JPM_Europe Year Ahead 2019_watermark

.pdf

vk.com/id446425943

Mislav Matejka, CFA (44-20) 7134-9741

mislav.matejka@jpmorgan.com

Overweight

2,732p

23 November 2018

Price Target: 4,400p

End date: 31 Dec 18

Celine Pannuti, CFAAC

(44-20) 7134-7123 celine.pannuti@jpmorgan.com JPMA PANNUTI <GO>

Neutral

2,467p

23 November 2018

Price Target: 2,900p

End date: 31 Dec 19

Celine Pannuti, CFAAC

(44-20) 7134-7123 celine.pannuti@jpmorgan.com JPMA PANNUTI <GO>

Europe Equity Research

03 December 2018

Top pick – British American Tobacco

BAT is our top-pick in EU Tobacco as we see strong re-rating on the back of:

We see excessive concerns over FDA regulation: FDA released a statement on 15th November outlining their intention to a) limit youth use of ENDS products and b) seek a ban on menthol cigars and cigarettes. We see JPMe 2-12% EBIT risk from menthol ban, however the process is lengthy, and FDA proposals would need to be 'supported by science'.

Strong LFL driven by EM franchise and robust price-mix: We expect FY18E LFL growth of +4.6% and FY19E LFL of +5.7%, driven by BAT exposure to EMs, with Asia-Pacific (APME) LFL +15.8%/+14.3% in FY18E/FY19E respectively. Whilst US Nielsen numbers have been disappointing in recent months, management flagged at Oct-18 sell-side lunch improvement in US volumes (4-4.5% volume decline in FY18 with improvement in H218E) and good pricing, with BATS growing market share in premium brands.

FCF opportunity: FY18E and FY19E FCF yield at 10.7% and 12.6% respectively, materially ahead of peers (7.9% FY18, 8.5% FY19). Positive FCF contribution from NNPs coupled with strong FCF generation from Reynolds (inc. synergies) should lead to JPMe 15% FCF per share growth per annum during the next three years.

Least preferred – Imperial Brands PLC

We remain Neutral on IMB on the back of:

Weaker position in cigarettes, Imperial is a price-setter in very few of its markets and, in our view, is likely to grow modestly slower than peers in EPS terms over the medium term.

Optimistic management’s NGP target (£1.5bn NGP revenues by 2020) offset by lower bottom-line visibility. Management expects vapor operating margin to progress to c40% thanks to operating leverage and A&P normalization (scale benefits, steady state P&L), though we remain unconvinced that such a high margin can be achieved on a new category with less regulation and barrier to entry than tobacco. We remain cautious given bottom-line risk: any uptick of heated tobacco penetration in IMB’s key European market could lead to additional investments in this category (Management flagged that the building of a relevant Heated tobacco business requires £1.5-2.5bn investment).

Relative valuation discrepancy: the compression of Imperial’s valuation discount vs peers seems unsustainable given the higher uncertainty on Imperial’s profit pool vs other Tobacco players (no heated tobacco product, price competition from premium brands in key European market, risk of further NGP reinvestments).

111

vk.com/id446425943

vk.com/id446425943

Mislav Matejka, CFA (44-20) 7134-9741

mislav.matejka@jpmorgan.com

Overweight

CHF675.00

23 November 2018

Price Target: CHF900.00

End date: 31 Dec 19

Gurjit S Kambo, CFAAC

(44-20) 7742-0719 gurjit.s.kambo@jpmchase.com JPMA KAMBO <GO>

Europe Equity Research

03 December 2018

Top pick – Partners Group

The private markets asset management sector is set to benefit from structural growth opportunities, with investment performance and asset raising outpacing public markets. Institutional allocations to private markets remain low but are expected to see the greatest allocation shifts over the medium term. Private market asset managers should be more immune to market volatility given the LT duration of funds, in our view.

Within the growing alternative asset management sector, we view Partners Group as a key industry leader, estimating strong earnings CAGR over the next five years. Partners Group trades at a sector premium; we believe this is justified given the group’s core strengths, namely the greater proportion of recurring management fees, fee stability and faster rate of asset growth relative to the industry.

Further supporting our positive stance, Partner Group management have indicated that performance fees should continue to come through going forward given they are “quasi” recurring in nature. Partners Group is the only listed private markets manager that provides one-year forward guidance on asset raising, hence offering greater visibility.

Neutral

€24.66

23 November 2018

Price Target: €25.00

End date: 31 Dec 19

Gurjit S Kambo, CFAAC

(44-20) 7742-0719 gurjit.s.kambo@jpmchase.com JPMA KAMBO <GO>

Least preferred – DWS Group

We believe the underperformance since IPO reflects the tough market backdrop &

2018 outflows. Whilst we expect an improvement in net flows as headwinds from the US tax reform abate, combined with potential positive flows in passives/multiasset/alternatives, we believe it will be challenging to meet management's medium term guidance on inflows, underpinning our more cautious stance.

DWS has a meaningful presence in growth areas, particularly in passive/alternative/multi-asset strategies. These three strategies accounted for +€77bn of cumulative net inflows between Jan 14-Sept 18, but over the same period net outflows of €67bn across other strategies resulted in group net flows of only +€9bn.

In this context, the net flow target of 3-5% appears optimistic. Between 2013 and 2017 net inflows added c1% CAGR to AUM, which we believe makes management’s 3-5% medium term target look optimistic.

DWS’s CIR target may also prove challenging, holding back any share price performance. DWS is seeking to drive the CIR to below 65% medium term. We assume a CIR only reaching below 64% in 2022. To achieve 65% in 2020 would require a further 7% revenue growth (equivalent to avg. AUM €55bn higher) or further cost reduction of c€100m, both of which seem challenging in our view.

113

vk.com/id446425943

vk.com/id446425943

Mislav Matejka, CFA (44-20) 7134-9741

mislav.matejka@jpmorgan.com

Overweight

€76.86

23 November 2018

Price Target: €103.00

End date: 30 Jun 19

Elodie RallAC

(44-20) 7134-5911 elodie.rall@jpmorgan.com JPMA RALL <GO>

Neutral

€136.45

23 November 2018

Price Target: €146.00

End date: 31 Dec 19

Elodie RallAC

(44-20) 7134-5911 elodie.rall@jpmorgan.com JPMA RALL <GO>

Europe Equity Research

03 December 2018

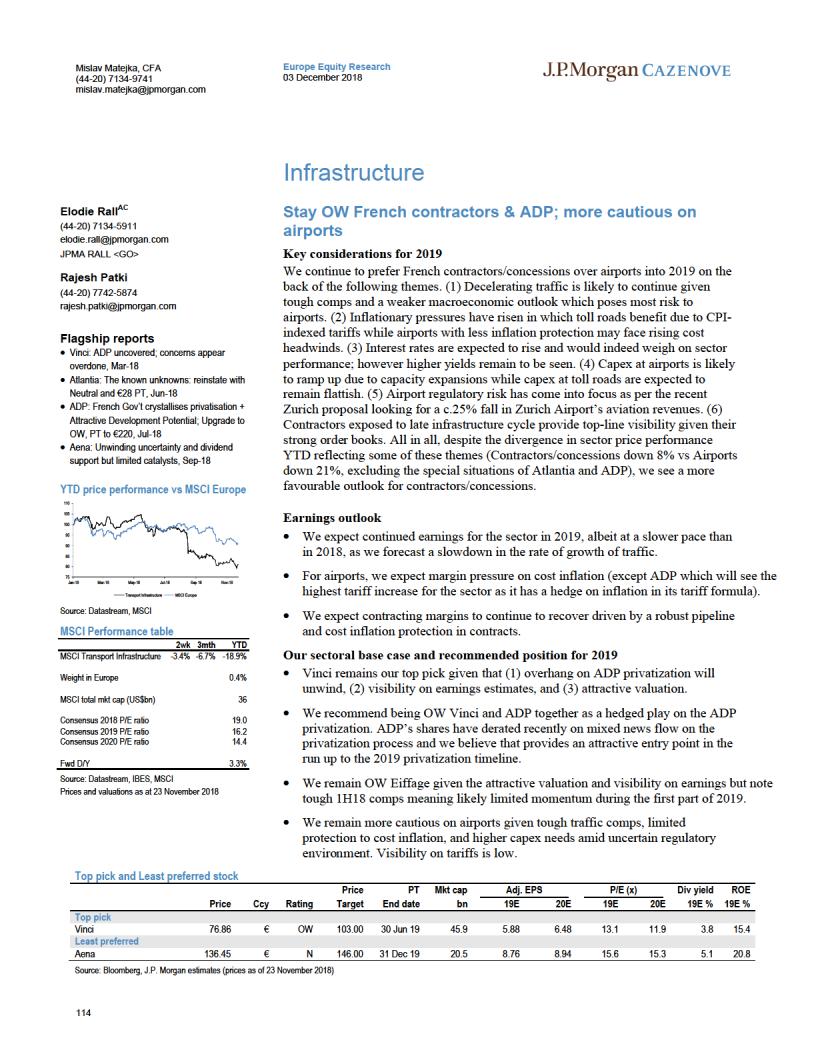

Top pick – Vinci

Vinci is our top pick. We believe the earnings momentum remains positive, driven by a solid outlook at both the concession and contracting divisions, while we continue to see the current overhang from the potential ADP privatisation as a buying opportunity. Shares are down 10% YTD (vs Eiffage -6% and SXXP -9%) dragged down by the ADP overhang and overall equity market derating. Valuation looks attractive with a 13.1x 2019E P/E and 7.2% FCF yield.

Scope for positive surprises in contracting margins. Going forward, we believe Vinci will surprise positively driven by improving trends in the French contracting operations. This is also be supported by Vinci’s order intake, up 5% y/y at the end of Q3, and order book up 7%. We forecast contracting margin to continue to increase and note that our forecasts remain below peak (JPMe 4.8% contracting EBIT margin by 2020 vs. peak of >5%) despite the order book being at an all-time high.

The potential ADP takeover would remove the overhang and prove accretive.

We see the potential ADP transaction as being double-digit accretive for Vinci and making huge strategy sense. We do not see a risk that Vinci would raise capital as an entirely debt funded transaction. We note that Vinci could also bring in financial partners as long as they could keep control of the asset.

Least preferred – Aena

Exposed to inflationary pressure, slowdown in traffic and regulatory risks. The shares de-rated in recent months due to (1) strategy uncertainty, (2) TCI overhang,

(3) weaker traffic growth, (4) higher inflationary pressures, and (5) reset of expectations following the October CMD. While we see more limited downside to 2019 expectations following management guidance issued at the CMD, we see limited positive catalysts near-term and think the market will remain cautious on regulatory risk and TCI overhang.

Management guidance for 2019 means estimates were rebased; we see limited downside risk to estimates near-term. For our estimates in 2019E, we forecast 2% traffic growth (Management guidance: 2.0% +/- 0.5%), 2019E EBITDA margins of c.60% to reflect higher wage costs from contract renegotiations, and c.€600m capex. Note traffic in Oct was better than expected and could pose upside risk to estimates if it continues on this trend.

Regulatory risk remains an overhang. Following the Zurich regulator’s proposal to cut Zurich Airport’s aviation revenues by c.25%, regulatory risk comes into focus as an overhang. For Aena, the next review is around 2021. Decreasing tariffs at a time of higher capex needs and increasing capex would weigh on FCF generation.

TCI remains an overhang. TCI continues to hold 8.3% of Aena and their potential to sell remains an overhang on the shares.

115

vk.com/id446425943

vk.com/id446425943

Mislav Matejka, CFA (44-20) 7134-9741

mislav.matejka@jpmorgan.com

Overweight

CHF89.34

23 November 2018

Price Target: CHF120.00

End date: 31 Dec 19

Edward Morris, CFAAC

(44-20) 7134-0636 edward.morris@jpmorgan.com JPMA MORRIS <GO>

Underweight

€38.60

23 November 2018

Price Target: €34.00

End date: 31 Dec 19

Ashik Musaddi, CFAAC

(44-20) 7134-4708 ashik.x.musaddi@jpmorgan.com JPMA MUSADDI <GO>

Europe Equity Research

03 December 2018

Top pick – Swiss Re

We have an Overweight rating on Swiss Re for the following reasons.

Best-in-class financial strength. Swiss Re’s solvency position at 285% (SST) is the strongest in the European insurance sector (on a Solvency II equivalent basis). We see this excellent financial strength as a key asset for investors, as it allows optionality to deploy capital into new opportunities as they arise and underpins the shareholder-friendly capital return programme.

Exceptional total capital return. Swiss Re’s buyback programme of CHF1bn per annum is equivalent to annual accretion of ~3.5%, which on top of the ordinary dividend at ~6% point to a total capital return of 9.5%. This also is the highest in the insurance sector; and one of the highest in the wider European market we believe.

Underappreciated growth potential. In addition to delivering some growth in its reinsurance business (mainly via the exposure to Asia), we see long-term growth potential for CorSo and the open books within Life capital. In our view, these growth opportunities are not adequately captured by the valuation (<9x our FY19E EPS), which we believe implies a business in decline.

In addition, we see a catalyst in 2019 from the proposed IPO of ReAssure, the closed life consolidator business. We expect Swiss Re to receive significant cash proceeds from the partial sale of its stake, which we believe may be returned to investors.

Least preferred – ASR Nederland N.V.

We have an UW on ASR Group due to the following reasons

1)The FCF yield on ASR Group is relatively low (c. 7%) compared to a sector average of 8.5% and part of the FCF yield includes run off capital release i.e. like for like FCF yield is c. 6% compared to sector average of 8.5%.

2)We do acknowledge that ASR remain well positioned to consolidate in Dutch insurance market with the potential acquisition of Vivat and/or Loyalis, however we believe that a large part of such M&A potential is already priced in. There remain material uncertainties around such M&A such as deal price, funding structure, synergy benefits, timing of cash flows etc.

3)Over the past three years, IFRS earnings have benefited from capital gains reserve release whereas such benefit haven’t flows through capital generation. In our view, capital generation is a more relevant measure compared to headline IFRS earnings.

117

vk.com/id446425943

vk.com/id446425943

Mislav Matejka, CFA (44-20) 7134-9741

mislav.matejka@jpmorgan.com

Overweight

€21.23

23 November 2018

Price Target: €42.00

End date: 31 Dec 19

Daniel KervenAC

(44-20) 7134-3057 daniel.kerven@jpmorgan.com JPMA KERVEN <GO>

Underweight

433p

23 November 2018

Price Target: 416p

End date: 31 Dec 18

Marcus DiebelAC

(44 20) 7742-4447 marcus.diebel@jpmorgan.com JPMA DIEBEL <GO>

Europe Equity Research

03 December 2018

Top pick – Vivendi

Vivendi is one of our key Overweight picks in European media. Vivendi is one of the best ways to get exposure to Music, which in our view offers the best content stories in media.

We believe Universal Music more than underpins Vivendi’s entire EV and has the potential to drive multiples of upside as subscriptions become the global norm, driving revenue growth, margin expansion, improved earnings visibility and a rerating.

We expect the planned sale of a stake in UMG to strategic investors followed by a significant cash return will help pull forward future upside & provide technical support.

Least preferred – Rightmove

Rightmove has been a strong outperformer in recent years, but we see clouds on the horizon. High operational gearing of its business model and its dominant market position have led to fast recent EBITDA growth and high margins. However, we believe the current valuation still factors in perfect execution, while we see several challenges ahead from 1) The migration from print to online coming to an end, making the business more cyclical; 2) Exposure to a consistently weak UK housing market and 3) The rise and underappreciated market share gains of online agents, such as Purplebricks. This is a new development and likely to cause traditional agent commission rates to continue to see sharp declines, in our view. We calculate that commission rates will fall further causing further pressure on Rightmove’s clients.

Although we do not believe that the business model will be meaningfully threatened short term, we do see downside risk from further consolidation of agency offices, declining housing transactions and broadly stable house prices. Further, the strong rise of (cheaper priced) online agents – we assume at least a 20% share by 2022 versus 6% today – is likely to result in a further decline in commission rates.

In terms of valuation, Rightmove trades on a premium relative to its growth profile and significantly higher versus the rest of the Media and Internet sector.

119

vk.com/id446425943