GPB_Russian Utilities Initiation_231118_watermark

.pdf

vk.com/id446425943

NOVEMBER 23, 2018 RUSSIA > EQUITY RESEARCH > UTILITIES

Table 9. Mosenergo forecast (IFRS based) and valuation, RUB bln or RUB per share

P&L (IFRS), RUB bln: Mosenergo |

2013 |

2014 |

2015 |

2016 |

2017 |

2018E |

2019E |

2020E |

2021E |

2022E |

2023E |

2024E |

2025E |

2026E |

TV'2027 |

Revenue electricity: old |

62.8 |

63.9 |

60.9 |

63.8 |

64.9 |

64.9 |

66.6 |

68.9 |

72.7 |

74.9 |

77.1 |

79.2 |

81.3 |

84.0 |

|

Revenue electicity: new |

19.1 |

19.6 |

24.4 |

37.0 |

44.0 |

38.6 |

29.9 |

32.9 |

31.9 |

32.4 |

33.0 |

27.8 |

25.3 |

26.1 |

|

Revenue electricity |

82.0 |

83.5 |

85.2 |

100.7 |

108.9 |

103.5 |

96.5 |

101.7 |

104.6 |

107.4 |

110.1 |

107.1 |

106.6 |

110.1 |

|

Heat revenue |

61.2 |

65.5 |

69.9 |

77.9 |

75.2 |

79.3 |

79.9 |

80.4 |

80.9 |

81.3 |

81.6 |

81.7 |

81.6 |

82.3 |

|

Revenue other (incl. reselling) |

12.8 |

15.0 |

16.0 |

12.0 |

12.0 |

12.4 |

10.0 |

8.2 |

6.8 |

5.7 |

4.8 |

4.1 |

3.5 |

3.1 |

|

Revenue (before subsidies) |

155.9 |

164.0 |

171.2 |

190.7 |

196.1 |

195.2 |

186.4 |

190.3 |

192.3 |

194.3 |

196.5 |

192.8 |

191.7 |

195.5 |

|

Subsidies |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Revenue |

155.9 |

164.0 |

171.2 |

190.7 |

196.1 |

195.2 |

186.4 |

190.3 |

192.3 |

194.3 |

196.5 |

192.8 |

191.7 |

195.5 |

|

Fuel costs electricity, old |

(53.8) |

(57.4) |

(56.2) |

(62.6) |

(61.1) |

(64.5) |

(65.2) |

(65.7) |

(66.8) |

(68.0) |

(69.1) |

(70.1) |

(71.1) |

(72.9) |

|

Fuel costs heat, old |

(28.0) |

(29.9) |

(29.2) |

(32.6) |

(31.8) |

(33.6) |

(33.9) |

(34.2) |

(34.8) |

(35.4) |

(35.9) |

(36.5) |

(37.0) |

(37.9) |

|

Fuel costs, new |

(7.6) |

(8.4) |

(10.9) |

(15.1) |

(15.0) |

(16.1) |

(16.4) |

(16.8) |

(17.3) |

(17.8) |

(18.3) |

(18.8) |

(19.3) |

(19.8) |

|

Fuel costs,old and new |

(89.4) |

(95.7) |

(96.3) |

(110.2) |

(107.8) |

(114.2) |

(115.5) |

(116.7) |

(118.8) |

(121.1) |

(123.3) |

(125.4) |

(127.4) |

(130.6) |

|

Purchased power & Re-selling |

(9.4) |

(8.6) |

(8.8) |

(9.6) |

(10.0) |

(10.5) |

(8.7) |

(7.3) |

(6.1) |

(5.2) |

(4.5) |

(3.9) |

(3.3) |

(2.9) |

|

Heat transportation |

(7.6) |

(7.3) |

(6.5) |

(4.0) |

(1.9) |

(0.9) |

(0.9) |

(0.9) |

(0.9) |

(1.0) |

(1.0) |

(1.0) |

(1.0) |

(1.0) |

|

Water payment |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Gross profit |

49.5 |

52.4 |

59.5 |

66.9 |

76.3 |

69.6 |

61.3 |

65.4 |

66.4 |

67.1 |

67.7 |

62.6 |

60.0 |

61.0 |

|

Non-fuel Opex: Old plants |

(21.0) |

(24.6) |

(25.3) |

(23.4) |

(23.1) |

(23.9) |

(25.0) |

(26.1) |

(27.1) |

(28.1) |

(29.0) |

(29.8) |

(30.5) |

(31.1) |

|

Non-fuel Opex: new plants |

(2.6) |

(2.8) |

(3.8) |

(5.0) |

(5.2) |

(5.5) |

(5.8) |

(6.0) |

(6.3) |

(6.5) |

(6.7) |

(6.9) |

(7.1) |

(7.5) |

|

Cost of subsidies |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Non-fuel Opex |

(23.5) |

(27.4) |

(29.2) |

(28.3) |

(28.4) |

(29.4) |

(30.8) |

(32.1) |

(33.4) |

(34.6) |

(35.8) |

(36.8) |

(37.6) |

(38.7) |

|

EBITDA, old plants |

13.5 |

10.2 |

13.5 |

19.2 |

22.3 |

21.3 |

21.5 |

22.3 |

24.0 |

23.9 |

23.7 |

23.5 |

23.3 |

23.5 |

|

EBITDA, new plants |

9.0 |

8.5 |

9.6 |

16.9 |

23.8 |

17.0 |

7.7 |

10.1 |

8.3 |

8.1 |

7.9 |

2.1 |

(1.1) |

(1.2) |

|

EBITDA, reselling / other |

3.5 |

6.4 |

7.3 |

2.5 |

1.9 |

1.9 |

1.3 |

0.9 |

0.6 |

0.5 |

0.3 |

0.2 |

0.2 |

0.1 |

|

EBITDA |

26.0 |

25.1 |

30.3 |

38.6 |

48.0 |

40.2 |

30.5 |

33.3 |

32.9 |

32.4 |

32.0 |

25.9 |

22.4 |

22.3 |

|

Depreciation: Old plants |

(11.5) |

(12.1) |

(14.5) |

(10.7) |

(10.7) |

(10.9) |

(10.9) |

(10.9) |

(10.9) |

(10.9) |

(10.9) |

(10.9) |

(10.9) |

(10.9) |

|

Depreciation: New plants |

(2.5) |

(3.4) |

(4.1) |

(4.4) |

(4.4) |

(4.4) |

(4.4) |

(4.4) |

(4.4) |

(4.4) |

(4.4) |

(4.4) |

(4.4) |

(4.4) |

|

Depreciation |

(14.0) |

(15.5) |

(18.6) |

(15.1) |

(15.1) |

(15.2) |

(15.2) |

(15.2) |

(15.2) |

(15.2) |

(15.2) |

(15.2) |

(15.2) |

(15.2) |

|

EBIT |

12.0 |

9.6 |

11.7 |

23.5 |

32.9 |

25.0 |

15.3 |

18.1 |

17.7 |

17.2 |

16.8 |

10.6 |

7.1 |

7.1 |

|

Finance (costs) / income |

0.5 |

1.4 |

(1.9) |

4.4 |

1.3 |

1.1 |

1.6 |

2.4 |

3.4 |

4.2 |

4.8 |

5.2 |

5.3 |

5.2 |

|

One-offs (cash) |

0.0 |

0.0 |

0.0 |

(0.0) |

1.2 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

One-offs (non-cash): operational |

(2.2) |

(8.0) |

(12.2) |

(6.9) |

(4.9) |

(3.7) |

(1.8) |

(0.9) |

(0.5) |

(0.2) |

(0.1) |

(0.1) |

(0.0) |

(0.0) |

|

One-offs (non-cash): financial |

(1.2) |

(6.3) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

EBT |

9.2 |

(3.3) |

(2.4) |

20.9 |

30.5 |

22.5 |

15.1 |

19.6 |

20.6 |

21.2 |

21.4 |

15.8 |

12.4 |

12.3 |

|

Income tax |

(1.7) |

0.2 |

0.6 |

(7.4) |

(5.7) |

(4.7) |

(3.2) |

(4.1) |

(4.3) |

(4.4) |

(4.5) |

(3.3) |

(2.6) |

(2.6) |

|

Net profit (pre-minorities) |

7.5 |

(3.1) |

(1.8) |

13.5 |

24.8 |

17.7 |

11.9 |

15.5 |

16.3 |

16.7 |

16.9 |

12.5 |

9.8 |

9.7 |

|

Minority |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Net profit (reported) |

7.5 |

(3.1) |

(1.8) |

13.5 |

24.8 |

17.7 |

11.9 |

15.5 |

16.3 |

16.7 |

16.9 |

12.5 |

9.8 |

9.7 |

|

Net profit (adj) |

10.2 |

10.2 |

7.7 |

22.0 |

27.0 |

20.6 |

13.3 |

16.2 |

16.7 |

16.9 |

17.0 |

12.5 |

9.8 |

9.7 |

|

Leverage, RUB bn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TV'2027 |

Net (Debt) / Cash (year end) |

(24) |

(39) |

(43) |

(18) |

(3) |

19 |

29 |

41 |

51 |

58 |

64 |

64 |

64 |

65 |

(45) |

Net Debt or (Cash) / EBITDA (year end) |

0.9 |

1.6 |

1.4 |

0.5 |

0.1 |

(0.5) |

(1.0) |

(1.2) |

(1.5) |

(1.8) |

(2.0) |

(2.5) |

(2.8) |

(2.9) |

2.0 |

Multiples |

|

|

` |

|

|

|

|

|

|

|

|

|

|

|

|

FCF Yield |

-13% |

10% |

-4% |

37% |

39% |

32% |

21% |

24% |

23% |

23% |

22% |

14% |

9% |

8% |

|

|

|||||||||||||||

DY |

2% |

2% |

3% |

5% |

10% |

7% |

5% |

9% |

10% |

12% |

12% |

9% |

7% |

7% |

|

EV/EBITDA |

3.5 |

4.0 |

3.6 |

2.6 |

1.6 |

1.6 |

1.7 |

1.3 |

1.1 |

1.0 |

0.9 |

1.0 |

1.1 |

1.1 |

|

PE (adj) |

6.7 |

6.6 |

8.8 |

3.1 |

2.5 |

3.3 |

5.1 |

4.2 |

4.1 |

4.0 |

4.0 |

5.4 |

6.9 |

7.0 |

|

Dividend, RUB / s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TV'2027 |

DPS: regular |

0.04 |

0.03 |

0.06 |

0.08 |

0.17 |

0.11 |

0.09 |

0.15 |

0.18 |

0.21 |

0.21 |

0.16 |

0.12 |

0.12 |

0.98 |

DPS: special (leverage optimization) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.75 |

DPS: special (non-core assets sale) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

DPS: total |

0.04 |

0.03 |

0.06 |

0.08 |

0.17 |

0.11 |

0.09 |

0.15 |

0.18 |

0.21 |

0.21 |

0.16 |

0.12 |

0.12 |

3.73 |

Dividend / Net profit (nominal) |

21% |

0% |

0% |

25% |

27% |

25% |

31% |

37% |

44% |

50% |

50% |

50% |

50% |

50% |

|

Dividend / Net profit (adj) |

16% |

12% |

29% |

15% |

24% |

22% |

28% |

36% |

43% |

49% |

50% |

50% |

50% |

50% |

|

Dividend / FCF |

neg |

18% |

neg |

13% |

25% |

21% |

26% |

35% |

45% |

55% |

57% |

66% |

83% |

86% |

|

Cash Flow, RUB bn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TV'2027 |

NOPAT: old plants |

1.7 |

(1.9) |

(1.0) |

6.7 |

9.1 |

8.3 |

8.4 |

9.1 |

10.4 |

10.3 |

10.2 |

10.0 |

9.8 |

9.9 |

|

NOPAT: new |

5.3 |

4.7 |

4.4 |

9.9 |

15.3 |

10.0 |

2.7 |

4.5 |

3.1 |

3.0 |

2.8 |

(2.3) |

(5.5) |

(5.6) |

|

NOPAT: reselling / other |

2.8 |

6.0 |

5.7 |

1.9 |

1.5 |

1.5 |

1.0 |

0.7 |

0.5 |

0.4 |

0.3 |

0.2 |

0.1 |

0.1 |

|

NOPAT |

9.8 |

8.8 |

9.1 |

18.6 |

26.0 |

19.8 |

12.1 |

14.3 |

14.0 |

13.6 |

13.2 |

7.9 |

4.5 |

4.4 |

|

CapEx: Maintenance |

0.0 |

0.0 |

(7.7) |

(8.2) |

(11.0) |

(13.5) |

(13.0) |

(13.2) |

(13.3) |

(13.5) |

(13.6) |

(13.8) |

(13.9) |

(14.0) |

|

CapEx: New |

(27.8) |

(17.8) |

(15.4) |

0.0 |

(4.2) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

CapEx |

(27.8) |

(17.8) |

(23.1) |

(8.2) |

(15.2) |

(13.5) |

(13.0) |

(13.2) |

(13.3) |

(13.5) |

(13.6) |

(13.8) |

(13.9) |

(14.0) |

|

Working Capital Red./ (Incr.) |

(5.0) |

0.0 |

(7.1) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

FCF; old plants |

8.2 |

10.2 |

(1.4) |

9.2 |

8.8 |

5.6 |

6.3 |

6.8 |

7.9 |

7.6 |

7.4 |

7.1 |

6.8 |

6.8 |

58.8 |

FCF; new plants |

(20.0) |

(9.7) |

(7.0) |

14.3 |

15.5 |

14.3 |

7.0 |

8.9 |

7.5 |

7.3 |

7.2 |

2.1 |

(1.1) |

(1.2) |

35.5 |

FCF: reselling / other |

2.8 |

6.0 |

5.7 |

1.9 |

1.5 |

1.5 |

1.0 |

0.7 |

0.5 |

0.4 |

0.3 |

0.2 |

0.1 |

0.1 |

0.7 |

FCF: cash one-offs |

0.0 |

0.0 |

0.0 |

(0.0) |

1.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

FCF (to EV) |

(9.0) |

6.5 |

(2.6) |

25.4 |

26.8 |

21.5 |

14.3 |

16.4 |

15.9 |

15.3 |

14.8 |

9.4 |

5.9 |

5.7 |

95.0 |

Interest (CF) |

0.3 |

0.3 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

FCF (to Equity) |

(8.7) |

6.7 |

(2.6) |

25.5 |

26.8 |

21.5 |

14.3 |

16.4 |

15.9 |

15.3 |

14.8 |

9.4 |

5.9 |

5.7 |

|

Discounting parameters |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period for discounting, years |

DCF |

|

|

|

|

(1.4) |

(0.4) |

0.6 |

1.6 |

2.6 |

3.6 |

4.6 |

5.6 |

6.6 |

0.6 |

|

DDM |

|

|

|

|

(0.4) |

0.6 |

1.6 |

2.6 |

3.6 |

4.6 |

5.6 |

6.6 |

7.6 |

1.6 |

Discounting factor |

DCF |

|

|

|

|

|

1.03 |

0.93 |

0.81 |

0.72 |

0.63 |

0.56 |

0.49 |

0.43 |

0.38 |

|

DDM |

|

|

|

|

1.03 |

0.91 |

0.79 |

0.68 |

0.59 |

0.50 |

0.44 |

0.38 |

0.32 |

0.28 |

DCF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DCF: Old plants |

|

|

|

|

|

|

6.4 |

6.3 |

6.4 |

5.5 |

4.7 |

4.0 |

3.3 |

2.9 |

22.3 |

DCF: New plants |

|

|

|

|

|

|

7.2 |

8.2 |

6.1 |

5.3 |

4.5 |

1.2 |

(0.5) |

(0.5) |

13.5 |

DCF: Reselling / other |

|

|

|

|

|

|

1.1 |

0.7 |

0.4 |

0.3 |

0.2 |

0.1 |

0.1 |

0.0 |

0.3 |

DCF: total |

|

|

|

|

|

|

14.7 |

15.1 |

12.9 |

11.0 |

9.4 |

5.2 |

2.9 |

2.4 |

36.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TP (DCF), RUB bln or RUB/s |

|

|

TP (w-average, rounded), RUB/s |

|

|

|

|

Valuation parameters |

|

DDM |

DCF |

Other |

|||

EV, RUB bln |

110 |

|

TP |

|

RUB/s |

Weight |

|

|

|

CoE |

|

|

16.0% |

|

|

Non-core assets |

- |

|

DDM |

|

1.90 |

60% |

|

DDM is a floor for PT |

WACC |

|

|

|

13.6% |

|

|

Net (debt) / Cash (discounted), end 2018 |

13 |

|

DCF |

|

3.10 |

40% |

|

|

|

TG (Dividends) |

|

|

3.5% |

|

|

Equity, RUB bln |

123 |

|

Result (rounded) |

2.40 |

100% |

|

|

|

TG (FCF): "old" assets |

|

|

2.0% |

0.0% |

||

# of shares: current |

40 |

|

|

|

|

|

|

|

|

TG (FCF): "new" assets |

|

|

2.0% |

|

|

# of shares: Ord: New |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# of shares: Ord |

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# of shares: Ord: treasury |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# of shares: Pref |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# of shares: effective, total |

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TP (DCF), RUB |

3.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: company data, Gazprombank estimates

41

vk.com/id446425943

NOVEMBER 23, 2018 |

RUSSIA > EQUITY RESEARCH > UTILITIES |

|

|

INITIATION OF COVERAGE

TGK-1

RU

SSI

FCFY-to-CoE premium is sustainable until 2022, but the need to upgrade heat network adds uncertainty

TGK-1 should deliver a FCFY-to-CoE premium until 2022 with a decline in 2023 due to CSA expirations. Potential capex needs for St. Petersburg Heat network is a source of additional uncertainty.

Operations

Key regional provider of electrical and heat energy in St. Petersburg and surrounding regions (electrical capacity ~7 GW) with a high (>40%) proportion of hydro capacity.

Positives

High share of hydro generation within total capacity (~3 GW out of ~7 GW).

FCF-to-CoE premium in 2018-22, partially on the back of the start of CSA uplift for selected units.

Potential increase in dividend payout (from ~25% of 2017 IFRS net income) on the back of premium FCF starting from 2018 and no net debt starting from end 2019.

Presence of Fortum as a blocking shareholder reduces corporate governance risks.

Possible sale of St. Petersburg Heat Network could limit upside risk to capex.

Potential beneficiary of the change in heat regulation ("alternative boiler shop").

Negatives

Modest historical dividend payout, e.g. ~25% of 2017 IFRS net income paid as dividends.

FCFY to decline after 2020 with the expiration of CSAs at South CHP (Dec. 2020), Pervomai CHP (June 2020, Dec. 2021) and Pravoberezh CHP (Dec. 2022).

Uncertaintly to medium-term capex due to the potential needs to upgrade St. Petersburg Heat Network.

Uncertain progress in the attempted sale of St. Petersburg Heat Network.

Valuation (2018-2026)

FCFY-to-CoE premium: 2018-22.

DY-to-CoD premium: 2019-20, 2022.

Note: Share prices as of closure 20-Nov-2018

TICKER |

TGKA RX |

Currency |

RUB |

|

|

Target price |

0.010 |

Upside |

16% |

|

|

Recommendation |

Neutral |

MCap, bln |

33 |

|

|

Share price |

0.009 |

52-week high |

0.013 |

|

|

52-week low |

0.009 |

|

|

Source: Bloomberg, Gazprombank estimates

|

SHAREHOLDERS |

|

|

|

|

|

|

|

|

||

|

|

Gazprom |

51.8% |

|

|

|

|

Energoholding |

|

||

|

|

|

|

||

|

|

Fortum |

|

29.5% |

|

|

|

Free-float |

19.7% |

|

|

|

|

|

|

|

|

Source: company data

12M PRICE PERFORMANCE |

|

||||

140% |

|

|

|

|

|

120% |

|

|

|

|

|

100% |

|

|

|

|

|

80% |

|

|

|

|

|

60% |

|

MOEX INDEX |

|

|

|

|

TGKA |

|

|

|

|

|

|

|

|

|

|

40% |

Jan-18 |

Mar-18 |

May-18 |

Jul-18 |

|

Nov-17 |

Sep-18 |

||||

Source: Bloomberg

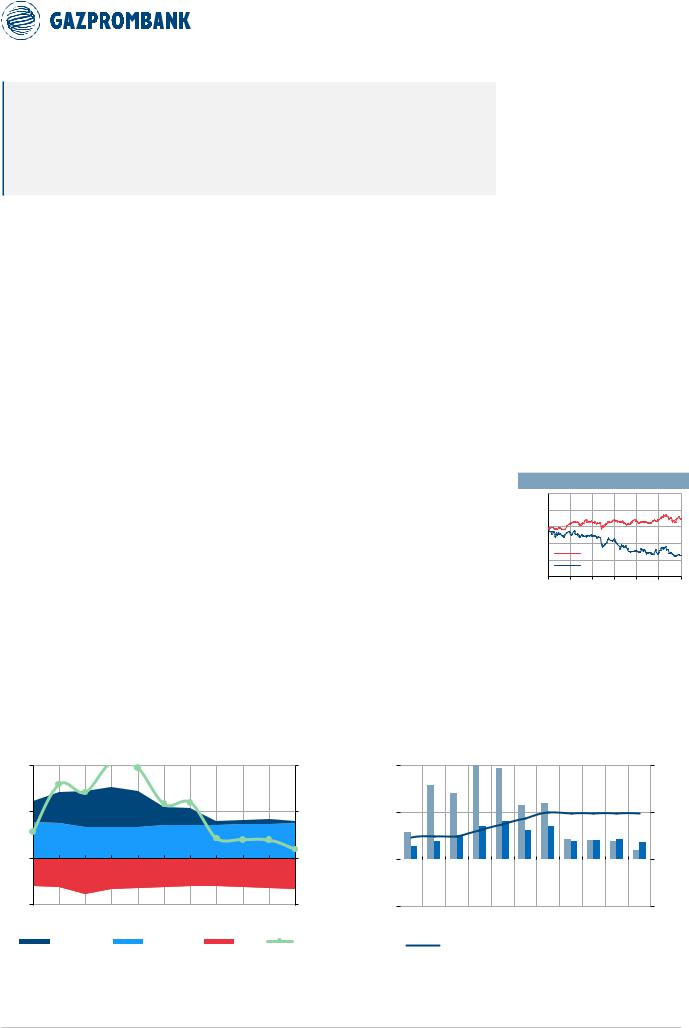

Chart 53. TGK-1: FCF profile |

Chart 54. TGK-1: FCFY and DY profile |

EBITDA (lhs), capex (lhs), FCFY (rhs) |

FCFY (lhs), DY (lhs) and dividend payout vs IFRS net profit (rhs) |

30 |

EBITDA, Capex |

|

|

|

|

|

|

FCFY |

30% |

30% |

||

|

|

|

|

|

|

|

|

|

||||

|

RUB bln |

|

|

|

|

|

|

|

(line) |

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

15% |

15% |

0 |

|

|

|

|

|

|

|

|

|

|

0% |

0% |

-15 |

|

|

|

|

|

|

|

|

|

|

-15% |

-15% |

|

2016 |

2017 |

2018E |

2019E |

2020E |

2021E |

2022E |

2023E |

2024E |

2025E |

2026E |

|

|

|

EBITDA ("NEW") |

|

EBITDA ("OLD") |

|

CAPEX |

|

FCFY |

|

|||

|

FCFY and DY |

|

|

|

|

|

|

|

Dividend |

|

100% |

||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||||

|

(columns) |

|

|

|

|

|

|

|

|

payout (line) |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

2016 |

2017 |

2018E |

2019E |

2020E |

2021E |

2022E |

2023E |

2024E |

2025E |

2026E |

|

|||

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FCF YIELD (LHS) |

|

|

|

|

DIVIDEND YIELD (LHS) |

||||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

DIVIDEND PAYOUT (RHS) |

|

|

|

|

|

|

|

|

|||

Source: company data, Gazprombank estimates |

Source: company data, Gazprombank estimates |

42

vk.com/id446425943

NOVEMBER 23, 2018 RUSSIA > EQUITY RESEARCH > UTILITIES

Table 10. TGK-1 forecast (IFRS-based) and valuation, RUB bln or RUB per share

P&L (IFRS), RUB bln: TGK-1 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018E |

2019E |

2020E |

2021E |

2022E |

2023E |

2024E |

2025E |

2026E |

TV'2027 |

Revenue electricity: old |

21.8 |

20.7 |

19.7 |

22.4 |

23.3 |

25.3 |

26.1 |

27.2 |

28.8 |

30.0 |

31.2 |

32.4 |

33.6 |

34.9 |

|

Revenue electicity: new |

15.6 |

14.0 |

13.1 |

15.4 |

20.3 |

22.6 |

24.5 |

23.3 |

17.9 |

18.2 |

14.2 |

14.7 |

15.2 |

14.7 |

|

Revenue electricity |

37.4 |

34.7 |

32.9 |

37.8 |

43.6 |

47.9 |

50.6 |

50.6 |

46.8 |

48.1 |

45.5 |

47.1 |

48.8 |

49.6 |

|

Heat revenue |

26.0 |

27.7 |

29.6 |

33.7 |

35.3 |

35.5 |

35.8 |

36.2 |

36.5 |

36.8 |

37.0 |

37.2 |

37.3 |

37.7 |

|

Revenue other (incl. reselling) |

6.1 |

6.1 |

6.0 |

7.1 |

8.4 |

8.7 |

6.7 |

5.2 |

4.1 |

3.3 |

2.6 |

2.1 |

1.8 |

1.5 |

|

Revenue (before subsidies) |

69.4 |

68.4 |

68.5 |

78.6 |

87.3 |

92.1 |

93.1 |

91.9 |

87.4 |

88.2 |

85.1 |

86.5 |

87.8 |

88.8 |

|

Subsidies |

0.4 |

0.6 |

0.9 |

0.3 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

Revenue |

69.9 |

69.0 |

69.4 |

78.9 |

87.4 |

92.1 |

93.2 |

92.0 |

87.4 |

88.3 |

85.2 |

86.6 |

87.9 |

88.9 |

|

Fuel costs electricity, old |

(10.8) |

(10.4) |

(9.6) |

(10.7) |

(11.4) |

(12.5) |

(12.7) |

(12.8) |

(13.1) |

(13.3) |

(13.6) |

(13.8) |

(14.1) |

(14.4) |

|

Fuel costs heat, old |

(12.8) |

(12.4) |

(11.4) |

(12.7) |

(13.5) |

(14.8) |

(15.0) |

(15.1) |

(15.4) |

(15.7) |

(16.0) |

(16.2) |

(16.5) |

(16.9) |

|

Fuel costs, new |

(5.9) |

(5.8) |

(5.4) |

(6.1) |

(7.1) |

(7.9) |

(8.1) |

(8.3) |

(8.6) |

(8.9) |

(9.2) |

(9.5) |

(9.7) |

(10.0) |

|

Fuel costs,old and new |

(29.5) |

(28.5) |

(26.4) |

(29.5) |

(31.9) |

(35.2) |

(35.8) |

(36.3) |

(37.1) |

(37.9) |

(38.7) |

(39.5) |

(40.3) |

(41.4) |

|

Purchased power & Re-selling |

(5.4) |

(5.5) |

(5.8) |

(6.2) |

(7.1) |

(7.3) |

(5.7) |

(4.6) |

(3.7) |

(3.0) |

(2.4) |

(2.0) |

(1.7) |

(1.4) |

|

Heat transportation |

(0.6) |

(1.2) |

(2.0) |

(2.1) |

(2.6) |

(2.7) |

(2.7) |

(2.8) |

(2.8) |

(2.8) |

(2.8) |

(2.8) |

(2.9) |

(2.9) |

|

Water payment |

(2.2) |

(2.3) |

(2.4) |

(2.6) |

(2.7) |

(2.9) |

(3.0) |

(3.1) |

(3.2) |

(3.4) |

(3.5) |

(3.6) |

(3.7) |

(3.7) |

|

Gross profit |

32.0 |

31.4 |

32.8 |

38.5 |

43.1 |

44.1 |

46.0 |

45.3 |

40.6 |

41.2 |

37.7 |

38.6 |

39.5 |

39.5 |

|

Non-fuel Opex: Old plants |

(12.5) |

(13.4) |

(13.0) |

(16.5) |

(17.4) |

(17.9) |

(18.7) |

(19.5) |

(20.3) |

(21.1) |

(21.7) |

(22.3) |

(22.9) |

(23.3) |

|

Non-fuel Opex: new plants |

(2.3) |

(2.4) |

(2.5) |

(2.7) |

(3.0) |

(3.1) |

(3.3) |

(3.4) |

(3.6) |

(3.7) |

(3.9) |

(4.0) |

(4.1) |

(4.3) |

|

Cost of subsidies |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Non-fuel Opex |

(14.8) |

(15.8) |

(15.5) |

(19.1) |

(20.4) |

(21.0) |

(22.0) |

(23.0) |

(23.9) |

(24.8) |

(25.6) |

(26.3) |

(26.9) |

(27.6) |

|

EBITDA, old plants |

8.8 |

8.7 |

11.0 |

11.6 |

11.1 |

10.0 |

9.9 |

10.0 |

10.5 |

10.5 |

10.6 |

10.8 |

10.9 |

11.3 |

|

EBITDA, new plants |

7.4 |

5.9 |

5.2 |

6.6 |

10.2 |

11.5 |

13.0 |

11.6 |

5.7 |

5.5 |

1.2 |

1.3 |

1.4 |

0.4 |

|

EBITDA, reselling / other |

1.1 |

1.1 |

1.1 |

1.2 |

1.4 |

1.5 |

1.0 |

0.7 |

0.5 |

0.4 |

0.3 |

0.2 |

0.2 |

0.1 |

|

EBITDA |

17.2 |

15.6 |

17.3 |

19.4 |

22.7 |

23.1 |

23.9 |

22.3 |

16.7 |

16.4 |

12.1 |

12.3 |

12.5 |

11.9 |

|

Depreciation: Old plants |

(3.9) |

(4.1) |

(4.6) |

(5.1) |

(5.9) |

(5.4) |

(5.4) |

(5.4) |

(5.4) |

(5.4) |

(5.4) |

(5.4) |

(5.4) |

(5.4) |

|

Depreciation: New plants |

(2.3) |

(2.5) |

(2.6) |

(2.6) |

(2.6) |

(2.6) |

(2.6) |

(2.6) |

(2.6) |

(2.6) |

(2.6) |

(2.6) |

(2.6) |

(2.6) |

|

Depreciation |

(6.2) |

(6.6) |

(7.2) |

(7.7) |

(8.4) |

(8.0) |

(8.0) |

(8.0) |

(8.0) |

(8.0) |

(8.0) |

(8.0) |

(8.0) |

(8.0) |

|

EBIT |

11.0 |

9.1 |

10.1 |

11.7 |

14.3 |

15.1 |

15.9 |

14.3 |

8.7 |

8.4 |

4.1 |

4.3 |

4.5 |

3.9 |

|

Finance (costs) / income |

(2.0) |

(2.6) |

(2.6) |

(2.1) |

(1.5) |

(0.7) |

(0.5) |

0.1 |

0.6 |

0.8 |

1.0 |

0.9 |

0.9 |

0.9 |

|

One-offs (cash) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

One-offs (non-cash): operational |

(1.1) |

(2.6) |

(0.1) |

(3.1) |

(2.2) |

(1.6) |

(0.8) |

(0.4) |

(0.2) |

(0.1) |

(0.1) |

(0.0) |

(0.0) |

(0.0) |

|

One-offs (non-cash): financial |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

EBT |

7.9 |

3.9 |

7.5 |

6.5 |

10.6 |

12.7 |

14.5 |

14.0 |

9.1 |

9.0 |

5.0 |

5.1 |

5.4 |

4.7 |

|

Income tax |

(0.7) |

0.8 |

(0.8) |

(0.9) |

(2.6) |

(2.8) |

(3.0) |

(2.9) |

(1.9) |

(1.9) |

(1.0) |

(1.1) |

(1.1) |

(1.0) |

|

Net profit (pre-minorities) |

7.2 |

4.7 |

6.7 |

5.6 |

8.0 |

10.0 |

11.5 |

11.1 |

7.2 |

7.2 |

4.0 |

4.1 |

4.3 |

3.7 |

|

Minority |

0.0 |

(0.3) |

0.2 |

0.1 |

(0.3) |

0.0 |

(0.1) |

(0.2) |

(0.1) |

(0.1) |

(0.0) |

(0.0) |

(0.0) |

(0.0) |

|

Net profit (reported) |

7.2 |

4.5 |

6.9 |

5.7 |

7.7 |

10.0 |

11.4 |

10.9 |

7.1 |

7.1 |

3.9 |

4.0 |

4.2 |

3.7 |

|

Net profit (adj) |

7.3 |

6.3 |

5.3 |

7.4 |

10.1 |

11.3 |

12.1 |

11.3 |

7.3 |

7.2 |

4.0 |

4.0 |

4.2 |

3.7 |

|

Leverage, RUB bn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TV'2027 |

Net (Debt) / Cash (year end) |

(33) |

(28) |

(28) |

(24) |

(18) |

(7) |

1 |

8 |

9 |

12 |

11 |

11 |

11 |

10 |

(24) |

Net Debt or (Cash) / EBITDA (year end) |

1.9 |

1.8 |

1.6 |

1.2 |

0.8 |

0.3 |

(0.1) |

(0.3) |

(0.6) |

(0.7) |

(0.9) |

(0.9) |

(0.9) |

(0.8) |

2.0 |

Multiples |

|

|

` |

|

|

|

|

|

|

|

|

|

|

|

|

FCF Yield |

7% |

11% |

4% |

8% |

24% |

21% |

31% |

29% |

17% |

18% |

6% |

6% |

6% |

3% |

|

|

|||||||||||||||

DY |

2% |

1% |

3% |

4% |

6% |

7% |

11% |

12% |

9% |

11% |

6% |

6% |

6% |

5% |

|

EV/EBITDA |

3.8 |

4.0 |

3.5 |

3.0 |

2.4 |

2.0 |

1.5 |

1.4 |

1.6 |

1.6 |

2.1 |

2.1 |

2.1 |

2.2 |

|

PE (adj) |

4.5 |

5.3 |

6.3 |

4.5 |

3.3 |

2.9 |

2.7 |

2.9 |

4.5 |

4.6 |

8.4 |

8.3 |

7.9 |

9.0 |

|

Dividend, RUB / s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TV'2027 |

DPS: regular |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

DPS: special (leverage optimization) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.01 |

DPS: special (non-core assets sale) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

DPS: total |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

Dividend / Net profit (nominal) |

9% |

11% |

13% |

24% |

25% |

25% |

31% |

37% |

43% |

49% |

49% |

49% |

49% |

49% |

|

Dividend / Net profit (adj) |

9% |

7% |

18% |

18% |

19% |

22% |

29% |

36% |

42% |

49% |

49% |

49% |

49% |

49% |

|

Dividend / FCF |

26% |

13% |

77% |

47% |

24% |

35% |

34% |

42% |

54% |

59% |

92% |

100% |

108% |

193% |

|

Cash Flow, RUB bn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TV'2027 |

NOPAT: old plants |

4.1 |

4.6 |

5.0 |

5.1 |

4.1 |

3.6 |

3.5 |

3.6 |

4.0 |

4.0 |

4.1 |

4.2 |

4.3 |

4.7 |

|

NOPAT: new |

4.4 |

3.4 |

2.1 |

3.2 |

6.0 |

7.1 |

8.3 |

7.1 |

2.5 |

2.3 |

(1.4) |

(1.3) |

(1.2) |

(2.2) |

|

NOPAT: reselling / other |

0.6 |

0.5 |

0.2 |

0.8 |

1.1 |

1.2 |

0.7 |

0.5 |

0.3 |

0.2 |

0.2 |

0.1 |

0.1 |

0.1 |

|

NOPAT |

9.0 |

8.5 |

7.3 |

9.0 |

11.2 |

11.8 |

12.5 |

11.2 |

6.8 |

6.6 |

2.9 |

3.1 |

3.3 |

2.5 |

|

CapEx: Maintenance |

0.0 |

(8.3) |

(9.5) |

(9.2) |

(8.0) |

(11.5) |

(10.0) |

(9.7) |

(9.3) |

(9.0) |

(9.3) |

(9.5) |

(9.8) |

(10.0) |

|

CapEx: New |

(7.1) |

0.0 |

(0.3) |

0.0 |

(1.4) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

CapEx |

(7.1) |

(8.3) |

(9.8) |

(9.2) |

(9.4) |

(11.5) |

(10.0) |

(9.7) |

(9.3) |

(9.0) |

(9.3) |

(9.5) |

(9.8) |

(10.0) |

|

Working Capital Red./ (Incr.) |

(2.9) |

(0.6) |

(0.6) |

(2.1) |

(1.5) |

(0.7) |

0.0 |

0.0 |

(0.0) |

(0.0) |

0.0 |

0.0 |

0.0 |

0.0 |

|

FCF; old plants |

5.2 |

(0.2) |

(0.4) |

(1.0) |

0.5 |

(3.1) |

(1.1) |

(0.6) |

0.1 |

0.4 |

0.3 |

0.1 |

0.0 |

0.1 |

31.4 |

FCF; new plants |

(0.4) |

5.9 |

4.3 |

5.7 |

7.2 |

9.6 |

10.8 |

9.7 |

5.1 |

4.9 |

1.2 |

1.3 |

1.4 |

0.4 |

21.2 |

FCF: reselling / other |

0.6 |

0.5 |

0.2 |

0.8 |

1.1 |

1.2 |

0.7 |

0.5 |

0.3 |

0.2 |

0.2 |

0.1 |

0.1 |

0.1 |

0.4 |

FCF: cash one-offs |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

FCF (to EV) |

5.3 |

6.2 |

4.1 |

5.5 |

8.8 |

7.7 |

10.5 |

9.6 |

5.5 |

5.6 |

1.7 |

1.6 |

1.5 |

0.5 |

53.0 |

Interest (CF) |

(2.9) |

(2.5) |

(2.9) |

(2.7) |

(0.9) |

(0.7) |

(0.2) |

0.1 |

0.3 |

0.3 |

0.4 |

0.4 |

0.4 |

0.4 |

|

FCF (to Equity) |

2.4 |

3.7 |

1.2 |

2.8 |

7.9 |

7.0 |

10.3 |

9.6 |

5.8 |

5.9 |

2.1 |

2.0 |

1.9 |

0.9 |

|

Discounting parameters |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period for discounting, years |

DCF |

|

|

|

|

(1.4) |

(0.4) |

0.6 |

1.6 |

2.6 |

3.6 |

4.6 |

5.6 |

6.6 |

0.6 |

|

DDM |

|

|

|

|

(0.4) |

0.6 |

1.6 |

2.6 |

3.6 |

4.6 |

5.6 |

6.6 |

7.6 |

1.6 |

Discounting factor |

DCF |

|

|

|

|

|

1.03 |

0.93 |

0.82 |

0.72 |

0.64 |

0.57 |

0.50 |

0.44 |

0.39 |

|

DDM |

|

|

|

|

1.03 |

0.92 |

0.79 |

0.69 |

0.60 |

0.52 |

0.45 |

0.39 |

0.34 |

0.29 |

DCF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DCF: Old plants |

|

|

|

|

|

|

(1.1) |

(0.6) |

0.1 |

0.3 |

0.2 |

0.1 |

0.0 |

0.0 |

12.3 |

DCF: New plants |

|

|

|

|

|

|

11.1 |

9.0 |

4.2 |

3.6 |

0.8 |

0.7 |

0.7 |

0.2 |

8.3 |

DCF: Reselling / other |

|

|

|

|

|

|

0.8 |

0.5 |

0.3 |

0.2 |

0.1 |

0.1 |

0.0 |

0.0 |

0.2 |

DCF: total |

|

|

|

|

|

|

10.8 |

8.9 |

4.5 |

4.0 |

1.1 |

0.9 |

0.8 |

0.2 |

20.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TP (DCF), RUB bln or RUB/s |

|

|

TP (w-average, rounded), RUB/s |

|

|

|

|

Valuation parameters |

|

DDM |

DCF |

Other |

|||

EV, RUB bln |

52 |

|

TP |

|

RUB/s |

Weight |

|

|

|

CoE |

|

|

15.4% |

|

|

Non-core assets |

- |

|

DDM |

|

0.008 |

60% |

|

DDM is a floor for PT |

WACC |

|

|

|

13.2% |

|

|

Net (debt) / Cash (discounted), end 2018 |

(7) |

|

DCF |

|

0.012 |

40% |

|

|

|

TG (Dividends) |

|

|

3.5% |

|

|

Equity, RUB bln |

45 |

|

Result (rounded) |

|

0.010 |

100% |

|

|

|

TG (FCF): "old" assets |

|

|

3.0% |

0.0% |

|

# of shares: current |

3,854 |

|

|

|

|

|

|

|

|

TG (FCF): "new" assets |

|

|

3.0% |

|

|

# of shares: Ord: New |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# of shares: Ord |

3,854 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# of shares: Ord: treasury |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# of shares: Pref |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# of shares: effective, total |

3,854 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TP (DCF), RUB |

0.012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: company data, Gazprombank estimates

43

vk.com/id446425943

NOVEMBER 23, 2018 |

RUSSIA > EQUITY RESEARCH > UTILITIES |

|

|

INITIATION OF COVERAGE

OGK-2

RU

SSI

Major FCFY-to-CoE premium until 2024 despite substantial decline thereafter

OGK-2 should preserve a major FCFY-to-CoE premium until 2024, followed by a substantial FCFY decline in 2025 on the back of expiration of CSAs.

Operations

OGK-2 is a major inter-regional thermal generator (electrical capacity ~19 GW) with belowaverage efficiency of "old" capacity but a substantial EBITDA contribution from "new" CSAsupported capacity.

Positives

FCFY-to-CoE premium from 2017 following completion of the CSA program in mid2016 should last until 2024.

Potential increase in dividend payout (from ~25% of 2017 IFRS net income) on the back of positive FCF and reduced leverage.

High share of core shareholder (Gazprom Energoholding) in the capital of OGK-2 (~73%) should raise its propensity to pay dividends.

Negatives

Modest historical dividend payout: e.g. ~25% of 2017 IFRS net income paid as dividends.

FCF to decline after 2024 due to expiration of CHPs at Ryazan TPP (Nov. 2024), Serov TPP (Nov. 2024), Troitsk TPP (Nov. 2024) and Novocherkassk TPP (Nov. 2024).

Leverage is above the industry average: Net debt/EBITDA’18=~1.4x.

Below-average efficiency of "old" power plants triggering a sharp decline in EBITDA after CSA expirations.

Note: Share prices as of closure 20-Nov-2018

TICKER |

OGKB RX |

Currency |

RUB |

|

|

Target price |

0.44 |

Upside |

31% |

|

|

Recommendation |

Overweight |

MCap, bln |

37 |

|

|

Share price |

0.34 |

52-week high |

0.54 |

|

|

52-week low |

0.33 |

|

|

Source: Bloomberg, Gazprombank estimates

SHAREHOLDERS

Gazprom

EnergoHolding 73.4% (via Centerenergy-

holding)

Free-float |

26.6% |

|

|

Source: company data

12M PRICE PERFORMANCE

140% |

|

|

|

|

|

120% |

|

|

|

|

|

100% |

|

|

|

|

|

80% |

|

|

|

|

|

60% |

|

MOEX INDEX |

|

|

|

|

|

|

|

|

|

40% |

|

OGKB |

|

|

|

Jan-18 |

Mar-18 |

May-18 |

Jul-18 |

|

|

Nov-17 |

Sep-18 |

||||

Source: Bloomberg

Valuation (2018-26)

FCFY-to-CoE premium: 2018-24.

DY-to-CoD premium: 2021-24.

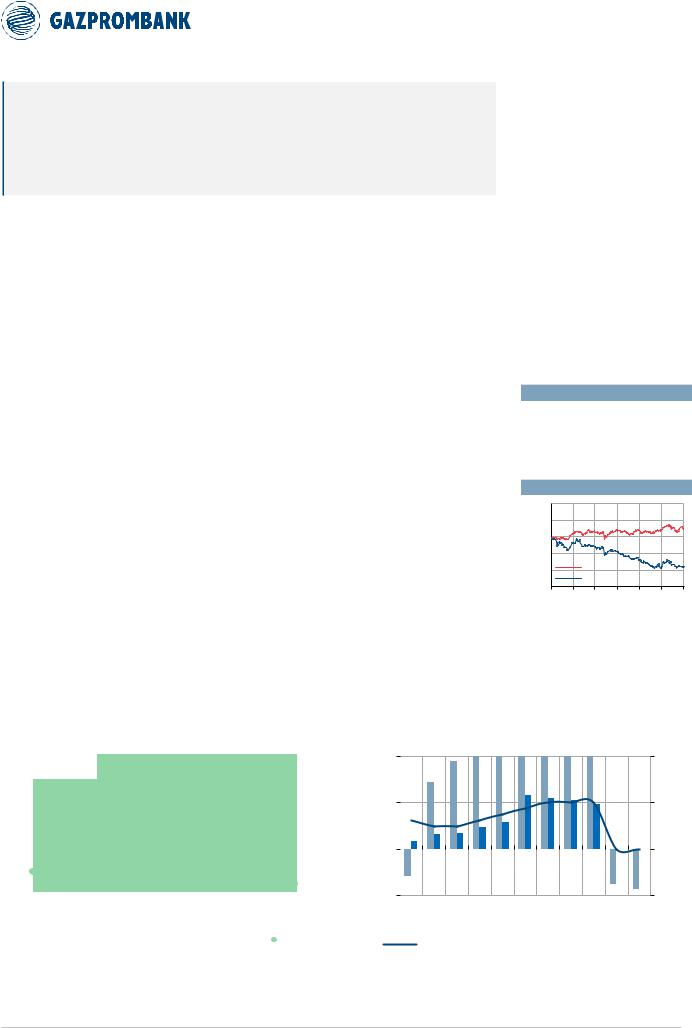

Chart 55. OGK-2: FCF profile

EBITDA (lhs), capex (lhs), FCFY (rhs)

40 |

EBITDA, Capex |

30% |

|

FCFY |

|

|

RUB bln |

(line) |

20 |

|

15% |

0 |

|

|

|

|

|

|

|

|

|

|

|

0% |

|

-20 |

|

|

|

|

|

|

|

|

|

|

|

-15% |

|

2016 |

2017 |

2018E |

2019E |

2020E |

2021E |

2022E |

2023E |

2024E |

2025E |

2026E |

|||

|

|

EBITDA ("NEW") |

|

|

|

CAPEX |

|

EBITDA ("OLD") |

|

FCFY |

|||

|

|

|

|

|

|

|

|||||||

Chart 56. OGK-2: FCFY and DY profile

FCFY (lhs), DY (lhs) and dividend payout vs IFRS net profit (rhs)

30% |

|

FCFY and DY |

|

|

|

|

|

|

|

|

Dividend |

|

100% |

|||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

(columns) |

|

|

|

|

|

|

|

|

payout (line) |

|

|

||

15% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50% |

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

-15% |

|

|

|

2018E |

2019E |

2020E |

2021E |

2022E |

2023E |

2024E |

2025E |

2026E |

|

-50% |

||

2016 |

2017 |

|

||||||||||||||

|

|

|

|

|||||||||||||

|

|

|

|

FCF YIELD (LHS) |

|

|

|

|

|

DIVIDEND YIELD (LHS) |

||||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

DIVIDEND PAYOUT (RHS) |

|

|

|

|

|

|

|

|

|

|||

Source: company data, Gazprombank estimates |

Source: company data, Gazprombank estimates |

44

vk.com/id446425943

NOVEMBER 23, 2018 RUSSIA > EQUITY RESEARCH > UTILITIES

Table 11. OGK-2 forecast (IFRS-based) and valuation, RUB bln or RUB per share

P&L (IFRS), RUB bln: OGK-2 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018E |

2019E |

2020E |

2021E |

2022E |

2023E |

2024E |

2025E |

2026E |

TV'2027 |

Revenue electricity: old |

81.6 |

82.6 |

75.0 |

78.1 |

73.4 |

71.8 |

73.6 |

76.1 |

80.8 |

82.9 |

85.0 |

86.9 |

88.7 |

91.9 |

|

Revenue electicity: new |

15.7 |

16.4 |

20.9 |

38.5 |

46.9 |

48.3 |

51.0 |

51.6 |

57.3 |

54.2 |

53.6 |

52.4 |

29.9 |

31.0 |

|

Revenue electricity |

97.3 |

99.0 |

95.9 |

116.6 |

120.4 |

120.1 |

124.6 |

127.7 |

138.1 |

137.1 |

138.6 |

139.3 |

118.6 |

122.9 |

|

Heat revenue |

4.2 |

4.6 |

4.5 |

5.0 |

5.0 |

5.3 |

5.4 |

5.4 |

5.4 |

5.4 |

5.4 |

5.4 |

5.4 |

5.4 |

|

Revenue other (incl. reselling) |

10.5 |

12.4 |

11.8 |

12.7 |

15.9 |

18.2 |

12.9 |

9.3 |

6.8 |

5.1 |

3.9 |

3.0 |

2.3 |

1.9 |

|

Revenue (before subsidies) |

112.0 |

116.0 |

112.2 |

134.4 |

141.3 |

143.7 |

142.8 |

142.3 |

150.3 |

147.6 |

147.9 |

147.7 |

126.3 |

130.2 |

|

Subsidies |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Revenue |

112.0 |

116.0 |

112.2 |

134.4 |

141.3 |

143.7 |

142.8 |

142.3 |

150.3 |

147.6 |

147.9 |

147.7 |

126.3 |

130.2 |

|

Fuel costs electricity, old |

(54.5) |

(55.1) |

(51.9) |

(53.8) |

(50.7) |

(47.5) |

(48.2) |

(48.8) |

(49.6) |

(50.5) |

(51.3) |

(52.0) |

(52.5) |

(54.4) |

|

Fuel costs heat, old |

(2.6) |

(2.6) |

(2.5) |

(2.6) |

(2.4) |

(2.3) |

(2.3) |

(2.3) |

(2.4) |

(2.4) |

(2.4) |

(2.5) |

(2.5) |

(2.6) |

|

Fuel costs, new |

(7.3) |

(7.7) |

(8.4) |

(12.5) |

(13.2) |

(12.7) |

(13.3) |

(13.8) |

(14.4) |

(15.0) |

(15.6) |

(16.2) |

(16.7) |

(17.3) |

|

Fuel costs,old and new |

(64.3) |

(65.4) |

(62.8) |

(68.9) |

(66.3) |

(62.5) |

(63.7) |

(64.9) |

(66.4) |

(67.9) |

(69.3) |

(70.6) |

(71.8) |

(74.2) |

|

Purchased power & Re-selling |

(9.3) |

(11.3) |

(10.7) |

(11.6) |

(13.0) |

(13.2) |

(9.8) |

(7.4) |

(5.7) |

(4.4) |

(3.4) |

(2.7) |

(2.1) |

(1.7) |

|

Heat transportation |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Water payment |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Gross profit |

38.4 |

39.3 |

38.7 |

53.9 |

62.0 |

68.1 |

69.3 |

70.0 |

78.3 |

75.4 |

75.2 |

74.4 |

52.4 |

54.3 |

|

Non-fuel Opex: Old plants |

(23.4) |

(23.3) |

(23.9) |

(26.0) |

(25.0) |

(31.2) |

(32.7) |

(34.1) |

(35.5) |

(36.8) |

(37.9) |

(39.0) |

(39.9) |

(40.7) |

|

Non-fuel Opex: new plants |

(2.3) |

(2.5) |

(3.6) |

(6.8) |

(8.4) |

(8.8) |

(9.3) |

(9.7) |

(10.1) |

(10.5) |

(10.8) |

(11.1) |

(11.4) |

(12.1) |

|

Cost of subsidies |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Non-fuel Opex |

(25.7) |

(25.9) |

(27.6) |

(32.8) |

(33.4) |

(40.0) |

(42.0) |

(43.8) |

(45.6) |

(47.2) |

(48.8) |

(50.1) |

(51.3) |

(52.8) |

|

EBITDA, old plants |

5.3 |

6.2 |

1.2 |

0.8 |

0.4 |

(3.8) |

(4.2) |

(3.7) |

(1.3) |

(1.3) |

(1.3) |

(1.1) |

(0.9) |

(0.3) |

|

EBITDA, new plants |

6.2 |

6.2 |

8.9 |

19.2 |

25.4 |

26.8 |

28.4 |

28.1 |

32.8 |

28.7 |

27.2 |

25.1 |

1.8 |

1.6 |

|

EBITDA, reselling / other |

1.2 |

1.1 |

1.0 |

1.1 |

2.9 |

5.1 |

3.0 |

1.9 |

1.2 |

0.7 |

0.5 |

0.3 |

0.2 |

0.1 |

|

EBITDA |

12.7 |

13.4 |

11.1 |

21.1 |

28.7 |

28.0 |

27.3 |

26.3 |

32.7 |

28.1 |

26.4 |

24.3 |

1.1 |

1.4 |

|

Depreciation: Old plants |

(2.1) |

(1.8) |

(2.1) |

(4.7) |

(6.1) |

(7.6) |

(7.6) |

(7.6) |

(7.6) |

(7.6) |

(7.6) |

(7.6) |

(7.6) |

(7.6) |

|

Depreciation: New plants |

(2.5) |

(3.2) |

(4.1) |

(4.8) |

(5.1) |

(5.2) |

(5.2) |

(5.2) |

(5.2) |

(5.2) |

(5.2) |

(5.2) |

(5.2) |

(5.2) |

|

Depreciation |

(4.6) |

(5.0) |

(6.2) |

(9.5) |

(11.3) |

(12.8) |

(12.8) |

(12.8) |

(12.8) |

(12.8) |

(12.8) |

(12.8) |

(12.8) |

(12.8) |

|

EBIT |

8.1 |

8.5 |

4.9 |

11.5 |

17.4 |

15.2 |

14.5 |

13.4 |

19.9 |

15.3 |

13.6 |

11.5 |

(11.7) |

(11.4) |

|

Finance (costs) / income |

(1.4) |

0.3 |

(0.5) |

(4.4) |

(5.4) |

(4.4) |

(3.1) |

(2.0) |

(1.1) |

0.3 |

1.2 |

2.1 |

2.9 |

2.1 |

|

One-offs (cash) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

One-offs (non-cash): operational |

(1.2) |

(9.3) |

(1.0) |

(2.1) |

(1.9) |

(1.4) |

(0.7) |

(0.3) |

(0.2) |

(0.1) |

(0.0) |

(0.0) |

(0.0) |

(0.0) |

|

One-offs (non-cash): financial |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

EBT |

5.4 |

(0.5) |

3.4 |

5.0 |

10.1 |

9.4 |

10.7 |

11.0 |

18.7 |

15.5 |

14.8 |

13.6 |

(8.8) |

(9.3) |

|

Income tax |

(1.2) |

(0.9) |

(0.8) |

(1.9) |

(2.9) |

(2.0) |

(2.2) |

(2.3) |

(3.9) |

(3.3) |

(3.1) |

(2.8) |

0.0 |

0.0 |

|

Net profit (pre-minorities) |

4.2 |

(1.4) |

2.6 |

3.1 |

7.2 |

7.4 |

8.4 |

8.7 |

14.7 |

12.2 |

11.7 |

10.7 |

(8.8) |

(9.3) |

|

Minority |

0.0 |

(0.1) |

(0.8) |

(0.1) |

0.0 |

0.0 |

(0.1) |

(0.0) |

(0.1) |

(0.1) |

(0.1) |

(0.1) |

0.1 |

0.1 |

|

Net profit (reported) |

4.2 |

(1.6) |

1.8 |

2.9 |

7.2 |

7.4 |

8.3 |

8.7 |

14.7 |

12.1 |

11.6 |

10.6 |

(8.8) |

(9.2) |

|

Net profit (adj) |

5.2 |

25.8 |

3.5 |

5.6 |

9.5 |

8.5 |

9.0 |

9.0 |

14.9 |

12.3 |

11.7 |

10.7 |

(7.0) |

(7.3) |

|

Leverage, RUB bn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TV'2027 |

Net (Debt) / Cash (year end) |

(29) |

(34) |

(65) |

(63) |

(54) |

(38) |

(25) |

(13) |

4 |

15 |

26 |

36 |

26 |

21 |

(3) |

Net Debt or (Cash) / EBITDA (year end) |

2.3 |

2.5 |

5.8 |

3.0 |

1.9 |

1.4 |

0.9 |

0.5 |

(0.1) |

(0.5) |

(1.0) |

(1.5) |

(23.4) |

(14.8) |

2.0 |

Multiples |

|

|

` |

|

|

|

|

|

|

|

|

|

|

|

|

FCF Yield |

-20% |

-20% |

-64% |

-9% |

22% |

28% |

31% |

32% |

48% |

43% |

41% |

38% |

-11% |

-13% |

|

|

|||||||||||||||

DY |

0% |

1% |

2% |

2% |

5% |

5% |

7% |

9% |

17% |

16% |

16% |

14% |

0% |

0% |

|

EV/EBITDA |

5.2 |

5.1 |

7.8 |

4.8 |

3.3 |

3.0 |

2.5 |

2.1 |

1.3 |

1.1 |

0.9 |

0.7 |

14.9 |

14.8 |

|

PE (adj) |

7.2 |

1.4 |

10.7 |

6.6 |

3.9 |

4.4 |

4.1 |

4.1 |

2.5 |

3.0 |

3.2 |

3.5 |

neg |

neg |

|

Dividend, RUB / s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TV'2027 |

DPS: regular |

0.00 |

0.00 |

0.01 |

0.01 |

0.02 |

0.02 |

0.02 |

0.03 |

0.06 |

0.06 |

0.05 |

0.05 |

0.00 |

0.00 |

0.00 |

DPS: special (leverage optimization) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.22 |

DPS: special (non-core assets sale) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

DPS: total |

0.00 |

0.00 |

0.01 |

0.01 |

0.02 |

0.02 |

0.02 |

0.03 |

0.06 |

0.06 |

0.05 |

0.05 |

0.00 |

0.00 |

0.22 |

Dividend / Net profit (nominal) |

0% |

0% |

34% |

31% |

25% |

25% |

31% |

38% |

44% |

50% |

50% |

50% |

0% |

0% |

|

Dividend / Net profit (adj) |

0% |

2% |

18% |

16% |

19% |

22% |

29% |

36% |

43% |

49% |

50% |

50% |

0% |

0% |

|

Dividend / FCF |

neg |

neg |

neg |

neg |

22% |

17% |

22% |

28% |

36% |

38% |

38% |

37% |

neg |

neg |

|

Cash Flow, RUB bn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TV'2027 |

NOPAT: old plants |

2.5 |

4.4 |

(0.9) |

(3.9) |

(5.8) |

(11.4) |

(11.8) |

(11.3) |

(8.9) |

(8.9) |

(8.9) |

(8.7) |

(8.5) |

(7.9) |

|

NOPAT: new |

2.9 |

3.0 |

3.8 |

11.3 |

16.0 |

17.0 |

18.3 |

18.1 |

21.8 |

18.5 |

17.4 |

15.7 |

(3.4) |

(3.6) |

|

NOPAT: reselling / other |

0.9 |

1.1 |

0.8 |

0.9 |

2.3 |

4.0 |

2.4 |

1.5 |

0.9 |

0.6 |

0.4 |

0.2 |

0.2 |

0.1 |

|

NOPAT |

6.3 |

8.5 |

3.7 |

8.3 |

12.5 |

9.6 |

9.0 |

8.2 |

13.8 |

10.2 |

8.9 |

7.2 |

(11.8) |

(11.4) |

|

CapEx: Maintenance |

0.0 |

0.0 |

(2.5) |

(3.4) |

(5.0) |

(7.0) |

(7.1) |

(7.3) |

(7.4) |

(7.5) |

(7.6) |

(7.8) |

(7.9) |

(8.0) |

|

CapEx: New |

(17.0) |

(19.0) |

(24.3) |

(11.4) |

(5.1) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

CapEx |

(17.0) |

(19.0) |

(26.8) |

(14.8) |

(10.1) |

(7.0) |

(7.1) |

(7.3) |

(7.4) |

(7.5) |

(7.6) |

(7.8) |

(7.9) |

(8.0) |

|

Working Capital Red./ (Incr.) |

0.0 |

0.0 |

(2.9) |

(0.4) |

0.0 |

(0.2) |

0.0 |

0.0 |

(0.6) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

FCF; old plants |

4.6 |

6.2 |

(4.1) |

(3.0) |

(4.6) |

(11.0) |

(11.3) |

(11.0) |

(9.2) |

(8.8) |

(8.9) |

(8.9) |

(8.8) |

(8.3) |

88.7 |

FCF; new plants |

(11.6) |

(12.8) |

(16.5) |

4.7 |

16.0 |

22.2 |

23.6 |

23.3 |

27.0 |

23.8 |

22.6 |

20.9 |

1.8 |

1.6 |

46.8 |

FCF: reselling / other |

0.9 |

1.1 |

0.8 |

0.9 |

2.3 |

4.0 |

2.4 |

1.5 |

0.9 |

0.6 |

0.4 |

0.2 |

0.2 |

0.1 |

0.8 |

FCF: cash one-offs |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

FCF (to EV) |

(6.1) |

(5.6) |

(19.8) |

2.6 |

13.7 |

15.2 |

14.7 |

13.8 |

18.8 |

15.5 |

14.1 |

12.3 |

(6.8) |

(6.6) |

136.3 |

Interest (CF) |

(1.5) |

(2.1) |

(3.9) |

(5.9) |

(5.7) |

(4.7) |

(3.1) |

(2.0) |

(1.0) |

0.3 |

1.1 |

1.9 |

2.6 |

1.8 |

|

FCF (to Equity) |

(7.6) |

(7.6) |

(23.7) |

(3.3) |

8.1 |

10.6 |

11.6 |

11.8 |

17.7 |

15.8 |

15.2 |

14.2 |

(4.2) |

(4.8) |

|

Discounting parameters |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period for discounting, years |

DCF |

|

|

|

|

(1.4) |

(0.4) |

0.6 |

1.6 |

2.6 |

3.6 |

4.6 |

5.6 |

6.6 |

0.6 |

|

DDM |

|

|

|

|

(0.4) |

0.6 |

1.6 |

2.6 |

3.6 |

4.6 |

5.6 |

6.6 |

7.6 |

1.6 |

Discounting factor |

DCF |

|

|

|

|

|

1.03 |

0.93 |

0.82 |

0.72 |

0.64 |

0.56 |

0.50 |

0.44 |

0.39 |

|

DDM |

|

|

|

|

1.03 |

0.92 |

0.79 |

0.69 |

0.59 |

0.51 |

0.45 |

0.39 |

0.33 |

0.29 |

DCF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DCF: Old plants |

|

|

|

|

|

|

(11.6) |

(10.2) |

(7.5) |

(6.4) |

(5.7) |

(5.0) |

(4.4) |

(3.7) |

34.5 |

DCF: New plants |

|

|

|

|

|

|

24.2 |

21.6 |

22.1 |

17.2 |

14.4 |

11.8 |

0.9 |

0.7 |

18.2 |

DCF: Reselling / other |

|

|

|

|

|

|

2.5 |

1.4 |

0.8 |

0.4 |

0.2 |

0.1 |

0.1 |

0.0 |

0.3 |

DCF: total |

|

|

|

|

|

|

15.1 |

12.8 |

15.4 |

11.2 |

9.0 |

6.9 |

(3.4) |

(2.9) |

53.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TP (DCF), RUB bln or RUB/s |

|

|

TP (w-average, rounded), RUB/s |

|

|

|

|

Valuation parameters |

|

DDM |

DCF |

Other |

|||

EV, RUB bln |

117 |

|

TP |

|

RUB/s |

Weight |

|

|

|

CoE |

|

|

15.5% |

|

|

Non-core assets |

- |

|

DDM |

|

0.25 |

60% |

|

DDM is a floor for PT |

WACC |

|

|

|

13.2% |

|

|

Net (debt) / Cash (discounted), end 2018 |

(38) |

|

DCF |

|

0.72 |

40% |

|

|

|

TG (Dividends) |

|

|

3.5% |

|

|

Equity, RUB bln |

79 |

|

Result (rounded) |

|

0.44 |

100% |

|

|

|

TG (FCF): "old" assets |

|

|

2.0% |

0.0% |

|

# of shares: current |

110 |

|

|

|

|

|

|

|

|

TG (FCF): "new" assets |

|

|

2.0% |

|

|

# of shares: Ord: New |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# of shares: Ord |

110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# of shares: Ord: treasury |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# of shares: Pref |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# of shares: effective, total |

110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TP (DCF), RUB |

0.72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: company data, Gazprombank estimates

45

vk.com/id446425943

NOVEMBER 23, 2018 |

RUSSIA > EQUITY RESEARCH > UTILITIES |

|

|

INITIATION OF COVERAGE

ROSSETI (Russian Grids)

RU

SSI

Potentially solid dividends are currently muted by cross-financing within the group

ROSSETI (Russian Grids) enjoys major dividend inflow from subsidiaries and can potentially benefit from the government’s new regulatory initiatives. But the existing mechanism of cross-financing within the group prevents the translation of solid dividend inflow into a healthy dividend outflow.

Operations

ROSSETI (Russian Grids) is the key holding company in Russia’s power grid sector, owning controlling stakes in FSK (~80%) as well as mega-regional power distribution companies.

Positives

Modest P&L-based valuation: consolidated P/E'18 < 1.5x.

"Exclusive" channel for the government to collect dividends from the power grid sector.

Substantial dividend inflow from underlying grids: ~RUB 24 bln in 2018 (>15% of Russian Grids' MCap).

New dividend policy (2017) implies a more structural approach to calculation of dividends (50% of adjusted RAS or IFRS net income, whichever is larger).

Note: Share prices as of closure 20-Nov-2018

TICKER |

RSTI RX |

Currency |

RUB |

|

|

Target price |

0.75 |

Upside |

7% |

|

|

Recommendation |

Neutral |

MCap, bln |

139 |

|

|

Share price |

0.70 |

52-week high |

0.96 |

|

|

52-week low |

0.66 |

|

|

Source: Bloomberg, Gazprombank estimates

SHAREHOLDERS (ORD.)

Russian Government |

88.9% |

|

|

Free-float |

11.1% |

|

|

Source: company data

Positive regulatory initiatives considered, including: a) long-term tariff agreements with regional authorities; b) restrictions on preferential connections, c) charges for excessive capacity, and d) limits ("social norm") for subsidized residenial supply.

Negatives

Modest medium-term growth in power transportation tariffs envisioned by the government (~3% p.a.).

Cross-financing within Russian Grids group as major part of the dividend inflow from underlying companies (e.g. FSK) is used for "financial support" of selected subsidiaries.

12M PRICE PERFORMANCE

140% |

|

|

|

|

|

120% |

|

|

|

|

|

100% |

|

|

|

|

|

80% |

|

|

|

|

|

|

|

MOEX INDEX |

|

|

|

60% |

|

RSTI |

|

|

|

|

|

|

|

|

|

40% |

Jan-18 |

Mar-18 |

May-18 |

Jul-18 |

|

Nov-17 |

Sep-18 |

||||

|

Substantial subtractions from IFRS net profit before it becomes the basis for dividends, |

Source: Bloomberg |

|

incl. : a) the difference between IFRS and RAS (sum for subsidiaries) depreciaton, b) |

|

|

the value of "financial support" to subsidiaries, c) portion of net profit used for CapEx. |

|

|

"Grids digitalization" program may trigger hikes in capex and opex on a mid-term horizon. |

|

Valuation

PE'18<1.5x (IFRS), DY'18 = ~3-4%.

Our target price is based on a DDM approach, even though we run DCF as well.

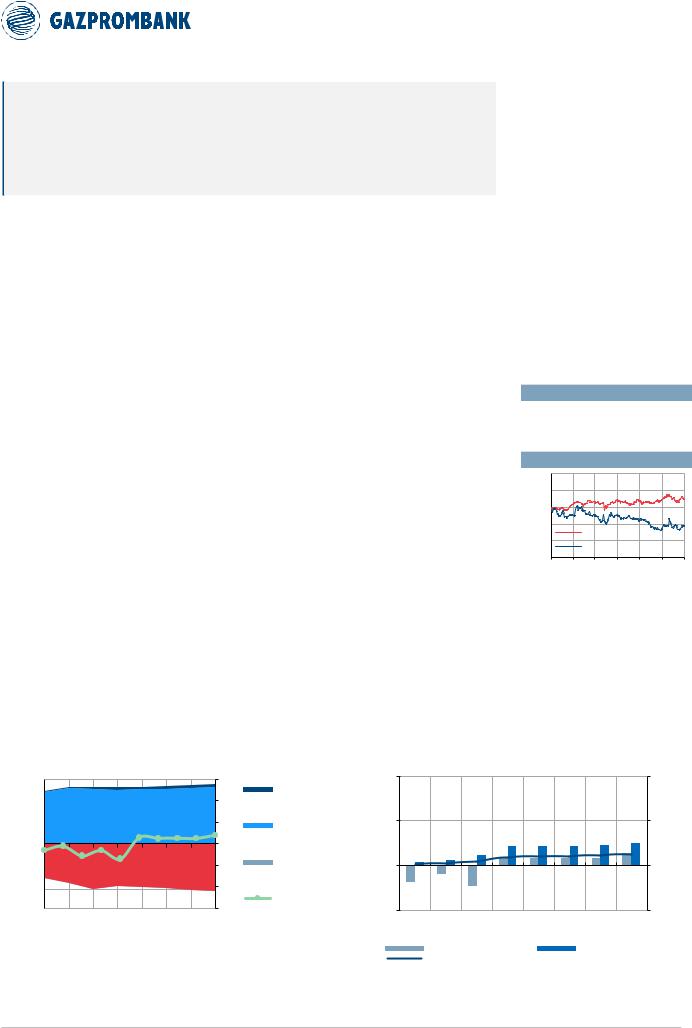

Chart 57. Russian Grids: FCF profile |

Chart 58. Russian Grids: FCFY and DY profile |

EBITDA (lhs), capex (lhs), FCFY (rhs) |

FCFY, DY (lhs) and dividend payout vs connection adjusted IFRS profit(rhs) |

350 |

EBITDA, Capex |

|

|

|

FCFY (line) |

30% |

||

RUB bln |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

250 |

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

150 |

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

0% |

(50) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(150) |

|

|

|

|

|

|

|

-10% |

|

|

|

|

|

|

|

|

|

(250) |

|

|

|

|

|

|

|

-20% |

|

|

|

|

|

|

|

|

|

(350) |

|

2018E |

2019E |

2020E |

2021E |

2022E |

2023E |

-30% |

2016 |

2017 |

|

||||||

30%

CONNECTION |

|

|

(ONE-OFF): |

|

|

CASH |

15% |

|

EBITDA: |

||

|

||

CONNECTION |

|

|

-ADJ |

|

|

CAPEX |

0% |

|

|

||

FCF YIELD |

|

|

|

-15% |

FCFY and DY (columns)

2016 |

2017 |

2018E |

2019E |

2020E |

FCF YIELD (LHS)

DIVIDEND PAYOUT (RHS)

|

|

100% |

|

Dividend payout |

|

|

|

(line) |

|

|