Sberbank CIB _Polyus_watermark

.pdf

vk.com/id446425943

INVESTMENT RESEARCH

RUSSIA | METALS AND MINING NOVEMBER 8, 2018 | 16:50 MSK

GDR |

|

PLZL LI |

Recommendation |

|

BUY |

Last price |

|

$32.05 |

Target price |

(from $38.53) |

$44.00 |

Upside |

|

37% |

Free float |

|

16% |

|

|

|

Common |

|

PLZL RX |

Recommendation |

|

BUY |

Last price |

|

$64.19 |

Target price |

(from $77.50) |

$82.46 |

Upside |

|

28% |

Free float |

|

16% |

|

|

|

Market cap |

$8,561 mln |

|

Enterprise value |

$12,260 mln |

|

ADT, 100 days |

$5.1 mln |

|

Prices as of November 7, 2018 |

|

|

Key data

|

2017 |

2018E |

2019E |

2020E |

Financials (IFRS), $ mln |

|

|

|

|

Revenues |

2,721 |

2,977 |

3,606 |

3,626 |

EBITDA |

1,705 |

1,877 |

2,280 |

2,177 |

EBIT |

1,455 |

1,640 |

2,000 |

1,858 |

Net income |

1,004 |

1,167 |

1,465 |

1,349 |

Adjusted EPS, $ |

3.70 |

4.37 |

5.49 |

5.05 |

Profitability |

|

|

|

|

EBITDA margin |

63% |

63% |

63% |

60% |

EBIT margin |

53% |

55% |

55% |

51% |

Net margin |

36% |

39% |

41% |

37% |

Price ratios |

|

|

|

|

P/S |

3.1 |

2.9 |

2.4 |

2.4 |

EV/EBITDA |

7.1 |

6.5 |

5.1 |

5.2 |

P/E |

8.7 |

7.3 |

5.8 |

6.3 |

P/CF |

8.6 |

6.4 |

5.0 |

5.3 |

Growth |

|

|

|

|

Revenues |

11% |

9% |

21% |

1% |

EBITDA |

11% |

10% |

21% |

5% |

Adjusted EPS |

4% |

18% |

26% |

8% |

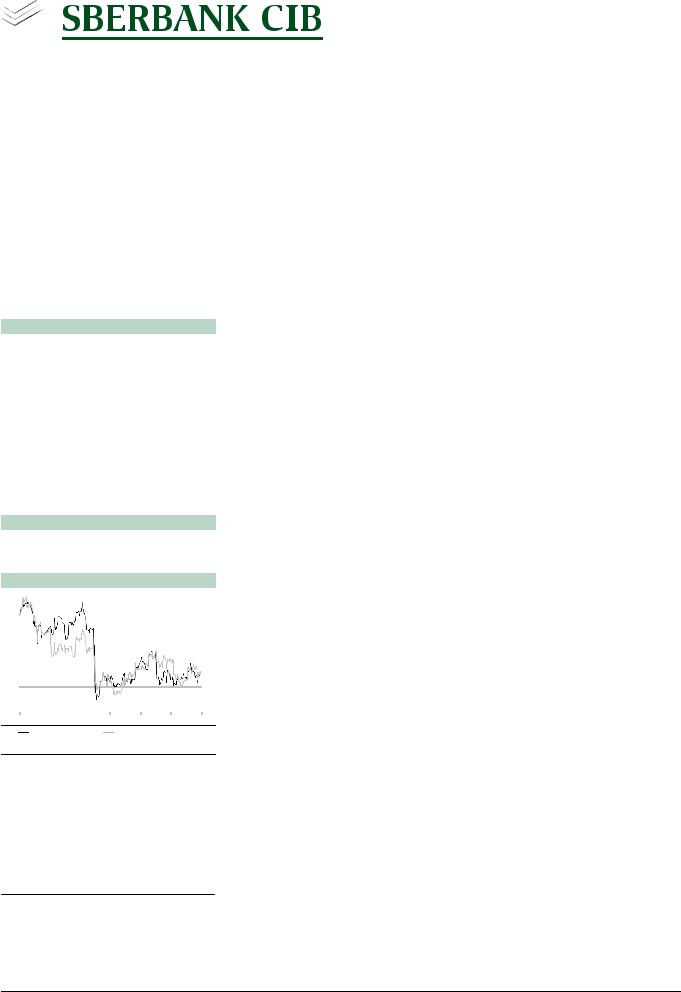

Price performance, %

|

1m |

3m |

6m |

YTD |

GDR |

2.4 |

8.9 |

2.2 |

16.4 |

Relative to RTS |

2.0 |

10.3 |

1.3 |

17.1 |

Price performance, $

44 |

|

42 |

|

40 |

|

38 |

|

36 |

|

34 |

|

32 |

|

30 |

|

28 |

|

26 |

|

Nov '17 Jan '18 Mar '18 |

May '18 Jul '18 Sep '18 Nov '18 |

Share price |

Relative to RTS |

Max 43.13 (Nov 14, ’17) |

Min 27.90 (Apr 11, ’18) |

Source: Bloomberg, Sberbank CIB Investment Research

Irina Lapshina |

Senior Analyst |

|

+7 (495) 933 9852 |

|

Irina_Lapshina@sberbank-cib.ru |

Alexey Kirichok |

Analyst |

|

+7 (495) 933 9850 |

|

Alexey_Kirichok@sberbank-cib.ru |

Polyus

Strong 3Q18 IFRS, Attractively

Priced Versus Peers

Polyus reported strong 3Q18 IFRS results yesterday. Thanks to higher gold sales and flat average TCC, EBITDA rose 18% Q o Q to $537 mln. The company reiterated its plans to put the broken ball mill at Natalka back into operation this month and quickly ramp up the processing plant to full capacity. We slightly upgrade our financial forecasts for Polyus following the 3Q18 results and based on gold price forecasts of $1,270/oz for 2018 and $1,300/oz for 2019 and USD/RUB projections of 62.4 in 2018 and 64.4 in 2019. Polyus is trading at a 2018E EV/EBITDA of 6.5 and 2019E EV/EBITDA of 5.1, a discount to both Polymetal and its peer group of global senior gold miners. Using a target EV/EBITDA of 7.5 8.0 for 2018 and 6.5 for 2019, we upgrade our target price for Polyus to $44.00 per GDR and reiterate our BUY recommendation.

█The 3Q18 IFRS results were in line with our estimates and the consensus. Revenues grew 20% Q o Q to $832 mln on 32% higher sales volumes. Despite part of the sales from Natalka – Polyus’s highest cost asset excluding alluvials – having been included in the P&L in 3Q18, TCC were flat Q o Q at $345/oz on the back of the weaker ruble and higher byproduct credit from sales of antimony rich flotation concentrate of $33/oz (up from $8/oz in 2Q18). EBITDA thus was up 18% Q o Q to $537 mln.

█Capex (including capitalized stripping) decreased 7% Q o Q to $188 mln. The company ceased capitalization of borrowing costs and other directly attributable operating costs at Natalka. Leveraged FCF came in at $148 mln, up 30% Q o Q on higher EBITDA and lower capex. Net debt as of the end of September had already been announced during the trading update at $3,029 mln. Net debt/LTM EBITDA thus decreased to 1.6 (versus 1.8 as of the end of June).

█In an update on Natalka, the company reiterated its plans to have the ball mill back up and running this month. The ball mill went offline in late 3Q18, which resulted in lower throughput and recoveries. The company expects to ramp up the processing plant to full capacity soon after the repairs are completed. As Polyus confirmed its guidance on the repair schedule for Natalka, we reiterate our 2018 Natalka gold production forecast of 150 koz.

█We have updated our financial forecasts for Polyus following the results release. We apply our updated assumptions for the gold price ($1,270/oz in 2018 and $1,300/oz in 2019) and USD/RUB (62.4 in 2018 and 64.4 in 2019). We recently discussed our updated outlook on the gold price in more detail in our report on Polymetal from October 29. We decrease our 2018 TCC estimate from around $390/oz to around $370/oz on better cost performance and the weaker ruble. As all Natalka sales will be included in Polyus’s P&L starting in 2019, we see the company’s average 2019 TCC increasing to $390 400/oz (versus our previous forecast of circa $410/oz).

THIS REPORT MAY NOT BE INDEPENDENT OF THE PROPRIETARY INTERESTS OF SBERBANK CIB USA, INC. OR ITS AFFILIATES (TOGETHER, “SBERBANK”). SBERBANK TRADES THE SECURITIES COVERED IN THIS REPORT FOR ITS OWN ACCOUNT AND ON A DISCRETIONARY BASIS ON BEHALF OF CERTAIN CLIENTS. SUCH TRADING INTERESTS MAY BE CONTRARY TO THE RECOMMENDATION(S) OFFERED IN THIS REPORT.

In accordance with US SEC Regulation AC, important US regulatory disclosures and analyst certification can be found on the last page of this report.

research@sberbank-cib.ru, http://research.sberbank-cib.com

This document is being provided for the exclusive use of strogaas@baltinvest.com |

This document is being provided for the exclusive use of strogaas@baltinvest.com |

vk.com/id446425943

NOVEMBER 8, 2018 POLYUS – STRONG 3Q18 IFRS, ATTRACTIVELY PRICED VERSUS PEERS

█We thus slightly upgrade our 2018 EBITDA estimate to $1,877 mln and 2019E EBITDA to $2,280 mln, almost in line with the current Bloomberg consensus. We expect 2018 LFCF of $380 mln (up from our previous estimate of $270 mln), for a 4% yield, and 2019E LFCF of $830 mln (almost unchanged) for a 10% yield.

█Polyus is trading at a EV/EBITDA of 6.5 for 2018E and 5.1 for 2019E, whereas the multiples for Polymetal are a respective 7.7 and 5.6 (at the same macro assumptions). This implies that Polyus is trading at a 9 15% discount to Polymetal on EV/EBITDA. We see this discount as partially due to Polyus’s lower short term EBITDA growth. The companies’ production growth profiles are comparable (7% production CAGR for Polyus in 2018E 20E and 5% for Polymetal if accounting for Polymetal’s planned disposal of the Kapan mine), although Polymetal is adding to its portfolio its lowest cost asset (Kyzyl), while Polyus is ramping up its highest cost one (Natalka), meaning that Polymetal’s TCC should decline next year, while Polyus’s looks set to increase. Therefore, on our numbers, Polyus’s 2018 20E EBITDA CAGR is 8% versus around 15% for Polymetal. Polymetal has an investor day this Monday at which we see a possibility that it will update its production guidance, given the planned Kapan disposal.

█On the other hand, over the longer term we think Polyus offers significant upside, especially given that the value of the Sukhoi Log project is almost certainly not fairly priced in. We see that the current Bloomberg consensus estimates have global senior gold mining peers trading at an average 2018E EV/EBITDA of 7.9 and 2019E EV/EBITDA of 6.5. Overall, we use the same target EV/EBITDA multiples for Polyus as for Polymetal (2018E of 7.5 8.0 and 2019E of 6.5). We raise our target price for Polyus to $44.00 per GDR and reiterate our BUY recommendation.

Polyus 3Q18 IFRS results, $ mln

|

3Q17 |

4Q17 |

1Q18 |

2Q18 |

3Q18A |

Q o Q y o y |

3Q18E |

A/E |

3Q18C |

A/C |

|

Gold sales, koz |

578 |

597 |

459 |

531 |

699 |

32% |

21% |

699 |

– |

– |

– |

gold selling price, $/oz |

1,279 |

1,275 |

1,336 |

1,300 |

1,209 |

7% |

5% |

1,209 |

– |

– |

– |

TCC, $/oz |

380 |

324 |

383 |

345 |

345 |

0% |

9% |

351 |

2% |

– |

– |

Revenues |

744 |

743 |

617 |

692 |

832 |

20% |

12% |

830 |

0% |

828 |

0% |

EBITDA |

475 |

465 |

387 |

457 |

537 |

18% |

13% |

534 |

1% |

533 |

1% |

EBITDA margin |

64% |

63% |

63% |

66% |

65% |

1 pp |

1 pp |

64% |

0 pp |

64% |

0 pp |

Leveraged FCF |

118 |

(27) |

(16) |

114 |

148 |

30% |

26% |

179 |

17% |

– |

– |

LFCF yield |

1.4% |

0.3% |

0.2% |

1.3% |

1.7% |

0 pp |

0 pp |

2.1% |

0 pp |

– |

– |

Net debt |

3,151 |

3,077 |

3,079 |

3,208 |

3,029 |

6% |

4% |

3,029 |

– |

– |

– |

C – Interfax consensus estimates |

|

|

|

|

|

|

|

|

|

|

|

Source: Company, Interfax, Sberbank CIB Investment Research

2 |

SBERBANK CIB INVESTMENT RESEARCH |

This document is being provided for the exclusive use of strogaas@baltinvest.com |

This document is being provided for the exclusive use of strogaas@baltinvest.com |

vk.com/id446425943

POLYUS – STRONG 3Q18 IFRS, ATTRACTIVELY PRICED VERSUS PEERS NOVEMBER 8, 2018

Polyus cash flow profile

|

2016 |

2017 |

2018E |

2019E |

2020E |

Gold production, koz |

1,968 |

2,160 |

2,433 |

2,792 |

2,808 |

Gold price, $/oz |

1,250 |

1,259 |

1,270 |

1,300 |

1,300 |

Gold average realized, $/oz |

1,268 |

1,244 |

1,270 |

1,300 |

1,300 |

USD/RUB |

67.0 |

58.3 |

62.4 |

64.4 |

64.4 |

Total cash costs, $/oz |

389 |

364 |

368 |

390 |

411 |

All in sustaining cash costs, $/oz |

572 |

621 |

565 |

546 |

590 |

Revenues, $ mln |

2,458 |

2,721 |

2,977 |

3,606 |

3,626 |

Adjusted EBITDA, $ mln |

1,536 |

1,705 |

1,877 |

2,280 |

2,177 |

EBITDA margin |

62% |

63% |

63% |

63% |

60% |

Other non operating income/(expenses), $ mln |

45 |

147 |

– |

– |

– |

Working capital release/(increase), $ mln |

(93) |

(100) |

(13) |

(51) |

(41) |

Interest, $ mln |

(245) |

(291) |

(270) |

(277) |

(268) |

Income tax, $ mln |

(261) |

(264) |

(258) |

(256) |

(240) |

Capex, $ mln |

(405) |

(831) |

(952) |

(867) |

(682) |

Leveraged FCF, $ mln |

577 |

366 |

384 |

829 |

945 |

LFCF yield |

7% |

4% |

4% |

10% |

11% |

(Acquisition)/disposal of subsidiaries, $ mln |

(138) |

127 |

– |

(28) |

(28) |

IPO proceeds, $ mln |

0 |

400 |

– |

– |

– |

Share buyback, $ mln |

(3,443) |

(1) |

– |

– |

– |

Dividends paid, $ mln |

– |

(574) |

(573) |

(624) |

(669) |

Dividend yield |

0% |

7% |

7% |

7% |

8% |

FX effect and other, $ mln |

127 |

(154) |

15 |

– |

– |

Net debt, bop, $ mln |

364 |

3,241 |

3,077 |

3,250 |

3,073 |

Net debt, eop, $ mln |

3,241 |

3,077 |

3,250 |

3,073 |

2,824 |

Net debt/EBITDA |

2.11 |

1.80 |

1.73 |

1.35 |

1.30 |

Source: Company, Sberbank CIB Investment Research

SBERBANK CIB INVESTMENT RESEARCH |

3 |

This document is being provided for the exclusive use of strogaas@baltinvest.com |

This document is being provided for the exclusive use of strogaas@baltinvest.com |

vk.com/id446425943

NOVEMBER 8, 2018 POLYUS – STRONG 3Q18 IFRS, ATTRACTIVELY PRICED VERSUS PEERS

Ownership structure

Said Kerimov |

82.4% |

Treasury shares |

1.2% |

Free float |

16.3% |

|

|

Polyus IFRS financials, $ mln

|

2014 |

2015 |

2016 |

2017 |

2018E |

2019E |

2020E |

INCOME STATEMENT |

|

|

|

|

|

|

|

Revenues |

2,239 |

2,188 |

2,458 |

2,721 |

2,977 |

3,606 |

3,626 |

COGS |

(1,207) |

(901) |

(919) |

(1,000) |

(1,080) |

(1,341) |

(1,496) |

Gross income |

1,032 |

1,287 |

1,539 |

1,721 |

1,897 |

2,265 |

2,130 |

Gross margin |

46.1% |

58.8% |

62.6% |

63.2% |

63.7% |

62.8% |

58.7% |

SG&A |

(183) |

(143) |

(151) |

(211) |

(226) |

(232) |

(238) |

EBITDA |

1,011 |

1,271 |

1,505 |

1,643 |

1,877 |

2,280 |

2,177 |

Adjusted EBITDA |

1,011 |

1,279 |

1,536 |

1,705 |

1,877 |

2,280 |

2,177 |

EBITDA margin |

45.2% |

58.5% |

62.5% |

62.7% |

63.0% |

63.2% |

60.0% |

DD&A |

(182) |

(129) |

(148) |

(188) |

(237) |

(280) |

(318) |

EBIT |

829 |

1,142 |

1,357 |

1,455 |

1,640 |

2,000 |

1,858 |

Interest income |

(26) |

(45) |

(145) |

(200) |

(214) |

(277) |

(268) |

Forex gain |

– |

– |

– |

– |

– |

– |

– |

Revaluation gain |

– |

– |

– |

– |

– |

– |

– |

Other gains |

(903) |

69 |

40 |

28 |

– |

– |

– |

Exceptionals |

123 |

24 |

515 |

12 |

– |

– |

– |

EBT |

23 |

1,190 |

1,767 |

1,295 |

1,426 |

1,723 |

1,590 |

Income tax |

(222) |

(191) |

(326) |

(290) |

(258) |

(256) |

(240) |

Minority interest |

18 |

(34) |

(25) |

(1) |

(1) |

(1) |

(1) |

Discontinued operations |

– |

– |

– |

– |

– |

– |

– |

Net income |

(181) |

965 |

1,416 |

1,004 |

1,167 |

1,465 |

1,349 |

Adjusted net income |

497 |

980 |

1,029 |

987 |

1,167 |

1,465 |

1,349 |

Net margin |

22.2% |

44.8% |

41.9% |

36.3% |

39.2% |

40.6% |

37.2% |

EPS, $ |

(0.68) |

3.61 |

5.30 |

3.76 |

4.37 |

5.49 |

5.05 |

Adjusted EPS, $ |

1.86 |

3.67 |

3.85 |

3.70 |

4.37 |

5.49 |

5.05 |

|

|

|

|

|

|

|

|

BALANCE SHEET |

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

Cash and equivalents |

1,217 |

1,825 |

1,740 |

1,204 |

1,031 |

1,427 |

1,176 |

Receivables |

75 |

99 |

166 |

236 |

259 |

288 |

290 |

Inventories |

667 |

480 |

633 |

735 |

720 |

838 |

935 |

Other current assets |

282 |

218 |

20 |

14 |

14 |

14 |

14 |

Total current assets |

2,241 |

2,622 |

2,559 |

2,189 |

2,023 |

2,568 |

2,415 |

Total non current assets |

2,573 |

2,488 |

3,107 |

4,258 |

5,030 |

5,644 |

6,036 |

Total assets |

4,814 |

5,110 |

5,666 |

6,447 |

7,053 |

8,212 |

8,451 |

Liabilities |

|

|

|

|

|

|

|

Short term borrowings |

90 |

38 |

283 |

12 |

12 |

13 |

11 |

Payables |

190 |

180 |

315 |

405 |

400 |

497 |

554 |

Other current liabilities |

547 |

– |

– |

– |

– |

– |

– |

Total current liabilities |

827 |

218 |

598 |

417 |

412 |

509 |

565 |

Long term borrowings |

1,723 |

2,151 |

4,698 |

4,269 |

4,269 |

4,487 |

3,989 |

Other non current liabilities |

644 |

694 |

784 |

1,105 |

1,105 |

1,105 |

1,105 |

Total non current liabilities |

2,367 |

2,845 |

5,482 |

5,374 |

5,374 |

5,592 |

5,094 |

Total liabilities |

3,194 |

3,063 |

6,080 |

5,791 |

5,786 |

6,102 |

5,659 |

Minority interest |

146 |

71 |

94 |

92 |

93 |

95 |

96 |

Equity |

1,474 |

1,976 |

(508) |

564 |

1,174 |

2,016 |

2,696 |

Total liabilities and equity |

4,814 |

5,110 |

5,666 |

6,447 |

7,053 |

8,212 |

8,451 |

Net debt/(cash) |

596 |

364 |

3,241 |

3,077 |

3,250 |

3,073 |

2,824 |

|

|

|

|

|

|

|

|

CASH FLOW STATEMENT |

|

|

|

|

|

|

|

Net income |

(181) |

965 |

1,416 |

1,004 |

1,167 |

1,465 |

1,349 |

Minority interest |

(18) |

34 |

25 |

1 |

1 |

1 |

1 |

DD&A |

182 |

129 |

148 |

188 |

237 |

280 |

318 |

Working capital change |

35 |

43 |

(91) |

(98) |

(13) |

(51) |

(41) |

Other assets change |

753 |

(157) |

(541) |

(93) |

(55) |

1 |

1 |

Operating cash flow |

789 |

980 |

932 |

1,001 |

1,336 |

1,696 |

1,627 |

Maintenance capex |

(208) |

(153) |

(128) |

(150) |

(167) |

(194) |

(200) |

Expansionary capex |

(317) |

(115) |

(300) |

(688) |

(785) |

(673) |

(482) |

Other investments |

(249) |

(408) |

148 |

220 |

– |

(28) |

(28) |

Investing cash flow |

(774) |

(676) |

(280) |

(618) |

(952) |

(895) |

(710) |

Change in debt |

960 |

538 |

2,698 |

(777) |

– |

219 |

(500) |

Dividends paid |

(500) |

– |

– |

(574) |

(573) |

(624) |

(669) |

Share issues/(purchases) |

– |

– |

(3,443) |

399 |

– |

– |

– |

Other |

10 |

(194) |

(25) |

19 |

– |

– |

– |

Financing cash flow |

470 |

344 |

(770) |

(933) |

(573) |

(405) |

(1,169) |

Forex effects |

– |

– |

– |

– |

– |

– |

– |

Net change in cash |

485 |

648 |

(118) |

(550) |

(189) |

397 |

(251) |

RATIOS |

|

|

|

|

|

|

|

P/E |

17.2 |

8.7 |

8.3 |

8.7 |

7.3 |

5.8 |

6.3 |

EV/EBITDA |

10.0 |

7.4 |

8.0 |

7.1 |

6.5 |

5.1 |

5.2 |

P/BV |

5.8 |

4.3 |

neg |

15.2 |

7.3 |

4.2 |

3.2 |

Net debt/EBITDA |

0.6 |

0.3 |

2.1 |

1.8 |

1.7 |

1.3 |

1.3 |

Total debt/EBITDA |

1.8 |

1.7 |

3.2 |

2.5 |

2.3 |

2.0 |

1.8 |

ROE |

19.3% |

56.8% |

n/m |

n/m |

n/m |

91.9% |

57.2% |

ROIC |

8.3% |

24.4% |

25.6% |

23.6% |

24.6% |

26.1% |

23.5% |

Dividend per share, $ |

1.87 |

– |

– |

2.15 |

2.14 |

2.33 |

2.50 |

Dividend yield |

5.8% |

– |

– |

6.7% |

6.7% |

7.3% |

7.8% |

P/S |

3.8 |

3.9 |

3.5 |

3.1 |

2.9 |

2.4 |

2.4 |

P/CF |

10.9 |

8.7 |

9.2 |

8.6 |

6.4 |

5.0 |

5.3 |

Revenue growth |

4% |

2% |

12% |

11% |

9% |

21% |

1% |

EBITDA growth |

11% |

27% |

20% |

11% |

10% |

21% |

5% |

EPS growth |

4% |

97% |

5% |

4% |

18% |

26% |

8% |

Source: Company, Sberbank CIB Investment Research

4 |

SBERBANK CIB INVESTMENT RESEARCH |

This document is being provided for the exclusive use of strogaas@baltinvest.com |

This document is being provided for the exclusive use of strogaas@baltinvest.com |

vk.com/id446425943

POLYUS – STRONG 3Q18 IFRS, ATTRACTIVELY PRICED VERSUS PEERS NOVEMBER 8, 2018

Disclosure appendix

IMPORTANT US REGULATORY DISCLOSURES

This report may not be independent of Sberbank's proprietary interests. Sberbank may trade the securities covered in this report for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to the recommendation(s) offered in this report.

The research analysts, strategists, or research associates principally responsible for the preparation of this research communication have received compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors, firm revenues and overall investment banking revenues.

Analyst certification

The following analyst(s) hereby certify that the views expressed in this research report accurately reflect such research analyst's personal views about the subject securities and issuers and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in the research report: Alexey Kirichok, Irina Lapshina.

SBERBANK CIB INVESTMENT RESEARCH |

5 |

This document is being provided for the exclusive use of strogaas@baltinvest.com |

This document is being provided for the exclusive use of strogaas@baltinvest.com |

vk.com/id446425943

Sberbank CIB equity research ratings have a twelve month horizon and are driven by upside/downside to a fundamentals based target price. The “BUY”, “HOLD” or “SELL” rating is for reference purposes only, and represents a positive, neutral or negative view by Sberbank CIB with respect to potential total return over that period, inclusive of anticipated dividends, as of date of publication. During changes to an analyst model, the rating will revert to “UR” (under review).

This Sberbank CIB Investment Research analytical review (hereinafter – “this analytical review”) was prepared jointly by JSC Sberbank CIB and Sberbank CIB (UK) and/or any of their affiliated persons (collectively – “Sberbank CIB”).

This analytical review accurately reflects analysts’ personal opinions about the company (companies) analyzed and its (their) securities. Analysts’ compensation is not in any way, directly or indirectly, related to the specific recommendations and opinions expressed in this analytical review. The personal views of analysts may differ from one another. Sberbank CIB may have issued or may issue Sberbank CIB Investment Research analytical reviews that are inconsistent with, and/or reach different conclusions from, the information presented herein.

This analytical review may be used as general information only and is based on current public information that Sberbank CIB considers reliable, but Sberbank CIB does not represent it as accurate or complete, and it should not be relied on as such. Neither the information nor any opinion expressed constitutes a recommendation, an offer or an invitation to make an offer, to buy or sell any securities or other investment or any options, futures or any other financial instruments. This analytical review does not constitute investment advice and does not take into account any special or individual investment objectives, financial situations or particular needs of any particular person who may receive this analytical review. The services, securities and investments discussed in this analytical review may be neither available to nor suitable for all investors. Investors should seek financial advice regarding the appropriateness of investing in any security or other investment and the investment strategies discussed or recommended in this analytical review and should understand that statements regarding future prospects may not be realized.

Investors should note that income from such securities or other investments, if any, may fluctuate and that the price or value of such securities and investments may rise or fall. Accordingly, investors may receive back less than was originally invested. Past performance is not necessarily a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Sberbank CIB accepts no liability whatsoever for any direct and indirect losses, damage, or other consequences of any kind that may arise out of the partial or full usage of the materials from Sberbank CIB Investment Research analytical reviews. Investors should conduct their own evaluation of risks and should not rely solely on the information presented in Sberbank CIB Investment Research analytical reviews. Investors should obtain individual legal, tax, financial, accounting or other professional advice based on their particular circumstances. Any information relating to the tax status of financial instruments discussed herein is not intended to provide tax advice or to be used by anyone to provide tax advice.

Sberbank CIB is not committed to update the information or to correct any inaccuracies contained in Sberbank CIB Investment Research analytical reviews.

From time to time, Sberbank CIB or the principals or employees and their connected persons of Sberbank CIB may have or have had positions in the securities or other instruments referred to herein or may conduct or may have conducted market making activities or otherwise act or have acted as principal in transactions in any of these securities or instruments or may provide or have provided investment banking or consulting services to or serve or have served as a director or a supervisory board member of a company referred to in this analytical review. Sberbank CIB’s sales managers, traders, and other professionals may provide oral or written market commentary or trading strategies to Sberbank CIB’s clients, as well as its proprietary trading desks, where transactions are entered into at the expense and in the interest of Sberbank CIB, and such commentary may reflect opinions that are contrary to the opinions expressed in analytical reviews of Sberbank CIB Investment Research. Sberbank CIB’s asset management, proprietary trading and investment banking business units may make investment decisions that are inconsistent with the recommendations or views expressed in this analytical review. Sberbank CIB maintains internal policies that are designed to manage any actual or potential conflicts of interest.

Other than certain industry specific analytical reviews published on a regular basis, Sberbank CIB Investment Research analytical reviews are published at irregular intervals as appropriate in the analyst’s judgment.

Further information on the securities referred to herein may be obtained from Sberbank CIB upon request. This analytical review may not be reproduced or copied in whole or in any part without written consent of Sberbank CIB.

This analytical review does not constitute or contain legal advice. Further, Sberbank CIB should not in any way be viewed as soliciting, facilitating, brokering or causing any persons within any country to invest in or otherwise engage in transactions that may be prohibited to those persons under relevant law. Sberbank CIB Investment Research analytical reviews are provided in respect of entities or investments in both Russian domestic and international financial markets (as applicable in each case) and are intended for eligible investors in compliance with the legal requirements and trading rules of the relevant markets. Sberbank CIB Investment Research analytical reviews received by such eligible investors concerning entities or investments that may be sanctioned in other jurisdictions are not directed to, and should not be considered as investment advice in respect of, any transaction that implicates such sanctions or that involves persons within the jurisdiction of such sanctions, including but not limited to U.S., Canadian, Australian, Japanese, Swiss, European or EU investors. Sberbank CIB Investment Research analytical reviews are never to be used for unlawful activity, including activity that is contrary to or that circumvents economic sanctions requirements. After having read this analytical review, investors should determine the legality of any planned transactions in consultation with their legal advisers in respect of their compliance with the legal requirements and trading rules applicable to their activities.

UNITED KINGDOM. For Professional and/or Eligible Counterparties (not to be used with or passed on to retail clients). The research and analysis included in this document has been produced and approved for distribution in the United Kingdom by Sberbank CIB for its own investment management activities. Sberbank (CIB) UK Limited is registered in England and Wales under No. 4783112 at 85 Fleet Street, London, EC4Y 1AE, United Kingdom and is authorised and regulated in the UK by the Financial Conduct Authority.

EUROPEAN UNION. Unless otherwise specified herein, this analytical review is intended for persons who are qualified as eligible counterparties or professional clients only and not for distribution to retail clients, as defined by the EU Markets in Financial Instruments Directive – 2004/39/EC. This document is distributed in the EU by Sberbank (CIB) UK Limited and is authorised and regulated in the UK by the Financial Conduct Authority.

For investors outside of the EU and Switzerland this analytical review is disseminated to either eligible or professional investors as regulated in the respective jurisdiction. If this analytical review is obtained by a person who is not considered to be an eligible or professional investor under applicable local laws in the respective jurisdiction, this person should not review it, should disregard and/or immediately delete it and undertake their best effort to inform Sberbank CIB about having received this analytical review by mistake.

FOR RESIDENTS OF THE UNITED STATES. Under Rule 15a 6 under the Securities Exchange Act of 1934, this research report is available solely for distribution from JSC Sberbank CIB, to major U.S. institutional investors, and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. All major U.S. institutional investors or persons outside the United States that have received this analytical review shall neither distribute the original nor a copy hereof to any other person in the United States. This analytical review has been prepared and reviewed by research analysts who are neither employed by Sberbank CIB USA, Inc., nor registered or qualified as research analysts with FINRA, and are not subject to the rules of FINRA. Sberbank CIB USA, Inc. accepts responsibility for the contents hereof.

This analytical review, however, may also be redistributed in the United States by Sberbank CIB USA, Inc., a U.S. registered broker and dealer and a member of FINRA, to both major and non major institutional investors under FINRA Rules for the redistribution of research. All transactions in any security or financial instrument mentioned herein with or for any U.S. institutional investor or major U.S. institutional investor must be effected through Sberbank CIB USA, Inc. Please contact a registered representative of Sberbank CIB USA, Inc., by phone at 212.300.9600 or by mail at Carnegie Hall Tower 152 W 57th Street 46th Floor New York, NY 10019.

© SBERBANK CIB 2018

This document is being provided for the exclusive use of strogaas@baltinvest.com |

This document is being provided for the exclusive use of strogaas@baltinvest.com |