RenCap_Alrosa_watermark

.pdf

vk.com/id446425943

Alrosa

TP increase and 3Q18 preview

We increase our TP for Alrosa by 4% to RUB106 as higher diamond realisations increase our medium-term earnings forecasts by up to 6%. Alrosa is scheduled to report 3Q18 financial results on 8 November 2018. We maintain our BUY rating.

Our earnings forecasts benefit from higher sales realisations

We increase our medium-term earnings by up to 6% following Alrosa’s 3Q18 operational results on 22 October 2018, as we incorporate higher-than-previously- forecast gem diamonds realisations over the medium term. Alrosa’s 3Q18 diamond production grew 2% YoY, but came in 5% below our forecast. FY18 production guidance remained at 36.6mn cts, in line with our forecast. Alrosa achieved realised prices for gem diamonds of $199/ct which were significantly higher than our forecast of $164/ct. This implies a 97% realisation compared with the rough diamond index price in 3Q18. We have recalibrated our model to take these higher realisations into account and increased our forecast realisation percentage relative to the rough diamond index from 76% previously to 78-80% over the medium term.

3Q18 financial results preview

Alrosa 3Q18 results are due tomorrow (8 November). We forecast the following for 3Q18:

▪EBITDA growth of 30% YoY to RUB35,371mn

▪Net profit growth of 76% YoY to RUB22,732mn

▪Net debt declining by 67% YoY to RUB29,323mn

Key risks to our investment stance

Among the biggest downside risks to our earnings forecasts and valuation are lower- than-forecast diamond prices or a stronger rouble; lower-than-forecast gem diamond production; less or poorer-quality reserves/resources than disclosed; sanctions against Alrosa; and the potential for the government to raise royalties and taxes, or required social infrastructure investment for Alrosa in particular or for the sector in general. Upside risks stem from the converse of the above factors.

Increasing TP

BUY (maintained)

TP: RUB106 (previously RUB102)

Diamonds

Russia

Johann Pretorius +27 (11) 750-1450

JPretorius2@rencap.com

Siphelele Mhlongo +27 (11) 750-1420

SMhlongo@rencap.com

Steven Friedman +27 (11) 750-1481

SFriedman@rencap.com

Kabelo Moshesha +27 (11) 750-1472

KMoshesha@rencap.com

Derick Deale

+27 (11) 750-1458 DDeale@rencap.com

Report date: |

|

|

7 November 2018 |

|||

Current price, RUB |

|

|

|

|

103.0 |

|

Upside/downside, % |

|

|

|

|

17.1 |

|

MktCap, RUBmn |

|

|

|

758,983.7 |

||

Average daily volume, RUBmn |

|

1,318.9 |

||||

Free float, RUBmn |

|

|

|

311,562.8 |

||

Bloomberg |

|

|

|

|

ALRS RX |

|

|

|

|

||||

Summary valuation and financials |

|

|

||||

IFRS |

2017 |

2018E |

2019E |

2020E |

||

EPS, RUB |

|

10.47 |

15.22 |

14.64 |

14.76 |

|

EPS growth, % |

-41.3 |

45.4 |

-3.8 |

0.8 |

||

DPS, RUB |

|

8.93 |

16.08 |

14.43 |

14.72 |

|

Dividend yield, % |

10.3 |

15.6 |

14.0 |

14.3 |

||

EBITDA margin, % |

|

46.1 |

52.8 |

52.3 |

51.8 |

|

Capex/EBITDA, % |

21 |

|

18 |

16 |

16 |

|

FCF yield, % |

|

10.1 |

18.0 |

15.1 |

14.5 |

|

RoCE, % |

27.4 |

40.7 |

41.0 |

41.1 |

||

RoE, % |

|

30.0 |

43.7 |

43.0 |

43.2 |

|

Net debt/EBITDA, x |

0.7 |

|

0.2 |

0.1 |

0.2 |

|

P/E, x |

|

8.3 |

|

6.8 |

7.0 |

7.0 |

EV/EBITDA, x |

5.6 |

|

4.5 |

4.5 |

4.4 |

|

BVPS, RUB |

|

36.2 |

34.7 |

34.9 |

34.9 |

|

Source: Company data, Renaissance Capital estimates |

||||||

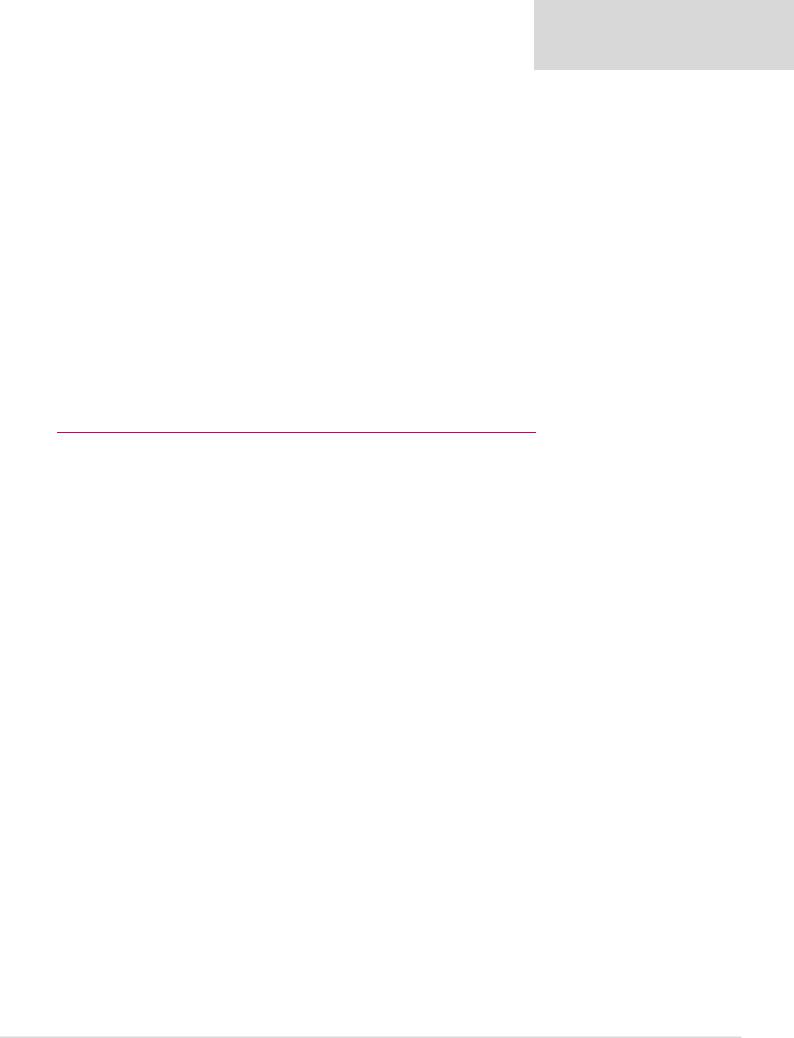

Figure 1: Price performance – 52 weeks |

|

|||||

RUB |

|

|

ALRS RX |

|

|

|

|

|

|

|

|||

120 |

|

|

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

80 |

|

|

|

|

|

|

|

|

|

|

|

|

60 |

|

Jan-18 |

Feb-18 |

Mar-18 |

Apr-18 |

May-18 |

Jun-18 |

Jul-18 |

|

|

Oct-18 |

|

Nov-17 |

Dec-17 |

Aug-18 |

Sep-18 |

Nov-18 |

Source: Bloomberg

© 2018 Renaissance Securities (Cyprus) Limited. All rights reserved. Regulated by the Cyprus Securities and Exchange Commission (Licence No: KEPEY 053/04). Hyperlinks to important information accessible at www.rencap.com: Disclosures and Privacy Policy, Terms & Conditions, Disclaimer.

vk.com/id446425943

Renaissance Capital

7 November 2018

Alrosa

Earnings revisions

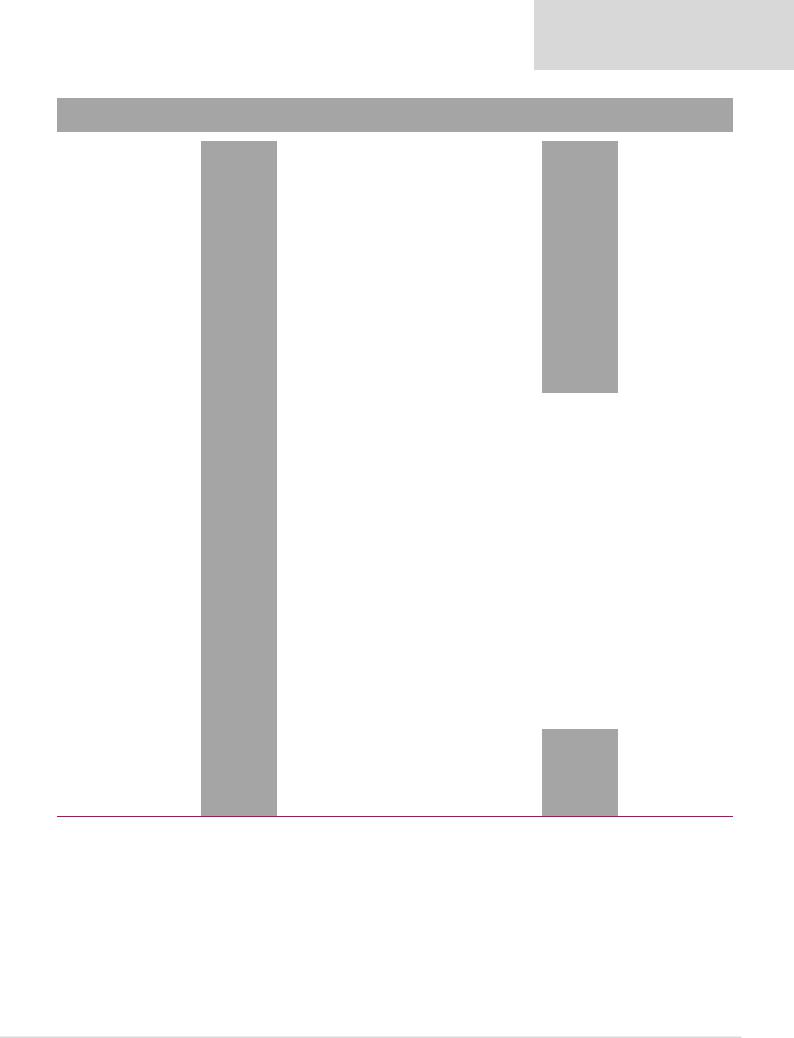

Figure 2: Alrosa – EPS forecasts, RUB

Dec-YE |

2018E |

2019E |

2020E |

2021E |

2022E |

New |

15.22 |

14.64 |

14.76 |

13.57 |

14.24 |

Old |

14.56 |

13.85 |

14.15 |

14.16 |

14.64 |

% difference |

5% |

6% |

4% |

-4% |

-3% |

|

|

|

|

|

|

Thomson Reuters consensus |

14.52 |

15.20 |

16.15 |

|

|

RenCap vs consensus |

5% |

-4% |

-9% |

|

|

Source: Thomson Reuters, Renaissance Capital estimates

3Q18 results preview

Figure 3: Alrosa – forecasts vs previously reported numbers, RUBmn (unless otherwise stated)

Dec-YE |

3Q18E |

2Q18 |

% change |

3Q17 |

% change |

|

forecasts |

reported |

QoQ |

reported |

YoY |

||

|

||||||

Income statement |

|

|

|

|

|

|

Revenue |

67,270 |

72,242 |

-7% |

58,927 |

14% |

|

Adjusted EBITDA |

35,371 |

41,340 |

-14% |

27,158 |

30% |

|

EBITDA margin |

53% |

57% |

|

46% |

|

|

Net profit |

22,732 |

25,378 |

-10% |

12,950 |

76% |

|

|

|

|

|

|

|

|

Balance sheet |

|

|

|

|

|

|

Net debt (cash) |

29,323 |

6,027 |

387% |

88,629 |

-67% |

Source: Company data, Renaissance Capital estimates

2

vk.com/id446425943

Alrosa – BUY

Renaissance Capital

7 November 2018

Alrosa

Figure 4: Alrosa, RUBmn (unless otherwise noted)

Alrosa |

|

|

|

|

ALRS.MM |

|

|

|

Market capitalisation, RUBmn: |

|

758,984 |

|

|

|

|||

Enterprise value, RUBmn: |

|

|

859,665 |

|

|

|

||

|

|

|

|

|

|

|

|

|

Dec-YE |

|

|

|

2016 |

2017 |

2018E |

2019E |

2020E |

Income statement |

|

|

|

|

|

|

|

|

Revenue |

|

|

317,090 |

275,381 |

324,307 |

321,548 |

327,993 |

|

Adjusted EBITDA |

|

|

176,418 |

126,890 |

171,387 |

168,320 |

169,814 |

|

Adjusted EBIT |

|

|

151,750 |

103,098 |

147,207 |

142,459 |

143,809 |

|

EBIT |

|

|

|

142,965 |

99,083 |

148,541 |

142,459 |

143,809 |

Net |

interest |

|

|

24,124 |

-1,320 |

-9,217 |

-9,284 |

|

Taxation |

|

|

|

-36,268 |

-22,174 |

-30,370 |

-29,298 |

|

Equity accounted income |

|

|

2,650 |

3,027 |

3,795 |

3,617 |

3,635 |

|

Net profit for the year |

|

|

133,471 |

78,616 |

112,748 |

107,494 |

108,388 |

|

Minority |

interest |

in |

profit |

-2,079 |

-1,541 |

-2,042 |

-2,150 |

|

Attributable net profit |

|

|

131,392 |

77,075 |

110,707 |

105,344 |

106,220 |

|

EPS, RUB |

|

|

17.85 |

10.47 |

15.22 |

14.64 |

14.76 |

|

Thomson Reuters consensus EPS, RUB |

|

|

14.52 |

15.20 |

16.15 |

|||

DPS declared, RUB |

|

|

2.09 |

8.93 |

16.08 |

14.43 |

14.72 |

|

Adjusted EBIT |

|

|

|

-0.41345 |

|

|

|

|

|

|

|

|

|

|

|

||

Diamonds |

|

|

205,235 |

132,879 |

185,256 |

183,506 |

185,570 |

|

Transportation |

|

|

933 |

1,298 |

135 |

861 |

886 |

|

Social |

infrastructure |

|

|

-5,559 |

-3,537 |

-4,287 |

-4,939 |

|

Other (SG&A, other expenses) |

|

-48,859 |

-27,542 |

-33,896 |

-36,970 |

-37,612 |

||

Income statement ratios |

|

|

|

|

|

|

||

EBITDA margin |

|

|

56% |

46% |

53% |

52% |

52% |

|

EBIT margin |

|

|

45% |

36% |

46% |

44% |

44% |

|

EPS growth |

|

|

328% |

-41% |

45% |

-4% |

1% |

|

Payout ratio |

|

|

12% |

85% |

106% |

99% |

100% |

|

Input assumptions |

|

|

|

|

|

|

|

|

Rough diamond index, $/ct |

|

197 |

198 |

201 |

207 |

214 |

||

Alrosa average gem realisations, $/ct |

150.1 |

135.6 |

164.1 |

162.3 |

166.7 |

|||

Gem realisations vs. index prices |

76% |

68% |

82% |

79% |

78% |

|||

Alrosa average industrial realisations, $/ct |

8.5 |

7.6 |

9.7 |

10.3 |

10.8 |

|||

Alrosa average realisations, $/ct |

|

110.8 |

101.1 |

120.9 |

116.7 |

119.9 |

||

RUB/$ |

|

|

|

67 |

58 |

62 |

65 |

64 |

All in cash costs, net of by-products |

|

|

|

|

|

|||

Estimated required breakeven price, $/ct |

128 |

148 |

130 |

142 |

148 |

|||

Production volumes, kct |

|

|

|

|

|

|

||

Diamonds |

|

|

|

|

|

|

|

|

Aikhal division |

|

|

12,228 |

13,010 |

11,300 |

8,962 |

8,539 |

|

Mirny division |

|

|

7,808 |

7,231 |

4,415 |

3,692 |

3,691 |

|

Udachny division |

|

|

3,167 |

3,821 |

5,288 |

8325 |

8343 |

|

Nyurba division |

|

|

6,793 |

7,713 |

7,351 |

7,321 |

7,382 |

|

Severalmaz |

|

|

2,217 |

2,642 |

3,320 |

3,823 |

4,198 |

|

Almazy Anabara & Nizhne-Lenskoye |

5,145 |

5,197 |

4,977 |

4,973 |

4,999 |

|||

Other production |

|

|

0 |

0 |

-5 |

0 |

0 |

|

Total |

|

|

|

37,358 |

39,614 |

36,646 |

37,096 |

37,152 |

Sales volumes , kct |

|

|

|

|

|

|

|

|

Gem-quality |

|

|

28,900 |

30,100 |

28,772 |

27,856 |

28,068 |

|

Industrial |

|

|

11,100 |

11,100 |

11,188 |

11,938 |

12,029 |

|

Total |

|

|

|

40,000 |

41,200 |

39,960 |

39,794 |

40,097 |

Balance sheet |

|

|

|

|

|

|

|

|

Net operating assets |

|

|

340,325 |

352,534 |

289,975 |

274,740 |

278,515 |

|

Equity |

|

|

|

257,202 |

266,825 |

249,331 |

250,868 |

251,187 |

Minority interest |

|

|

-232 |

-338 |

566 |

781 |

998 |

|

Net debt |

|

|

|

83,355 |

86,047 |

40,078 |

23,091 |

26,330 |

|

|

|

Target Price, RUB: |

|

|

106.0 |

|

|

|

|

|

|

Share price, RUB: |

|

|

103.0 |

|

|

|

|

|

|

Potential 12-month return: |

|

17.1% |

|

|

||

|

|

|

|

|

|

|

|

|

|

Dec-YE |

|

|

2016 |

2017 |

2018E |

2019E |

2020E |

|

|

Balance sheet ratios |

|

|

|

|

|

|

|

|

|

Gearing (net debt/(net debt+equity)) |

24.5% |

24.4% |

13.8% |

8.4% |

9.5% |

|

|

||

Net debt/(EBITDA+dividends from associat |

0.5x |

0.7x |

0.2x |

0.1x |

0.2x |

|

|||

RoCE |

|

|

40.0% |

27.4% |

40.7% |

41.0% |

41.1% |

|

|

RoIC (after tax) |

|

|

35.8% |

17.6% |

31.0% |

32.0% |

32.1% |

|

|

-9,511 |

RoE |

|

65.3% |

30.0% |

43.7% |

43.0% |

43.2% |

|

|

-29,546 |

|

|

|

|

|

|

|

|

|

Cash flow statement |

|

|

|

|

|

|

|

|

|

Operating cash flow |

|

143,138 |

100,464 |

143,518 |

141,741 |

139,475 |

|

|

|

-2,168 |

Capex |

|

-31,752 |

-26,944 |

-31,600 |

-26,400 |

|

-28,000 |

|

Other FCF |

|

|

0 |

0 |

30,827 |

0 |

0 |

|

|

FCF |

|

|

111,386 |

73,520 |

142,745 |

115,341 |

111,475 |

|

|

Equity shareholders' cash |

|

134,076 |

63,014 |

136,799 |

106,350 |

102,296 |

|

|

|

Dividends and share buy backs |

|

-14,775 |

-65,706 |

-90,830 |

-89,364 |

|

-105,534 |

||

Surplus (deficit) cash |

|

119,301 |

-2,692 |

45,969 |

16,987 |

-3,239 |

|

|

|

Cash flow ratios |

|

|

|

|

|

|

|

|

|

Working capital days |

|

104 |

145 |

114 |

114 |

115 |

|

|

|

Cash conversion |

|

|

1.0x |

0.8x |

1.2x |

1.0x |

1.0x |

|

|

FCF yield |

|

|

17.3% |

10.1% |

18.0% |

15.1% |

14.5% |

|

|

-5,034 |

Equity |

shareholders'23.9%yield 9.8% |

18.2% |

14.3% |

13.8% |

|

|

||

Capex/Adjusted EBITDA |

|

18.0% |

21.2% |

18.4% |

15.7% |

16.5% |

|

|

|

Valuation |

|

|

|

|

|

|

|

|

|

SoTP DCF valuation and calculation of target price |

|

|

RUBmn |

RUB/sh |

|

||||

Diamonds |

|

|

|

|

|

975,632 |

135.6 |

|

|

Transportation |

|

|

|

|

|

7,770 |

1.1 |

|

|

Other |

|

|

|

|

|

-131,577 |

-18.3 |

|

|

Total enterprise value |

|

|

|

|

851,825 |

118.4 |

|

|

|

Net debt as at 31 December 2017 |

|

|

|

|

-86,047 |

-12.0 |

|

|

|

Cash used in share buy-backs |

|

|

|

|

10,160 |

1.4 |

|

|

|

Other investments |

|

|

|

|

0 |

0.0 |

|

|

|

Minority interest |

|

|

|

|

|

-14,634 |

-2.0 |

|

|

Equity value as at 7/11/2018 |

|

|

|

|

761,303 |

105.8 |

|

|

|

Rounded to |

|

|

|

|

|

|

106.0 |

|

|

Share price on 6/11/2018 |

|

|

|

|

|

103.0 |

|

|

|

Expected share price return |

|

|

|

|

|

2.9% |

|

|

|

Plus: expected dividend yield |

|

|

|

|

|

14.2% |

|

|

|

Total implied one-year return |

|

|

|

|

|

17.1% |

|

|

|

Share price range, RUB: |

|

|

|

|

|

|

|

|

|

12-month high on 1/10/2018 |

|

107.9 |

12-month low on 16/11/2017 |

72.5 |

|

|

|||

Price move since high |

|

-4.5% |

Price move since low |

|

42.1% |

|

|

||

Calculation of discount rate |

|

|

|

|

|

|

|

|

|

WACC |

|

|

14.0% |

Cost of debt |

|

|

8.5% |

|

|

Risk-free rate |

|

|

7.0% |

Tax rate |

|

|

20% |

|

|

Equity risk premium |

|

6.0% |

After-tax cost of debt |

|

6.8% |

|

|

||

Beta |

|

|

1.30 |

Debt weighting |

|

10% |

|

|

|

Cost of equity |

|

|

14.8% |

Terminal growth rate |

4.0% |

|

|

||

Valuation ratios |

|

|

|

|

|

|

|

|

|

Dec-YE |

|

|

2016 |

2017 |

2018E |

2019E |

2020E |

|

|

P/E multiple |

|

|

4.3x |

8.3x |

6.8x |

7.0x |

7.0x |

|

|

Dividend yield |

|

|

2.7% |

10.3% |

15.6% |

14.0% |

14.3% |

|

|

EV/(EBITDA+Equity income) |

|

3.6x |

5.6x |

4.5x |

4.5x |

4.4x |

|

||

P/B |

|

|

2.2x |

2.4x |

3.0x |

3.0x |

3.0x |

|

|

NAV per share, USc |

|

52.1 |

62.1 |

54.9 |

54.1 |

54.9 |

|

|

|

NAV per share, RUB |

|

34.9 |

36.2 |

34.2 |

34.9 |

34.9 |

|

|

|

Source: Bloomberg, Thomson Reuters, Company data, Renaissance Capital estimates

3