- •On Markets

- •In Russia & the Near Abroad

- •In focus

- •On Russian companies

- •Earnings and operating results this week

- •In focus

- •Also in the news

- •Around the Globe

- •In focus

- •Also in the news

- •Most/Least Liked Stocks (MLLS)

- •Historical performance

- •Appendix

- •Disclosures

- •Production and Distribution of VTB Capital Research Reports outside the United States

- •Distribution of VTB Capital Research Reports to Investors within the United States

- •Relationship between VTB and Xtellus

- •Conflict of Interest Disclosures.

- •Issuer Specific Disclosures

- •Analysts Certification

- •Investment Ratings

- •12-month Target Prices

- •Conflicts Management Arrangements

vk.com/id446425943

Russia

Equities

30 November 2018

Most/Least Liked Stocks

|

|

|

|

Name |

|

|

|

|

Ticker |

|

Rec |

|

|

12-mo TP |

|

ETR |

||||||||||

|

|

|

Most liked |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Sberbank |

|

SBER RX |

|

Buy |

|

|

RUB 330 |

|

79% |

||||||||||||||

|

|

|

Inter RAO |

|

|

IRAO RX |

|

Buy |

|

|

RUB 8.40 |

|

116% |

|||||||||||||

|

|

|

Nornickel |

|

GMKN RX |

|

Buy |

|

RUB 17,700 |

|

52% |

|||||||||||||||

|

|

|

PhosAgro |

|

|

PHOR LI |

|

Buy |

|

USD 17.00 |

|

32% |

||||||||||||||

|

|

Gazprom Neft |

|

|

SIBN RX |

|

Hold |

|

|

USD 6.10 |

|

22% |

||||||||||||||

|

|

|

Rosagro |

|

|

AGRO LI |

|

Buy |

|

USD 14.50 |

|

37% |

||||||||||||||

|

|

|

|

Luxoft |

|

|

|

|

LXFT US |

|

Buy |

|

USD 50.00 |

|

55% |

|||||||||||

|

|

|

Least liked |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Novatek |

|

|

NVTK LI |

|

Sell |

|

USD 100.00 |

|

-43% |

|||||||||||||

|

|

|

|

NLMK |

|

|

|

|

NLMK LI |

|

Hold |

|

USD 23.50 |

|

11% |

|||||||||||

|

|

|

EVRAZ plc |

|

|

EVR LN |

|

Sell |

|

|

GBp 450 |

|

5% |

|||||||||||||

|

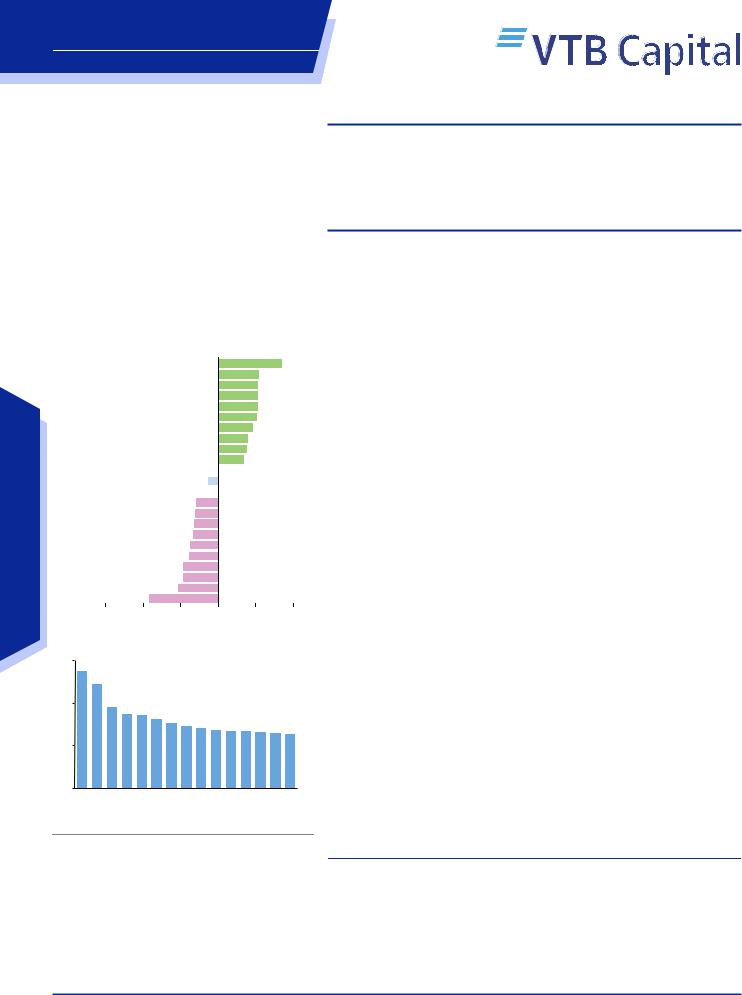

Top-Bottom performance, 1W, USD % |

|

|

|

|

|||||||||||||||||||||

|

|

|

SSA LI |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

+8 |

|

|

|

|

|

|

|

|||||

|

|

|

FIVE LI |

|

|

|

|

|

|

|

|

|

|

|

+5 |

|

|

|

|

|

|

|

||||

|

|

EPAM US |

|

|

|

|

|

|

|

|

|

|

|

+5 |

|

|

|

|

|

|

|

|||||

|

|

GMKN RX |

|

|

|

|

|

|

|

|

|

|

|

+5 |

|

|

|

|

|

|

|

|||||

|

|

GAZP RX |

|

|

|

|

|

|

|

|

|

|

|

+5 |

|

|

|

|

|

|

|

|||||

|

|

MSNG RX |

|

|

|

|

|

|

|

|

|

|

|

+5 |

|

|

|

|

|

|

|

|||||

|

|

|

POG LN |

|

|

|

|

|

|

|

|

|

|

|

+4.6 |

|

|

|

|

|

|

|

||||

|

|

|

PHOR LI |

|

|

|

|

|

|

|

|

|

|

|

+3.9 |

|

|

|

|

|

|

|

||||

|

|

SVAV RX |

|

|

|

|

|

|

|

|

|

|

|

+3.8 |

|

|

|

|

|

|

|

|||||

|

|

|

GLPR LI |

|

|

|

|

|

|

|

|

|

|

|

+3.3 |

|

|

|

|

|

|

|

||||

Strategy |

|

RTS Index |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

-1.4 |

|

|

|

|

|

|

|

|

||||||

|

|

|

EVR LN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

-3.0 |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

TMKS LI |

|

|

|

|

|

|

|

|

|

-3.1 |

|

|

|

|

|

|

|

|

|

||||

Equities |

|

SNGSp RX |

|

|

|

|

|

|

|

|

|

-3.1 |

|

|

|

|

|

|

|

|

|

|||||

|

MTLR RX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

-3.3 |

|

|

|

|

|

|

|

|

|

||||||

|

|

SBER RX |

|

|

|

|

|

|

|

|

|

-3.7 |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

486 HK |

|

|

|

|

|

|

|

|

|

-3.9 |

|

|

|

|

|

|

|

|

|

||||

|

|

HYDR RX |

|

|

|

|

|

|

|

|

|

-4.7 |

|

|

|

|

|

|

|

|

|

|||||

|

|

NLMK RX |

|

|

|

|

|

|

|

|

|

-4.7 |

|

|

|

|

|

|

|

|

|

|||||

|

|

ENPL RX |

|

|

|

|

|

|

|

|

|

|

-5 |

|

|

|

|

|

|

|

|

|

||||

|

|

OBUV RX |

|

|

|

|

|

|

|

|

|

|

-9 |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

-15 |

|

|

-10 |

|

|

-5 |

|

0 |

|

|

|

5 |

|

10 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Avg. Daily Traded Volumes 1W/6M |

|

|

|

|

|

||||||||||||||||||||

|

3.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.7x |

2.4x |

1.9x |

1.7x |

|

1.7x |

1.6x |

1.5x |

|

1.5x |

1.4x |

1.4x |

|

1.3x |

1.3x |

1.3x |

1.3x |

1.3x |

|||||||

|

0.0 |

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

MVID RX |

SVAV RX |

PIKK RX |

AFLT RX |

|

BSPB RX |

POLY LN |

TRCN RX |

|

OBUV RX |

HYDR RX |

MTLR RX |

|

CHMF RX |

DSKY RX |

PLZL RX |

MAGN RX |

PHOR LI |

|||||||

|

|

|

|

|

|

|

||||||||||||||||||||

Source: Bloomberg, VTB Capital Research

Some of the links in the document are to the sources requiring paid subscriptions.

Prices and market indicator values are as of 15:00 Moscow time / 12:00 London time on Friday 30 November. All changes are from the close of Friday 23 November, unless stated otherwise.

Periodical

Week Endnotes

Week #48; Russia Calling! Forum, G20 summit, earnings season tailing off

In Russia and the near abroad. This week witnessed our Russia Calling Forum. The plenary session of the Russia Calling! 2018 investment forum centred on Russia’s international ties with its partners, as well as its appeal for foreign investment. The highlight was Russian President Vladimir Putin’s speech, in which he outlined the country’s key strategic objectives for boosting economic growth above the global average and placing Russia among the world’s top five economies. CBR Governor Elvira Nabiullina noted that under current conditions the CBR deemed it fit to restart FX purchases in January and a decision on catch-up purchases would be made after the regular ones had started. Otherwise, during the meeting with Deputy Prime Minister Dmitry Kozak, leading food retail chains asked to put further amendments to the retail law on hold in order to assess the impact of the latest amendments. System Operator has released its 3Q18 analysis of the electricity sector balance.

On Russian companies. The 3Q18 earnings season is drawing to the close. Over this week, the TCS Group, Aeroflot and Lukoil IFRS results positively surprised the Street. Gazprom’s management is going to make a suggestion to the company’s BoD to increase DPS for FY18, potentially to a double-digit number in roubles, according to Interfax, citing the Deputy Chairman of its Executive Board, Andrey Kruglov. Interfax has quoted Sistema’s majority shareholder, Vladimir Evtushenkov, talking about a principal agreement to sell a stake in Detsky Mir by the end of this year or in early 2019.

Around the globe. Markets were lent a hand by the Fed’s dovish shift, while waiting for the G20 summit. There were various headlines about US-China trade talks, with expectations of a truce swinging back and forth. The US is studying new auto import tariffs. If implemented, it could potentially lower PGM demand. The weakness in the melee diamonds segment continued in November. Georgia elected its first woman president, Salome Zurabishvili.

Most/Least liked stocks. Our RTS-hedged MLLS portfolio advanced over this week. The Most Liked (ML) basket went up +0.8%, along with the benchmark. The Least Liked (LL) stocks underperformed the broader market.

What lies ahead. Sat: G20 summit, US-China presidents meeting. Mon: US, EA and UK PMIs. Tue: BR IP. Wed: EIA oil report, US Beige Book, India rate decision, CN PMI. Thu: OPEC+ meeting. Fri: US employment, EA GDP, DE and FR IPs.

Earnings season. S&P500: 10 companies. Stoxx600: 5 companies.

Ilya Piterskiy, Strategist

+7 495 660 67 47 // ilya.piterskiy@vtbcapital.com

Nikolay Mikheev, Strategist

+7 495 287 68 69 // nikolay.mikheev@vtbcapital.com

Duc Nguyen, Strategist

+7 495 663 47 23 // duc.nguyen@vtbcapital.com

Prices cited in the body of this report are as of the last close before, or the close on, 29 Nov 2018 (except where indicated otherwise). VTB Capital analysts update their recommendations periodically as required. This research report was prepared by the analyst(s) named above who is(are) associated with JSC VTB Capital and is distributed by JSC VTB Capital and VTB Capital PLC and their non-U.S. affiliates outside the United States. This VTB Capital research report is distributed to investors located within United States by Xtellus Capital Partners, Inc. (“Xtellus”) as a “third-party research report” as defined in Rule 2241(a)(14) and Rule 2242(a)(17) of the U.S. Financial Industry Regulatory Authority. Please refer to the Disclosures section of this report for other important disclosures, including the analyst certification and information required by regulation.

vk.com/id446425943 |

Week Endnotes |

Russia |

|

Equities |

|

On Markets

Global backdrop. Global stocks held on to their gains this week ahead of the G20 summit. The Fed’s dovish shift lent markets a hand amid Sino-American trade uncertainty. The MSCI World (+3.1%) and MSCI EM (+3.0%) were both up. The S&P 500 (+4.0%) rallied. The dollar (DXY unch.) was flat, while the UST 10Y yield (3.01%; -3bp) moved lower. The European bourses (Stoxx 600 +0.9%; DAX +0.6%; CAC 40 +1.1%, FTSE 100 +0.1%) were positive. Italian assets also posted solid gains as the Italian government adopted a more conciliatory tone on its budget: the FTSE MIB (2.5%) was up, while the Italian 10Y yield (3.2%; -20bp) tightened significantly. The pound (-0.5%) weakened after UK Prime Minister Theresa May warned the government to prepare for a No Deal Brexit if she loses the parliamentary vote on her deal on 11December. Asia (Topix +1.9%, Kospi +2.9%, Hang Seng +2.3%) held up well amid trade anxiety. China (Shanghai Comp +0.4%) was the region’s laggard. The G20 summit is due to kick off today, but investors’ eyes will be on the Saturday meeting between US President Donald Trump and his Chinese counterpart Xi Jinping. Back home, Russia (RTS +0.7%) posted muted gains, while the rouble (-1.2%) depreciated on the back of heightened geopolitical tensions. Other CEEMEA markets fared much better, with Turkey (BIST 100 +4.2% / TRY +2.4%), Poland (WIG 20 +2.6% / PLN +0.2%) and South Africa (TOP 40 +2.1% / ZAR +0.8%) up. In the commodities space, Oil (Brent -0.2%) was slightly down on the week, as pressure came from Saudi Arabian Energy Minister Khalid al-Falih’s comments that the kingdom would not cut its output alone, given how Russia has recently been elusive about production cuts. President Vladimir Putin, speaking at VTB Capital’s Russia Calling! Investment Forum on Wednesday, said Oil prices at USD 60/bbl were balanced and fair. Today, Russian Energy Minister Alexander Novak said Russia would keep its output steady until the end of the year, as current prices are agreeable to both producers and customers. Moreover, EIA data showed the tenth straight week of rises in US crude stockpiles (+3.6mn bbl vs. BBGe +0.6mn), weighing on oil prices. Base metals (LMEX -0.3%) were slightly negative, mainly due to Aluminium (-0.5%), while Copper (+0.1%) and Nickel (+1.3%) were up.

Russia – equities. The Russian market delivered gains. The USD-valued RTS index (+0.7%) reversed its Monday’s weakness over the week, returning to the area above the 1,100 level. The RUB-valued MOEX Russia index (+1.8%) tested the 2,400 level, although that was unsuccessfully and the benchmark retreated from it on Friday. RUB (-1.2%) depreciated over the week, making several forays below the 67 level. As for individual names, SSA (+8%) jumped on the back of leaks that Sistema might sell Detsky Mir. FIVE (+5%) continued its recovery, consolidating above its 100D MA. EPAM (+5%) bounced after recent underperformance. GMKN (+5%) expanded both MTD and YTD gains to +14%, marking a fresh record high in RUB-terms. GAZP (+5%) advanced, thanks to headlines that the company’s dividends might be a double-digit number. Among laggards, we note ENPL (-5%) and UC Rusal (486 HK - 4.0%). Steels also turned to the red, with NLMK (-4.7%) underperforming the most. HYDR (-4.7%) continued to slide, halving in USD-terms since its peak in October 2017. SBER (-3.8%) declined as well.

30 November 2018 |

2 |