GPB_Russian Utilities Initiation_231118_watermark

.pdf

vk.com/id446425943

NOVEMBER 23, 2018 |

RUSSIA > EQUITY RESEARCH > UTILITIES |

|

|

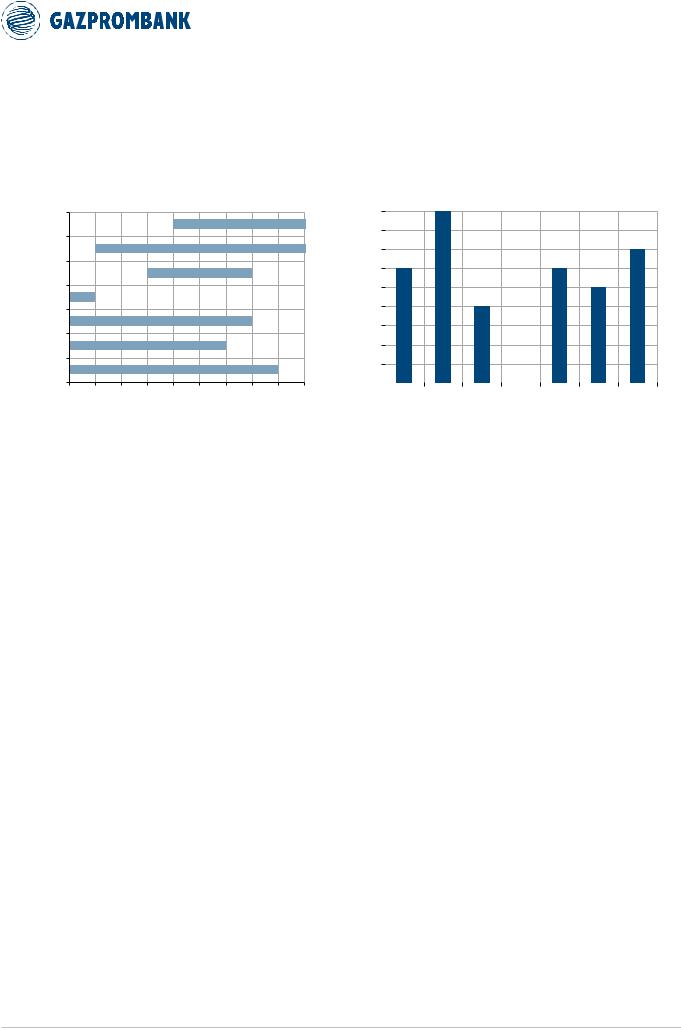

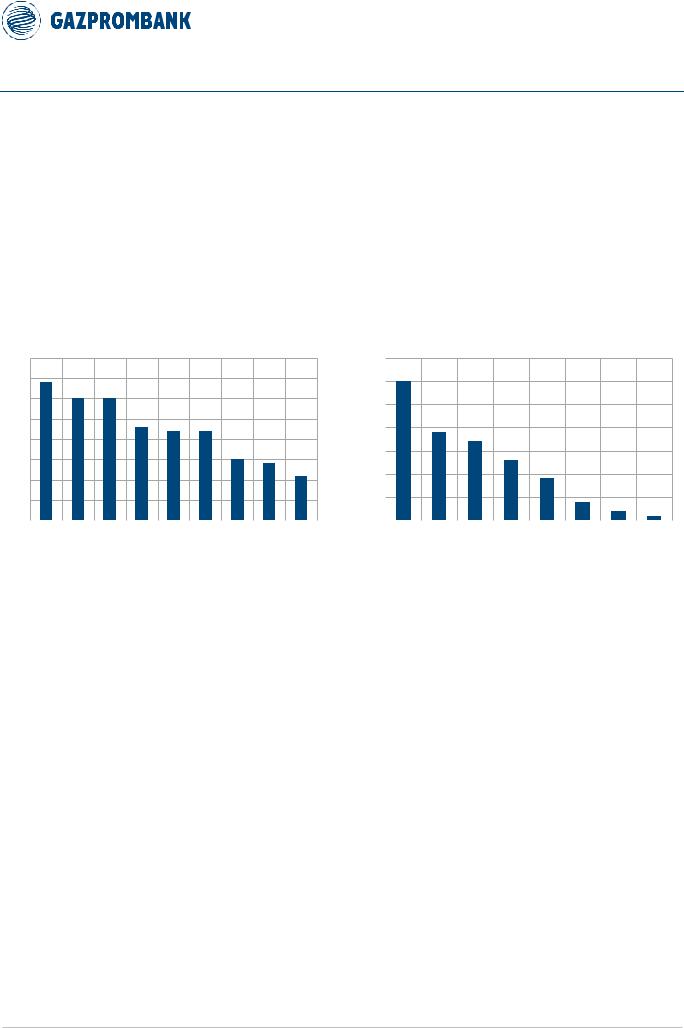

FCFY to CoE premium for generators: duration varies substantially

Covered generators differ not only with regard to the general “shape” of their FCF profile (Chart 27), but also the duration of periods when their FCFY exceeds CoE (Chart 28).

Chart 28. Timing of FCFY-to-CoE premium differs by GenCo

Years when FCFY>CoE (within 2018-26)

Rushydro…

InterRAO

Unipro

Enel Russia

Mosenergo

TGK-1

OGK-2

Chart 29. Inter RAO, RusHydro and Gazprom-controlled gencos may show the longest period of FCFY-to-CoE premium

Number of years when FCFY>CoE (within 2018-26)

9 |

|

# of years |

|

||

|

|

|

8 |

|

with |

|

FCFY>CoE |

|

|

|

|

7 |

|

(within 2018- |

6 |

|

26) |

|

|

|

5 |

|

|

4 |

|

|

3 |

|

|

2 |

|

|

1 |

|

|

0 |

|

|

|

|

2017E |

2018E |

2019E |

2020E |

2021E |

2022E |

2023E |

2024E |

2025E |

2026E |

Rushydro (group) |

InterRAO |

Unipro |

EnelRussia |

Mosenergo |

TGK-1 |

OGK-2 |

|

Years when FCFY >CoE |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Source: company data, Gazprombank estimates |

|

|

|

Source: company data, Gazprombank estimates |

|||||||||

We generally prefer those generators that can sustain a FCFY-to-CoE premium over a longer period of time (Chart 29) and highlight the following (not accounting for the FCF impact of the “modernization” program):

The longest period of FCFY-to-CoE premium could be delivered by Inter RAO, which may sustain its FCFY-to-CoE premium beyond 2024 thanks to a diversified portfolio of CSA projects with introductions spread out over an extended period.

The shortest period of FCFY-to-CoE premium could be delivered by Enel Russia, whose FCFY should be undermined in the near term due to a) expiration of current CSA agreements (which last until end 2020), and b) investment to build new wind-based capacity (“wind parks”), which are planned for introduction at end 2020 and in 2021.

21

vk.com/id446425943

NOVEMBER 23, 2018 |

RUSSIA > EQUITY RESEARCH > UTILITIES |

|

|

DIVIDENDS

Dividend payout: Unipro, Enel Russia are more generous than average

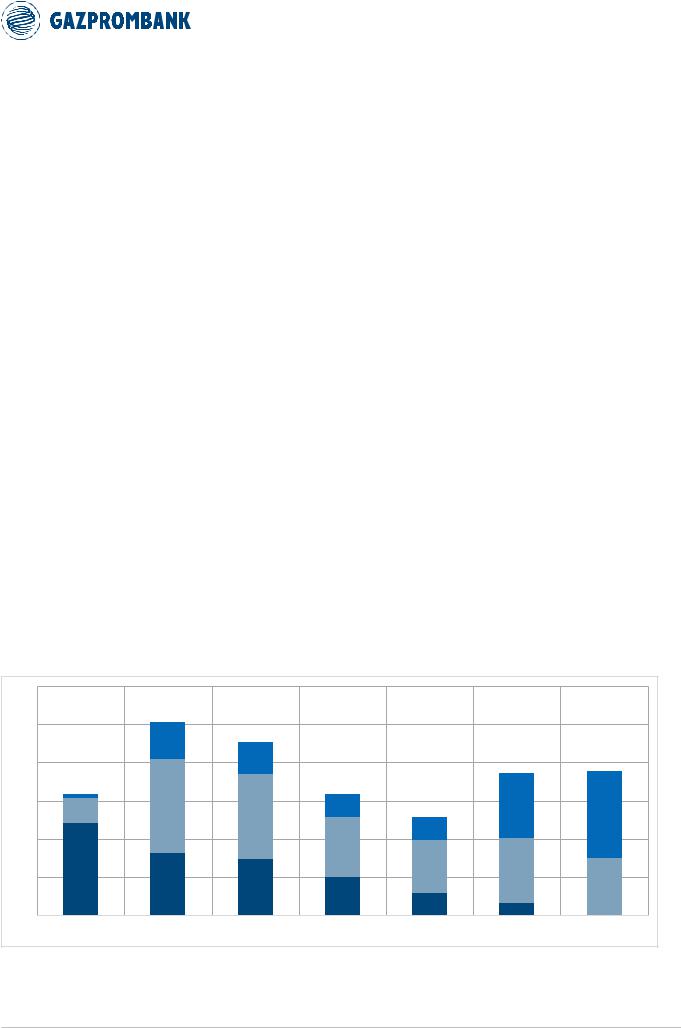

Russian electric utilities continue to show substantial differences in dividend payout approaches, with Unipro and Enel Russia being more generous in sharing their earnings and FCF with shareholders than the average Russian utility under our coverage (Chart 30).

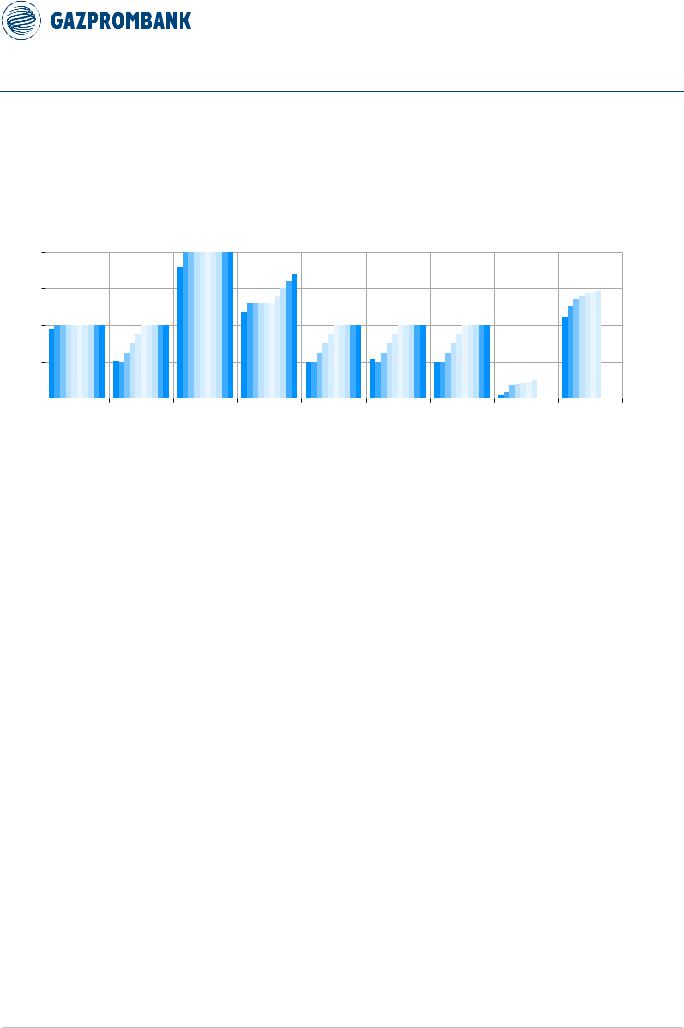

Chart 30. Unipro, Enel Russia-controlled gencos may continue to show above-average dividend payouts

Estimated dividend payouts 2017-26 relative to profit (nominal or adjusted): 2017-2026

100% |

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

75% |

|

|

|

|

|

|

|

|

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

50% |

|

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

25% |

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

0% |

|

|

|

|

|

|

|

|

|

|

|

2025 |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

2026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Rushydro |

InterRAO |

Unipro |

Enel Russia |

TGK-1 |

Mosenergo |

OGK-2 |

Russian Grids |

FSK |

|||

Source: company data, Gazprombank estimates

Note: Payout ratios calculated in relation to the profit indicators that are most relevant for dividend decisions of the corresponding companies. For RusHydro, Inter RAO, Unipro, Mosenergo, TGK-1 and OGK-2 – nominal net income under IFRS; for Enel Russia and Russian Grids – adjusted net income under IFRS; for FSK – connection adjusted net income under RAS.

Although longer-term dividend payout forecasts have limited reliability, we expect Unipro, Enel Russia generators to remain more generous than the sector average in sharing their earnings and FCF with shareholders. We also expect the payouts of other utilities to gradually increase, with the exception of utilities that already employ relatively high payouts (e.g. RusHydro) or those that have recently adopted new dividend policies (Russian Grids, FSK).

Our specific expectations with regard to dividend payouts by covered utilities are as follows:

Government-controlled GenCos: stable payout for RusHydro, growing payout for Inter RAO

-RusHydro. We expect the company to continue paying 50% of IFRS net income, as has been the case over the past three years. Following the report by Kommersant, we do not exclude the introduction of a rule that the dividend should not be lower than the average for the three previous years, which may prevent sharp downward deviations.

-Inter RAO. We expect the company to gradually increase its dividend payout ratios from a current 25% of IFRS net income on the back of strong FCF and a solid balance sheet. The recent buyback of stakes from RusHydro and partly from FSK should raise the propensity of the company and its core shareholder (Rosneftegas) to pay higher dividends, as a smaller proportion of dividends would be channeled outside the Inter RAO/Rosneftegas perimeter.

Unipro, Enel Russia: to remain more generous dividend payers than the industry average:

-Unipro. Following the re-launch of the damaged unit at Beryozovsksaya TPP (expected in 2H19), we expect the company should be ready to distribute the bulk (80% or more) of its FCF as dividends. Prior to this, we expect the company to follow its guidance to pay DPS=RUB 0.22 p.a., implying a dividend yield of 8% based on the current share price.

-Enel Russia. We expect the company to follow its guidance and pay out 65% of adjusted net income until results for 2020, with a further increase in the

22

vk.com/id446425943

NOVEMBER 23, 2018 |

RUSSIA > EQUITY RESEARCH > UTILITIES |

|

|

payout possible in the longer term. A separate special dividend in case of the successful sale of Reftinskaya TPP is possible but not guaranteed, in our view.

Gazprom-controlled gencos: to gradually raise their payout from ~25% of IFRS net income on the back of positive FCF and solid balance sheets:

-Mosenergo/TGK-1/OGK-2. We expect a gradual increase in dividend payouts from around 25% of IFRS net income paid as dividends for 2017 on the back of solid positive FCF and balance sheets (for Mosenergo and TGK-1), but the companies have yet to provide specific guidance in this regard.

National grids (Russian Grids, FSK): We expect national grids to pay out 50% of adjusted net profit (the larger of IFRS or RAS) in accordance with new adopted dividend policies. To become the basis for dividend payments, net income should be adjusted (i.e. effectively reduced) by an number of items, including:

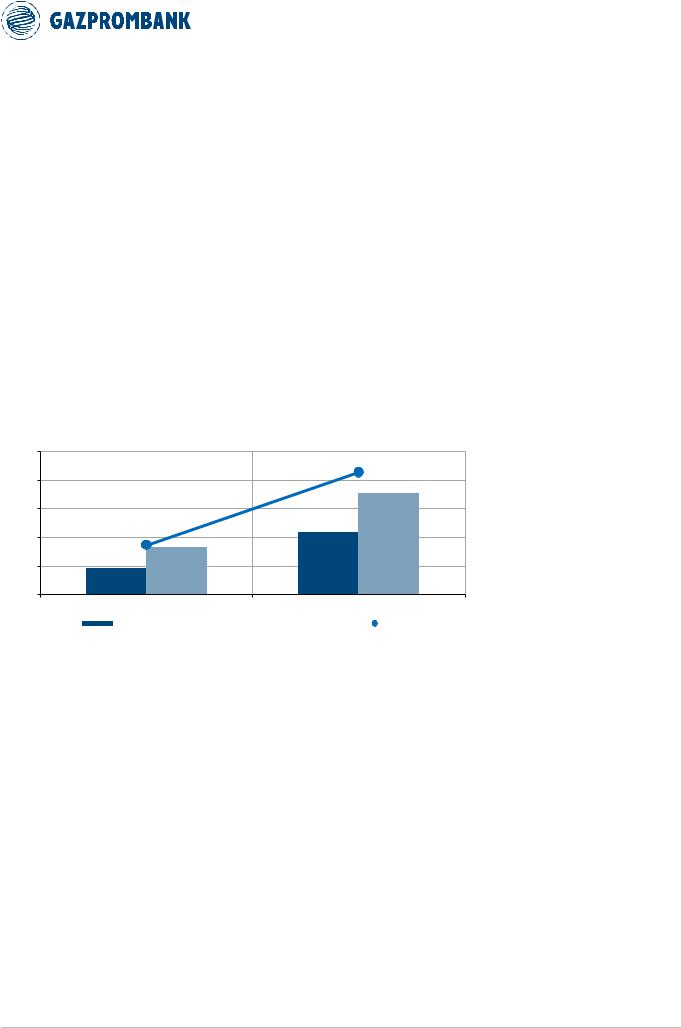

-differences between IFRS and RAS-based depreciation, implying that calculation of the dividend base should effectively employ RAS-based depreciation, which for Russian Grids and FSK is substantially higher than IFRS-based depreciation, but still below current levels of capex (Chart 31). For Russian Grids, RAS-based depreciation in this context is estimated based on sum of RAS-based depreciations of its subsidiaries.

Chart 31: Depreciation of national grids under RAS is well above that under IFRS, but still below current levels of capex

Depreciation of Russian Grids and FSK under IFRS and RAS (columns) capex (line), 2017

250

RUB bln

200

150

100

50

-

FSK |

|

|

RusGrids |

||

DEPRECIATION (IFRS) |

|

DEPRECIATION (RAS) |

|

|

CAPEX (IFRS) |

|

|

|

|||

Note: RAS-based depreciation for Russian Grids is calculated as the sum of RAS-based depreciation of its subsidiaries.

Source: company data, Gazprombank estimates

-Non-cash portion of revenues for connecting consumers and generators to the network. Connection revenues for FSK were hiked substantially starting from 2015 on the back of recognition of revenues for connecting new electric power plants to the network. However, in practice a major portion of this revenue was not supported by cash, as the generators have the right to pay for connection in arrears over a 10-year period. Non-cash connection revenues are effectively excluded from the basis for dividend calculation.

-Portion of net income used for capex as per official investment programs.

-Financial support of selected subsidiaries of Russian Grids, which can total up to RUB 39 bln in 2016-18, according to Kommersant.

-Revaluation of financial assets, e.g. FSK’s stake in InterRAO.

Key practical implications of these adjustments are as follows:

-The dividend base is below net income under IFRS, especially for ROSSETI (Russian Grids), whose dividend base is additionally undermined by subtraction of “financial support of subsidiaries”.

-Dividends for FSK are calculated effectively based on adjusted RAS net income, as IFRS net income is additionally reduced by the difference between IFRS and RAS-based depreciation. This is one of the reasons why we base our valuation for FSK on the company’s RAS accounts.

23

vk.com/id446425943

NOVEMBER 23, 2018 |

RUSSIA > EQUITY RESEARCH > UTILITIES |

|

|

Dividend yield: depends on willingness – not just the ability – to pay

Combining our profit and FCF forecasts with assumptions on dividend-payout approaches, we expect the following DY dynamics relative to current share prices (Chart 32).

Chart 32. Unipro, Enel Russia, RusHydro and FSK may show solid DY in the medium term on the back of solid dividend payouts

Estimated DY (declared for the year) of covered companies (without the effect of modernization program): 2017-26

25% |

|

|

DY |

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

2018E |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15% |

|

|

|

|

|

|

|

|

|

|

|

|

|

2020E |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

10% |

|

|

|

CoD |

|

|

|

|

|

|

|

|

|

2021E |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

2022E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

2023E |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

2024E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

2025E |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Rushydro |

InterRAO |

Unipro |

Enel Russia |

TGK-1 |

Mosenergo |

OGK-2 |

Russian Grids |

FSK |

|

|

2026E |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

||||||||||

|

|

|

|

|

Source: company data, Gazprombank estimates

We highlight the following differences in the DY profiles:

Companies with the most solid DY profiles in the medium term:

-RusHydro, Unipro, Enel Russia, FSK – on the back of relatively generous dividend payouts that they currently employ;

-Mosenergo, TGK-1 – on the back of a potential increase in payouts due to strong FCF and solid balance sheets.

Companies with the least solid DY profile in the medium term: Russian Grids if the mechanism of cross-financing within the group is not scaled down substantially.

DY to CoD premium for generators: significant variations

An important indicator of the solidity of a dividend flow is the period during which the company may deliver DY exceeding CoD. From this standpoint, we highlight the following (Chart 33, Chart 33):

Chart 33. Timing of DY-to-CoD premium differs by GenCo

Years when DY>CoD (within 2018-26)

Rushydro…

InterRAO

Unipro

Enel Russia

Mosenergo

TGK-1

Years when DY >CoD

OGK-2

Chart 34. RusHydro, Unipro and Enel Russia may show the longest periods of DY-to-CoD premium

Number of years when DY>CoD (within 2018-26)

9 |

|

|

# of years |

|

|||

|

|

|

|

8 |

|

|

with DY>CoD |

7 |

|

|

(within 2018- |

6 |

|

|

26) |

|

|

|

|

5 |

|

|

|

4 |

|

|

|

3 |

|

|

|

2 |

|

|

|

1 |

|

|

|

0 |

|

|

|

|

|

|

2017E |

2018E |

2019E |

2020E |

2021E |

2022E |

2023E |

2024E |

2025E |

2026E |

Rushydro (group) |

InterRAO |

Unipro |

Enel Russia |

Mosenergo |

TGK-1 |

OGK-2 |

|

|

|

|

Source: company data, Gazprombank estimates |

|

|

|

Source: company data, Gazprombank estimates |

||||||||

Generators with the longest periods of DY-to-CoD premium: RusHydro, Unipro and Enel Russia due to their relatively generous dividend payment approaches. These companies have been paying out no less than 50% of net income (nominal or adjusted).

24

vk.com/id446425943

NOVEMBER 23, 2018 |

RUSSIA > EQUITY RESEARCH > UTILITIES |

|

|

FINANCIAL LEVERAGE

Having entered positive FCF territory on average around 2015-16 (with the completion of most CSA-supported capacity introductions), Russian generators on average have substantially reduced their leverage.

Chart 35: Inter RAO, Mosenergo have the most solid cash position; FSK and Enel Russia – heaviest leverage

Net (debt) or cash / EBITDA for covered companies

2.0 |

|

|

Net (debt) or Cash / |

Net cash |

|

2017 |

|

2018E |

|

2019E |

|

|

|

|

|||||||

1.5 |

|

|

|

|

|

|||||

|

|

|

|

|

||||||

|

|

EBITDA |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||

1.0 |

|

|

|

|

|

|

|

|

|

|

0.5 |

|

|

|

|

|

|

|

|

|

|

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(0.5) |

|

|

|

|

|

|

|

|

|

|

(1.0) |

|

|

|

|

|

|

|

|

|

|

(1.5) |

|

|

|

Net debt |

|

|

|

|

|

|

(2.0) |

|

|

|

|

|

|

|

|

|

|

|

|

Rushydro InterRAO |

Unipro Enel Russia Mosenergo TGK-1 |

OGK-2 |

Russian |

|

FSK |

|||

|

|

|||||||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

Grids |

|

|

Source: company data, Gazprombank estimates

Note: RusHydro net debt includes the value of the forward contract with VTB.

While the average leverage of covered generators appears healthy, there are substantial inter-company variations as follows (Chart 24):

Lowest leverage: Inter RAO, Mosenergo, Unipro and TGK-1, which either already show a net cash position (Inter RAO, Mosenergo, Unipro) or should have no net debt by end 2019 (TGK-1).

Highest leverage: Russian Grids, FSK, Enel Russia, RusHydro and OGK-2

(even though the leverage of OGK-2 is declining rapidly, as the company prefers to retain a major part of its healthy FCF).

We note that our conservative estimate of Net Debt/EBITDA of RusHydro accounts for the estimated value of the forward contact with VTB even though this value fluctuates over time depending in particular on RusHydro share price..

25

vk.com/id446425943

NOVEMBER 23, 2018 |

RUSSIA > EQUITY RESEARCH > UTILITIES |

|

|

FINANCIAL RESULTS FOR 2018

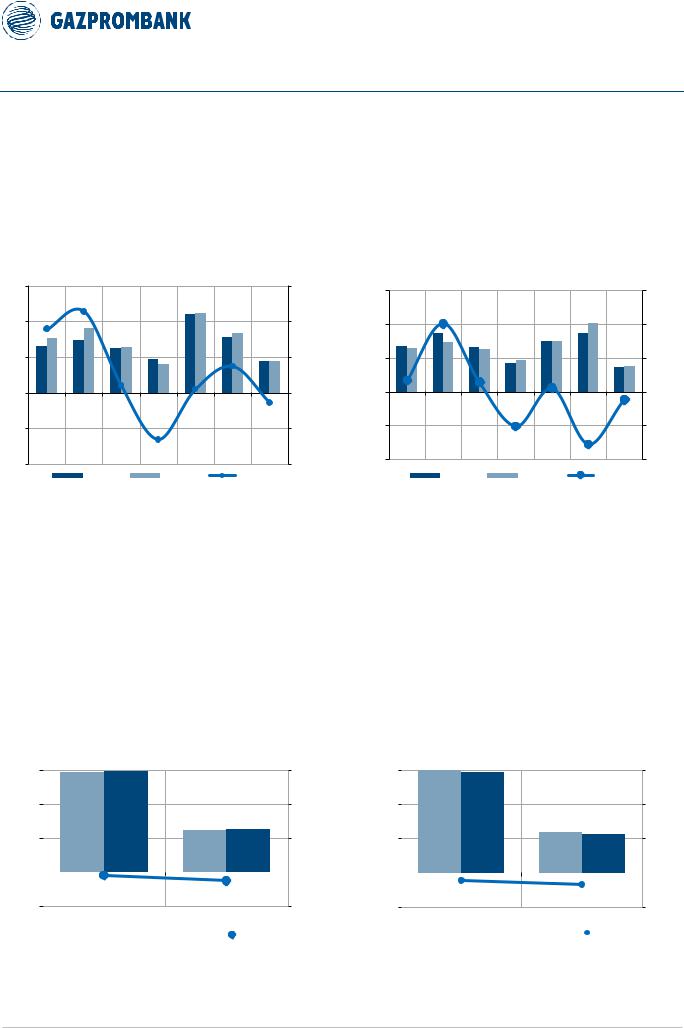

Generators: EBITDA of Enel Russia and Mosenergo may show a decline for different reasons

In 1H18, electricity generators generally showed growth in EBITDA (Chart 36). The key exception was:

Enel Russia, the EBITDA of which has declined largely on the back of a softening

supply-demand balance in Urals region.

Chart 36. Majority of covered generators showed EBITDA growth in 1H18

EBITDA/capacity for covered gencos, 1H18, 1H17 (lhs), YoY change (rhs)

Chart 37. EBITDA growth for generators should slow down in 2H18 but generally continue for FY18. Mosenergo –key exception

EBITDA/capacity for covered gencos, 2018, 2017 (lhs), YoY change (rhs)

3

2

1

0

-1

-2

RUB mln/kW

Rushydro (group) |

InterRAO |

Unipro |

Enel Russia |

Mosenergo |

|

1H17 |

|

1H18 |

|

YoY

TGK-1 |

OGK-2 |

YOY CHANGE

30%

20%

10%

0%

-10%

-20%

6

4

2

0

-2

-4

Rb mln/ KW |

y/y change |

Rushydro (group) |

InterRAO |

Unipro |

Enel Russia |

TGK-1 |

Mosenergo |

OGK-2 |

|

2018 |

|

2017 |

|

|

YOY CHANGE |

30%

20%

10%

0%

-10%

-20%

Source: company data, Gazprombank estimates |

Source: company data, Gazprombank estimates |

For FY18, we expect YoY EBITDA dynamics to be broadly similar to 1H18 (Chart 37).

The key exception is:

Mosenergo, the EBITDA of which should decline in 2H18 and FY18 on the back of expiration of two CSA contracts in mid-2018 (new units at CHP-21 and CHP-27). Another CSA is to expire at end 2018 and should negatively affect 2019.

National grids: Connection-adjusted EBITDA may show mild decline due to modest tariff hike

Russian Grids and FSK showed a small decline in EBITDA in 1H18 on the back of below-inflation growth in the electricity transportation tariff (Chart 38).

Chart 38. Russian Grids and FSK showed a minor decline in connection-adjusted EBITDA in 1H17

Connection-adjusted EBITDA 1H18, 1H17 (lhs), YoY change (rhs)

150 |

|

|

|

|

|

|

|

|

|

YoY |

|

30% |

|

|

|

|

|

||||||||||

|

|

|

RUB bln |

|

|

|

|

|

|

|

|

||

100 |

|

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

|

|

|

|||

50 |

|

|

|

|

|

|

|

|

|

|

|

10% |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

||

- 50 |

|

|

|

|

|

|

|

|

|

|

|

-10% |

|

|

|

|

|

||||||||||

|

|

|

|

Russian Grids |

|

|

FSK |

||||||

|

|

|

|

|

|

1H18 |

|

1H17 |

|

Y/Y GROWTH |

|||

|

|

|

|

|

|

|

|

||||||

Source: company data, Gazprombank estimates

Chart 39. Minor decline in connection-adjusted EBITDA of Russian Grids and FSK may continue throughout 2018

Connection-adjusted EBITDA FY18, FY17 (lhs), YoY change (rhs)

300 |

|

|

|

|

|

|

|

|

|

YoY |

|

30% |

|

|

|

|

RUB bln |

|

|

|

|

|

|

|

|

||

200 |

|

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

|

|

|

|||

100 |

|

|

|

|

|

|

|

|

|

|

|

10% |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

||

- 100 |

|

|

|

|

|

|

|

|

|

|

|

-10% |

|

|

|

|

|

||||||||||

|

|

|

|

Russian Grids |

|

|

FSK |

||||||

|

|

2017 |

|

2018E |

|

Y/Y GROWTH |

|||||||

|

|

|

|

||||||||||

Source: company data, Gazprombank estimates

For FY18, we expect similarly modest dynamics of EBITDA for national grids (after adjusting for abnormal connection revenues) due to modest growth in the transmission tariff.

26

vk.com/id446425943

NOVEMBER 23, 2018 |

RUSSIA > EQUITY RESEARCH > UTILITIES |

|

|

REGULATORY CHANGES

Electricity generation: “modernization” of “old” thermal capacities

The Russian government is preparing to launch a new mechanism that should provide regulatory support for investment in modernization of existing (“old”) thermal capacity, according to indications by the Energy Ministry, market participants and business media (e.g. Kommersant). The reasons for launching the new mechanism are as follows:

old age of the Russian electricity generation fleet in comparison to that of the largest countries, as is seen from a comparison of average age (Chart 40) as well as the share of capacities exceeding a certain threshold (Chart 41).

gradual decline in Russian electricity consumer payments for CSAs after 2020, which should make them able to “pay” for a new wave of modernization.

Chart 40. Average age of Russian generation exceeds that of other key economies

Average age of capacity by country (2017)

Chart 41. Share of “old” generating capacities in Russia exceeds that in other key economies

Share of generation capacity aged >45 years by country (2017), %

40 |

# years |

|

|

|

|

|

|

|

|

|

35 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

35 |

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

RUSSIA |

US |

JAPAN |

GERMANY |

UK |

BRAZIL |

INDIA |

TURKEY |

CHINA |

|

RUSSIA |

US |

JAPAN |

UK |

GERMANY |

TURKEY |

INDIA |

CHINA |

||||

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

Source: Inter RAO |

|

|

|

|

|

|

|

|

Source: Inter RAO |

||||

This mechanism is envisioned as broadly similar to the already employed CSA mechanism, with the key difference being that it is meant to support investment in modernization of existing (“old”) capacity, while CSAs were designed to support investment in new capacity. Although the mechanism is not officially launched yet, its key features – as proposed by the Energy Ministry – appear to be as follows:

Volume of capacity to be modernized: ~40 GW, including:

-~3 GW of capacities with modernization completed by 2022;

-~4 GW p.a. of capacities with modernization completed annually in 2023-31.

Type of compensation: via “premium” (i.e. above KOM) capacity payments to be collected following completion of the project (similar to the CSA mechanism).

Duration of “premium” capacity payments: 15 years. The “premium” payment is to start in the second year after completion of a modernization project. During the first year, the capacity payment for modernized capacity should cover only its opex.

-This implies that the duration of the “premium” capacity payment under the modernization program is longer than that under CSAs, where payments for thermal units last for 10 years. On the flipside, the new mechanism does not presume an uplift to the capacity payment during the last years of the compensation period (as is the case for years 7-10 of CSAs).

Base rate of return on invested capital: 12-14% with adjustments for fluctuations in the yield on Russian government bonds. The final value of base ROIC is yet to be determined.

27

vk.com/id446425943

NOVEMBER 23, 2018 |

RUSSIA > EQUITY RESEARCH > UTILITIES |

|

|

-Currently, the government is considering a proposal to set the target ROIC at

14% for the “first” wave of modernization projects (to be selected in 2018 and launched in 2022-24) and 12% for later projects, according to Kommersant.

Project selection approach:

-Process: annual selection with a six-year horizon (except for 2018, when selection applies to projects to be completed by 2022-24). To synchronize the regulatory decisions of the “modernization” program and KOM, the government is preparing an expansion of the KOM horizon to six years as well, according to industry participants (e.g. Inter RAO, Unipro).

-Selection criteria: lowest value of the aggregate indicator of project efficiency. The indicator combines both targeted capex and opex of a project.

Sources for recovery of investment in modernization: payments by consumers. As consumer payments under CSAs are to decline after 2020, the new mechanism should not trigger an additional hike in consumer prices for electricity.

Duration of the program:

-Modernization activities: 2019-31. The first wave of projects (to be completed by 2022-24) should be selected in late 2018 – early 2019.

-Premium capacity payments for modernized capacity: 2023-47.

Total investments under the program: ~RUB 1.45 trln (in 2020 prices), according to estimates by the Energy Ministry as cited by Kommersant.

We do not yet incorporate the implications of the modernization programs in our forecasts, as the specific parameters for each generator (e.g. capacity selected for modernization, return on modernization projects) remain uncertain.

28

vk.com/id446425943

NOVEMBER 23, 2018 |

RUSSIA > EQUITY RESEARCH > UTILITIES |

|

|

Heat generation: “Alternative boiler-shop” pricing

In July 2017, the Russian government approved a gradual switch to a new approach for regulation of regional heat energy markets. Key features of the new approach are as follows:

Regional “price cap” for heat energy. Regional tariffs for heat are to be capped by the prices of a hypothetical new boiler shop (“alternative boiler shop”). The cap is to be set by regional regulators based on the approach approved by the federal government.

Gradual convergence of the regional heat price with the “price cap”, as follows:

-If the heat selling price of a producer exceeds the “price cap”, the selling price is “frozen” until the “price cap” inflates towards it.

-If the heat selling price of a producer is below the “price cap”, the selling price is gradually raised toward the price cap level over a five-year period.

Decision on switching to new regulation is to be made by regional authorities and approved by the federal government.

Practical introduction of the new regulation could be potentially beneficial for generators with substantial shares of co-generating units (CHPs) (e.g. among covered companies, Mosenergo and TGK-1), as it could imply a potential hike in heat selling prices for these units. However, we do not yet incorporate this change into our forecasts, as its practical introduction by regional authorities remains uncertain.

Electricity grids: “Digitalization” program

In early 2018, the management of Russian Grids proposed a program for “digitalization” of grids, with its broad features as follows:

Duration of program: 2018-30.

Goal of program: To increase the efficiency of grid operations via implementation of automatic and digital control and management tools.

Cost of program: RUB 1.3 trln until 2030, split over several directions (Chart 42). - The split of the expenditures between additional capex and opex is unclear.

Chart 42: Program of ‘digitalization” of the electricity network presumes RUB 1.3 trln of expenditures in various directions by 2030

Potential expenditures for realization of the program on “digitalization” of electricity grids broken down by direction and time

300

RUB bln |

|

before 2022 |

|

2023-25 |

|

2026-30 |

|

|

|

||||

|

|

|

250

200

150

100

50

0

METERING DEVICES |

TELEAUTOMATION |

TELECOMMUNICATIONS |

CYBER SECURITY |

CONTROL SYSTEMS |

CONTROLLABLE GRID |

SECONDARY SYSTEMS |

|

|

|

|

|

ELEMENTS |

OF SUBSTATIONS |

Source: Russian Grids, Kommersant

29

vk.com/id446425943

NOVEMBER 23, 2018 |

RUSSIA > EQUITY RESEARCH > UTILITIES |

|

|

Economic effect of the program: Potential reduction of electricity losses, opex and capex by ~30% after its realization (i.e. after 2030), according to Russian Grids estimates.

Effect on tariffs: should not be material if Russian Grids is allowed to “keep” the savings from realization of the program, according to company estimates.

Status of approval: the program is broadly supported by key government officials, e.g. Deputy Prime Minister Dmitry Kozak, according to an interview with RBC.

We do not yet incorporate into our valuation either expenditures or efficiency gains associated with potential realization of the “digitalization” program. However, we consider the program as potentially risky for minority shareholders of Russian Grids, at least over the first years of its realization, assuming no additional tariff hike associated with the program. The risk is triggered by the fact that, at least during the initial stages of realization of the program, the actual hike in expenditures and pressure on FCF is likely to prevail in investors’ minds over hypothetical future benefits.

Electricity retail: “Benchmark” pricing

Starting from July 2018, the approach to regulation of electricity retail companies

(“supply companies”) should be gradually shifted to one based on “benchmarking”. Key features of the new approach are as follows:

Markup of the electricity supply company (on top of purchase costs) is to be set to cover “allowed” expenditures plus a profit margin.

“Allowed” opex is to be set based on a benchmark approach, including the following components:

-Fixed opex (payroll, rent, bill processing, call centers, payments, etc) are to be set for three years based on the region and scale of the supply company.

-Doubtful debt reserves – defined as 1.5% of revenues.

Allowed other expenditures are to be set as follows:

-Interest on loans: CBR key rate +4%.

-Deprecation, capex: based on the investment program.

Allowed profit margin (on top of purchase costs and other allowed costs) – 1.5%.

Shift to the new regulation should occur over a 2-3 year period starting July 1, 2018.

The shift to the new regulation should potentially be beneficial for efficient supply companies, including subsidiaries of Inter RAO, in our view. That said, we do not yet explicitly account for this in our valuation approach.

30