- •On Markets

- •In Russia & the Near Abroad

- •On companies

- •Investment views updated this week

- •Earnings and operating results this week

- •In focus

- •Also in the news

- •Around the Globe

- •In focus

- •Also in the news

- •Most/Least Liked Stocks (MLLS)

- •Historical performance

- •What we are changing this time

- •To the ML basket

- •Appendix

- •Disclosures

- •Production and Distribution of VTB Capital Research Reports outside the United States

- •Distribution of VTB Capital Research Reports to Investors within the United States

- •Relationship between VTB and Xtellus

- •Conflict of Interest Disclosures.

- •Issuer Specific Disclosures

- •Analysts Certification

- •Investment Ratings

- •12-month Target Prices

- •Conflicts Management Arrangements

vk.com/id446425943

Russia

Equities

16 November 2018

Most/Least Liked Stocks

|

|

Name |

Ticker |

|

Rec |

|

12-mo TP |

|

ETR |

||

|

|

Most liked |

|

|

|

|

|

|

|

|

|

|

|

Sberbank |

SBER RX |

Buy |

|

RUB 330 |

+74% |

||||

|

|

Inter RAO |

IRAO RX |

Buy |

|

RUB 8.40 |

+115% |

||||

|

|

Nornickel |

GMKN RX |

Buy |

RUB 14,200 |

+34% |

|||||

|

|

PhosAgro |

PHOR LI |

|

Buy |

|

USD 17.00 |

+35% |

|||

|

|

Gazprom Neft |

SIBN RX |

|

Hold |

|

USD 6.10 |

+17% |

|||

|

|

Rosagro |

AGRO LI |

Buy |

|

USD 13.50 |

+33% |

||||

|

|

Luxoft |

LXFT US |

Buy |

|

USD 50.00 |

+50% |

||||

|

|

Least liked |

|

|

|

|

|

|

|

|

|

|

|

Novatek |

NVTK LI |

|

Sell |

USD 100.00 |

-42% |

||||

|

|

NLMK |

NLMK LI |

|

Hold |

|

USD 23.50 |

+6% |

|||

|

|

EVRAZ plc |

EVR LN |

|

Sell |

|

GBp 450 |

-8% |

|||

|

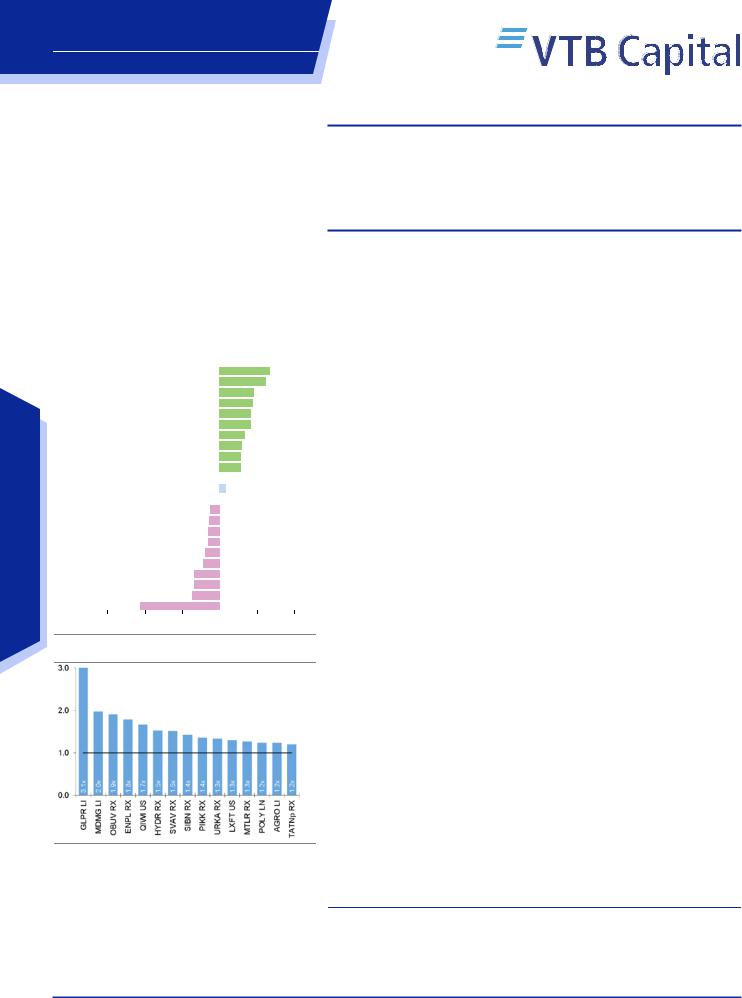

Top-Bottom performance, 1W, USD % |

|

|

||||||||

|

|

QIWI US |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

+13 |

|

|

|

||

|

|

MTL US |

|

|

|

|

+12 |

|

|

|

|

|

|

AFLT RX |

|

|

|

|

+9 |

|

|

|

|

|

|

ENRU RX |

|

|

|

|

+9 |

|

|

|

|

|

|

NMTP RX |

|

|

|

|

+8 |

|

|

|

|

|

|

MOEX RX |

|

|

|

|

+8 |

|

|

|

|

|

|

VTBR RX |

|

|

|

|

+7 |

|

|

|

|

|

|

ENPL RX |

|

|

|

|

+6 |

|

|

|

|

|

|

LSRG LI |

|

|

|

|

+6 |

|

|

|

|

Strategy |

|

SBER RX |

|

|

|

|

+5 |

|

|

|

|

|

MSNG RX |

|

|

-2.7 |

|

|

|

|

|

||

|

|

RTS Index |

|

|

|

|

+1.6 |

|

|

|

|

|

|

TMKS LI |

|

|

|

|

|

|

|

|

|

|

|

|

|

-2.4 |

|

|

|

|

|

||

Equities |

|

EPAM US |

|

|

|

|

|

|

|

|

|

|

|

|

-3.0 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

||||

|

POG LN |

|

|

-7 |

|

|

|

|

|

||

|

|

EVR LN |

|

|

-3.0 |

|

|

|

|

|

|

|

|

GLPR LI |

|

|

-4.0 |

|

|

|

|

|

|

|

|

TATN RX |

|

|

-4.5 |

|

|

|

|

|

|

|

|

ROSN RX |

|

|

|

|

|

|

|

|

|

|

|

|

|

-7 |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|||

|

|

MDMG LI |

|

|

-7 |

|

|

|

|

|

|

|

|

LXFT US |

|

|

|

-21 |

|

|

|

|

|

|

-30 |

-20 |

-10 |

|

0 |

10 |

|

20 |

|||

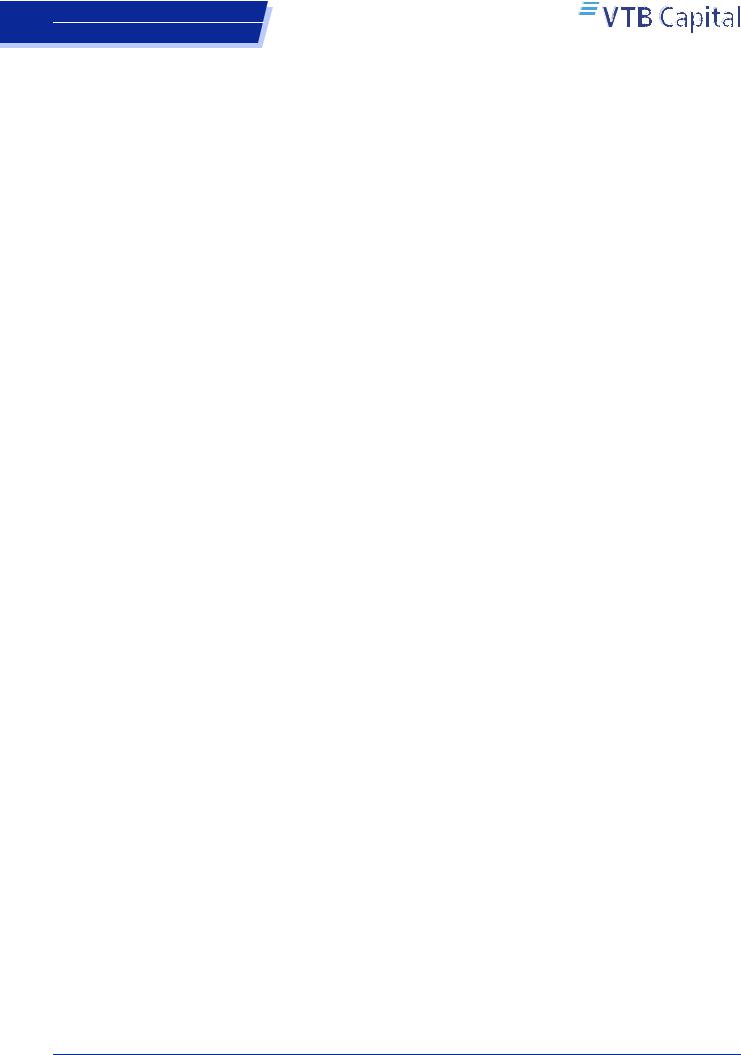

Avg. Daily Traded Volumes 1W/6M

Source: Bloomberg, VTB Capital Research

Some of the links in the document are to the sources requiring paid subscriptions. Prices and market indicator values are as of 15:00 Moscow time / 13:00 London time on

Friday 16 November. All changes are from the close of Friday 9 November, unless stated otherwise.

Periodical

Week Endnotes

Week #46; Oils downgrade,

LXFT to Buy and to ML, MSCI Review

In Russia and the near abroad. This week, we refreshed our Russia Economy Q&A Compendium. The Ministry of Finance has released its preliminary data on the federal budget execution for 10mo18. On 7-10 November, integrated oil companies, the FAS and the Ministry of Energy signed an agreement on freezing wholesale and retail motor fuel prices. The Russian media market increased +13% YoY. Meanwhile, we launched our quarterly wrap on the operational statistics from the real estate development segment.

On companies. We reviewed Russian oil stocks after the fall in Oil prices. As a result, we downgraded Gazprom Neft and Lukoil (from Buy to Hold) and Tatneft ords (from Hold to Sell). Mosenergo was also downgraded to Sell, after releasing a net loss in its earnings. In the meantime, after the recent overreaction on guidance for a further slowdown, we upgraded Luxoft to Buy. The earnings season continued to offer strong IFRS results, with Qiwi, Luxoft and Gazprom Neft coming well above consensus. Rusagro also released robust financial results. In the meantime, the MSCI announced the results of its November Semi-Annual Index Review. Moscow Exchange won a cassation against the previous court decision.

Around the globe. Global stocks were mixed this week. Among the negative developments were Brexit uncertainties, Italian budget concerns and an oil rout. On the bright side, the US-China trade dialogue resumed. Meanwhile, a German administrative court has ruled that the western state of North RhineWestphalia must ban older diesel vehicles from certain areas, which is positive for PGM demand outlook. The EU is switching from diesel cars to petrol, which is supportive for palladium. Bloomberg reports that the lame duck US Congress is unlikely to pass the new sanctions legislation against Russia before the end of the year. Otherwise, the thing to watch is the possible announcement of the second phase of the CBW sanctions.

Most/Least liked stocks. Our RTS-hedged MLLS portfolio recovered after last week’s weakness. The Most Liked and the Least Liked baskets outperformed the broader market, both going up +2.0%. Meanwhile, we included LXFT into our ML basket, while ALRS and UPRO were excluded from that universe.

What lies ahead. Sun: CN Caixin summit. Mon: DK macroprudential policy conference. Tue: US housing starts, building permits. Wed: EIA oil report; OECD forecasts; European Commission’s budget plans. Thu: EZ ECB accounts, consumer conf.; ZA rate decision. Fri: US & EZ PMIs.

Earnings season. Tue: MTS. Wed: PhosAgro. S&P500: 20 companies.

Stoxx600: 20 companies.

Ilya Piterskiy, Strategist

+7 495 660 67 47 // ilya.piterskiy@vtbcapital.com

Nikolay Mikheev, Strategist

+7 495 287 68 69 // nikolay.mikheev@vtbcapital.com

Duc Nguyen, Strategist

+7 495 663 47 23 // duc.nguyen@vtbcapital.com

Prices cited in the body of this report are as of the last close before, or the close on, 15 Nov 2018 (except where indicated otherwise). VTB Capital analysts update their recommendations periodically as required. This research report was prepared by the analyst(s) named above who is(are) associated with JSC VTB Capital and is distributed by JSC VTB Capital and VTB Capital PLC and their non-U.S. affiliates outside the United States. This VTB Capital research report is distributed to investors located within United States by Xtellus Capital Partners, Inc. (“Xtellus”) as a “third-party research report” as defined in Rule 2241(a)(14) and Rule 2242(a)(17) of the U.S. Financial Industry Regulatory Authority. Please refer to the Disclosures section of this report for other important disclosures, including the analyst certification and information required by regulation.

vk.com/id446425943 |

Week Endnotes |

Russia |

|

Equities |

|

On Markets

Global backdrop. Global stocks were mixed this week. The MSCI World (-1.7%) underperformed MSCI EM (+0.5%).The European bourses (Stoxx 600 -1.9%, DAX -1.4%, CAC 40 -1.5%, FTSE 100 -2.3%, FTSE MIB -1.7%) turned south on Brexit uncertainties and Italian budget concerns. The pound (-1.3%) slid, while the UK gilt 10Y yield (1.40%; -9bp) tightened. The Italy 10Y yield (3.45%; +5bp) widened. The euro (unch.) pared its declines earlier this week to finish flat. While European woes had a negative impact on US stocks, an oil rout also took a bite out of the Energy sector. As a result, the S&P 500 (-1.8%) was down. The dollar (DXY +0.1%) was little changed, while the UST 10Y yield (3.10%; -8bp) tightened as sentiment soured and Fed Chair Jerome Powell softened his tone regarding the rate path outlook. In Asia, China (Shanghai Comp +3.2%) and Hong Kong (Hang Seng +2.3%) posted solid gains as US-China trade dialogue resumed, outperforming other regions: Japan (TOPIX -2.2%), South Korea (KOSPI +0.2%). Returning home, Russia (RTS +1.6%) advanced, mainly due to the firmer rouble, ignoring the fall in Oil (Brent -3.6%) prices. The crude was down on supply and demand concerns. OPEC+ met last Sunday, concluding “2019 prospects point to higher supply growth than global requirements.” Later, Saudi Arabia announced its plans to cut output 0.5mmb/day in December. The announcement drew criticism from US President Donald Trump, sending oil prices down. Additional headwinds came from OPEC lowering its oil demand growth estimates 70,000bbl/d to 1.29mmbbl/day for 2019. Back in Russia, the OFZ market enjoyed a broad rally on Wednesday, which was sparked by Bloomberg reports that the lame duck US Congress is unlikely to pass the new sanction legislation before the end of the year. Otherwise, the thing to watch is the possible announcement regarding the second phase of the CBW sanctions (according to the US Chemical and Biological Weapons act of 1991, the US has to impose sanctions for alleged use of chemical weapons – the first phase has been made effective starting from 27 August). The focus will be on the details of the sanctions (how painful they might be for the economy), if any, as well as on whether they are announced at all or postponed. Strong MinFin auctions added a tailwind to the positive sentiment. Thus, the OFZ 10Y yield (8.65%; -28bp) tightened notably. The rouble (+2.8) appreciation against the dollar was largely driven by the non-resident bid for OFZs and also likely by the closure of short RUB positions following positive news from the sanctions front. Turkey (BIST 100 +3.6% / TRY +2.0%) outperformed its CEEMEA peers: Poland (WIG 20 -3.7% / PLN -0.5%), South Africa (TOP 40 -1.1% / ZAR +0.9%). In the commodities markets, base metals (+0.7%) were up thanks to Copper (+2.1%), while Aluminium (-1.3%) and Nickel (-1.8%) declined.

Russia – equities. The USD-valued RTS index (+1.6%) went up over this week, bouncing from the 1,100 level for the second time this autumn. In the meantime, the RUB-valued MOEX Russia index (-0.9%) was in the red, consolidating below its 50D MA. RUB (+2.8%) recovered after last Friday’s sell-off. The 10Y OFZ also recovered, with yield noteworthy tightened (-28bp to 8.65%). As for individual names, QIWI (+13%) was catapulted by its earnings well above consensus expectations. MTL (+12%) also delivered double digit gains. AFLT (+9%) also joined the leaders. ENRU (+9%) went up for four days out of five over this week. NMTP (+8%) expanded its advance to +13% since trough on 31 October. MOEX (+8.2%) jumped, aided by the risk of exclusion from MSCI disappearing. On the negative side, LXFT (-21%) collapsed, after the weak guidance, despite earnings being well above consensus. MDMG (-7%) declined in two days, while the stock traded unchanged over the rest days over the week. ROSN (-7%) and TATN (-4.5%) were under pressure of weak Oil prices. POG (-7%), GLPR (-4.0%) and EVR (-3.0%) went south as well.

16 November 2018 |

2 |

vk.com/id446425943

Russia

Equities

Russian Economy Q&A Compendium

– 4Q18; Mulling over the CBR's more forward-looking policy, of 12 November, by Alexander Isakov et al

Federal Budget in October – surplus at RUB 3tn, of 15 November, by Alexander Isakov et al

Oil sector – oil companies agree to freeze wholesale and retail motor fuel prices – not market moving, of 13 November, by Dmitry Loukashov et al

Real Estate Watch – 3Q18; rushing for mortgages and flats, of 12 November, by Maria Kolbina et al

Media market – maintained 13% YoY growth in 3Q18, of 13 November, by Vladimir Bespalov et al

RusHydro – Russian Far East modernisation project could get a special fund, of 14 November, by Vladimir Sklyar et al

Week Endnotes

In Russia & the Near Abroad

In the previous issue, we argued that the CBR’s response to the bout of FX volatility in August-September would reveal its preferred trade-off between monetary policy gradualism and continuity in implementing the fiscal rule. The decision to increase the key rate 25bp to 7.5% in September and to extend the pause in FX purchases until YE18 suggests that the approach to monetary policy is even more tactical than we argued earlier, and is more forward looking as well.

The Ministry of Finance has released its preliminary data on the federal budget execution for 10mo18. The most notable figure in the report was the federal budget surplus, which had climbed to RUB 3tn, in line with our estimates. If, in the remaining two months of the year, revenues move in line with our projections and spending matches the plan, the 2018F surplus will total RUB 2.5tn, or 2.5% of GDP, we estimate. This is the first surplus since 2011, generated by i) larger than expected oil & gas revenues and ii) adherence to the fiscal rule.

On 7-10 November, integrated oil companies, the FAS and the Ministry of Energy signed an agreement on freezing wholesale and retail motor fuel prices, according to Deputy Prime Minister Dmitry Kozak. Kozak said that motor fuel prices had stabilised and would grow in line with inflation until March 2019, according to Vedomosti. Following the VAT increase in 2019, motor fuel prices are supposed to increase 1.7%, while thereafter, they are going to grow in line with inflation. The announced agreement between oil companies and the government is in line with the previously discussed agreement (for details, see our Morning Comment, of 6 November).

This report launches our quarterly wrap on the operational statistics from the real estate development segment. It saw upbeat volumes in 3Q18, as clients enjoyed a gradual recovery in incomes, the extended offer from homebuilders, a local bottom in mortgage rates, and uncertainties associated with changing regulations. The stock performances overlook that, in our view, with the shares of listed developers down - 24% YTD.

According to estimates from the Association of Russian Advertisers (AKAR), the Russian media market increased +13% YoY to RUB 326-328bn in 9mo18, in line with the 13% shown in 1H18. All the main trends across ad segments remained intact. However, the rapid growth of the Internet ad segment (around +23% YoY, according to our estimates based on AKAR’s data) in 3Q18 was more visible on the back of the slightly weaker performance of other segments in 3Q18 vs. 1H18. For example, the TV ad market was up around +10% YoY in 3Q18 vs. +13% in 1H18.

Citing the proposal by the Ministry for Economic Development on the modernisation in the Russian Far East, Kommersant reports that it could be financed through the fund that would accumulate the difference between the actual indexed non-subsidised tariff and the subsidised tariff (no potential size was indicated, while the current Russian Far East subsidy stands at RUB 35bn). This implies that consumers (except for state enterprises) getting a subsidised tariff could need to contribute to the fund and, if they do not make any contribution one year, their tariff for the subsequent year is set to grow, depending on the underpayment. The article also states that the proceeds from the fund could be applied for renewables projects.

16 November 2018 |

3 |