- •Introduction

- •1 . General characteristic of financial investments

- •1.2 Features of financial investments management .

- •1.3Models of estimation of cost of financial instruments of investment

- •2.Method of an assessment of profitability and risk of financial investments

- •2.1.Concept of profitability

- •2.2.Classification of investment activities risks

- •2.3.Risk and profitability ratio.

- •3. Analysis of Program on attraction of investments, development of special economic zones and export promotion in the Republic of Kazakhstan for 2010 - 2014 years.

- •3.1Passport of the program.

- •4. Ways of improvement of the mechanism of attracting investments into the economy of Kazakhstan

1.3Models of estimation of cost of financial instruments of investment

Efficiency of separate financial instruments of investment, as well as real investments, is determined on the basis of comparison of volume of investment expenses, on the one hand, and the sums of a returnable cash flow by them, with another. At the same time, formation of these indicators in the conditions of financial investment has essential distinctive features.

First of all, in the sum of a returnable cash flow at financial investment there is no indicator of depreciation charges as financial instruments, unlike real investments, don't contain in the structure of depreciable assets. Therefore the basis of the current returnable cash flow on financial instruments of investment is made by the sums of percent periodically paid on them (on deposits to authorized capitals; on deposit deposits in banks; on bonds and other debt securities) and dividends (on stocks and other share securities).

Besides, so far as financial assets of the enterprise (what financial instruments of investment are) won't be amortized, they are on sale (are repaid) at the end of the term of their use by the enterprise (or at the end of the caused fixed term of their address) at that price which developed on them at the time of sale in the financial market (or on in advance caused fixed their sum). Therefore, the cost of their realization is a part of a returnable cash flow on financial instruments of investment upon termination of the term of their use (the fixed cost on debt financial assets and the current course cost on share financial assets).

Certain differences develop and in formation of rate of return on the invested capital. If on real investments this indicator show level of the forthcoming operating profit which develops in the conditions of objectively existing branch restrictions, on financial investments the investor himself chooses the expected rate of return taking into account a risk level of investments in various financial instruments. Careful (or conservative) the investor will prefer a choice of financial instruments with a low risk level (and respectively and with low norm of investment profit) while risky (or aggressive) the investor will prefer a choice for investment of financial instruments with high norm of investment profit (despite of a high risk level on them).

So far as the expected norm of investment profit is set by the investor, this indicator forms also the sum of investment expenses of this or that instrument of financial investment which has to provide it the expected sum of profit. This settlement sum of investment expenses represents the real cost of a financial instrument of investment which develops in the conditions of the expected rate of return on it taking into account an appropriate level of risk.

If the actual sum of investment expenses on a financial instrument exceeds its real cost, efficiency of financial investment will decrease (i.e. the investor won't get the expected sum investment profit). To the contrary, if the actual sum of investment expenses will be below the real cost of a financial instrument, efficiency of financial investment will increase (i.e. the investor will get investment profit in the sum, bigger than expected).

Taking into account stated the assessment of efficiency of this or that financial instrument of investment is reduced to an assessment of its real cost providing expected norm of investment profit on it. The basic model of estimation of cost of a financial instrument of investment has the following appearance:

PV=∑

Where PV — the real cost of a financial instrument of investment;

CF — an expected returnable cash flow during use of a financial instrument;

r — the expected rate of return on the financial instrument, expressed in decimal fraction (formed by the investor independently taking into account a risk level);

n — number of the periods of formation of returnable streams (in all their forms).

Features of formation of a returnable cash flow determine a variety of variations of used models of an assessment of their real cost by separate types of financial instruments.

We will consider the maintenance of these models in relation to debt and share financial instruments of investment on the example of bonds and actions.

Models of estimation of cost of bonds are constructed on the following initial indicators: a) bond face value: b) the sum of percent paid on the bonds; c) expected norm of gross investment profit (standard of profitability) on the bond: d) quantity of the periods to a bond maturity date.

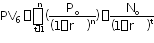

The basic model of estimation of cost of the bond [Basis Bond Valuation Model] or the bond with periodic payment of percent has the following appearance:

WhereCB — the real cost of the bond with periodic payment of percent;

P0 — the sum of percent paid in every period (representing work of its face value on the declared rate of percent);

Models of estimation of cost of actions are constructed on the following initial indicators: a) type of an action — exclusive or simple; b) the sum of dividends assumed to receiving in the concrete period; c) expected course stock price at the end of the period of its realization (when using action during in advance defined period); d) expected norm of gross investment profit (standard of profitability) on actions; e) number of the periods of use of an action.

The model of estimation of cost of the preference share is based that these actions grant the right them to owners on receiving regular dividend payments in a fixed size. It has the following appearance:

PV = D/r

where CPS — the real cost of the preference share;

D — the sum of dividends provided to payment on the preference share in the forthcoming period;

r — expected norm of gross investment profit (profitability) on the preference share, expressed in decimal fraction.

The economic maintenance of this model consists that the current real cost of the preference share represents private from division of the sum of the dividends provided on it into norm of gross investment profit expected by the investor.