- •Business plan for the new venture Master Thesis

- •Valovaya str.,

- •Declaration of Authorship

- •Abstract

- •Contents

- •1. Introduction………………………………………………………………………………..6

- •2 Theoretical Framework…………………………………………………………………..11

- •4.1. World’s industry outlook…………………………………………………………….….37

- •4.2. Economic trends affecting consulting services in Russia…………………………….…58

- •4.3. Types of consulting firms in Russia…………………………………………………….39

- •6.2 Target customer segments………………………………………………………………...71

- •8. Financial Plan………………………………………………………………………………78

- •6. Conclusion and recommended future work…………………………………………….85

- •7. Appendix a……………………………………………………………………………….88

- •1. Introduction

- •Background

- •1.2 Purpose and objectives of the Master thesis Purpose

- •Objectives of the Master thesis:

- •1.3 Methods and approaches of mastering business plan

- •Data collection

- •1.4 Outline of the Master thesis

- •2. Theoretical framework

- •2.1 Entrepreneurship in business services

- •2.1.1 Entrepreneurial qualities

- •2.1.2 The new venture decision making

- •2.1.3 The new venture creation process

- •2.1.4 Stages of company growth

- •Identify and Define a Market Niche

- •2.2 Management structure in consulting business and types of consulting activities

- •2.3 Tools to create business plan of the new enterprise

- •3. Company idea

- •3.1 Motivation for establishing the new business entity

- •3.2 Positioning concept of the company

- •4. Market analyses

- •4.1. World’s industry outlook

- •4.2. Economic trends affecting consulting services in Russia

- •4.3. Types of consulting firms in Russia

- •4.4 Qualitative evaluation of consulting services

- •4.5 Market capacity and market growth

- •4.6. Main factors of competition

- •5. Business Plan

- •1. Executive Summary

- •1.1 Vision and Mission

- •Vision Statement

- •1.2 Core competences

- •1.3 Management Team

- •1.4 Legal form of company Ownership

- •1.5 Service Targeting

- •1.6 Financial Summary

- •1.6.1. Financial objective

- •Products Through of experience of Marktune consultants have been practicing marketing management, financial management, human resources management and information technologies management consulting.

- •4. Competitor Analysis

- •5. Swot Analysis

- •6. Marketing Plan

- •6.1 Marketing Objectives

- •6.2 Target customer segments

- •6.3 Size of the market and market share of Marktune

- •6.4 Marketing Strategies

- •6.4.1 Products

- •6.4.2 Price

- •6.4.3 Distribution

- •6.4.4 Promotion

- •Investment in Advertising and Promotion

- •7. Key Strategic Issues

- •8. Financial Plan

- •8.1 Start-up costs

- •8.2 Sales Forecast

- •8.3 Organization Structure Chart

- •8.4 Projected financial statements

- •8.5 Business Ratios

- •6. Conclusion and recommended future work

- •7. Appendix a

- •Magazine articles

- •40 Http://www.Raexpert.Ru/ratings/consulting/2009/

- •41 Http://www.Raexpert.Ru/ratings/consulting/2009/

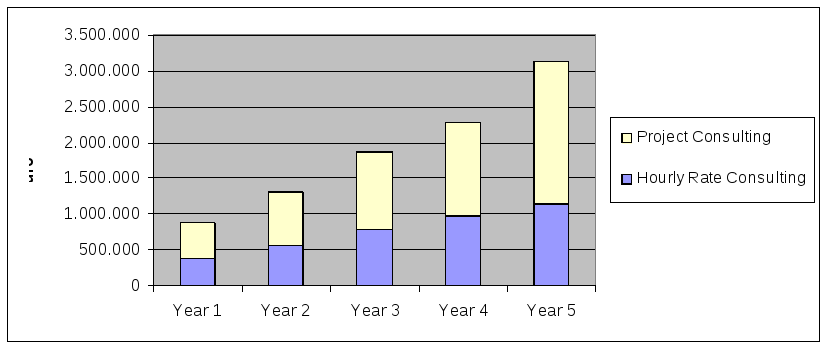

8.2 Sales Forecast

One of our targets is focus on the new channels to increase net sales beyond 870 thousand Euro by the second year of operations. Our marketing strategy is maintained relationships with the customer based the excellent service because we believe service is top spear of the sales itself. Based on the market research undertaken, strategies developed and existing customer relationships, the following sales forecasts were developed (in units and Euro) (see Table 12, Figure 15):

|

|

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

Sales in units |

|

|

|

|

|

|

Hourly Rate Consulting (hours) |

7.400 |

11.000 |

13.000 |

16.000 |

19.000 |

|

Project Consulting (projects) |

10 |

15 |

18 |

22 |

22 |

|

Sales in Euro |

|

|

|

|

|

|

Hourly Rate Consulting |

370.000 |

550.000 |

780.000 |

960.000 |

1.140.000 |

|

Project Consulting |

500.000 |

750.000 |

1.080.000 |

1.320.000 |

1.980.000 |

|

Total Sales (Euro) |

870.000 |

1.300.000 |

1.860.000 |

2.280.000 |

3.120.000 |

Table 12. Sales Forecast

Figure 15. Sales forecast

8.3 Organization Structure Chart

The Organizational structure charts (see Table 13) appearing below show how the organization's staffing needs change over the five years.

|

Year 1 |

Year 5 |

|

Board |

Board |

|

CEO |

CEO |

|

Admin Staff 1 |

Admin Staff 1 |

|

Finance Staff 1 |

Finance Staff 1 |

|

Marketing Staff 1 |

Marketing Staff 1 |

|

Sales Staff 1 |

Sales Staff 3 |

|

Consultant Staff 10 |

Consultant Staff 26 |

Table 13. Organizational structure chart

8.4 Projected financial statements

The financial forecast (projection) (see Figures 16, 17, 18) of Marktune shows that it will make profit by the beginning of the third year and will accumulate sufficient retained earnings.

|

REVENUE |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

Unit Sales |

|

|

|

|

|

|

Hourly Rate Consulting |

7.400 |

11.000 |

13.000 |

16.000 |

19.000 |

|

Project Consulting |

10 |

15 |

18 |

22 |

22 |

|

Total Unit Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit Prices |

|

|

|

|

|

|

Hourly Rate Consulting |

50 |

50 |

60 |

60 |

60 |

|

Project Consulting |

50.000 |

50.000 |

60.000 |

60.000 |

90.000 |

|

|

|

|

|

|

|

|

Sales |

|

|

|

|

|

|

Hourly Rate Consulting |

370.000 |

550.000 |

780.000 |

960.000 |

1.140.000 |

|

Project Consulting |

500.000 |

750.000 |

1.080.000 |

1.320.000 |

1.980.000 |

|

Total Sales |

870.000 |

1.300.000 |

1.860.000 |

2.280.000 |

3.120.000 |

|

|

|

|

|

|

|

|

Sales returns and allowances |

87.000 |

130.000 |

186.000 |

228.000 |

312.000 |

|

Net Sales |

783.000 |

1.170.000 |

1.674.000 |

2.052.000 |

2.808.000 |

|

OPERATING EXPENSES |

|

|

|

|

|

|

Payroll |

504.000 |

720.000 |

966.000 |

1.176.000 |

1.344.000 |

|

Marketing/Promotion |

120.000 |

160.000 |

200.000 |

250.000 |

300.000 |

|

Sales |

30.000 |

35.000 |

40.000 |

50.000 |

60.000 |

|

Depreciation |

0 |

0 |

0 |

0 |

0 |

|

Rent |

100.000 |

130.000 |

150.000 |

180.000 |

200.000 |

|

Utilities |

30.000 |

32.500 |

35.000 |

40.000 |

50.000 |

|

Bank interest |

7.500 |

7.500 |

|

|

|

|

Furniture & equipment |

40.000 |

50.000 |

50.000 |

60.000 |

70.000 |

|

Other |

30.000 |

35.000 |

40.000 |

50.000 |

60.000 |

|

Total Operating Expenses |

861.500 |

1.170.000 |

1.481.000 |

1.806.000 |

2.084.000 |

|

|

|

|

|

|

|

|

Net Income Before Taxes |

-78.500 |

0 |

193.000 |

246.000 |

724.000 |

|

Taxes on income (20 %) |

|

0 |

38.600 |

49.200 |

144.800 |

|

|

|

|

|

|

|

|

NET INCOME (LOSS) |

-78.500 |

0 |

154.400 |

196.800 |

579.200 |

Figure 16. Projected Profit and Loss

Marktune will reach break-even within the second quarter of the third year and all five years will have a positive cash flow.

|

Period ending |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

Net income (loss) |

-78.500 |

0 |

154.400 |

196.800 |

579.200 |

|

Operating activities, cash flows provided by or used in: |

|

|

|

|

|

|

Depreciation and amortization |

0 |

0 |

0 |

0 |

0 |

|

Adjustments to net income |

0 |

0 |

0 |

0 |

0 |

|

Decrease (increase) in accounts receivable |

-30.000 |

-5.000 |

-5.000 |

-5.000 |

-5.000 |

|

Increase (decrease) in liabilities (A/P, taxes payable) |

10.000 |

10.000 |

10.000 |

10.000 |

10.000 |

|

Decrease (increase) in inventories |

0 |

0 |

0 |

0 |

0 |

|

Increase (decrease) in other operating activities |

0 |

0 |

0 |

0 |

0 |

|

Net cash flow from operating activities |

-98.500 |

5.000 |

159.400 |

201.800 |

584.200 |

|

Investing activities, cash flows provided by or used in: |

|

|

|

|

|

|

Capital expenditures |

0 |

0 |

0 |

0 |

0 |

|

Investments from the owners |

100.000 |

0 |

0 |

0 |

0 |

|

Other cash flows from investing activities |

0 |

0 |

0 |

0 |

0 |

|

Net cash flows from investing activities |

100.000 |

0 |

0 |

0 |

0 |

|

Financing activities, cash flows provided by or used in: |

|

|

|

|

|

|

Dividends paid |

0 |

0 |

0 |

0 |

0 |

|

Sale (repurchase) of stock |

0 |

0 |

0 |

0 |

0 |

|

Increase (decrease) in debt |

50.000 |

0 |

-50.000 |

0 |

0 |

|

Other cash flows from financing activities |

0 |

0 |

0 |

0 |

0 |

|

Net cash flows from financing activities |

50000 |

0 |

-50000 |

0 |

0 |

|

Net increase (decrease) in cash and cash equivalents |

51.500 |

5.000 |

109.400 |

201.800 |

584.200 |

|

Beginning cash |

0 |

51.500 |

56.500 |

165.900 |

367.700 |

|

Ending cash |

51.500 |

56.500 |

165.900 |

367.700 |

951.900 |

Figure 17. Projected Cash Flow

|

ASSETS |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

Current Assets |

|

|

|

|

|

|

Cash & cash equivalents |

51.500 |

56.500 |

165.900 |

367.700 |

951.900 |

|

Net accounts receivable |

30.000 |

35.000 |

40.000 |

45.000 |

50.000 |

|

Inventory |

0 |

0 |

0 |

0 |

0 |

|

Prepaid expenses |

0 |

0 |

0 |

0 |

0 |

|

Total Current Assets |

81.500 |

91.500 |

205.900 |

412.700 |

1.001.900 |

|

Fixed Assets |

|

|

|

|

|

|

Property, office and equipment |

40.000 |

50.000 |

50.000 |

60.000 |

70.000 |

|

Less : Accumulated Depreciation |

40.000 |

50.000 |

50.000 |

60.000 |

70.000 |

|

Other intangible fixed assets |

0 |

0 |

0 |

0 |

0 |

|

Total Net Fixed Assets |

0 |

0 |

0 |

0 |

0 |

|

TOTAL ASSETS |

81.500 |

91.500 |

205.900 |

412.700 |

1.001.900 |

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

Accounts payable |

10.000 |

20.000 |

30.000 |

40.000 |

50.000 |

|

Accruals & other payables |

0 |

0 |

0 |

0 |

0 |

|

Total Current Liabilities |

10.000 |

20.000 |

30.000 |

40.000 |

50.000 |

|

Long-term Liabilities |

|

|

|

|

|

|

Bank Loans |

50.000 |

50.000 |

0 |

0 |

0 |

|

Other long-term liabilities |

0 |

0 |

0 |

0 |

0 |

|

Total Long-term Liabilities |

50.000 |

50.000 |

0 |

0 |

0 |

|

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

Capital stock |

|

|

|

|

|

|

Existing shareholders (51%) |

51.000 |

51.000 |

51.000 |

51.000 |

51.000 |

|

New shareholders (49%) |

49.000 |

49.000 |

49.000 |

49.000 |

49.000 |

|

Retained earnings |

-78.500 |

-78.500 |

75.900 |

272.700 |

851.900 |

|

Total Shareholders' Equity |

21.500 |

21.500 |

175.900 |

372.700 |

951.900 |

|

TOTAL LIABILITIES & EQUITY |

81.500 |

91.500 |

205.900 |

412.700 |

1.001.900 |

Figure 18. Projected Balance Sheet

The company intends to borrow 50 000 Euro from a bank in the first year of operations and pays loan back in the third year.