- •Introduction to Macroeconomics

- •Aggregate demand

- •Long-run aggregate supply

- •Problem 2 (apt’94, p2)

- •Aggregate demand

- •Price level

- •Problem 1 (apt’93, p1)

- •Problem 2 (apt’94, p1)

- •Problem 3 (apt’95, p1)

- •Aggregate demand

- •Real interest rates

- •Nominal interest rates

- •Inflation.

- •Problem 2 (apt’94, p3)

- •Price level

- •Sample answer:

- •Problem 7 (apt’2001, p2)

- •Sample answer

- •Problem 1 (apt’95, p2)

Contents:

Introduction to Macroeconomics 1

Aggregate Supply and Aggregate Demand 2

Fiscal Policy. 3

Money Market and Monetary Policy. 9

Efficiency of Fiscal and Monetary Policies. Policy Mix. 17

Inflation. 26

Open Economy: Balance of Payments and Exchange Rate. 27

Macroeconomic Policy Debate. 33

Introduction to Macroeconomics

Problem 1 (APT’97, P2)

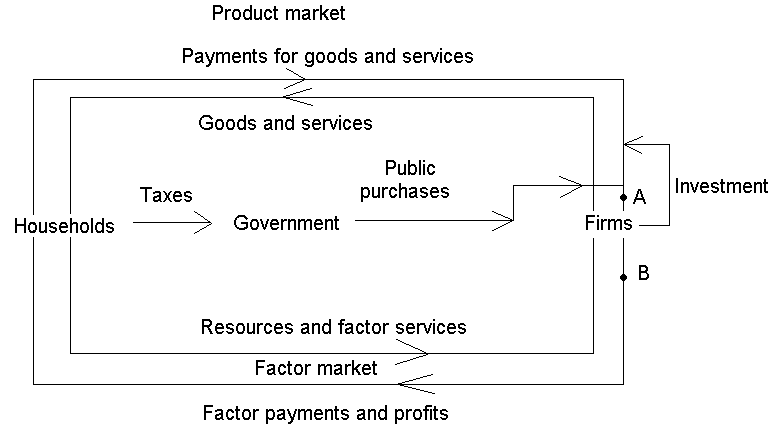

Assume a market economy with a business sector, a household sector, and a government sector, but no international sector.

Draw and label a circular diagram for this economy.

Referring to the diagram you have drawn in part (a), identify two ways of calculating the economy’s gross domestic product (GDP).

Identify each of the following.

The components of aggregate demand

The determinants of aggregate supply

Sample

answer:

We can evaluate the economy’s total production by measuring the value of payments at any point of the circular flow. Hence, gross domestic product can be calculated either by summing all expenditures on final goods and services, which includes consumption, investment and government purchases (point A), or by summing income flows, i.e. wages and salaries, interest and rents, plus economic profit (point B).

(i) Aggregate demand consists of consumption demand, investment demand and public expenditure.

(ii) Aggregate supply depends on two main factors, namely, the amount of resources available to the economy at a given moment (i.e. capital, labor force and natural resources) and the level of technological development, that is, the effectiveness with which the available resources are utilized.

Problem 2 (APT’99, P2)

Assume an open economy with a public sector.

Identify two methods of calculating gross domestic product for this economy.

Explain why the two methods you identified in part (a) must yield the same value of gross domestic product.

Identify one shortcoming of using gross domestic product as an indicator of the actual level of national output.

If nominal gross domestic product increased by 4 percent in 1996, identify two additional pieces of information you need before you can conclude that the living standard of the typical person increased by 4 percent during that year.

Sample answer:

One of the ways to calculate GDP is by summing up the value added for all goods at each stage of production. The alternative method of doing the same thing is to use the income approach, which consists of summing all factor payments, such as wages, rent and profits.

The two methods will give absolutely the same result. At each stage of production the value added is equal to the difference between the value of output and the value of goods and services purchased from other firms. This money is all businesses have to pay wages to their employees and the rent for the use of capital. Everything left over after paying salaries and rent is, by definition, the profit of the firm. Thus, the equality of value added and factor earnings for a single firm is a mere accounting identity and remains valid if we do summation over all firms:

VA = W + R + π ΣVA = Σ(W + R + π) = ∑W + ∑R + ∑π.

Gross domestic product (GDP) is not always an adequate measure of the national output because much of economic activity goes on beyond the scenes and consequently does not get reported in official statistics (e.g. black markets). Another important reason why GDP often underestimates the true size of production is that many transactions (such as household work), while certainly contributing to the national output, do not involve money payment and therefore cannot be evaluated.

The conventional measure of the living standard of the typical person is real GDP per capita, i.e. total output of the economy divided by the size of the population. Hence, to conclude that the living standards have improved following a 4% increase in nominal GDP we also need to know the rate of inflation and the rate of population growth.

Aggregate Supply and Aggregate Demand

Problem 1 (APT’99)

Assume that an economy is at full employment.

Explain how an increase in net investment will affect each of the following.

Aggregate demand

Capital stock

Long-run aggregate supply

Output

Explain how the increase in net investment will affect the country’s production possibilities curve shown below.

Good Y

Production

Possibilities

Curve

Curve

Good X

Sample answer:

i) Since net investment is equal to gross investment minus depreciation and given that the latter is constant, gross investment must go up as well, which, in turn, means that aggregate demand, of which gross investment is an important component, will increase.

ii) As positive net investment adds to the capital stock, the amount of capital will rise.

iii) Long run supply curve is fully determined by the amounts of resources available to the economy and the current technology. Therefore, the already mentioned capital stock increase will raise the potential output and shift the long run supply curve to the right.

iv) Output will rise both in the short and the long run. In the short run – due to an increase in aggregate demand, and in the long run – due to increased potential output:

Short Run Long Run

LRAS0 LRAS1

LRAS0 LRAS1

P AS P

P AS P

AD1 AD1

AD0 AD0

Y Y

Y Y

Y0 Y1

The production possibilities curve reflects the maximum amounts of goods the economy can produce simultaneously given the available resources and technology. Thus, an increase in one of the factors of production, the capital stock, will allow the economy to have more of both X and Y, which corresponds to an outward shift in the PPF:

Y

Y

X

Fiscal Policy.

Problem 1 (APT’98, P1)

The economy is at full employment. An increase in government spending causes the government deficit to increase.

Draw an aggregate supply and demand graph showing the economy at full employment. Show on the graph and explain completely the impact of the increase in government spending on each of the following.

Price level

Real output

Explain how the increase in the deficit will affect each of the following in the long run.

Nominal interest rates

Real interest rates

Define each of the following.

Government deficit

National debt

Do each of the following.

Identify one tax policy the government could use to promote long-run growth in this economy.

Explain how this tax policy will promote long-run growth.

Draw a production possibilities curve for this economy that produces capital goods and consumption goods. Show how this tax policy will affect this economy’s production possibilities curve.

Sample answer:

The following graph shows the aggregate supply and aggregate demand of an economy at full employment:

LRAS

P SRAS

P SRAS

AD

Y Y

The effect of an expansionary fiscal policy such as an increase in government spending will be a rightward shift in the AD curve. As the graph below illustrates, in the short run, when the AS curve is upward sloping, this will lead both to a rise in prices and expansion of real output.

LRAS

P SRAS

AD2

AD1

Y Y

However, in the long run, when the output is determined solely by the production capacities of the economy and fixed at its potential level, increased prices will be the only result of the policy. The explanation for this can be found in the operation of the labour market. In the short run, when higher government purchases induce firms to expand their output by hiring more workers at the going wage rate, this generates a shortage of labour placing a strain on the market and pushing the wages up. Besides, the increase in output will be accompanied by rising prices and a reduction in the real wage workers receive for their job. Hence, even if they suffer from money illusion and are unable to see it immediately, sooner or later they will figure out that they are being underpaid and will bid for higher wages. This, in turn, will lead to an increase in the costs of production and shift the AS curve up until the potential level of output is restored and all markets are in the long run equilibrium (see the graph below):

LRAS

P

SRAS1

SRAS1

SRAS2

SRAS2

AD2

AD1

Y Y

Thus, if the economy is at full employment and both prices and wages can adjust freely, an increase in government spending will result in inflation (i), but will not affect the real output (ii).

To finance its deficit the government will have to increase its borrowing from the public: either through issuing bonds or in any other way available to it. Whatever way the government uses to raise money it will have to offer a higher real interest rate to attract the lenders, which, in turn, will raise real interest rates in the rest of the economy (r will go up in the long run). Since the nominal interest rate is approximately the rate of inflation plus the real interest rate, given that the latter increases and there is some inflation, as we have seen in part (a), nominal interest rate must go up as well.

i) Government deficit is the excess of the government’s spending over its revenues in a certain period of time. It occurs when the government spends more than it earns through taxes and various duties and is a flow variable.

ii) In contrast to government deficit, national debt is a stock variable which shows the accumulated debt of the government and the public sector, and is comprised of two parts: the internal debt to the citizens of the country and the external debt to other states. One of the major sources of national debt is government deficit which is funded via borrowing.

i) One possible tax policy that would encourage long run economic growth is a reduction in taxes on the profits of corporations.

ii) The result of this policy will be a rise in investment since now big firms will have more money left after paying taxes and dividends to seek and realise new business opportunities. Increased investment will lead to accumulation of the capital stock, which will expand the production capacity of the economy.

iii) Since capital is one of the factors of production, the increase in its amount, which we identified above, will allow the economy to produce more of both types of goods. Thus, the effect of this tax policy will be an outward shift in the production possibilities frontier, as shown below:

Capital goods

Consumption goods

Problem 2 (APT'2000, P1)

Suppose that the United States economy is in a deep recession.

Using a correctly labeled aggregate demand and supply graph, show the equilibrium price level and real gross domestic product.

There is a debate in Congress as to whether to decrease personal income taxes by a given amount or to increase government purchases by this amount. Which of these two fiscal policies will have a larger impact on real gross domestic product? Explain.

Explain how a decrease in personal income taxes will affect each of the following in the short run.

Consumption

Real gross domestic product

Imports

Exports

Explain the mechanism by which an increase in net investment will cause each of the following to change.