- •International business school

- •Current asset management in the enterprise

- •Executive summary

- •Table of contents

- •Introduction

- •Chapter 1. Theoretical background of current assets organization and management

- •1.1. Essence, constitution, structure and functions of current assets

- •1.2. Operating cycle of the enterprise and its relationship to current assets

- •1.3. Strategies of financing current assets

- •Chapter 2. Analysis of current assets management of spetsstroy-svyaz Ltd

- •2.1. Characteristics of spetsstroysvyaz Ltd activity

- •2.2. The analysis of solvency and liquidity of spetsstroysvyaz Ltd balance

- •2.3. Analysis of company’s current assets for the previous periods

- •2.4. Identification and evaluation of external factors affecting the formation of the optimum amount of current assets

- •2.6. Analysis of Cash flows

- •2.7. Analysis of accounts receivable

- •Chapter 3. Recommendations for the management of current assets on of spetsstroy-svyaz Ltd

- •Conclusion

- •Appendix 1. The listof spetsstroy-svyaz’es debtors and related accounts receivable

- •Appendix 2. The Balance shit of spetsstroy-svyaz ltd

- •Appendix 3. Current Assets structure

- •Appendix 5. Vertical and Horizontal analysis of cash flows

- •Bibliography

2.4. Identification and evaluation of external factors affecting the formation of the optimum amount of current assets

The structure of the most important factors of the external financial environment of indirect impact to be assessed includes5:

• The level and pace of inflation in the country;

• The dynamics of exchange rates;

• The dynamics of interest rates;

• The dynamics of economic development;

• State regulation of activity of individual economies;

• Government policy in the field of taxation.

The structure of the most important factors of the external financial environment of the direct impact to be assessed includes:

• conditions and transparency of financial, credit and commodity markets;

• credit policies of commercial banks;

• composition of credit products of banks;

•nature, level and stability of commercial relationships with suppliers, customers, financial institutions.

Table 2.4.1. The main factors of external financial environment

|

|

2005 |

2006 |

2007 |

2008 |

2009 |

|

Inflation in Russia according to official data |

10,90% |

9% |

11,90% |

13,30% |

8,80% |

|

Pace of inflation in Russia |

|

-17,43% |

32,22% |

11,76% |

-33,83% |

|

Refinancing rate at December 31th |

12% |

11% |

10% |

13% |

8,75% |

|

Cost of credit resources for the organization |

19% |

13,20% |

14,50% |

15% |

18% |

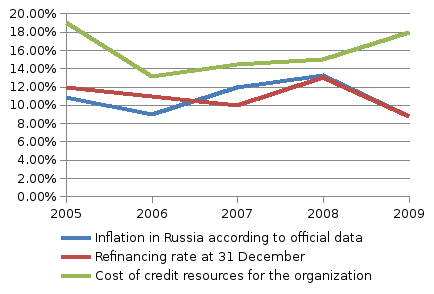

Figure 2.4.1. The main factors of external financial environment

During the reporting period, according to official statistics, inflation in Russia amounted to 67%. In 2008, inflation reached the highest growth over the period. The prices for products of considered enterprise changed only by 25% while wage costs have increased.

The U.S. dollar and the Euro from 2007 to 2009 dropped by 20%. For the production of equipment manufactured by the enterprise, 80-90% of the components used are imported. Prices are very dependent on the aforementioned exchange rates. In the structure of prices, components occupy 30-40%, therefore it greatly influenced the turnover of inventories.

By 2009, the CBR refinancing rate had reached 13%. It is interesting to note that the cost of credit in 2009 increased by 20%, despite the fact that the CBR refinancing rate for 2009 decreased by 34%.

Table 2.4.2. Major economic indicators of Russia (according to statistics6)

|

Parameter |

2007 |

2008 |

2009 |

|

Changes in real gross domestic product growth |

8,5 |

5,2 |

-7,8 |

|

Dynamics of of industrial production, increase (decrease) |

6,8 |

0,6 |

-9,3 |

|

Consumer price increase (decrease): |

9 |

14,1 |

11,7 |

|

Unemployment rate (% of economically active population) |

6,1 |

6,3 |

8,4 |

|

GDP growth rate |

1,5 |

-1,3 |

-5,2 |

In the state regulation of high-tech economic activities it may be noted that in Russia there are manufacturers that can produce competitive on quality equipment. Nevertheless, state enterprises are purchasing mostly imported analogues even though they significantly exceed in price. On the other hand, the government encourages entrepreneurs to engage in scientific and technical developments, provides grants, but to use them it is nearly impossible. They are not designed for long term and often constitute a percentage of own investment of enterprises for the previous period, or cancel part of the interest already paid for the use of credit money if the loan is taken to carry out development activities or research. In this case, in the contract of subsidies company must undertake increase of the number of jobs or pay taxes to the budget in excess of the amount of subsidies.

During the considered period taxes did not significantly change (since 2009 income tax has decreased by 4%).