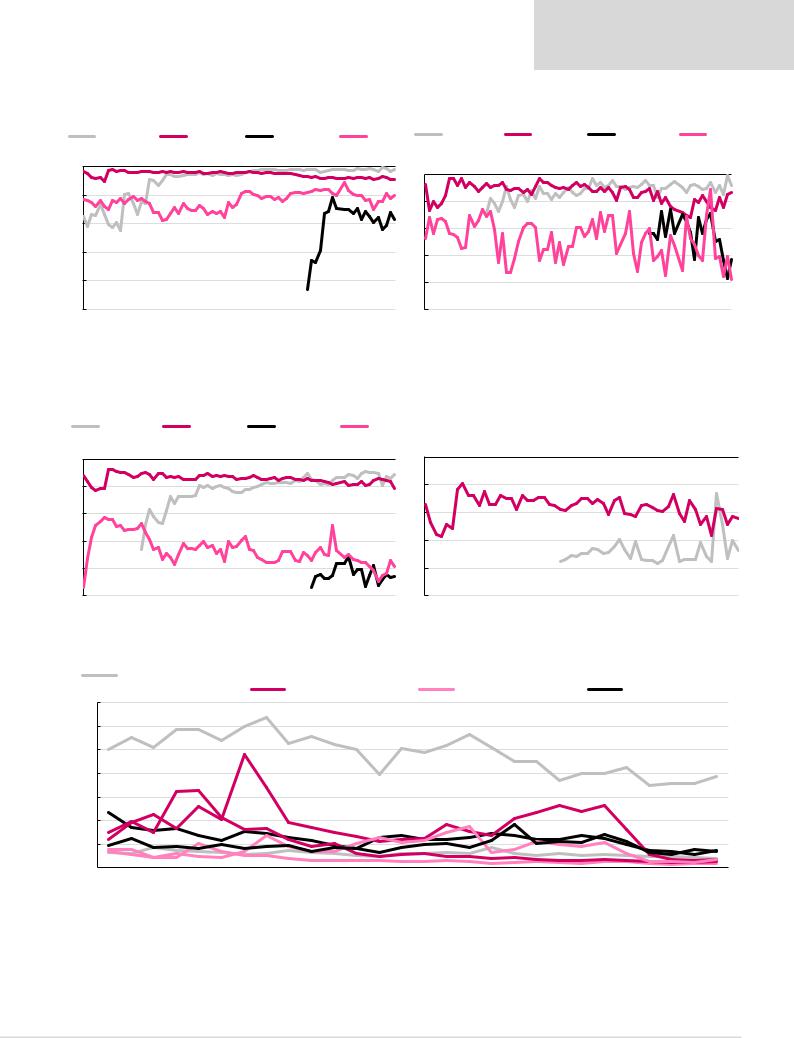

Mail’s key mobile games, War Robots and Hustle Castle, continued to do well in 4Q in terms of popularity. In terms of revenue, they were in the top 50 and top 20 in Russia in grossing rankings, respectively. In the US, their performance was also stable QoQ (both were in the top 100 on GooglePlay and top 150 on iOS). More recently, ‘Left to Survive’ has been gaining traction on Android in Russia and Hawk is reasonably popular in Russia. On PC, Warface remains popular and well-monetised. We expect Mail to report solid top-line growth in its game division in 4Q and given its “full pipeline for 2019” the businesses top-line outlook looks good to us.

At the same time, we expect games profitability to visibly improve in 4Q (vs 5% in 3Q), with a slight deterioration in Hustle Castle’s usage in December 2018 potentially suggesting a reduction in marketing spend, albeit probably to a lesser extent than many investors expect. However, the real issue is whether improving profitability continues in 2019 and to what extent. We currently have little visibility on usage of Mail’s mobile games once initial marketing is scaled back, or on what a sustainable margin may be in the medium term for mature titles. In 2019, Mail’s games business could surprise on both the upside and downside, as is often the case. However, given the breadth of its titles and level of scepticism in the market currently we would rather be cautiously optimistic, at least for now.

Figure 16: War Robots and Hustle Castle have been showing strong user |

Figure 17: …the US (Android DAU, ‘000s)… |

|

|

|

|||||||||||

trends in Russia (Android DAU, ‘000s)… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

War Robots |

|

|

Star Wars™: Galaxy of Heroes |

|

War Robots |

|

|

|

Star Wars™: Galaxy of Heroes |

|||||

|

World of Tanks Blitz |

|

Modern Combat 5 |

|

World of Tanks Blitz |

|

|

Hustle Castle |

|

||||||

|

Hustle Castle |

|

|

Left to Survive |

|

|

Left to Survive |

|

|

Hawk |

|

|

|||

400 |

Hawk |

|

|

|

|

|

250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

200 |

|

|

|

|

|

|

|

|

300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

150 |

|

|

|

|

|

|

|

|

200 |

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

100 |

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jan-17 |

Apr-17 |

Jul-17 |

Oct-17 |

Jan-18 |

Apr-18 |

Jul-18 |

Oct-18 |

||

Jun-17 |

Sep-17 |

Dec-17 |

Mar-18 |

Jun-18 |

Sep-18 |

Dec-18 |

|||||||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

Source: SimilarWeb |

|

|

|

|

|

|

|

Source: SimilarWeb |

|

Figure 18: … and Germany (Android DAU, ‘000s)… |

|

|

|||||

|

War Robots |

|

|

Mobile strike |

|

||

|

Star Wars™: Galaxy of Heroes |

World of Tanks Blitz |

|||||

|

Hustle Castle |

|

|

Left to survive |

|

||

75 |

Hawk |

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

Jan-17 |

Apr-17 |

Jul-17 |

Oct-17 |

Jan-18 |

Apr-18 |

Jul-18 |

Oct-18 |

Figure 19: …while War Robots is also popular in Japan (Android DAU, ‘000s)

|

War Robots |

Mobile strike |

|

Star Wars™: Galaxy of Heroes |

Modern Combat 5 |

|

World of Tanks Blitz |

Hustle Castle |

40 |

Hawk |

|

|

|

|

30 |

|

|

20 |

|

|

10 |

|

|

0 |

|

|

|

Jan-17 Apr-17 Jul-17 Oct-17 Jan-18 |

Apr-18 Jul-18 Oct-18 |

Source: SimilarWeb |

Source: SimilarWeb |

8

vk.com/id446425943

Figure 20: Hustle Castle has overtaken War Robots in grossing rankings in Russia and is now a top-10 grossing game on Android…

GooglePlay grossing rankings among games (Russia)

Renaissance Capital

23 January 2019

Media

Figure 21: …and in the top 25 on iOS

AppStore grossing rankings among games (Russia)

|

Hustle Castle |

War Robots |

Left to survive |

Hawk |

|

Hustle Castle |

War Robots |

Left to survive |

Hawk |

|||||

Jul-17 |

Sep-17 |

Nov-17 |

Jan-18 Mar-18 |

May-18 |

Jul-18 |

Sep-18 |

Nov-18 |

Jul-17 |

Sep-17 Nov-17 |

Jan-18 Mar-18 |

May-18 |

Jul-18 |

Sep-18 |

Nov-18 |

0 |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

200 |

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

300 |

|

|

|

|

|

|

|

150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

400 |

|

|

|

|

|

|

|

200 |

|

|

|

|

|

|

500 |

|

|

|

|

|

|

|

250 |

|

|

|

|

|

|

Source: SimilarWeb |

Source: SimilarWeb |

Figure 22: Hustle Castle is now broadly similar to War Robots on grossing |

Figure 23: …and iOS |

rankings in the US on both Android… |

|

GooglePlay grossing rankings among games (USA)

|

Hustle Castle |

War Robots |

Left to survive |

Hawk |

|

|||

Jul-17 |

Sep-17 |

Nov-17 |

Jan-18 Mar-18 |

May-18 |

Jul-18 |

Sep-18 |

Nov-18 |

Jul-17 |

0 |

|

|

|

|

|

|

|

0 |

100 |

|

|

|

|

|

|

|

50 |

200 |

|

|

|

|

|

|

|

100 |

300 |

|

|

|

|

|

|

|

150 |

400 |

|

|

|

|

|

|

|

200 |

500 |

|

|

|

|

|

|

|

250 |

AppStore grossing rankings among games (US)

|

|

|

Hustle Castle |

|

War Robots |

|

||

|

|

|

|

|

||||

Sep-17 |

Nov-17 |

Jan-18 |

Mar-18 |

May-18 |

Jul-18 |

|||

Source: SimilarWeb Source: SimilarWeb

Figure 24: Mail’s Warface remains a highly popular online game (monthly unique website visitors, mn) |

|

|

||||||

|

|

Archage |

|

Warface |

|

Skyforge |

|

Armored Warfare |

|

|

|

||||||

|

|

Revelation |

|

Revelation International |

|

Skyforge International |

|

AW International |

|

|

|

|

|

||||

3.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sep-16 |

Nov-16 |

Jan-17 |

Mar-17 |

May-17 |

Jul-17 |

Sep-17 |

Nov-17 |

Jan-18 |

Mar-18 |

May-18 |

Jul-18 |

Sep-18 |

Nov-18 |

Source: SimilarWeb

9

vk.com/id446425943

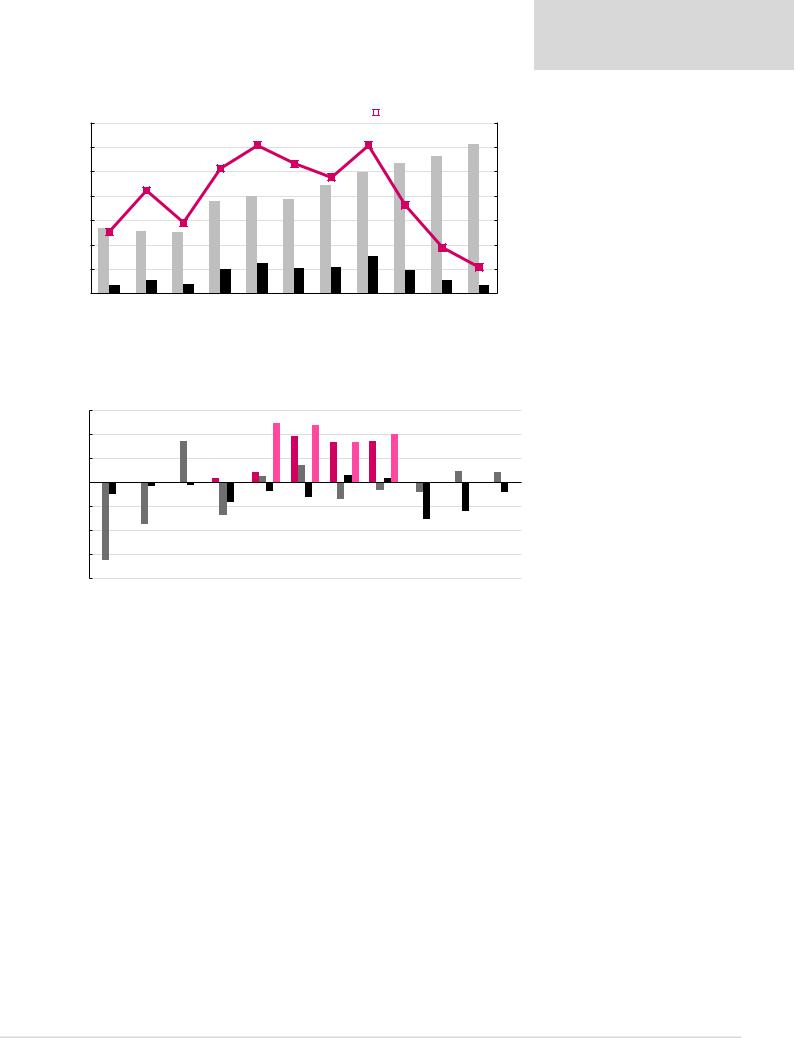

Figure 25: Mail’s games profitability likely bottomed out in 3Q18

|

Revenue, RUBmn |

|

EBITDA, RUBmn |

|

|

|

EBITDA margin, % |

7,000 |

|

|

|

|

|

|

|

|

|

35.0% |

6,000 |

|

|

|

|

|

|

|

|

|

30.0% |

5,000 |

|

|

|

|

|

|

|

|

|

25.0% |

4,000 |

|

|

|

|

|

|

|

|

|

20.0% |

3,000 |

|

|

|

|

|

|

|

|

|

15.0% |

2,000 |

|

|

|

|

|

|

|

|

|

10.0% |

1,000 |

|

|

|

|

|

|

|

|

|

5.0% |

0 |

|

|

|

|

|

|

|

|

|

0.0% |

1Q16 |

2Q16 |

3Q16 |

4Q16 |

1Q17 |

2Q17 |

3Q17 |

4Q17 |

1Q18 |

2Q18 |

3Q18 |

Source: Company data

Figure 26: EBITDA profitability of international mobile games companies varies and is often quite modest (EBITDA margin, %)

|

King |

|

Zynga |

|

Glu Mobile |

|

Supercell |

|

|

|

|

||||

|

|

|

|

60%

40%

20%

0%

-20%

-40%

-60%

-80%

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

9M18 |

Source: Bloomberg

Delivery Club – competition vs Yandex.Foods negative for near-term margin but good for long-term revenue potential

Delivery Club has been performing well and we expect 2018 revenue growth in excess of 40% YoY. The offset, however, is that break-even has been delayed on several occasions. We think it highly probable that profitability will not turn positive until at least 2020, the key reason being increased competition from Yandex.Foods.

Delivery Club remains dominant and more widely present across Russian regions than Yandex’s food delivery service; however, Yandex.Foods is expanding rapidly (now present in 24 cities vs Delivery Club’s 63) and growing fast in terms of popularity. Yandex has materially ramped up its investments (over $40mn annual loss run-rate in 3Q18) and we think Mail will remain highly aggressive, with both businesses loss-making in 2019.

Ultimately, we think stronger competition is positive for user adoption, order frequency and long-term revenue potential for both companies, as higher investments are likely to drive faster overall market growth. Thus, we would not overplay the potential near-term margin pressure, and we continue to believe that the online food delivery business model can generate high profitability and returns as suggested by multiple international examples. It is too early to predict the long-term market share split between Mail and Yandex, although we believe Delivery Club’s earlier entry, current leadership and

Renaissance Capital

23 January 2019

Media

10