- •Previous month’s headlines

- •Calendar

- •Upstream (Mining)

- •Upstream (Mining)

- •Mid-stream (cutting and polishing)

- •Downstream (Jewellery)

- •Valuation and forecasts

- •Disclosures

- •Production and Distribution of VTB Capital Research Reports outside the United States

- •Distribution of VTB Capital Research Reports to Investors within the United States

- •Relationship between VTB and Xtellus

- •Conflict of Interest Disclosures.

- •Issuer Specific Disclosures

- •Analysts Certification

- •Investment Ratings

- •12-month Target Prices

- •Conflicts Management Arrangements

vk.com/id446425943 |

Diamonds Watch |

Global |

|

Materials: Diversified Metals & Mining |

|

|

Mid-stream (cutting and polishing) |

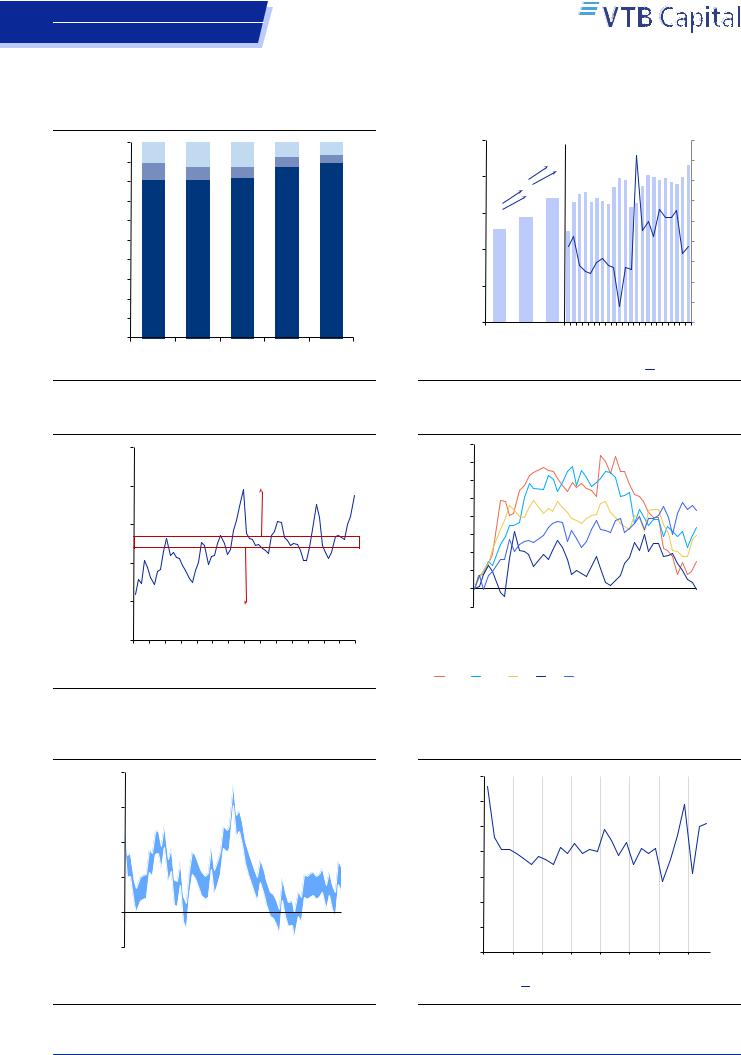

Figure 12: India’s share in diamond cutting and polishing

cutting |

|

100% |

10% |

12% |

12% |

7% |

6% |

|||||

|

|

|||||||||||

|

90% |

5% |

4% |

|||||||||

|

9% |

|

7% |

6% |

||||||||

|

|

|

|

|

|

|

|

|

|

|||

diamondsroughfrom |

countriespolishing |

80% |

|

|

|

|

|

|

|

|

|

|

70% |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60% |

|

|

|

|

|

|

|

|

|

|

|

|

50% |

|

|

|

|

|

|

|

|

88% |

90% |

|

|

40% |

81% |

81% |

82% |

|||||||

|

|

|

|

|||||||||

importof and |

30% |

|

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Net |

|

10% |

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

2012 |

2013 |

2014 |

2015 |

2016 |

||||||

|

|

|

||||||||||

|

|

|

|

|

India |

|

China |

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

Source: Bain, VTB Capital Research

Figure 13: India polished diamonds net exports

2,500 |

|

|

18% |

|

|

|

|

35% |

||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

18% |

|

|

|

|

30% |

|

|

|

|

|

|

YoY |

|

|

|

|

|||

|

|

|

|

|

|

YoY |

|

|

|

|

|

|

2,000 |

13% |

1,439 |

1,696 |

|

|

|

|

10% |

||||

USDmn |

1,270 |

|

|

|

|

|

||||||

|

|

|

13% |

|

|

|

|

|

|

25% |

||

|

|

|

YoY |

|

|

|

|

|

|

|

|

|

|

|

|

YoY |

|

|

|

|

|

|

|

20% |

|

1,500 |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

15% |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

1,000 |

|

|

|

|

|

|

|

|

|

5% |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

500 |

|

|

|

|

|

|

|

|

|

0% |

||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

-5% |

0 |

|

|

|

|

|

Feb-17 |

|

Nov-17 |

Feb-18 |

-10% |

||

|

|

|

2014 |

2015 |

2016 |

May-17 Aug-17 |

May-18 Aug-18 |

|||||

|

|

|

Monthly run-rate |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

India net polished exports, 3M MA |

|

YoY, rhs |

||||||||

|

|

|

||||||||||

|

|

|

||||||||||

Source: GJEPC, VTB Capital Research

Figure 14: India polished exports vs rough imports

|

250% |

|

|

rough |

200% |

|

Mid-stream |

MA |

|

||

|

stocks release |

||

|

|

||

|

|

|

|

exports/4mnetpolished valueinimportsnet |

150% |

|

2015-17 avg |

|

|

||

|

|

|

|

|

100% |

|

|

|

|

|

|

|

|

|

Mid-stream |

|

50% |

|

stocks accumulation |

|

|

|

|

4m MA |

0% |

Jan-13 Jun-13 Nov-13 Apr-14 Sep-14 Feb-15 Jul-15 Dec-15 May-16 Oct-16 Mar-17 Aug-17 Jan-18 Jun-18 |

|

|

|

||

Source: GJEPC, VTB Capital Research

Figure 16: Global polishers’ margin improves in 2018

|

20.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

range |

15.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

margin |

10.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating |

5.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-5.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jan-13 Jun-13 Nov-13 Apr-14 Sep-14 Feb-15 Jul-15 Dec-15 May-16 Oct-16 Mar-17 Aug-17 Jan-18 Jun-18 Nov-18 |

|||||||||||||||

Source: Rapaport, Bloomberg, VTB Capital Research

Figure 15: Polished prices trim gains in 2H18

|

8% |

|

|

|

7% |

|

|

% |

6% |

|

|

5% |

|

||

gain, |

4.3% |

||

4% |

|||

price |

3.4% |

||

3% |

|||

2.9% |

|||

YTD |

2% |

1.5% |

|

1% |

|||

|

|

||

|

0% |

-0.1% |

|

|

-1% |

|

|

31-Dec |

31-Jan |

28-Feb |

31-Mar |

30-Apr |

31-May 30-Jun |

31-Jul |

31-Aug 30-Sep |

31-Oct |

|

|

|

|

|

|

|

|||

|

Rapaport indices: |

|

|

|

|

|

|||

|

0.3ct |

0.5ct |

1ct |

3ct |

PolishedPrices.com overall index |

||||

|

|

|

|

|

|

|

|

|

|

Source: Rapaport, VTB Capital Research

Figure 17: Asian Star (Indian public polisher) EBITDA margin

quarterly |

7% |

|

6% |

||

|

||

margin, |

5% |

|

4% |

||

EBITDA |

3% |

|

|

||

star |

2% |

|

|

||

Asian |

1% |

|

|

||

|

0% |

1Q112Q113Q114Q111Q122Q123Q124Q121Q132Q133Q134Q131Q142Q143Q144Q141Q152Q153Q154Q151Q162Q163Q164Q161Q172Q173Q174Q171Q182Q183Q18 Asian star EBITDA margin

Source: Company data, VTB Capital Research

26 November 2018 |

6 |

vk.com/id446425943 |

Diamonds Watch |

Global |

|

Materials: Diversified Metals & Mining |

|

|

Downstream (Jewellery) |

Figure 18: Global diamond jewellery market structure

|

Tiffany 2Q18: +8% YoY |

|

|

|||

Tiffany 2Q18: double |

Richemont Apr-Sep 18: +42% YoY* |

|||||

Signet 2Q18: +1.5% YoY |

|

|

||||

digit growth YoY |

|

|

||||

Total jewellery sales Jan-Aug: +9.3% YoY |

||||||

Luk Fook 3Q18:+4% |

||||||

|

|

|

|

|

||

YoY |

|

|

|

|

|

|

Chow Tai Fook |

|

|

|

|

|

|

3Q18: -2% YoY |

|

22% |

|

|

||

|

|

52% |

||||

Titan 3Q18: +32% YoY |

|

|

|

|||

|

3% |

|

|

|||

|

|

|

|

|||

Chow Tai Fook 3Q18: +1% |

|

|

|

|

||

YoY |

|

12% |

|

|

||

Luk Fook 3Q18: +18% YoY |

|

|

|

|

||

Tiffany 2Q18: +28% YoY |

4%7% |

|

|

|||

Richemont Apr-Sep 18: high |

|

|

||||

single digit growth YoY* |

|

|

|

|

|

|

* Sales growth in all business areas; |

|

US |

|

Japan |

||

|

|

|||||

|

|

|||||

Global Jewellery Maisons sales growth in |

|

Gulf |

|

Mainland China |

||

|

|

|||||

Apr-Sep 18 is 9%. |

|

|

India |

|

Others |

|

|

|

|

||||

|

|

|

||||

Source: US Census Bureau, VTB Capital Research

Figure 19: US jewellery and watches sales growth

15%

sales |

|

|

|

|

|

|

|

|

|

|

|

7.4% |

7.7% |

8.1% |

7.3% |

10.8% |

8.7% |

8.9% |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.3% |

|

9.4% |

|

10.7% |

|

||

watchesandjewellery YoYgrowth, |

10% |

0.2%0.1% |

0.1% |

|

0.5% 1.1% |

|

1.8% |

|

6.2% |

|

|

9.7% |

|

8.5% 5.3% |

|||||||

|

|

|

|

4.4% |

|

|

|||||||||||||||

|

5% |

0.8% |

1.4% |

2.5% |

1.8% |

4.7% |

2.7% |

|

4.5% |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

2.7% |

|

|

3.1% |

|

|

|

|

|

|

|

|

|

|

|

||

TotalUS |

0% |

0.2%- |

|

1.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

-5% |

|

-1.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jan-16 |

Apr-16 |

Jul-16 |

Oct-16 |

Jan-17 |

|

Apr-17 |

|

Jul-17 |

Oct-17 |

|

Jan-18 |

Apr-18 |

Jul-18 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Source: IDEX, VTB Capital Research |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Figure 20: China jewellery retail sales

|

5.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-16% YoY in |

15% |

|

4.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.0 |

4.0 |

4.1 |

|

|

|

October |

10% |

||||||||||

|

4.0 |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.8 |

|

|

|

|||

|

3.5 |

|

|

2.9 |

|

|

|

|

|

|

|

|

|

|

|

5% |

||||

USDbn |

3.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

2.5 |

|

|

2.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-5% |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

2.0 |

1.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

1.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-10% |

|

1.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-15% |

|

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.0 |

|

2010 |

|

2011 |

|

2012 |

|

2013 |

|

|

2014 |

|

2015 |

|

2016 |

|

Feb-17 May-17 Aug-17 Nov-17 |

Feb-18 May-18 Aug-18 |

-20% |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

Monthly |

run |

-rate |

|

|||||||||||

|

|

|

|

China jewellery retail sales, lhs |

YoY, rhs |

|

||||||||||||||

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

||||||||||||||||

Source: Bloomberg, VTB Capital Research

Figure 22: Top-5* diamond jewellery retailers revenue and inventory continue recovery

50%

40%

30% |

Jewellers started |

re-stocking |

20%

10%

Jewellers de-stocking

0%

-10%

-20%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 |

|

Top |

5 retailers' inventories, YoY |

Top |

5 retailers' revenue, YoY |

Source: Company Data, VTB Capital Research * Tiffany, Signet, Luk Fook, Chow Tai Fook and Chow Sang Sang

Figure 21: Hong Kong jewellery & watches retail sales

1.6 |

|

|

|

|

|

|

|

|

|

2% YoY in |

40% |

||

|

|

|

|

|

|

|

|

|

|||||

1.4 |

|

|

|

|

1.3 |

|

|

|

|

September |

35% |

||

|

|

|

|

|

|

|

|

|

30% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

1.2 |

|

|

|

|

1.1 |

|

|

|

|

||||

|

1.01.0 |

|

|

|

|

25% |

|||||||

|

|

|

|

|

|

|

|

||||||

1.0 |

|

|

|

|

|

|

|

||||||

|

|

|

0.9 |

|

20% |

||||||||

USDbn0.8 |

0.7 |

|

|

|

|

|

|

|

|

||||

|

|

|

|

0.8 |

|

15% |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||

0.6 |

|

|

|

|

|

|

|

|

|

|

10% |

||

|

|

|

|

|

|

|

|

|

|

5% |

|||

0.4 |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

0% |

|||

0.2 |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

-5% |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.0 |

|

|

2011 |

|

|

2014 |

|

2015 |

|

Feb-17 May-17 Aug-17 Nov-17 Feb-18 May-18 Aug-18 |

-10% |

||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

2010 |

|

Monthly2012 2013 run-rate2016 |

|

|||||||

|

|

Hong Kong jewellery and watches retail sales, lhs |

YoY |

||||||||||

|

|

||||||||||||

|

|

||||||||||||

Source: Bloomberg, VTB Capital Research

Figure 23: Top 5* retailers inventories turnover (days) broadly flat YoY in 1-2Q18

|

250 |

|

days |

200 |

|

|

||

turnover, |

150 |

|

|

||

Inventory |

100 |

|

50 |

||

|

-

1Q12 |

3Q12 |

1Q13 |

3Q13 |

1Q14 |

3Q14 |

1Q15 |

3Q15 |

1Q16 |

3Q16 |

1Q17 |

3Q17 |

1Q18 |

|

|

|

|

Post-holiday sales re-stocking |

|

|||||||

Source: Company data, VTB Capital Research * Tiffany, Signet, Luk Fook, Chow Tai Fook and Chow Sang Sang

26 November 2018 |

7 |

vk.com/id446425943 |

|

Diamonds Watch |

|

|

|

|

|

|

|

|

||||

|

Global |

|

|

|

|

|

|

|

|

|

|

|||

|

Materials: Diversified Metals & Mining |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Valuation and forecasts |

|

|

|

|

|

|

||||

|

Figure 24: Alrosa vs. peers valuation |

|

|

|

|

|

|

|

|

|

|

|||

|

Company |

Country |

Price, |

Mcap, |

EV, |

|

— P/E (x) — |

|

— EV/EBITDA (x) — |

|

— FCF yield — |

|

||

|

|

|

USD |

USD mn |

USD mn |

2018F |

2019F |

2020F |

2018F |

2019F |

2020F |

2018F |

2019F |

2020F |

|

VTBC coverage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alrosa* |

Russia |

1.52 |

11,162 |

15,435 |

6.4 |

6.2 |

5.8 |

4.7 |

4.6 |

4.2 |

16% |

15% |

17% |

|

Global peers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petra |

UK |

0.51 |

442 |

964 |

12.1 |

10.0 |

7.4 |

4.4 |

3.7 |

2.9 |

-1% |

19% |

26% |

|

Gem |

UK |

1.48 |

206 |

256 |

6.5 |

10.1 |

9.6 |

2.5 |

3.4 |

3.1 |

18% |

7% |

12% |

|

Lucara Diamonds |

S. Africa |

1.41 |

559 |

519 |

17.4 |

9.9 |

10.9 |

6.8 |

4.2 |

4.3 |

1% |

12% |

10% |

|

Diamond median |

|

|

|

|

12.1 |

10.0 |

9.6 |

4.4 |

3.7 |

3.1 |

1% |

12% |

12% |

|

Global miners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VTBC coverage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Norilsk Nickel* |

Russia |

17.6 |

27,851 |

35,076 |

6.5 |

5.8 |

5.4 |

5.7 |

5.1 |

5.0 |

16% |

12% |

12% |

|

Global miners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BHP Billiton |

Australia |

23.7 |

118,839 |

134,496 |

12.8 |

12.8 |

13.6 |

5.6 |

5.8 |

6.0 |

9% |

8% |

8% |

|

VALE |

Brazil |

14.1 |

74,353 |

77,217 |

10.3 |

8.4 |

9.3 |

5.1 |

4.8 |

4.8 |

13% |

12% |

12% |

|

Rio Tinto |

UK |

48.7 |

86,500 |

98,016 |

10.2 |

11.3 |

11.7 |

5.4 |

5.6 |

5.7 |

10% |

8% |

8% |

|

Glencore |

Swiss |

3.8 |

53,358 |

83,629 |

7.7 |

7.9 |

7.9 |

4.9 |

4.4 |

4.2 |

15% |

17% |

16% |

|

Anglo American |

UK |

21.3 |

27,550 |

36,280 |

8.9 |

8.9 |

9.9 |

4.1 |

4.0 |

4.3 |

12% |

11% |

8% |

|

Median |

|

|

|

|

9.6 |

8.6 |

9.6 |

5.2 |

4.9 |

4.9 |

13% |

11% |

10% |

Source: Company data, VTB Capital Research estimates (marked with an *), Bloomberg consensus as of 20 November 2018 (all the rest)

Figure 25: Alrosa consensus EV/EBITDA vs. Global Miners

|

9.0x |

|

|

20% |

EV/EBITDA |

8.0x |

|

|

10% |

5.0x |

|

|

-20% |

|

|

7.0x |

|

|

0% |

|

6.0x |

|

|

-10% |

FWD |

4.0x |

|

|

-30% |

|

|

|

||

12mo |

3.0x |

|

4.6x, -1% vs. |

-40% |

2.0x |

|

-50% |

||

|

|

|

VTBC estimate |

|

|

1.0x |

|

global miners |

-60% |

|

0.0x |

Nov-13 Apr-14 Sep-14 Feb-15 Jul-15 |

Dec-15 May-16 Oct-16 Mar-17 Aug-17 Jan-18 Jun-18 |

-70% |

|

Jan-13 Jun-13 |

Nov-18 |

||

|

|

Discount, rhs |

|

|

Alrosa cons. 12-m fwd EV/EBITDA

Global Miners 12-m fwd EV/EBITDA

Source: VTB Capital Research, Bloomberg consensus as of 20 November 2018

Figure 26: Alrosa consensus P/E vs. Global Miners

|

20.0x |

|

0% |

|

18.0x |

|

-10% |

EV/EBITDA |

16.0x |

|

-20% |

14.0x |

|

-30% |

|

|

|

||

|

12.0x |

|

-40% |

FWD |

10.0x |

|

-50% |

8.0x |

|

-60% |

|

12mo |

6.0x |

|

-70% |

|

|

||

|

4.0x |

VTBC estimate |

-80% |

|

2.0x |

6.2x, -30% vs. |

-90% |

|

global miners |

||

|

0.0x |

-100% |

|

|

|

||

|

Jan-13 Jun-13 Nov-13 Apr-14 Sep-14 Feb-15 Jul-15 Dec-15 |

May-16 Oct-16 Mar-17 Aug-17 Jan-18 Jun-18 |

Nov-18 |

|

Discount, rhs |

Alrosa cons. 12-m fwd P/E |

|

|

Global Miners 12-m fwd P/E |

|

|

Source: VTB Capital Research, Bloomberg consensus as of 20 November 2018

Figure 27: Diamond jewellery retailers valuation and revenue growth expectations

Company |

Country |

Price |

Mcap |

EV |

Revenue growth |

EV/EBITDA, x |

|

P/E, x |

|

FCFE yield |

||||||

|

|

USD |

USD mn |

USD mn |

2018F |

2019F |

2020F |

2018F |

2019F |

2020F |

2018F |

2019F |

2020F |

2018F |

2019F |

2020F |

Tiffany |

US |

102.4 |

12,529 |

12,701 |

9% |

6% |

5% |

11.6 |

10.5 |

9.7 |

21.3 |

19.0 |

17.4 |

3% |

3% |

4% |

Signet |

US |

52.8 |

2,740 |

4,022 |

0% |

-1% |

-3% |

6.7 |

6.3 |

5.8 |

10.8 |

12.4 |

n/a |

34% |

13% |

11% |

Chow Tai Fook |

China |

0.9 |

8,860 |

9,625 |

10% |

10% |

7% |

10.0 |

8.8 |

8.0 |

14.8 |

12.9 |

11.7 |

6% |

6% |

7% |

Luk Fook |

China & HK |

3.2 |

1,874 |

1,705 |

13% |

10% |

7% |

7.3 |

6.4 |

5.7 |

10.3 |

9.2 |

8.6 |

2% |

6% |

8% |

Chow Sang Sang |

China |

1.6 |

1,090 |

1,140 |

13% |

8% |

8% |

6.2 |

5.5 |

5.1 |

8.2 |

7.4 |

6.8 |

5% |

1% |

1% |

Titan |

India |

13.0 |

11,571 |

11,723 |

4% |

19% |

18% |

40.9 |

33.1 |

27.3 |

61.1 |

49.4 |

41.5 |

1% |

1% |

1% |

Average |

|

|

|

|

8% |

9% |

7% |

13.8 |

11.8 |

10.3 |

21.1 |

18.4 |

17.2 |

8% |

5% |

5% |

Median |

|

|

|

|

9% |

9% |

7% |

8.7 |

7.6 |

6.9 |

12.8 |

12.7 |

11.7 |

4% |

5% |

5% |

Source: VTB Capital Research, Bloomberg consensus as of 20 November 2018

26 November 2018 |

8 |