- •Contents

- •Standing Against the Headwinds

- •Flat is still good

- •GEM selloff

- •Domestic backdrop: Solid and boring

- •Market overview

- •Top picks for 2018

- •Financials: Looking to Avoid Repeat of 2018 Dichotomy

- •TMT: Betting on the Digital Economy

- •Consumer: Headwinds to Abate in 2019

- •Transport: Mixed Outlook

- •Global Context

- •Russian Macro Data

- •Stock Liquidity and Commodities

vk.com/id446425943

DECEMBER 10, 2018 THE RUSSIAN EAGLE – 2019 STRATEGY: STANDING AGAINST THE HEADWINDS

Given that current sanctions on Russia from the US, EU and partners are largely based around the developments in Ukraine since 2014, the combined story of the Azov Sea and the Ukrainian election will remain key to watch for the market through 1Q19.

Market overview

While we see meaningful headwinds for global equity markets and GEMs in particular, we stay fairly constructive on Russia. We expect cheap and boring Russian equities to continue outperforming emerging markets, similar to what has happened this year. We set our 2019 year end RTS Index target at 1,400 points. This target may look ambitious given the uninspiring global economic outlook. However, achieving this target would not require much, in our view. We base this forecast on an assumption that implied ERP will come down from the current 10% to 8%. Our bottom up estimate for EPS growth in 2019 is 8% and flat in 2020. This is equivalent to P/E expansion from 5.3 to 6.3. Our base case scenario assumes the status quo continues on international relations and that Brent averages $65/bbl.

As we have already mentioned, the ERP expansion in 2018 has not been driven by fundamental changes. Sanction risks should be priced in on the cost of debt level, while ERP is responsible for equity specific risks like corporate governance and should not react to geopolitical news flow. We treat ERP expansion as a temporary market dislocation caused primarily by a bout of sanction fears in an environment of insufficient domestic demand. Assuming we do not see more significant sanction moves, ERP should tend to compress, supporting valuations.

Implied cost of equity and cost of debt |

|

Implied equity risk premium |

|||||

20% |

|

|

|

12% |

|

|

|

18% |

|

|

|

10% |

|

|

|

16% |

|

|

|

8% |

|

|

|

|

|

|

|

|

|

||

14% |

|

|

|

6% |

|

|

|

12% |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

10% |

|

|

|

4% |

|

|

|

|

|

|

|

|

|

|

|

8% |

|

|

|

2% |

|

|

|

|

|

|

|

|

|

|

|

6% |

|

|

|

0% |

|

|

|

|

|

|

|

|

|||

Jul ’15 Jan ’16 Jul ’16 Jan ’17 |

Jul ’17 Jan ’18 Jul ’18 |

|

Jul ’15 Jan ’16 Jul ’16 Jan ’17 Jul ’17 Jan ’18 Jul ’18 |

||||

|

|

|

|

|

|

||

|

Implied cost of equity |

Corp bond yield, Cbonds |

|

Source: Sberbank CIB Investment Research |

|||

|

|

|

|

|

|||

Source: Cbonds, Sberbank CIB Investment Research

Any bigger rerate would require a repricing of cost of debt and can only materialize once the fear of new sanctions has disappeared from investors’ minds. Cost of debt of 7 8% could be considered reasonable in this case, given the 4% inflation target. After all, we saw corporate bond yields approaching 7% just before the April 2018 sanctions announcement. ERP in this case should compress even more, to the historic mean of 5 6%. In this scenario, Russia’s P/E could move up to around 8, or roughly 50% higher than now. While this is not our core scenario, this option is worth considering to gain an idea of the magnitude of upside risk.

It is of course not realistic to forecast with certainty when the US (or the EU and partners) might decide to again shift policy on Russia, be it in a bullish or bearish way for markets. Hence, it makes the most sense to be overweight stocks that can outperform against any geopolitical backdrop.

Exporters give exactly that opportunity, in our view. If the backdrop for international relations does not improve, foreign capital outflows are likely to continue. Moreover, the CBR is bound to resume its FX interventions in January after having taken a pause in September. Adding the FX purchases to ongoing capital outflows should weaken the ruble and benefit exporters.

If, on the other hand, sanction risks materially dissipate, the whole market could see a spectacular rerating, including energy stocks. Of course, the ruble would be likely to appreciate in this scenario,

12 |

SBERBANK CIB INVESTMENT RESEARCH |

This document is being provided for the exclusive use of iremizov1@bloomberg.net |

This document is being provided for the exclusive use of iremizov1@bloomberg.net |

vk.com/id446425943

THE RUSSIAN EAGLE – 2019 STRATEGY: STANDING AGAINST THE HEADWINDS DECEMBER 10, 2018

and exporters would underperform in relative terms, but in absolute terms they would do quite well anyway, as a rising tide raises all boats.

Were market concerns that the US will consider more measures to dissipate (either from the simple passage of time or via a policy shift, such as a focus shift to more pressing issues such as Saudi Arabia or China), banks would be best set to perform in an overall improved outlook for the Russian economy and market. The banking sector was beaten down the most in April and August. In fact, banks are now the highest beta sector in an otherwise low beta market, another reason they should outperform if sentiment turns materially more positive.

Sector beta to RTS

Financials

Media/Internet

Metals&Mining

Utilities

Telecoms

Oil&Gas

Transport

Consumer

0.0 |

0.5 |

1.0 |

1.5 |

2.0 |

Source: Sberbank CIB Investment Research

Top picks for 2018

█Lukoil. The company’s approach to dividend payouts promises the best dividend yield in the sector, and its commitment to dividends is relatively strong. The management has also indicated that buybacks will accelerate next year. This implies that the total return could improve by around 3 pp (or almost 50%) to 10% (including a 5% dividend yield).

█Novatek. The company has stayed ahead of expectations and has continued to exhibit solid execution on its LNG strategy throughout the year. It launched its Yamal LNG project well ahead of schedule and signed up its first partner in the Arctic LNG 2 project. We expect key catalysts to materialize for the stock next year, such as the announcement of the FID for Arctic LNG 2 and new partners for projects. The first cash flow from Yamal LNG and SeverEnergia could lead to discussion of a higher dividend payout toward the end of the year.

█Norilsk Nickel. The stock is set to deliver a double digit dividend yield next year. On top of this, the company has finally drawn up a growth plan, including for the South Cluster, a project that boasts rather attractive economics. This should help the company solidify its leadership in the global palladium market.

█TCS Bank. TCS Bank amply illustrates the share price fundamentals dichotomy, with almost 40% EPS growth expected and 60% ROE in 2018 but a share price that has been dragged down with other Russian banks. We think another year of 20%+ EPS growth looks likely, while the overall build out of the ecosystem (8 mln customers) and non credit card businesses are progressing well.

█InterRAO UES. The company’s combination of strong financial indicators and cheap valuation (a current EV/EBITDA of 1.4, or 3.7 if the net cash position and treasury stake are not accounted for) makes it an attractive investment opportunity. For the upside to materialize in this classic deep value story, the market will need to see the company start using the cash it has accumulated, either via major M&A deals or dividend distributions.

SBERBANK CIB INVESTMENT RESEARCH |

13 |

This document is being provided for the exclusive use of iremizov1@bloomberg.net |

This document is being provided for the exclusive use of iremizov1@bloomberg.net |

vk.com/id446425943

DECEMBER 10, 2018 THE RUSSIAN EAGLE – 2019 STRATEGY: STANDING AGAINST THE HEADWINDS

█Yandex. Although we strategically prefer exporters and are wary of tech in the wider global macro environment, we like Yandex as it is in its best ever fundamental shape given improved visibility over the profitability of the taxi segment (which could make the plans for an IPO more viable) and the monetization of new verticals, including Zen, Yandex.Auto and Yandex.Station. We think the market should slowly but surely start to price in these factors.

█Mail.ru Group. In general, we strategically prefer exporters. But within domestics, Mail.ru Group’s outlook for ad and gaming revenues remains solid, and there are a number of positive catalysts that we expect in 2019, including the closing of the AliExpress Russia JV deal and the crystallization of the value of the O2O businesses.

APKuznetsov@sberbank-cib.ru, Cole_Akeson@sberbank-cib.ru

14 |

SBERBANK CIB INVESTMENT RESEARCH |

This document is being provided for the exclusive use of iremizov1@bloomberg.net |

This document is being provided for the exclusive use of iremizov1@bloomberg.net |

vk.com/id446425943

THE RUSSIAN EAGLE – 2019 STRATEGY: STANDING AGAINST THE HEADWINDS DECEMBER 10, 2018

STRATEGY SUMMARY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

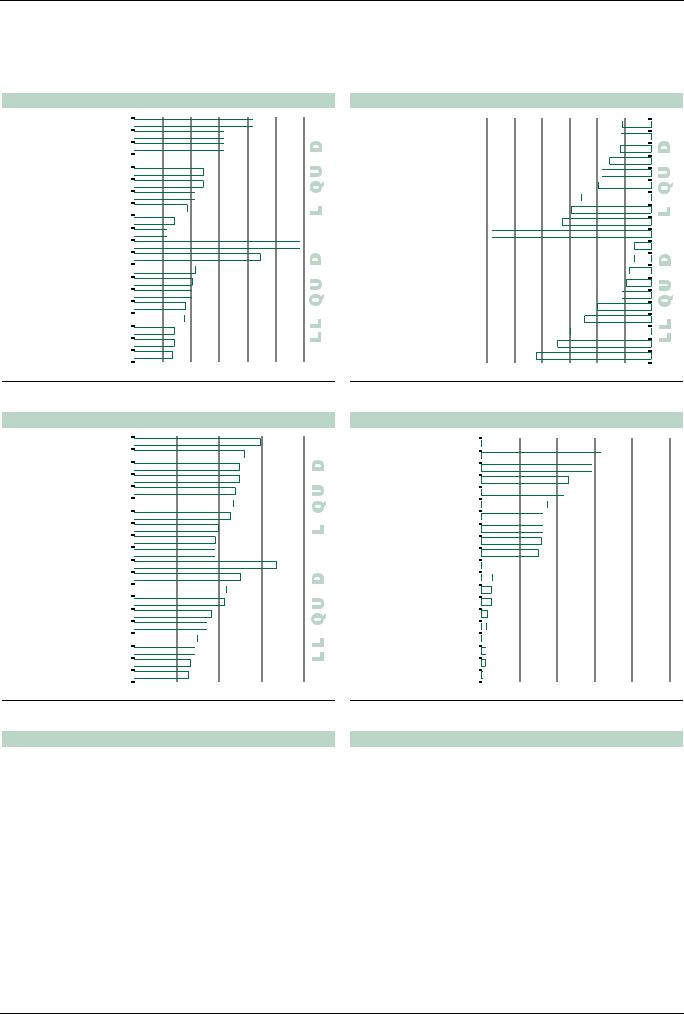

Sector performance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RTS Index relative to peers, Dec ’17 = 100 |

|||||

Gas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7% |

|

|

20% |

120 |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Oil |

|

|

|

|

|

|

|

|

|

|

|

|

|

1% |

|

|

|

|

|

|

19% |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Russia Exporters |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3% |

|

9% |

|

|

|

110 |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

RTS |

|

|

|

|

|

|

2% |

|

|

|

|

|

|

|

5% |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Steel |

|

|

|

|

|

|

7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|

9% |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Precious metals |

|

|

|

|

|

|

3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Media and IT |

|

|

|

|

|

|

4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

90 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Real estate |

20% |

|

|

4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Telecoms |

20% |

|

|

0% |

|

|

|

|

1% |

|

|

|

|

|

|

|

80 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Fertilizers |

21% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec ’17 Feb ’18 |

Apr ’18 Jun ’18 |

Aug ’18 Oct ’18 Dec ’18 |

||||||||

Transport |

22% |

|

|

|

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11% |

|

|

|

|

RTS Index |

Relative to MSCI EM |

Relative to MSCI World |

|||||||

Base metals |

23% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

5% |

|

|

|

|

|

|

|||||||||||||

Russia Domestics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

25% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: Sberbank CIB Investment Research |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8% |

|

|

|

|

|

|

||||||||||

Banks |

26% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Utilities |

28% |

|

|

|

|

|

1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Consumer 38% |

|

|

|

|

|

|

|

3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40% |

20% |

0% |

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

3m |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YTD |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

Source: Bloomberg, Sberbank CIB Investment Research |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

Russian sectors’ 2018E P/E as % of GEM peers |

|

|

|

|

|

|

Forward P/E |

|

|

|

|

|

|

|||||||||||||||

Media and IT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Real estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Gas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telecoms |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Steel |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Banks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base metals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Retail |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Russia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Utilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2005 |

2007 |

2009 |

2011 |

2013 |

2015 |

2017 |

||||

0% |

20% |

40% |

60% |

80% |

100% |

120% |

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Russia |

EM |

|

DM |

|

Russia excl. oil and gas |

|||

Source: Bloomberg, Sberbank CIB Investment Research |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Source: Thomson Reuters, Sberbank CIB Investment Research |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Sector valuation ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

MCap |

|

|

|

P/E |

|

|

EV/EBITDA |

|

EPS growth |

|

P/BV |

Div yield |

Net debt/EBITDA |

|||||||||||

|

|

|

|

|

ADT |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

$ mln |

$ mln |

2018E |

2019E |

|

2018E |

2019E |

|

2018E |

2019E |

|

2018E |

|

2018E |

2018E |

||||||||||

Financials |

84,484 |

|

364 |

4.9 |

|

|

4.6 |

|

|

– |

|

– |

|

1% |

5% |

|

1.1 |

|

8.8% |

– |

||||||||

Oil |

202,655 |

|

281 |

5.9 |

|

|

5.5 |

|

3.6 |

3.4 |

|

47% |

6% |

|

0.7 |

|

6.8% |

56% |

||||||||||

Gas |

108,516 |

|

165 |

5.0 |

|

|

4.3 |

|

3.9 |

3.8 |

|

43% |

20% |

|

0.5 |

|

3.8% |

102% |

||||||||||

Media |

23,693 |

|

147 |

23.9 |

17.9 |

|

13.6 |

9.7 |

|

14% |

33% |

|

3.3 |

|

0.0% |

226% |

||||||||||||

Base metals |

37,132 |

|

63 |

5.3 |

|

|

4.8 |

|

5.4 |

4.8 |

|

66% |

8% |

|

2.8 |

11.6% |

220% |

|||||||||||

Precious metals |

25,862 |

|

63 |

9.1 |

|

|

7.8 |

|

6.2 |

5.5 |

|

9% |

12% |

|

1.8 |

|

5.5% |

123% |

||||||||||

Steel |

43,127 |

|

60 |

6.4 |

|

|

7.7 |

|

4.1 |

4.6 |

|

32% |

16% |

|

2.1 |

12.3% |

56% |

|||||||||||

Telecoms |

20,721 |

|

45 |

9.6 |

|

|

8.6 |

|

3.3 |

3.1 |

|

76% |

11% |

|

1.2 |

|

8.3% |

140% |

||||||||||

Consumer |

19,502 |

|

36 |

11.2 |

10.7 |

|

5.6 |

5.2 |

|

1% |

7% |

|

1.7 |

|

4.2% |

156% |

||||||||||||

Utilities |

12,800 |

|

16 |

2.8 |

|

|

3.1 |

|

3.1 |

3.3 |

|

12% |

9% |

|

0.2 |

|

8.6% |

143% |

||||||||||

Transport |

|

|

6,079 |

|

15 |

7.4 |

|

|

5.8 |

|

5.2 |

4.3 |

|

16% |

31% |

|

1.9 |

|

6.8% |

156% |

||||||||

Other |

21,840 |

|

13 |

5.0 |

|

|

4.5 |

|

2.7 |

2.3 |

|

23% |

12% |

|

0.5 |

|

4.7% |

81% |

||||||||||

Fertilizers |

11,638 |

|

6 |

6.1 |

|

|

6.3 |

|

5.4 |

5.2 |

|

25% |

5% |

|

2.4 |

|

4.7% |

206% |

||||||||||

Real Estate |

|

|

5,419 |

|

2 |

5.7 |

|

|

5.7 |

|

4.2 |

4.3 |

|

72% |

5% |

|

1.2 |

|

9.0% |

70% |

||||||||

Russia |

618,152 |

|

1,274 |

5.8 |

|

|

5.4 |

|

4.0 |

3.8 |

|

30% |

8% |

|

0.8 |

|

6.8% |

94% |

||||||||||

Russia Domestics |

179,445 |

|

580 |

5.8 |

|

|

5.4 |

|

3.7 |

3.5 |

|

4% |

6% |

|

0.8 |

|

7.0% |

118% |

||||||||||

Russia Exporters |

438,707 |

|

694 |

5.8 |

|

|

5.4 |

|

4.0 |

3.9 |

|

44% |

8% |

|

0.8 |

|

6.7% |

87% |

||||||||||

EM |

|

|

– |

|

|

– |

11.0 |

|

|

9.9 |

|

6.5 |

5.9 |

|

18% |

11% |

|

1.4 |

|

3.6% |

109% |

|||||||

DM |

|

|

– |

|

|

– |

15.5 |

14.4 |

|

9.7 |

8.9 |

|

14% |

9% |

|

2.2 |

|

2.7% |

150% |

|||||||||

Source: Bloomberg, Sberbank CIB Investment Research

SBERBANK CIB INVESTMENT RESEARCH |

15 |

This document is being provided for the exclusive use of iremizov1@bloomberg.net |

This document is being provided for the exclusive use of iremizov1@bloomberg.net |

vk.com/id446425943

DECEMBER 10, 2018 THE RUSSIAN EAGLE – 2019 STRATEGY: STANDING AGAINST THE HEADWINDS

STOCK SUMMARY

Top performers, Q o Q

Polymetal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21% |

|

|

|

|

|

Polyus |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Mail.ru Group |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Norilsk Nickel |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14% |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Gazprom |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12% |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

X5 Retail Group |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12% |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Sberbank |

|

|

|

|

|

|

|

|

|

|

|

|

11% |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Sberbank pref |

|

|

|

|

|

|

|

|

|

9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

QIWI |

|

|

|

|

|

|

7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Lukoil |

|

|

|

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Raspadskaya |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22% |

|

|

|||

Transneft pref |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Bashneft pref |

|

|

|

|

|

|

|

|

|

|

11% |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Raven Russia |

|

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

RosSeti |

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Lenenergo pref |

|

|

|

|

|

|

|

9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Gazprom Neft |

|

|

|

|

|

|

9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Unipro |

|

|

|

|

|

7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Bank of St Petersburg |

|

|

|

|

7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Rusagro |

|

|

|

7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

0% |

5% |

10% |

15% |

20% |

25% |

30% |

|

|||||||||||||||||||||

Source: Bloomberg

Highest dividend yields

NLMK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14.9% |

|

|

||

Severstal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13.1% |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

MTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.5% |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

RusHydro |

|

|

|

|

|

|

|

|

|

|

|

|

|

12.5% |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

MMK |

|

|

|

|

|

|

|

|

|

|

|

|

|

11.9% |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Norilsk Nickel |

|

|

|

|

|

|

|

|

|

|

|

|

|

11.8% |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

VEON |

|

|

|

|

|

|

|

|

|

|

|

11.4% |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Surgutneftegaz pref |

|

|

|

|

|

|

|

|

|

10.0% |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Moscow Exchange |

|

|

|

|

|

|

|

|

9.6% |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

VTB |

|

|

|

|

|

|

|

9.6% |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bashneft |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16.8% |

|

|

|

Enel Russia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.6% |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Federal Grid Company |

|

|

|

|

|

|

|

|

11.0% |

|

|

|

|

|||||||||

Globaltrans |

|

|

|

|

|

|

|

10.7% |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Gazprom Neft |

|

|

|

|

|

|

9.2% |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Unipro |

|

|

|

|

|

8.6% |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Rostelecom |

|

|

|

|

7.5% |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Detsky Mir |

|

|

|

7.2% |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

O`Key |

|

|

6.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

PhosAgro |

|

|

6.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

0% |

5% |

10% |

|

|

15% |

20% |

|

|||||||||||||||

Source: Sberbank CIB Investment Research

Biggest underperformers, Q o Q

TCS |

5% |

|

|

|

|

|

|

|

||||||||||

Yandex |

5% |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|||||||||||||

VEON |

6% |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

||||||||||||

Severstal |

7% |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|||||||||||

Tatneft |

9% |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||||

EPAM Systems |

10% |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||||||

Evraz |

13% |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Magnit |

15% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

RusHydro |

16% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Luxoft 29% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Global Ports |

3% |

|

|

|

|

|

||||||||||||

PIK Group |

3% |

|

|

|

|

|

||||||||||||

|

|

|

|

|||||||||||||||

LSR Group |

4% |

|

|

|

|

|

||||||||||||

|

|

|

|

|

||||||||||||||

Mechel |

5% |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|||||||||||||

Mosenergo |

5% |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

||||||||||||

Petropavlovsk |

10% |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||||||

O`Key |

12% |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Globaltrans |

15% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Lenta |

17% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

TMK |

21% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30% 25% 20% 15% 10% 5% 0%

Source: Bloomberg

Lowest and highest P/BV

Polyus |

|

|

|

|

|

|

|

|

|

|

|

7.9 |

Norilsk Nickel |

|

|

|

|

|

|

|

|

|

6.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

EPAM Systems |

|

|

|

|

|

|

|

|

5.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

TCS |

|

|

|

|

|

|

4.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Yandex |

|

|

|

|

|

|

4.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Severstal |

|

|

|

|

3.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Novatek |

|

|

|

3.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

MTS |

|

|

|

3.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

PIK Group |

|

|

|

3.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Evraz |

|

|

|

3.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Sistema |

0.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Rostelecom |

0.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Obuv Rossii |

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Transneft pref |

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Bank of St Petersburg |

0.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

RusHydro |

0.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Gazprom |

0.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Surgutneftegaz |

0.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Federal Grid Company |

0.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Rosseti |

0.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

0 |

2 |

|

4 |

|

6 |

8 |

10 |

|||||

Source: Sberbank CIB Investment Research

Major upgrades this quarter

|

Recommendation |

Target price, $ |

Change |

||

|

From |

To |

From |

To |

in TP |

Aeroflot |

SELL |

HOLD |

1.61 |

1.56 |

3% |

Enel Russia |

HOLD |

BUY |

0.0255 |

0.0206 |

19% |

Polyus |

BUY |

BUY |

38.53 |

44.00 |

14% |

Polymetal |

HOLD |

HOLD |

9.64 |

10.60 |

10% |

Source: Sberbank CIB Investment Research

Major downgrades this quarter

|

|

Rec |

Target price, $ |

Change |

|

|

From |

To |

From |

To |

in TP |

Lenta |

BUY |

BUY |

8.00 |

5.50 |

31% |

O`Key |

SELL |

SELL |

2.10 |

1.50 |

29% |

Obuv Rossii |

BUY |

BUY |

2.85 |

2.09 |

27% |

Luxoft |

BUY |

BUY |

61.89 |

47.68 |

23% |

VTB |

HOLD |

HOLD |

2.00 |

1.60 |

20% |

X5 Retail Group |

BUY |

BUY |

38.00 |

31.00 |

18% |

Magnit |

HOLD |

HOLD |

20.00 |

17.00 |

15% |

Source: Sberbank CIB Investment Research

16 |

SBERBANK CIB INVESTMENT RESEARCH |

This document is being provided for the exclusive use of iremizov1@bloomberg.net |

This document is being provided for the exclusive use of iremizov1@bloomberg.net |

vk.com/id446425943

THE RUSSIAN EAGLE – 2019 STRATEGY: STANDING AGAINST THE HEADWINDS DECEMBER 10, 2018

Oil and Gas: Keep “Maneuvering” the

Macro Tailwinds

KEY DEVELOPMENTS

The Russian energy sector has gained 17% this year, outperforming the MSCI EM Energy Index by 10% and Brent by circa 30%. Brent had been rising steadily for most of the year, peaking at $86/bbl in October (up around 30% YTD). However, since then it has dropped back to a low of $59/bbl (down 12% YTD).

As we had anticipated, Novatek has been the best performer this year, up 42% YTD. The call we made in February and reiterated in July returned 25% versus the sector YTD. Novatek is followed by Tatneft commons, Gazprom Neft and Lukoil, which saw 26 28% gains. All of these names have substantially improved their distribution of cash flow to shareholders. Transneft prefs, Surgutneftegaz and Bashneft commons lagged the sector.

STRATEGIC VIEW

The sector demonstrated solid improvement in its financial performance this year on the back of the oil price recovery and the still weak ruble. Current market conditions and the macro outlook suggest a still relatively favorable outlook for Russian oil and gas producers, with the oil price in ruble terms almost flat y o y despite the recent correction. That said, our preference in the sector is for the names where we can still see further material improvement in the payout to shareholders.

The so called “tax maneuver” approved for the oil sector in 2019 24 replaces downstream export duty related subsidies with a direct recoverable excise. The impact on the integrated oil companies would seem to be fairly limited at first glance. However, the domestic product market, a big part of their business, will effectively become regulated. This is not something that has been fully acknowledged by the market, but the effects could become visible if oil prices move significantly from the current levels. We expect the oil companies to be more careful in budgeting for their downstream projects and focus more on greenfield opportunities in the upstream, where the government could be more generous with tax incentives.

TOP PICKS

█Lukoil. The company’s approach to dividend payouts promises the best dividend yield in the sector, and its commitment to dividends is relatively strong. Although the dividend is unlikely to increase by more than 10% y o y on a per share basis, the management has indicated that buybacks will accelerate next year. This implies that the total return could improve by around 3 pp (or almost 50%) to 10% (including a 5% dividend yield).

█Novatek. The company stayed ahead of expectations and continued to exhibit solid execution on its LNG strategy throughout the year. It launched its Yamal LNG project well ahead of schedule and signed up its first partner in the Arctic LNG 2 project. We expect key catalysts to materialize for the stock next year, such as the announcement of the FID for Arctic LNG 2 and new partners for projects. The first cash flow from Yamal LNG and SeverEnergia could lead to discussion of a higher dividend payout toward the end of the year.

Andrey_Gromadin@sberbank-cib.ru; Anna_Kotelnikova@sberbank-cib.ru

SBERBANK CIB INVESTMENT RESEARCH |

17 |

This document is being provided for the exclusive use of iremizov1@bloomberg.net |

This document is being provided for the exclusive use of iremizov1@bloomberg.net |

vk.com/id446425943

DECEMBER 10, 2018 THE RUSSIAN EAGLE – 2019 STRATEGY: STANDING AGAINST THE HEADWINDS

OIL AND GAS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Performance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sector performance versus peers and RTS |

|

|

||

Novatek |

|

9% |

|

|

|

|

|

|

1% |

|

|

|

|

|

|

|

|

|

42% |

140 |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Tatneft |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28% |

|

|

130 |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Gazprom Neft |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9% |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28% |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Lukoil |

|

2% |

|

|

|

|

|

|

|

6% |

|

|

|

|

26% |

|

|

120 |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Rosneft |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24% |

|

|

110 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Tatneft pref |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19% |

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Bashneft pref |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17% |

|

|

100 |

|

|

|

|

|||||||||

Russian oil and gas |

|

|

|

|

|

|

|

|

|

|

|

|

4% |

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

17% |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Surgutneftegaz pref |

|

|

|

|

|

|

|

|

|

|

|

|

4% |

|

15% |

|

|

90 |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

MSCI EM Energy |

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec ’17 Feb ’18 |

Apr ’18 Jun ’18 Aug ’18 Oct ’18 Dec ’18 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Gazprom |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12% |

|

|

|

|

|

|

|

Russian oil and gas |

Relative to MSCI World Energy |

Relative to RTS |

||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6% |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

MSCI World Energy |

|

12% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

9% |

|

|

|

|