- •Introduction

- •1 . General characteristic of financial investments

- •1.2 Features of financial investments management .

- •1.3Models of estimation of cost of financial instruments of investment

- •2.Method of an assessment of profitability and risk of financial investments

- •2.1.Concept of profitability

- •2.2.Classification of investment activities risks

- •2.3.Risk and profitability ratio.

- •3. Analysis of Program on attraction of investments, development of special economic zones and export promotion in the Republic of Kazakhstan for 2010 - 2014 years.

- •3.1Passport of the program.

- •4. Ways of improvement of the mechanism of attracting investments into the economy of Kazakhstan

2.2.Classification of investment activities risks

In a general view classification of the risks most significant and specific to investment is presented in Figure 5.

Investment risk

Specific risks

Inflation

Risks of investment portfolio

Risk of investment objects

Internal economic

External economic

General risks

Operational risk

Risks connected with measures of state Regulation

Risk of misbalance

Selective risk

Regional risk

Credit risk

Ecological

Country risk

Liquidity risk

Tactical

Capital risk

Excessive econcentration

Time term risk

Social-political

Industry risk

Another risks

Figure -5.

Note – Done by author based on [3]

Definition of criteria and ways of risk analysis.

The following block of process of regulation of risks is definition of criteria and ways of risk analysis. For this purpose in relation to each object of investment it is expedient to develop a complex of indicators under articles of the nomenclature of risks identified earlier and to determine critical and optimum values by separate indicators and their complex.

As the investment risk characterizes probability of short-reception of the expected income, its level is estimated as a rejection of the expected income on investments from average or settlement size. At calculation of probability of obtaining the expected income can be used both statistical data, and expert estimates. However at insufficiently representative statistics the best method processing by experts of statistical information and implementation on this basis of expert estimates is represented.

Traditionally statistical assessment of investment risks is carried out by two methods:

1) method of probabilistic distribution;

2) methodof an assessment on coefficient .

Measurement of investment risks on the basis of probabilistic distribution proceeds from consideration of the expected income on investment investments as casual variable and existence of probabilistic distribution of its possible values. According to it the risk level is estimated by the following sizes:

Mathematic

expectations of profitability : M[E]= );

);

Profitability

dispersions : =

= ;

;

Mean

square deviation of profitability: =

= ;

;

Coefficient

of variation : =

= /M(E)

;

/M(E)

;

where –

–

p –probability ;

n–numberofobservations.

Thus the most probable value of profitability Aver is in the range

M(E)- <

< <M(E)+

<M(E)+

In case of identical values of level of the expected income more reliable are investments which are characterized by smaller value of the mean square deviation showing a volatility of probability of receipt of the expected income (a profitability variation).

In case of distinction of values of the average levels of profitability on compared investment objects the choice of the direction of investments proceeding from values of a variation is impossible therefore in these cases the investment decision is made on the basis of the coefficient of a variation estimating the extent of risk at a size of profitability. The preference is given to those investment projects according to which value of coefficient of a variation is lower that testifies to the best ratio of the income and risk.

Evaluation method on coefficient it is used in case of risk identification of this investment object (generally share tools) in relation to level of systematic (market) risk. The coefficient is determined by a formula.

where Kr — correlation between profitability of this share tool and the average level of profitability of share tools as a whole;

—

a

mean square deviation of profitability on this share tool;

—

a

mean square deviation of profitability on this share tool;

—

a

mean square deviation of profitability on the security market as a

whole.

—

a

mean square deviation of profitability on the security market as a

whole.

In case of β = 1 this share tool is characterized by the average level of risk, in case of β>1 — a high risk level and in case of β<1 — a low risk level. Therefore, to increase β there is an increase of level of systematic risk of investment investments.

Use of statistical methods for a risks assessment of investing activities in the Russian economy has limited nature that is connected with absence or not representativeness of statistical data on many investment objects. With a certain degree of care statistical methods can be applied to risk analysis on a number of share tools, in particular on the most traded corporate securities. However the risks assessment of investment crediting and project financing on the basis of statistical methods, as a rule, isn't reliable.

In the absence of necessary information and statistical data for calculation of size of risks on the basis of statistical methods the risks assessment is carried out by an expert way. For this purpose in relation to each investment object it is reasonable to develop a complex of indicators under articles of the nomenclature of risks identified earlier and to determine limiting and optimum values by separate indicators and their complex.

After determination of simple risks the issue of a choice of a method of data of various indicators to a single integrated assessment is resolved. As such method it is possible to use one of traditional methods of receipt of rating indicators: index method, method of distances, the relative sizes, the weighed mark estimates.

For an assessment of a role of separate risks in general risk weighing is used; thus various approaches can be applied to each investment object in case of observance of such general requirements, as not negativity of weight coefficients and equating of their amount with unit.

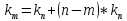

The greatest attention is deserved by the approach assuming ranging of separate risks on degrees of priority and determination of weight coefficients of k according to the importance of these risks. So, the maximum value of weight coefficient k1prisvaivayetsya to the risks having in the circumstances paramount value, the minimum kn — risks of the last rank; risks with the equal importance receive identical weight coefficients. Value of a ratio between weight coefficients of the first and last ranks (q = k1/kn) is determined also. As a method of weighing calculation of the average arithmetic or average geometrical is used. The distance between the next ranks can be estimated on a formula:

(q-1)/(n-1)

(q-1)/(n-1)

The weight coefficient of separate risk with a rank of m makes

=

= +(n-m)s

+(n-m)s

From here

(q-1)/(n-1)

=

(q-1)/(n-1)

=

[1+(n-m)(q-1)(n-1)]

[1+(n-m)(q-1)(n-1)]

If simple risks aren't ranged on priority degree, they, respectively, have equal weight coefficients (1/n).

For the purpose of control of reliability of results of a risks assessment when using weight coefficients according to degree of priority it is possible to estimate general risk of an investment object, applying the weight coefficients found by means of accidental distribution. As values of weight coefficients it is possible to use, in particular, average size (1/n) and the size of the mean square deviation calculated proceeding from possible value of coefficient of a variation (Var/ n).