- •Contents

- •Investment summary

- •Total sector return in 2018 YtD

- •Upstream outlook for 2019

- •A year of regulatory change

- •Downstream outlook: EE refiners

- •Gas market outlook

- •Company profiles

- •Rosneft

- •LUKOIL

- •Surgutneftegas

- •Gazprom Neft

- •Tatneft

- •Gazprom

- •NOVATEK

- •Transneft

- •MOL Group

- •Grupa LOTOS

- •OMV Petrom

- •Tupras

- •Petkim

- •Appendix 1. Oil price outlook

- •Disclosures appendix

vk.com/id446425943

Total sector return in 2018 YtD

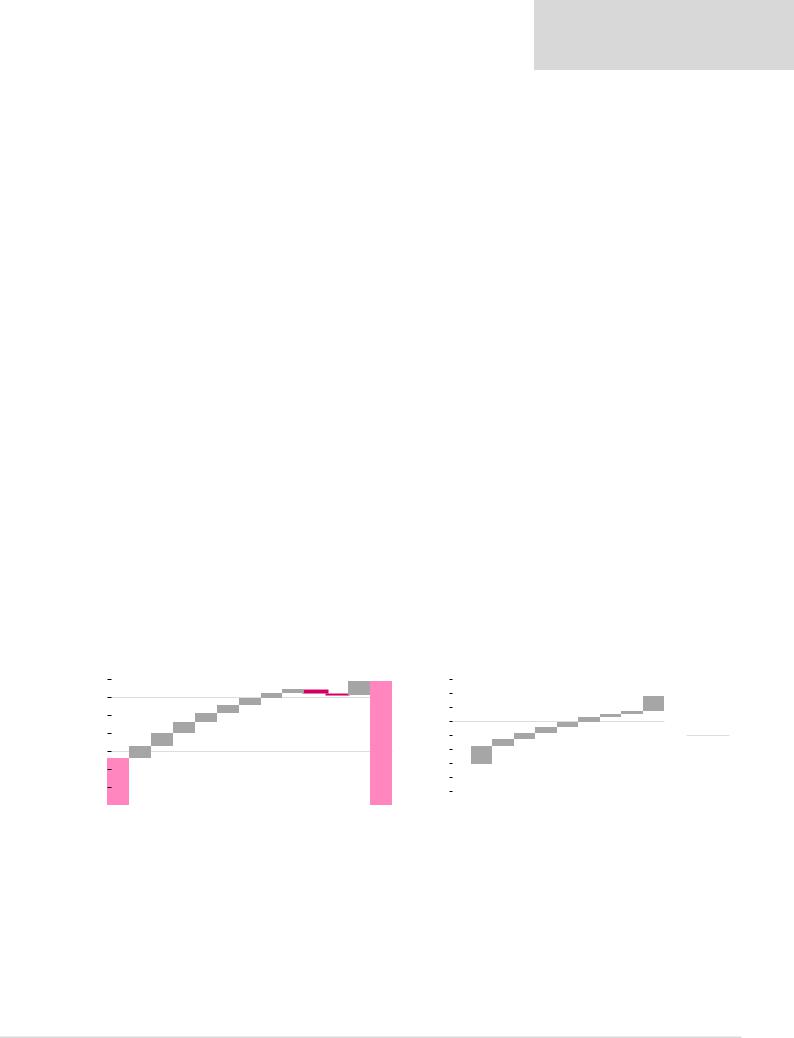

2018 YtD has proved a strong year for the Russian oil & gas sector (as represented by total return on the Thomson Reuters Russia Oil & Gas Index), which is overall up 21% YtD, outperforming Brent by 31%, EM Oils by 17% and Global Oils by 22% (Figures 9- 11). EM refiners, on average, performed negatively YtD (-2%); underperforming vs EM Oils by 6%, but outperforming vs the Brent price by 8%.

Figure 9: Russian oils and EM refiners – total shareholder return 2018 YtD (measured in $)

60% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39% |

41% |

43%45% |

35% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

32% |

32%33% |

|

|

|

|

|

|

|

|

|

|

|||

40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

22% |

|

|

|

26% |

21% |

|||||||||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

||||||||||

20% |

|

|

11% |

|

|

|

|

|

|

4% |

|

|

||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-5% -2% |

|

|

-1% |

|

|

|

|

||||

-20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

-11% |

|

|

|

|

|

|

-10% |

|

|

|

|

|

|

|||

|

|

|

-15% |

|

|

|

|

|

-20% |

|

|

|

|

|

|

|

|

|

-20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

-40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-46% |

|

|

|

|

|

|

|

|

|

||

-60% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bashneft |

Transneft pref Surgutneftegas Gazprom Surgutneftegas pref |

Bashneft pref |

Gazprom Neft Rosneft Tatneft pref |

LUKOIL NOVATEK Tatneft |

Petkim Tupras PKN ORLEN MOL OMV Petrom Grupa LOTOS |

Brent Global oils EM oils Russian oils |

|||||||||||

|

|

|||||||||||||||||

Source: Bloomberg, Thomson Reuters, Renaissance Capital

Renaissance Capital

14 December 2018

Oil & Gas

Figure 10: Russian oils – total shareholder return relative to EM Oils, Global Oils, Figure 11: Emerging refiners – total shareholder return 2017 YtD (measured in $) and Brent (measured in $)

|

|

|

EM oils |

|

Global oils |

|

Brent |

|

|

||

140 |

|

|

|

|

|

|

|

|

|

|

160 |

|

|

|

|

|

|

|

|

|

|

|

|

130 |

|

|

|

|

|

|

|

|

|

|

140 |

120 |

|

|

|

|

|

|

|

|

|

|

120 |

|

|

|

|

|

|

|

|

|

|

|

|

110 |

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60 |

90 |

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

80 |

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

70 |

|

|

|

|

|

|

|

|

|

|

0 |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

|

PKN ORLEN |

|

|

Grupa LOTOS |

|

Tupras |

|

||||

|

Petkim |

|

|

OMV Petrom |

|

|

MOL |

|

|

||

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Source: Thomson Reuters, Renaissance Capital |

Source: Bloomberg, Thomson Reuters, Renaissance Capital |

8

vk.com/id446425943

Figure 12: Performance of Russian oil & gas stocks in terms of total shareholder return (measured in $)

|

2017 |

1Q18 |

2Q18 |

3Q18 |

QtD |

YtD |

Russian oils |

|

|

|

|

|

|

Rosneft |

-21% |

8% |

18% |

19% |

-12% |

33% |

LUKOIL |

10% |

19% |

1% |

14% |

3% |

41% |

Gazprom |

-4% |

9% |

-9% |

17% |

-4% |

11% |

NOVATEK |

-7% |

9% |

7% |

31% |

-6% |

43% |

Gazprom Neft |

33% |

21% |

2% |

10% |

-2% |

32% |

Tatneft |

34% |

28% |

1% |

20% |

-7% |

45% |

Tatneft pref |

92% |

14% |

3% |

22% |

-2% |

39% |

Surgutneftegas |

-2% |

2% |

-8% |

-6% |

0% |

-11% |

Surgutneftegas pref |

-5% |

5% |

-2% |

20% |

-1% |

22% |

Bashneft |

-28% |

-2% |

-11% |

-6% |

-3% |

-20% |

Bashneft pref |

1% |

27% |

-9% |

15% |

-2% |

32% |

Transneft pref |

29% |

-2% |

-13% |

0% |

1% |

-15% |

EM refiners |

|

|

|

|

|

|

PKN ORLEN |

53% |

-19% |

-9% |

26% |

2% |

-5% |

Grupa LOTOS |

84% |

-7% |

-1% |

36% |

9% |

35% |

Tupras |

71% |

-4% |

-14% |

-5% |

2% |

-20% |

Petkim |

111% |

0% |

-46% |

-7% |

7% |

-46% |

OMV Petrom |

27% |

14% |

1% |

13% |

-3% |

26% |

MOL |

36% |

-6% |

-8% |

12% |

1% |

-2% |

Russian oils |

-4% |

13% |

-2% |

12% |

-3% |

21% |

EM oils |

17% |

7% |

-6% |

11% |

-7% |

4% |

Global oils |

10% |

3% |

5% |

4% |

-12% |

-1% |

Brent |

52% |

5% |

13% |

4% |

-27% |

-10% |

Source: Bloomberg, Thomson Reuters, Renaissance Capital

Tatneft commons is the best performing stock among Russian oils YtD and Tatneft prefs fourth best, with total returns YtD of 45% and 39%, respectively, driven by a much improved FCF and dividend payout ratio. NOVATEK is the second best-performing stock among Russian oils YtD, +43% in terms of total return if measured in dollars, which we associate with the positive development of its LNG strategy and supportive natural gas prices in Europe and Asia. LUKOIL follows with a total dollar return YtD of 41%, followed by Rosneft with 33%. LUKOIL has delivered on its commitment to launch a $3bn share buyback plan during 2018 and cancel 100mn of its treasury shares, while Rosneft benefitted from strong production growth and FCF. Gazprom Neft also showed strong YtD total return, +32%, benefitting from strong growth in tax-efficient production and favourable tax changes affecting its core Novoportovskoye field.

Surgutneftgas prefs, up 22% YtD, have outperformed common shares (down 11%) due to better dividend prospects, associated with a weaker rouble vs the dollar. Gazprom’s YtD total return is 11%, as the slow start to the year was followed by a 17% return in 3Q18, driven by strong financial results, a higher market value of its subsidiaries and improved dividend hopes. Transneft prefs were amongst the worst-performing stock in our universe YtD, with a total negative return of 15%, with higher-than-expected dividend payments having failed to provide support.

In the emerging European refining sector, Grupa LOTOS was the best performer with a total dollar return YtD of 35%, driven by stronger refining margins and takeover hopes. It was closely followed by OMV Petrom, with a total return YtD of 26%, where a combination of recovering refining margins and significant upstream exposure helped the share price performance.

MOL Group and PKN ORLEN had a weak performance in the sector YtD with total returns of negative 2% and negative 5%, respectively. We believe both stocks suffered from low dividend payouts, with PKN ORLEN raising concerns over its future investment programme. Tupras was the second-worst performer among our EM refiners, with a total return YtD of -20%, which is mainly attributable to 43% Turkish lira depreciation during the year. Petkim was the worst performer in our coverage universe, with a total return of -46% YtD. We associate this poor performance with lower petrochemical margins YtD, with the LDPE-Naphtha spread down 11% YtD, we estimate, and a weak Turkish lira.

Renaissance Capital

14 December 2018

Oil & Gas

9

vk.com/id446425943

Upstream outlook for 2019

Renaissance Capital

14 December 2018

Oil & Gas

Russia’s crude production trends in 2018 were affected by the relaxation of the OPEC+ agreement (originally stipulating a 300kb/d production cut by Russia from levels reached in November 2016) in June 2018. Although it was reported by the media that Russia has agreed to raise its production by 200kbp/d (i.e. reflecting a 100kb/d effective cut vs November 2016 levels), we note that the last reported actual output in November 2018 stood at 11.369mnb/d, or 122kb/d above the November 2016 levels and up 3.9% YoY. In hindsight, it is obvious to us that the June 2018 agreement did not impose any firm production constraints, with all OPEC+ members trying to maximise their output in the following months. The subsequent 20% reduction in the Brent oil price between June and November 2018 reflected higher supply growth expectations and prompted another 1.2mnb/d output cut and a six-month production freeze agreed by OPEC+ countries on 7

December 2018. Russia’s share of the production cut was reported at 228kb/d, reflecting a

2.0% reduction vs the October 2018 actual figure. We note that when a similar cut was agreed in November 2016, it took Russia about six months to deliver it, as it is not easy to cut output in Russia in the winter months. We think this time it will be no different. Therefore, assuming a gradual reduction in Russia’s output during the next six months, we calculate Russia’s 2019 oil production will average 11.21mnb/d, still reflecting YoY growth of 0.6%.

Figure 13: Russian oil production growth, % YoY |

Figure 14: Russian crude production history and expectations (mnt) |

14.0% |

|

|

|

|

|

|

|

|

|

12.0% |

|

|

|

|

|

|

|

|

|

10.0% |

|

|

|

|

|

|

|

|

|

8.0% |

|

|

|

|

|

|

|

|

|

6.0% |

|

|

|

|

|

|

|

|

|

4.0% |

|

|

|

|

|

|

|

|

|

2.0% |

|

|

|

|

|

|

|

|

|

0.0% |

|

|

|

|

|

|

|

|

|

-2.0% |

|

|

|

|

|

|

|

|

|

-4.0% |

|

|

|

|

|

|

|

|

|

2001 |

2003 |

2005 |

2007 |

2009 |

2011 |

2013 |

2015 |

2017 |

2019 |

600 |

|

|

|

|

|

|

|

|

|

580 |

|

|

|

|

|

|

|

|

|

560 |

|

|

|

|

|

Surgutneftegas greenfields |

|||

540 |

|

|

|

|

|

|

Rosneft greenfields |

||

|

|

|

|

|

|

|

|||

520 |

|

|

|

|

|

|

|

|

|

500 |

|

|

|

|

|

|

LUKOIL greenfields |

||

480 |

|

|

|

|

|

|

|||

|

|

|

|

|

Gazprom neft greenfields |

||||

|

|

|

|

|

|

||||

460 |

|

|

|

|

|

|

|

|

|

440 |

|

|

|

|

|

|

Brownfields |

||

|

|

|

|

|

|

|

|||

420 |

|

|

|

|

|

|

|

|

|

400 |

|

|

|

|

|

|

|

|

|

2007 |

2009 |

2011 |

2013 |

2015 |

2017 |

2019E |

2021E |

2023E |

2025E |

Source: CDU TEK, InfoTEK, Renaissance Capital research Source: CDU TEK, Renaissance Capital estimates

Figure 15: Russian oil production expectations vs OPEC+ commitments, mnb/d

|

CDU TEK consolidation |

|

IFRS consolidation |

|||

|

Oct-18 |

Assumed cut |

3Q18 |

2018 |

2019 |

Change YoY |

Russia |

11,412 |

(228) |

11,260 |

11,150 |

11,214 |

0.6% |

Russia ex. PSA |

11,004 |

(228) |

10,892 |

10,778 |

10,823 |

0.4% |

Rosneft |

4,004* |

(83)* |

4,726 |

4,663 |

4,693 |

0.6% |

LUKOIL |

1,671 |

(35) |

1,643 |

1,628 |

1,637 |

0.6% |

Surgutneftegas |

1,228 |

(25) |

1,240 |

1,222 |

1,237 |

1.2% |

Gazprom Neft |

803** |

(17)** |

1,034 |

1,007 |

1,029 |

2.2% |

Tatneft |

604 |

(13) |

596 |

587 |

603 |

2.8% |

Bashneft |

380 |

(8) |

386 |

389 |

399 |

2.6% |

Slavneft |

283 |

(6) |

378*** |

364*** |

435*** |

19.2% |

Russneft |

144 |

(3) |

144 |

144 |

144 |

0.0% |

NOVATEK |

170 |

(4) |

231 |

236 |

241 |

2.4% |

Others |

1,716 |

(36) |

514 |

538 |

405 |

-24.8% |

PSAs |

408 |

- |

368 |

372 |

392 |

5.3% |

Kharyaga |

32 |

- |

31 |

30 |

30 |

0.0% |

Sakhalin-1 |

262 |

- |

250 |

230 |

250 |

8.6% |

Sakhalin-2 |

114 |

- |

88 |

112 |

112 |

0.0% |

*Excludes Bashneft, Slavneft, Tomskneft. **Excludes Slavneft, Tomskneft.

***Includes East Messoyakhinskoye and Kuyumbinskoye fields.

Source: CDU TEK, InfoTEK, Renaissance Capital estimates

10

vk.com/id446425943

Renaissance Capital

14 December 2018

Oil & Gas

We believe all Russian oil producers will have to contribute to the production freeze, which will have the most significant impact on those producers with the most ambitious near-term growth plans, notably Rosneft and Gazprom Neft. The new OPEC+ deal may prompt Rosneft to revise its previously advertised production plans for new greenfields; in addition, we believe both companies may be forced to accelerate declines at their fullytaxed West Siberian fields to give room for planned production growth at the taxadvantaged greenfields. We detail our 2019 production growth expectations in Figure 15.

Our 2019 production forecasts come on the back of a solid recovery in 2018, with November 2018 production up 3.9% YoY. Rosneft’s core output (excluding Bashneft) was up 5.3% YoY in November 2018, while Bashneft output was down 0.8% YoY. Trebs &

Titov production was down 0.1% YoY. Rosneft’s YoY production dynamics were driven by Yuganskneftegas (+2.7%) and greenfield projects, mainly the Taas-Yuryakh, Yurubcheno-Tokhomskoye, Tagul and Kondinskoe fields, which alone increased their production by 95kb/d YoY following the relaxation of the OPEC+ constraints, offset by declines at Vankor (-1.8% YoY) and several other brownfields. Following a 12-month decline at the Uvat field from April 2016 to March 2017, the company continued to demonstrate a positive YoY production dynamic, growing 39.0% YoY.

LUKOIL’s output in November 2018 was up 1.1% YoY, driven by an 11.4% YoY increase in Caspian output and at other brownfields, offset by declines at LUKOIL’s West Siberian fields (down 1.4% YoY). Gazprom Neft production was down 0.5% YoY, driven by 8.7% and 15.3% declines at Gazpromneft-Khantos and Zapolyaryeneft, as well as a 12.2% decline at Prirazlomnoye, partially offset by an increase in production at the

Novoportovskoye field (+13.4% YoY). NOVATEK’s liquids production was up 11.8% YoY, according to Reuters, on accounting for Yamal LNG production of 20kb/d. Excluding Yamal LNG, Novatek’s output was down 1.9% YoY in November 2018. Elsewhere,

Surgutneftegas’s output was down 0.1% YoY, while Tatneft’s output was up 6.1% YoY.

In Figure 16 we break down the 2018E production dynamics by key fields. Rosneft’s

Yurubcheno-Takhomskoye, Taas-Yuriakh and Kondinskoye fields will contribute 90kb/d to its

2018 production growth, offset by a 12kb/d decline at Vankor, we estimate. LUKOIL’s greenfields will contribute 46kb/d to Russia’s crude production increase this year, while 34kb/d will be added by Gazprom Neft’s Prirazlomnoye and Novoportovskoye fields. We estimate production-sharing agreements (PSA) will add a further 36kb/d, driven by Sakhalin 1.

Figure 16: 2018E production waterfall chart, kb/d |

|

|

|

|

|

|

|

Figure 17: 2019E production waterfall chart, kb/d |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

11,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

12 |

|

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

11,150 |

|

|

|

|

|

|

|

21 |

13 |

5 |

|

|

11,450 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

57 |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

11,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

11,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

9 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

31 |

25 |

|

|

|

|

|

|

|

|

|

11,350 |

|

|

|

|

|

|

19 |

18 |

18 |

|

180 |

|

|

|

|

|

|||

11,050 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

34 |

|

|

|

|

|

|

|

|

|

11,195 |

|

|

|

|

24 |

24 |

|

|

|

|

|

|

|

|

|

|

|

||||

11,000 |

|

|

34 |

|

|

|

|

|

|

|

|

|

|

|

|

11,250 |

|

|

|

64 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,950 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,261 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

10,981 |

|

|

|

|

|

|

|

|

|

|

|

|

|

11,150 |

|

11,195 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

10,900 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,850 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,050 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017 production |

Yurubcheno-Tokhomskoye |

LUKOIL-Caspian |

Taas-Yuriakh |

Kondinskoye |

East Messoyakhinskoye |

Novoportovskoye |

Prirazlomnoye |

Imilorskoye |

Vankor |

Other fields |

PSAs |

2018E production |

|

2018E production |

Kuyumba |

Tagul |

Russkoye |

Yurubcheno-Tokhomskoye |

Rospan |

Prirazlomnoye |

Imilorskoye |

Messoyakha |

Other greenfields |

Brownfields |

PSAs |

|

2019E production |

||||||

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

Source: CDU TEK, Renaissance Capital estimates |

|

|

|

|

|

|

|

|

|

|

|

Source: Renaissance Capital estimates |

||||||||||||||

11

vk.com/id446425943

Renaissance Capital

14 December 2018

Oil & Gas

Overall, we expect that Russia’s 2019 output of crude and gas condensate will see positive contributions from all major Russian producers. Rosneft, Gazprom Neft and NOVATEK will continue developing their greenfields (Rosneft’s Yurubcheno-Takhomskoye, Rospan and Russkoye; Gazprom Neft’s Prirazlomnoye and Novoport as well as their 50/50 JVs – Messoyakh and Kuyumba; NOVATEK should benefit from the annualised effect from the recent launch of Yamal LNG’s trains 2 and 3 and the associated start of its gas condensate production), as shown in Figures 15 and 19. We expect LUKOIL’s production will benefit from Filanovskogo, Yaregskoye and Imilorskoye growth, offset by production declines at core West Siberian assets. Production from Tatneft and Surgutneftegas should also increase YoY, reflecting OPEC+ production cuts during the first six months of 2018. We expect the balance of the production decline to be offset by other assets, such as Bashneft, PSAs and joint ventures, as well as smaller Russian oil producers.

Our longer-term outlook for Russia’s crude and condensate production (Figure 14) shows significant upside potential related to the scheduled development of new greenfield opportunities, led by Rosneft. We expect Rosneft will increase its greenfield oil output by 470kb/d between 2018 and 2025, and will account for 80% of Russian total greenfield growth in the period.

12