- •Revisiting our analysis on “Russian food retail race for space”

- •X5: From growth to value and dividends; reiterate Buy

- •Magnit: We see a bumpy road for operational turnaround, remain Neutral

- •Lenta: Operational performance to remain challenged, Neutral

- •Valuation, price target and estimate changes

- •Financials

vk.com/id446425943

Goldman Sachs

Russia Retail

Financials

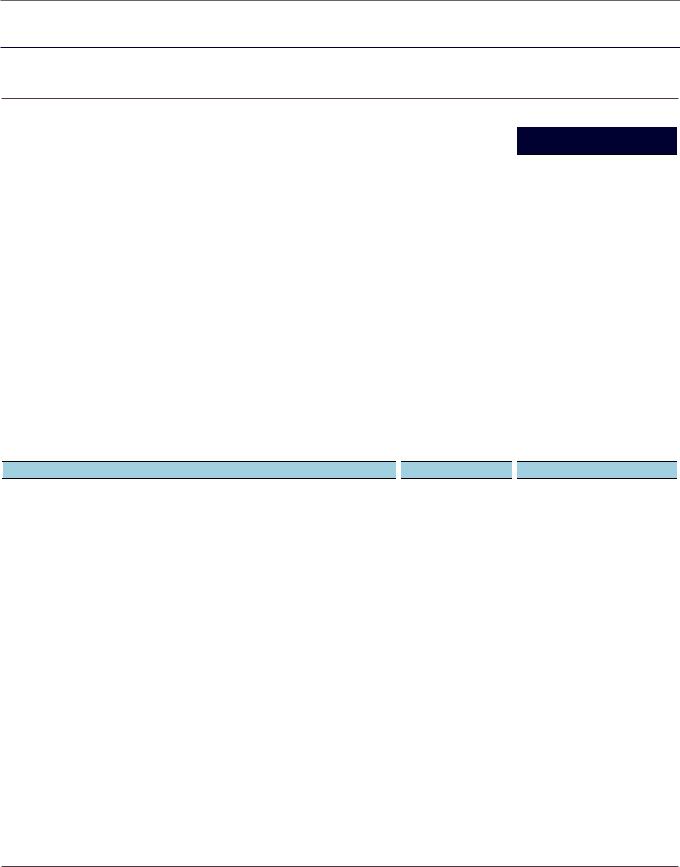

Exhibit 69: X5 - income and balance sheet statements

Income statement, Rub mn |

2017 |

2018E |

2019E |

2020E |

2021E |

|

|

CAGR |

|

2018-20 |

2017-21 |

||||||

|

|

|

|

|

|

|

||

Sales |

1,295,008 |

1,529,474 |

1,767,428 |

1,995,710 |

2,214,513 |

14.2% |

14.4% |

|

yoy growth, % |

25% |

18% |

16% |

13% |

11% |

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

308,938 |

369,674 |

430,545 |

486,554 |

539,898 |

14.7% |

15.0% |

|

margin, % |

23.9% |

24.2% |

24.4% |

24.4% |

24.4% |

|

0.2pp |

0.5pp |

EBITDA |

96,193 |

105,761 |

119,315 |

132,159 |

144,578 |

11.8% |

10.7% |

|

margin, % |

7.4% |

6.9% |

6.8% |

6.6% |

6.5% |

|

-0.3pp |

-0.9pp |

EBITDA (adjusted) |

99,131 |

107,761 |

121,836 |

134,180 |

146,599 |

|

|

|

margin, % |

7.7% |

7.0% |

6.9% |

6.7% |

6.6% |

|

|

|

|

|

|

|

|

|

|

|

|

EBIT |

57,758 |

57,645 |

65,298 |

71,067 |

76,698 |

11.0% |

7.3% |

|

margin, % |

4.5% |

3.8% |

3.7% |

3.6% |

3.5% |

|

-0.2pp |

-1.0pp |

|

|

|

|

|

|

|

|

|

Net Interest expense |

(16,017) |

(17,739) |

(17,171) |

(17,503) |

(17,862) |

|

|

|

Other non-ops income/(expense) |

75 |

(253) |

0 |

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

PBT |

41,816 |

39,652 |

48,127 |

53,565 |

58,836 |

16.2% |

8.9% |

|

|

|

|

|

|

|

|

|

|

Provision for income tax |

(10,422) |

(9,636) |

(12,032) |

(13,391) |

(14,709) |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

31,394 |

30,017 |

36,095 |

40,173 |

44,127 |

15.7% |

14.6% |

|

margin, % |

2.4% |

2.0% |

2.0% |

2.0% |

2.0% |

|

0.1pp |

-0.4pp |

|

|

|

|

|

|

|

|

|

Dividends |

(21,590) |

(21,012) |

(36,095) |

(40,173) |

(44,127) |

38.3% |

na |

|

Payout, % |

69% |

70% |

100% |

100% |

100% |

|

|

|

Combined group

Comments

EBITDA margin to gradually decline in 2019-21 as a result of increasing competition

We expect interest rates to decline due to easing monetary cycle, interest payments increasing due to higher debt (in absolute terms)

We expect X5 to increase its payout ratio above minimum approved 25% to 100% in 2019

Total number of stores |

12,121 |

14,308 |

16,195 |

17,997 |

19,579 |

+3689 stores |

+7458 stores |

New openings |

2,934 |

2,187 |

1,887 |

1,802 |

1,582 |

|

|

Total selling space |

5,480 |

6,429 |

7,270 |

8,044 |

8,719 |

11.9% |

12.3% |

Selling space growth |

31.9% |

18.0% |

13.2% |

11.1% |

8.8% |

|

|

LFL growth |

5.4% |

0.8% |

1.4% |

1.3% |

1.2% |

1.4% |

2.0% |

We expect X5 to gradually slow down the number of new openings

LFL to remain positive supported by improving value proposition in Moscow, food inflation, regional model adjustment

Selected Items, BS and CFS, Rub |

2017 |

2018E |

2019E |

2020E |

2021E |

|

Comments |

mn |

|

||||||

|

|

|

|

|

|

|

|

Balance Sheet |

|

|

|

|

|

|

|

Total debt |

194,296 |

233,160 |

243,816 |

256,260 |

254,096 |

|

|

Cash |

27,605 |

30,589 |

35,349 |

43,906 |

44,290 |

|

Do not expect a significant deleveraging below ~2x target, with available cash paid |

Net Debt / EBITDA |

1.7x |

1.9x |

1.7x |

1.6x |

1.5x |

|

out as dividends |

Working capital days |

|

|

|

|

|

|

|

Days inventories |

32.0 |

36.0 |

34.5 |

32.5 |

31.5 |

|

|

Days receivable |

4.4 |

4.4 |

4.4 |

4.4 |

4.4 |

|

Expect marginal improvement in inventory management |

Days payable |

48.4 |

46.4 |

46.4 |

46.4 |

46.4 |

|

|

Cash conversion cycle |

-12.0 |

-6.0 |

-7.5 |

-9.5 |

-10.5 |

|

|

|

|

|

|

|

|

|

|

Cash Flow Statement |

|

|

|

|

|

|

|

Operating cash flow |

58,658 |

76,229 |

98,321 |

111,915 |

120,273 |

|

We expect an annual capex of Rub 80bn to be spent on new stores as well as IT / |

Investing cash flow (Capex) |

(87,274) |

(90,519) |

(83,205) |

(79,708) |

(77,552) |

|

logistics |

|

|

|

|

|

|

|

FCF generation to improve from 2019 |

FCF |

(28,616) |

(14,290) |

15,116 |

32,207 |

42,722 |

|

|

|

|

|

|

|

|

|

We expect increasing payout ratio from 70% in 2018 to 100% in 2019-21 |

Dividends |

0 |

(21,590) |

(21,012) |

(36,095) |

(40,173) |

|

|

Increase / Decrease in borrowings |

38,017 |

38,864 |

10,655 |

12,445 |

(2,164) |

|

|

Total financing cash flow |

38,017 |

17,274 |

(10,356) |

(23,650) |

(42,337) |

|

|

Total cash flow |

9,401 |

2,984 |

4,759 |

8,557 |

385 |

|

|

ROIC (lease adjusted) |

12.9% |

11.5% |

11.5% |

11.6% |

11.7% |

|

We expect returns to be supported by growing store maturity and improved FCF |

ROA |

6.0% |

5.0% |

5.5% |

5.8% |

6.1% |

|

generation |

Source: Company data, Goldman Sachs Global Investment Research

28 November 2018 |

28 |

vk.com/id446425943

Goldman Sachs

Russia Retail

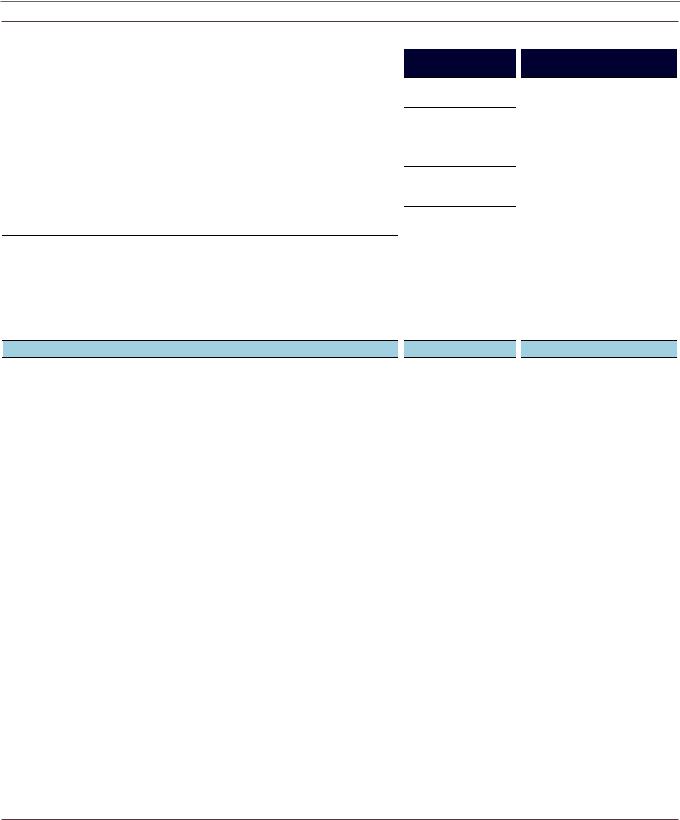

Exhibit 70: Magnit - income and balance sheet statements

Income statement, Rub mn |

2017 |

2018E |

2019E |

2020E |

2021E |

|

|

|

|

|

|

Sales |

1,143,314 |

1,235,507 |

1,379,908 |

1,573,945 |

1,793,396 |

yoy growth, % |

6% |

8% |

12% |

14% |

14% |

|

|

|

|

|

|

Gross profit |

296,621 |

300,228 |

333,938 |

381,682 |

434,898 |

margin, % |

25.9% |

24.3% |

24.2% |

24.3% |

24.3% |

EBITDA |

91,778 |

89,576 |

98,361 |

115,532 |

134,806 |

margin, % |

8.0% |

7.3% |

7.1% |

7.3% |

7.5% |

|

|

|

|

|

|

EBIT |

58,062 |

52,916 |

58,107 |

70,404 |

82,489 |

margin, % |

5.1% |

4.3% |

4.2% |

4.5% |

4.6% |

|

|

|

|

|

|

Net Interest expense |

(12,638) |

(9,354) |

(10,961) |

(12,147) |

(12,983) |

CAGR

2018-20 2017-21

12.9% 11.9%

12.8% 10.0%

-0.1pp -1.7pp

13.6% 10.1%

0.1pp -0.5pp

15.3% 9.2%

0.2pp -0.5pp

Comments

EBITDA margin to decline in 2019 on the back of disruption from refurbishments and growing shrinkage

We expect interest expense to increase due to higher leverage

PBT |

45,424 |

43,562 |

47,146 |

58,257 |

69,506 |

15.6% |

11.2% |

|

Provision for income tax |

(9,885) |

(8,930) |

(9,901) |

(12,234) |

(14,596) |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

35,539 |

34,631 |

37,245 |

46,023 |

54,910 |

15.3% |

11.5% |

|

margin, % |

3.1% |

2.8% |

2.7% |

2.9% |

3.1% |

0.1pp |

0.0pp |

|

|

|

|

|

|

|

|

|

|

Dividends |

(24,732) |

(19,047) |

(18,623) |

(23,012) |

(27,455) |

9.9% |

2.6% |

We expect Magnit to maintain 50-55% payout |

Payout, % |

70% |

55% |

50% |

50% |

50% |

|

|

ratio in 2018-21 |

|

|

|

Combined group

Total number of stores |

16,350 |

18,043 |

20,229 |

22,866 |

25,316 |

+4823 stores |

+8966 stores |

New openings |

2,291 |

1,693 |

2,186 |

2,637 |

2,450 |

|

|

Total selling space |

5,755 |

6,285 |

6,963 |

7,803 |

8,585 |

11.4% |

10.5% |

Selling space growth |

16.3% |

9.2% |

10.8% |

12.1% |

10.0% |

|

|

LFL growth |

-3.4% |

-2.8% |

1.5% |

2.3% |

2.2% |

1.9% |

0.0% |

Openings to be driven by new proximity and drogerie stores

Selected Items, BS and CFS, Rub |

2017 |

2018E |

2019E |

2020E |

2021E |

|

Comments |

mn |

|

||||||

|

|

|

|

|

|

|

|

Balance Sheet |

|

|

|

|

|

|

|

Total debt |

126,460 |

143,333 |

160,724 |

176,306 |

184,554 |

|

|

Cash |

18,337 |

14,826 |

16,559 |

18,887 |

21,521 |

|

We expect leverage to increase in 2019 due to acceleration of openings and |

Net Debt / EBITDA |

1.2x |

1.4x |

1.5x |

1.4x |

1.2x |

|

refurbishments |

|

|

||||||

Working capital days |

|

|

|

|

|

|

|

Days inventories |

69.9 |

70.0 |

66.0 |

64.0 |

63.0 |

|

|

Days receivable |

2.2 |

2.2 |

2.2 |

2.2 |

2.2 |

|

Expect marginal improvement in inventory management |

Days payable |

42.7 |

44.0 |

44.0 |

44.0 |

44.0 |

|

|

Cash conversion cycle |

29.4 |

28.2 |

24.2 |

22.2 |

21.2 |

|

|

|

|

|

|

|

|

|

|

Cash Flow Statement |

|

|

|

|

|

|

|

Operating cash flow |

61,008 |

67,168 |

80,195 |

87,681 |

100,499 |

|

We expect an annual capex of Rub70-80bn to be spent on new stores and |

Investing cash flow (Capex) |

(74,195) |

(51,543) |

(70,367) |

(80,794) |

(81,565) |

|

refurbishments |

|

|

||||||

|

|

|

|

|

|

|

|

FCF |

(13,186) |

15,625 |

9,829 |

6,887 |

18,933 |

|

|

Dividends |

(29,233) |

(13,809) |

(25,487) |

(20,140) |

(24,548) |

|

|

Share Issue / repurchase |

44,989 |

(22,200) |

0 |

0 |

0 |

|

|

Increase / Decrease in borrowings |

(791) |

16,873 |

17,391 |

15,582 |

8,248 |

|

|

Total financing cash flow |

14,965 |

(19,136) |

(8,096) |

(4,558) |

(16,300) |

|

|

Total cash flow |

18,337 |

14,826 |

16,559 |

18,887 |

21,521 |

|

|

ROIC (lease adjusted) |

12.0% |

10.7% |

10.7% |

11.4% |

11.7% |

|

We expect returns to be under pressure in 2019 on the back of margin declines |

|

and investments in refurbishments, but improve afterwards once turnaround |

||||||

ROA |

13.7% |

12.4% |

12.8% |

14.5% |

15.8% |

|

|

|

progresses |

Source: Company data, Goldman Sachs Global Investment Research

28 November 2018 |

29 |

vk.com/id446425943

Goldman Sachs

Russia Retail

Exhibit 71: Lenta - income and balance sheet statements

Income statement, Rub mn |

2017 |

2018E |

2019E |

2020E |

2021E |

|

|

CAGR |

|

Comments |

|

2018-20 |

2017-21 |

|

|||||||

|

|

|

|

|

|

|

|

|

||

Sales |

365,178 |

418,214 |

459,292 |

485,192 |

504,005 |

7.7% |

8.4% |

|

|

|

yoy growth, % |

19% |

15% |

10% |

6% |

4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

78,236 |

90,225 |

98,628 |

103,705 |

107,222 |

7.2% |

8.2% |

|

|

|

margin, % |

21.4% |

21.6% |

21.5% |

21.4% |

21.3% |

|

-0.2pp |

-0.1pp |

|

|

EBITDA |

35,490 |

37,749 |

40,941 |

42,877 |

43,536 |

6.6% |

5.2% |

|

EBITDA margin to decline on the back of |

|

margin, % |

9.7% |

9.0% |

8.9% |

8.8% |

8.6% |

|

-0.2pp |

-1.1pp |

|

intensifying competition, cannibalization and |

|

|

changing store ownership structure (more |

||||||||

|

|

|

|

|

|

|

|

|

|

|

EBIT |

25,799 |

25,629 |

27,889 |

28,969 |

28,754 |

6.3% |

2.7% |

|

leased stores) |

|

margin, % |

7.1% |

6.1% |

6.1% |

6.0% |

5.7% |

|

-0.2pp |

-1.4pp |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest expense |

(10,497) |

(8,937) |

(8,800) |

(7,917) |

(6,574) |

|

|

|

|

|

Other non-ops income/(expense) |

(130) |

0 |

0 |

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PBT |

15,172 |

16,692 |

19,089 |

21,052 |

22,180 |

12.3% |

10.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income tax |

(1,908) |

(3,172) |

(3,818) |

(4,210) |

(4,436) |

|

|

|

|

|

Net income |

13,264 |

13,521 |

15,271 |

16,841 |

17,744 |

11.6% |

7.5% |

|

|

|

margin, % |

3.6% |

3.2% |

3.3% |

3.5% |

3.5% |

|

0.2pp |

-0.1pp |

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

0 |

0 |

0 |

0 |

0 |

|

|

|

|

We expect no dividends in the next 5 years |

Payout, % |

0% |

0% |

0% |

0% |

0% |

|

|

|

|

|

|

|

|

|

|

||||||

Combined group

Total number of stores |

328 |

386 |

425 |

464 |

503 |

New hypers openings |

40 |

18 |

9 |

9 |

9 |

Total selling space |

1,382 |

1,503 |

1,571 |

1,638 |

1,704 |

Selling space growth |

20.6% |

8.8% |

4.5% |

4.3% |

4.1% |

LFL growth (hypers) |

0.8% |

3.0% |

0.9% |

-0.1% |

-0.6% |

Selected Items, BS and CFS, Rub |

2017 |

2018E |

2019E |

2020E |

2021E |

|

mn |

||||||

|

|

|

|

|

||

Balance Sheet |

|

|

|

|

|

|

Total debt |

107,082 |

110,811 |

105,474 |

90,446 |

73,921 |

|

Cash |

14,302 |

12,546 |

13,779 |

14,556 |

15,120 |

|

Net Debt / EBITDA |

2.6 |

2.6 |

2.2 |

1.8 |

1.4 |

|

Working capital days |

|

|

|

|

|

|

Days inventories |

47.0 |

47.0 |

47.0 |

47.0 |

47.0 |

|

Days receivable |

11.0 |

11.0 |

11.0 |

11.0 |

11.0 |

|

Days payable |

72.8 |

68.8 |

68.8 |

68.8 |

68.8 |

|

|

|

|

|

|

|

|

Cash conversion cycle |

-14.9 |

-10.9 |

-10.9 |

-10.9 |

-10.9 |

|

|

|

|

|

|

|

|

Cash Flow Statement |

|

|

|

|

|

|

Operating cash flow |

23,745 |

23,362 |

29,771 |

31,689 |

33,229 |

|

Investing cash flow (Capex) |

(27,275) |

(28,346) |

(15,581) |

(15,885) |

(16,139) |

FCF |

(3,531) |

(4,984) |

14,189 |

15,805 |

17,090 |

Dividends |

0 |

0 |

0 |

0 |

0 |

Increase / Decrease in borrowings |

4,795 |

3,729 |

(5,337) |

(15,028) |

(16,526) |

Share Issue / repurchase |

0 |

(500) |

(7,620) |

0 |

0 |

Total financing cash flow |

4,795 |

3,229 |

(12,957) |

(15,028) |

(16,526) |

Total cash flow |

1,264 |

(1,755) |

1,232 |

777 |

564 |

ROIC (lease adjusted) |

13.1% |

11.2% |

11.0% |

11.1% |

10.9% |

ROA |

5.6% |

5.3% |

5.6% |

6.0% |

6.2% |

+78 stores |

+175 stores |

Expect slowdown of new hypers openings from 2019

4.4% 5.4%

0.4% 0.8%

Comments

We expect leverage to decline as a result of slower expansion

Expect stable inventory management

We expect a decrease in capex from 2019

We expect returns to remain broadly stable as a result of slower expansion

Source: Company data, Goldman Sachs Global Investment Research

28 November 2018 |

30 |