Pure market model.

Assumptions of pure market economy - free entry to the market and free exit; very many producers and consumers in the market, all being price takers; product is homogeneous, there are no trade marks; free access to the market information (complete information); free access to absolutely mobile factors of production)

Perfect/imperfect competition - if the first two assumption are true competition is perfect, if not competition is imperfect.

Market economy - an economy in which a substantial proportion of economic decisions are taken by the use of markets. This is contrasted with a planned economy, in which most major decisions are taken by a centralized decision-making process working in quantitative terms.

Conditions of a development of a market economy - social division of labour (technological, product, inter-industrial, national, international division of labour); economic independence and autonomy of producers(free choice and private enterprise); private property on the means of production and on the goods produced; people are motivated by self-interest; goods are produced for sale, for exchange, for other people’s wants; autonomous producers and consumers are linked together through the market exchange.

Market - system of economic and social relations; a mechanism that brings the buyers and sellers of a good into contact with one another; a system of communication through which innumerable individual free choices are recorded, summarized, and balanced against one another; a basic organizing force of production and consumption; a mechanism of allocating resources and distributing final goods and services; a place where buyers and sellers meet.

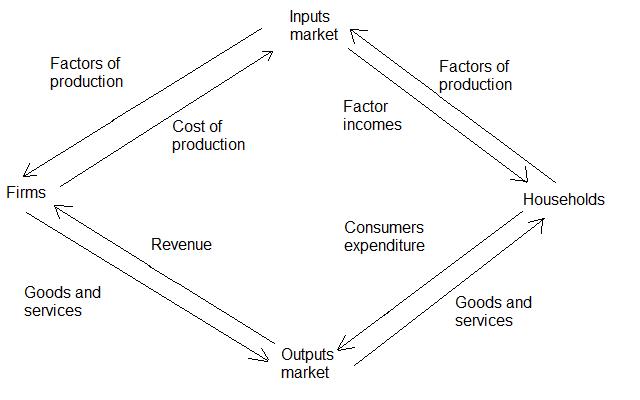

Circular flow model.

(по часовой) Flow of money

(против часовой) Flow of resources, goods and services in a market model

Basic property rights - the right of an owner(appropriation, alienation), the right of a user(use), the right of a manager(management)

Transaction costs - costs of transferring (delegating) the rights of property. Transaction costs include: costs of information search; costs of negotiating and singing contracts; costs of specification and protection of property rights; costs of opportunistic behaviour (when people minimize or avoid the obligations written in a contract).

Coase theorem - if all property rights are specified and transaction costs are zero, the final result (maximization of the value of production) does not depend on the distribution of property rights (income effect being the same). Otherwise saying, under perfect competition private and social costs are equal.

Commodity - a raw material or primary agricultural product that can be bought and sold, such as copper or coffee.

Properties of a commodity – use value; exchange value.

Use value - the ability to satisfy human wants.

Exchange value - the ability to be exchanged.

Social value - a specific mechanism of recognition and measurement of the social character of labour spent by private producers.

Social necessary quantity of labour – determines the social value of a commodity and characterizes the average level of productivity and intensiveness of labour in the given time period and in the given economy.

Dual character of labour – Marx’s theory that any labour has two aspects: concrete and abstract.

Concrete labour – creates qualitatively different goods with specific use values.

Abstract labour – human labour in general; all specific kinds of labour have something in common: in a given society they belong to the system of social division of labour and create socially valuable goods, or the goods wanted by the society.

Barter - a system of exchanging goods and services for other goods and services(rather than using money). The formula of a barter transaction is: Good A --- Good B.

Coincidence - a necessary condition of a barter exchange(sometimes it is said “a double coincidence” because there are two transactors). Each trader should be interested in the good (service) offered by the other person.

Money - a specific commodity that monopolistically plays the role of a general and universal equivalent of value in most communities. Money is a commodity of general acceptability and of universal utility. It is an embodiment of value and its universal equivalent.

Money functions - the measure of value; the medium of exchange; treasure, or a store of value; the means of payment; the world money.

Measure of value – the quintessence of money. This function is fulfilled by gold (previously, by silver), for only commodities with a considerable value of its own can measure the value of other goods.

Medium of exchange - an intermediary used in trade to avoid the inconveniences of a pure barter system. A medium of exchange permits the value of goods to be assessed and rendered in terms of the intermediary, most often, a form of money widely accepted to buy any other good.

Treasure – money function, store of value. It helps people to accumulate money for future purchases and/or investments. It automatically regulates the amount of money in circulation. When there are few goods in the market, people make treasures, excessive money leaves the market, and the money supply diminishes. Treasure can be either in the form of coins (gold/silver), bullions, or in the form of jewellery.

Means of payment – different means which can help to pay for goods and services or pay off credits and so on: money, credit cards, and cheque.

World money – is used as a universal means of payment and purchase and a universal embodiment of wealth. Originally it was gold, now it’s dollar, euro.

5

Price - the value of a good/service in terms of money of a good. Price depends directly (positively) on the value of the good in question and indirectly (negatively) on the value of good.

The unit of account - the unit in which prices are quoted and accounts are kept.

IOU money - a means of payment based on the debt of a private firm or individual.

Demand - shows the various amounts of product which consumers are willing and able to purchase at each specific price in a series of possible prices during some period of time. (It shows relationship between price and quantity demanded.Price-per unit.Quantity demanded-per time.)

Quantity demanded - the amount of a product that a consumer would buy in a given period if it could buy all it wanted at the current market price.

Law of demand - a negative relationship between quantity demanded and price.(A term first used by Alfred Marshall in 1890).

Determinants of demand – non-price factors. The determinants of demand make the demand curve shift to the right or to the left. Increase in demand – rightwards (Consumers are willing to buy and able to buy more goods at each specific price level). Decrease in demand – leftwards (the willingness of consumers to buy less at all price levels)

The substitution effect of a price decline - this particular product becomes more attractive than other goods,so its consumption grows.

A demand schedule - shows how much of a given product households would be willing to buy at different prices.

The market demand for a specific good - the sum of all the quantities of a good demanded per period by all the households buying in the market at each price level.

Normal goods - goods for which demand goes up when income is higher.

Inferior goods - goods for which demand falls when income rises.

Substitutes – goods that can serve as replacements for another one.

Complements – goods that are consumed together (and cannot be consumed separately). If price changes, QD changes.That is a movement along the demand curve.If non-price factors change,that is a shift of demand curve.

6

Supply - shows the various amounts of a product which a producer is willing and able to produce and make available for sale in the market at each specific price in a series of possible prices during some time period.

Quantity supplied - the quantity of a good supplied at any given price. If an arbitrary price is set, quantity supplied traces out the supply curve as this price is changed. The equilibrium price is that at which quantity supplied is equal to quantity demanded.

Determinants of supply – the non-price factors. When the price of a product changes, other things being the same, a change in the QS follows – a movement along the supply curve takes place. When the non-price factors change, that causes the supply curve to shift.

Law of supply - a positive relationship between the quantity of a good supplied and price.

Market supply - the sum of all that is supplied each period by all producers of a single product.

As cost of production grows, other things equal, producers tend to supply less at alternative prices.

Market equilibrium - the situation when supply and demand in a market are equal at the prevailing price. The equilibrium price is determined by supply and demand.

Excess demand – the QD exceeds the QS at the current price.

Excess supply – the QS exceeds the QD at the current price.

Functions of price in a market economy - provide market information to producers and consumers,which is essential to make rational decisions; allocate scarce resources between competing users; determine proportions of the economy; encourage technical progress; distribute goods and services; distribute incomes; provide market self-regulation.