- •Clients have the late cycle blues. Us too.

- •But we disagree with consensus on a few things: the Fed…

- •…and the dollar…

- •…and investors are now more bullish on EM. We are not.

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Raw data

- •Analyst Certifications and Important Disclosures

- •Important Disclosures Continued

- •Disclaimer

- •Disclaimer (continued)

vk.com/id446425943

Raw data

Table of Contents

Sample characteristics..……………………………..page 7

Macro………………………………………………….pages 8-10

Equities………………………………………………..pages 11-12

Credit…………………………………………………..pages 13-14

Interest rates……………………………………...…..pages 15-17

Foreign exchange..…………………………………..pages 18-20 Emerging Markets …………………………………..pages 21-23

Commodities…………………………………..……..pages 24-26

Restricted - External

6 |

December 14, 2018 |

vk.com/id446425943

Raw data

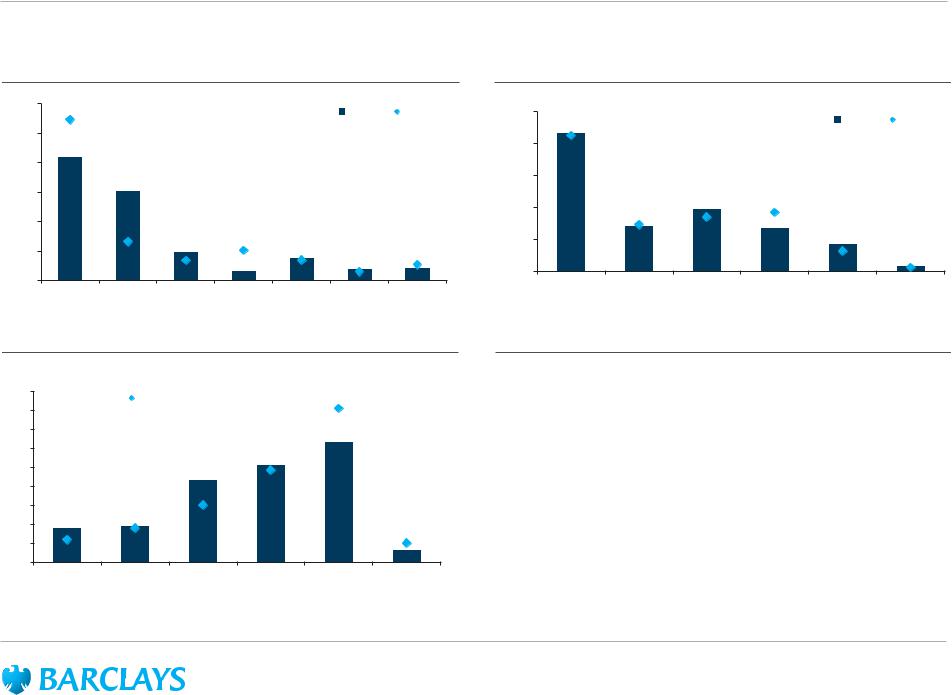

Sample characteristics

The region where you are based: |

|

The type of investor you are: |

|

|

|

||||||

60% |

|

|

Q4 2018 |

Q3 2018 |

50% |

|

|

|

|

|

|

|

|

|

|

|

|

Q4 2018 |

Q3 2018 |

||||

|

|

|

|

|

|

|

|

|

|||

50% |

|

|

|

|

40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30% |

|

|

|

|

|

|

30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

|

|

10% |

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

0% |

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

Long only |

Leveraged |

Bank |

Corporate |

Official |

Commodity |

||

North |

Europe |

UK |

Japan Asia ex-Japan CEEMEA |

LatAm |

|||||||

|

|

|

|

institution |

Trading |

||||||

America |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Advisors (CTA) |

|||

|

|

|

|

|

|

|

|

|

|||

The one area that best describes your primary focus:

45% |

|

Q4 2018 |

Q3 2018 |

40% |

|

||

|

|||

|

|

|

35%

30%

25%

20%

15%

10%

5%

0%

EM |

Foreign |

Rates |

Credit |

Equities |

Commodities |

|

Exchange |

|

|

|

|

Restricted - External

7 |

December 14, 2018 |

vk.com/id446425943

Raw data

Macro

Which asset class do you think will provide the best return in the next three months?

If there is a surprise in global growth in the next 12 months, it will be:

60% |

|

|

|

|

|

|

Q4 2018 |

Q3 2018 |

60% |

|

|

|

|

|

|

Q4 2018 |

Q3 2018 |

|

|

|

|

|

|

|

|

|

|

|

|||||||

50% |

|

|

|

|

|

|

50% |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40% |

|

|

|

|

|

|

|

|

40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30% |

|

|

|

|

|

|

|

|

30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equities |

Commodities Emerging |

Credit |

Short-end, |

Long-end, |

0% |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Markets (rates, |

|

high-quality |

high-quality |

|

|

An upside surprise |

A downside surprise |

Growth will be around the |

||||||

|

|

|

|

|

|

|

|||||||||||

|

|

|

credit & FX) |

|

bonds |

bonds |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

consensus |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Where do you think growth is most likely to:

80% |

|

|

|

Q4 2018 |

|

|

Q3 2018 |

|

|

|

|

|

|

|

||

70% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Surprise to the upside |

|

|

Surprise to the downside |

Surprise to the upside |

Surprise to the downside |

Surprise to the upside |

Surprise to the downside |

Surprise to the upside |

Surprise to the downside |

Surprise to the upside |

Surprise to the downside |

|

|||

|

|

|

|

|

||||||||||||

|

|

|

US |

|

Eurozone |

Japan |

China |

EM ex-China |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What is the biggest risk to market prices in the next 12-24 months?

90%

Q4 2018

Q4 2018  Q3 2018

Q3 2018

80%

70%

60%

50%

40%

30%

20%

10%

0%

Inflation |

Deflation |

Restricted - External

8 |

December 14, 2018 |

vk.com/id446425943

Raw data

Macro

In 2019, will the market risks presented by the following issues will increase, decrease, or remain the same compared to 2018?

70%

60%

50%

40%

30%

20%

10%

0%

|

Decrease |

|

Remain the same |

|

Increase |

|

|

|

|||

|

|

|

Economic confrontation |

North Korean nuclear escalation |

Regional conflict in Iraq |

Conflict in Yemen leading to |

Russian political/military |

Brexit |

Migration into Europe leading |

between the United States and |

|

and Syria drawing in major |

Saudi Arabia / Iran tensions |

resurgence and power |

|

to a rise in European populism |

China ("Trade War") |

|

powers (particularly Russia and |

|

projection (High North, Baltic, |

|

and fragmentation |

|

|

the US) |

|

Black Sea, Syria) |

|

|

What is the biggest risk to markets over the next 12 months? |

|

Over the next six months, which of the following do you |

|

|

consider to be the biggest risk to investor sentiment to arise |

|

|

from Europe? |

|

|

|

30% |

|

|

|

|

40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25% |

|

|

|

|

35% |

|

|

|

|

20% |

|

|

|

|

30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15% |

|

|

|

|

25% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10% |

|

|

|

|

20% |

|

|

|

|

|

|

|

|

15% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5% |

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

5% |

|

|

|

|

Geopolitical |

A trade war |

An acceleration |

Weak growth in |

A substantial |

Other |

|

|

|

|

developments |

|

in monetary |

China/emerging deterioration in |

0% |

|

|

|

|

|

|

|

policy tightening |

markets |

the pace of |

Brexit negotiation |

Budget |

ECB policy |

Disappointing |

Other |

|

|

|

|

developed |

risks |

uncertainty in Italy |

uncertainty |

euro area activity |

|

|

|

|

|

market growth |

Restricted - External |

|

|

data |

|

9 |

December 14, 2018 |