Oil_and_Gas_Weekly-031218__watermark

.pdf

vk.com/id446425943

Oil & Gas

Weekly Monitor

Price performance

Russian oil & gas stocks were up 4% on average last week, outperforming the Brent oil price (+1%), the RTS Index (+2) and global oil & gas stocks (+3%), but underperforming EE refiners (+5%). The two best-performing stocks in our sector universe last week were PKN ORLEN (+10%) and Gazprom (+8%). The worst-performing stocks in the sector were Nostrum oil & gas (-24%) and Surgutneftgas prefs (-2%). On a YtD basis, the two best performers are NOVATEK (+73%) and Tatneft commons (+50%).

Gazprom’s dividend promise

Gazprom’s CFO Andrey Kruglov said last week that the company’s management will propose to unfreeze 2018 dividends which could grow to a “double-digit” figure. Previously, the company has guided for its dividend to remain flat at RUB8.04/share until 2020. The CFO’s comments are in line with our expectations and follow a significant increase in the company’s estimated 2018 earnings. A flat RUB8.04/share dividend (a yield of 4.9%) would represent a payout ratio of just 14%, as we expect

Gazprom’s profits to rise by 76% this year on higher gas sales. A hypothetical 25% dividend payout ratio would produce a double-digit dividend of RUB14/share, a yield of 8.7%. This would double to 17.4% if a 50% dividend payout ratio were used.

Chart of the week

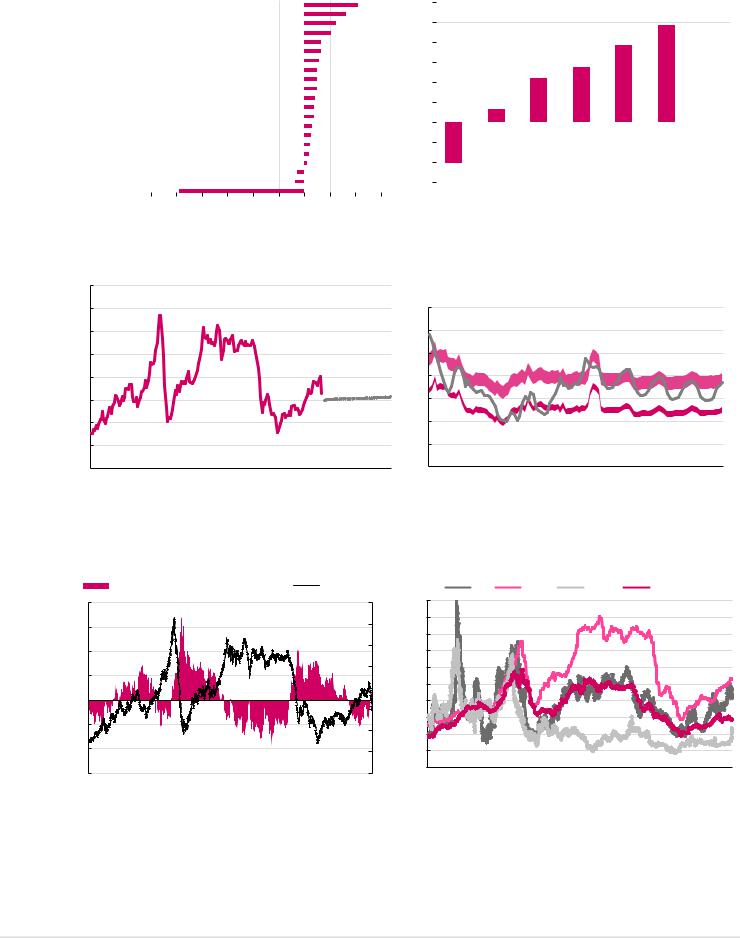

Last week, Interfax reported October 2018 drilling statistics in Russia. Russia’s total development drilling footage increased by 1% YtD to 23.4k km. This was led by Rosneft (+24%), Bashneft (+4%) and Surgutneftegas (+3%), with Rosneft alone accounting for 42% of Russia’s drilling volumes, led by Samotlorneftegas (+49%).

Surgutneftegas, with a 17% share in total drilling, has maintained its number-two position, with LUKOIL slipping back to number three with a share of 11%. Other major Russian oil producers saw their development drilling either flat or decline in 10M18, according to Interfax, as detailed in Figure 1.

Figure 1: Development drilling growth in 10M18, YoY |

|

|

|

|

||

10% |

|

|

|

|

|

|

|

0% |

3% |

4% |

4% |

1% |

|

|

|

|

|

|||

|

|

|

|

|

||

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

-10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

-20% |

|

|

|

|

|

|

|

-18% |

|

|

|

|

|

|

|

|

|

|

|

|

-30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

-40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

-50% |

|

|

|

|

|

|

|

-54% |

|

|

|

|

|

-60% |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Tatneft Gazprom Neft LUKOIL Surgutneftegas |

Bashneft |

Rosneft |

Total Russia |

|

Source: Interfax

Sector update

Equity Research 3 December 2018

Oil & Gas

Russia

Alexander Burgansky +44 (207) 005-7982 ABurgansky@rencap.com

Oleg Chistyukhin

+7 (495) 258-7770 x4073 OChistyukhin@rencap.com

Richard Wisentaner

+44 (207) 005-7594 x8954 RWisentaner@rencap.com

Gazprom (BUY) |

|

GAZP RX |

TP/Current price, RUB |

|

220.0/165.0 |

Upside potential, % |

|

33.3 |

|

|

|

LUKOIL (BUY) |

|

LKOH RX |

TP/Current price, RUB |

|

5,600.0/4,766.0 |

Upside potential, % |

|

17.5 |

|

|

|

NOVATEK (HOLD) |

|

NVTK RX |

TP/Current price, RUB |

|

1070.0/1167.8 |

Upside potential, % |

|

(8.4) |

|

|

|

Rosneft (BUY) |

|

ROSN RX |

TP/Current price, RUB |

|

550.0/417.0 |

Upside potential, % |

|

31.9 |

|

|

|

Gazprom Neft (HOLD) |

|

SIBN RX |

TP/Current price, RUB |

|

360.0/359.1 |

Upside potential, % |

|

0.3 |

|

|

|

SurgutNG (HOLD / BUY) |

SNGS RX |

SNGSP RX |

TP/Current price, RUB |

110.0/27.2 |

110.0/37.1 |

Upside potential, % |

304.3 |

196.1 |

|

|

|

Tatneft (HOLD / BUY) |

TATN RX |

TATNP RX |

TP/Current price, RUB |

740.0/714.0 |

740.0/512.8 |

Upside potential, % |

3.6 |

44.3 |

|

|

|

Transneft (BUY) |

|

TRNFP RX |

TP/Current price, RUB |

215,000.0/171,350.0 |

|

Upside potential, % |

|

25.5 |

|

|

|

PKN ORLEN (HOLD) |

|

PKN PW |

TP/Current price, PLN |

|

98.0/112.9 |

Upside potential, % |

|

(13.2) |

|

|

|

MOL Group (BUY) |

|

MOL HB |

TP/Current price, HUF |

|

4,200.0/3,178. |

Upside potential, % |

|

32.2 |

|

|

|

Tupras (BUY) |

|

TUPRS TI |

TP/Current price, TRY |

|

176.0/125.8 |

Upside potential, % |

|

39.9 |

|

|

|

OMV Petrom (BUY) |

|

SNP RE |

TP/Current price, RON |

|

0.46/0.37 |

Upside potential, % |

|

25.3 |

|

|

|

Grupa LOTOS (BUY) |

|

LTS PW |

TP/Current price, PLN |

|

92.0/81.2 |

Upside potential, % |

|

13.2 |

|

|

|

Petkim (HOLD) |

|

PETKM TI |

TP/Current price, TRY |

|

8.0/5.3 |

Upside potential, % |

|

49.8 |

Prices in this report as of close 29 November 2018

Source: Bloomberg, Renaissance Capital estimates

Important disclosures are found at the Disclosures Appendix. Communicated by Renaissance Securities (Cyprus) Limited, regulated by the Cyprus Securities & Exchange Commission, which together with non-US affiliates operates outside of the USA under the brand name of Renaissance Capital.

vk.com/id446425943

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Renaissance Capital |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 December 2018 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil & Gas |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Figure 2: Price performance, last week, % |

|

|

|

|

Figure 3: Russian oil production (in b/d terms) growth in October 2018, YoY |

||||||||||||

PKN ORLEN |

|

|

|

|

|

|

|

|

10.5% |

|

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.9% |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Gazprom |

|

|

|

|

|

|

|

|

8.2% |

|

5% |

|

|

|

|

||

Grupa LOTOS |

|

|

|

|

|

|

|

6.2% |

|

|

|

4.4% |

|

||||

NOVATEK |

|

|

|

|

|

|

|

5.2% |

|

|

4% |

|

3.9% |

|

|

|

|

Rosneft |

|

|

|

|

|

|

|

3.4% |

|

|

|

|

|

|

|

|

|

LUKOIL |

|

|

|

|

|

|

|

3.3% |

|

|

|

|

2.8% |

|

|

|

|

Gazprom Neft |

|

|

|

|

|

|

|

2.8% |

|

|

3% |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

2.2% |

|

|

|

||||

Transneft |

|

|

|

|

|

|

2.6% |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Petkim |

|

|

|

|

|

|

2.5% |

|

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Tupras |

|

|

|

|

|

|

2.5% |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

0.7% |

|

|

|

|

|

|||

Exillon Energy |

|

|

|

|

|

|

2.2% |

|

|

1% |

|

|

|

|

|

||

Bashneft prefs |

|

|

|

|

|

|

2.0% |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

OMV Petrom |

|

|

|

|

|

|

1.9% |

|

|

0% |

|

|

|

|

|

|

|

Tatneft prefs |

|

|

|

|

|

|

1.5% |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Bashneft |

|

|

|

|

|

|

1.3% |

|

|

-1% |

|

|

|

|

|

|

|

Russneft |

|

|

|

|

|

|

1.1% |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

MOL |

|

|

|

|

|

|

1.0% |

|

|

-2% |

|

|

|

|

|

|

|

Surgutneftegas |

|

|

|

|

|

|

0.6% |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Tatneft |

|

|

|

|

|

-1.4% |

|

|

|

|

|

-2.1% |

|

|

|

|

|

Surgutneftegas prefs |

|

|

|

|

|

-1.8% |

|

|

|

|

-3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Nostrum Oil & Gas |

-24.4% |

|

|

|

|

|

|

|

|

|

|

Bashneft Surgut |

LUKOIL Gazprom Tatneft Rosneft Russia |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

-30% -25% -20% -15% -10% |

-5% 0% 5% 10% 15% |

|

|

|

Neft |

||||||||||||

|

|

|

|

|

|

|

|

Source: Bloomberg |

|

|

|

Source: CDU TEK, Interfax, Renaissance Capital |

|||||

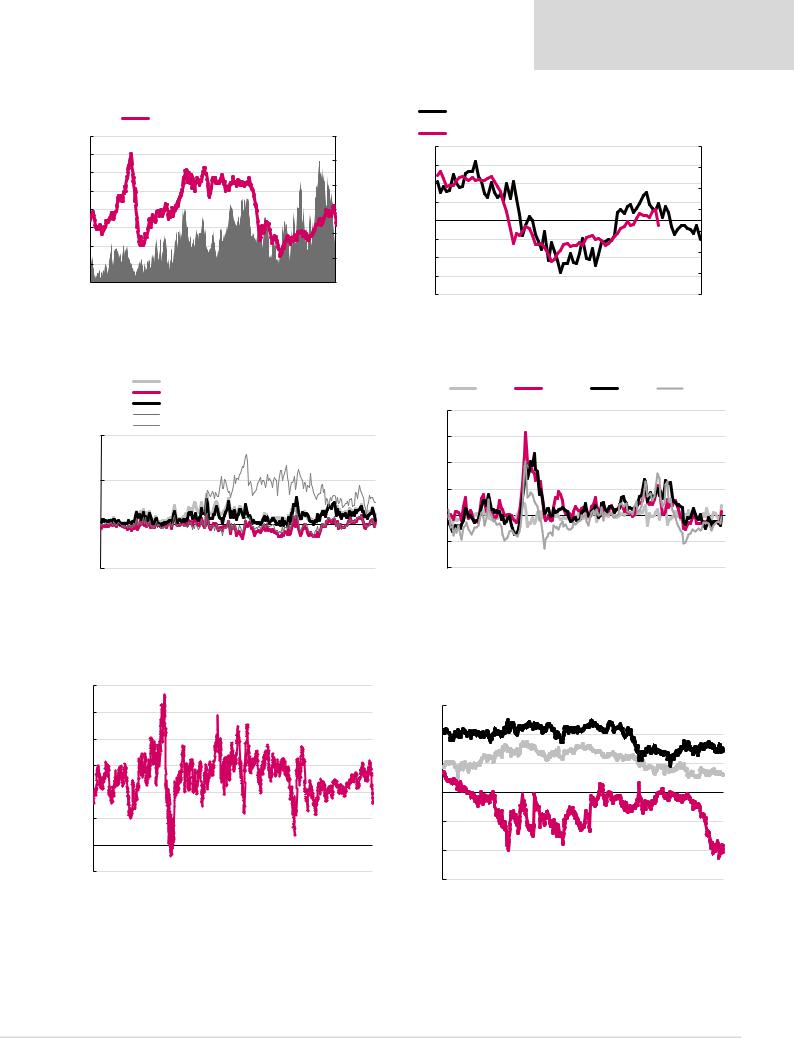

Figure 4: Brent strip, $/bl |

|

|

|

|

Figure 5: Full costs* of US LNG vs European hub prices ($/mmbtu) |

||||||||||||

160 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Short-term breakeven range |

|

Long-term breakeven range |

|

|

||

|

|

||

|

NBP |

|

|

|

|

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

*Based on typical contract price formula, incl. 115% of HH, $2.4 - 3.0/mmbtu tolling, shipping ($1.0) |

|

Source: Bloomberg |

and regasification costs ($1.0). |

|

Source: Bloomberg, Renaissance Capital estimates |

|

|

|

|

Figure 6: Contango or backwardation, $/bl |

|

Figure 7: European gas prices – Gazprom vs spot, $/mmbtu |

|

One-year contango/(backwardation) (LHS) |

|

Brent (RHS) |

$/Mmbtu |

|

NBP |

|

LNG Asia |

|

|

Henry Hub |

|

Germany BAFA import price |

||||||||||

20 |

|

|

|

|

|

|

160 |

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

140 |

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

10 |

|

|

|

|

|

|

120 |

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

5 |

|

|

|

|

|

|

100 |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

0 |

|

|

|

|

|

|

60 |

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

-5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

40 |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

-10 |

|

|

|

|

|

|

20 |

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-15 |

|

|

|

|

|

|

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|||

04 |

06 |

08 |

10 |

12 |

14 |

16 |

18 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

Source: Bloomberg |

|

|

|

|

|

|

|

|

Source: Bloomberg, Gazprom, Renaissance Capital |

|||||||

2

vk.com/id446425943

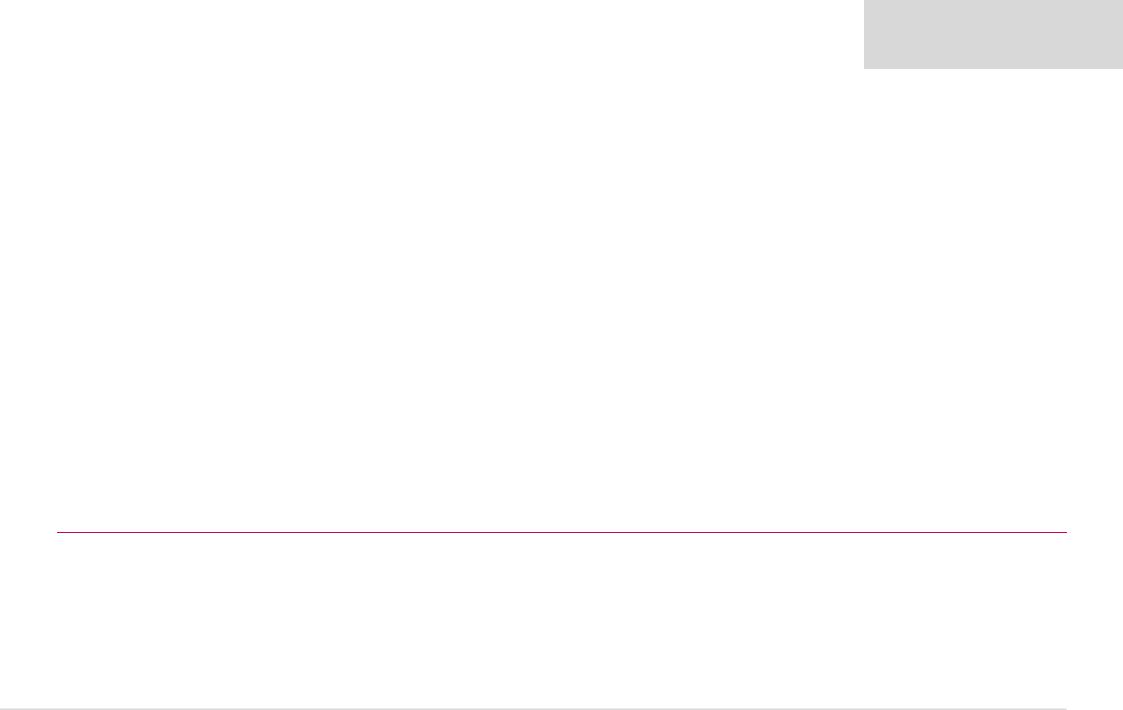

Figure 8: Oil futures open interest vs Brent price

Managed Money, no. of long positions (RHS)

Managed Money, no. of long positions (RHS)

Brent spot price, $/bl (LHS)

160 |

|

|

|

|

|

|

|

|

|

|

|

600,000 |

140 |

|

|

|

|

|

|

|

|

|

|

|

500,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

120 |

|

|

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

|

400,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

80 |

|

|

|

|

|

|

|

|

|

|

|

300,000 |

60 |

|

|

|

|

|

|

|

|

|

|

|

200,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

100,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

- |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Bloomberg

Figure 10: Refining margin Russia vs Europe, $/bl

Urals (cracking)

Urals (hydroskimming) Brent (cracking)

Brent (hydroskimming)

Average gross refining margin in Russia

40.0

20.0

-

(20.0)

1997 |

1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: EIA, Bloomberg, Argus, InfoTEK, Renaissance Capital

Figure 12: Gross margin contribution for Russian crude exporters, $/bl |

|||||||||||||

(Urals oil price less export duty less MET) |

|

|

|

|

|

|

|||||||

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

` |

|

|

|

|

|

|

(10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

Source: Bloomberg, Interfax, Renaissance Capital

Renaissance Capital

3 December 2018

Oil & Gas

Figure 9: OECD commercial inventories and Brent oil price (rhs)

OECD inventories (days of supply) in excess of 5-yr average, mn bls (lhs,

inverted)

Brent oil price, $/bl (rhs)

(8) |

|

140 |

(6) |

|

120 |

|

|

|

(4) |

|

100 |

|

|

|

(2) |

|

80 |

|

|

|

- |

|

|

2 |

|

60 |

|

|

|

4 |

|

40 |

|

|

|

6 |

|

20 |

|

|

|

8 |

|

- |

Jan-13 Nov-13 Sep-14 |

Jul-15 |

May-16 Mar-17 Jan-18 Nov-18 Sep-19 |

Source: EIA, Bloomberg

Figure 11: Russian domestic price premium vs export netbacks

|

|

Crude |

|

Gasoline |

|

|

Diesel |

|

Fuel oil |

|

||||

200% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

150% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

Source: Bloomberg, Argus, InfoTEK, Renaissance Capital

Figure 13: Preferred share price discount to commons

60% |

|

|

Sberbank |

|

Surgutneftegas |

|

Tatneft |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40%

20%

0%

-20%

-40%

-60% |

|

|

|

|

2013 |

2014 |

2015 |

2016 |

2017 |

Source: Bloomberg

3

vk.com/id446425943

Renaissance Capital

3 December 2018

Oil & Gas

Figure 14: MOL model refining margin 7-day average, $/bl |

Figure 15: Grupa LOTOS model refining margin 7-day average, $/bl |

|

|

|

|

|

5Y range |

|

Margin |

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

14 |

12 |

|

|

|

|

|

|

|

|

|

|

12 |

10 |

|

|

|

|

|

|

|

|

|

|

10 |

8 |

|

|

|

|

|

|

|

|

|

|

8 |

6 |

|

|

|

|

|

|

|

|

|

|

6 |

4 |

|

|

|

|

|

|

|

|

|

|

4 |

2 |

|

|

|

|

|

|

|

|

|

|

2 |

0 |

February |

March |

|

May |

|

July |

|

|

|

|

0 |

January |

April |

June |

August |

September |

October |

November |

December |

||||

|

|

|

|

|

5Y range |

|

Margin |

|

|

|

|

January |

February |

March |

April |

May |

June |

July |

August |

September |

October |

November |

December |

Source: Bloomberg, Thomson Reuters Datastream Source: Bloomberg, Thomson Reuters Datastream

Figure 16: PKN ORLEN model refining margin 7-day average, $/bl Figure 17: Tupras model refining margin 7-day average, $/bl

16 |

|

|

|

|

5Y range |

|

Margin |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

16 |

||

14 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

14 |

||

12 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

10 |

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

8 |

|

|

|

|

|

|

|

|

|

|

|

10 |

|

6 |

|

|

|

|

|

|

|

|

|

|

|

8 |

|

4 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

6 |

||

2 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

0 |

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

-2 |

|

|

|

|

|

|

|

|

|

|

|

2 |

|

-4 |

February |

March |

April |

May |

June |

July |

August |

|

|

November |

December |

0 |

|

January |

September |

October |

|||||||||||

|

|||||||||||||

|

|

|

|

|

5Y range |

|

Margin |

|

|

|

|

January |

February |

March |

April |

May |

June |

July |

August |

September |

October |

November |

December |

Source: Bloomberg, Thomson Reuters Datastream Source: Bloomberg, Thomson Reuters Datastream

Figure 18: OMV Petrom model refining margin 7-day average, $/bl Figure 19: North-Western Europe LDPE-Naphtha spread, $/t

|

|

|

|

|

5Y range |

|

Margin |

|

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

1,600 |

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

1,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

1,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

1,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

600 |

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

February |

March |

April |

May |

June |

July |

|

|

|

November |

December |

200 |

|

|

|

|

|

|

January |

August |

September |

October |

|

|

|

|

|

|

|||||||||

- |

|

|

|

|

|

|

||||||||||||

Nov-10 Nov-11 |

Nov-12 |

Nov-13 |

Nov-14 |

Nov-15 |

Nov-16 |

Nov-17 |

||||||||||||

Source: Bloomberg, Thomson Reuters Datastream |

Source: Thomson Reuters Datastream |

4

vk.com/id446425943

Renaissance Capital

3 December 2018

Oil & Gas

Figure 20: Summary valuation for oil and gas companies we cover

Company name |

Ticker |

Currency |

Rating |

TP |

Current price |

Potential upside / |

MktCap, |

EV, |

|

P/E, x |

|

EV/EBITDA, x |

Div yield, % |

EV/reserves EV/production |

||||

|

29-Nov-18 |

downside |

$mn |

$mn |

2018E |

2019E |

2020E |

2018E |

2019E |

2020E |

2018E |

2019E |

$/boe, 2017 |

$/boe, 2017 |

||||

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Russian Oil and Gas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gazprom (RenCap estimates) |

GAZP RX |

RUB |

BUY |

220.0 |

165.0 |

33% |

59,021 |

92,297 |

2.9 |

3.2 |

3.2 |

2.6 |

2.9 |

2.8 |

4.9 |

4.9 |

0.7 |

25.3 |

Gazprom (consensus estimates) |

GAZP RX |

|

|

|

|

|

|

|

3.0 |

2.9 |

2.9 |

2.6 |

2.5 |

2.5 |

5.9 |

7.6 |

|

|

NOVATEK (RenCap estimates) |

NVTK RM |

RUB |

HOLD |

1,070.0 |

1,167.8 |

-8% |

53,580 |

54,638 |

19.8 |

15.0 |

13.5 |

14.6 |

15.1 |

14.2 |

1.3 |

1.4 |

3.7 |

108.4 |

NOVATEK (consensus estimates) |

NVTK RM |

|

|

|

|

|

|

|

15.3 |

11.7 |

11.0 |

12.6 |

13.0 |

12.0 |

1.7 |

2.1 |

|

|

Rosneft (RenCap estimates) |

ROSN RX |

RUB |

BUY |

550.0 |

417.0 |

32% |

66,781 |

128,889 |

6.5 |

5.7 |

4.8 |

4.4 |

4.3 |

4.1 |

7.7 |

8.8 |

3.1 |

59.4 |

Rosneft (consensus estimates) |

ROSN RX |

|

|

|

|

|

|

|

6.6 |

5.4 |

4.8 |

4.1 |

3.9 |

3.7 |

6.8 |

8.9 |

|

|

LUKOIL (RenCap estimates) |

LKOH RX |

RUB |

BUY |

5,600.0 |

4,766.0 |

17% |

54,014 |

54,003 |

5.3 |

7.0 |

8.5 |

3.0 |

3.4 |

3.8 |

5.1 |

5.7 |

3.5 |

68.6 |

LUKOIL (consensus estimates) |

LKOH RX |

|

|

|

|

|

|

|

5.6 |

5.4 |

5.4 |

3.1 |

3.0 |

2.9 |

5.1 |

5.5 |

|

|

Surgutneftegas (RenCap estimates) |

SNGS RX |

RUB |

HOLD |

110.0 |

27.2 |

304% |

19,012 |

(14,256) |

1.8 |

2.7 |

3.0 |

n/a |

n/a |

n/a |

2.4 |

2.4 |

0.3 |

n/a |

Surgutneftegas prefs (RenCap estimates) |

SNGSP RX |

RUB |

BUY |

110.0 |

37.1 |

196% |

4,323 |

|

|

|

- |

- |

- |

- |

17.2 |

11.6 |

|

|

Surgutneftegas (consensus estimates) |

SNGS RX |

|

|

|

|

|

|

|

3.0 |

3.5 |

3.5 |

n/a |

n/a |

n/a |

2.7 |

2.4 |

|

|

Gazprom Neft (RenCap estimates) |

SIBN RX |

RUB |

HOLD |

360.0 |

359.1 |

0% |

25,728 |

33,617 |

4.3 |

5.5 |

6.4 |

3.6 |

4.2 |

4.5 |

8.1 |

7.4 |

3.2 |

54.9 |

Gazprom Neft (consensus estimates) |

SIBN RX |

|

|

|

|

|

|

|

4.5 |

4.3 |

4.5 |

3.6 |

3.6 |

3.6 |

6.5 |

8.0 |

|

|

Tatneft (RenCap estimates) |

TATN RM |

RUB |

HOLD |

740.0 |

714.0 |

4% |

24,649 |

25,896 |

7.2 |

8.3 |

9.0 |

5.3 |

5.9 |

6.2 |

9.6 |

5.9 |

4.1 |

123.3 |

Tatneft prefs (RenCap estimates) |

TATNP RX |

RUB |

BUY |

740.0 |

512.8 |

44% |

1,143 |

|

|

|

- |

- |

- |

|

13.4 |

8.3 |

|

|

Tatneft (consensus estimates) |

TATN RM |

|

|

|

|

|

|

|

8.1 |

7.4 |

7.0 |

5.6 |

5.6 |

5.2 |

8.1 |

7.6 |

|

|

Weighted average |

|

|

|

|

|

|

|

|

7.4 |

7.0 |

6.9 |

5.2 |

5.5 |

5.4 |

5.6 |

5.5 |

2.7 |

63.0 |

EM refiners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tupras (RenCap estimates) |

TUPRS TI |

TRY |

BUY |

176.0 |

125.8 |

40% |

6,085 |

7,814 |

7.4 |

4.8 |

4.6 |

5.9 |

4.3 |

4.2 |

10.8 |

16.7 |

n/a |

37.9 |

Tupras (consensus estimates) |

TUPRS TI |

|

|

|

|

|

|

|

9.5 |

6.8 |

5.4 |

5.8 |

5.3 |

4.7 |

11.9 |

16.3 |

|

|

MOL (RenCap estimates) |

MOL HB |

HUF |

BUY |

4,200.0 |

3,178.0 |

32% |

7,835 |

10,153 |

8.3 |

9.0 |

9.4 |

4.0 |

4.1 |

4.2 |

2.9 |

3.2 |

n/a |

66.3 |

MOL (consensus estimates) |

MOL HB |

|

|

|

|

|

|

|

8.2 |

7.5 |

7.0 |

4.1 |

4.0 |

3.9 |

3.7 |

3.6 |

|

|

PKN ORLEN (RenCap estimates) |

PKN PW |

PLN |

HOLD |

98.0 |

112.9 |

-13% |

12,802 |

14,179 |

8.3 |

9.3 |

9.2 |

5.9 |

5.8 |

5.8 |

2.8 |

2.9 |

n/a |

55.0 |

PKN ORLEN (consensus estimates) |

PKN PW |

|

|

|

|

|

|

|

9.8 |

10.2 |

9.8 |

5.9 |

6.1 |

5.8 |

2.9 |

3.0 |

|

|

Grupa LOTOS (RenCap estimates) |

LTS PW |

PLN |

BUY |

92.0 |

81.2 |

13% |

3,984 |

4,978 |

10.8 |

7.5 |

6.4 |

7.2 |

5.2 |

4.6 |

1.4 |

1.4 |

n/a |

64.7 |

Grupa LOTOS (consensus estimates) |

LTS PW |

|

|

|

|

|

|

|

9.8 |

10.1 |

8.2 |

6.0 |

6.0 |

5.1 |

2.2 |

2.6 |

|

|

OMV Petrom (RenCap estimates) |

SNP RE |

RON |

BUY |

0.46 |

0.37 |

25% |

5,060 |

3,889 |

6.6 |

7.1 |

8.0 |

2.2 |

2.2 |

2.4 |

5.7 |

6.0 |

n/a |

117.9 |

OMV Petrom (consensus estimates) |

SNP RE |

|

|

|

|

|

|

|

6.4 |

5.8 |

6.0 |

2.1 |

2.1 |

2.1 |

7.8 |

7.8 |

|

|

Petkim (RenCap estimates) |

PETKM TI |

TRY |

HOLD |

8.0 |

5.3 |

50% |

1,702 |

2,334 |

9.0 |

3.6 |

3.2 |

10.0 |

6.7 |

4.8 |

0.0 |

13.8 |

n/a |

n/a |

Petkim (consensus estimates) |

PETKM TI |

|

|

|

|

|

|

|

8.8 |

7.6 |

6.3 |

8.1 |

6.9 |

7.1 |

7.9 |

9.1 |

|

|

Weighted average |

|

|

|

|

|

|

|

|

8.2 |

7.8 |

7.8 |

5.3 |

4.7 |

4.6 |

4.2 |

6.0 |

|

61.6 |

Source: Company data, Bloomberg, Renaissance Capital estimates

5

vk.com/id446425943

Renaissance Capital

3 December 2018

Oil & Gas

Figure 21: Comparable multiples analysis for oil companies

Company name |

Ticker |

Currency Rating |

TP |

Current price |

Potential upside / |

MktCap, |

EV, |

|

P/E, x |

|

EV/EBITDA, x |

|

Div yield, % |

EV/reserves |

EV/production |

||||

29-Nov-18 |

downside |

$mn |

$mn |

2018E |

2019E |

2020E |

2018E |

2019E |

2020E |

2018E |

2019E |

$/boe, 2017 |

$/boe, 2017 |

||||||

|

|

|

|

|

|||||||||||||||

Russian Oil and Gas majors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rosneft (RenCap estimates) |

ROSN RX |

RUB |

BUY |

550.0 |

417.0 |

32% |

66,781 |

128,889 |

6.5 |

5.7 |

4.8 |

4.4 |

4.3 |

4.1 |

7.7 |

8.8 |

3.1 |

59.4 |

|

Rosneft (consensus estimates) |

ROSN RX |

|

|

|

|

|

|

|

6.6 |

5.4 |

4.8 |

4.1 |

3.9 |

3.7 |

6.8 |

8.9 |

|

|

|

LUKOIL (RenCap estimates) |

LKOH RX |

RUB |

BUY |

5,600 |

4,766 |

17% |

54,014 |

54,003 |

5.3 |

7.0 |

8.5 |

3.0 |

3.4 |

3.8 |

5.1 |

5.7 |

3.5 |

68.6 |

|

LUKOIL (consensus estimates) |

LKOH RX |

|

|

|

|

|

|

|

5.6 |

5.4 |

5.4 |

3.1 |

3.0 |

2.9 |

5.1 |

5.5 |

|

|

|

Surgutneftegas (RenCap estimates) |

SNGS RX |

RUB |

HOLD |

110.0 |

27.2 |

304% |

19,012 |

(14,256) |

1.8 |

2.7 |

3.0 |

n/a |

n/a |

n/a |

2.4 |

2.4 |

0.3 |

n/a |

|

Surgutneftegas prefs (RenCap estimates) |

SNGSP RX |

RUB |

BUY |

110.0 |

37.1 |

196% |

4,323 |

|

|

|

|

|

|

|

17.2 |

11.6 |

|

|

|

Surgutneftegas (consensus estimates) |

SNGS RX |

|

|

|

|

|

|

|

3.0 |

3.5 |

3.5 |

n/a |

n/a |

n/a |

2.7 |

2.4 |

|

|

|

Gazprom Neft (RenCap estimates) |

SIBN RX |

RUB |

HOLD |

360.0 |

359.1 |

0% |

25,728 |

33,617 |

4.3 |

5.5 |

6.4 |

3.6 |

4.2 |

4.5 |

8.1 |

7.4 |

3.2 |

54.9 |

|

Gazprom Neft (consensus estimates) |

SIBN RX |

|

|

|

|

|

|

|

4.5 |

4.3 |

4.5 |

3.6 |

3.6 |

3.6 |

6.5 |

8.0 |

|

|

|

Tatneft (RenCap estimates) |

TATN RM |

RUB |

HOLD |

740.0 |

714.0 |

4% |

24,649 |

25,896 |

7.2 |

8.3 |

9.0 |

5.3 |

5.9 |

6.2 |

9.6 |

5.9 |

4.1 |

123.3 |

|

Tatneft prefs (RenCap estimates) |

TATNP RX |

RUB |

BUY |

740.0 |

512.8 |

44% |

1,143 |

|

|

|

|

|

|

|

13.4 |

8.3 |

|

|

|

Tatneft (consensus estimates) |

TATN RM |

|

|

|

|

|

|

|

8.1 |

7.4 |

7.0 |

5.6 |

5.6 |

5.2 |

8.1 |

7.6 |

|

|

|

Weighted average |

|

|

|

|

|

|

|

|

5.5 |

6.1 |

6.4 |

4.0 |

4.2 |

4.4 |

7.0 |

6.8 |

3.0 |

62.0 |

|

Other FSU oil companies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nostrum (RenCap estimates) |

NOG LI |

GBp |

HOLD 136.0 |

134.6 |

1% |

324 |

1,322 |

10.3 |

17.0 |

128.4 |

5.1 |

6.2 |

6.5 |

0.0 |

0.0 |

2.7 |

92.4 |

||

Nostrum (consensus estimates) |

NOG LN |

|

|

|

134.6 |

|

|

|

11.0 |

6.8 |

4.8 |

5.2 |

5.1 |

4.5 |

0.0 |

0.3 |

|

|

|

Russneft (consensus estimates) |

RNFT RX |

|

|

|

527.6 |

|

2,337 |

3,634 |

7 |

5 |

4.5 |

5.5 |

4.1 |

4.1 |

n/a |

n/a |

n/a |

n/a |

|

Exillon Energy (consensus estimates) |

EXI LN |

|

|

|

71.1 |

|

147 |

271 |

n/a |

n/a |

n/a |

n/a |

n/a |

n/a |

n/a |

n/a |

1.5 |

54.4 |

|

Weighted average |

|

|

|

|

|

|

|

|

7.2 |

5.7 |

18.6 |

5.1 |

4.1 |

4.1 |

0.0 |

0.0 |

0.4 |

13.5 |

|

Other GEM oil companies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petrobras |

PETR3 BZ |

BRL |

|

|

27.7 |

|

90,417 |

164,380 |

9.5 |

7.6 |

7.2 |

5.1 |

4.4 |

4.3 |

2.3 |

2.9 |

16.9 |

162.8 |

|

Petrochina |

601857 CH |

CNY |

|

|

7.6 |

|

192,262 |

259,713 |

20.7 |

18.2 |

16.9 |

5.0 |

4.8 |

4.7 |

2.5 |

2.8 |

12.8 |

178.2 |

|

Sinopec |

386 HK |

HKD |

|

|

6.6 |

|

102,917 |

117,642 |

9.2 |

9.3 |

9.3 |

3.5 |

3.4 |

3.4 |

8.7 |

8.5 |

47.9 |

262.1 |

|

CNOOC |

883 HK |

HKD |

|

|

12.8 |

|

75,694 |

74,690 |

9.2 |

8.1 |

8.5 |

3.6 |

3.5 |

3.5 |

5.3 |

5.8 |

16.8 |

158.8 |

|

ONGC |

ONGC IN |

INR |

|

|

140.6 |

|

25,558 |

42,734 |

7.5 |

5.6 |

5.4 |

4.8 |

3.8 |

3.8 |

5.1 |

5.8 |

10.0 |

92.3 |

|

Sasol |

SOL SJ |

ZAr |

|

|

42,107 |

|

19,013 |

26,420 |

27.9 |

8.3 |

7.3 |

10.3 |

5.2 |

4.6 |

3.3 |

4.4 |

n/a |

n/a |

|

YPF |

YPFD AR |

ARS |

|

|

579.4 |

|

5,910 |

13,259 |

12.1 |

13.4 |

7.2 |

3.4 |

2.9 |

2.7 |

0.5 |

0.8 |

14.7 |

65.5 |

|

Ecopetrol |

ECOPETL CB |

COP |

|

|

3,115 |

|

39,485 |

51,140 |

9.1 |

9.0 |

9.6 |

4.8 |

4.7 |

5.1 |

3.6 |

4.9 |

30.8 |

196.0 |

|

Cap-weighted average |

|

|

|

|

|

|

|

|

13.9 |

11.8 |

11.2 |

4.7 |

4.2 |

4.2 |

4.2 |

4.6 |

21.3 |

178.6 |

|

International oil companies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exxon Mobil |

XOM US |

$ |

|

|

78.5 |

|

334,725 |

375,559 |

16.5 |

13.6 |

13.1 |

7.5 |

6.4 |

6.2 |

4.1 |

4.3 |

17.7 |

258.2 |

|

Chevron |

CVX US |

$ |

|

|

118.1 |

|

227,096 |

254,558 |

14.1 |

12.1 |

12.8 |

5.8 |

5.2 |

5.3 |

3.8 |

3.9 |

21.8 |

255.7 |

|

ConocoPhillips |

COP US |

$ |

|

|

66.4 |

|

76,984 |

87,519 |

14.0 |

12.7 |

13.2 |

5.4 |

5.0 |

5.2 |

1.7 |

1.9 |

17.4 |

174.1 |

|

Marathon |

MRO US |

$ |

|

|

16.5 |

|

13,758 |

17,692 |

20.2 |

15.4 |

14.3 |

4.6 |

4.3 |

4.0 |

1.2 |

1.2 |

12.2 |

122.1 |

|

Occidental |

OXY US |

$ |

|

|

70.7 |

|

53,539 |

60,903 |

12.9 |

12.5 |

14.9 |

6.1 |

5.7 |

6.1 |

4.4 |

4.4 |

23.4 |

277.2 |

|

BP |

BP/ LN |

GBp |

|

|

$522 |

|

133,781 |

173,259 |

11.2 |

10.5 |

10.1 |

4.6 |

4.2 |

4.2 |

6.1 |

6.2 |

9.4 |

133.7 |

|

Royal Dutch Shell |

RDSB LN |

GBp |

|

|

2,415 |

|

252,077 |

315,286 |

11.2 |

9.6 |

9.5 |

5.3 |

4.9 |

4.8 |

6.1 |

6.1 |

25.8 |

235.8 |

|

Total |

FP FP |

EUR |

|

|

48.4 |

|

147,993 |

176,953 |

10.3 |

9.2 |

9.1 |

5.1 |

4.6 |

4.5 |

5.4 |

5.5 |

15.4 |

188.9 |

|

ENI |

ENI IM |

EUR |

|

|

14.2 |

|

58,783 |

69,536 |

11.4 |

9.7 |

9.9 |

3.2 |

2.9 |

2.9 |

5.8 |

6.0 |

9.2 |

104.9 |

|

Repsol YPF |

REP SM |

EUR |

|

|

15.1 |

|

27,496 |

36,080 |

9.6 |

8.4 |

7.6 |

4.5 |

4.1 |

3.9 |

6.0 |

6.4 |

15.3 |

142.2 |

|

Equinor ASA |

EQNR NO |

NOK |

|

|

199.8 |

|

77,954 |

87,823 |

11.3 |

9.6 |

9.4 |

3.0 |

2.7 |

2.6 |

3.9 |

4.2 |

16.4 |

115.7 |

|

Cap-weighted average |

|

|

|

|

|

|

|

|

13.1 |

11.3 |

11.3 |

5.6 |

5.0 |

5.0 |

4.7 |

4.8 |

18.5 |

212.8 |

|

Source: Company data, Bloomberg, Renaissance Capital estimates

6

vk.com/id446425943

Renaissance Capital

3 December 2018

Oil & Gas

Figure 22: Comparable multiples analysis for gas companies

Company name |

Ticker |

Currency |

Rating |

TP |

Current price Potential upside / MktCap, |

|

EV, |

|

|

P/E, x |

|

|

|

|

EV/EBITDA, x |

Div yield, % |

|

EV/reserves |

|

EV/production |

||||||||||||||||

29-Nov-18 |

|

downside |

|

$mn |

|

$mn |

2018E |

2019E |

2020E |

|

2018E |

|

2019E |

2020E |

2018E |

2019E |

|

$/boe, 2017 |

|

$/boe, 2017 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

Russian Oil and Gas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gazprom (RenCap estimates) |

GAZP RX |

|

RUB |

BUY |

220.0 |

165.0 |

|

33% |

|

59,021 |

92,297 |

|

2.9 |

3.2 |

3.2 |

|

2.6 |

2.9 |

2.8 |

4.9 |

4.9 |

|

|

0.7 |

25.3 |

|

||||||||||

Gazprom (consensus estimates) |

GAZP RX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.0 |

2.9 |

2.9 |

|

2.6 |

|

2.5 |

2.5 |

5.9 |

7.6 |

|

|

|

|

|

|

|

||||

NOVATEK (RenCap estimates) |

NVTK RM |

|

RUB |

HOLD |

1,070.0 |

1,167.8 |

|

-8% |

|

53,580 |

54,638 |

|

20 |

15.0 |

13.5 |

|

14.6 |

15.1 |

14.2 |

1.3 |

1.4 |

|

|

3.7 |

108.4 |

|||||||||||

NOVATEK (consensus estimates) |

NVTK RM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15.3 |

11.7 |

11.0 |

|

12.6 |

|

13.0 |

12.0 |

1.7 |

2.1 |

|

|

|

|

|

|

|

||||

Weighted average |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11.0 |

8.8 |

8.1 |

|

8.3 |

8.7 |

8.3 |

3.2 |

3.2 |

|

|

2.1 |

64.9 |

|

||||||

Premium/(discount) to International, % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(33.6) |

(33.7) |

(25.7) |

|

39.4 |

|

69.1 |

78.6 |

22.7 |

14.1 |

|

|

-86.6 |

-47.7 |

|

|||||

International oil companies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Engie |

ENGI FP |

|

EUR |

|

|

12.5 |

|

|

|

|

|

34,608 |

63,866 |

|

12.7 |

11.8 |

10.1 |

|

6.2 |

|

5.9 |

5.5 |

6.0 |

6.2 |

|

|

n/a |

|

n/a |

|

||||||

Devon Energy |

DVN US |

|

$ |

|

|

26.9 |

|

|

|

|

12,599 |

15,545 |

|

12.7 |

14.2 |

10.6 |

|

4.9 |

4.6 |

3.8 |

1.1 |

1.3 |

|

|

7.2 |

78.4 |

|

|||||||||

Murphy Oil |

MUR US |

|

$ |

|

|

32.0 |

|

|

|

|

|

5,520 |

7,498 |

|

18.8 |

8.7 |

9.5 |

|

4.6 |

|

3.4 |

3.3 |

3.1 |

3.1 |

|

|

10.7 |

125.6 |

||||||||

Chesapeake Energy |

CHK US |

|

$ |

|

|

3.0 |

|

|

|

|

2,769 |

14,371 |

|

3.5 |

2.5 |

1.8 |

|

6.1 |

5.3 |

4.5 |

0.0 |

0.0 |

|

|

7.5 |

71.9 |

|

|||||||||

Encana |

ECA CN |

|

CAD |

|

|

$9 |

|

|

|

|

|

6,624 |

10,227 |

|

11.7 |

5.6 |

4.8 |

|

4.6 |

|

2.9 |

2.2 |

0.9 |

1.1 |

|

|

12.9 |

89.5 |

|

|||||||

Pioneer Natural Resources |

PXD US |

|

$ |

|

|

148 |

|

|

|

|

25,428 |

26,238 |

|

21.5 |

13.3 |

10.6 |

|

7.8 |

6.0 |

5.0 |

0.2 |

0.3 |

|

|

26.6 |

264.0 |

||||||||||

Apache |

APA US |

|

$ |

|

|

35.3 |

|

|

|

|

|

13,489 |

22,433 |

|

17.1 |

20.1 |

16.7 |

|

4.4 |

|

4.5 |

4.4 |

2.8 |

2.8 |

|

|

19.1 |

134.4 |

||||||||

Anadarko Petroleum |

APC US |

|

$ |

|

|

52.5 |

|

|

|

|

27,080 |

44,426 |

|

20.2 |

15.4 |

12.2 |

|

5.7 |

5.0 |

4.5 |

1.7 |

2.1 |

|

|

30.9 |

181.1 |

||||||||||

Cap-weighted average |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16.5 |

13.3 |

10.9 |

|

6.0 |

|

5.2 |

4.6 |

2.6 |

2.8 |

|

|

15.8 |

124.1 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: Company data, Bloomberg, Renaissance Capital estimates |

||||||||

Figure 23: Comparable multiples analysis for pipeline operators |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Company name |

|

Ticker |

|

Currency Rating |

TP |

Current price |

Potential upside / |

|

MktCap, |

EV, |

|

|

|

|

|

P/E, x |

|

|

|

EV/EBITDA, x |

|

Div yield, % |

||||||||||||||

|

|

|

29-Nov-18 |

|

downside |

|

$mn |

|

$mn |

|

2018E |

2019E |

2020E |

|

2018E |

2019E |

|

2020E |

|

2018E |

2019E |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Russian pipeline operators |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transneft (RenCap estimates) |

|

TRNFP RX |

RUB |

BUY |

215,000.0 |

|

171,350.0 |

|

25% |

18,445 |

24,118 |

6.0 |

|

|

6.2 |

6.4 |

|

2.8 |

2.7 |

2.7 |

|

8.4 |

8.1 |

|||||||||||||

Transneft (consensus estimates) |

|

TRNFP RX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.1 |

|

|

5.6 |

4.9 |

|

3.6 |

3.4 |

|

3.2 |

|

5.9 |

6.5 |

|||||

Gazprom (RenCap estimates) |

|

GAZP RX |

RUB |

BUY |

220.0 |

|

165.0 |

|

33% |

59,021 |

92,297 |

2.9 |

|

|

3.2 |

3.2 |

|

2.6 |

2.9 |

2.8 |

|

4.9 |

4.9 |

|||||||||||||

Gazprom (consensus estimates) |

|

GAZP RX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.0 |

|

|

2.9 |

2.9 |

|

2.6 |

2.5 |

|

2.5 |

|

5.9 |

7.6 |

|||||

Weighted average |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.7 |

|

|

3.9 |

4.0 |

|

2.6 |

2.9 |

2.8 |

|

5.7 |

5.6 |

||||||

Premium/(discount) to International, % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(74.4) |

|

(71.5) |

(70.8) |

|

(74.1) |

(69.9) |

|

(70.4) |

|

25.1 |

16.2 |

|||||

European pipeline operators |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elia |

|

ELI BB |

|

EUR |

|

|

|

|

57.9 |

|

|

|

|

4,012 |

7,246 |

|

13.6 |

|

13.5 |

13.0 |

|

8.6 |

7.4 |

|

7.0 |

|

2.9 |

2.9 |

||||||||

Red Electrica |

|

REE SM |

|

EUR |

|

|

|

|

19.0 |

|

|

|

11,669 |

17,890 |

14.6 |

|

14.1 |

14.7 |

|

10.2 |

10.0 |

10.2 |

|

5.1 |

5.5 |

|||||||||||

Transelectrica |

|

TEL RO |

|

RON |

|

|

|

|

23.8 |

|

|

|

|

425 |

|

421 |

|

19.9 |

|

11.2 |

9.1 |

|

n/a |

|

n/a |

|

n/a |

|

n/a |

n/a |

||||||

Terna |

|

TRN IM |

|

EUR |

|

|

|

|

4.9 |

|

|

|

11,170 |

20,011 |

14.1 |

|

13.4 |

13.0 |

|

10.8 |

10.2 |

9.9 |

|

4.7 |

5.1 |

|||||||||||

Cap-weighted average |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14.3 |

|

13.7 |

13.6 |

|

10.0 |

9.5 |

|

9.5 |

|

4.6 |

4.9 |

|||||

Source: Company data, Bloomberg, Renaissance Capital estimates

7

vk.com/id446425943

Renaissance Capital

3 December 2018

Oil & Gas

Figure 24: E&Ps – comparable multiples analysis

|

|

Country of |

|

Current price |

|

MktCap, |

EV, |

|

Earnings |

EBITDA |

P/E, x |

EV/EBITDA, x 2P reserves, 2C resources, Production, EV/2P |

EV/(2P+2C), |

EV/production |

|||||||||||||||

Company name |

Ticker major operations Currency |

|

29-Nov-18 |

|

|

|

$mn |

$mn |

2017, $mn 2017, $mn |

2017 |

|

2017 |

mn boe |

mn boe |

kboe |

|

$/boe, 2017 |

$/boe |

$/boe, 2017 |

||||||||||

Nostrum Oil&Gas |

NOG LN |

Kazakhstan |

GBp |

|

134.6 |

|

|

|

323.7 |

1321.9 |

-23.88 |

253.63 |

n/m |

|

5.2 |

488.0 |

221.8 |

14308 |

|

|

2.7 |

1.9 |

92.4 |

||||||

Exillon Energy |

EXI LN |

Russia |

GBp |

|

71.1 |

|

|

|

146.7 |

271.5 |

47.6 |

80.5 |

3.1 |

|

3.4 |

500.3 |

0 |

|

3874 |

|

|

0.5 |

0.5 |

70.1 |

|||||

Petroneft resources |

PTR LN |

Russia |

GBp |

|

1.5 |

|

|

|

13.6 |

14.6 |

n/m |

|

n/m |

n/m |

|

n/m |

65.0 |

16 |

|

817 |

|

|

0.2 |

0.2 |

17.8 |

||||

Volga Gas |

VGAS LN |

Russia |

GBp |

|

56.0 |

|

|

|

56.3 |

44.0 |

0.3 |

8.8 |

170.6 |

|

5.0 |

26.5 |

0 |

|

1806 |

|

|

1.7 |

1.7 |

24.4 |

|||||

Zoltav resources |

ZOL LN |

Russia |

GBp |

|

16.5 |

|

|

|

29.9 |

47.4 |

n/m |

|

n/m |

n/m |

|

n/m |

210.4 |

5 |

|

3344 |

|

|

0.2 |

0.2 |

14.2 |

||||

Araca energy |

ARACA NS |

Russia |

NOK |

|

0.1 |

|

|

|

17.3 |

17.6 |

n/m |

|

n/m |

n/m |

|

n/m |

2.6 |

|

|

87 |

|

|

6.9 |

6.9 |

201 |

||||

Urals energy |

UEN LN |

Russia |

GBp |

|

30.0 |

|

|

|

4.8 |

24.1 |

n/m |

|

n/m |

n/m |

|

n/m |

108.2 |

0 |

|

757 |

|

|

0.2 |

0.2 |

31.8 |

||||

JKX |

JKX LN |

Ukraine |

GBp |

|

31.5 |

|

|

|

69.1 |

72.4 |

-17.7 |

25.3 |

n/m |

|

2.9 |

95.1 |

166 |

|

3160 |

|

|

0.8 |

0.3 |

22.9 |

|||||

Regal petroleum |

RPT LN |

Ukraine |

GBp |

|

44.4 |

|

|

|

181.9 |

141.8 |

2.3 |

17.3 |

79.5 |

|

8.2 |

13.5 |

75 |

|

596 |

|

10.5 |

1.6 |

237.9 |

||||||

Caspian Sunrise |

CASP LN |

Kazakhstan |

GBp |

|

6.3 |

|

|

|

135.5 |

131.8 |

n/m |

|

n/m |

n/m |

|

n/m |

29.9 |

|

|

|

|

|

4.4 |

4.4 |

|

||||

Jupiter Energy |

JPR AU |

Kazakhstan |

AUD |

|

0.1 |

|

|

|

5.8 |

5.5 |

|

-6.1 |

-2.2 |

n/m |

|

n/m |

19.2 |

64 |

|

|

|

|

0.3 |

0.1 |

|

||||

Average |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

84.4 |

|

4.9 |

|

|

|

|

|

|

|

2.6 |

1.6 |

79.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: Company data, Bloomberg, Renaissance Capital |

|||

Figure 25: Comparable valuation multiples for oil refiners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Company name |

|

Ticker |

Currency Rating |

Target |

|

Current price |

Upside/ |

MktCap, Net debt, |

EV, |

|

P/E, x |

|

EV/EBITDA, x |

Div yield, % |

Refining capacity |

EV/production |

|||||||||||||

|

price |

|

29-Nov-18 |

downside |

$mn |

|

$mn |

$mn |

2018E 2019E |

2020E |

2018E |

2019E |

2020E |

2018E |

2019E |

mnt pa, 2017 |

$/boe, 2017 |

||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Our coverage universe |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tupras (RenCap estimates) |

|

TUPRS TI |

TRY |

|

BUY |

176.0 |

125.8 |

|

|

40% |

6,085 |

1,729 |

7,814 |

7.4 |

4.8 |

4.6 |

5.9 |

4.3 |

4.2 |

10.8 |

16.7 |

|

28.1 |

37.9 |

|||||

Tupras (consensus estimates) |

|

TUPRS TI |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.5 |

6.8 |

5.4 |

5.8 |

5.3 |

4.7 |

11.9 |

16.3 |

|

|

|

|

MOL (RenCap estimates) |

|

MOL HB |

HUF |

|

BUY |

4,200 |

3,178 |

|

|

32% |

7,835 |

2,317 |

10,153 |

8.3 |

9.0 |

9.4 |

4.0 |

4.1 |

4.2 |

2.9 |

3.2 |

|

20.9 |

66.3 |

|||||

MOL (consensus estimates) |

|

MOL HB |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.2 |

7.5 |

7.0 |

4.1 |

4.0 |

3.9 |

3.7 |

3.6 |

|

|

|

|

PKN ORLEN (RenCap estimates) |

PKN PW |

PLN |

|

HOLD |

|

98.0 |

112.9 |

|

|

-13% |

12,802 |

1,378 |

14,179 |

8.3 |

9.3 |

9.2 |

5.9 |

5.8 |

5.8 |

2.8 |

2.9 |

|

35.2 |

55.0 |

|||||

PKN ORLEN (consensus estimates) |

PKN PW |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.8 |

10.2 |

9.8 |

5.9 |

6.1 |

5.8 |

2.9 |

3.0 |

|

|

|

||

Grupa LOTOS (RenCap estimates) |

LTS PW |

PLN |

|

BUY |

|

92.0 |

81.2 |

|

|

13% |

3,984 |

994 |

4,978 |

10.8 |

7.5 |

6.4 |

7.2 |

5.2 |

4.6 |

1.4 |

1.4 |

|

10.5 |

64.7 |

|||||

Grupa LOTOS (consensus estimates) |

LTS PW |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.8 |

10.1 |

8.2 |

6.0 |

6.0 |

5.1 |

2.2 |

2.6 |

|

|

|

||

OMV Petrom (RenCap estimates) |

SNP RE |

RON |

BUY |

|

0.46 |

0.37 |

|

|

25% |

5,060 |

(1,171) |

3,889 |

6.6 |

7.1 |

8.0 |

2.2 |

2.2 |

2.4 |

5.7 |

6.0 |

|

4.5 |

117.9 |

||||||

OMV Petrom (consensus estimates) |

SNP RE |

|

|

|

|

|