- •International business school

- •Current asset management in the enterprise

- •Executive summary

- •Table of contents

- •Introduction

- •Chapter 1. Theoretical background of current assets organization and management

- •1.1. Essence, constitution, structure and functions of current assets

- •1.2. Operating cycle of the enterprise and its relationship to current assets

- •1.3. Strategies of financing current assets

- •Chapter 2. Analysis of current assets management of spetsstroy-svyaz Ltd

- •2.1. Characteristics of spetsstroysvyaz Ltd activity

- •2.2. The analysis of solvency and liquidity of spetsstroysvyaz Ltd balance

- •2.3. Analysis of company’s current assets for the previous periods

- •2.4. Identification and evaluation of external factors affecting the formation of the optimum amount of current assets

- •2.6. Analysis of Cash flows

- •2.7. Analysis of accounts receivable

- •Chapter 3. Recommendations for the management of current assets on of spetsstroy-svyaz Ltd

- •Conclusion

- •Appendix 1. The listof spetsstroy-svyaz’es debtors and related accounts receivable

- •Appendix 2. The Balance shit of spetsstroy-svyaz ltd

- •Appendix 3. Current Assets structure

- •Appendix 5. Vertical and Horizontal analysis of cash flows

- •Bibliography

2.7. Analysis of accounts receivable

In the national financial and economic literature, much attention is paid to analysis of the structure of current assets to the achievement of their equilibrium, to the identification of reserves for reduction accounts receivable, to rationalization of cash flows and inventory. However, in publications of scientific and educational nature there are insufficiently represented the theoretical and methodological approaches, based on systematic research into the causes and consequences of company's debtors for its products shipped and services rendered. In essence it comes to building management system of accounts receivable which would control the relationships with debtors and would regulate the size of debt within the limits that provide liquidity and financial security.

G. Chitaya7 offers a method of constructing a system of management of accounts receivable, including a statistical analysis of the effectiveness of the actual level of management and use of company's human resources capacity without the formation of a specialized organizational structure. The aim is to demonstrate the approach to improving working capital management on the basis of designing an effective system of enforcement, reduction and control of receivables.

Statistical analysis of the effectiveness of company's accounts receivable

Based on of data of company's receivables by major debtors there can be evaluated the effectiveness of management using the methods of statistical analysis of variations. These, above all, are such indicators as the weighted arithmetic mean, mode, median, concentration ratio and the uneven distribution of attribute (accounts receivable). In the latter case it comes to the legitimacy of using the Gini coefficient, Herfindahl, variations, as well as graphic illustrations of uneven distribution of debtors using the Lorenz curve.

Obtaining analytical statistical tables, which allows to determine the characteristics of the of the variation series of accounts receivable of the enterprise involves a series computational actions.

1. Determining the optimal number of groups for the collection of debtors.

At this stage, application of Sturges formula is appropriate:

r = 1 + 3,32 lg n = 1 + 1,44 ln n, (2.7.1)

where n - number of population units (enterprises-debtors).

Since n = 45 (the number of debtors, according to Appendix 1)

r = 1 + 1.44 ln n = 1 + 1.44 ln (44) ≈ 6.45, number of groups can be taken as 6, i.e. r = 6.

Establishment of interval variational series of debtors

Intervals are set regarding to concentration of accounts receivable (see column A, table 2.7.1)

Table 2.7.1. The calculation of basic statistical characteristics of variational series of accounts receivable of the enterprise by major debtors

|

Accounts receivable, thousand rur |

Number of debtors |

Interval mean, xi |

ximi |

Cumulative frequencies Fi |

Relative cumulative frequencies Pi, % |

Distribution density, %, |

Proportion of acc. rec. of groups of debtors in total |

|

|

||||||||||||

|

Yk = wi / |

|||||||||||||||||||||

|

xk – 1 |

xk |

mi |

in % to total, wi |

|

|

|

|

/ xk |

|

Cumulative, qi |

|

|

|||||||||

|

А |

B |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

|||||||||

|

0 |

10 |

14 |

31,1 |

5 |

70 |

14 |

31,1 |

3,11 |

0,0010 |

0,0010 |

0,000001 |

350,00 |

|||||||||

|

10 |

100 |

6 |

13,3 |

55 |

330 |

20 |

44,4 |

0,15 |

0,0046 |

0,0056 |

0,000022 |

18 150,00 |

|||||||||

|

100 |

500 |

12 |

26,7 |

300 |

3600 |

32 |

71,1 |

0,07 |

0,0507 |

0,0563 |

0,002571 |

1 080 000,00 |

|||||||||

|

500 |

1 000 |

4 |

8,9 |

750 |

3000 |

36 |

80,0 |

0,02 |

0,0423 |

0,0986 |

0,001785 |

2 250 000,00 |

|||||||||

|

1 000 |

10 000 |

8 |

17,8 |

5500 |

44000 |

44 |

97,8 |

0,0020 |

0,6197 |

0,7183 |

0,384051 |

242 000 000,00 |

|||||||||

|

10 000 |

30 000 |

1 |

2,2 |

20000 |

20000 |

45 |

100,0 |

0,0001 |

0,2817 |

1,0000 |

0,079349 |

400 000 000,00 |

|||||||||

|

|

Total |

45 |

100 |

|

71000 |

|

|

|

1 |

|

0,46778 |

645 348 511,00 |

|||||||||

The calculation of the average characteristics of interval variations of the series: a weighted average, mode and median

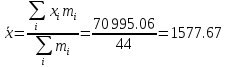

The weighted average will be:

(2.7.2)

(2.7.2)

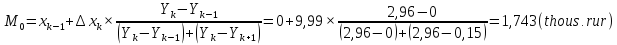

Mode (Mo) for a series with unequal intervals is determined using a density distribution of (Yk). This is feature value that occurs most often in units of the aggregate. For a discrete series mode will be the option with the greatest frequency

Distribution density is the highest in group 1:

Yk = Y1 = 2,96.

(2.6.3)

(2.6.3)

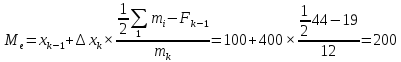

Median (Me) is a feature value falling in the middle of a ranked set (for ranged series with an odd number of individual values of the median would be the value, which is located in the center of the series, in this case 44 / 2 = 22), is calculated using the cumulative frequency index:

(2.7.4)

(2.7.4)

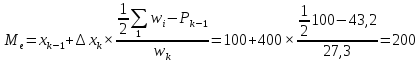

The same value is obtained if we use the cumulative relative frequency.

(2.7.5)

(2.7.5)

Calculation of variation

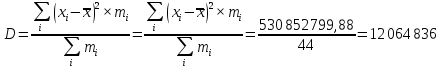

Dispersion (D):

(2.7.6)

(2.7.6)

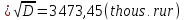

Standard deviation:

(2.7.7)

(2.7.7)

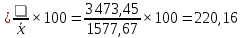

Coefficient of variation:

(2.7.8)

(2.7.8)

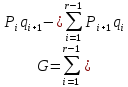

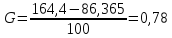

Calculation of the Gini concentration coefficient (G)

This ratio is used to measure the degree of uneven distribution of population units (accounts receivable of the company in 2009). This ratio it is appropriate to define by formula:

(2.7.9)

(2.7.9)

where Pi and Pi + 1 are consecutive values of the accumulated relative frequencies;

qi and qi + 1 are consecutive values of the elements of column 9 table 1;

qi (i =) are calculated according to the cumulative elements of column 8 table 1.

The results of support the calculations required to obtain the value of the Gini coefficient are given in Table 2.7.2.

(2.7.10)

(2.7.10)

Table 2.7.2. Intermediate estimates for the Gini coefficient of uneven distribution of accounts receivable of the company

|

Piqi+1 |

Pi+1qi+ |

||

|

29,5*0,0056= |

0,164411076 |

43,2*0,0009= |

0,039575 |

|

43,2*0,0563= |

2,429945947 |

7,05*0,0056= |

0,392057 |

|

70,5*0,0985= |

6,941808209 |

79,5*0,0563= |

4,476216 |

|

79,5*0,7183= |

57,13672669 |

97,7*0,0985= |

9,62896 |

|

97,7*1= |

97,72727273 |

100*0,7183= |

71,82903 |

|

Total: |

164,4001646 |

Total: |

86,36584 |

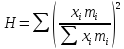

Establishing Herfindahl coefficient

This ratio indicates the total proportion of the dominant group among the debtors of the company (H) and is calculated as follows:

(2.7.11)

(2.7.11)

In accordance with data in table 2.7.1. H (%) = 46,78%

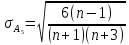

The calculation of the asymmetry coefficient of Pearson (Kas)

(2.7.12)

(2.7.12)

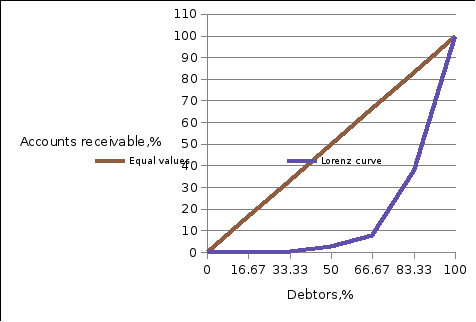

Using the Table. 2, there can be constructed Lorentz curve. On a horizontal axis there will be located cumulative relative frequency (Pi), and on a vertical there will be values of the parameters qi. Coordinates of the points the diagonal line correspond to equal values of the pair (Pi, qi). They are increasing multiple of 100 / 6 = 16.67.

Lorenz curve of uneven distribution of accounts receivable of analyzed company in 2009 is shown in Fig. 2.7.1.

Figure 2.7.1. Lorenz curve of accounts receivable distribution for 2009

Statistical indicators for assessing the distribution of enterprise's debtors by value of their debt may be used to assess the effectiveness of current assets management, and above all, their most significant part - accounts receivable. Table 2.7.3 represents the main statistical indicators of efficiency assessment for accounts receivable management.

Table 2.7.3. Main statistical indicators of efficiency assessment for accounts receivable management for 2009

|

Indicator |

Symbol |

Value |

|

Weighted average, thousand rur. |

x |

1 577,67 |

|

Mode, thousand rur. |

Мо |

1,743 |

|

Median thousand rur. |

Ме |

200 |

|

Variance |

D |

11 064 836 |

|

Standard deviation, mln rur. |

s |

3473,45 |

|

The coefficient variation,% |

n |

220,16 |

|

The Gini coefficient,% |

G |

0,78 |

|

Herfindahl coefficient,% |

H |

46,78 |

|

The asymmetry coefficient of Pearson |

Кas |

0,45 |

Weighted

arithmetic average of accounts receivable was 1,613.64 rubles. For 44

debtors the value is small that is a consequence of the greater

concentration of debt up to 1 million rur. This is evidenced by

values of mode and median (1.743 and 200 thousand rubles.,

respectively). According to the value of Pearson coefficient, the

asymmetry of the total debt debtors is dextral. From the general

theory of statistics it is known that if the ratio

,

where

,

where

and

n

is the number of debtors, then the asymmetry of distribution is

reasonable, despite the heterogeneity of total debts. In given case,

this ratio is 1.31 and indicates a moderate asymmetry of the

aggregate. This is confirmed by the fact that the median is located

between mode and a weighted average. It follows that the distribution

of the receivables can be explained within the framework normal

probability law, which, in turn, allows assessing the degree of

predictability of debtors that is their controllability. The high

value of standard deviation (3473.45 thousand rub.) indicates a large

scatter in accounts receivable and indicates the existence of risk in

dealing with collection of its expired parts.

and

n

is the number of debtors, then the asymmetry of distribution is

reasonable, despite the heterogeneity of total debts. In given case,

this ratio is 1.31 and indicates a moderate asymmetry of the

aggregate. This is confirmed by the fact that the median is located

between mode and a weighted average. It follows that the distribution

of the receivables can be explained within the framework normal

probability law, which, in turn, allows assessing the degree of

predictability of debtors that is their controllability. The high

value of standard deviation (3473.45 thousand rub.) indicates a large

scatter in accounts receivable and indicates the existence of risk in

dealing with collection of its expired parts.

The high level of variation coefficient characterizes the inhomogeneity of total receivables and a low degree of controllability. The Gini coefficient shows that the distribution of accounts receivable is uneven (78%) and most of the debt is concentrated in the dominant group, accounting for 46.78% (Herfindahl coefficient).

Identified patterns using statistical methods to a large extent demonstrate the risks and low accounts receivable management effectiveness and the feasibility of designing an improved system.