GS_The_European_Conviction_List_watermark

.pdf

vk.com/id446425943

EQUITY RESEARCH | November 28, 2018 | 09:58PM GMT

The

European

Conviction List

Our best and brightest ideas

Katherine Alexakis, CFA |

Richard Manley |

John |

Sawtell |

+44 20 7774-1319 |

+44 20 7051-5829 |

+44 20 |

7774-6196 |

katherine.alexakis@gs.com |

richard.manley@gs.com |

john.sawtell@gs.com |

|

Goldman Sachs International |

Goldman Sachs International |

Goldman Sachs International |

|

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S.

The Goldman Sachs Group, Inc.

vkTable.com/id446425943of Contents

Industrials (Machinery, A&D, Chemicals)

ABB Late cycle capex exposure with SOTP optionality p. 8

Akzo Nobel Self-help with inflecting end markets p. 9

BAE Systems US opportunity overlooked p. 10

Clariant Portfolio high-grading the right move p. 11

CNHi Exposure to the Ag Cycle with SOTP optionality p. 12 Melrose Multiple catalysts for value crystallization p. 13 Rolls-Royce Preparing for FCF take-off p. 14

Business Services and

Transport, Travel & Leisure

Deutsche Post DHL Robust structural growth opportunity p. 15 Elis Cleaning up p. 16

Eurofins Scientific Positive test results for the growth story p. 17 Experian Accelerating organic growth p. 18

Ferrovial Momentum in contracting; SOTP optionality p. 19 Vinci Building success p. 20

Technology, Media and Telcos

ASML Leading position in a structurally growing market |

p. 21 |

Capgemini Organic growth consistency coming to the fore |

p. 22 |

Orange The winner in a competitive market p. 23 |

|

SAP S4 HANA gets into its stride p. 24 |

|

Telenet Top cable pick with digitalisation tailwind p. 25 Telia Best-in-class ‘Digital Divergence’ cost cutter p. 26 Wirecard Wired for growth p. 27

Basic Resources & Energy

Anglo American Improved commodity mix p. 28

ArcelorMittal A value opportunity with earnings momentum p. 29

BP Approaching a FCF sweetspot; higher cash returns ahead p. 30 Fresnillo Attractive entry point post recent sell-off p. 31

Naturgy Attractive income; SOTP optionality p. 32

Randgold Resources Poised for success p. 33

RWE Five routes to a re-rating p. 34

Voestalpine Value in Carbon Steel p. 35

Consumer & Healthcare

Anheuser-Busch InBev Brewing up a storm p. 36 Just Eat A double order of growth p. 37

Kering Bags of Value p. 38

Novo Nordisk Embarking on a new compounding cycle p. 39 Novartis Firing on all cylinders p. 40

Philips In improving health p. 41

Financials (Banks, Real Estate

and Insurance)

AEDAS Homes Quality exposure to Spanish housing |

p. 42 |

Aviva Balance sheet focus could pay dividends p. 43 |

|

AXA Value in restructuring p. 44 |

|

Banco Sabadell Post de-risking, risks to the upside |

p. 45 |

BAWAG Group High return bank in a low-return market p. 46 |

|

BNP Paribas Increasing dividend credibility p. 47

ING Discount valuation, stable profitability & dividend yield p. 48 Kojamo Finish market leader p. 49

Standard Chartered Valuation gap presents opportunity p. 50 Vonovia Market consolidator and innovator p. 51

Zurich Insurance Group Dividend upside p. 52

Contributing Analysts

Daniela Costa, Georgina Iwamoto, Chris Hallam, Theodora Lee Joseph, Gungun Verma, Jack O’Brien, Matija Gergolet, Patrick Creuset, Alexander Duval, Mohammed Moawalla, Andrew Lee, Michael Bishop, Eugene King, Michele Della Vigna, Alberto Gandolfi, Mitch Collett, Louise Singlehurst, Rob Joyce, Keyur Parekh, Veronika Dubajova, Jonathan Kownator, Alex Fries, Jose Abad, Pawel Dziedzic, Jean-Francois Neuez, Johnny Vo, Martin Leitgeb, Manuel Losa

vk.com/id446425943

Goldman Sachs

GS Conviction List

showcases our analyst’s

top stock

recommendations,

selected bottom up on a

sector-relative basis.

Equity markets have been through a turbulent period since our last Conviction List

Compendium was published on July 10. Over that time, MSCI Europe is down c.7% (in € terms), with a max drawdown of c.10% between the July highs and recent lows. Market leadership has also changed meaningfully. In 1H18 the Oil & Gas sector led the market, with Banks and Telecoms lagging. More recently, Telecoms (along with other ‘defensive’ sectors including Healthcare and Food & Beverages) have outperformed, as the market has digested slowing global growth and repriced the mid-term rates outlook, to the detriment of Technology and other ‘growthier’ segments of the market (see Exhibits 1 and 2). Elsewhere, the Autos sector has remained under pressure, afflicted recently with the dual challenges presented by WLTP in Europe and slower data out of China: the SXAP is now down c.20% in the YTD.

Exhibit 1: Our sector-neutral IP Growth factor has been weak since early September; meanwhile Low Volatility stocks have been meaningfully outperforming

Performance of GS long-short IP factors; for more see our weekly European Factor Barometer

1.14 |

|

|

|

|

|

1.12 |

|

|

|

|

|

1.10 |

|

|

|

|

|

1.08 |

|

|

|

|

|

1.06 |

|

|

|

|

|

1.04 |

|

|

|

|

|

1.02 |

|

|

|

|

|

1.00 |

|

|

|

|

|

0.98 |

|

|

|

|

|

0.96 |

|

|

|

|

|

0.94 |

|

|

|

|

|

0.92 |

|

|

|

|

|

0.90 |

|

|

|

|

|

0.88 |

|

|

|

|

|

Jan-18 |

Feb-18 |

Mar-18 |

Apr-18 May-18 |

Jun-18 Jul-18 |

Aug-18 Sep-18 Oct-18 Nov-18 |

|

|

|

Growth |

Volatility |

Value |

Exhibit 2: Sector leadership has shifted since we published our last CL compendium on July 10 (based on ICB sectors)

SXXP-relative performance of ICB sectors in 2018

Source: Goldman Sachs Global Investment Research |

Source: Bloomberg |

Amidst a broader market dialogue about a potential ‘macro regime shift’, our analysts have made several changes to the European Conviction List. Since early July, a total of 13 names have been removed and 10 names have been added, whilst one stock (South32) was both added and removed from the list during the period. This leaves 45 names on the current List. In aggregate, the changes made in recent months have significantly reduced our exposure to the Momentum factor and slightly reduced our exposure to top quintile Growth assets.

The most positive contributors to Conviction List performance since the publication of our last Compendium note were: Schibsted, supported by the announced listing of its global classified business; Telenet, driven by strong 2Q numbers and a better-than-expected special dividend; Roche, which raised 2018 group revenue guidance in late July; and Randgold, benefiting from the more defensive rotation within the Basic Resources sector. The most negative contributors over the period included:

BillerudKorsnas, removed from the list on July 23; Anheuser-Busch Inbev, which reported a challenging 3Q and a halving of the dividend in late October; and JUST EAT which has underperformed with the broader growth sell-off and which was weak on news reports of a bid for rival Deliveroo.

28 November 2018 |

3 |

vk.com/id446425943

Goldman Sachs

Exhibit 3: Since July, the European Conviction List has modestly outperformed our coverage, but underperformed relative to MSCI Europe

Rated coverage universe is equal-weighted for performance measurement purposes

120% |

100% |

80% |

60% |

40% |

20% |

0% |

Europe Conviction Calls Performance Relative to Rated Coverage Universe

Europe Conviction Calls Performance Relative to MSCI Europe

2.5% |

2.0% |

1.5% |

1.0% |

0.5% |

0.0% |

-0.5% |

-1.0% |

-1.5% |

-2.0% |

-2.5% |

-3.0% |

Performance relative to rated coverage universe

Performance relative to MSCI Europe

Source: Goldman Sachs Global Investment Research, Bloomberg

Capgemini and Dassault Systemes are covered by Mohammed Moawalla.

See pp 22 for more on Capgemini.

Johnny Vo is GS lead Europe Insurance analyst. See pp 45 and 46 for more on Aviva and AXA.

TOTAL and BP are covered by Michele Della Vigna. Cairn Energy is covered by Duncan Milligan. See page 30 for more on BP.

Burberry and Kering are covered by Louise Singlehurst. See p 40 for more on Kering.

Changes to the Conviction List since July 10th - 10 additions; 13 removals

Software: Capgemini was added to the Conviction List on September 28, following a period of underperformance which left the stock trading at a 15% discount to global IT peers. See ‘Capgemini: organic growth consistency coming to the fore; valuation attractive post the recent pullback’ for more. Meanwhile Dassault Systemes was removed from the list having outperformed our European Technology coverage by 32% from Jan 1 to Sept. 28. See ‘Dassult Systemes: Off Conviction List post out-performance, core thesis intact; remains Buy’ (September 28) for more.

Insurance: In their recent deep dive ‘Benelux & UK Insurance: Delineating Dividends and Value‘ (October 22), our Insurance team removed NN Group from the Conviction List (following a period of outperformance), replacing it with Aviva. In their view, Aviva has scope to improve its balance sheet in the coming years, helping to evolve the equity story. Elsewhere in the sector, the team added AXA to the Conviction List in their August note ‘Navigating Volatility‘, arguing that the recent sale of AXA Life Europe meaningfully improves the group’s liquidity position. They also see scope for an array of other non-core holdings to be divested. Finally, the team removed Standard Life Aberdeen from the list on October 22; see ‘Indian stakes in focus; Off CL, remain Buy-rated‘ for more.

Oil: BP replaced TOTAL on the list on August 8. Our Oil team removed TOTAL after a period of outperformance which left the stock trading at a dividend yield more closely aligned with peers. See ‘Industry leader with less upside after outperformance‘ for more. Meanwhile, BP was added, based on the team’s view that the stock is approaching a ‘FCF sweetspot’. Elsewhere in the energy sector, Cairn Energy was also removed from the list (October 16) given increased uncertainty around the timing of the Sangomar development in Senegal.

Luxury: Kering replaced Burberry on the List on September 6. Our Luxury team downgraded Burberry to Neutral after the stock had risen 27% since March supported by FX, better-than-feared FY18 numbers and increased investor expectations about the new collections. They replaced Burberry with Kering, arguing that the stock’s 20%

28 November 2018 |

4 |

vk.com/id446425943

Goldman Sachs

Kevin Hellegard covers Billerud; Eugene King covers Glencore and South32.

Kojamo and Vonovia are covered by Jonathan Kownator. See p 51 and p 53 for more.

RWE is covered by Alberto Gandolfi.

Europcar Mobility Group is covered by Daria Fomina

Novartis is covered by Keyur Parekh.

discount to peers looks unmerited in the context of its superior forecast growth profile. See ‘Bags of Value‘ for more detail on the Kering Buy case.

Basic Resources: On July 19, our Paper and Packaging analyst removed BillerudKorsnas from the Conviction List after a period of substantial underperformance (see ‘Near-term headwinds overshadow positive growth outlook‘ for more). Billerud’s 2Q adjusted EBITDA came in 29% below consensus driven by a miss in the consumer board division due to increased raw material costs. Elsewhere, South32 was both added and removed from the list during the period. During its time on the List (September 13-October 7), the stock rose c.12% on a market-relative basis. Glencore was also removed from the list since the publication of our last compendium note, due to uncertainties associated with the ongoing DoJ investigation - see ‘ Short-term headwinds outweigh long-term tailwinds; S32 replaces GLEN on Conviction List‘ for more.

Real Estate: On October 8, we added Finnish residential landlord Kojamo to the Conviction List, along with German residential landlord Vonovia. In ‘Mostly in good shape; Buys skewed to residential and continental offices; COL, SGRO and VNAn onto Buy List’ (October 8), our real estate team argues that Kojamo offers attractive growth prospects in a less regulated market than sector peers, while still offering a relatively low risk profile. The team believes its valuation at 5.7% 2018E earnings yield and 25% discount to 2018E NAV is attractive. Meanwhile, the team notes that Vonovia, as a market consolidator, will continue to invest both through modernisation and acquisition, benefiting from its push in innovation to capitalise on economies of scale and drive returns higher.

Utilities: On October 24, our Utilities team reinstated coverage of RWE, adding the stock to the Conviction List. They outline 5 routes to a re-rating of the stock in their reinstatement note, including potential restructuring which in their view could unlock up to 30% of value.

Travel & Leisure: On November 9, Europcar Mobility Group was removed from the Conviction List on macro and pricing concerns. While our analyst continues to expect low single digit organic growth, she believes that slowing global growth with consequent impact on traffic and travel patterns could have a negative impact on earnings and hence weigh on the share price performance in the short term.

Healthcare: On November 16, our Pharma team upgraded Novartis to Buy and added it to the Conviction List, highlighting upside from both recently launched products and the company’s late-stage pipeline assets. In their view, a more streamlined portfolio with greater exposure to speciality pharma warrants a valuation premium to large cap pharma. Meanwhile, the team removed Roche from the list, retaining a Buy rating. See here for more.

In the Media sector, we suspended coverage of Mediaset and Vivendi (previously on the

Conviction List) on September 28, 2018. Naspers and Schibsted were also removed from the Conviction List on the same date.

28 November 2018 |

5 |

vk.com/id446425943

Goldman Sachs

The Current Conviction List

Our ‘best ideas’ list currently features a wide variety of investment themes, several of which we characterise below.

nOversold growth stocks: The recent sell-off in high growth assets has been relatively indiscriminate. The realised correlation of stocks in the long leg of our IP Growth factor has increased meaningfully, suggesting opportunities to buy oversold names. We believe CL stocks including Wirecard, Just Eat, ASML and Kering (all of which offer top quintile sector-relative growth and >50% upside to our analysts’ price target) offer such opportunities.

nValue stocks with earnings momentum: In ‘Revisiting Value‘ we recently showed that adding earnings momentum would have significantly improved the alpha-generation of Value strategies in recent years. We therefore look not just for companies on low absolute and relative valuations, but also those with scope for positive revisions. On the current Conviction List such names include Orange, Telia, ArcelorMittal and Banco Sabadell.

nSimplification and streamlining opportunities: 2018 was a watershed year for corporate restructuring in Europe, with an unprecedented volume of asset divestments, spin-offs and equity carve-outs announced. From here we continue to see a significant opportunity for European companies to ‘unlock value’ by simplifying their structures. Amongst the names where our analysts see compelling opportunities are Naturgy, RWE, CNHi and ABB.

nRevenue growth inflection points: We also look for ‘change’ stories where a companies’ revenue trajectory is inflecting either as a result of a new product cycle, a change in market structure or a new demand tailwind in their core markets. Our two pharmaceutical stocks on the list (Novo and Novartis) both fall into this category, as do stocks including Experian (driven by innovation in their Software services offering) and SAP as cloud becomes a bigger piece of the group revenue profile.

nStrategic targets: In total, 11 stocks on the current Conviction List include some M&A component, implying that our analysts see each of these names as attractive strategic targets in their sector context. These include Telenet, Wirecard, Kojamo and Just Eat to name a few. All the stocks for which our analysts see an M&A likelihood can be found in our M&A basket (Bloomberg ticker GSTRACQN) which has risen >480 bp on an annualised basis since inception vs. the MSCI Europe.

nQuality compounders: We also highlight companies with high returns (CROCI) and offering meaningful compound earnings growth (>8%) over the forecast horizon. These include Telenet, Philips, Eurofins, Elis and BAE Systems.

For more information on all our Conviction List ideas, and to sign up for regular alerts on these names, please visit the European Conviction List page on the GS Research Portal (research.gs.com). Our Global Conviction List page also showcases the investment thesis for our analysts’ top ideas across the Americas, CEEMEA and Asia (inc. Australia and New Zealand).

28 November 2018 |

6 |

vk.com/id446425943

CONVICTION LIST CURIOS

The average stock on the current |

The average upside to our |

Conviction List has been on the list |

analysts’ price targets for stocks |

1 for 415 days. |

2 on the list is 49%. |

3 The median stock on the Conviction List trades at an 8% discount to our coverage on 2019E PE.

We forecast a cumulative CROCI 4 expansion of 350bps between 2018

and 2021 for stocks on the current CL (average).

5 For the median stock on the list, GS estimates are 4% ahead of I/B/E/S consensus on 2019 EPS.

6 Liquidity: The average ADVT of the stocks on the list is c€90mn (vs. c€40mn for broader coverage).

7 The average stock on the list offers a c9% sales CAGR (2017-21E), vs c.6% for the average stock in our coverage.

8 Strategic targets: for 11 stocks on the list, our analysts include some M&A component in their price target derivation: Banco Sabadell, Elis SA, Eurofins

Scientific, Experian, Akzo Nobel, Clariant, JUST EAT, Kojamo, Naturgy, Telenet and Wirecard.

9 Our most out-of- consensus large cap calls (>€15bn market cap) include BAE Systems, Naturgy, Telia, ASML and ABB (GS is ahead of consensus by >10% in 2019E for each of these names).

vk.com/id446425943

Goldman Sachs

ABB Ltd. (ABBN.S): Late-cycle capex exposure with SOTP optionality

GS Analyst

Daniela Costa

+44(20) 7774-8354

daniela.costa@gs.com

Despite a reduction to our adj. EBITA estimates post a weaker-than-expected 3Q, we continue to see ABB as one of the names in our sector with accelerating topline in 2019.

Investment Thesis: With c.70% of ABB’s sales exposed to industrial capex (vs. c.55% for our broader Capital Goods coverage), we see the company as a key beneficiary of still-robust global capex in utilities, mining and marine end markets. This compounds the structural tailwinds ABB sees through its exposure to areas such as robotics, the Internet of Things and the Power Shift. With positive signs from management’s Next Level Strategy (targeting top-line momentum, cost and cash efficiency) beginning to come through, we see risk-reward as compelling.

Structural growth drivers: Beyond higher capex in ABB’s end markets, we expect its products to gain share. Against a backdrop of expansion in wind offshore, increasing penetration of electric vehicles and upcoming nuclear shutdowns in Germany, we believe ABB is exposed to strong structural growth drivers, specifically in T&D capex.

Portfolio simplification a potential catalyst: We highlight recent news flow (link) around the potential sale of the company’s Power Grids division as a catalyst for portfolio simplification. As discussed in ‘Taking ABB to the Next Level’, we see clear scope for simplification at the group, with both Power Grids and Robotics representing undervalued ‘hidden gems’. At the current share price we estimate the valuation implied for these two assets is <1x EV/EBIT 2019/20E, offering ample room for management to crystallize value. We expect news regarding simplification at the Strategic Update to be provided along with 4Q results on February 6, 2019.

What’s it worth? Our 12m PT of SFr30.5 is based on a 1-year forward EV/IC to ROIC/WACC valuation framework. This price target is also consistent with our SOTP-derived fair value.

Exhibit 4: ABB showed signs of backlog growth at 3Q, which we |

Exhibit 5: Our ABB SOTP implies >40% upside |

expect will drive above-sector organic growth for 2019 |

ABB SOTP valuation based on our 2019 estimates |

Organic sales growth |

|

Source: Goldman Sachs Global Investment Research, Datastream, Company data |

Source: Goldman Sachs Global Investment Research, Datastream |

28 November 2018 |

8 |

vk.com/id446425943

Goldman Sachs

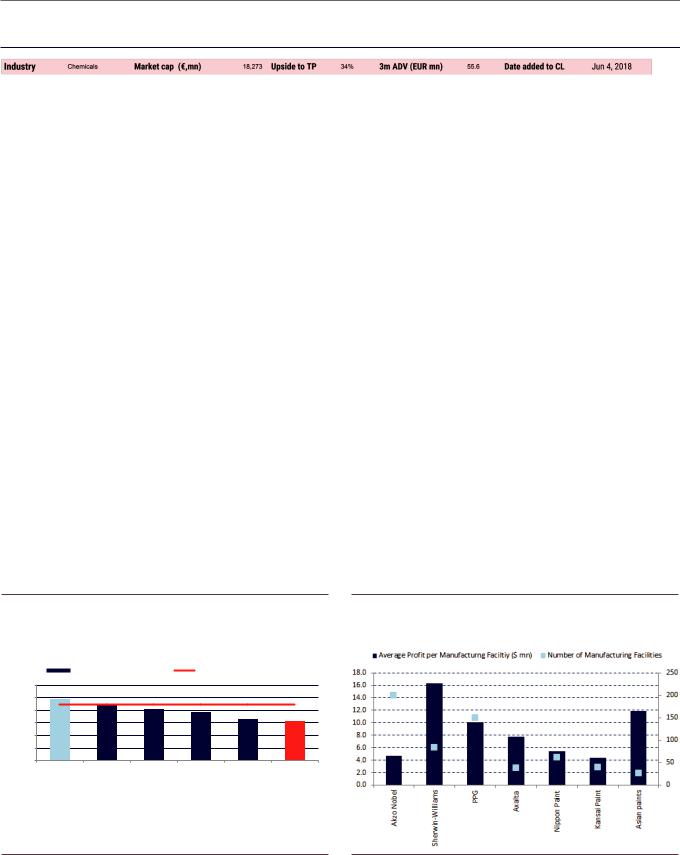

Akzo Nobel (AKZO.AS): Self-help with inflecting end markets

GS Analyst

Georgina Iwamoto

+44(20)7552-5984

georgina.iwamoto@gs.com

Our 2019/20 EBIT estimates are

19.8%/16.6% ahead of consensus, given our expectations for self-help, and the potential for improved pricing.

Investment thesis: We believe that Akzo’s current valuation fails to reflect its portfolio simplification, self-help measures and earnings outlook. As a leading global producer of paints and coatings, Akzo has now almost secured its transformation to a pure-play coatings company following the sale of Specialty Chemicals. This simplification opens the door to improved returns and from here we expect self-help driven earnings upgrades and multiple rerating to drive outperformance.

Self-help targets profitability: We see significant scope for Akzo to deliver operating profit ahead of undemanding consensus expectations, albeit we are somewhat short of the ambitious restructuring programme (management targets 15% ROS and 25% ROI by 2020). The company has detailed its route for reaching these targets via a €200 mn pa Supply Chain Transformation by 2020 and a “Fit-for-purpose” organization initiative.

Margin expansion and shareholder returns: The past four years have been tough for AkzoNobel and coatings peers, characterised by weak demand growth and - more recently - margin contraction on the back of rising input costs. Based on improving pricing trends however (we expect Akzo to exit 2018 at a 6% pricing run rate in Deco) and our view that raw material headwinds will moderate in 2019 vs. 2018, we believe that the coatings industry is about to enter a period of margin expansion. The company’s recently announced plan to return €5.5bn to shareholders from the Specialty Chemicals sale proceeds is also incrementally positive and in our view demonstrates Akzo’s cultural shift to a more shareholder friendly institution.

What’s it worth? Our €97 12-month price target is based on an 85%/15% weighting of our fundamental and M&A-based valuations (20x EV/DACF and 14.4x EV/EBITDA

respectively).

Exhibit 6: We see scope for Akzo to improve profitability vs. peers via headcount reduction…

EBIT/employee for global coatings (continuing operations)

|

|

|

EBIT/Employee (USD ’000) |

Akzo Nobel 2020 EBIT GSe |

|

||

’000) |

60 |

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

(USD |

40 |

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBIT/Employee |

10 |

|

|

|

|

|

|

0 |

|

PPG Industries Inc. |

Axalta Coating Systems Ltd. |

Sherwin-Williams Co. |

Nippon Paint Holdings |

Akzo Nobel |

|

Akzo Nobel 2020 |

Target |

||||||

Exhibit 7: ...and manufacturing facility rationalisation

Avg NI ($) per manufacturing facility/ number of facilities (2017)

Source: Company data, Goldman Sachs Global Investment Research |

Source: Company data |

28 November 2018 |

9 |

vk.com/id446425943

Goldman Sachs

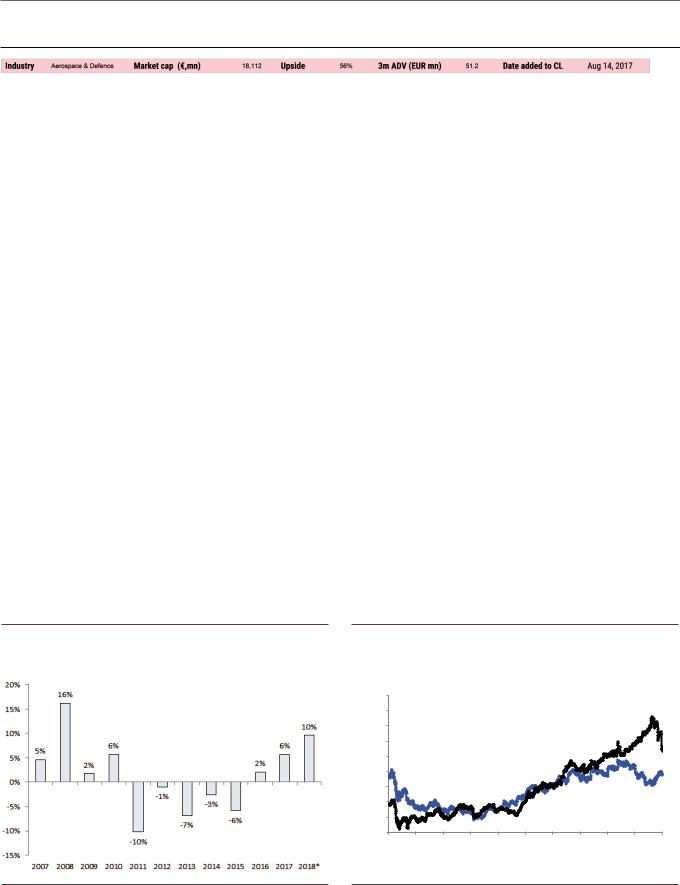

BAE Systems (BAES.L): US opportunity overlooked

GS Analyst

Chris Hallam

+44(20)7552-2958

chris.hallam@gs.com

We expect revenues to grow to $13 bn (10% CAGR) by 2020, driven by Armour, Air Systems and Ship Repair

Investment thesis: BAE Systems is a global defence company operating across air, land, sea and cyber domains. Driven by the US business, we expect group revenues to grow by 7% organically on average to 2020E; we note that the recently-announced US Marine Amphibious Vehicle contract and Australian SEA 5000 contract both support this view. Coupled with margin expansion, we expect this revenue increase to drive £600 mn in EBITA growth over the period. At the same time, working capital pressures should ease and pension contributions stabilise, allowing FCF to expand to over £1.7 bn.

Made in the USA… We believe that in 2017, the USA surpassed the UK as BAE’s single largest market. Under the umbrella of ‘BAE Inc’, the company booked $10 bn in revenues across the Land, Sea, Air and Cyber domains. With over $5 bn of sales direct to the US DoD and more indirectly as a tier 1 supplier, BAE looks set to benefit from the lowto mid-single-digit budget growth out to 2021 that our US Economists expect. As outlined in our most recent work (see here) recent hard datapoints from the US Defence industry point towards a continued improvement in the US end-market for BAE.

…but with a valuation disconnect: The financial performance of BAE is not too dissimilar to US peers such as Northrop Grumman and Lockheed Martin, but the group trades at a significant discount to both. If we were to use US peer multiples to value BAE Inc, it would leave the rest of BAE Systems trading at just 7x 2018E EV/EBIT.

Expect robust 2H: While P&S US sales were flat in 1H in USD, growth is set to be heavily 2H weighted and is supported by a clear orderbook for key programmes like the AMPV, ACV, and M109A. We expect organic sales growth of 8%/10% in 2019/20E.

What’s it worth? Our 12-month price target of 791p is based on 15.3x EV/DACF applied to our 2019 estimates. The 15.3x multiple represents a 0.5x premium to the long-run median of 14.8x, reflecting our expectations for higher cash flow growth.

Exhibit 8: US Department of Defense outlays are growing at the fastest rate in a decade

DoD outlays (*2018 is YTD)

Exhibit 9: Valuation appears attractive vs. US peers

I/B/E/S 12 month forward EV/EBIT |

24.0x |

22.0x |

20.0x |

18.0x |

16.0x |

14.0x |

12.0x |

10.0x |

8.0x |

6.0x |

Jul |

Jul |

Jul |

|

Jul |

Jul |

Jul |

Jul |

Jul |

Jul |

Jul |

Jul |

||

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|||

|

|

|

|

|

BAE Systems |

|

|

Peer Average |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||

Source: Department of Defense, Goldman Sachs Global Investment Research |

Source: Company data, Goldman Sachs Global Investment Research |

28 November 2018 |

10 |