- •Introduction 3

- •Introduction

- •1. Long-term (perspective) intrafirm planning.

- •2. Short-term (current) intrafirm financing.

- •3. Operative intrafirm financial planning

- •1. Balance Sheet.

- •2. Income Statement

- •3. Cash-flow Statement

- •1. Horizontal analysis

- •2. Vertical Analysis

- •Income Statement

- •1. Methods of planning of the finance

- •2. Calculating the break-even

2. Calculating the break-even

The break-even point in business is the point at which sales revenue equals total expenses. At that point you neither make money, nor do you lose any. The break-even lets you know what it is going to take in sales just to survive. It provides a good indication of the viability of a business project.

The break-even can also be used to evaluate a business expansion or any other business expenditure. You are simply asking how much additional revenue will be required to cover the additional cost. There are some key definitions necessary to determine the break-even for the business. They are:

Fixed Costs (Overhead) are costs that do not vary directly with sales. Utilities, salaries, advertising, office supplies and telephone are just a few examples. They do not have to be the same every month. What is important is that you pay them regardless of sales made.

Variable Costs (Cost of Goods) are the actual costs of making the product or providing the service. They can include materials, shipping and contract labour.

Capacity governs your output. It can be measured in units of production, billable hours, or sales volume. To calculate the break-even in units we use the following formula:

Fixed Costs

────────────── = Break-even in Units

(Unit Price - Unit Cost)

This method is known as Total Absorption Costing, because dividing the total cost by the units sold absorbs the fixed costs. Every business plan – be it for growth or for start-up – needs to establish project and business costs before proceeding.

Break Even with a Gross Profit Margin

Sometimes, a company does not sell products, or it sells so many different products that doing a break-even for each unit does not make sense. When this is the case, such as in a retail business, we calculate the break-even in revenue rather than in units.

This is done with the following formula:

Fixed Costs

─────────── = Break-even in Units

Gross Margin

Where:

(Price - Cost)

───────── = Gross Margin

Price

The break-even is a great first step in evaluating business opportunities. The business

should make a profit, but the break-even is often the first step in determining the

viability of a business idea.

Chapter 7. Financial planning in Russia

Efficient control the enterprise finance is possible only at planning of all financial streams, processes and relations of the managing subject.

The market economy as the difficult and organized social and economic system requires qualitatively other financial planning as for all negative consequences and miscalculations of plans responsibility bears the enterprise aggravation of the financial condition.

However along with necessity of wide application of financial planning for present conditions the factors limiting its use at the enterprises act: high degree of uncertainty in the Russian market, connected with proceeding global changes in all spheres of a public life; an insignificant share of the enterprises engaging financial possibilities for realization of serious financial workings out; absence of effective is standard-legal base of domestic business.

The big possibilities for realization of effective financial planning have the large companies. They have sufficient financial assets for attraction of the competent experts ensuring realization of large-scale planned work in the field of the finance.

At the small enterprises, as a rule, for this purpose there are no means, though requirement for financial planning more than at the large. Small firms to a bowl require attraction of extra means for maintenance of the economic activities while the environment at such enterprises less gives in to the control and is more aggressive. And as consequence — the future of the small enterprise more vaguely also is unpredictable.

In our country at a branch control system existing before the enterprise long-term plan was made for 5 years with breakdown on years. The plan was defined by tasks of the branch ministry. The annual financial plans confirmed by the enterprise it is independent, nevertheless were made on the basis of estimated figures on volume of realized production, the nomenclature of the major products, the sum of profit, profitability, payments in the budget, lead up to the enterprises the higher organizations, and were coordinated with them. Firmness of the planned decision was gradually transformed to updating "from above" which have not been connected with search of an alternative variant. Plans were bulky, and many indicators could not be really used in management. Such approach to planning does not do by its tool of management in modern understanding, studying of the saved up world experience in financial planning and forecasting area therefore is of interest. It is necessary to have in view of that the uniform system of intrafirm planning does not exist, financial planning can be considered only as a whole, having allocated that useful that can be used in the Russian conditions. Modern methods of financial planning are already applied at some domestic enterprises.

Conclusion Although ratio analysis is more commonly used by investors or other external decision makers with a potential stake in operations and performance, management within the organization will want to know how well they are performing and how they are viewed externally. Understanding organizational performance as it is viewed by others provides management with information relative to the desired level of performance in all areas in which the company might be evaluated. Problem areas are recognized through understanding this performance, providing opportunity to correct these areas and present the company as a more desirable investment opportunity. Countless ratios are applied to the data on the financial statements to determine profitability, operational efficiency, financial leverage, liquidity, asset use, and market value. Financial ratios provide specific numeric values or percentage values that answer questions related to the organization's ability to repay debts, how quickly finished inventory is sold, or how much each shareholder has earned over the purchase price of their stock. It is obvious that specific information such as this will be needed by those judging the organization's potential for success, and easily understood that knowledge of these specific elements within the organization provide us with financial performance targets.

From appropriate pricing and product selection practices, through projecting operational expectations, the role of financial statements and their inclusive data is evident in successful completion of the many responsibilities of the manager and the continual success of the organization. Planning a strategy for success and procuring all necessary resources to attain organizational objectives, and having the specific cost information for products and processes allowing managers to better control operational activities and achieve optimal efficiency are significant elements in the organization's efforts toward continual improvement and increasing value and stability.

Periodically created financial statements reflecting the historical economic transactions of the company can serve the organization and its shareholders through internal application and analysis of the data as well as through their general purpose of external reporting. Internal analysis of the financial data presented in the organization's financial statements differs from the analyses of external users, as the internal purposes are geared toward operational planning and controlling. Used externally, the financial statements provide the user with an overall view of the operational performance of the company. However, applied internally, more specific details can be added to the financial data to provide the managers specific performance and operational data that meets the informational needs associated with planning and controlling activities. The lack of regulation associated with using this economic data internally allows the organization to reorganize the data in such a way that provides essential, customized economic data that will assist in appropriately adjusting operational strategies to further the organization toward its goals.

Bibliography

Internet-resources

1.1. http://www.associatedcontent.com/ :

1.1.1. Financial Forecasting By Tara Cellars Published 4/30/2007

1.1.2.The Financial Statements as Tools for Planning and Control By Misty Walker | Published 10/7/2008

1.1.3. Understanding Small Business Financial Statements By Angie Mohr | Published 11/27/2007

1.1.4. Forecasting Financial Statements By John Olley | Published 12/2/2006

1.1.5. Learning to Read a Financial Statement is an Important Skill to Have for Stock Investing By Jason Elliot, published Jul 24, 2007

1.1.6. Guide to Financial Planning What is Financial Planning? By Crystal, published Sep 22, 2006

Financial Planning: The Basics By Velaha, published Aug 26, 2008

Understand Financial Statements http://hubpages.com/

http://finmanagment.ru/

2. Paper works:

2.1. The Role of Forecasting in Financial Planning November 1, 1998 by Fay Hansen in Business Strategy

2.2. Western Economic Diversification Canada & the Ministry of Small Business and Economic Development. Business Planning and Financial Forecasting: A Guide for Business Start-Up.

2.3. Л.В. Перекрестова. Финансы и кредит. Академия, 2004

2.4. В.Я. Горфинкель. Курс предпринимательства. ЮНИТИ, 1997

Appendices

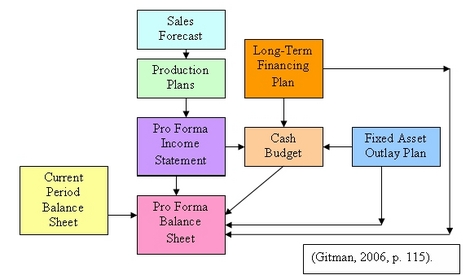

Chart 1. The Short-term financial forecasting process