EXAM IN MICROECONOMICS

(October, 2008)

VARIANT 2

SOLUTIONS

Section 1. Multiple choice questions

You have 60 minutes to do this part of the exam.

Marking scheme: 1 point for a correct answer, -0.25 for a wrong answer, 0 if the answer has not been given.

Suppose that Country A can produce either 6 million tons of wheat or 3 million tons of meat per year (or any linear combination of those). Country B can produce either 2 million tons of meat or 6 million tons of wheat (or any linear combination of those). In this setup:

Country A should specialize in wheat and trade with B

Country B should specialize in wheat and trade with A

Countries should trade, but not necessarily specialize in any good

Countries should not trade

Can not determine from the information given

The correct answer is (b), due to the principle of comparative advantage.

Which of the following statements is/are normative, rather than positive?

«Firms should always maximize their profits»

«Given equal prices, a utility-maximizing individual should increase the consumption of goods for which marginal utility is higher»

«Considering the current economic situation, the government should back up the banking system with additional financial aid»

More than one of the above

None of the above

The correct answer is (d), as both (a) and (c) are normative (they express opinions rather than logical conclusions).

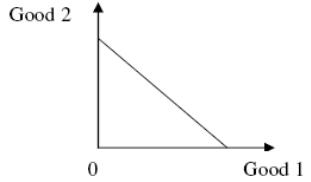

Consider the following PPF:

Which of the following does this shape of PPF NOT satisfy?

Principle of scarcity

Principle of increasing opportunity costs

Both (a) and (b)

None of the above

The correct answer is (b), since the opportunity costs are constant for a linear PPF.

When economic agents with linear PPF's decide to engage in trade according to the principle of comparative advantage, their aggregate PPF after trade is:

A horizontal sum of the individual PPF's

A vertical sum of the individual PPF's

The frontier of the set representing the intersection of individual production possibility sets

The frontier of the set representing the union of individual production possibility sets

A line obtained by combining individual PPF's in the order of increasing (in absolute values) slopes left to right

The correct answer is (e), by construction.

Suppose that you prefer cinema to playing computer games and you prefer playing computer games to studying microeconomics before the exam. However, you choose to study microeconomics for some reason. Your opportunity costs in this case are:

The utility of going to cinema

The utility of playing computer games

The utility of going to cinema minus the utility of playing computer games

The utility of going to cinema minus the utility of studying microeconomics

The utility of playing computer games minus the utility of studying microeconomics

The correct answer is (a), which corresponds to the best alternative foregone. Note that the definition of opportunity costs does not yet embrace individual rationality.

Vasya Pupkin studies microeconomics. He makes three statements:

A good is defined to be inferior if price and quantity demanded of the good move in the same direction.

Higher consumer incomes always benefit producers.

An inferior good is less durable1 than a luxury good

Which statements are correct?

I only

II only

III only

II and III only

All statements are wrong

The correct answer is (e). (I) is wrong because that is definition of Giffen good. (II) is wrong when the good is inferior. (III) is wrong because less durability doesn’t necessarily imply inferiority.

If the absolute value of income elasticity for a good is greater than 1, it must be:

A Giffen good

An inferior good

A luxury good

A normal good

No true answer

The correct answer is (e). The income elasticity of the good in question can be both <-1 or >1, since we are talking about the absolute value, and none of these goods match this description. However, since luxury goods satisfy this partially by having income elasticity >1, this answer will also be accepted.

The competitive market for gasoline is currently in equilibrium. Which of the following would most likely increase the price of gasoline?

A decrease in household income

Improvement in gasoline production technology

A decrease in the price of subway tickets and other public transportation

An increase in the price of crude oil

An increase in the price of car insurance

The correct answer is (d), since crude oil is an input is gasoline production.

A consequence of a binding price floor is:

A persistent shortage of the good

An increase in total welfare

A persistent surplus of the good

Elimination of deadweight loss

An increase in quantity demanded and a decrease in quantity supplied

The correct answer is (c), since producers would want to supply more of the good than the buyers would be willing to purchase at the price that is above the equilibrium price.

Suppose good X is inferior (but not Giffen). If consumers’ incomes rise, and technology for producing good X improves, then, given the usual shape of the supply and demand curves:

Price of good X will increase

Price of good X will decrease

Equilibrium quantity of good X will increase

Equilibrium quantity of good X will decrease

Nothing can be said for sure

The correct answer is (b), the equilibrium price will decline in response to lower demand and higher supply.

When the price of popsicles rose from $10 to $11, consumer expenditures on them dropped by 10%, indicating that:

Demand for popsicles had a price elasticity of -1

Demand for popsicles was price-elastic

Popsicles are a normal good

Popsicles are an inferior good

More than one answer is correct

The correct answer is (b). The price elasticity is greater than 1 (in absolute value) because the expenditures (price*quantity) drop by the same percentage amount as the percentage increase in price. For that too be the case, the quantity demanded should decrease by more than 10%.

At a price of $10, Jane would buy 8 CDs. At a price of $12, Jane would buy 6 CDs. Her price elasticity of demand would then be:

-1/2

-11/7

-5/4

-5/8

-4/5

The correct answer is (c).

Wayne’s cross-price elasticity of demand for peanuts with respect to the price of bananas is -0,44. This means that, for Wayne, peanuts and bananas are ______________ and that a reduction in supply of bananas would cause ______________ his peanut demand curve.

Complements; a rightward shift of

Complements; a movement along

Complements; a leftward shift of

Substitutes; a rightward shift of

Substitutes; a leftward shift of

The correct answer is (c).

If the price of watches falls by 3% and the quantity demanded of clocks increases by 2%, cross-price elasticity of clock demand with respect to the price of watches is _______ and clocks are _______________.

-1,5; substitute to watches

-2/3; complement to watches

1,5; complement to watches

2/3; substitute to watches

No right answer

The correct answer is (b). The cross-price elasticity is -2/3, and the clocks are complements to watches.

An extraordinary draught destroyed much of the coffee crops in Africa. The most likely consequence of this event for the instant coffee market would be:

a deficit of instant coffee

an increase in consumer surplus

a decrease in demand

an increase in supply

a decrease in supply

The correct answer is (e).

If demand for silver coins increases by 5 at each price when income increases by 5% then the income elasticity of demand at quantity 100:

2

1/3

2/5

1

The correct answer is (d): (5%)/(5%)=1.

If total revenue rises when price falls, the demand curve is:

elastic

unit-elastic

inelastic

the answer cannot be determined

The correct answer is (a).

Demand for a good is likely to be more elastic:

the smaller the fraction of consumer income absorbed by the good

in the short run than in the long run

the more broadly defined the good

the greater the number of available substitutes for the good

The correct answer is (d). The greater the number of substitutes - if the price rises, you can easily buy something else

When the price of cigars was $2, consumers bought 1 000 000 of them. After the government introduced an excise tax on cigars, the price of cigars has increased by $1, and the sales dropped to 800 000 cigars. We can tell that consumer surplus:

decreased by $900 000

decreased by $1 000 000

decreased by $800 000

decreased by $1 400 000

didn’t change

The correct answer is (a): 1*800 000 + (1/2)*1*(1 000 000 – 800 000)=900 000.

Given the usual shape of demand and supply curves, if the demand curve is steeper than the supply curve, the greater tax burden will fall on:

producers

consumers

the tax burden will be distributed equally

not enough information – we have to know their price elasticities

not enough information – we have to know the size of the tax that is imposed

The correct answer is (b).

Consider a competitive market for tennis shoes, where the demand curve is linear and downward-sloping, and supply is perfectly elastic. There is a tax t on every pair of tennis shoes sold. If the government doubles that tax:

total DWL (dead-weight-loss) caused by the doubled tax will be exactly twice the original DWL

total DWL caused by the doubled tax will be more than twice the original DWL

total DWL caused by the doubled tax will be less than twice the original DWL

to know if total DWL caused by the doubled tax would be more or less than twice the original DWL, we would need to know the slope of the demand curve

None of the above

The correct answer is (b). Drawing graphs would help you to determine the answer.

The market for a good is characterized by downward sloping demand curve and a perfectly inelastic supply curve. Suppose the government imposes a price ceiling that is below the equilibrium price. As a result of this policy,

producer surplus must decrease

consumer surplus must increase

consumer surplus must decrease

producer surplus must decrease by the exact amount of the increase in consumer surplus

total surplus must decrease

More than one answer is correct

The correct answer is (f), since both (a), (b) and (d) are correct.

The country that produces 40% of the world's oil limits its oil exports in order to increase its income from sales abroad. Which of the following conditions would contribute the most to the success of this policy?

inelastic demand by oil importers; inelastic supply by other oil producers

inelastic demand by oil importers; elastic supply by other oil producers

elastic demand by oil importers; inelastic supply by other oil producers

elastic demand by oil importers; elastic supply by other oil producers

The correct answer is (a). Inelastic demand for oil means that lowering quantity would raise the price quite a lot, raising revenues as well. Inelastic supply by other oil-producing countries would mean that they cannot respond to the high price by substantially increasing their supply of oil.

Let a utility function be given as U(x, y)=min{2x, 2y}. Then:

Goods x and y are substitutes

Goods x and y are complements

Income effect is zero for any price changes

Both (b) and (c) are correct

The correct answer is (b), as the function perfect complements. Both goods are normal, and price effect is equal to income effect (substitution effect is zero).

Which of the following should always be true for indifference curves, given the usual assumptions?

Indifference curves are strictly convex

An indifference curve can be drawn through any point corresponding to a bundle of goods

Indifference curves should approach axes asymptotically

All of the above

None of the above

The correct answer is (b), which corresponds to the axiom of completeness.

If indifference curves exhibit constant marginal rate of substitution at all points, they should be defined as:

Symmetric hyperbolae

Homothetic right angles

Straight lines

Circular arches

None of the above

The correct answer is (c). The only functional form with a constant derivative is linear, and right angles do not fit due to MRS being undefined at the kink.

Suppose that a per-unit tax is levied on purchases of good X. Then:

The budget line of a consumer will shift parallelly downwards

The budget line of a consumer will rotate around a point on the Y-axis

The budget line of a consumer will rotate around a point on the X-axis

The budget set will expand

The consumer will always consume less of X

The correct answer is (b). (e) does not hold for a strongly inferior X or for a corner solution with no X consumed.

Which of the following should always hold when utility is maximized?

Marginal rate of substitution equals to the price ratio

The indifference curve has only one point in common with the budget set

The indifference curve has no points below the budget constraint

More than one applies

None applies

The correct answer is (c), which follows from nonsatiation of preferences (or a stronger assumption of “more is better”). A counterexample to (a) is a corner solution, and a counterexample to (b) is a solution with perfect substitutes (coincidence of the budget constraint with the indifference curve).

Which of the following should always be true about the substitution effect?

It should be positive

It should be negative

It should be nonpositive

It should be nonnegative

None applies

The correct answer is (c). A decrease in the relative price of the good alone should lead to increase in its consumption (substitution effect can be zero, however, as in the case of perfect complements).

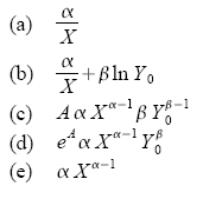

Suppose consumer’s preferences for X and Y are described by

![]() .

.

Then MU (X) given Y=Y0 is:

The correct answer is (d), which can be obtained by exponentiating and differentiating the equation with respect to X.

Suppose that a monetary subsidy is combined with an in-kind transfer in X (on the horizontal axis). Which of the following represents the change to the budget set?

The correct answer is (e).