Varian Microeconomics Workout

.pdf

Here you will solve the problems of consumers who wish to divide their wealth optimally between a risky asset and a safe asset. The expected rate of return on a portfolio is just a weighted average of the rate of return on the safe asset and the expected rate of return on the risky asset, where the weights are the fractions of the consumer's wealth held in each. The standard deviation of the portfolio return is just the standard deviation of the return on the risky asset times the fraction of the consumer's wealth held in the risky asset. Sometimes you will look at the problem of a consumer who has preferences over the expected return and the risk of her portfolio and who faces a budget constraint. Since a consumer can always put all of her wealth in the safe asset, one point on this budget constraint will be the combination of the safe rate of return and no risk (zero standard deviation). Now as the consumer puts x percent of her wealth into the risky asset, she gains on that amount the di®erence between the expected rate of return for the risky asset and the rate of return on the safe asset. But she also absorbs some risk. So the slope of the budget line will be the di®erence between the two returns divided by the standard deviation of the portfolio that has x percent of the consumer's wealth invested in the risky asset. You can then apply the usual indi®erence curve{budget line analysis to ¯nd the consumer's optimal choice of risk and expected return given her preferences. (Remember that if the standard deviation is plotted on the horizontal axis and if less risk is preferred to more, the better bundles will lie to the northwest.) You will also be asked to apply the result from the Capital Asset Pricing Model that the expected rate of return on any asset is equal to the sum of the risk-free rate of return plus the risk adjustment. Remember too that the expected rate of return on an asset is its expected change in price divided by its current price.

13.1 (3) Ms. Lynch has a choice of two assets: The ¯rst is a risk-free asset that o®ers a rate of return of rf , and the second is a risky asset (a china shop that caters to large mammals) that has an expected rate of return of rm and a standard deviation of ¾m.

(a) If x is the percent of wealth Ms. Lynch invests in the risky asset, what is the equation for the expected rate of return on the portfolio?

What is the equation for the standard deviation

of the portfolio? |

|

. |

(b) By solving the second equation above for x and substituting the result into the ¯rst equation, derive an expression for the rate of return on the

portfolio in terms of the portfolio's riskiness. |

|

. |

|

(c) Suppose that Ms. Lynch can borrow money at the interest rate rf and invest it in the risky asset. If rm = 20, rf = 10, and ¾m = 10, what will be Ms. Lynch's expected return if she borrows an amount equal to 100% of her initial wealth and invests it in the risky asset? (Hint: This

is just like investing 200% of her wealth in the risky asset.)

.

(d) Suppose that Ms. Lynch can borrow or lend at the risk-free rate. If rf is 10%, rm is 20%, and ¾m is 10%, what is the formula for the \budget

line" Ms. Lynch faces? |

|

|

|

|

|

|

Plot this budget line in the graph |

||||

below. |

|

|

|

|

|

|

|

|

|

|

|

Expected return |

|

|

|

|

|

|

|

||||

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

0 |

10 |

20 |

30 |

40 |

|||||||

|

|

|

|

|

Standard deviation |

||||||

(e) Which of the following risky assets would Ms. Lynch prefer to her present risky asset, assuming she can only invest in one risky asset at a time and that she can invest a fraction of her wealth in whichever risky asset she chooses? Write the word \better," \worse," or \same" after each of the assets.

Asset A with ra =17% and ¾a = 5%. |

|

|

|

. |

|

|

|

|

|||

Asset B with rb =30% and ¾b = 25%. |

|

|

. |

||

|

|

||||

Asset C with rc =11% and ¾c = 1%. |

|

|

. |

||

|

|

||||

Asset D with rd =25% and ¾d = 14%. |

|

. |

|||

|

|||||

(f) Suppose Ms. Lynch's utility function has the form u(rx; ¾x) = rx¡2¾x. How much of her portfolio will she invest in the original risky asset? (You might want to graph a few of Ms. Lynch's indi®erence curves before answering; e.g., graph the combinations of rx and ¾x that imply

u(rx; ¾x) = 0; 1; : : :). |

|

. |

|

13.2 (3) Fenner Smith is contemplating dividing his portfolio between two assets, a risky asset that has an expected return of 30% and a standard deviation of 10%, and a safe asset that has an expected return of 10% and a standard deviation of 0%.

(a) If Mr. Smith invests x percent of his wealth in the risky asset, what

will be his expected return? |

|

. |

(b) If Mr. Smith invests x percent of his wealth in the risky asset, what

will be the standard deviation of his wealth? |

|

. |

(c) Solve the above two equations for the expected return on Mr. Smith's

wealth as a function of the standard deviation he accepts.

.

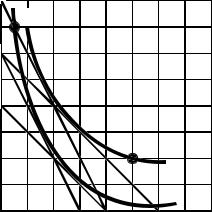

(d) Plot this \budget line" on the graph below.

Expected return

40

30

20

10

0 |

5 |

10 |

15 |

20 |

|

|

Standard deviation |

||

(e) If Mr. Smith's utility function is u(rx; ¾x) = minfrx; 30 ¡ 2¾xg, then

Mr. Smith's optimal value of rx is |

|

, and his optimal value of ¾x |

||

|

||||

is |

|

(Hint: You will need to solve two equations in two unknowns. |

||

One of the equations is the budget constraint.)

(f) Plot Mr. Smith's optimal choice and an indi®erence curve through it in the graph.

(g) What fraction of his wealth should Mr. Smith invest in the risky asset?

.

13.3 (2) Assuming that the Capital Asset Pricing Model is valid, complete the following table. In this table p0 is the current price of asset i and Ep1 is the expected price of asset i in the next period.

rf |

rm |

ri |

¯i |

p0 |

Ep1 |

10 |

20 |

10 |

|

100 |

|

|

|

|

|

|

|

10 |

20 |

|

1.5 |

|

125 |

|

|

|

|

|

|

10 |

|

20 |

2 |

200 |

|

|

|

|

|

|

|

0 |

30 |

|

2=3 |

40 |

48 |

|

|

|

|

|

|

10 |

22 |

|

0 |

80 |

|

|

|

|

|

|

|

13.4 (2) Farmer Alf Alpha has a pasture located on a sandy hill. The return to him from this pasture is a random variable depending on how much rain there is. In rainy years the yield is good; in dry years the yield is poor. The market value of this pasture is $5,000. The expected return from this pasture is $500 with a standard deviation of $100. Every inch of rain above average means an extra $100 in pro¯t and every inch of rain below average means another $100 less pro¯t than average. Farmer Alf has another $5,000 that he wants to invest in a second pasture. There are two possible pastures that he can buy.

(a) One is located on low land that never °oods. This pasture yields an expected return of $500 per year no matter what the weather is like. What is Alf Alpha's expected rate of return on his total investment if

he buys this pasture for his second pasture? |

|

|

What is the |

|

standard deviation of his rate of return in this case? |

|

|

. |

|

(b) Another pasture that he could buy is located on the very edge of the river. This gives very good yields in dry years but in wet years it °oods. This pasture also costs $5,000. The expected return from this pasture is $500 and the standard deviation is $100. Every inch of rain below average means an extra $100 in pro¯t and every inch of rain above average means another $100 less pro¯t than average. If Alf buys this pasture and keeps his original pasture on the sandy hill, what is his expected rate of return

on his total investment? |

|

|

What is the standard deviation of |

||||

the rate of return on his total investment in this case? |

|

|

. |

||||

(c) If Alf is a risk averter, |

which of these two pastures should |

he |

|||||

buy and why? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

In this chapter you will study ways to measure a consumer's valuation of a good given the consumer's demand curve for it. The basic logic is as follows: The height of the demand curve measures how much the consumer is willing to pay for the last unit of the good purchased|the willingness to pay for the marginal unit. Therefore the sum of the willingnesses-to-pay for each unit gives us the total willingness to pay for the consumption of the good.

In geometric terms, the total willingness to pay to consume some amount of the good is just the area under the demand curve up to that amount. This area is called gross consumer's surplus or total bene¯t of the consumption of the good. If the consumer has to pay some amount in order to purchase the good, then we must subtract this expenditure in order to calculate the (net) consumer's surplus.

When the utility function takes the quasilinear form, u(x) + m, the area under the demand curve measures u(x), and the area under the demand curve minus the expenditure on the other good measures u(x) + m. Thus in this case, consumer's surplus serves as an exact measure of utility, and the change in consumer's surplus is a monetary measure of a change in utility.

If the utility function has a di®erent form, consumer's surplus will not be an exact measure of utility, but it will often be a good approximation. However, if we want more exact measures, we can use the ideas of the compensating variation and the equivalent variation.

Recall that the compensating variation is the amount of extra income that the consumer would need at the new prices to be as well o® as she was facing the old prices; the equivalent variation is the amount of money that it would be necessary to take away from the consumer at the old prices to make her as well o® as she would be, facing the new prices. Although di®erent in general, the change in consumer's surplus and the compensating and equivalent variations will be the same if preferences are quasilinear.

In this chapter you will practice:

²Calculating consumer's surplus and the change in consumer's surplus

²Calculating compensating and equivalent variations

Suppose that the inverse demand curve is given by P (q) = 100 ¡ 10q and that the consumer currently has 5 units of the good. How much money would you have to pay him to compensate him for reducing his consumption of the good to zero?

Answer: The inverse demand curve has a height of 100 when q = 0 and a height of 50 when q = 5. The area under the demand curve is a trapezoid with a base of 5 and heights of 100 and 50. We can calculate

the area of this trapezoid by applying the formula

Area of a trapezoid = base £ |

1 |

(height1 |

+ height2): |

2 |

In this case we have A = 5 £ 12 (100 + 50) = $375.

Suppose now that the consumer is purchasing the 5 units at a price of $50 per unit. If you require him to reduce his purchases to zero, how much money would be necessary to compensate him?

In this case, we saw above that his gross bene¯ts decline by $375. On the other hand, he has to spend 5 £ 50 = $250 less. The decline in net surplus is therefore $125.

Suppose that a consumer has a utility function u(x1; x2) = x1 + x2. Initially the consumer faces prices (1; 2) and has income 10. If the prices change to (4; 2), calculate the compensating and equivalent variations.

Answer: Since the two goods are perfect substitutes, the consumer will initially consume the bundle (10; 0) and get a utility of 10. After the prices change, she will consume the bundle (0; 5) and get a utility of 5. After the price change she would need $20 to get a utility of 10; therefore the compensating variation is 20 ¡ 10 = 10. Before the price change, she would need an income of 5 to get a utility of 5. Therefore the equivalent variation is 10 ¡ 5 = 5.

14.1 (0) Sir Plus consumes mead, and his demand function for tankards of mead is given by D(p) = 100 ¡ p, where p is the price of mead in shillings.

(a) If the price of mead is 50 shillings per tankard, how many tankards of

mead will he consume? .

(b) How much gross consumer's surplus does he get from this consump-

tion? |

|

|

|

. |

(c) How much money does he spend on mead? |

|

|

. |

|

(d) What is his net consumer's surplus from mead consumption? |

|

|

||

|

|

|

|

. |

14.2 (0) Here is the table of reservation prices for apartments taken from Chapter 1:

Person |

= |

A |

B |

C |

D |

E |

F |

G |

H |

Price |

= |

40 |

25 |

30 |

35 |

10 |

18 |

15 |

5 |

(a) If the equilibrium rent for an apartment turns out to be $20, which

consumers will get apartments? |

|

. |

(b) If the equilibrium rent for an apartment turns out to be $20, what is the consumer's (net) surplus generated in this market for person A?

For person B? |

|

. |

(c) If the equilibrium rent is $20, what is the total net consumers' surplus

generated in the market? |

|

. |

(d) If the equilibrium rent is $20, what is the total gross consumers'

surplus in the market? |

|

. |

(e) If the rent declines to $19, how much does the gross surplus increase?

(f) If the rent declines to $19, how much does the net surplus increase?

14.3 (0) Quasimodo consumes earplugs and other things. His utility function for earplugs x and money to spend on other goods y is given by

u(x; y) = 100x ¡ x2 + y:

2

(a) What kind of utility function does Quasimodo have?

.

(b) What is his inverse demand curve for earplugs? |

|

. |

(c) If the price of earplugs is $50, how many earplugs will he consume?

.

(d) If the price of earplugs is $80, how many earplugs will he consume?

.

(e) Suppose that Quasimodo has $4,000 in total to spend a month. What is his total utility for earplugs and money to spend on other things if the

price of earplugs is $50? |

|

. |

(f) What is his total utility for earplugs and other things if the price of

earplugs is $80? |

|

|

|

. |

(g) Utility decreases by |

|

when the price changes from $50 to |

||

$80. |

|

|

|

|

(h) What is the change in (net) consumer's surplus when the price changes

from $50 to $80? |

|

. |

14.4 (2) In the graph below, you see a representation of Sarah Gamp's indi®erence curves between cucumbers and other goods. Suppose that the reference price of cucumbers and the reference price of \other goods" are both 1.

Other goods

40

A

3 0

20

B

10

0 |

10 |

20 |

30 |

40 |

Cucumbers

(a) What is the minimum amount of money that Sarah would need in

order to purchase a bundle that is indi®erent to A? |

|

. |

(b) What is the minimum amount of money that Sarah would need in

order to purchase a bundle that is indi®erent to B? |

|

. |

(c) Suppose that the reference price for cucumbers is 2 and the reference price for other goods is 1. How much money does she need in order to

purchase a bundle that is indi®erent to bundle A? |

|

. |

(d) What is the minimum amount of money that Sarah would need to

purchase a bundle that is indi®erent to B using these new prices? |

|

. |

|