ESG_140119(1)_watermark

.pdf

vk.com/id446425943

EM fund flows: Allocations

The following charts show sector allocations of non-ETF GEM funds benchmarked to MSCI EM vs index weights, with shaded areas highlighting over/underweights, based on a sample of c. 40% of MSCI EM-benchmarked active AuM.

Renaissance Capital

14 January 2019

ESG

Figure 190: Non-ETF allocation to IT vs benchmark

|

Overweight |

|

Underweight |

|

|

||

|

|

||

|

IT, Fund weight |

|

IT, Index weight |

|

|

30% |

25% |

20% |

15% |

10% |

5% |

0% |

Aug-06 Feb-07 Aug-07 Feb-08 Aug-08 Feb-09 Aug-09 Feb-10 Aug-10 Feb-11 Aug-11 Feb-12 Aug-12 Feb-13 Aug-13 Feb-14 Aug-14 Feb-15 Aug-15 Feb-16 Aug-16 Feb-17 Aug-17 Feb-18 Aug-18 |

Figure 191: Non-ETF allocation to Financials vs benchmark

|

Overweight |

|

Underweight |

|

|

||

|

|

||

|

Financials, Fund weight |

|

Financials, Index weight |

|

|

35% |

30% |

25% |

20% |

15% |

10% |

5% |

0% |

Aug-06 Feb-07 Aug-07 Feb-08 Aug-08 Feb-09 Aug-09 Feb-10 Aug-10 Feb-11 Aug-11 Feb-12 Aug-12 Feb-13 Aug-13 Feb-14 Aug-14 Feb-15 Aug-15 Feb-16 Aug-16 Feb-17 Aug-17 Feb-18 Aug-18 |

Source: MSCI, EPFR.com Source: MSCI, EPFR.com

Figure 192: Non-ETF allocation to Consumer Discretionary vs benchmark Figure 193: Non-ETF allocation to Energy vs benchmark

|

Overweight |

|

Underweight |

|

|

||

|

|

||

|

Cons. Disc., Fund weight |

|

Cons. Disc., Index weight |

|

|

16% |

25% |

14% |

|

12% |

20% |

|

|

10% |

15% |

|

|

8% |

|

6% |

10% |

|

|

4% |

5% |

|

|

2% |

|

0% |

0% |

|

Aug-06 Feb-07 Aug-07 Feb-08 Aug-08 Feb-09 Aug-09 Feb-10 Aug-10 Feb-11 Aug-11 Feb-12 Aug-12 Feb-13 Aug-13 Feb-14 Aug-14 Feb-15 Aug-15 Feb-16 Aug-16 Feb-17 Aug-17 Feb-18 Aug-18 |

|

Overweight |

|

Underweight |

|

|

||

|

|

||

|

Energy, Fund weight |

|

Energy, Index weight |

|

|

Aug-06 Feb-07 Aug-07 Feb-08 Aug-08 Feb-09 Aug-09 Feb-10 Aug-10 Feb-11 Aug-11 Feb-12 Aug-12 Feb-13 Aug-13 Feb-14 Aug-14 Feb-15 Aug-15 Feb-16 Aug-16 Feb-17 Aug-17 Feb-18 Aug-18 |

Source: MSCI, EPFR.com Source: MSCI, EPFR.com

Figure 194: Non-ETF allocation to Materials vs benchmark Figure 195: Non-ETF allocation to Consumer Staples vs benchmark

|

Overweight |

|

Underweight |

|

|

||

|

|

||

|

Materials, Fund weight |

|

Materials, Index weight |

|

|

20% |

16% |

|

|

|

14% |

15% |

12% |

|

10% |

10% |

8% |

|

6% |

5% |

4% |

|

2% |

0% |

0% |

|

Aug-06 Feb-07 Aug-07 Feb-08 Aug-08 Feb-09 Aug-09 Feb-10 Aug-10 Feb-11 Aug-11 Feb-12 Aug-12 Feb-13 Aug-13 Feb-14 Aug-14 Feb-15 Aug-15 Feb-16 Aug-16 Feb-17 Aug-17 Feb-18 Aug-18 |

|

Overweight |

|

Underweight |

|

|

||

|

|

||

|

Cons. Staples, Fund weight |

|

Cons. Staples, Index weight |

|

|

Aug-06 Feb-07 Aug-07 Feb-08 Aug-08 Feb-09 Aug-09 Feb-10 Aug-10 Feb-11 Aug-11 Feb-12 Aug-12 Feb-13 Aug-13 Feb-14 Aug-14 Feb-15 Aug-15 Feb-16 Aug-16 Feb-17 Aug-17 Feb-18 Aug-18 |

Source: MSCI, EPFR.com |

Source: MSCI, EPFR.com |

99

vk.com/id446425943

EM fund Flows: Allocations

Renaissance Capital

14 January 2019

ESG

Figure 196: Non-ETF allocation to Industrials vs benchmark |

Figure 197: Non-ETF allocation to Telecoms vs benchmark |

Overweight |

Underweight |

|

Industrials, Fund weight |

Industrials, Index weight |

|

14% |

18% |

|

|

||

12% |

16% |

|

10% |

14% |

|

12% |

||

|

||

8% |

10% |

|

|

||

6% |

8% |

|

4% |

6% |

|

4% |

||

2% |

||

2% |

||

|

||

0% |

0% |

|

Aug-06 Feb-07 Aug-07 Feb-08 Aug-08 Feb-09 Aug-09 Feb-10 Aug-10 Feb-11 Aug-11 Feb-12 Aug-12 Feb-13 Aug-13 Feb-14 Aug-14 Feb-15 Aug-15 Feb-16 Aug-16 Feb-17 Aug-17 Feb-18 Aug-18 |

||

|

Overweight |

|

Underweight |

|

|

||

|

|

||

|

Telecoms, Fund weight |

|

Telecoms, Index weight |

|

|

Aug-06 Feb-07 Aug-07 Feb-08 Aug-08 Feb-09 Aug-09 Feb-10 Aug-10 Feb-11 Aug-11 Feb-12 Aug-12 Feb-13 Aug-13 Feb-14 Aug-14 Feb-15 Aug-15 Feb-16 Aug-16 Feb-17 Aug-17 Feb-18 Aug-18 |

Source: MSCI, EPFR.com Source: MSCI, EPFR.com

Figure 198: Non-ETF allocation to Real Estate vs benchmark Figure 199: Non-ETF allocation to Healthcare vs benchmark

|

Overweight |

|

Underweight |

|

|

||

|

|

||

|

Real Estate, Fund weight |

|

Real Estate, Index weight |

|

|

4.5% |

|

|

|

|

|

|

|

|

|

|

3.5% |

|

|

|

|

|

|

|

|

|

|

|

|

4.0% |

|

|

|

|

|

|

|

|

|

|

3.0% |

3.5% |

|

|

|

|

|

|

|

|

|

|

2.5% |

|

|

|

|

|

|

|

|

|

|

|

|

3.0% |

|

|

|

|

|

|

|

|

|

|

2.0% |

2.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.0% |

|

|

|

|

|

|

|

|

|

|

1.5% |

1.5% |

|

|

|

|

|

|

|

|

|

|

1.0% |

|

|

|

|

|

|

|

|

|

|

|

|

1.0% |

|

|

|

|

|

|

|

|

|

|

0.5% |

0.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.0% |

|

|

|

|

|

|

|

|

|

|

0.0% |

|

|

|

|

|

|

|

|

|

|

|

|

Apr-13 |

Oct-13 |

Apr-14 |

Oct-14 |

Apr-15 |

Oct-15 |

Apr-16 |

Oct-16 |

Apr-17 |

Oct-17 |

Apr-18 |

Oct-18 |

|

Overweight |

|

Underweight |

|

|

||

|

|

||

|

Healthcare, Fund weight |

|

Healthcare, Index weight |

|

|

Aug-06 Feb-07 Aug-07 Feb-08 Aug-08 Feb-09 Aug-09 Feb-10 Aug-10 Feb-11 Aug-11 Feb-12 Aug-12 Feb-13 Aug-13 Feb-14 Aug-14 Feb-15 Aug-15 Feb-16 Aug-16 Feb-17 Aug-17 Feb-18 Aug-18 |

Source: MSCI, EPFR.com Source: MSCI, EPFR.com

Figure 200: Non-ETF allocation to Utilities vs benchmark Figure 201: Non-ETF allocation to Cash

|

Overweight |

Underweight |

|

4.5% |

Utilities, Fund weight |

Utilities, Index weight |

|

|

|

14% |

|

|

|

|

|

4.0% |

|

|

12% |

3.5% |

|

|

|

|

|

|

|

3.0% |

|

|

10% |

2.5% |

|

|

8% |

|

|

|

|

2.0% |

|

|

6% |

1.5% |

|

|

|

|

|

|

|

1.0% |

|

|

4% |

|

|

|

|

0.5% |

|

|

2% |

0.0% |

Aug-06 Feb-07 Aug-07 Feb-08 Aug-08 Feb-09 Aug-09 Feb-10 Aug-10 Feb-11 Aug-11 Feb-12 Aug-12 Feb-13 Aug-13 Feb-14 Aug-14 Feb-15 Aug-15 Feb-16 Aug-16 Feb-17 Aug-17 Feb-18 Aug-18 |

0% |

|

|

|||

|

|

||

|

|

|

|

|

|

|

Cash |

|

|

|

Average Cash |

|

|

|

|

|

Jan-96 |

Jan-97 |

Jan-98 |

Jan-99 |

Jan-00 |

Jan-01 |

Jan-02 |

Jan-03 Jan-04 Jan-05 |

Jan-06 |

Jan-07 |

Jan-08 |

Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 |

Jan-14 |

Jan-15 |

Jan-16 |

Jan-17 |

Jan-18 |

Source: MSCI, EPFR.com |

Source: MSCI, EPFR.com |

100

vk.com/id446425943

Market watch

Performance: EM and Frontier ($)

Renaissance Capital

14 January 2019

ESG

Month to 31 December

a |

|

|

|

|

|

|

|

|

|

|

|

a |

1m |

3m |

6m |

12m |

2018 |

2017 |

2016 |

2015 |

2014 |

2013 |

12M Trend |

EM |

-2.9 |

-7.8 |

-9.7 |

-16.6 |

-16.6 |

34.3 |

8.6 |

-17.0 |

-4.6 |

-5.0 |

|

Frontier |

-3.0 |

-4.5 |

-6.9 |

-19.1 |

-19.1 |

27.7 |

-1.3 |

-17.3 |

2.9 |

21.4 |

|

DM |

-7.7 |

-13.7 |

-9.8 |

-10.4 |

-10.4 |

20.1 |

5.3 |

-2.7 |

2.9 |

24.1 |

|

LatAm |

-1.3 |

-0.4 |

3.6 |

-9.3 |

-9.3 |

20.8 |

27.9 |

-32.9 |

-14.8 |

-15.7 |

|

EMEA |

-1.8 |

-4.6 |

-7.2 |

-18.8 |

-18.8 |

21.0 |

16.4 |

-22.4 |

-17.5 |

-8.0 |

|

EM Asia |

-3.4 |

-9.6 |

-12.1 |

-17.3 |

-17.3 |

40.1 |

3.8 |

-11.8 |

2.5 |

-0.2 |

|

EM Value |

-2.6 |

-7.2 |

-5.4 |

-13.7 |

-13.7 |

24.3 |

11.4 |

-21.2 |

-7.1 |

-8.0 |

|

EM Growth |

-3.3 |

-8.5 |

-13.8 |

-19.5 |

-19.5 |

44.9 |

5.8 |

-12.8 |

-2.2 |

-2.1 |

|

Iron ore |

11.9 |

4.2 |

11.7 |

-2.4 |

-2.4 |

-7.6 |

85.1 |

-36.5 |

-49.3 |

-6.9 |

|

Gold |

5.1 |

7.7 |

2.4 |

-1.6 |

-1.6 |

13.5 |

8.1 |

-10.4 |

-1.4 |

-28.3 |

|

Copper |

-3.8 |

-4.7 |

-10.0 |

-17.7 |

-17.7 |

30.9 |

17.7 |

-25.3 |

-14.4 |

-7.2 |

|

Oil |

-9.0 |

-35.9 |

-32.4 |

-20.4 |

-20.4 |

20.6 |

55.0 |

-35.9 |

-49.7 |

-1.0 |

|

Mexico |

3.2 |

-19.4 |

-14.2 |

-17.4 |

-17.4 |

13.6 |

-10.7 |

-16.0 |

-10.2 |

-2.0 |

|

Peru |

1.5 |

-3.1 |

-5.3 |

-0.3 |

-0.3 |

33.5 |

53.8 |

-32.5 |

9.2 |

-31.0 |

|

Philippines |

1.5 |

5.2 |

6.0 |

-17.4 |

-17.4 |

23.3 |

-7.7 |

-8.1 |

23.7 |

-4.3 |

|

Malaysia |

1.4 |

-6.2 |

-3.7 |

-8.9 |

-8.9 |

21.1 |

-6.7 |

-22.4 |

-13.4 |

4.2 |

|

Indonesia |

0.8 |

9.4 |

11.4 |

-11.2 |

-11.2 |

22.0 |

14.8 |

-21.0 |

24.1 |

-25.0 |

|

UAE |

0.2 |

-5.6 |

-3.2 |

-11.9 |

-11.9 |

-1.3 |

9.0 |

-20.6 |

11.5 |

84.7 |

|

Poland |

0.2 |

-3.0 |

5.6 |

-14.5 |

-14.5 |

52.2 |

-2.2 |

-27.2 |

-16.8 |

-1.7 |

|

Hungary |

-0.1 |

5.9 |

10.8 |

-8.5 |

-8.5 |

36.9 |

32.3 |

33.1 |

-29.6 |

-9.0 |

|

India |

-0.2 |

2.2 |

-0.5 |

-8.8 |

-8.8 |

36.8 |

-2.8 |

-7.4 |

21.9 |

-5.3 |

|

S Africa |

-0.7 |

-4.1 |

-12.0 |

-26.5 |

-26.5 |

33.1 |

15.1 |

-27.2 |

2.5 |

-8.8 |

|

Qatar |

-1.0 |

8.4 |

22.3 |

23.9 |

23.9 |

-14.4 |

2.3 |

-22.7 |

11.7 |

23.9 |

|

Egypt |

-1.0 |

-10.1 |

-16.2 |

-16.3 |

-16.3 |

4.5 |

-12.8 |

-24.8 |

26.2 |

6.2 |

|

Taiwan |

-1.4 |

-13.7 |

-10.0 |

-11.8 |

-11.8 |

23.8 |

14.8 |

-14.4 |

6.9 |

6.6 |

|

Brazil |

-2.5 |

12.4 |

18.0 |

-3.9 |

-3.9 |

21.0 |

61.3 |

-43.4 |

-17.4 |

-18.7 |

|

Czech |

-3.0 |

-8.7 |

-5.1 |

-8.4 |

-8.4 |

29.4 |

-9.6 |

-21.9 |

-7.9 |

-14.9 |

|

Thailand |

-3.0 |

-10.5 |

1.0 |

-8.0 |

-8.0 |

30.9 |

23.0 |

-25.5 |

13.3 |

-16.9 |

|

Korea |

-3.1 |

-14.2 |

-13.8 |

-22.6 |

-22.6 |

45.5 |

7.0 |

-7.9 |

-12.6 |

3.1 |

|

Chile |

-3.8 |

-8.9 |

-10.8 |

-21.0 |

-21.0 |

39.8 |

13.2 |

-18.9 |

-14.5 |

-23.0 |

|

Russia |

-4.0 |

-10.1 |

-6.7 |

-5.6 |

-5.6 |

0.3 |

48.9 |

0.0 |

-48.5 |

-2.6 |

|

Colombia |

-4.1 |

-19.5 |

-21.9 |

-13.9 |

-13.9 |

13.8 |

23.9 |

-43.9 |

-22.3 |

-23.7 |

|

Turkey |

-5.3 |

4.4 |

-17.2 |

-43.6 |

-43.6 |

34.3 |

-10.5 |

-33.6 |

16.7 |

-28.1 |

|

Greece |

-5.7 |

-16.4 |

-31.1 |

-37.8 |

-37.8 |

27.1 |

-13.2 |

-62.1 |

-40.3 |

46.2 |

|

China |

-6.1 |

-10.8 |

-18.3 |

-20.4 |

-20.4 |

51.1 |

-1.4 |

-10.0 |

4.7 |

0.4 |

|

Pakistan |

-12.4 |

-23.7 |

-28.1 |

-37.8 |

-37.8 |

-28.0 |

32.7 |

-18.3 |

7.6 |

26.5 |

|

Jordan |

4.5 |

-4.0 |

-12.2 |

-8.4 |

-8.4 |

4.3 |

-4.7 |

-4.3 |

-5.3 |

-9.5 |

|

Serbia |

4.4 |

3.4 |

1.4 |

-0.1 |

-0.1 |

28.2 |

9.7 |

-30.7 |

-24.7 |

19.5 |

|

Slovenia |

3.9 |

3.4 |

-2.0 |

-3.7 |

-3.7 |

26.3 |

-19.2 |

-9.3 |

-10.8 |

19.8 |

|

Saudi Arabia |

2.1 |

-2.2 |

-5.1 |

14.7 |

14.7 |

3.7 |

5.9 |

-15.4 |

-5.8 |

26.6 |

|

Morocco |

1.0 |

-0.6 |

-3.4 |

-10.2 |

-10.2 |

7.2 |

29.9 |

-17.3 |

-4.1 |

-7.1 |

|

Nigeria |

0.6 |

-3.4 |

-17.5 |

-18.2 |

-18.2 |

30.7 |

-39.2 |

-23.5 |

-29.6 |

24.3 |

|

Croatia |

0.4 |

-3.5 |

-5.2 |

-12.4 |

-12.4 |

12.9 |

17.6 |

-10.0 |

-17.3 |

-4.7 |

|

Lebanon |

0.3 |

6.6 |

-8.8 |

-17.6 |

-17.6 |

-8.3 |

4.6 |

0.9 |

1.5 |

-9.0 |

|

Kuwait |

-0.2 |

-0.9 |

7.6 |

11.1 |

11.1 |

14.2 |

-0.9 |

-19.4 |

-7.3 |

2.1 |

|

Bangladesh |

-1.8 |

-0.5 |

-7.1 |

-15.9 |

-15.9 |

15.7 |

8.2 |

-18.8 |

47.4 |

0.9 |

|

Mauritius |

-2.3 |

0.8 |

1.1 |

-24.2 |

-24.2 |

36.9 |

4.8 |

-21.1 |

-9.3 |

21.9 |

|

Tunisia |

-2.3 |

-12.4 |

-18.6 |

9.8 |

9.8 |

7.0 |

-3.2 |

-17.7 |

2.2 |

-8.7 |

|

Sri Lanka |

-2.6 |

5.6 |

-8.9 |

-13.8 |

-13.8 |

-1.0 |

-7.7 |

-24.8 |

16.7 |

8.3 |

|

Oman |

-2.9 |

-2.7 |

7.0 |

-9.0 |

-9.0 |

-14.9 |

2.8 |

-13.9 |

-3.9 |

10.4 |

|

WAEMU |

-4.0 |

-15.7 |

-31.7 |

-35.8 |

6.4 |

6.7 |

na |

na |

na |

na |

|

Bahrain |

-4.4 |

-8.9 |

0.8 |

-5.8 |

-5.8 |

5.4 |

-4.0 |

-25.2 |

-35.0 |

-8.3 |

|

Argentina |

-4.8 |

-1.4 |

-10.6 |

-51.7 |

-51.7 |

72.3 |

3.9 |

-1.2 |

17.3 |

63.7 |

|

Vietnam |

-5.8 |

-6.7 |

-10.9 |

-13.5 |

2.1 |

61.2 |

-8.5 |

-6.4 |

2.9 |

3.7 |

|

Lithuania |

-5.8 |

-15.4 |

-16.1 |

-12.9 |

-12.9 |

10.8 |

-7.4 |

-9.8 |

-13.3 |

13.6 |

|

Kazakhstan |

-6.1 |

-0.9 |

-9.1 |

-6.5 |

-6.5 |

68.1 |

6.7 |

-49.3 |

-16.1 |

0.7 |

|

Kenya |

-6.9 |

-10.0 |

-23.8 |

-15.8 |

-15.8 |

29.8 |

-4.6 |

-20.9 |

19.9 |

43.4 |

|

Estonia |

-7.0 |

5.6 |

-4.4 |

-16.4 |

-16.4 |

43.9 |

6.2 |

7.9 |

-32.9 |

6.4 |

|

Romania |

-16.5 |

-15.2 |

-12.1 |

-6.2 |

-6.2 |

21.7 |

3.2 |

-1.4 |

-5.4 |

29.8 |

|

Note: $ performance of MSCI country indices, sorted by last month's returns

MSCI Index performance ($)

200 |

|

|

|

|

EM |

|

|

Frontier |

|

|

DM |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

180 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

160 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jan-10 |

Jul-10 |

Jan-11 |

Jul-11 |

Jan-12 |

Jul-12 Jan-13 |

Jul-13 |

Jan-14 |

Jul-14 |

Jan-15 |

Jul-15 |

Jan-16 |

Jul-16 |

Jan-17 |

Jul-17 |

Jan-18 |

Jul-18 |

Jan-19 |

MSCI EM Asia vs EMEA vs LatAm ($) |

|

|

|

|

|

|

|

|

|

||||||||

180 |

|

|

|

EM Asia |

|

|

EMEA |

|

|

|

LatAm |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

160 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jan-10 |

Jul-10 |

Jan-11 |

Jul-11 |

Jan-12 |

Jul-12 Jan-13 |

Jul-13 |

Jan-14 |

Jul-14 |

Jan-15 |

Jul-15 |

Jan-16 |

Jul-16 |

Jan-17 |

Jul-17 |

Jan-18 |

Jul-18 |

Jan-19 |

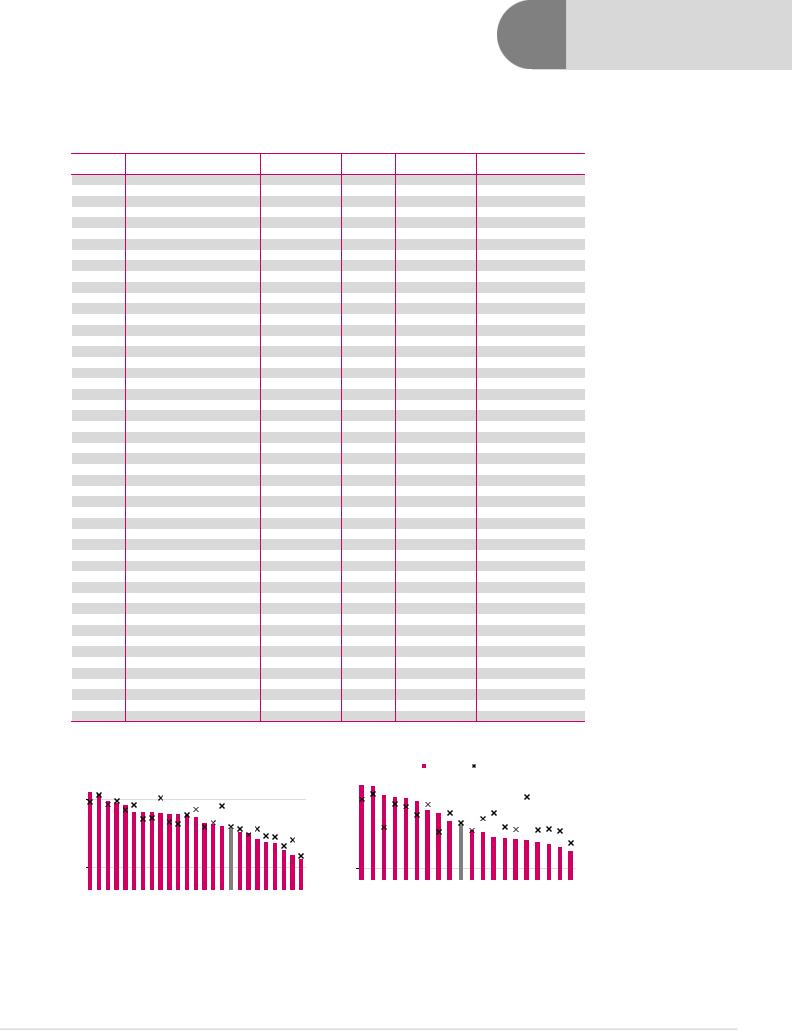

MSCI EM performance, last month and YtD ($)

30 |

EM performance, 1m ($) |

EM performance, YtD ($) |

20 |

|

|

10 |

|

|

0 |

|

|

-10 |

|

|

-20 |

|

|

-30 |

|

|

-40 |

|

|

-50 |

Mexico Peru Philippines Malaysia Indonesia UAE Poland Hungary India S Africa Qatar Egypt Taiwan Brazil EM Czech Thailand Korea Chile Russia Colombia Turkey Greece China Pakistan |

|

|

||

MSCI FM performance, last month and YtD ($)

20

FM performance, 1m ($) FM performance, YtD ($)

10

0 -10

-20 -30 -40

-50 -60

Romania

WAEMU

Estonia

Kenya

Kazakhstan

Lithuania

Argentina

Vietnam

Bahrain

Frontier

Oman

Sri Lanka

Tunisia

Mauritius

Bangladesh

Kuwait

Lebanon

Croatia

Nigeria

Morocco

Saudi Arabia

Slovenia

Serbia

Jordan

Source: Bloomberg

101

vk.com/id446425943

Renaissance Capital

14 January 2019

ESG

Performance: Sectors ($)

|

Weight |

1m |

3m |

6m |

12m |

2018 |

2017 |

2016 |

2015 |

2014 |

2013 |

12M Trend |

MSCI EM Sector Index performance ($) |

|

|

|

||||||

EM Sectors |

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

EM sector performance, 1m ($) |

|

|

|||||

Utilities |

3.6% |

0.5 |

3.3 |

0.6 |

-6.4 |

-6.4 |

13.2 |

-0.5 |

-22.9 |

-1.1 |

-5.9 |

|

0 |

|

EM sector performance, YtD ($) |

|

|

|||||

Cons. Staples |

7.2% |

-0.1 |

-5.1 |

-8.3 |

-15.3 |

-15.3 |

23.3 |

-1.6 |

-10.8 |

-6.8 |

-5.5 |

|

-5 |

|

|

|

|

|

|

|

|

|

|

-10 |

|

|

|

|

|

|

|

|

|

||||||||||||

Industrials |

17.2% |

-0.5 |

-4.1 |

-1.7 |

-14.2 |

-14.2 |

24.0 |

-3.7 |

-18.0 |

-4.4 |

-2.8 |

|

|

|

|

|

|

|

|

|

|

|

|

-15 |

|

|

|

|

|

|

|

|

|

||||||||||||

Real Estate |

6.0% |

-0.9 |

1.1 |

-6.5 |

-20.5 |

-20.5 |

45.1 |

-6.3 |

-9.6 |

-6.8 |

-18.3 |

|

|

|

|

|

|

|

|

|

|

|

|

-20 |

|

|

|

|

|

|

|

|

|

||||||||||||

Materials |

7.8% |

-1.1 |

-11.3 |

-9.1 |

-14.4 |

-14.4 |

30.2 |

28.7 |

-23.7 |

-21.8 |

-19.1 |

|

|

|

|

|

|

|

|

|

|

|

|

-25 |

|

|

|

|

|

|

|

|

|

||||||||||||

Communications |

9.3% |

-1.6 |

-4.1 |

-4.1 |

-17.9 |

-17.9 |

12.3 |

-1.1 |

-22.3 |

-4.9 |

-5.3 |

|

|

|

|

|

|

|

|

|

|

|

|

-30 |

|

|

|

|

|

|

|

|

|

||||||||||||

Financials |

18.4% |

-2.1 |

-1.3 |

-1.4 |

-11.7 |

-11.7 |

28.8 |

9.2 |

-21.1 |

2.1 |

-7.0 |

|

|

|

|

|

|

|

|

|

|

|

|

-35 |

|

|

|

|

|

|

|

|

|

||||||||||||

IT |

10.5% |

-4.1 |

-13.0 |

-17.4 |

-20.6 |

-20.6 |

58.6 |

15.0 |

-8.7 |

8.1 |

12.2 |

|

|

|

|

|

|

|

|

|

|

|

|

-40 |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrials |

|

Materials Communications |

Financials |

|

Energy |

|

|

|

Energy |

5.0% |

-5.6 |

-11.4 |

0.0 |

0.8 |

0.8 |

17.2 |

32.5 |

-19.7 |

-29.4 |

-13.6 |

|

Utilities |

Cons.Staples |

RealEstate |

IT |

Cons.Disc. |

Healthcare |

||||

Healthcare |

3.2% |

0.3 |

2.4 |

-4.5 |

-6.4 |

-6.4 |

22.6 |

-9.9 |

2.5 |

na |

na |

|

||||||||||

Cons. Disc. |

10.4% |

-7.1 |

-13.8 |

-23.1 |

-33.3 |

-33.3 |

38.5 |

-0.4 |

-12.6 |

-3.1 |

4.3 |

|

|

|

|

|

|

|

|

|

|

|

Healthcare |

4.5% |

-7.9 |

-16.3 |

-22.5 |

-21.5 |

-21.5 |

31.4 |

-8.3 |

-6.0 |

18.2 |

8.0 |

|

|

|

|

|

|

|

|

|

|

|

FM Sectors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Materials |

5.7% |

-0.3 |

-9.0 |

-14.5 |

-18.9 |

-18.9 |

13.9 |

9.7 |

-8.2 |

na |

na |

|

|

|

|

|

|

|

|

|

|

|

Financials |

44.4% |

-1.8 |

-2.3 |

-4.3 |

-16.3 |

-16.3 |

29.2 |

-1.1 |

-1.4 |

na |

na |

|

MSCI FM Sector Index performance ($) |

|

|

|

||||||

Cons. Staples |

9.3% |

-2.1 |

-7.2 |

-12.1 |

-22.6 |

-22.6 |

34.4 |

-33.4 |

-2.3 |

na |

na |

|

10 |

|

FM sector performance, 1m ($) |

|

|

|||||

Industrials |

4.5% |

-2.8 |

-4.1 |

-4.5 |

-15.1 |

-15.1 |

29.8 |

6.7 |

-3.9 |

na |

na |

|

0 |

|

FM sector performance, YtD ($) |

|

|

|||||

Communications |

12.2% |

-3.6 |

-6.8 |

-8.5 |

-20.6 |

-20.6 |

18.0 |

13.0 |

-2.2 |

na |

na |

|

-10 |

|

|

|

|

|

|

|

|

|

Cons. Disc. |

1.5% |

-4.6 |

-16.4 |

-27.9 |

-36.6 |

-36.6 |

-50.7 |

19.5 |

-2.0 |

na |

na |

|

|

|

|

|

|

|

|

|

|

|

|

-20 |

|

|

|

|

|

|

|

|

|

||||||||||||

Real Estate |

8.3% |

-5.3 |

-5.3 |

-9.4 |

-8.3 |

-8.3 |

20.7 |

7.3 |

na |

na |

na |

|

|

|

|

|

|

|

|

|

|

|

|

-30 |

|

|

|

|

|

|

|

|

|

||||||||||||

Utilities |

3.9% |

-6.4 |

-2.1 |

-9.6 |

-47.9 |

-47.9 |

60.3 |

15.6 |

-4.3 |

na |

na |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Energy |

5.4% |

-9.5 |

-10.5 |

-2.8 |

-29.6 |

-29.6 |

38.7 |

4.1 |

-9.5 |

na |

na |

|

-40 |

|

|

|

|

|

|

|

|

|

EM largest 10 country sectors |

|

|

|

|

|

|

|

|

|

|

|

-50 |

|

|

|

|

|

|

|

|

|

|

Malaysia Communications |

4.3% |

5.9 |

-9.9 |

-0.8 |

-24.5 |

-24.5 |

18.5 |

-19.3 |

-24.8 |

1.9 |

-5.9 |

|

-60 |

|

|

|

|

|

|

|

|

|

|

|

-0.6 |

|

-1.2 |

-10.3 |

-10.3 |

15.2 |

|

|

-23.4 |

|

|

|

Financials |

Cons.Staples |

Industrials |

Communications |

|

|

Utilities |

Energy |

|

Korea Industrials |

4.6% |

-9.0 |

-3.6 |

-18.6 |

-4.2 |

|

Healthcare |

Materials |

Cons.Disc. |

RealEstate |

||||||||||||

China Industrials |

7.6% |

-3.9 |

-8.6 |

-6.9 |

-16.8 |

-16.8 |

16.3 |

-11.6 |

-8.5 |

6.9 |

5.2 |

|

||||||||||

Taiwan IT |

6.5% |

-0.7 |

-15.3 |

-11.0 |

-16.2 |

-16.2 |

29.1 |

18.4 |

-15.1 |

18.4 |

2.9 |

|

|

|

|

|

|

|

|

|

|

|

China Real Estate |

2.8% |

-0.9 |

1.1 |

-10.3 |

-14.9 |

-14.9 |

97.1 |

-14.6 |

na |

na |

na |

|

|

|

|

|

|

|

|

|

|

|

S Africa Financials |

2.6% |

-2.2 |

-1.7 |

-2.0 |

-20.7 |

-20.7 |

33.1 |

24.1 |

-32.0 |

10.7 |

-11.1 |

|

|

|

|

|

|

|

|

|

|

|

China Financials |

3.8% |

-4.4 |

-7.0 |

-9.1 |

-16.4 |

-16.4 |

28.8 |

-3.5 |

-12.6 |

14.1 |

-3.6 |

|

|

|

|

|

|

|

|

|

|

|

Czech Financials |

1.9% |

-4.9 |

-10.6 |

-8.9 |

-14.1 |

-14.1 |

23.0 |

-15.2 |

-3.8 |

-6.6 |

5.5 |

|

|

|

|

|

|

|

|

|

|

|

China Materials |

1.8% |

-6.6 |

-15.8 |

-18.5 |

-21.6 |

-21.6 |

50.0 |

17.5 |

-21.0 |

-0.5 |

-16.0 |

|

|

|

|

|

|

|

|

|

|

|

China Cons. Disc. |

2.6% |

-11.3 |

-20.6 |

-35.1 |

-39.6 |

-39.6 |

61.6 |

-9.7 |

-4.9 |

-9.4 |

-1.2 |

|

|

|

|

|

|

|

|

|

|

|

EMEA largest country-sectors (weight in MSCI EMEA >1%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

S Africa Materials |

6.4% |

7.1 |

-9.5 |

-7.8 |

-13.5 |

-13.5 |

16.4 |

35.3 |

-44.3 |

-24.4 |

-46.4 |

|

|

|

|

|

|

|

|

|

|

|

Qatar Real Estate |

2.0% |

3.0 |

20.1 |

44.8 |

10.3 |

10.3 |

-15.3 |

-15.8 |

na |

na |

na |

|

|

|

|

|

|

|

|

|

|

|

Poland Energy |

1.3% |

2.4 |

6.4 |

29.8 |

1.1 |

1.1 |

48.6 |

14.4 |

16.2 |

-11.7 |

-9.3 |

|

|

|

|

|

|

|

|

|

|

|

Poland Communications |

4.1% |

2.3 |

-5.0 |

-15.6 |

-39.1 |

-39.1 |

18.3 |

-21.5 |

-28.8 |

-27.5 |

-17.9 |

|

|

|

|

|

|

|

|

|

|

|

Poland Materials |

2.5% |

0.7 |

-1.6 |

-5.0 |

-32.2 |

-32.2 |

46.0 |

5.4 |

-31.4 |

-27.7 |

-29.7 |

|

|

|

|

|

|

|

|

|

|

|

Poland Financials |

9.2% |

0.1 |

-4.0 |

4.2 |

-16.4 |

-16.4 |

59.5 |

-7.9 |

-33.6 |

-16.5 |

14.0 |

|

|

|

|

|

|

|

|

|

|

|

Qatar Financials |

1.6% |

-1.5 |

8.3 |

22.8 |

32.8 |

32.8 |

-12.6 |

3.7 |

-17.3 |

24.4 |

20.3 |

|

|

|

|

|

|

|

|

|

|

|

S Africa Real Estate |

2.6% |

-2.1 |

-4.9 |

-9.0 |

-35.6 |

-35.6 |

14.3 |

-1.7 |

na |

na |

na |

|

|

|

|

|

|

|

|

|

|

|

S Africa Financials |

15.0% |

-2.2 |

-1.7 |

-2.0 |

-20.7 |

-20.7 |

33.1 |

24.1 |

-32.0 |

10.7 |

-11.1 |

|

|

|

|

|

|

|

|

|

|

|

Russia Materials |

1.8% |

-2.5 |

-2.9 |

-0.8 |

-3.4 |

-3.4 |

3.3 |

49.2 |

-8.6 |

-30.9 |

-23.3 |

|

|

|

|

|

|

|

|

|

|

|

S Africa Cons. Staples |

2.5% |

-2.7 |

-2.0 |

-11.9 |

-28.6 |

-28.6 |

28.3 |

21.2 |

-33.7 |

4.7 |

-32.5 |

|

|

|

|

|

|

|

|

|

|

|

Russia Energy |

3.9% |

-3.2 |

-10.4 |

1.8 |

16.1 |

16.1 |

-3.9 |

47.1 |

-3.3 |

-45.0 |

-5.3 |

|

|

|

|

|

|

|

|

|

|

|

S Africa Cons. Disc. |

3.8% |

-3.9 |

-9.7 |

-22.2 |

-31.3 |

-31.3 |

50.7 |

5.0 |

-3.5 |

18.9 |

21.2 |

|

|

|

|

|

|

|

|

|

|

|

Turkey Cons. Disc. |

5.6% |

-4.6 |

4.2 |

-24.0 |

-49.1 |

-49.1 |

22.2 |

8.7 |

-20.2 |

17.2 |

-8.6 |

|

|

|

|

|

|

|

|

|

|

|

Czech Financials |

10.8% |

-4.9 |

-10.6 |

-8.9 |

-14.1 |

-14.1 |

23.0 |

-15.2 |

-3.8 |

-6.6 |

5.5 |

|

|

|

|

|

|

|

|

|

|

|

Turkey Industrials |

2.9% |

-5.6 |

-2.3 |

-5.4 |

-35.5 |

-35.5 |

55.8 |

-15.4 |

-29.4 |

23.1 |

-5.9 |

|

|

|

|

|

|

|

|

|

|

|

S Africa Healthcare |

2.6% |

-5.8 |

-8.0 |

-31.6 |

-41.2 |

-41.2 |

3.1 |

9.7 |

-35.0 |

24.4 |

12.8 |

|

|

|

|

|

|

|

|

|

|

|

Greece Cons. Disc. |

1.2% |

-6.0 |

-11.0 |

-21.7 |

-36.5 |

-36.5 |

31.3 |

21.1 |

-18.8 |

-19.2 |

82.8 |

|

|

|

|

|

|

|

|

|

|

|

Turkey Financials |

2.1% |

-6.1 |

15.8 |

-23.7 |

-51.1 |

-51.1 |

22.1 |

-9.6 |

-38.6 |

19.3 |

-37.7 |

|

|

|

|

|

|

|

|

|

|

|

UAE Real Estate |

2.9% |

-7.3 |

-15.2 |

-17.8 |

-35.2 |

-35.2 |

-6.0 |

-1.7 |

na |

na |

na |

|

|

|

|

|

|

|

|

|

|

|

Note: $ performance of MSCI sector indices, sorted by last month's returns

Source: Bloomberg

102

vk.com/id446425943

Renaissance Capital

14 January 2019

ESG

Valuation watch - key metrics

|

Price/Earnings (x) |

|

|

|

Dividend yield |

|

Price/Book (x) |

Return on Equity |

|

EPS Growth |

|

|

|||||

Country |

T12M |

12MF |

17 |

18E |

19E |

T12M |

18E |

19E |

T12M |

12MF |

T12M |

18E |

19E |

16 |

17 |

18E |

19E |

EM |

12.0 |

11.0 |

12.2 |

11.2 |

10.0 |

2.8% |

3.2% |

3.6% |

1.5 |

1.4 |

13% |

12% |

13% |

17% |

25% |

10% |

7% |

Brazil |

17.0 |

11.8 |

19.1 |

14.6 |

11.9 |

3.5% |

3.4% |

4.1% |

2.0 |

1.8 |

12% |

14% |

16% |

-3% |

6% |

16% |

15% |

Chile |

17.2 |

15.4 |

21.1 |

15.8 |

14.4 |

3.0% |

2.9% |

3.0% |

1.8 |

1.7 |

10% |

10% |

11% |

13% |

16% |

23% |

9% |

China |

11.5 |

10.3 |

13.4 |

11.9 |

10.4 |

3.3% |

2.7% |

3.0% |

1.5 |

1.3 |

13% |

15% |

13% |

3% |

26% |

12% |

14% |

Colombia |

12.7 |

11.3 |

15.6 |

11.4 |

11.2 |

3.0% |

3.5% |

4.1% |

1.3 |

1.2 |

10% |

12% |

13% |

55% |

10% |

44% |

3% |

Czech |

14.0 |

13.5 |

13.1 |

14.2 |

13.7 |

6.8% |

5.5% |

5.7% |

1.4 |

1.3 |

10% |

10% |

10% |

-13% |

-1% |

-8% |

4% |

Egypt |

7.7 |

8.3 |

10.4 |

10.1 |

8.7 |

2.4% |

3.3% |

4% |

1.3 |

2.2 |

17% |

31% |

29% |

42% |

40% |

4% |

16% |

Greece |

17.4 |

13.8 |

15.2 |

14.9 |

12.4 |

4.1% |

4.6% |

5.0% |

0.8 |

0.8 |

5% |

5% |

6% |

28% |

-14% |

14% |

9% |

Hungary |

10.5 |

10.0 |

10.8 |

10.8 |

10.7 |

2.3% |

2.4% |

2.7% |

1.5 |

1.3 |

14% |

15% |

14% |

86% |

27% |

0% |

1% |

India |

20.2 |

17.3 |

22.2 |

19.2 |

16.1 |

1.6% |

1.6% |

1.8% |

2.9 |

2.5 |

14% |

16% |

16% |

9% |

14% |

12% |

17% |

Indonesia |

16.9 |

15.1 |

18.8 |

16.5 |

14.7 |

2.5% |

2.5% |

2.8% |

2.8 |

2.4 |

16% |

17% |

17% |

1% |

18% |

14% |

12% |

Malaysia |

17.2 |

15.7 |

17.3 |

17.4 |

15.6 |

3.5% |

3.4% |

3.4% |

1.7 |

1.5 |

10% |

10% |

10% |

6% |

4% |

-1% |

11% |

Mexico |

18.0 |

13.6 |

20.6 |

16.4 |

14.0 |

2.9% |

2.8% |

3.1% |

2.1 |

1.8 |

12% |

14% |

15% |

30% |

13% |

24% |

18% |

Pakistan |

9.2 |

7.1 |

8.9 |

9.3 |

7.0 |

6.3% |

6.5% |

7.6% |

1.2 |

1.1 |

13% |

12% |

16% |

-12% |

-6% |

-4% |

32% |

Peru |

16.4 |

13.8 |

16.9 |

15.8 |

13.7 |

2.0% |

2.6% |

3.0% |

2.4 |

2.1 |

15% |

15% |

16% |

14% |

21% |

3% |

12% |

Philippines |

19.5 |

16.9 |

20.3 |

18.3 |

16.2 |

1.6% |

1.6% |

1.7% |

2.1 |

1.9 |

11% |

12% |

12% |

5% |

7% |

11% |

13% |

Poland |

12.6 |

11.8 |

12.0 |

12.3 |

11.6 |

2.9% |

2.8% |

3.2% |

1.4 |

1.2 |

11% |

11% |

11% |

-7% |

26% |

-3% |

8% |

Qatar |

15.0 |

13.4 |

16.1 |

14.4 |

13.2 |

3.5% |

3.7% |

3.9% |

2.0 |

2.0 |

13% |

16% |

16% |

-1% |

3% |

11% |

6% |

Russia |

5.7 |

5.6 |

8.1 |

5.3 |

5.1 |

6.2% |

6.8% |

7.4% |

0.8 |

0.8 |

15% |

16% |

15% |

18% |

4% |

48% |

5% |

S Africa |

16.6 |

13.2 |

18.7 |

15.3 |

13.1 |

3.3% |

3.3% |

3.6% |

2.0 |

1.8 |

12% |

15% |

15% |

-11% |

11% |

22% |

17% |

Korea |

7.3 |

8.5 |

7.8 |

6.9 |

7.7 |

2.3% |

2.7% |

2.9% |

0.9 |

0.8 |

12% |

13% |

11% |

8% |

51% |

13% |

-10% |

Taiwan |

11.7 |

12.9 |

13.3 |

12.4 |

12.3 |

4.8% |

4.7% |

4.9% |

1.6 |

1.5 |

13% |

13% |

12% |

4% |

8% |

10% |

2% |

Thailand |

14.1 |

13.8 |

15.0 |

14.7 |

13.8 |

3.1% |

3.1% |

3.2% |

2.0 |

1.8 |

14% |

14% |

13% |

3% |

14% |

1% |

7% |

Turkey |

6.3 |

6.2 |

7.4 |

6.6 |

6.3 |

5.5% |

5.1% |

6.0% |

1.0 |

0.8 |

15% |

16% |

13% |

18% |

42% |

4% |

3% |

UAE |

9.9 |

9.0 |

10.2 |

9.5 |

8.8 |

6.2% |

5.5% |

5.8% |

1.3 |

1.2 |

14% |

14% |

13% |

6% |

4% |

8% |

7% |

Frontier |

11.3 |

9.5 |

11.9 |

9.7 |

Argentina |

10.9 |

11.6 |

26.3 |

11.1 |

Bahrain |

9.6 |

8.6 |

8.8 |

8.8 |

Bangladesh |

17.7 |

14.4 |

17.9 |

15.7 |

Croatia |

10.7 |

13.6 |

14.0 |

13.6 |

Estonia |

18.9 |

14.8 |

15.8 |

18.4 |

Ivory Coast |

6.1 |

|

6.4 |

|

Jordan |

10.7 |

7.2 |

11.4 |

8.2 |

Kazakhstan |

7.5 |

5.0 |

8.6 |

6.5 |

Kenya |

7.8 |

8.4 |

10.3 |

9.4 |

Kuwait |

15.9 |

7.5 |

14.3 |

15.1 |

Lebanon |

4.8 |

|

3.9 |

5.6 |

Lithuania |

6.0 |

7.0 |

9.5 |

5.4 |

Mauritius |

8.4 |

7.3 |

9.4 |

8.2 |

Morocco |

18.8 |

16.4 |

18.1 |

18.2 |

Nigeria |

6.0 |

5.7 |

6.7 |

6.3 |

Oman |

7.5 |

6.2 |

7.1 |

7.4 |

Romania |

6.8 |

6.6 |

7.2 |

6.6 |

Saudi Arabia |

15.0 |

14.1 |

16.3 |

14.9 |

Senegal |

12.3 |

|

10.7 |

9.4 |

Serbia |

14.0 |

2.7 |

6.0 |

3.8 |

Slovenia |

10.8 |

10.2 |

11.5 |

11.1 |

Sri Lanka |

10.3 |

12.1 |

14.0 |

11.1 |

Tunisia |

15.7 |

|

15.8 |

14.9 |

Vietnam |

21.8 |

16.4 |

25.3 |

19.0 |

Note: excludes companies with negative earnings, except

EM 12M fwd P/E vs 10yr average

12M fwd P/E

12M fwd P/E  10 yr avg

10 yr avg

20

18

16

14 12 10 8 6 4 2 0

EM

Colombia

Poland

Brazil

Taiwan

S Africa

Qatar

Czech

Mexico

Peru

Thailand

Greece

Indonesia

Chile

Malaysia

Philippines

India

8.1 |

3.8% |

4.9% |

5.0% |

1.8 |

1.3 |

16% |

17% |

17% |

-20% |

18% |

3% |

16% |

10.8 |

3.9% |

1.9% |

2.4% |

2.3 |

2.2 |

21% |

21% |

15% |

29% |

44% |

118% |

1% |

8.0 |

6.8% |

6.8% |

7.0% |

1.2 |

1.3 |

13% |

9% |

10% |

5% |

12% |

-5% |

9% |

13.3 |

2.4% |

2.0% |

2.6% |

3.7 |

3.1 |

21% |

24% |

24% |

33% |

24% |

14% |

18% |

13.5 |

3.8% |

3.6% |

3.6% |

0.8 |

1.1 |

8% |

8% |

8% |

24% |

-13% |

2% |

0% |

14.1 |

2.9% |

8.4% |

5.2% |

1.0 |

1.0 |

5% |

5% |

7% |

-18% |

-6% |

-14% |

30% |

|

7.5% |

|

|

1.6 |

|

26% |

|

|

|

|

|

|

7.3 |

5.0% |

5.4% |

5.7% |

0.9 |

0.6 |

9% |

7% |

8% |

-31% |

7% |

29% |

13% |

5.7 |

6.5% |

5.5% |

8.8% |

1.5 |

1.2 |

20% |

24% |

24% |

-17% |

30% |

33% |

14% |

8.5 |

5.6% |

6.1% |

6.6% |

2.8 |

2.2 |

36% |

29% |

30% |

3% |

11% |

10% |

11% |

13.0 |

3.4% |

7.8% |

9.7% |

1.7 |

0.9 |

11% |

11% |

12% |

9% |

4% |

-5% |

16% |

3.9 |

11.6% |

0.0% |

0.0% |

0.6 |

0.5 |

14% |

|

|

13% |

-1% |

16% |

4% |

6.9 |

3.0% |

2.4% |

3.7% |

1.0 |

0.8 |

17% |

19% |

13% |

83% |

-32% |

52% |

-21% |

7.3 |

3.7% |

3.8% |

4.3% |

1.3 |

1.1 |

15% |

15% |

15% |

15% |

1% |

14% |

13% |

17.2 |

3.8% |

3.9% |

4.0% |

3.4 |

2.5 |

18% |

17% |

17% |

11% |

10% |

2% |

6% |

5.6 |

6.8% |

7.0% |

7.5% |

1.2 |

0.5 |

20% |

19% |

20% |

13% |

32% |

13% |

8% |

6.5 |

7.0% |

6.7% |

7.1% |

0.8 |

0.6 |

11% |

10% |

11% |

-7% |

-10% |

-4% |

14% |

6.7 |

10.4% |

9.2% |

9.0% |

1.0 |

0.9 |

15% |

15% |

14% |

-35% |

35% |

9% |

-1% |

13.8 |

4.0% |

3.2% |

4.0% |

1.9 |

1.8 |

13% |

11% |

12% |

-1% |

11% |

9% |

8% |

8.8 |

9.8% |

9.7% |

10.3% |

3.1 |

2.2 |

25% |

26% |

26% |

-4% |

-15% |

13% |

7% |

3.4 |

6.3% |

|

|

1.9 |

|

14% |

|

|

|

|

|

|

10.4 |

5.6% |

5.7% |

6.0% |

1.2 |

1.1 |

11% |

10% |

11% |

-21% |

30% |

4% |

7% |

12.3 |

4.0% |

4.3% |

4.5% |

1.1 |

1.0 |

11% |

9% |

9% |

7% |

2% |

26% |

-10% |

13.5 |

3.0% |

3.0% |

3.1% |

3.6 |

|

23% |

21% |

21% |

31% |

14% |

2% |

9% |

16.1 |

2.9% |

2.0% |

2.2% |

3.6 |

3.3 |

17% |

22% |

22% |

48% |

21% |

11% |

19% |

12M fwd P/E, which are Bloomberg convention. EM and Frontier aggregate EPS growth is Bloomberg convention |

|

|||||||||||

|

|

|

|

FM 12M fwd P/E vs 10yr average |

|

|

|

|

|

|||

|

|

|

|

|

|

|

12M fwd P/E |

10 yr avg |

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

China Hungary UAE Korea Egypt Pakistan Turkey Russia |

|

Vietnam Morocco |

Estonia Bangladesh |

Saudi Arabia Croatia |

Sri Lanka Argentina Slovenia |

Frontier Bahrain |

Kenya Kuwait Mauritius |

Jordan Lithuania |

Romania Oman Nigeria |

Kazakhstan |

||

Source: Bloomberg

103

vk.com/id446425943

Renaissance Capital

14 January 2019

ESG

Valuation watch - 12M fwd P/E focus

Country |

Cons. Disc. |

Cons. Stples |

Financials |

Energy |

Healthcare |

Industrials |

IT |

Materials |

Real Estate |

Telecoms |

Utilities |

Overall |

5yr avg |

10yr avg |

S.N P/E* |

EM |

16.5 |

21.6 |

8.5 |

7.6 |

22.1 |

11.2 |

10.2 |

9.4 |

6.6 |

19.8 |

11.4 |

11.0 |

11.6 |

11.2 |

11.0 |

India |

18.0 |

40.8 |

17.3 |

11.1 |

20.5 |

20.0 |

16.7 |

13.3 |

|

|

10.2 |

17.3 |

16.7 |

15.6 |

17.4 |

Philippines |

38.0 |

26.5 |

14.1 |

|

|

16.2 |

|

|

21.5 |

12.6 |

14.9 |

16.9 |

18.1 |

16.8 |

15.4 |

Malaysia |

12.2 |

27.3 |

12.5 |

28.2 |

33.2 |

14.8 |

|

15.7 |

13.8 |

23.0 |

13.6 |

15.7 |

15.7 |

15.1 |

15.8 |

Chile |

22.4 |

17.7 |

15.7 |

14.5 |

|

21.1 |

|

15.3 |

|

28.6 |

11.5 |

15.4 |

15.6 |

15.7 |

17.5 |

Indonesia |

13.6 |

25.0 |

14.4 |

8.1 |

29.0 |

17.3 |

|

12.2 |

12.2 |

16.8 |

15.1 |

15.1 |

15.0 |

14.1 |

14.0 |

Greece |

11.5 |

|

36.3 |

|

|

|

|

15.8 |

|

15.8 |

|

13.8 |

19.8 |

15.1 |

18.6 |

Thailand |

25.0 |

24.1 |

10.1 |

10.4 |

30.6 |

34.1 |

13.7 |

9.2 |

20.6 |

19.0 |

18.4 |

13.8 |

13.9 |

12.5 |

14.1 |

Peru |

|

|

13.2 |

|

|

|

|

15.7 |

|

|

|

13.8 |

13.2 |

12.8 |

17.1 |

Mexico |

20.1 |

21.2 |

8.6 |

|

|

14.7 |

|

9.4 |

10.0 |

15.0 |

13.6 |

13.6 |

17.2 |

16.2 |

11.3 |

Czech |

|

|

11.1 |

|

|

|

|

|

|

|

17.9 |

13.5 |

13.8 |

12.1 |

14.3 |

Qatar |

|

|

12.9 |

|

|

17.0 |

|

|

|

12.1 |

12.8 |

13.4 |

12.6 |

11.6 |

13.1 |

S Africa |

15.1 |

18.1 |

10.9 |

5.2 |

11.3 |

13.9 |

|

10.0 |

10.2 |

19.2 |

|

13.2 |

14.9 |

13.2 |

11.2 |

Taiwan |

15.4 |

23.8 |

10.2 |

16.6 |

235.2 |

14.3 |

12.9 |

12.3 |

|

22.6 |

|

12.9 |

13.2 |

14.2 |

13.9 |

Brazil |

23.6 |

20.0 |

12.0 |

8.6 |

16.0 |

21.4 |

9.6 |

8.4 |

20.2 |

13.6 |

12.6 |

11.8 |

11.7 |

11.2 |

12.5 |

Poland |

20.5 |

25.2 |

12.2 |

10.3 |

|

|

|

7.0 |

|

26.2 |

|

11.8 |

12.3 |

11.9 |

13.5 |

Colombia |

|

|

10.1 |

10.2 |

|

|

|

31.7 |

|

|

10.3 |

11.3 |

12.5 |

14.8 |

14.6 |

China |

19.3 |

19.0 |

6.0 |

8.8 |

16.9 |

7.8 |

13.2 |

5.9 |

5.1 |

20.5 |

10.4 |

10.3 |

10.8 |

10.8 |

9.3 |

Hungary |

|

|

9.9 |

8.4 |

14.6 |

|

|

|

|

|

|

10.0 |

10.8 |

9.8 |

12.2 |

UAE |

|

|

10.2 |

|

|

11.3 |

|

|

5.0 |

16.2 |

|

9.0 |

12.2 |

10.9 |

11.4 |

Korea |

9.0 |

16.4 |

5.9 |

7.6 |

65.0 |

10.4 |

7.1 |

8.3 |

|

17.6 |

16.1 |

8.5 |

9.5 |

9.5 |

8.4 |

Egypt |

|

8.2 |

8.3 |

|

|

8.4 |

|

|

|

|

|

8.3 |

10.3 |

9.3 |

9.1 |

Pakistan |

|

|

7.9 |

6.0 |

|

|

|

|

|

|

|

7.1 |

8.8 |

7.9 |

9.7 |

Turkey |

9.0 |

18.0 |

4.5 |

6.1 |

|

6.2 |

|

5.3 |

|

8.2 |

|

6.2 |

8.4 |

8.9 |

6.1 |

Russia |

|

12.7 |

4.8 |

5.2 |

|

|

|

8.3 |

|

8.3 |

4.8 |

5.6 |

5.8 |

6.0 |

6.3 |

Frontier |

16.6 |

20.7 |

9.9 |

9.8 |

13.1 |

11.4 |

27.5 |

9.7 |

18.2 |

14.0 |

10.6 |

9.5 |

10.6 |

9.8 |

9.5 |

Vietnam |

|

21.8 |

15.6 |

|

|

9.3 |

|

5.8 |

19.4 |

|

14.3 |

16.4 |

16.4 |

14.0 |

15.2 |

Morocco |

8.9 |

15.5 |

14.9 |

|

|

|

|

20.3 |

|

20.0 |

|

16.4 |

16.5 |

14.9 |

17.3 |

Estonia |

|

|

|

|

|

14.0 |

|

|

|

|

|

14.8 |

10.7 |

9.1 |

11.8 |

Bangladesh |

|

|

13.1 |

|

14.6 |

|

|

|

|

14.3 |

|

14.4 |

13.7 |

13.2 |

16.1 |

Saudi Arabia |

15.6 |

23.0 |

12.5 |

13.7 |

20.1 |

11.7 |

|

13.8 |

23.7 |

18.0 |

15.0 |

14.1 |

13.4 |

12.7 |

14.9 |

Croatia |

14.4 |

|

|

|

|

|

|

|

|

13.1 |

|

13.6 |

12.1 |

11.2 |

11.6 |

Sri Lanka |

|

16.2 |

|

|

|

11.8 |

|

|

|

|

|

12.1 |

12.1 |

13.1 |

11.5 |

Argentina |

22.5 |

|

8.6 |

13.9 |

|

8.9 |

27.5 |

18.6 |

|

12.4 |

8.7 |

11.6 |

10.0 |

8.4 |

11.3 |

Slovenia |

|

|

9.4 |

|

10.3 |

|

|

|

|

|

|

10.2 |

10.8 |

11.6 |

12.7 |

Bahrain |

|

|

8.8 |

|

|

|

|

6.3 |

|

|

|

8.6 |

8.7 |

8.6 |

11.3 |

Kenya |

|

14.6 |

5.0 |

|

|

|

|

|

|

13.0 |

|

8.4 |

11.1 |

10.6 |

7.1 |

Kuwait |

|

|

10.8 |

|

|

|

|

1.1 |

10.2 |

12.6 |

|

7.5 |

11.7 |

11.6 |

7.3 |

Mauritius |

|

|

7.3 |

|

|

|

|

|

|

|

|

7.3 |

10.2 |

9.2 |

10.1 |

Jordan |

|

|

7.2 |

|

|

|

|

|

|

|

|

7.2 |

8.3 |

8.7 |

10.0 |

Lithuania |

|

|

6.8 |

|

|

|

|

|

|

|

|

7.0 |

7.7 |

14.4 |

9.4 |

Romania |

|

|

7.2 |

5.8 |

|

|

|

|

|

|

12.0 |

6.6 |

9.4 |

8.7 |

9.4 |

Oman |

|

|

6.5 |

|

|

|

|

|

|

5.7 |

|

6.2 |

8.5 |

8.8 |

7.8 |

Nigeria |

|

19.4 |

3.8 |

7.3 |

|

|

|

10.9 |

|

|

|

5.7 |

8.1 |

8.5 |

5.7 |

Kazakhstan |

|

|

4.1 |

|

|

|

|

|

|

15.0 |

|

5.0 |

6.7 |

6.4 |

6.0 |

*Sector Neutral P/E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EM Sector neutral 12M fwd P/E vs actual 12M fwd P/E |

|

|

|

FM Sector neutral 12M fwd P/E vs actual 12M fwd P/E |

|

|

|||||||||

|

Sector neutral 12M fwd P/E |

12M fwd P/E |

|

|

|

Sector neutral 12M fwd P/E |

12M fwd P/E |

|

|||||||

20 |

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

0 |

Vietnam SaudiArabia |

Slovenia Estonia Croatia |

SriLanka Bahrain Argentina |

Mauritius Jordan |

|

Oman Kuwait Kenya |

Kazakhstan Nigeria |

|

|

|

|

|

|

|

Morocco Bangladesh |

Frontier Romania Lithuania |

|||||||

Greece Chile India Peru Malaysia Philippines Colombia Czech Thailand Indonesia Taiwan Poland Qatar Brazil Hungary UAE Mexico AfricaS EM Pakistan China Egypt Korea Russia Turkey |

|

||||||||||||||

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MSCI EM vs DM 12M fwd P/E (x)

|

|

EM 12M fwd P/E (x) |

|

|||

18 |

|

DM 12M fwd P/E (x) |

|

|||

16 |

|

|

|

|

|

|

14 |

|

|

|

|

|

|

12 |

|

|

|

|

|

|

10 |

|

|

|

|

|

|

8 |

|

|

|

|

|

|

6 |

|

|

|

|

|

|

4 |

|

|

|

|

|

|

Jan-06 |

Jan-08 |

Jan-10 |

Jan-12 |

Jan-14 |

Jan-16 |

Jan-18 |

MSCI EM 12M fwd P/E (x) prem/disc. to DM |

|

|||||

10% |

|

EM premium/discount to DM |

|

|||

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

+1 SD |

|

-10% |

|

|

|

|

|

|

-20% |

|

|

|

|

avg |

|

|

|

|

|

|

|

|

-30% |

|

|

-1 SD |

|

|

|

|

|

|

|

|

|

|

-40% |

|

|

|

|

|

|

Jan-06 |

Jan-07 Jan-08 |

Jan-09 Jan-10 |

Jan-11 Jan-12 |

Jan-13 Jan-14 |

Jan-15 Jan-16 Jan-17 |

Jan-18 Jan-19 |

MSCI FM vs EM 12M fwd P/E (x)

|

|

|

FM 12M fwd P/E (x) |

|

|

||||

14 |

|

|

EM 12M fwd P/E (x) |

|

|

||||

12 |

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

Jan-10 |

Jan-11 |

Jan-12 |

Jan-13 |

Jan-14 |

Jan-15 |

Jan-16 |

Jan-17 |

Jan-18 |

Jan-19 |

MSCI FM 12M fwd P/E (x) prem/disc. to EM |

|

|

|||||||

30% |

|

FM premium/discount to EM |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

+1 SD |

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

-10% |

|

|

|

|

|

avg |

|

|

|

|

|

|

|

|

|

|

|

|

|

-20% |

|

|

|

-1 SD |

|

|

|

|

|

-30% |

|

|

|

|

|

|

|

|

|

Jan-10 |

Jan-11 |

Jan-12 |

Jan-13 |

Jan-14 |

Jan-15 |

Jan-16 |

Jan-17 |

Jan-18 |

Jan-19 |

Source: Bloomberg

104

vk.com/id446425943

Renaissance Capital

14 January 2019

ESG

Top and bottom 30 - EM ($)

|

|

|

|

|

Best/Worst |

12MF |

|

|

|

|

Best/Worst |

12MF |

||

Name |

Ticker |

|

Country |

Sector |

-1m |

P/E (x) |

Name |

Ticker |

|

Country |

Sector |

2018 |

P/E (x) |

|

Viromed |

084990 |

KQ |

Korea |

Healthcare |

29.4 |

|

Tjiwi Kimia |

TKIM IJ |

|

Indonesia |

Materials |

255.7 |

7.0 |

|

China Tower Co-H |

788 HK |

|

China |

Communications |

27.5 |

40.8 |

Fila Korea Ltd |

081660 |

KP |

Korea |

Cons. Disc. |

214.9 |

14.0 |

|

Anglogold Ashanti |

ANG SJ |

S Africa |

Materials |

26.4 |

15.1 |

Yihai Internatio |

1579 HK |

China |

Cons. Staples |

154.2 |

28.2 |

|||

Rural Electrification |

RECL IS |

India |

Financials |

22.4 |

|

China Ding Yi Fe |

612 HK |

|

China |

Financials |

144.4 |

|

||

Amorepacific |

090430 |

KP |

Korea |

Cons. Staples |

22.0 |

24.7 |

Daewoo Shipbldg |

042660 |

KP |

Korea |

Industrials |

136.0 |

15.3 |

|

CP Indonesia |

CPIN IJ |

|

Indonesia |

Cons. Staples |

19.8 |

26.8 |

CP Indonesia |

CPIN IJ |

|

Indonesia |

Cons. Staples |

125.4 |

26.8 |

|

Indiabulls Housing Fin. |

IHFL IS |

|

India |

Financials |

19.4 |

7.1 |

Irb Brasil Resse |

IRBR3 BS |

Brazil |

Financials |

109.6 |

17.3 |

||

Gold Fields |

GFI SJ |

|

S Africa |

Materials |

18.3 |

19.7 |

Indah Kiat Pulp |

INKP IJ |

|

Indonesia |

Materials |

100.1 |

6.9 |

|

Alfa |

ALFAA MM |

Mexico |

Industrials |

18.3 |

10.7 |

Jiayuan Internat |

2768 HK |

China |

Real Estate |

98.9 |

|

|||

Samsung Biologics |

207940 |

KP |

Korea |

Healthcare |

17.5 |

|

Hlb Inc |

028300 |

KQ |

Korea |

Cons. Disc. |

98.6 |

|

|

GAP Airports |

GAPB MM |

Mexico |

Industrials |

17.2 |

17.8 |

Magazine Luiza S |

MGLU3 BS |

Brazil |

Cons. Disc. |

92.7 |

44.5 |

|||

Amplats |

AMS SJ |

S Africa |

Materials |

17.0 |

16.1 |

B2W Cia Digital |

BTOW3 BS |

Brazil |

Cons. Disc. |

75.0 |

|

|||

China First Capi |

1269 |

HK |

China |

Cons. Disc. |

17.0 |

|

Suzano Papel |

SUZB3 BS |

Brazil |

Materials |

73.9 |

7.2 |

||

Perfect World -A |

002624 |

C2 |

China |

Communications |

16.8 |

15.3 |

Cemig (P) |

CMIG4 BS |

Brazil |

Utilities |

72.2 |

10.1 |

||

Telekom Malaysia |

T MK |

|

|

Malaysia |

Communications |

15.4 |

17.4 |

Bukit Asam Tbk P |

PTBA IJ |

Indonesia |

Energy |

63.6 |

9.1 |

|

Hdc Hyundai Deve |

294870 |

KP |

Korea |

Industrials |

15.3 |

|

Alibaba Health |

241 HK |

|

China |

Healthcare |

60.4 |

225.3 |

|

JG Summit |

JGS PM |

Philippines |

Industrials |

15.3 |

16.9 |

Qatar Islamic Bk. |

QIBK QD |

Qatar |

Financials |

57.1 |

14.5 |

|||

Buenaventura |

BVN UN |

Peru |

Materials |

14.7 |

18.0 |

Kingdee Intl Sft |

268 HK |

|

China |

IT |

56.9 |

38.4 |

||

Tsingtao Brew-A |

600600 |

C1 |

China |

Cons. Staples |

14.4 |

26.1 |

Qatar National Bk. |

QNBK QD |

Qatar |

Financials |

55.2 |

12.7 |

||

Amorepacific (P) |

090435 |

KP |

Korea |

Cons. Staples |

14.3 |

|

Ql Resources Bhd |

QLG MK |

Malaysia |

Cons. Staples |

53.8 |

43.6 |

||

Shandong Gold-A |

600547 |

C1 |

China |

Materials |

13.1 |

35.5 |

Posco Chemtech |

003670 |

KQ |

Korea |

Materials |

53.7 |

19.8 |

|

Amorepacific Grp. |

002790 |

KP |

Korea |

Cons. Staples |

12.6 |

25.4 |

Viromed |

084990 |

KQ |

Korea |

Healthcare |

49.4 |

|

|

Ultrapar |

UGPA3 BS |

Brazil |

Energy |

12.5 |

19.7 |

Gs E&C |

006360 |

KP |

Korea |

Industrials |

48.5 |

6.5 |

||

Interglobe Aviat |

INDIGO IS |

India |

Industrials |

12.3 |

19.8 |

China First Capi |

1269 HK |

China |

Cons. Disc. |

47.0 |

|

|||

ASUR |

ASURB MM |

Mexico |

Industrials |

12.1 |

16.9 |

Hyundai E&C |

000720 |

KP |

Korea |

Industrials |

44.5 |

12.1 |

||

Elswedy Electri |

SWDY EC |

Egypt |

Industrials |

12.1 |

8.4 |

Guangdong Investment |

270 HK |

|

China |

Utilities |

44.4 |

18.4 |

||

KEPCO |

015760 |

KP |

Korea |

Utilities |

12.0 |

19.9 |

Walsin Tech |

2492 TT |

Taiwan |

IT |

42.5 |

|

||

China Yangtze-A |

600900 |

C1 |

China |

Utilities |

12.0 |

15.4 |

Novatek |

NVTK LI |

Russia |

Energy |

42.3 |

13.0 |

||

Bharat Petroleum |

BPCL IS |

India |

Energy |

11.9 |

8.2 |

Grupa Lotos |

LTS PW |

Poland |

Energy |

41.6 |

11.0 |