КАЗАНЬ Sbornik materalov Kazan 2014

.pdfthe application of these acts. Technical standards being delegated records in fact are a statutory instrument of the European Commission, which the EU is authorized to give norms universally tying about technical character based on. The specificity of BTS therefore would provide: a detailed, technical and practical nature, allowing for standardization and consistency of supervisory practices in the Member States, and their role is to strict EU financial market integration. This integration is expressed both in eliminating the distinction between national insurance markets in the Member States, as well as seizing the delimitation between the various sectors of the financial market in the Member States due to the comprehensive approach to financial services. The removal of legal and procedural and substantive autonomy related to the conduct of the business of insurers in thesystem cross border and cross-EU financial market is helpful EIOPA activities that have the greatest influence on the content of the BTS [6, pp. 174].

On insurance markets issuing guidelines and directed orders to competent bodies or entities of the financial market is a next instrument of EIOPA. It seems that guidelines and recommendations don't have aEurotying power, but the pean legislator is forcing them addressees into following. In regulations in addition a test procedure was established meaning, that if within two months of issuing the guideline or an order everyone is confirming competent bodies orliesentities,with whether comp

them or is planning to do. If bodies or entities aren't goingeto comply with the guid line or the recommendation is obliged to notify the officebof it stating grounds. Pu lishing by the Office information is means disciplining bodies or entities (of if necessary also justifying) about-compliancethe non with the given guideline or the re c- ommendation. Such a publication is reprimanding participants in the turnover to the malfunction of the domestic organ of the supervision,gnalingperforming the function in this respect. Such a centre isn't deprived of meaning due to the greater sensi-

tivity of insuranceetsmarkto all negative information |

[7, pp. 312]. |

|

Fastening to the issuance administrative resolutions which can is EIOPA new |

||

instrument torectedbe di both to domestic organs of the supervision, as well as ind |

i- |

|

vidual decision. EIOPA only have autonomous competencein giving decisions co |

|

|

bining the domestic supervision and insurers what he is buying, that the EU supervisory system incurredssibilityhas a pof direct disciplining of participants in the i n- surance market the EU, constituting copying the EU on itherung in this sense activ ties of domestic organs of supervision [6, pp. 177].

It is possible to divide these decisions in four groups:

1)decisions in the event that competent domestic supervision or insurers didn't apply EU acts (Art. 17 regulations 1094/2010),

2)decisions made in extraordinary situations (Art. 18 regulations

1094/2010),

3) |

decisions made at the settlement of disputespriatebetweena |

appro |

u- |

thorities in -cross border situations (Art.19 regulations 1094/2010), |

|

|

|

4) |

special decisions ec(Art.of.95sregulations 1094/2010) |

[6, pp. 179]. |

|

EIOPA decisions constitute the instrument of individual tying determining the legal situation of subjects of the insurance market (it concerns the obligation is eating

171

for the defined action or the omission) on the base of applicableregulations of regul tions and EU directives, with which the EU law is applied and so are supervisory decisions of meaning strictly [6,pp. 177 and 178]. This one decisions can directly be directed to insurers on the market, as well as to domestic organs of the supervision of the insurance market. Decisions directed at individual entities have priority towards

all decisions adopted earlier by appropriate authorities in the same matter. |

|

May be problems associated with the change of administrative decisions, |

the |

consequences of the decision final and final [4, pp. 313]. Doubts arise also subject to determine the extent to which there is a decision to replace national supervisors by the decisions of EIOPA. In addition, the EU legislature did not indicate the scope of potential liability associated with the repeal of the decision by the national supervisory authority and its replacement decision EIOPA [7, pp. 314].

Additionally the EU legislator didn't show legal effects of giving such decisions and directed opinions to domestic organs of the supervision in the event that in-

directly such decisions or opinions are producingsinsurersffects.Thesetowardi |

s- |

sues require and so clarifying and intervention for the EU legislator. |

|

Resume |

|

Supervision macroprudential, performed by ERRS, doesn't constitute the supervision sensu stricto, but is a crucial element of the supervisory politics in the EU.

EIOPA decisions are binding instruments for supervision at national supervisors and insurers operating in the market and are the means of supervision at the EU financial market in sensu stricto. Such construction supervision makes the national supervisory authorities lose in this respect certain supervisory powers, and EIOPA become the ultimate supervisory authority, but onlya insituation in which

the national supervisory position violates EU law or there is no decision of national supervisory authority to ensure the financial stability of the EU market. It is also important that decisions EIOPA are guaranteed precedence of bypassing previously issued national supervisory decisions on the insurance market in the same case.

References

[1]Piotrowska A. Supervision macroprudential above the insurance market randin extrao dinary situations [in:] Directions of the development of economic insurance, ed. B. Gnela, M. Szaraniec, Warsaw 2013.

[2]Zalcewicz A. The Change of the institutional structure and the concept of the supervision of uniform financial markets of the EU, [in:] System of the public finance. Revenue law in view of challenges of the 21st century,A. ed. Dobaczewska, E. Juchniewicz, T. Sowiński, CeDeWu publishing company, Warsaw 2010.

[3]The PE regulation and the No. council 1092 / 2010 from 24 November 2010 on the EU supervision macroprudential above the financial system and of establishing the European Council for System risk, OJ The EU L 2010. 331.1, farther ruling No. 1092 / 2010.

[4]Stanisławiszyn P. Prospects of changes of European regulations in the financial control in 2011 (in:) J. Szambelańczyk (ed.), control Challenges in view of experience of the global financial crisis, Warsaw 2011.

[5]Treaty on functioning of the European Union – consolidated version (OJ C 326 EU from 26.10.2012, p. 47)

[6]Fedorowicz M. Supervision of financial markets of the European Union, Warsaw 2013.

172

[7] Michór A. Administrative-legal forms of the interference of European organs of the supervision on the financial market of the European Union, Economics and the law, volume VII, Gen-

eration 2011. |

|

[8] Directive 2009/138/EC Parliamentof European |

and of the Council (EU) of25.11.2009 |

on the taking-up and pursuit of business of Insurance and Reinsurance (Solvency II) OJ l 335 z 17.12.2009.

[9] Regulation of the European Parliament and of the Council (EU) No. 1094/2010 of

24.11.2010 in the matter of establishing a EuroSupervisoryean Authority ( |

EIOPA) OJ L 331/48, |

15.12.2010. |

|

УДК 378.4 (476.6)

DIRECT – EXPERIENCES OF THE POLISH INSURANCE MARKET Ryszard Pukala,

State School of Technology and Economics in Jaroslaw, Poland e-mail: ryszard.pukala@interia.pl

Dynamic development of an insurance market on the turn of centuries is also a development of new direct distribution channels. Their role is gradually growing and the assortment of offered products not only includes vehicle insurance, but also a vast spectrum of personal (including life insurances) and property products aimed at natural persons and business entities. We need to assume that due to client expectations and a dynamic development of electronic distribution channels, direct insurances will become one of the most rapidly developing segmentsrof the insurance ma ket in the years to come, not only in Poland, but also in Europe.

DIRECT – ОПЫТ ПОЛЬСКОГО СТРАХОВОГО РЫНКА

Динамическое развитие страхового рынка на рубеже XXI и XX века – это также развитие новых каналов дистрибуции типа direct. Их роль постепенно увеличивается, и ассортимент предлагаемых продуктов включает не только автомобильное страхование, но также широкий спектр продуктов личного страхования (в том числе жизненного), а также имущественного, направленных частным и юридическим лицам. Надо полагать, что в связи с ожиданиями клиентов и динамическим развитием электронных каналов продажи в ближайшие годы direct будет одним из наиболее быстро развивающихся сегментов страхового рынка не только в Польше, но и во всей Европе.

The turn of the centuriesemaperioked ofth dynamic development of new communication technologies and direct sale systems. The use of electronic channels considerably facilitates trading and client service processes,- by generating new d velopment opportunities for the companies. This particularly relates to the insurance sector, which due to the financial crisis needs to undertakezactions aimed at optimi ing operating costs, including reduction of expenditure related to accessing a client. Therefore, lots of insurance companies operating on the market strive to increase their product sale and at the same time reduce operating costs by using alternative distribution channels to this end, namely direct ones. Their effectiveness, efficiency

173

and rapid passing of information to the client provide an argument for their application. Both sides benefit from this solution:

•an insurance company – demonstrates lower acquisition costs and lowers the risk of potential fraud;

•client – saves time and money – since a company has much lower acquisition costs the product is cheaper.

We need to note though, that the direct system is most efficient when it comes to the sale of relatively simple insurance products, such as civil liability insurance for vehicle owners, personal accident insurance, real estate insurance and assistance. It is obvious that more complicated products require the meeting of an agent or a broker to present the offer in greater detail. These include, among others, property, health, professional liability and life insuranceus fundslinked. to vario

Undoubtedly, all these elements are characteristic for the Polish insurance market where the first direct policy was sold in January 2003. Thus, it is a relatively fresh market. In the first years insurances per call andlyInternetby were offered on

one company and clients kept their distance from products offered in such a way. The years 2006 – 2007 marked a breakthrough: the number of insurance companies offering direct insurances grew to over a dozen. Clients’ attitudes also changed, as they exhibited more trust towards this form of sale. It resulted in a dynamic growth of ac-

quired premiums– see Chart 1 – as well as a gradual broadening of the product offer.

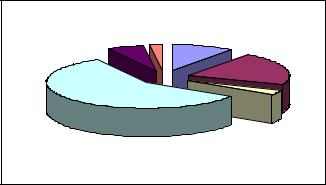

Chart 1. Premium written in the direct system in Poland– in the years 2006 2013 (PLN million)

1400 |

|

|

|

|

|

|

|

1200 |

|

|

|

|

|

|

|

1000 |

|

|

|

|

|

|

|

800 |

|

|

|

|

|

|

|

600 |

|

|

|

|

1088 |

1188 |

1189 |

|

|

|

|

|

|||

400 |

|

560 |

677 |

758 |

|

|

|

200 |

350 |

|

|

|

|||

170 |

|

|

|

||||

0 |

|

|

|

|

|

|

|

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

Source: data from the Polish InsuranceationforAssocithe years 2008 |

– 2013 |

|

(Where 1 PLN about 0, 25 EUR). |

|

|

As indicated by the data above for the last 8 years of operation, the direct mar- |

||

ket has observed-foldasevengrowth in Poland, whic |

h only confirms an ever greater |

|

client interest in this type of service, although they have snotbecome a significant di tribution channel so far, demonstrating a market share of 4 % in the propertyinsu

174

ances group, and are only entering the life insurances market. We also need to underline that a few years ago the range of products offered by property insurers was virtually limited to civil liability insurance for vehicle owners. Currently, the offer is

broader, although vehicle insurances dominate on |

the market |

with the share of |

||

78, 4 % of the direct market– |

Chart 2. |

|

|

|

Chart 2. Direct market structure in Poland (%) as of end 2013 |

||||

|

assistance |

another |

accident |

|

|

6,0% |

2,2% |

10,1% |

|

|

|

|

|

casco |

|

|

|

|

20,8% |

|

|

|

|

property |

MTPL |

|

|

|

3,3% |

|

|

|

|

|

57,6% |

|

|

|

|

Source: data from the Polish Insurance Association for the year 2013. |

||||

In the total vehicle |

insurances |

market, the |

direct system |

constitutes about |

5, 5 % of the entire sale. On the one hand, we can say that it is not much, but on the other hand, we need to remember that this is the freshest and definitely the most rapidly developing property insurance distribution. channel in Polan In other European countries the share of direct in the sale of vehicle insurances oscillates between several and over aperdozencent . Great Britain is an exception– insurers provide protection to over 40 % of drivers there. At the same time, it is the most mature direct market in Europe– the first company offering insurance per call appeared in the 1980s.

We must emphasize that along with vehicle, the share of accident insurances and assistance observes a growth in the insurance market. However, these are mostly products related to vehicle insurances that are a certain carrier of the sales.

Undoubtedly, extension of the insurance offer provides new opportunities for specifying a more client-friendly insurance contract. Due to changesin consumer b haviour, omnipresence of Internet and mobile apps in every field of life, clients seek uncomplicated and easy-to-buy products. Direct insurers stress that their products can be cheaper for selected client groups, since they can prepare an offer based on a very broad spectrum of variables that directly influence the risk evaluation, and consequently, the premium level. This is a doubtless advantage for a recipient. However, in the case of obligatory vehicle insurances, it is quite eansy,uras the civil liability i ance for vehicle owners covers the same aspects, no matter which insurer provides the service. The price is the main criterion for a downstream user. When it comes to voluntary insurances, it is not that obvious. Apart from theprice, we need to pay sp

175

cial attention to insurance conditions and claims adjustment system, since these offers can be less beneficial than the ones of traditional insurers, particularly for clients who value direct contact with insurer’s representatives on all stages, including the process of claims reporting and adjustment.

Insurances offered in the direct distribution channel not only increase the sale opportunities for an insurer, but also positively influencerthe development of insu ances marketed traditionally. We can point at new solutions that have appeared in Poland since the introduction of the direct offer on the market. These include, among others:

• possibility of concluding-cascoan autocontract without a visual inspe c- tion and taking photos of a vehicle before signing the contract;

•possibility of purchasingthe so called protection of bonuses, e.g. guarantee to keep them despite the; accident

•transferring-claimsno bonuses between; spouses

•bonuses for recommending the company to another; person

•extension of assistance services;

• |

separate insurance of car glass (apart from-casco)auto |

; |

• |

accelerating the adjustment of simple claims by making a payment only |

|

based on a visual inspection of an expert (or even a phone conversation). |

||

Individual clients have remainedominatingthetargetd group in sthe- |

direct di |

|

tribution channel, however the interest in corporate clients is observable as well. The

offer is aimed mainly at the micro,- |

small and more and moreoften |

medium-sized |

||

enterprises, covering an ever broadfofferedrangeproducts and adapting them to |

|

|

||

individual needs of an enterprise. |

|

|

|

|

Not long ago the direct offer constituted a serious contender for traditional in- |

||||

surance agents. Even more serious, since backed-wideupbyadvemassive, nation |

r- |

|||

tising campaigns,rowinga |

digitalization of thechangingsociety and |

client behav- |

||

iour aimed at a broader use of electronic contact channels. Currently the situation is undergoing gradual changes: insurance companies operating on the market mostly use a hybrid sale system combining electronic channels and insurance agents’ work. Both sides benefit from this solution. An insurer can offer its products to a considerably larger number of clients, while agents have been granted access to modern and attractively priced products. Both sides are using IT solutions that make lots of sale and client service processes more automatic to an ever greater extent. It has itsm-i pact on the policy price, facilitates services provided to a policy holder and makes communication between an insurer and a client more comfortable for an agent.

The Polish direct insurances market is gradually expanding. It reflects the tendency observed on the European market. According to Mount Onyx company, authors of the Online Insurance Trends 2012 report, the online sale of insurances and the sale using direct channels is now and will continue to be the most rapidly growing business model in Europe. Therefore, it is certainly a chance for a further, dynamic development of products offered to clients,not includingby insurersthe protection of

transport risks, but others aimed at natural persons and enterprises operating on the market. However, we need to note that while the online sale remains a leading chan-

176

nel of vehicle insurances sale, the global market research and consumer opinion surveys conducted by Ernst & Young (“Global Consumer Insurance Survey 2012”) or Deloittte (“2012 Global Insurance Outlook”) confirm thatrat purchasing life insu ances clients still exhibit the need for interaction with an agent and their expert advice, which indicates the growth of call centre sector and the use of traditional distribution channels based on a direct contact with a client, offered by insurance agents and brokers.

Looking from this angle at the development of direct insurances, we need to emphasize that they will certainly constitute a very important distribution channel along with the development of electronic communication tools. However, they will not replace traditional ways of selling products offered by insurers and insurance agents. They will only become a highly useful and modern supplement aimed at the broadest and-multi layer client services in the context of changing expectations and market conditions.

References

1.Global Consumer Insurance Survey 2012, Ernst & Young, http://www.ey.com/Publication/vwLUAssets/Global_Consumer_Insurance_Survey_2012__Time_for_insurers_to_rethink_their_relationships/$FILE/Global%20Consumer%20Insurance%20 Survey%202012%20-%20Trevor%20Rorbye-.pdf,03-30)(2014.

2.Information about direct in Poland, Polish Insurance Association, http://www.piu.org.pl/aktualnosci/project/1791/pagination/1 (2014-04-05).

3.Information about Polish insurance market in years 2006 – 2013, Polish Financial Supervision Authority, http://www.knf.gov.pl/opracowania/rynek_ubezpieczen/Dane_o_rynku/Dane_roczne/dzne_roczne.h tml(2014-04-06).

4.Online Insurance Trends 2012 report., Mount Onyx Company, http://www.mountonyx.com/fileadmin/user_upload/Ablagebox/Dokumente/MOG_OITFolder_Download_20121011.pdf, (2014-03-28).

5.Pukala R. Direct – панацея на кризис? Insurance TOP, nr 3 (27),Международная агенция “BeeZone”. Киев, 2009С. тр. 66 – 68.

6.Pukala R. The Polish insurance market in the–2011,yearsActa2004Oeconomicas- Ca

soviensia, University of Economics in Bratislava, 2012. Str. 56 – 81.

7. 2012 Global Insurance Outlook, Deloittte, https://www.deloitte.com/assets/Dcom-

Germany/Local%20Assets/Documents/09_Finanzdienstleister/2012/FSI_Global_Insurance_Outlook_2 012.pdf, (2014-04-02).

УДК 368.01

СОВРЕМЕННОЕ СОСТОЯНИЕ РЫНКАЫХУСЛУГТРАХОВ Л.В. Агаркова, И.М. Подколзина

ФГБОУ ВПО «Ставропольский государственный аграрный университет» alv23@mail,.ru privetia2003@mail.ru

В статье рассмотрено современное состояние рынка страховых услуг в России.

MODERN CONDITION OF THE MARKET OF INSURANCE SERVICES

L.V. Agarkova, I.M. Podkolzina

Stavropol State Agrarian University

177

In the article the modern condition of the market of insurance services in Russia is considered.

Страховой рынок – это неотъемлемое условие существования экономической системы развитой страны. Страхование позволяет обеспечить процесс воспроизводства посредством возмещения потерь общества в материальном выражении. Но, несмотря на это, страхование в РФ все еще не является мощным инструментом защиты личных материальных интересов граждан.

Современное состояние рынка российского рынка страховых услуг напрямую связано с экономической ситуацией как внутри страны, так и в мире, состоянием нормативно-правой базы, обеспечивающей функционирование этого сегмента экономики, обилием и разнообразием физических и юридических лиц, которые и формируют спрос на страховые услуги.

В 2012 г. был завершен процесс по приведению уставных капиталов в соответствие с Законом «Об организации страхового дела в РФ». Были установлены пороги размеров уставного капитала: для медицинских страховщиков – 60 млн руб.;ляд страховщиков жизни – 240 млн руб.; для перестраховщиков – 480 млн руб.; для компаний, не занимающихся страхованиемнижиз и перестрахованием – 120 млн руб. В итоге на 31.12.2012 г. на рынке осталось 458 компаний. По состоянию же на 2013 г. на рынке страховых услуг действовали 422 компании, что на 8 % меньше, чем в 2012 г.

|

|

|

|

|

Таблица 1 |

|

|

Ключевые показатели страхового рынка, 2011– 2013 г. |

|||||

Показатель |

2011 |

2012 |

2013 |

2013/2011, % |

|

|

Страховые премии |

665,02 |

809,06 |

904,86 |

+36 |

|

|

(млрд руб.) |

|

|

||||

|

|

|

|

|

|

|

Страховые |

выплаты |

303,76 |

369,44 |

420,77 |

+38 |

|

(млрд руб.) |

|

|

||||

|

|

|

|

|

|

|

Коэффициент |

выплат, |

45,68 |

45,66 |

46,5 |

+1,8 |

|

% |

|

|

||||

|

|

|

|

|

|

|

Из таблицы видно, что в целом объем страхового рынка увеличивается поступательно. Размер страховых премий в 2013 г. остановился на уровне 904,86 млрд руб., а страховых выплат – 420,77 млрд руб. По сравнению с 2011 г. прирост страховых премий составил 36 %, однако размер страховых выплат также увеличился на 38 %. Объем страховых выплатг. былв 2013 равен 0,46 объема страховых премий.

Динамика развития рынка страховых услуг за последние годы может быть охарактеризована как стабильно высокая с постепенным увеличением объема страховых премий. На долю топ-100 российских страховых компаний приходится более 90 % от общего размера премий страховщиков, а в 2013 г. этот показатель достиг отметки в 94 %. Причем первые 20 компаний из топ - листа демонстрируют свою устойчивость, а их состав практически не меняется.

178

Около 57 % всех премий за 2013 г. пришлось на долю десяти крупнейших российских страховщиков. В общей сложности размер страховых премий этих компаний составил 513,9 млрд руб.

Таблица 2

Топ-10 российских страховых компаний в 2013 г.

Наименование |

Премии (тыс. руб.) |

Выплаты (тыс. руб.) |

РОСГОССТРАХ (ООО) |

99 793 408 |

47 123 389 |

СОГАЗ |

84 773 198 |

38 792 760 |

ИНГОССТРАХ |

66 619 233 |

45 130 234 |

РЕСО-ГАРАНТИЯ |

57 441 194 |

33 623 939 |

СОГЛАСИЕ |

41 774 713 |

25 792 271 |

АЛЬФАСТРАХОВАНИЕ |

40 704 204 |

19 471 037 |

ВСК |

37 814 015 |

18 121 599 |

АЛЬЯНС |

32 917 561 |

16 472 576 |

ВТБ СТРАХОВАНИЕ |

30 755 929 |

11 829 005 |

РЕНЕССАНС ЖИЗНЬ |

21 323 556 |

252 929 |

Данные таблицы показывают, что лидером по сбору премий стал «Росгосстрах» (99,7 млрд руб.), на втором месте — СОГАЗ с 84,7 млрд руб., на третьем — «Ингосстрах», получивший 66,6 млрд руб. На долю первых трех компаний в 2013 г. пришлось 28 % общего объема страховых премий. Лидером по количеству выплат также является «Росгосстрах» (47,1 млрд руб.), на втором же месте находится «Ингосстрах» (45,1 млрд руб.), а на третьем – СОГАЗ (38,8 млрд руб.).

По итогам 2013 г. доля добровольных видов страхования составила 81,7 % в общей структуре страховых взносов и достигла 739,1 млрд руб. Значительное место в системе страхования занимает страхование жизни. Объем страховых премий по этому виду в 2013 г. составил 84,9 млрд руб. В области страхования жизни наблюдается увеличение премий в 1,5 раза по сравнению с 2012 г. В целом темпы роста по данному виду страхования превышают средние значения, что может быть связано с увеличением популярности классического страхования жизни. На топ-10 компаний прихлодится 87 % премий по данному виду страхования.

Страхование имущества занимает первое место по объему страховых премий в 2013 г. с показателем, равным 393,8 млрд руб. По сравнению с 2012 г. объем этого вида страхования увеличился на 6 %. Средства населения в общем объеме страхования имущества составляют 50,1 % (197,2 млрд руб.), а средства юридических лиц соответственно 49,9 % (196,6млрд руб.). Договоры о страховании в основном заключаются по поводу имущества, приобретенного посредством использования кредитов и лизинга либо участвующего в

крупномасштабных проектах. |

|

|

|

|

|

||

Объем премий |

в |

области |

личного |

страхования |

в |

2013 г. |

составил |

208,8 млрд руб., что |

на |

14,5 % |

больше, |

чем в 2012 |

г. |

(объем |

составлял |

182,4 млрд руб.). Объем премий по большей части формировался за счет средств юридических лиц (134,2 млрд руб.), в то время как за счет средств населения было получено 74,6 млрд руб. Общий объем выплат по этому виду страхования составил 103,1 млрд руб., это на 12 % больше, чем в 2012 г.

179

Положительное увеличение объема в этом секторе может быть связано с увеличением кредитования как физических, так и юридических лиц.

Страхование ответственности в 2013 г. принесло в общий объем страховых премий 29,8 млрд руб. По этому виду страхование наблюдается незначительное снижение на 1 % по сравнению с 2012 г. на 75 % объем премий по этому виду страхования формируется за счет средств юридических лиц (22,4 млрд руб.). Выплаты в данном сегменте составили 7,1 млрд руб., в 2012 г. Этот показатель находился на уровне 5,3 млрд руб. Таким образом, объем выплат в 2013 г. увеличился на 34 %.

Объем премий по ОСАГО в 2013 г. составил 134,2 млрд руб., что на 11 % больше, чем в 2012 г., когда этот показатель был равен 121,2 млрд руб. Средства населения в объеме премий по этому показателю составили 112,2 млрд руб., то есть 83 %, в то время как средства юридических лиц пополнили объем премий на 22 млрд руб. (17 %). Концентрация на рынке ОСАГО характеризуется как довольно высокая: на топ-10 страховых компаний приходится около 80 % всех премий, а уже на топ-20 компаний – более 90 %. Наиболее прибыльными компаниями в этом секторе являются «Росгосстрах», «Ингосстрах» и-«ГарантияРЕСО».

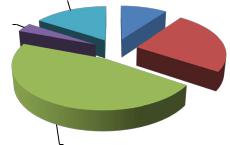

14.99.4

страхование жизни

страхование жизни

3.3

23.1

личное страхование

личное страхование

страхование имущества

страхование имущества

страхование

страхование

ответственности

ОСАГО

ОСАГО

43.7

Рисунок 1. Доля основных видов страхования в общем объеме страховых премий, 2013 г.

Из рисунка видно, что наибольший вклад в увеличение объема страховых премий в 2013 г. внесли премии, полученные от страхования имущества. На втором месте находится личное страхование, принесшее 23,1 % в общий объем страховых премий. Третье место занимает ОСАГО, на долю которого пришлось 14,9 %.

В целом можно сделать вывод о том, что рынок страховых услуг развивается достаточно стабильно, наблюдается тенденция к увеличению страховых премий, а также к увеличению привлекательности страхования в общем как среди обычного населения, так и среди юридических лиц.

Список литературы

1.Гребенщиков Э. С. После вхождения в ВТО: ориентиры российского страхового

рынка остаются прежними / Э. С. Гребенщиков // Финансы№.201112.С.-. 41 |

45. |

180