Front_Office_Operations

.pdf

Chapter 5– Guest accounting

Credit control

6.3 Establishing credit-worthiness

The key point about credit control, from the point of view of front office, is to ensure (as far as possible) that the hotel only extends credit to customers who are likely to repay the debt in full and on time.

This applies to an individual hotel guest checking-in for a night (especially chance guests), as well as to a company or tour operator seeking to open a credit account - because the hotel is effectively extending credit to any guest who hasn't pre-paid or guaranteed the booking. Guests may run up a large bill in accommodation, restaurant, bar and other extra charges, on the understanding that they will pay on check-out - and the hotel will have to ensure, as far as possible, that this will be the case.

Of course, the need for risk management is even greater for credit accounts, where guest bills are charged to the 'standing' account of a company, travel agent or tour operator: accounts of many thousands of pounds may be built up this way, for later payment upon presentation of the hotel's invoice to the account holder.

www.cthresources.com |

Page 321 |

|

www.cthawards.com |

Chapter 5– Guest accounting

Credit control

6.3 Establishing credit-worthiness continued…

So how do you ascertain a potential account customer's credit-worthiness? It is a comparatively easy matter to search an online credit database, to obtain credit ratings for prospective customers. If they have a low rating, or have outstanding county court judgements against them (for non-payment of debts), it would be best either to refuse credit or impose strict controls (such as credit limits or payment guarantees).

Other sources of information for assessing the credit status of a new customer include:

●Credit reference agency reports

●Information provided by the customer, on a credit application form

●Bank references or bank status report (which may be obtained on request, with the customer's permission)

●Trade references (from other businesses with whom the customer has credit accounts)

●The Insolvency Register (listing individuals and business notified as bankrupt)

●The Register of County Court Judgements (listing decisions about legal disputes over payment)

●The published financial statements and reports of corporate customers

www.cthresources.com |

Page 322 |

|

www.cthawards.com |

Chapter 5– Guest accounting

Credit control

6.4 Other credit control measures

|

Guest cycle |

|

|

stage |

Measures |

|

|

Inform guests that non-guaranteed and late bookings may have limited credit facilities |

|

pre-arrival |

Ensure that the correct room rate IS quoted (so that guests can plan to have funds available) |

|

|

Request prepayments and deposits where required |

|

|

Ascertain, confirm and record the method of payment |

|

|

Take a deposit, prepayment or credit card imprint (especially for chance guests) |

|

Check-in |

Verify settlement arrangements (e.g.. agency vouchers, corporate credit accounts) |

|

|

Inform guests clearly of acceptable payment methods, charges for which they will be responsible, |

|

|

and any credit limits that apply |

|

|

Require all departments to verify guests' credit status before allowing them to charge services to |

|

|

their accounts |

|

|

Monitor posted charges and guest balances against authorised credit limits, and issue 'high |

|

During |

balance reports' of guests whose accounts are near to or in excess of credit limits: computerised |

|

Occupancy |

systems do this automatically. |

|

|

Inform guests politely but firmly when credit limits have been reached and interim settlement is |

|

|

required. (This may be the responsibility of the credit manager, cashier or other senior |

|

|

staff.) |

www.cthresources.com |

Page 323 |

|

|

|

www.cthawards.com |

Chapter 5– Guest accounting

Credit control

6.4 Other credit control measures continued…

Guest cycle |

|

|

stage |

Measures |

|

|

Ensure (as far as possible) that last-minute charges have been posted |

|

|

Ensure that guests check and sign accounts to be billed to companies |

|

At check-out |

Observe all protocols for verifying and checking payments |

|

|

Record and receipt all payments |

|

|

Balance the guest account |

|

After |

Transfer corporate and agency payables to the ledger account, to be invoiced |

|

'Chase' late payments |

||

departure |

||

Report on late or defaulted payers |

||

|

www.cthresources.com |

Page 324 |

|

www.cthawards.com |

Chapter 5– Guest accounting

Summary

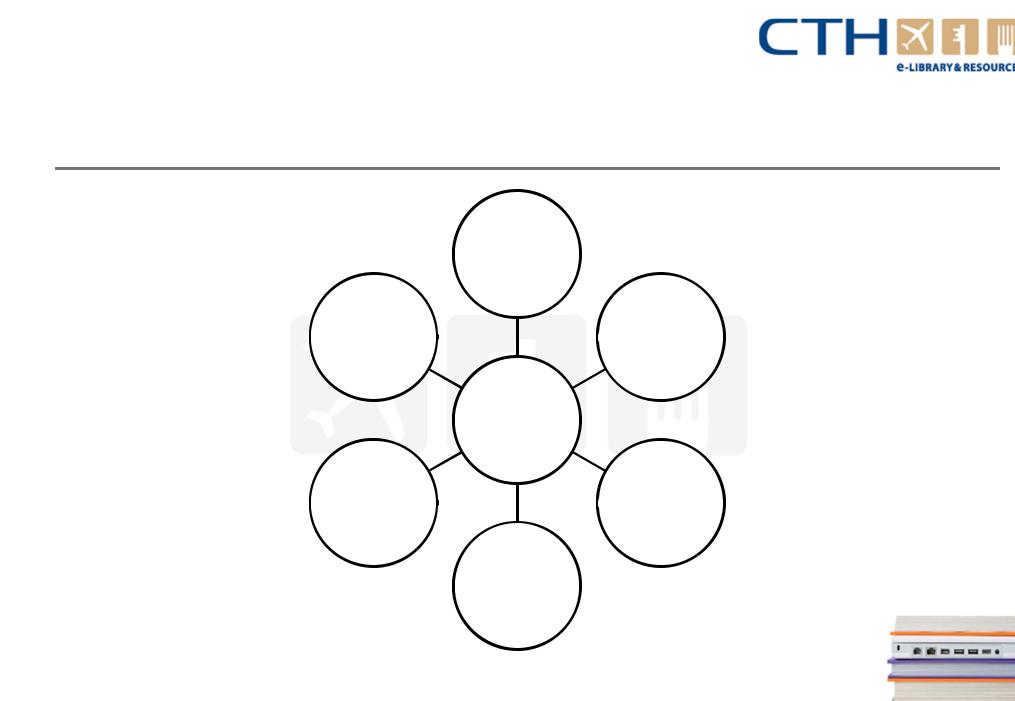

Credit control

- Payment

terms

- House limit

- creditworthiness

Night audit

- Ledger a/cs

- Operational

reports

Front office accounting

- Balance

- Control

checks

- Financial data

Billing system - Ledger

- Machine

- Computer

Guest

Accounting

Banking

- Documentation

- Reconciliation

Administration

of cash floats

www.cthresources.com |

Page 325 |

|

www.cthawards.com |

Chapters

1.Introduction to front office operations

2.Reservation procedures

3.Check-in procedures

4.Check-out procedures

5.Guest accounting

6.Yield management, statistics and reports

7.Security and safety responsibilities

8.Guest services and communications

9.Interpersonal and selling skills

www.cthresources.com |

Page 326 |

|

www.cthawards.com |

Chapter 6– Yield management, statistics and reports

Objectives

In this chapter you will learn to :-

●The nature and use of yield management

●How front office can contribute to maximise occupancy and revenue

●How to gather and use guest, occupancy and revenue statistics

●What notifications and operational reports are exchanged between front office and other departments of the hotel

●How to maintain and use guest history records

www.cthresources.com |

Page 327 |

|

www.cthawards.com |

Chapter 6– Yield management, statistics and reports

Yield management

1.Yield management

1.1Decisions involved in yield management

1.2When is yield management appropriate?

1.3Computerised yield management systems

www.cthresources.com |

Page 328 |

|

www.cthawards.com |

Chapter 6– Yield management, statistics and reports

Yield management

There are various pieces to the yield management 'Jigsaw’. Securing higher occupancy (letting more rooms) or raising the rate of the rooms increases the hotel’s revenue – the best possible return will be a combination of both of them.

Airlines saw the need to attract more advance bookings - so that they could secure at least a 'base' amount of revenue for a given flight. As the time of the flight got closer, it could then respond flexibly to demand: if demand was strong and there were fewer and fewer seats, it could raise seat prices; if demand was slow, it could discount seats to stimulate demand - If necessary, on a day-to-day basis.

At the same time, the airlines recognised that some categories of customer (or market segments) would pay more, while others would not, and that revenue could be maximised by seeking bookings from more profitable segments. Essentially, pricing became flexible - and different types of customer, or different customers, might be paying different fares for the same services: depending on how far in advance they booked; whether they placed a guaranteed booking (with no cancellations or amendments allowed); when they booked; what preferential terms they negotiated - and so on.

www.cthresources.com |

Page 329 |

|

www.cthawards.com |

Chapter 6– Yield management, statistics and reports

Yield management

Hotels have gradually realised that the same kind of situation applies to them. Like an airline, they need to consider:

●Which types of bookings or business are most profitable for them - and should, therefore, be prioritised.

●How they can secure profitable, guaranteed bookings in advance, to provide a 'base' revenue.

●How they can use different room rates (or 'differential pricing') to secure bookings from the most profitable market segments.

●How they can use flexible room rates and bookings to manipulate demand: charging higher rates when demand is strong, and lower rates when demand needs to be stimulated to increase occupancy.

www.cthresources.com |

Page 330 |

|

www.cthawards.com |