- •A project of Liberty Fund, Inc.

- •Frank A. Fetter, Economics, vol. 1: Economic Principles [1915]

- •The Online Library of Liberty Collection

- •Edition used:

- •About this title:

- •About Liberty Fund:

- •Copyright information:

- •Fair use statement:

- •Table of Contents

- •FOREWORD TO ECONOMISTS AND TEACHERS

- •ECONOMIC PRINCIPLES

- •PART I

- •ELEMENTS OF VALUE AND PRICE

- •CHAPTER 1

- •PURPOSE AND NATURE OF ECONOMICS

- •Note

- •CHAPTER 2

- •CHOICE AND VALUE

- •Notes

- •CHAPTER 3

- •GOODS AND PSYCHIC INCOME

- •CHAPTER 4

- •PRINCIPLES OF EVALUATION

- •Note

- •CHAPTER 5

- •TRADE BY BARTER

- •CHAPTER 6

- •MONEY AND MARKETS

- •CHAPTER 7

- •PRINCIPLES OF PRICE

- •CHAPTER 8

- •COMPETITION AND MONOPOLY

- •PART II

- •USANCE AND RENT

- •CHAPTER 9

- •AGENTS FOR CHANGING STUFF AND FORM

- •CHAPTER 10

- •AGENTS FOR EFFECTING CHANGES OF PLACE AND TIME

- •CHAPTER 11

- •CONSUMPTION AND DURATION

- •CHAPTER 12

- •THE PRINCIPLE OF PROPORTIONALITY

- •CHAPTER 13

- •THE CONCEPT OF USANCE-VALUE

- •CHAPTER 14

- •THE RENTING CONTRACT

- •Note

- •CHAPTER 15

- •PRINCIPLES OF RENT

- •PART III

- •VALUABLE HUMAN SERVICES, AND WAGES

- •CHAPTER 16

- •HUMAN BEINGS AND THEIR ECONOMIC SERVICES

- •CHAPTER 17

- •CONDITIONS FOR EFFICIENT LABOR

- •CHAPTER 18

- •THE VALUE OF LABOR AND THE CHOICE OF OCCUPATIONS

- •CHAPTER 19

- •PRINCIPLES OF WAGES

- •Notes

- •PART IV

- •TIME-VALUE AND INTEREST

- •CHAPTER 20

- •TIME-PREFERENCE

- •Note

- •CHAPTER 21

- •RATE OF TIME-PREFERENCE

- •CHAPTER 22

- •MONEY AND CAPITALIZATION

- •CHAPTER 23

- •CAPITALIZATION OF MONETARY INCOMES

- •CHAPTER 24

- •SAVING AND BORROWING

- •CHAPTER 25

- •CAPITALIZATION AND INTEREST

- •PART V

- •ENTERPRISE AND PROFIT

- •CHAPTER 26

- •ENTERPRISE

- •CHAPTER 27

- •MANAGEMENT

- •CHAPTER 28

- •PROFITS AND COSTS

- •Notes

- •CHAPTER 29

- •VARIOUS SHADES OF PROFITS

- •CHAPTER 30

- •COSTS AND COMPETITIVE PRICES

- •CHAPTER 31

- •MONOPOLY-PRICES; LARGE PRODUCTION

- •PART VI

- •DYNAMIC CHANGES IN ECONOMIC SOCIETY

- •CHAPTER 32

- •THE PROBLEM OF POPULATION

- •Note

- •CHAPTER 33

- •VOLITIONAL DOCTRINE OF POPULATION

- •CHAPTER 34

- •DECREASING AND INCREASING RETURNS

- •Note

- •CHAPTER 35

- •BASIC MATERIAL RESOURCES: THEIR USE, CONSUMPTION, AND CONSERVATION

- •CHAPTER 36

- •MACHINERY AND WAGES

- •CHAPTER 37

- •WASTE AND LUXURY

- •CHAPTER 38

- •ABSTINENCE AND PRODUCTION

- •CHAPTER 39

- •VALUE THEORY AND SOCIAL WELFARE

Online Library of Liberty: Economics, vol. 1: Economic Principles

[Back to Table of Contents]

CHAPTER 31

MONOPOLY-PRICES; LARGE PRODUCTION

§1. Tests of monopoly control. § 2. Uniform monopoly-price in relation to costs. § 3. General principle of uniform monopoly-price and cost. § 4. Temporary and limited monopoly and discrimination. § 5. Theory of discriminatory monopoly-prices. § 6. Problem of the economy of large production. § 7. Economy of labor in large production. § 8. Economical use of machinery in large production. § 9. Economy of buying and selling in large quantities. § 10. Certain limitations of large production. § 11. Certain disadvantages of large buying and selling. § 12. Large production and the two types of prices. § 13. Monopoly element in price-fixing.

§1. Tests of monopoly control. The essential condition that distinguishes monopoly from competition is the buyer’s lack of the power of substitution of one seller for another. The test of the degree of monopoly control is the seller’s power to continue raising prices without thereby driving enough buyers to other goods or to other sellers to prevent his making some net profit by raising the price. A seller is competitive when he must take the general market-price as a fixed fact, and can decide only whether and how much to sell at that price. A seller is a monopolist when he represents such a large proportion of the offers that he may withhold a part, raise the market-price, and make a larger profit on the smaller sale. The competitive seller makes his profit by selling all he can at the market-price; the monopolist makes his profit by selling less and altering the whole price equilibrium.

Ownership of an important fraction of an entire species of goods may give some power to affect price. If the control is slight, a very small rise of price will bring in competitors. The monopoly profits in this case either must be very small or they will be very brief. Those outside, controlling a large supply, will be tempted by large profits to market it at once and to increase it as fast as possible. One owning a large part of the desirable building sites or houses in a town may gain by occasionally letting one stand vacant in order to drive better bargains with tenants. A trade-union, controlling most of the labor supply of one kind in a town, may gain as a whole by keeping some of their members unemployed at times. But the test of monopoly is that a gain results from a higher price and fewer sales. It begins at the point where there is a motive to limit the supply in accordance with the paradox of value. The control of an entire species of goods gives price-fixing power limited only by substitution of goods. Even tho one person controlled all the coal in any market, its price still would be limited by the substitution of wood, oil, etc. If there were but one possible source of meat supply, most people could live without meat, but if one person owned all food of every kind, control of price would be as complete as is conceivable. The monopolist would be the absolute despot of the lives of his fellows. The monopoly of great species of goods can thus be seen gradually to merge from one grade into another. Monopoly is a matter of quality as well as quantity. There is more or less of it in the different industries, and it varies over time and territory. The monopolist

PLL v4 (generated January 6, 2009) |

224 |

http://oll.libertyfund.org/title/2088 |

Online Library of Liberty: Economics, vol. 1: Economic Principles

aims, just as the competitor does, to get the price that gives the maximum gain. The monopolist, however, is in a more or less favored position, as he can raise his price and yet retain enough of his customers to gain by the change.

§ 2. Uniform monopoly-price in relation to costs. Now the monopolist also in his sales is limited by cost, but not so often or in such a compelling way as is the competitive seller. Within the range of his monopoly power he may either sell his whole product at a price well above cost plus a profit or he may discriminate more successfully than can the seller exposed to competition, and thus sell all but a small part of his product at a wide margin of profit. Let us see how monopoly price-fixing is affected by cost. The crude monopoly-price (see above, Chapter 8), is that which yields the largest total selling price (this giving the largest profit) only when cost is zero.1

The highest uniform price which it is to the interest of a monopoly to charge is that which yields the largest profit; that is, the largest difference between total price and total cost. This is the product of the profit (not price) per unit by the number of units sold.2 This never can be less than crude monopoly-price. In cases of very inelastic demand it may with certain ranges of price be no greater; that is, the entire cost in such cases is a subtraction from what would otherwise be monopoly profit.

Fig. 47. Monopoly Price, Inelastic Demand.*

Fig. 48. Monopoly-Price, Medium Elasticity.*

§ 3. General principles of uniform monopoly-price and cost. Inspection of Figure 47 and of the figure showing a medium demand (Figure 48) and a more elastic demand (Figure 49) reveals certain general effects. Except in some peculiar situations an increase of cost raises the theoretical monopoly-price and reduces sales, and decrease of cost lowers theoretical monopoly-price and increases sales. The more elastic the demand for an article, the less is the difference between competitive price and monopoly-price. The less elastic the demand the greater the motive for monopoly, and the more elastic the demand the less the motive for a general monopoly-price. In some cases, where demand is very inelastic, the first increments of cost have slight effect either on monopoly-price or on the amount advantageously produced; cost within a certain range of monopoly falls largely upon profits and at certain situations may within a narrow range fall entirely upon them. The profits per unit being large, the price can not be raised without reducing sales. Choice will be made to give the largest profits (unit profit multiplied by sales). In this it is generally true that the greater the ratio of the cost to the crude monopoly-price (other things equal) the less is the range

PLL v4 (generated January 6, 2009) |

225 |

http://oll.libertyfund.org/title/2088 |

Online Library of Liberty: Economics, vol. 1: Economic Principles

of monopoly power. The amount of sales that is possible with the higher monopolyprice is always less than with a competitive price. Monopoly-price at any level of costs from zero upwards is always higher than a competitive price (when costs are the same for competitors and for monopoly). We must note later the peculiar case where monopoly cost is lower; that is, where cost falls with quantity of output, and where large output is dependent on monopoly.

Fig. 49. Monopoly-Price, More Elastic Demand.*

§ 4. Temporary and limited monopoly, and discrimination. The foregoing applies to uniform monopoly-price. This is sometimes the problem presented to the monopolist, as to the manufacturer of a patented article in determining the advertised price of an article. Even then, however, some variation in price may be made by paying freights, giving cut prices to wholesale dealers in some localities, because of distance, or of peculiar condition of competition with a similar article, or on the principle of dumping, etc. Again and again the monopolist is tempted to depart from the uniform monopoly-price—to maintain it within the range of monopoly power, but to cut it by successive reductions as the conditions shade off toward competition, as they always do, more or less.

If, however, the better quality or the particular thing needed is in the hands of one seller, there is a temporary and limited measure of monopoly. For example, a cabman’s business as a whole is usually competitive, as any one is free to engage in it if profits seem high. (There are, however, cases of monopoly through exclusive rights to certain locations, etc.). But in many cases the cabman has a distinct bargaining advantage over a passenger, as when no other cab is in sight, or on a rainy day. However, it may not always be “good business” to yield to the temptation to get the higher price. In a small town where men know each other, the cab fares charged to residents are not often discriminatory, for regular patrons resent this and the cabman would lose patronage. The sole druggist in a small town might occasionally get very high prices from particular customers at times of illness, but he would thus drive away much of his custom, and would tempt a fairer and less grasping competitor to come in. Public opinion develops as to what is a fair price to be asked alike of all. The customary price has both a moral and a legal sanction. Thus, when men and capital are free to come and go, there results an average or normal return for ability and agents of a certain grade. Prices come to equilibrium and continue pretty regularly to be virtually competitive, for they are determined by forces of competition, ever ready to appear where charging more than a normal supply price yields more than ordinary returns to active investors.

§ 5. Theory of discriminatory monopoly-prices. That a field of monopoly exists may be very certain, when it may be very difficult to find just who are the buyers who could be charged a higher price, and just how to make them pay it. If, however, in the measure that it can be done, it is done, there results a series of prices; highest to those

PLL v4 (generated January 6, 2009) |

226 |

http://oll.libertyfund.org/title/2088 |

Online Library of Liberty: Economics, vol. 1: Economic Principles

buyers in the field of monopoly, low in the field of competitive prices, and possibly still lower in a price-cutting, rate-war field, where the monopoly is striving to drive some competitors out of certain businesses. (See Figure 50.) Assuming that the normal unit cost is 4, that being the price at which normal returns on all factors result, but only the minimum of price profit, there would at this price at once be a wide field, a broad plateau, for sales for the monopolist, and as some of the competitors were driven out of certain fields, the range of monopoly control of the market would gradually widen. The shape of the demand curve would thus change.

Fig. 50. Price Discrimination in the Field of Monopoly.*

The region from 12 to 15, would, as soon as competitors were ruined, be transferred to the other end of the diagram. Where prices had been very low they would become very high, and remain so indefinitely until competition again threatened. Altho competitors see the lure of high profits, they fear the loss of their whole investment. Thus the threat of price cutting by the monopoly can paralyze potential competition for a long period following a price-war, as has often been shown by experience. The price-war policy should not be mistaken, as it often is, for typical competition, where the motive is to sell at a profit, however meager. The price-war policy is only undertaken to force a competitor to an agreement either to withdraw from the territory, or to maintain a higher scale of prices, or to sell out his business, etc. Usually selling at less than cost for a time is deliberately done with the purpose of selling at more than a normal profit later.

§6. Problem of the economy of large production. Size of the enterprise is a condition affecting unit cost in most important ways. There are in many cases advantages in large production; there are economies in large plants.3 We have already studied the principle of proportionality (Chapter 12) and have seen how the proper proportion of the various factors to each other within the enterprise must be maintained. But further, the industry as a whole may be in better or worse proportion to the outside conditions, to the size of the market which it has a chance to supply. There is here a problem of the most economic size for an enterprise. As the size of the whole enterprise grows, the various parts (factors and costs) of it must grow in some proportion, but not in precisely the same proportion. Some parts do not need to increase proportionally to the output of the plant, and herein lies the economy. The advantages of large production should not be assumed to be necessarily conditioned on monopoly control, even where monopoly is the only condition in which it seems that a large enough unit of enterprise can be secured to get the full economies of large production. In such cases the two problems coexist, but must be kept logically distinct if confusion is to be avoided.

§7. Economy of labor in large production. The economy of large production is a particular case of the advantages of division of labor, and we need consider only a few of the features peculiar to it. There are certain technical advantages that are possible

PLL v4 (generated January 6, 2009) |

227 |

http://oll.libertyfund.org/title/2088 |

Online Library of Liberty: Economics, vol. 1: Economic Principles

only by physical concentration; that is, by producing a large output in a single plant at one place. This makes possible the subdivision of tasks among a large number of men so that specialization of trades is carried to the furthest possible point of advantage.

Each worker can become skilful at his work in less time, having but one thing to do, lower paid workers can be used on many parts of the work, and less time is lost in changing from one thing to another. Division of labor decreases in some ways the difficulty of supervision in larger factories, where the processes are divided, systematized, and made a matter of routine. The necessary inspection of the results is more rapid and easy. The lower cost of labor per unit of product in a large group as compared with a small group is especially noticeable in producing form-value. In certain cases it appeared that in making plows nine men working separately could average 66 plows each per year, while one hundred and eighty men working together will average 110 each per year, the output per man being increased 66? per cent. In a rifle-factory with a daily output of one thousand, three men could turn out the same product that required eight men in a factory with a daily output of fifty, an increase per man of 166? per cent.

§ 8. Economical use of machinery in large production. In these examples the saving in labor is not merely the result of increased personal skill, but of the use of machinery. There is economy in the use of machinery partly because with a large output more complex, more nearly automatic, machinery can be used. Even when the same kinds of machines are used they can be kept specially adjusted for each pattern and process, whereas in a small factory much time and energy are wasted in adjusting one machine for various processes. The machinery in a large factory is thus better and more fully utilized. A comparison has been made of the machinery that would be used in one large ax-factory and in twenty-five small ax-factories having, it is assumed, the same number of workmen and the same total output, as follows:

[oc] |

Twenty-five small factories One large factory Saving |

|||

|

|

|

NumberPer cent |

|

Shears |

25 |

3 |

22 |

88 |

Triphammers |

100 |

20 |

80 |

80 |

Grindstone pits |

50 |

37 |

13 |

26 |

Polishing frames50 |

30 |

20 |

40 |

|

Total machines |

225 |

90 |

13560 |

|

The difference in cost due to machinery is not so great as these figures indicate, as the unused machine lasts longer; but in the small factory there is more depreciation from rust and decay, and a larger investment of capital for each unit of product. The average amount of stock and materials required in a small factory is greater in proportion to the output.

The cost of producing steam power is usually less per horse power in a large plant, because of automatic devices for unloading and handling coal and ashes, and because of greater efficiency of larger boilers and engines, etc. The use of power is, by the law of averages, distributed more evenly in a large plant than in a small one. Water power in some places may be developed at low cost per unit for a very large plant, by

PLL v4 (generated January 6, 2009) |

228 |

http://oll.libertyfund.org/title/2088 |

Online Library of Liberty: Economics, vol. 1: Economic Principles

construction of large reservoirs, etc., where the cost would be prohibitive in a small plant.

§ 9. Economy of buying and selling in large quantities. Materials can be more exactly standardized as to quality when bought regularly and in larger amounts, and in many cases more cheaply. Shipments in carload and trainload and shipload lots make freight rates per unit less for large amounts even without illegal concessions.

The cost per unit of selling the product in many cases becomes less as the output increases. Advertising to make a name “a household term” would be ruinous for a small enterprise, but becomes a minute item of unit cost when divided by a multitude of sales. Often more orders come unsolicited as a business grows. A larger organization of commercial travelers, carrying a larger line of goods, and each covering a smaller territory more thoroly, makes the unit selling cost lower.

§ 10. Certain limitations of large production. Not one of these advantages is absolute and unlimited, and for most of them there are offsetting disadvantages which at length put an end to the economy of size. Labor can not be indefinitely divided, and when the factory is large enough to keep running one each of the best machines known, there is little or no economy in duplicating machines. As the factory grows the head manager can have less and less complete oversight; the eye of the master can not be over all as in the smaller establishment. This defect soon proves disastrous unless mended by more elaborate methods of organization, reporting, records, bookkeeping, etc., and the best of these prove expensive. In a small perfectly equipped factory making a patented specialty, and employing about one hundred men all of whom are personally known to the executive, the office “overhead” is only about 5 per cent; whereas in very large factories this item sometimes amounts to 20 per cent.

The cost of transmitting steam power by shafts and pulleys puts a limit to the economy of large steam power; and in many locations electric power is or can be supplied as cheaply to the small factory as to the large one. The natural limit of water power sometimes gives a maximum of power economy to a factory while it is small, and as it grows additional power from coal costs more per horse power. As large factories tend to create cities around them, land rises in value and higher wages must be paid the workmen in large cities. Small factories are constantly seeking out lower rents, taxes, wages, salaries, cheaper local sources of materials, cheap tho limited sources of power, and thus they compete successfully in many markets.

§ 11. Certain disadvantages of large buying and selling. In many cases growth in size is in some respects a disadvantage both in buying and in selling. To serve a local market a small establishment has certain advantages which no large competitor can equal. A factory using materials found in the locality, as lumber for wagons and furniture, wheat for flour, etc., has an advantage in costs by saving of freights and the cost of this item increases with the output. In selling, likewise, the nearest market is partially a protected field, to which distant competitors can come only at greater cost. It costs more to send agents further, and either prices must be reduced or freights paid by the seller, and this cost of overcoming the limits of the market finally must offset all the other advantages of large industry. These facts help to explain the survival and

PLL v4 (generated January 6, 2009) |

229 |

http://oll.libertyfund.org/title/2088 |

Online Library of Liberty: Economics, vol. 1: Economic Principles

modest success of many thousands of retail stores, most notably grocery and drug stores, and of small factories such as griest mills, lumber and planing mills, wagon and furniture factories, fruit canneries, and thousands of small local shops for repairs and local orders in all the various crafts, working in gold, silver, iron, tin, wood, leather, etc. Further, it may be observed that the advantages of size are greatest where the production is the multiplication of a few patterns, most fully standardized; small production holds its place most successfully where there is need of individuality, variety, art, personal attention to the consumer’s wishes, and prompt service that can be rendered only in a narrow neighborhood.

It is evident that most of these limitations to growth apply to a single local factory as regards its internal economies, but do not apply fully to the buying and selling of a combination under one management of geographically scattered plants. The federative plan has thus been applied to the “chain store” of various kinds—groceries, drugs, tobacco, shoes, clothing, five and ten cent, general department. It has been applied to manufacturing on an enormous scale in such corporations as the U. S. Steel Corporation. These enterprises often, but not always, contain an element of monopoly. There are also cases where the necessary size for minimum cost is dependent on the existence of a condition of monopoly, as in most so-called “public utilities.”4

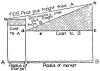

§ 12. Large production and the two types of prices. If there is a situation where two or more establishments are able steadily to decrease unit costs by the economy of size, and there is normal competition among them, the result should be a decrease of price. When furniture is made in small shops, where most of the work is done with hand tools, the radius and area of the market are small; the improvement of transportation widens the markets and makes possible large production with its economies. These two conditions might be represented in a map, or ground-plan, as in Figure 51.

Fig. 51. Areas of Small and of Large Production.

Each circle represents schematically an entire country, divided into markets, or regions of influence, each supplied by one establishment. At first it would appear as in the circle at the left, but after concentration had gone on to a large degree, the whole territory might be controlled almost entirely by a few large concerns such as A, B, C, and D. A factory located at B, for example, would market its product in all directions (as shown by the small lines leading out from B) until it came into contact with the competition of A, C, and D. The limits of influence would be determined mainly by navigable rivers, railroads, supplies of natural materials, distribution of population, etc., but also by various psychic influences, such as habit, personal acquaintance, etc.

Prices both in the small and the large market may vary according to two main principles shown in Figures 52-55. (1) The prices may be uniform to every one at the factory, or at the nearest railroad station. Such a price is called f.o.b. (free on board,

PLL v4 (generated January 6, 2009) |

230 |

http://oll.libertyfund.org/title/2088 |

Online Library of Liberty: Economics, vol. 1: Economic Principles

i.e., of the cars), the buyer having to pay the freight (Figure 52). The price to the various buyers’ doors varies throughout the territory in accordance with the differences in freights, and at the outer edge of each area the advantage of buying in one market or the other falls to zero. The cost is reckoned by the maker to be uniform on all the output and each factory has by this rule what appears to be its natural, or normal territory. (2) The prices may be uniform to all buyers for goods delivered within specified areas (Figure 53); as one manufacturer of scales at Binghamton, N. Y., advertised widely for many years, “Jones pays the freight.” Here the different units of products contribute unequally to profits, and the market extends to the point where price will cover variable costs and little more.

Fig. 52. Profits with F. O. B. Prices.*

Fig. 53. Profits with “Price Delivered.”

§ 13. Monopoly element in price-fixing. These two principles of price-fixing may be combined in various proportions, and especially in the case of goods not sold at an advertised price, but by agents, there is a strong temptation to depart from the f.o.b. price, not regularly but as appears necessary to effect a sale. Factory B (in Figure 54) may maintain the f.o.b. price within its own natural territory, and cut prices so as to invade the rival’s territory. If this is successful it may so limit the output of rival A, as to raise the average cost (Figure 55). The wider the territory over which a factory gets a market the greater its degree of monopoly control in the inner portions of its own territory. Instead of making its own costs a basis of price, it may make its smaller competitors’ costs the standard. Establishment A’s uniform price f.o.b. plus freight to destination is shown (Figure 55) on line ab. If B just meets these prices, a gross profit shown at be would be possible at the center of its territory, falling to zero at d. Under such conditions the price in a large portion of the territory of large production would be much higher than before with smaller production, and the large profit would offer a motive to some one to start a small factory, even if its costs would be higher per unit than those of B. But the fear, the certainty, that prices would be reduced could, after a few lessons, effectually prevent such an extra-hazardous investment.

Fig. 54. Profits with Prices Partly F. O. B. and Partly Delivered.

PLL v4 (generated January 6, 2009) |

231 |

http://oll.libertyfund.org/title/2088 |

Online Library of Liberty: Economics, vol. 1: Economic Principles

Fig. 55. Local Discrimination Complete.

This conquest of the market by one establishment can hardly happen in as simple and complete a way as that supposed. The competitor can play at the same game, and even tho smaller (as A in Figure 55) would struggle with like price-tactics to retain or recover the border territory (that between d and e). Then the competitors are not always divided territorially. Smaller factories exist alongside of larger ones in districts well suited to the kind of industry (iron, textiles, woodworking, etc.), and maintain their existence by serving special classes of customers in a special way. They are latent competitors for related lines of business in case prices are raised much above those yielding usual profits. For most kinds of goods some substitutes, or some other source of supply, can be had, if prices are greatly raised by monopoly power. With all these limitations, however, there still remains a considerable measure of monopoly power in many cases, and a wide range of apparent caprice in prices. Any one of the large competitors by a change in his policy may greatly alter the price situation in a certain territory, introduce a period of what may be called abnormal competition and abnormally low prices, and bring upon himself and others either loss or an increased monopoly power. In either case there is a return to higher prices later. The search for a prevention of this irregularity constitutes the large part of the practical problem of monopoly.

PLL v4 (generated January 6, 2009) |

232 |

http://oll.libertyfund.org/title/2088 |