- •On Markets

- •In Russia & the Near Abroad

- •On companies

- •Investment views updated this week

- •Earnings and operating results this week

- •In focus

- •Also in the news

- •Around the Globe

- •In focus

- •Also in the news

- •Most/Least Liked Stocks (MLLS)

- •Historical performance

- •Appendix

- •Disclosures

- •Important Disclosures

- •Issuer Specific Disclosures

- •Analysts Certification

- •Investment Ratings

- •Price Targets

- •Conflicts Management Arrangements

vk.com/id446425943

Russia

Equities

9 November 2018

Most/Least Liked Stocks

|

|

Name |

Ticker |

|

Rec |

|

12-mo TP |

ETR |

|||

|

|

Most liked |

|

|

|

|

|

|

|

|

|

|

|

Sberbank |

SBER RX |

|

Buy |

|

RUB 330 |

69% |

|||

|

|

Unipro |

UPRO RX |

Buy |

|

RUB 3.21 |

24% |

||||

|

|

Inter RAO |

IRAO RX |

|

Buy |

|

RUB 8.50 |

116% |

|||

|

|

Nornickel |

GMKN RX |

Buy |

RUB 14,200 |

33% |

|||||

|

|

PhosAgro |

PHOR LI |

|

Buy |

|

USD 17.00 |

34% |

|||

|

|

Alrosa |

ALRS RX |

|

Buy |

RUB 130.00 |

37% |

||||

|

|

Gazprom Neft |

SIBN RX |

|

Buy |

|

USD 7.50 |

33% |

|||

|

|

Rosagro |

AGRO LI |

|

Buy |

|

USD 13.50 |

37% |

|||

|

|

Least liked |

|

|

|

|

|

|

|

|

|

|

|

Novatek |

NVTK LI |

|

Sell |

USD 100.00 |

-41% |

||||

|

|

NLMK |

NLMK LI |

|

Hold |

|

USD 23.50 |

13% |

|||

|

|

EVRAZ plc |

EVR LN |

|

Sell |

|

GBp 450 |

-22% |

|||

|

Top-Bottom performance, 1W, USD % |

|

|

||||||||

|

|

486 HK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

+6 |

|

|

||

|

|

NMTP RX |

|

|

|

|

|

+5 |

|

|

|

|

|

MBT US |

|

|

|

|

|

+4.8 |

|

|

|

|

|

ENPL RX |

|

|

|

|

|

+3.9 |

|

|

|

|

|

EVR LN |

|

|

|

|

|

+2.6 |

|

|

|

|

|

EPAM US |

|

|

|

|

|

+2.4 |

|

|

|

|

|

SBER RX |

|

|

|

|

|

+2.2 |

|

|

|

Strategy |

|

AGRO LI |

|

|

|

|

|

+1.8 |

|

|

|

|

TATNp RX |

|

|

|

|

|

+1.6 |

|

|

||

|

|

RSTI RX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

+1.6 |

|

|

||

|

|

RTS Index |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

1.2 |

|

|

|||

|

|

URKA RX |

|

|

|

|

|

|

|

|

|

Equities |

|

|

|

-4.5 |

|

|

|

|

|||

|

|

SNGSp RX |

|

|

|

|

|

|

|

|

|

|

|

|

|

-4.6 |

|

|

|

|

|||

|

|

SIBN RX |

|

|

-4.6 |

|

|

|

|

||

|

|

NVTK LI |

|

|

-4.8 |

|

|

|

|

||

|

|

QIWI US |

|

|

-5.0 |

|

|

|

|

||

|

|

YNDX US |

|

|

-5 |

|

|

|

|

||

|

|

SVAV RX |

|

|

-6 |

|

|

|

|

||

|

|

MDMG LI |

|

|

-8 |

|

|

|

|

||

|

|

ETLN LI |

|

|

-10 |

|

|

|

|

||

|

|

OBUV RX |

|

|

|

-13 |

|

|

|

|

|

|

-15 |

-10 |

-5 |

|

|

0 |

5 |

10 |

|||

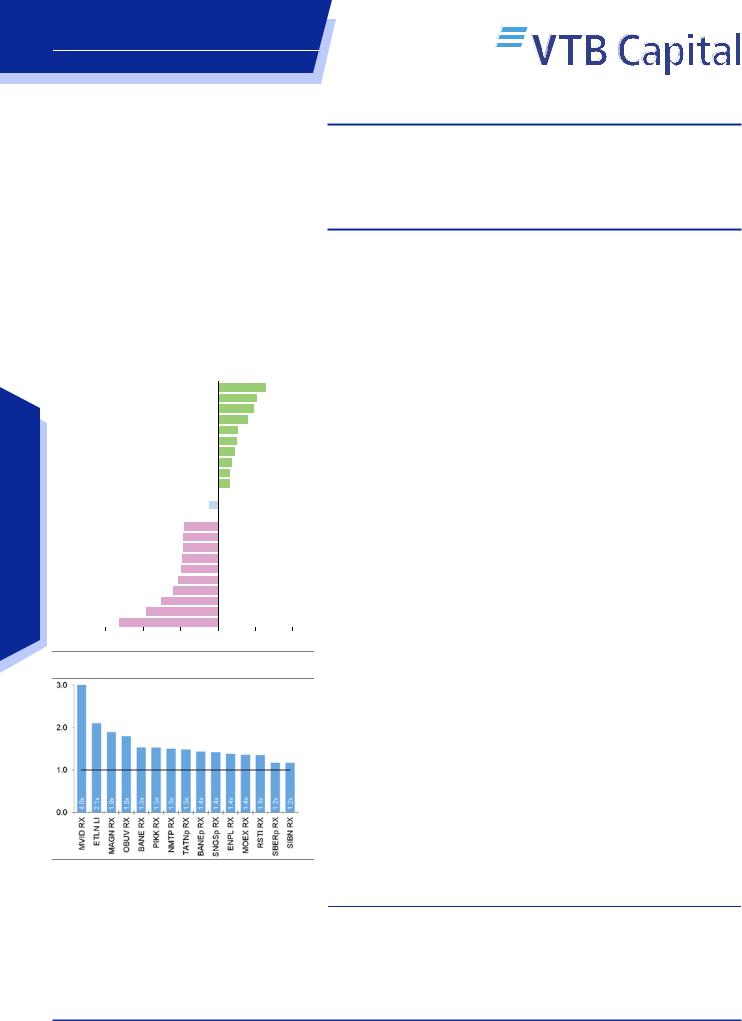

Avg. Daily Traded Volumes 1W/6M

Source: Bloomberg, VTB Capital Research

Some of the links in the document are to the sources requiring paid subscriptions.

Prices and market indicator values are as of 15:00 Moscow time / 12:00 London time on Friday 9 November. All changes are from the close of Friday 2 November, unless stated otherwise.

Periodical

Week Endnotes

Week #45; Oil declines, US election, AFLT to Buy, ENRU TP cut

In Russia and the near abroad. News about worsening relations between Russia and Austria appeared in the end of the week. As for Russian macro data, Fruits and Vegetables price grew below the typical pattern in October, showing the first MoM decline for this month since 2012. Overall, seasonally adjusted price growth, according to our estimates, was in line with the CBR’s inflation target. In the meantime, the government and oil companies might sign an agreement on freezing wholesale motor fuel price. Russian poultry and dairy has been allowed for export to China. Otherwise, Russia's car and LCV sales increased +8% YoY in October. The amendments to the retail law have passed the third reading at the State Duma. The Ministry of Energy has made some new proposals for the Russian Far East tariffs, which are currently fully regulated and subsidised by the consumers of the two pricing zones

On companies. We upgraded Aeroflot ords to Buy, after increasing our 12mo TP to RUB 130, following the new strategy announcement. In the meantime, we cut our 12-mo TP of Enel Russia ords, incorporating the 3Q18 earnings into our model. 3Q18 results are ongoing over this week, with a moderate number of surprises. Sberbank has released solid October RAS results. Meanwhile, Severstal’s Capital Markets Day might have a mixed impact on the company’s fundamentals.

Around the globe. Global stocks were mixed this week. The post-mid-terms rally quickly faded, as attention turned to the FOMC’s hawkish hold and China slowdown worries. The US midterm elections yielded a split Congress, proving that the consensus view was right. The US formally imposed sanctions on Iranian crude export, but granted eight countries temporary waivers, damping concerns over a supply crunch and sending oil prices to their lowest in three months. Moreover, the US has become the largest crude oil producer in the world, outpacing Russia. Elsewhere, the EU warned that Italy’s budget deficit would breach its limit.

Most/Least liked stocks. Our RTS-hedged MLLS portfolio stepped back -0.4% over this week as the Least Liked basket (-0.2%) outperformed the USD-valued benchmark, while the Most Liked stocks went down -1.5%.

What lies ahead. Sun: WWI centenary commemoration, OPEC+ meeting. Mon: APEC summit. Tue: IT budget, ASEAN summit, MSCI review, OPEC monthly report, DE CPI, US treasury budget. Wed: CN IP; US, UK CPIs, EZ, DE, JP GDPs. Thu: EIA oil report. Fri: US, TR IPs.

Earnings season. Mon: Rusagro, Mosenergo. Tue: Unipro. Wed: Inter RAO, Qiwi. Thu: Luxoft. Fri: TMK. S&P500: 13 companies. Stoxx600: 56 companies.

Ilya Piterskiy, Strategist

+7 495 660 67 47 // ilya.piterskiy@vtbcapital.com

Nikolay Mikheev, Strategist

+7 495 287 68 69 // nikolay.mikheev@vtbcapital.com

Duc Nguyen, Strategist

+7 495 663 47 23 // duc.nguyen@vtbcapital.com

Prices cited in the body of this report are as of the last close before, or the close on, 08 Nov 2018 (except where indicated otherwise). VTB Capital analysts update their recommendations periodically as required.

Please refer to the Disclosures section of this report for other important disclosures, including the analyst certification and information as required by EU-MAR. Additional disclosures regarding the subject company(ies) discussed in this report can be found at http://research.vtbcapital.com/ServicePages/Disclosures.aspx.

vk.com/id446425943 |

Week Endnotes |

Russia |

|

Equities |

|

On Markets

Global backdrop. Global stocks were mixed this week. MSCI World (+2.3%) outperformed MSCI EM (-0.3%). The post-mid-terms rally quickly faded, as attention turned to the FOMC’s hawkish hold and China slowdown worries. The S&P 500 (+3.1%) managed to hold on to its gains. The dollar (+0.2%) edged slightly higher, while the UST 10Y yield (3.21%; unch.) was flat, as a split Congress dims the chances of further fiscal expansion. The European bourses (Stoxx 600 -0.1%, DAX -0.8%, CAC 40 -0.6%) turned south. The EU released downbeat forecasts for Italy, which point to the country’s budget deficit breaching the bloc’s limit of 3% by 2020. As a result, Italy (FTSE MIB -1.4%) was the region’s underperformer, with the Italy 10Y yield (3.44%; +12bp). The euro (-0.4%) weakened to 1.134 against the dollar. Asia (KOSPI -1.1%, Shanghai Comp -3.7%, Hang Seng -3.4%) sold off, as China slowdown concerns mount, except for Japan (TOPIX +0.2%). The renminbi (-0.8%) depreciated to 6.95 against the dollar. Back home, Russia (RTS -1.1%) finished in the red, while Oil (Brent -4.1%) continued to decline as concerns over a supply crunch eased after the US granted eight countries temporary Iran sanctions waiver. Additional pressure came from the increase in the US crude oil production. Meanwhile, in Russia the OFZ 10Y yield (8.96%; +35bp) surged to a two-month high on the back of multiple factors: Wednesday’s disappointing auctions, concerns over a potentially more aggressive primary market offer from MinFin and, finally, yield growth in other EM local currency markets (10Y yields in South Africa, Brazil and Mexico widened. The rouble (-1.9%) was down as the pressure stemmed from the OFZ market and lower oil prices as well as negative sentiment in terms of international relationships. Other CEEMEA markets also fell, with Turkey (BIST 100 -2.6% / TRY -1.1%) and South Africa (TOP 40 -2.5% / ZAR +0.2%) down, except for Poland (WIG 20 +2.5% / PLN +0.2%). In the commodities space, base metals (LMEX -1.0%) mostly declined, with Copper (-2.0%) and Nickel (-1.3%) down, except for Aluminium (+0.9%).

Russia – equities. The Russian market faced headwinds at the end of week, as the market react negatively to the headlines on Russia-Austria relations. The USD-valued RTS index (-1.1%) turned red, deepening at -2.9% on Friday. The RUB-valued MOEX Russia index also declined -1.8% on Friday, diving below the 2,400. However, it ended the week with positive gains (+0.7%). RUB (-1.9%) depreciated, with the USDRUB rate making a foray above 67. The Russian currency weakened, following the sell-off of Russian 10Y OFZ, with the yield widening close to 9%. As for individual names, advances lagged declines in our deck (21-to-46). Among laggards, we note ETLN (-11%), which expanded its YTD decline to -27%. AFLT (-6%) reversed its previous week recovery, returning below RUB 100/share. TCS (-5%) underperformed the broader market as well. MDMG (-5%) refreshed its 52-weeks low. FIVE (-3.1%) retreated from its 100D MA on Friday, after it was broadly flat in the beginning. Among positives, we note the recovery of UC Rusal (486 HK +5%) and ENPL (+3.9%). NMTP (+4.6%) tested its 50D MA closer to the end of week, breaking though its 100D MA. MBT (+4.1%) returned to the level last seen in July, but it could not make to consolidate at that handle. EPAM (+3.5%) kept its momentum after the stock was catapulted by the earnings release.

9 November 2018 |

2 |

vk.com/id446425943

Russia

Equities

Russia CPI – Tomato-tornado, of 7 November, by Alexander Isakov et al

Oil sector – oil companies might sign agreement on freezing wholesale motor fuel prices from 7 November until 31 March 2019 – retail prices are to be fixed until January 2019 and slightly indexed afterwards, of 6 November, by Dmitry Loukashov et al

Agricultural sector – Russia might start exporting poultry and dairy to China – greenfield projects on the agenda, of 6 November, by Nikolay Kovalev et al

Car Sales – October; slowing, but still strong, of 7 November, by Vladimir Bespalov

Real estate sector – registered deals up 10% YoY and 24% MoM in October in MMA – support factors are not fully sustainable, of 9 November, by Maria Kolbina et al

Retail sector – amendments to retail law pass third reading – chains unable to return goods that have a shelf life of less than 30 days, of 8 November, by Maria Kolbina et al

Week Endnotes

In Russia & the Near Abroad

Fruits and vegetables price grew below the typical pattern in October, showing the first MoM decline for this month since 2012. The increasing supply of greenhouse vegetables, in particular tomatoes (+46% YoY) and cucumbers (+14% YoY), is likely behind the change in seasonality. Overall, seasonally adjusted price growth, according to our estimates, was in line with the CBR’s inflation target at +0.33% MoM SA, down from +0.52% and +0.37% in August and September, respectively. Combined with the retreat in households’ inflation expectations to 9.3%, we believe that the likelihood of the key rate remaining flat through 1H19 has increased. Fruit and vegetables’ inflation sank from +3.4% YoY in September to -0.5% YoY in October.

The government and oil companies might sign an agreement on freezing wholesale motor fuel prices, Vedomosti reports. The agreement fixes the average wholesale prices individually for regions, while the average 92 and 95 gasoline and diesel prices in Russia are not to exceed RUB 53,501/t (RUB 39.86/l), RUB 56,649/t (RUB 42.77/l) and RUB 51,201/t (RUB 43.11/l), respectively, until 31 March 2019. According to Deputy Prime Minister Dmitry Kozak, the agreed prices assume a RUB 2,700/t (RUB 2/l) margin for retail. In January 2019, oil companies are going to be able to raise retail prices 1.7% due to the VAT increase, but thereafter will only be able to increase retail prices gradually by the official forecasted inflation rate (4%), according to Kommersant. Oil companies have also agreed to meet the demand of independent fuel stations in full and supply at least 17.5% of the oil produced to the domestic market, according to Vedomosti. However, Kommersant reports that the requirement to sell 17.5% of oil supplies to the domestic market has yet to be discussed. In addition, the government also instructed the Ministry of Finance, the Federal Tax Service and the Ministry of Transport to consider the idea of transferring the excise payment from refineries to fuel stations and making the excise tax floating (the rate rises with a decrease in oil prices and vice versa).

According to Vedomosti, Russian poultry and dairy has been allowed for export to China. In 2017, China exported 436,000 tonnes of poultry and 25,000 tonnes of dairy. The Russian poultry segment is well balanced, with production and consumption having stabilised at 5mn tonnes. The dairy segment sees the share of households and imports at 58% and represents an organic growth pillar for industrial companies. Although the incremental export volumes are not large on the Russian scale, launching exports could trigger an improvement in the economics for domestic producers and provide room for the construction of new greenfield capacities.

Russia's car and LCV sales increased +8% YoY in October to 160,425 units, while 10mo18 sales were up +14% YoY to 1.46mn, according to the latest data from the Association of European Businesses (AEB). Based on the latest trends, we see some upside risk to our forecast of the market growing +11% YoY in FY18 – all the more so as the planned increase of VAT from 2019 might pull some demand forward.

According to CIAN, the number of registered deals in the Moscow Metropolitan Area reached a record high of 13,900 in October, implying advances of 10% YoY and 24% MoM. Residential demand in MMA and across the country has seen impressive trends YTD, supported by gradually recovering real incomes, historically low mortgage rates (down -40bp YTD to 9.4% in September), developers accelerating their offers and making them more affordable, as well as client concerns over the upcoming regulatory changes in the sector. We consider demand as being slightly inflated and do not think that these trends and support factors are fully sustainable in the medium term.

The amendments to the retail law have passed the third reading at the State Duma. Food retail chains are to lose the possibility to return goods that have a shelf life of less than 30 days to producers. The update primarily covers fresh categories and affects bread, dairy and meat most of all. Once the law comes into effect, we do not anticipate any material change in returns for either retailers or producers. If chains face an increased level of shrinkage, we think that will be passed through to lower incoming prices as retailers still continue to enjoy a better negotiating stance, providing truly federal coverage and logistics services.

9 November 2018 |

3 |

vk.com/id446425943 |

Week Endnotes |

Russia |

|

Equities |

|

RusHydro – subsidies in the Russian Far East could see more conditions for consumers – neutral for the company, of 7 November, by Vladimir Sklyar et al

According to Kommersant, the Ministry of Energy has made some new proposals for the Russian Far East tariffs, which are currently fully regulated and subsidised by the consumers of the two pricing zones. According to the article, the subsidies in the region could be cut 20-40% by guaranteeing lower tariffs only to middle and small business, while the government will have to pay in full for its enterprises. According to the Ministry, in order to increase efficiency and to encourage new investment in the region, and taking into account the non-market nature of the subsidy, certain criteria need to be met for industrial consumers to get the subsidy in the Russian Far East.

9 November 2018 |

4 |