Real Estate Watch_181112_watermark

.pdf

vk.com/id446425943

Russia

Real Estate

12 November 2018

Equities

Periodical

Real Estate Watch

3Q18; rushing for mortgages and flats

This report launches our quarterly wrap on the operational statistics from the real estate development segment. It saw upbeat volumes in 3Q18, as clients enjoyed a gradual recovery in incomes, the extended offer from homebuilders, a local bottom in mortgage rates, and uncertainties associated with changing regulations. The stock performances overlook that, in our view, with the shares of listed developers down 24% YTD.

The area under construction grew 9% YoY to 131mn sqm, after three flattish quarters.

Mortgage rates lost 45bp YTD to a historical low of 9.4% in September. New issues of RUB 2.07tn in 9mo18 are already greater than for the whole of 2017.

Moscow registered deals went up 35% YoY and 32% YoY in 3Q18 and 9mo18, respectively.

Primary prices increased 9-12% YoY in Moscow and St Petersburg in 3Q18, while the secondary market remained generally flat.

Stock valuations contradict the impressive operations. The market capitalisation discount to NAV is at a historical high of 55-67%.

Maria Kolbina, Equities Analyst

+7 495 663 46 48 // maria.kolbina@vtbcapital.com

Nikolay Kovalev, Equities Analyst

+7 495 287 68 65 // nikolay.kovalev@vtbcapital.com

Alexander Gnusarev, Equities Analyst

+7 495 660 67 99 // Alexander.Gnusarev@vtbcapital.com

Prices cited in the body of this report are as of the last close before, or the close on, 09 Nov 2018 (except where indicated otherwise). VTB Capital analysts update their recommendations periodically as required.

Please refer to the Disclosures section of this report for other important disclosures, including the analyst certification and information as required by EU-MAR. Additional disclosures regarding the subject company(ies) discussed in this report can be found at http://research.vtbcapital.com/ServicePages/Disclosures.aspx.

vk.com/id446425943

Russia

Real Estate

Real Estate Watch

Table of contents |

|

Consumer backdrop: no signs of material improvement......................................................... |

3 |

Supply side: acceleration prior to legislative changes............................................................. |

4 |

Mortgage market: going through the roof.................................................................................. |

5 |

Demand side: fuelled by gradual real incomes recovery and mortgages............................... |

6 |

Residential prices: promising primary trends........................................................................... |

7 |

Valuation....................................................................................................................................... |

8 |

12 November 2018 |

2 |

vk.com/id446425943 |

Real Estate Watch |

Russia |

|

Real Estate |

|

Consumer backdrop: no signs of a material improvement

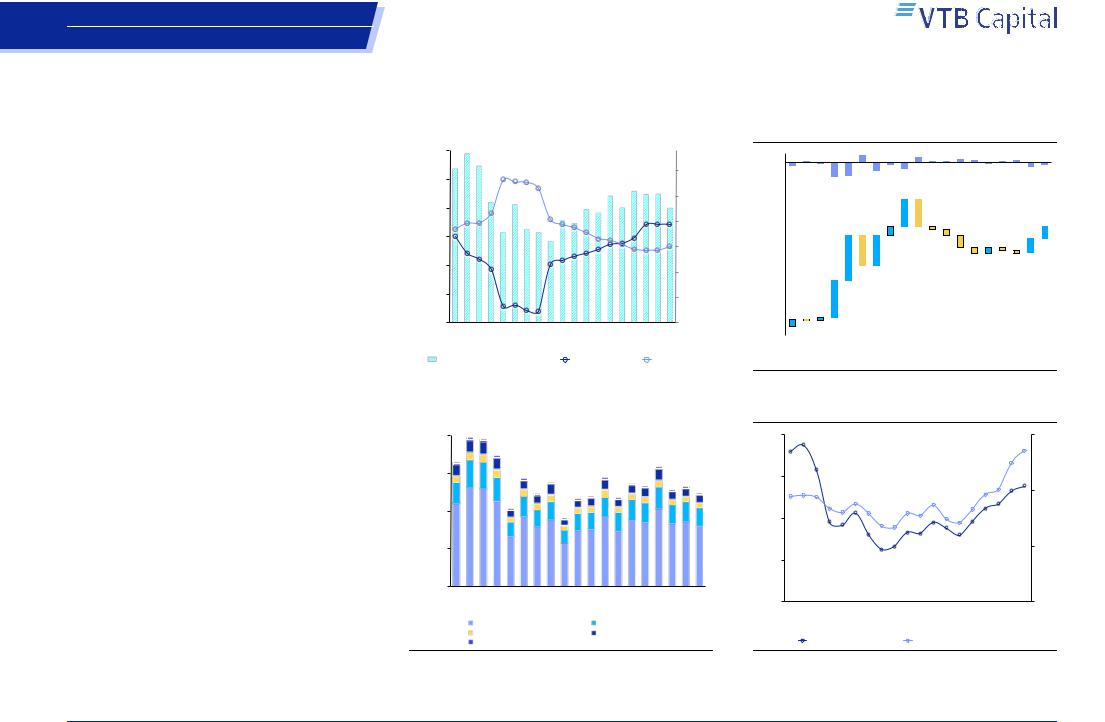

In 3Q18, consumer budgets remained stretched, posting only a gradual recovery from a modest base. Clients remained price-sensitive and highly reactive to promotional activities. Inflation was at 3.0% YoY during the quarter, while the 7.4% YoY advance in real wages reported by Rosstat has not been reflected by the listed constituents of the consumer segment, which reported results worsening from July to September.

USDRUB volatility has direct implications for consumer behaviour in Russia and sales on the residential development segment. The local currency depreciated 11% YoY and 6% QoQ in 3Q18. Clients’ front-loaded inflationary expectations are one reason for the 8.6% YoY growth in the non-food retail categories vs. 3.2% YoY for food turnover.

Residential sales were solid in 3Q18, with primary deals in Russia up 6% YoY. Among the key support factors, we highlight the gradual recovery in consumption, accelerating sales launches, the bottom in mortgage rates having been tested, and FX volatility. Across listed names, blended sales surged 25% YoY as the largest players reacted rapidly to the favourable trend.

Figure 1: Wages* and inflation

|

960 |

941 |

874 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

858 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18% |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

732715717 |

|

|

|

|||

|

|

|

|

|

672 |

|

|

659 |

|

|

|

|

|

|

|

|

|

705 |

|

|

13% |

|||||||

|

640 |

|

|

|

|

|

|

|

|

|

|

632612 |

|

|

640 |

|

|

639 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

568 |

553 |

|

|

|

|

|

|

|

|

|||||||

USD |

|

|

|

|

|

|

503 |

|

521 |

503 |

|

|

|

|

|

|

|

|

|

7.4% |

8% |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

480 |

|

|

|

|

|

|

|

|

455 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YoY |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.0% |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3% |

|

|

320 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

160 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-12% |

|

|

1Q14 |

2Q14 |

3Q14 |

4Q14 |

1Q15 |

2Q15 |

3Q15 |

|

4Q15 |

1Q16 |

2Q16 |

3Q16 |

4Q16 |

1Q17 |

2Q17 |

3Q17 |

4Q17 |

1Q18 |

2Q18 |

3Q18 |

|

|

||||||

|

Average monthly salary (lhs) |

Real wage (rhs) |

|

CPI (rhs) |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Source: Rosstat, VTB Capital Research |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

-* Accrued monthly nominal wages of employees of organizations |

|

|

|

|

||||||||||||||||||||||||

Figure 3: Monthly average income per capita* |

|

|||||||||||||||||||||||||||

|

800 |

780 774 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

651 |

|

|

|

686 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

627 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

600 |

|

|

|

|

|

|

|

|

565 |

|

|

546 |

|

|

|

|

|

570 |

|

|

539 525 |

|

|

522 |

|

||

|

|

|

|

|

|

|

|

|

|

|

485 |

|

|

|

|

|

|

|

|

|

|

506 |

489 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

459 471 |

|

|

463 |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

USD |

400 |

|

|

|

|

|

|

405 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

356 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Q14 |

2Q14 |

3Q14 |

4Q14 |

1Q15 |

2Q15 |

3Q15 |

4Q15 |

1Q16 |

2Q16 |

3Q16 |

4Q16 |

1Q17 |

2Q17 |

3Q17 |

4Q17 |

1Q18 |

2Q18 |

3Q18 |

|||||||||

|

|

|

|

Labour renumeration |

|

|

|

|

|

Social Transfer |

|

|

|

|

||||||||||||||

|

|

|

|

Property |

|

|

|

|

|

|

|

|

|

|

Entrepreneurial Activities |

|

||||||||||||

|

|

|

|

Others |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Source: Rosstat, VTB Capital Research

-*Includes gains of persons engaged in entrepreneurial business activity, paid remuneration of employees, social transfers (pensions, grants, benefits, insurance compensations), property income in the form of deposits, securities, dividends and other income.

2 USDRUB, quarterly

90 |

0% |

|

|

|

|

|

|

|

|

16% |

|

|

|

|

|

12% 2% 2% 7% 3% |

|

1% 3% |

|

|

|

|

|

|

||||||||||||

-8% |

|

|

|

-4% |

|

|

|

|

|

|

|

|

-20% |

-4%-13% |

|

|

|

|

|

|

-4% |

|

|

-9% -6% |

||||||||||||

|

|

|

|

|

-32%-31% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

63 |

|

|

63 |

66 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

66 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

66 |

65 |

|

|

|

|

|

|

62 |

|

|

|

|||||||||||

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

63 |

59 |

|

59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

57 |

|

58 |

57 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

48 |

|

|

|

|

53 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35 |

|

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Q14 |

2Q14 |

3Q14 |

4Q14 |

1Q15 |

2Q15 |

3Q15 |

4Q15 |

1Q16 |

2Q16 |

3Q16 |

4Q16 |

1Q17 |

2Q17 |

3Q17 |

4Q17 |

1Q18 |

2Q18 |

3Q18 |

||||||||||||||||||

Source: Bloomberg, VTB Capital Research

Figure 4: Oil prices

120 |

108 |

112 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.4 |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.0 |

|

|

90 |

|

|

|

95 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.8 |

3.8 |

3.7 |

|

3.5 |

|

|

|

|

|

|

|

|

|

3.8 4.0 |

79 |

83 |

4 |

|||

|

|

|

|

3.3 |

3.2 |

3.2 |

|

|

3.2 |

|

3.5 |

|

|

3.3 |

67 |

70 |

|

|

|

|

60 |

|

|

|

64 |

|

|

|

57 |

3.0 |

2.8 |

|

|

|

|

||||||

|

|

|

57 |

55 |

|

|

2.7 |

2.7 |

|

3.1 |

58 |

|

|

|

|

|

||||

|

|

|

|

|

|

|

48 |

|

|

50 |

49 |

|

53 |

48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

37 |

40 |

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

1Q14 |

2Q14 |

3Q14 |

4Q14 |

1Q15 |

2Q15 |

3Q15 |

4Q15 |

1Q16 |

2Q16 |

3Q16 |

4Q16 |

1Q17 |

2Q17 |

3Q17 |

4Q17 |

1Q18 |

2Q18 |

3Q18 |

0 |

|

|

|||||||||||||||||||

|

|

Brent Oil, USD (lhs) |

|

Brent Oil, 000'RUB (rhs) |

|

|

||||||||||||||

Source: Bloomberg, VTB Capital Research

12 November 2018 |

3 |

vk.com/id446425943 |

Real Estate Watch |

Russia |

Real Estate

Supply side: acceleration prior to legislative changes |

|

|

|

|

|

|

||||||||||||||||||

The upcoming |

regulatory changes concerning |

the |

Figure 5: Area under construction in Russia |

|

|

|

||||||||||||||||||

ability to collect client funds during the construction |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

stage and the |

implementation of |

escrow |

accounts |

|

180 |

6% |

|

10% |

14% |

15% |

|

|

|

9% |

|

|

||||||||

have pushed developers to pre-secure the construction |

|

|

|

|

|

4% |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

0% |

1% |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

pipeline |

and |

attain additional construction permits. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

131 |

|

|

|||||||||

Coupled |

with |

the |

pick-up in residential demand, |

the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

120 |

111 |

|

114 |

119 |

120 |

115 |

114 |

120 |

17% |

|

|

||||||||||||

trend saw the area under construction advance 9% |

|

|

14% |

15% |

15% |

|

|

|||||||||||||||||

mn sqm |

12% |

|

14% |

15% |

15% |

|

|

|

||||||||||||||||

YoY in 3Q18, following three flattish quarters. We also |

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

observed certain market consolidation as the top-10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

increased their share of the area currently under |

|

60 |

|

|

|

|

|

|

|

|

|

|

|

83% |

|

|

||||||||

construction to 17%, from 15% last year. |

|

|

|

|

88% |

|

86% |

86% |

85% |

85% |

85% |

85% |

|

|

||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||

9mo18 completions were down 2% YoY at 45mn sqm, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

primarily reflecting the unimpressive sales of 2015-16 at |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

a time of pressured consumer budgets and a high |

|

4Q16 |

1Q17 |

2Q17 |

3Q17 4Q17 1Q18 2Q18 3Q18 |

|

||||||||||||||||||

|

|

|

||||||||||||||||||||||

interest rate environment. Moscow was less impacted |

|

|

|

|

Top-10 developers |

Other Chng, YoY |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||

by the downbeat trends and observed an improvement |

|

|

|

|

|

|

|

|

||||||||||||||||

Source: United registry of homebuilders, VTB Capital Research |

|

|

|

|||||||||||||||||||||

early, overall printing 20% YoY advance in YTD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

completions. |

For |

2018, the ministry of construction |

Figure 7: Residential completions |

|

|

|

|

|

||||||||||||||||

estimates the country’s commissioning reaching 82- |

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

84mn sqm, a recovery of some 5% YoY. |

|

|

|

7% |

19% |

1% |

-6% |

|

-1% |

-2% |

|

|

||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||

In |

Moscow, |

|

the |

mass-market |

segment |

saw |

an |

|

|

|

|

|

84 |

|

85 |

80 |

|

79 |

|

|

|

|||

|

|

80 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

acceleration in the supply and share of unsold flats in |

|

70 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

36 |

|

|

31 |

|

|

|

|

|

|||||||||||||

the commissioned estates increased to 35%, from 30% |

|

|

|

|

|

|

33 |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a year ago, according to the latest IRN data. For the |

sqm |

60 |

|

|

|

|

|

|

|

|

|

|

33 |

|

|

|

||||||||

32 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

City, developers got 21mn sqm pre-approved estates |

|

|

|

|

|

|

|

|

|

|

45 |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

mn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

to |

build |

in-line |

with previous legislation, backing |

the |

40 |

|

|

|

19 |

|

18 |

18 |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

pipeline for 5-6 years. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

|

|

||||||

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

16 |

|

16 |

|

15 |

13 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

10 |

|

14 |

|

18 |

16 |

|

13 |

16 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

2013 |

2014 |

2015 |

2016 |

|

2017 |

9m18 |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Q |

2Q |

3Q |

4Q |

Chng, YoY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Source: Rosstat, VTB Capital Research

Figure 6: Top-10 developers, September 2018*

Etalon,MR Group,

FSK Lider, 0.9 0.8

1.0

PIK, 6.9

Samolet, 1.1

Glavstroi, 1.2

1.5 |

23mn sqm |

Ugstroiinvest, |

|

CDS, 1.6 |

|

LSR, 4.9

Setl Group, 2.7

Source: United registry of homebuilders, VTB Capital Research -*Area under construction, mn sqm

Figure 8: Sales launches of listed developers*

2,000

1,808

|

1,633 |

|

|

|

||

|

1,500 |

|

|

|

|

|

sqm |

1,000 |

|

|

|

|

|

000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

644 |

|

|

|

|

532 |

|

500 |

|

|

|

507 |

|

|

|

|

|

|

415 |

|

|

0 |

PIK |

|

|

LSR |

|

|

|

|

|

|||

|

|

|

9m16 |

9m17 |

9m18 |

|

|

|

|

|

|||

|

|

|

|

|||

Source: Company data, VTB Capital Research *-not disclosed by Etalon

12 November 2018 |

4 |

vk.com/id446425943 |

Real Estate Watch |

Russia |

|

Real Estate |

|

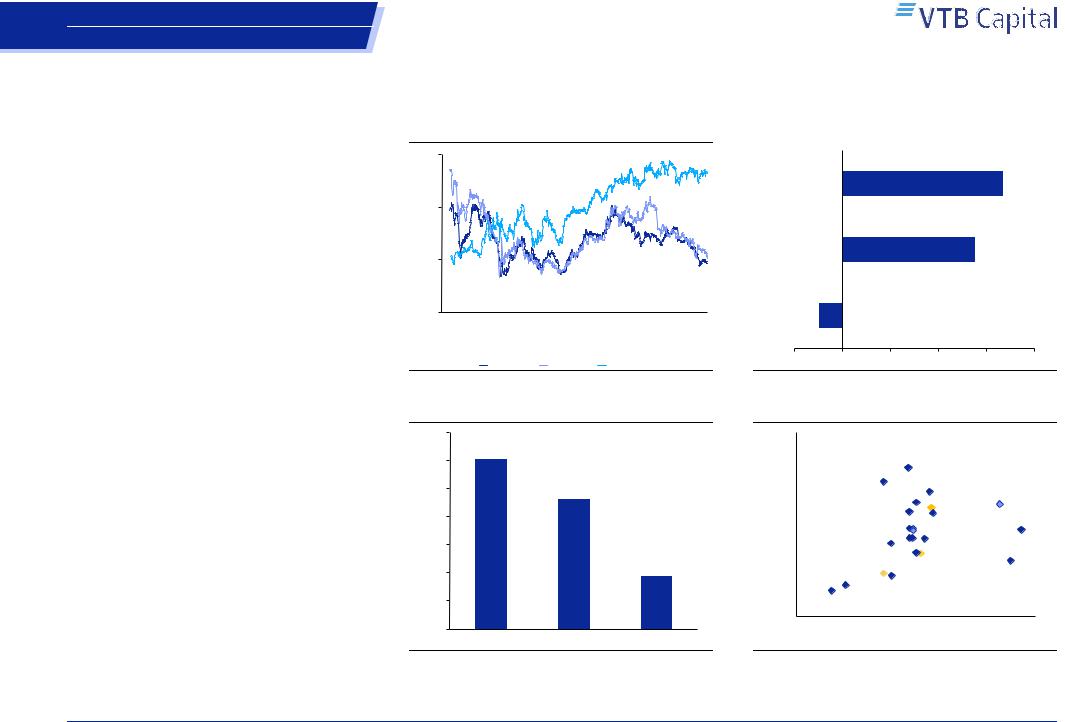

Mortgage market: going through the roof

The key rate in Russia had declined 25bp YTD to 7.5% as of September 2018. The mortgage rate followed the path and reached a record low blended level of 9.4% in 3Q18. The spread between the two rates has stabilised at 190bp lately and we see this as sustainable in the medium term.

The local bottom in the mortgage rates and clients’ view on the limited further easing sparked new mortgage origination in 9mo18. The total value surged 61% YoY to RUB 2tn, thus already overtaking the total figure for 2017. The market is consolidated: Sberbank and VTB accounted for 66% and 70%, respectively, of new issues in 3Q18 and 9mo18.

The share of credit sales in the results of public homebuilders has also reached an unmatched level of 55-65% in the mass-market segment. We see the share as capped at 80%, i.e. the level observed for peers at the developed markets.

Figure 9: Mortgage blended rate vs. key rate

15% |

|

|

|

|

|

15.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.4% |

|

|

|

|

13.1% |

13.0% |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

11.8% |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

11.2% |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

10.8% |

|

|

|

10.5% |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.9% |

|

|

|||||

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.5% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.8% |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

8.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.5% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Q14 |

2Q14 |

3Q14 |

4Q14 |

1Q15 |

2Q15 |

3Q15 |

4Q15 |

1Q16 |

2Q16 |

3Q16 |

4Q16 |

1Q17 |

2Q17 |

3Q17 |

4Q17 |

1Q18 |

2Q18 |

3Q18 |

||||||

|

|

|

|

|

|

|

|

|

Mortgage rate |

Key rate |

|

|

|

|

|

|

||||||||

Source: CBR, VTB Capital Research |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Figure 11: Share of mortgages in sales |

|

|

|

|

||||||||||||||||||||

70% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

64% 66% 64% 65% |

|||

60% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

59% 60% |

|

|

|

56% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

55% 54% |

|

|

|

54% |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

52% |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

49% |

50% |

|

|

|

|

|

|

|

|

50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47% |

|

52% |

|

||

|

43% |

|

|

|

|

|

|

44% 42% |

|

45% |

|

45% |

|

45% |

|

45% |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42% |

|

|||||||||

41% |

40% |

|

|

|

|

41% |

|

|

|

|

|

|

41% |

40% |

41% |

|||||||||

40% |

|

|

|

|

|

|

|

39% |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

35% |

|

|

|

|

|

37% |

32% 34% 34% |

|

42% |

|

33% |

35% |

|

|

|

|

|||||

37% 37% |

32% |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

30% |

|

23% |

28% |

23% 25% |

|

|

|

|

|

21% 22% 23% |

|

|

|

|

|

|

|

|||||||

20% |

|

|

|

20% |

|

|

20% |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

22% 22% |

|

|

|

|

|

|

|

|

22% |

|

|

|

|

|

|

||||

17% |

|

|

|

|

|

|

|

|

|

15% 15% |

|

|

|

|

|

|

|

|

|

|

||||

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

11% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Q14 |

2Q14 |

3Q14 |

4Q14 |

1Q15 |

2Q15 |

3Q15 |

|

4Q15 |

1Q16 |

2Q16 |

3Q16 |

4Q16 |

1Q17 |

2Q17 |

3Q17 |

4Q17 |

1Q18 |

2Q18 |

3Q18 |

|||||

|

|

|

|

|

|

|

|

|

|

PIK |

|

|

LSR |

Etalon |

|

|

|

|

|

|

||||

Source: Company data, VTB Capital Research |

|

|

|

|

|

|

|

|

|

|||||||||||||||

Figure 10: Mortgage origination |

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

2,400 |

|

32% |

|

31% |

|

-34% |

|

27% |

|

37% |

61% |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,021 |

2,071 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

1,800 |

|

|

|

|

1,753 |

|

|

|

|

|

|

|

|

|

761 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,472 |

|

736 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

1,339 |

|

538 |

|

|

|

|

|

|

|

|

|

|

|||||

|

bn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

1,200 |

|

|

|

|

|

|

|

1,158 |

|

446 |

|

|

|

|

|

|

||||||

|

RUB |

|

444 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

450 |

|

|

|

|

|

|

|

513 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

399 |

|

|

|

|

727 |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

362 |

|

|

|

|

||||||||

|

|

|

|

|

|

359 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

600 |

|

|

|

|

|

300 |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

433 |

|

|

341 |

|

452 |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

311 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

242 |

|

|

|

|

|

|

582 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

333 |

|

|

|

|

323 |

|

321 |

|

||||||

|

|

|

|

|

|

224 |

|

|

217 |

|

|

|

|

|

|||||||||

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

2013 |

|

2014 |

|

2015 |

|

2016 |

2017 |

9m18 |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

1Q |

2Q |

3Q |

4Q |

|

Chng, YoY |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Source: CBR, VTB Capital Research |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Figure 12: Mortgage availability |

|

|

|

|

|

|

|

||||||||||||||||

45 |

68% |

|

67% 66% |

70% |

|

|

|

|

|

|

|

|

|

|

|

|

44 |

|

70% |

||||

|

|

|

65% |

63% |

|

|

|

|

|

|

|

43 |

41 |

42 |

|||||||||

|

|

|

|

|

|

|

|

|

62% |

|

40 59% |

40 |

|

|

|

|

|||||||

|

|

|

|

65% |

|

|

|

|

|

59% |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

63% |

|

|

|

37 |

38 |

|

|

|

|

60% |

||||||

36 |

|

|

|

|

|

|

|

|

36 |

|

36 |

|

|

|

|

|

|||||||

|

|

|

|

|

35 |

|

|

34 57% |

|

|

53% |

|

|

|

|

||||||||

|

33 |

|

|

|

33 |

33 |

|

|

|

|

|

|

|

|

|||||||||

30 |

32 |

32 |

32 |

|

52% |

52% |

|

|

49% |

|

49% |

50% |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47% |

|

46% |

|

40% |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

000'RUB18 |

|

|

|

|

22 |

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

20 |

21 |

21 |

21 |

21 |

21 |

21 |

21 |

21 |

21 |

21 |

21 |

20 |

20 |

20 |

20 |

21 |

30% |

||||||

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10% |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

0 |

1Q14 |

2Q14 |

3Q14 |

4Q14 |

1Q15 |

2Q15 |

3Q15 |

4Q15 |

1Q16 |

2Q16 |

3Q16 |

4Q16 |

1Q17 |

2Q17 |

3Q17 |

4Q17 |

1Q18 |

2Q18 |

3Q18 |

0% |

|||

|

|

|

|

||||||||||||||||||||

|

|

Average monthly payment (lhs) |

|

|

Average monthly salary (lhs) |

|

|||||||||||||||||

|

|

|

|

|

|||||||||||||||||||

|

|

Payment as % of average salary (rhs) |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Source: |

|

VTB Capital Research |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

12 November 2018 |

5 |

vk.com/id446425943 |

Real Estate Watch |

Russia |

Real Estate

Demand side: fuelled by a gradual recovery in real incomes and mortgages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

Consolidated |

residential |

demand |

in |

Moscow |

has |

Figure 13: Moscow registered deals |

|

|

|

|

Figure 14: St. Petersburg registered deals |

|

|

|||||||||||||||||||||||||||

surprised on the upside YTD and the total number of |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

65 |

3% |

32% |

32% |

21% |

-2% |

5% |

14% |

21% |

36% |

26% |

35% |

50 |

35% |

50% |

24% |

6% |

0% |

-1% |

28% |

21% |

35% |

27% |

6% |

|||||||||||||||||

deals surged 35% YoY in 3Q18 and 32% YoY in |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

57.0 |

|

|

57.5 |

|

|

|

|

|

|

|

|

|

|

|

43.6 |

|

44.1 |

|

|||||||||||||

9mo18. The |

|

primary |

market |

(up |

47% |

|

YTD) |

|

|

|

|

|

|

|

|

|

|

56.0 |

|

|

|

|

|

|

|

|

|

|

|

|

40.9 |

|||||||||

|

|

52 |

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

38.6 |

|

|

|

|||||||||||||

outperformed |

the secondary |

(up 25%) |

as |

the |

|

|

|

|

47.2 |

|

|

|

|

|

|

|

|

|

|

|

|

36.0 |

|

|

|

35.9 |

|

|

||||||||||||

|

|

|

|

|

44.6 |

|

|

46.1 |

|

|

|

|

|

34.8 |

|

|

34.7 |

|

|

|

|

|||||||||||||||||||

developers |

extended |

and |

made |

the |

offer |

more |

|

|

42.3 |

|

|

42.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30.1 |

|

|

|

|

|

|

|

|

|||||||||||||||||

affordable |

and |

flexible. |

On |

the secondary |

market, |

39 |

34.8 |

|

|

37.4 |

|

34.0 |

|

|

69% |

|

68% |

65% |

30 |

26.5 |

|

|

26.6 |

|

|

65% |

|

65% |

66% |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

sellers are |

also |

more |

reluctant |

to |

price |

declines and |

'000 |

|

|

|

|

|

|

|

|

|

|

|

'000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

65% |

|

|

|

|

|

|

|

|

|

|

63% |

|

65% |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

discounts. |

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

74% |

|

70% |

70% |

|

|

|

20 |

|

|

|

67% |

68% |

70% |

|

73% |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

82% |

75% |

|

69% |

|

|

|

|

|

|

|

|

|

72% |

|

|

|

|

|

||||||||||

The trends in St Petersburg are also robust but inferior |

|

81% |

|

|

|

|

|

|

|

|

|

74% |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

13 |

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

to Moscow. Consolidated volumes added 6% YoY in |

|

|

|

|

|

|

|

|

31% |

35% |

32% |

35% |

|

|

|

33% |

|

|

|

|

37% |

35% |

35% |

35% |

34% |

|||||||||||||||

3Q18 and 20% YoY in 9mo18. As with Moscow, the |

|

|

|

|

25% |

26% |

31% |

30% |

30% |

|

|

26% |

32% |

30% |

28% |

27% |

||||||||||||||||||||||||

|

19% |

18% |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

city benefits at the expense of its surrounding region as |

0 |

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

1Q16 |

|

2Q16 |

3Q16 |

4Q16 |

1Q17 |

2Q17 |

3Q17 |

4Q17 |

1Q18 |

2Q18 |

3Q18 |

1Q16 |

2Q16 |

3Q16 |

4Q16 |

1Q17 |

2Q17 |

3Q17 |

4Q17 |

1Q18 |

2Q18 |

3Q18 |

||||||||||||||||||

the offer has become more comparable on prices while |

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

the real estate itself is more conveniently located. |

|

|

|

|

DDUs |

Buy-sell agreements |

|

Chng, YoY |

|

|

|

|

|

DDUs |

Buy-sell agreements |

Chng, YoY |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

The sales of listed developers were impressive, reflecting the overall strong market trends and are in our view the most appealing product among peers. LSR increased volumes 46% YoY in 9mo18, reflecting adjustments to real estate to target clients’ reduced budgets, the pressured comparison base, and the growing maturity of projects. PIK also surprised with a 6% YoY advance for 9mo18, outperforming the record 2017 sales for the segment.

The strong demand trends mainly reflect people’s desire to improve their living conditions and, to a lesser extent, investment purposes (10% of sales in 3Q18). The latest rental yields for housing were 5.9% and 6.8% in Moscow and St Petersburg, respectively, in 3Q18. Adjusted for taxes and utility costs, we consider this to be modest.

Source: Rosreestr, VTB Capital Research

Figure 15: Sales of listed homebuilders, YoY

1,800 |

56% |

95% |

|

|

|

|

|

|

63% |

|

|

|

|

|

|

30% |

|

46% |

2% |

19% |

|||

|

|

6% |

|

|

|

|

|||||

1,200 |

|

1,231 1,309 |

|

|

-17% |

|

|

|

|

||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

000 sqm |

632 |

|

|

|

|

|

|

620 |

|

|

|

600 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

509 |

424 |

|

|

|

417 |

|

|

|

|

|

|

|

|

|

342 |

350 |

||

|

|

|

|

|

|

|

|

|

|

||

0 |

|

PIK |

|

LSR |

|

|

Etalon |

|

|||

|

|

|

|

|

|

||||||

|

|

|

|

9m16 |

9m17 |

9m18 |

|

|

|

||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

Source: Company data, VTB Capital Research

Source: Rosreestr, VTB Capital Research

Figure 16: Annualized rental yields, 3Q18

9%

7.8% 7.9% 8.0% 8.2% 8.2% 8.3%

6.8% 7.1% 7.2%

6% 5.9%

3%

Moscow |

St.Petersburg |

Kazan |

Ufa |

Ekaterinburg |

Samara |

Novosibirsk |

Omsk |

Volgograd |

Rostov |

Source: Domofond, VTB Capital Research

12 November 2018 |

6 |

vk.com/id446425943 |

Real Estate Watch |

Russia |

|

Real Estate |

|

Residential prices: promising primary trends

In Moscow, primary prices increased 12% YoY in 3Q18 and YTD, supported by a spike in demand and gradually recovering household budgets. The secondary market is on a flattish trend and its premium to the primary market has been eliminated of late. The south and south-east regions demonstrated the most upbeat trends: they are significantly in the mass-market segment and have seen progress on large-scale projects and redevelopment areas through the construction stages.

In St Petersburg, primary and secondary prices added 9% YoY and 3% YoY in 9mo18. In the latest quarter, the growth rate was comparable for both segments at 8% YoY. Amid the recent pick-up on the secondary segment, its discount to the primary market in St Petersburg remains at a record high of 20%.

Listed residential developers were inflating LFL prices some 10% YTD with a gradual pace through the period. However, the greater focus on the less premium market offer caused a certain dilution, meaning a 3% YoY advance and 3% YoY correction for PIK and LSR in 9mo18, respectively. Etalon’s product mix is less volatile and the consolidated price increase for the period was 8% YoY.

Figure 17: Moscow residential prices

200

|

|

|

|

|

191 |

|

193 |

192 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

188 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

190 |

|

183185 |

|

|

|

188 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

181 |

183 |

182181 |

|

|

|

|

|

|

|

|||

|

180 |

179 |

|

|

|

|

|

|

|

|

179 |

|

|

|

|

|

|

|||

/ sqm |

|

|

|

|

|

|

182 |

|

|

|

|

176173174 |

|

|

|

|||||

|

|

|

|

|

|

|

175 |

|

|

|

|

|

|

|

|

173 |

||||

170 |

|

|

|

175174173 |

|

|

|

|

|

|

|

|

|

168 |

170172 |

|||||

000'RUB |

167 |

170170 |

|

|

|

|

|

160 |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

164 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

160 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

150 |

|

|

|

|

|

|

|

|

|

153 |

157 |

155 |

156 |

158 |

154154 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

140 |

1Q14 |

2Q14 |

3Q14 |

4Q14 |

1Q15 |

2Q15 |

3Q15 |

4Q15 |

1Q16 |

2Q16 |

3Q16 |

4Q16 |

1Q17 |

2Q17 |

3Q17 |

4Q17 |

1Q18 |

2Q18 |

3Q18 |

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

Primary |

Secondary |

|

|

|

|

|

|

|

|||||

Source: Rosstat, VTB Capital Research

Figure 19: St Petersburg residential prices

|

110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

107107108 |

||

|

105 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

101 |

|

|

|

|

|

99 100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

100 |

97 |

97 |

|

|

|

|

|

|

|

97 |

97 |

98 |

99 |

|

|

|

|

||

|

|

|

|

|

|

95 |

|

|

|

95 |

|

|

|

|

|

|

||||

sqm/ |

95 |

|

|

|

|

93 |

94 |

93 |

|

95 |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

91 |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

000'RUB |

90 |

|

90 |

91 |

91 |

|

|

|

|

|

90 |

90 |

90 |

|

|

|

|

|

90 |

92 |

|

89 |

|

|

|

|

|

89 |

88 |

|

89 |

89 |

|

||||||||

|

85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

86 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80 |

|

|

|

|

80 |

81 |

83 |

82 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

75 |

1Q14 |

2Q14 |

3Q14 |

4Q14 |

1Q15 |

2Q15 |

3Q15 |

4Q15 |

1Q16 |

2Q16 |

3Q16 |

4Q16 |

1Q17 |

2Q17 |

3Q17 |

4Q17 |

1Q18 |

2Q18 |

3Q18 |

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

Primary |

Secondary |

|

|

|

|

|

|

|

|||||

Source: Rosstat, VTB Capital Research

Figure 18: Moscow blended prices, 000’RUB/sqm*

Source: IRN, VTB Capital Research

-* Percent figures indicate YoY change in prices

Figure 20: Prices of the listed homebuilders

160 |

12% |

4% |

3% |

|

|

14% |

|

4% |

2% |

8% |

||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

-6% |

-3% |

|

120 |

|

|

|

|

|

|

|

|

|

|

|||

120 |

|

|

|

|

|

|

|

|

|

112 |

||

|

|

107 |

|

|

105 |

|

109 |

|

||||

|

|

|

103 |

|

|

|

|

|||||

/ sqm |

|

99 |

|

|

100 |

97 |

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

000'RUB |

80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|