Front_Office_Operations

.pdf

Chapter 4 – Check-out procedures

Payment procedures

3.Payment procedures

3.1Cash

3.2Foreign currency

3.3Cheques

3.4Traveller’s cheques

3.5Credit cards

3.6Debit card

3.7Travel agents’ vouchers

3.8Credit accounts

3.9Summary : comparison of methods

3.10What happens if a guest can’t pay the bill or fails to do so?

www.cthresources.com |

Page 231 |

|

www.cthawards.com |

Chapter 4 – Check-out procedures

Payment procedures

Once the guest has agreed the account, (s)he will offer payment in a variety of ways. The hotel may accept various forms of payment - and may prefer some more than others. What dictates this preference?

●Liquidity: the swiftness with which the payment becomes available for the hotel to spend (to purchase goods) or bank (to earn interest). cash is a highly liquid form of payment: it can be immediately deployed. If a guest pays on credit, on the other hand, it may take 30, 60 or 90 days (depending on the hotel's credit terms) for the money to reach the hotel's bank account.

●Security: the safety with which the payment can be handled, stored and transported. Cash poses a risk, because of the ease of theft, requiring strong security measures. Forms of payment requiring signatures or PIN numbers (such as traveller's cheques, credit and debit cards are more secure, as there is less likelihood of theft.

●Worth: the total amount of money received by the hotel once the transaction is completed. Different payment methods (notably credit cards) attract a variety of handling charges, commission and delays in payment, which will all cost the hotel money. On the other hotels accept payment in foreign currency, for example, they can make money on the transaction, by offering guests a rate of exchange which gives them a margin of pro

www.cthresources.com |

Page 232 |

|

www.cthawards.com |

Chapter 4 – Check-out procedures

Payment procedures

There are eight major methods of payment commonly accepted by hotels:

●Cash

●Foreign currency

●Cheque

●Traveller's cheques

●Credit cards

●Debit cards

●Credit accounts

●Vouchers

www.cthresources.com |

Page 233 |

|

www.cthawards.com |

Chapter 4 – Check-out procedures

Payment procedures

3.1 Cash

Is the only 'legal tender': this means that a hotel could, theoretically, insist on full payment of bills in cash and only accepts other methods of payment as a courtesy. cash is still the most commonly used payment instrument for low-value transactions - and the receptionist will inevitably handle some small cash payments, (e.g.. drinks and snacks, phone cards, newspapers). However, as accommodation prices have increased and other methods of payment (safer and more convenient for travellers than carrying cash) have developed, cash tends to be used less for payment of main accounts – and other methods of payment are accepted in order to attract and retain guests.

Where sales are made for cash, it is normal practice to have a cash till, which records the sale, calculates any change required, produces a receipt for the purchase a stores the cash received. The cashier may simply operate a secure cash box or tray, locked away when not in use, and never left unattended or on view to the general public. Either way, there be a cash 'float' (a standing amount of cash in different small denominations), allowing the receptionist to give change when required.

The use of cash requires good accounting records and security (because of the risk of theft). Guests must be given a receipt, or their bill should be marked 'paid by cash', to give them a record of payment.

www.cthresources.com |

Page 234 |

|

www.cthawards.com |

Chapter 4 – Check-out procedures

Payment procedures

3.1 Cash continued…

Advantages of accepting cash |

Disadvantages of accepting cash |

High liquidity: money can be reused (or banked to |

|

earn interest) without delay |

Low security: high risk of theft, counterfeit notes |

Fairly high worth: no processing costs associated |

Worth: bank charges for depositing cash, plus cost |

with cheques and card-based payments |

of transport, staff time, security |

Convenient for small-value transactions |

Time taken in 'cashing up', banking etc |

Anonymous (where privacy desired) |

Prone to errors in counting, change giving |

No special equipment required |

Inconvenient for large purchases |

www.cthresources.com |

Page 235 |

|

www.cthawards.com |

Chapter 4 – Check-out procedures

Payment procedures

3.2 Foreign currency

A hotel may choose to accept payment in a foreign currency, if it has significant international trade, or regular outgoings in foreign currencies, e.g.. if it can re-use Euros or US dollars for its own purchases. Some larger hotels also offer foreign currency exchange facilities for guests. The hotel can make a profit by accepting the currency at an advantageous exchange rate. In addition, the hotel will charge a commission, to allow for any charges the bank may apply when the currency is deposited. This is a legitimate charge for a service provided to guests.

Receptionists / cashiers need to be knowledgeable about which currencies are readily accepted by UK banks. They should also be familiar with the design of currencies (in order to avoid the accepting of fake or counterfeit money) and their exchange value. Current rates of exchange can be found on the Internet - or the hotel may request its bank to supply a list of daily exchange rates. Management can then determine the rate, or percentage difference from the central rate, offered by the hotel.

Only banknotes should be accepted as payment from guests, and not accept foreign coinage. Change must be given in pounds sterling or Euros, unless the hotel is registered as an authorised

foreign exchange dealer. If the hotel is not so registered, it is illegal to supply foreign currency. Receipts should be given for all currency transactions, in case of dispute.

www.cthresources.com |

Page 236 |

|

www.cthawards.com |

Chapter 4 – Check-out procedures

Payment procedures

3.2 Foreign currency continued…

Advantages of accepting foreign currency |

Disadvantages of accepting foreign currency |

Worth: can charge a commission and earn a |

|

profit on difference in buying/selling rates |

As for cash, plus |

Customer service: convenience for foreign |

Cost of staff training/information for exchange |

guests |

calculation |

No special equipment required |

Risk of errors in exchange calculation |

|

Risk that bank may not accept some currencies |

www.cthresources.com |

Page 237 |

|

www.cthawards.com |

Chapter 4 – Check-out procedures

Payment procedures

3.3 Cheques

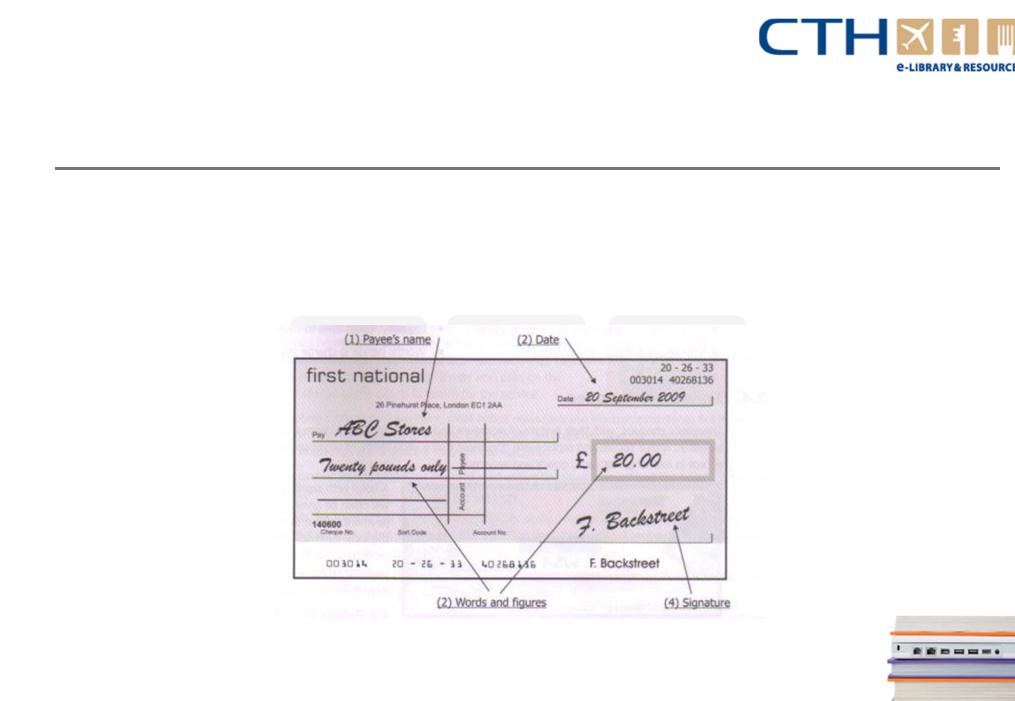

A cheque is a paper-based form of payment, effectively, a promise to pay the amount stated. A typical cheque is illustrated below.

Figure 4.5: A cheque

www.cthresources.com |

Page 238 |

|

www.cthawards.com |

Chapter 4 – Check-out procedures

Payment procedures

3.3 Cheques continued …

Payment by cheque suffers from some disadvantages of liquidity (the cheque will take at least three working days to 'clear' following banking, before the funds are received) and security (the cheque may not be honoured due to forgery, incorrect completion or lack of funds in the drawer's bank account). Front office staff need to keep to very strict rules when accepting cheques. If you accept a cheque and the guest has the benefit of services before the cheque has been cleared, you could have a situation where the guest does not in fact have sufficient funds to cover the cheque, which is returned to you unpaid - perhaps after the guest has departed.

Front office staff should follow procedures to establish that the cheque is correctly completed, valid, and backed by available funds.

●Check that the payee's name (the hotel) is correct; that the date is today's date; that the words and figures for the amount of the cheque are the same; and that the cheque has been signed, in the presence of the receptionist (in case of forgery). If any of these details are incorrect, the guest should be asked to amend them and to initial the amendment.

www.cthresources.com |

Page 239 |

|

www.cthawards.com |

Chapter 4 – Check-out procedures

Payment procedures

3.3 Cheques continued…

●The hotel should have a policy to accept cheques only if accompanied by a valid cheque guarantee card, the citing of which (by the receptionist writing the card number on the back of the cheque) guarantees that the cheque will be honoured up to a certain amount. Since this is normally only £50 or £100, and hotel bills are often larger than this, the hotel may only accept cheques in payment of larger amounts from known guests. The receptionist must check that the guarantee card has the same name and account number as the cheque, is not defaced or altered in any way, and is not past its expiry date - otherwise the guarantee will not apply. Only one cheque per transaction is guaranteed by the card; the use of two £100 cheques doesn't guarantee a payment of £200.

●The hotel may ask guests paying by cheque, to settle the main account three to four days before (if possible) their scheduled departure, to allow the cheque to clear.

●If none of the above securities are available, the hotel is entitled to request the guest (politely) to settle the account by some other means. This should have been discussed on reservation, so that it doesn't come as an unpleasant surprise to any guest!

www.cthresources.com |

Page 240 |

|

www.cthawards.com |