- •Unit 1 Finance

- •1(1) Listening. Listen and practice. Mind the new words.

- •2. How much do you know about money? Answer the questions.

- •Vocabulary

- •12. Give Russian equivalents:

- •13. Choose words from the list to fill in the gaps, then use them to make sentences:

- •14. Answer the questions:

- •Unit 2 Making money

- •1. Look the words in the box in the dictionary. Complete the text below with them.

- •Me and my money

- •2. Read the text again. Are these statements true or false.

- •3. Reading. Read the article and choose the correct answer to the questions below. Mind the new words.

- •Prince Alwaleed bin Talal

- •3. (1) Choose the correct answer.

- •3. (2) Match the numbers. Find them in the text. What do they refer to?

- •Staff receive day’s income

- •Vocabulary

- •8. Give Russian equivalents:

- •9. Choose words from the list to fill in the gaps, then use them to make sentences:

- •10. Correct the statements that are false:

- •11. Answer the questions:

Unit 1 Finance

1(1) Listening. Listen and practice. Mind the new words.

|

to borrow |

брать в долг, занимать |

|

interest rate |

процентная ставка |

|

offshore bank account |

банковский счет в оффшорной зоне |

|

to be tax-free |

не облагаться налогом |

|

public company |

государственная компания |

|

share |

акция |

|

shareholder |

акционер |

|

financial results |

финансовая отчетность |

|

tax year |

налоговый период |

|

annual report |

ежегодный отчет |

|

profit and loss account |

счет прибыли и убытков (доходов и расходов) |

|

turnover |

оборот |

|

to be obliged by law |

быть обязанным по закону |

Companies and

individuals often borrow money, and it is important to find a

favorable interest rate. Rates are variable, and can rise or fall

depending on the market. Many investors, (people who use their money

to earn more money), choose foreign or offshore bank accounts because

they are tax-free. Anyone can buy shares in a public company and

become a shareholder. All public companies in the UK are obliged by

law to publish their financial results at the end of the tax year.

They do this in their annual report to shareholders. Annual reports

include profit and loss accounts which show turnover, or the total

sum of money, which is coming into the company.

2. How much do you know about money? Answer the questions.

1. Why do public companies publish annual reports?

2. Who uses information in a profit and loss account?

3. Do the directors or shareholders own the company?

3. Look at the five lists of numbers and choose a term from the box that describes each one.

|

cardinal numbers, ordinal numbers, fractions, decimal numbers, percentages |

1. __________0, 10, 15, 20 …………………

2. __________1st, 2nd, 3rd, 4th………………..

3. __________ ½, ¼ ¾ ……………………..

4. __________0.25, 0.50, 0.75………………

5. __________9%, 25%, 75%.......................

4. Saying numerals. Look at the written forms of the dates, times, money and dimensions. Can you say them? Listen and repeat the numerals.

|

|

24.10.2001 24.11.1975 1.3.1960 27.5.2010 5.6.1961

|

|

|

7.05 p.m. 3.45 4.15 9.35 12.30 3.55 |

|

|

£ 100 $101 1,000 yen €1,101 £5000 $1,000,000 €1,000,000,000

|

|

|

10 cm 1,000 kg 100 cm2 5.8 km 15 m 4 g |

5(2). Listening. Listen and repeat the numerals above.

6. Say the numerals.

|

$105,673, 29.12.2011, 11.20 p.m., 7.9 km, €1,594, 17.06.2003, 5.45 a.m., £45,592, 56cm2 |

7(3). Listening.

Cardinal numbers

7.1. In 1999 a minimum wage was set in Britain. Workers were happy, but the employees were not. Why is this?

7.2. Listen and complete the paragraph.

In 1999 the minimum wage was set at £________ an hour for adults and £__________ for young workers aged between eighteen and twenty-one. Employers wanted the minimum wage to be £___________ but workers wanted it set at £_____________.

7.3. Is there a minimum wage in Russia? Do you think government should set a minimum wage?

8(4). Listening.

Ordinal numbers

8.1. Look at the chart. It shows the world ranking of the cost of living in 13 European cities. Listen and complete the gaps in the chart.

|

THE MOST EXPENSIVE CITIES IN THE WORLD | ||

|

City |

This year |

Last year |

|

a |

5 |

3 |

|

Zurich |

6 |

3 |

|

b |

7 |

6 |

|

Geneva |

8 |

5 |

|

c |

10 |

28 |

|

Stockholm |

13 |

8 |

|

Copenhagen |

14 |

8 |

|

Vienna |

14 |

8 |

|

Dusseldorf |

d |

14 |

|

Lyon |

e |

15 |

|

Amsterdam |

24 |

21 |

|

Helsinki |

24 |

23 |

|

f |

26 |

26 |

9(5). Listening.

Decimals

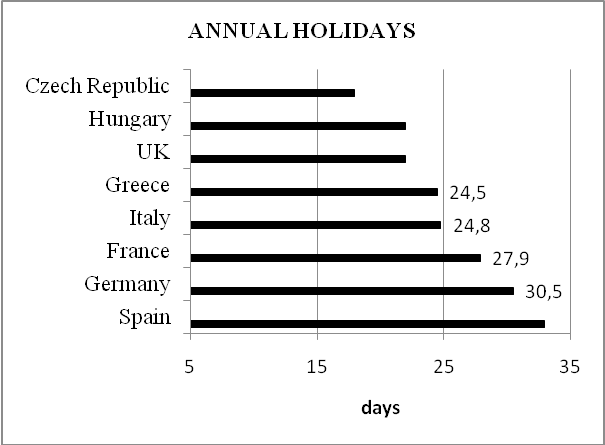

9.1 Look at the bar chart showing annual holidays in eight different countries. Listen and complete the missing figures at the end of the bars.

10(6). Listening.

Percentages

10.1 Listen to two people discussing their weekly expenditure on different things and complete the table.

|

|

Matthew (male) |

Robyn (female) |

Average British person (from the survey pie chart) |

|

Food and drink |

|

|

22% |

|

Housing |

|

not given |

16% |

|

Transport |

|

|

15.2% |

|

Household goods and services |

|

|

14% |

|

Leisure goods and services |

|

|

16% |

|

Tobacco |

|

0% |

2% |

10.2 Compare the percentages in the table with yours. Tell about your own weekly expenditure.

11. Reading. Read the text and explain the words in bold.

A Bank

A bank is a financial institution licensed by a government. It provides financial services to customers enriching its investors.

Banks act as payment agents. They conduct checking or current accounts for customers, pay cheques drawn by customers of the bank, and collect cheques deposited to customers' current accounts.

Banks borrow money when they accept funds deposited on current accounts or accept term deposits. They also issue debt securities such as banknotes and bonds.

Banks lend money by making advances to customers, or installment loans. They invest in marketable debt securities and other forms of money lending.

Banks provide almost all payment services.

The principal types of banks in the modern industrial world are commercial banks and central banks. Commercial banks accept deposits from the general public and make loans to individuals and businesses and sometimes to governments. Central banks, in contrast, deal mainly with their national governments, with commercial banks, and with each other. Central banks issue paper currency and are responsible for regulating commercial banks and national money stocks. Central banks operate for the public welfare and not for maximum profit.

There are institutions which are also called banks but they don’t perform all banking functions. They are classified as financial intermediaries. Such institutions include finance companies, savings banks, trust companies, insurance companies and so on.

1.

1. 2.

2. 3.

3. 4.

4.