- •Global backdrop: slower growth, monetary policy normalization, strong EUR

- •EMEA growth to slow to 1.6% in 2019, before rebounding to 2.6% in 2020

- •We are more pessimistic than consensus in 2019, but more optimistic in 2020

- •Key EMEA themes and asset calls

- •PIVOTAL QUESTIONS

- •Q: How much of UBS view on growth is shared by consensus?

- •Q: What are the key themes and asset calls to flag?

- •UBS VIEW

- •EVIDENCE

- •WHAT'S PRICED IN?

- •Emerging EMEA Outlook

- •Key global factors for EMEA

- •Emerging EMEA Growth outlook: faltering in 2019, with some rebound in 2020

- •Key regional themes

- •Russia

- •Turkey

- •South Africa

- •Poland

- •Czech Republic

- •Hungary

- •Greece

- •United Arab Emirates

- •Kazakhstan

- •Ukraine

- •Valuation Method and Risk Statement

vk.com/id446425943

Key regional themes

We highlight four key regional themes for 2019/20.

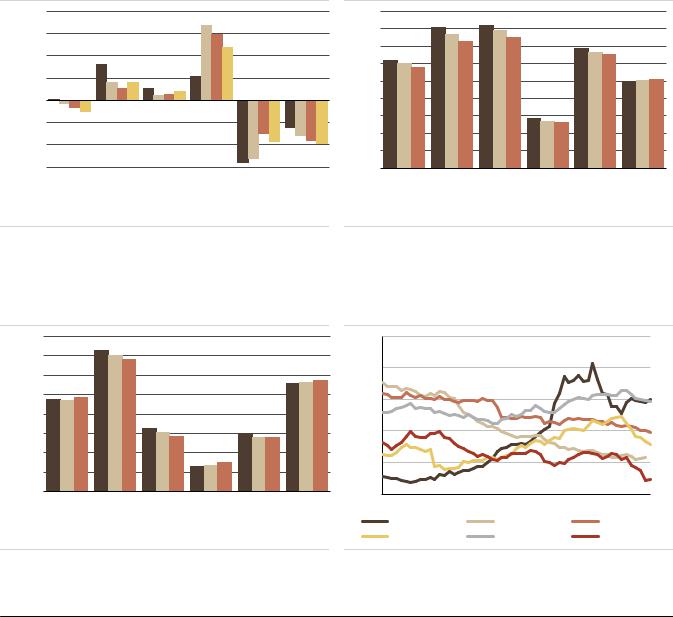

1.EMEA growth is definitely slower, but imbalances have improved and positioning is lighter. We believe that the slower EMEA growth trajectory in 2018-2020 has actually improved the sustainability of growth in EMEA. As positioning has lightened up uniformly — foreign ownership of local currency bonds is now 15-40% (versus 22-42% at the end of 2017) – we think that the region on average is now more resistant to external shocks. As shown here, by now, half of the countries have sustainable external surpluses (Russia, Czech Republic and Hungary), Poland has a tiny external deficit and Turkey's external position should see a dramatic improvement. When it comes to the government's balance sheet, the country dynamics are more diverse but generally we do not see it as a source for concerns about stability. For CE3 and Turkey we forecast stable or declining public debt/GDP, and the increase in Russia comes from very low levels. It is only in South Africa where we see some deterioration in both external and fiscal imbalances.

We are looking for more sustainable growth in EMEA as imbalances have reduced (outside South Africa). With lighter investor positioning, the region's resilience now looks better

Figure 3: External balance, % of GDP |

Figure 4: External debt, % of GDP |

8.0

6.0

4.0

2.0

0.0

(2.0)

(4.0)

(6.0)

Poland Hungary |

Czech |

Russia |

Turkey |

South |

|||||||

|

|

|

|

|

Republic |

|

|

|

Africa |

||

|

|

2017 |

|

|

2018F |

|

|

2019F |

|

2020F |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|||||||

90.0

80.0

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0.0

Poland Hungary |

Czech |

Russia |

Turkey |

South |

||||||

|

|

Republic |

|

|

|

|

Africa |

|||

|

|

2018F |

|

|

2019F |

|

|

2020F |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

Source: Haver, UBS |

Source: Haver, UBS |

Figure 5: Public debt, % of GDP

80.0

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0.0

Poland Hungary |

Czech |

Russia |

Turkey |

South |

||||||

|

|

Republic |

|

|

|

|

Africa |

|||

|

|

2018F |

|

|

2019F |

|

|

2020F |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

Source: Haver, UBS

Figure 6: Foreign ownership of local currency bonds, % of total

60% |

|

|

|

|

50% |

|

|

|

|

40% |

|

|

|

|

30% |

|

|

|

|

20% |

|

|

|

|

10% |

|

|

|

|

Jan-14 |

Jan-15 |

Jan-16 |

Jan-17 |

Jan-18 |

Czech Republic |

Hungary |

|

Poland |

|

Russia |

|

South Africa |

Turkey |

|

Source: Haver, UBS

EMEA Economic Perspectives 9 November 2018 |

6 |

vk.com/id446425943

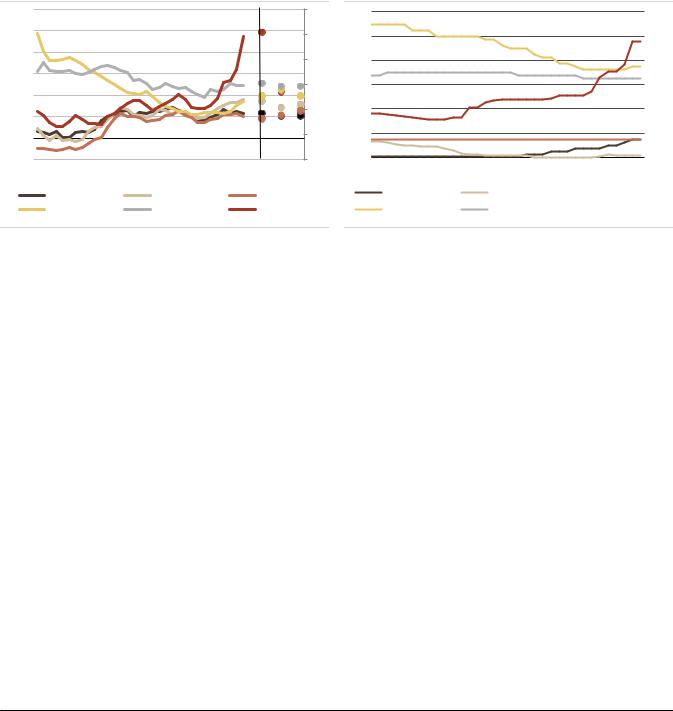

2.The trough in EMEA inflation should be behind us – CPI should be around the respective central banks' targets by end-2020 (outside Turkey). Monetary policy in the region is likely to follow three types of behaviour. Many EMEA countries have seen very low inflation prints in Q1-18 and generally inflation rates have been on the rise since then. This uniform trend reflects the impact of rising oil prices and currency weakness (against the USD), and in many cases accelerating food inflation in H2 2018. By 2020, we expect inflation in almost all of the countries to be back or close to (the mid-point of) the respective central banks' target levels: 2% in the Czech Republic, 2.5% in Poland, 3% in Hungary, 4% in Russia and 4.5% in South Africa. In Turkey, we expect inflation to fall significantly to single-digit levels (c9%) by end-2020 as the impact of the TRY shock should fade from the CPI readings by then.

Inflation should be around the respective central banks' targets by end-2020 — outside Turkey. We do see, however, diverging central bank behaviour in EMEA

Figure 7: Inflation outlook, % y/y |

Figure 8: Effective policy rates* |

12 |

|

|

UBS |

30.0 |

12 |

|

|

10 |

|

|

25.0 |

|

|

|

|

|

|

forecast |

10 |

|

|

||

|

|

|

|

|

|||

8 |

|

|

|

20.0 |

8 |

|

|

|

|

|

|

|

|

||

6 |

|

|

|

15.0 |

6 |

|

|

4 |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

2 |

|

|

|

10.0 |

4 |

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

5.0 |

2 |

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

|

0.0 |

0 |

|

|

Jan-16 |

Jan-17 |

Jan-18 |

Dec-18/19/20 |

Jan-16 |

Jul-16 |

Jan-17 |

|

Czech Republic |

Hungary |

Poland |

|

Czech Republic |

|

||

|

|

|

|

||||

Russia |

|

South Africa |

Turkey (rhs) |

|

Russia |

|

|

30

25

20

15

10

5

0

Jul-17 |

Jan-18 |

Jul-18 |

|

Hungary |

|

|

Poland |

|

|

||

South Africa |

|

|

Turkey (rhs) |

|

|

||

Source: Haver, UBS |

Source: Haver, UBS. *For Hungary it is 3-month BUBOR; for Turkey it is average |

|

cost of financing |

Does this mean that central banks behave uniformly in the region? Not at all. We actually see three distinct groups of central banks. The first group consists of the National Bank of Hungary and National Bank of Poland, which are likely to tie their monetary policy tightening to the course of ECB (BUBOR at 125bps, NBP's policy rate at 2.0% by end-2020). The second group consists of the Czech Republic and South Africa, where the respective central banks are expected to follow up their indications and signals to tighten monetary policy further (which is in line with their published model-based policy responses) — we see rate hikes in the Czech Republic and South Africa (CNB's policy rate at 2.50% and the SARB's is at 7.25% by end-2020).

The third group consists of the Central Bank of Turkey (CBRT), and more recently the Russian Central Bank (moving from group 2). In our view, the CBRT's policy rate path is going to be driven by the FX movements, the evolution of corporate pricing behaviour and financial stability concerns. We see the CBRT reducing its repo rate from Q3 2019 onwards to 13% by end-2020. The CBR has also turned more reactive and short-termist recently as the number of (mainly external) near-term risks to RUB and inflation has increased; we forecast one more rate hike in December 2018 or Q1 2019 to 7.75% followed by a reversal to 7.25% by end-2020.

We expect central banks in Czech Republic and South Africa to follow up their indications for tighter monetary policy; policymakers in Hungary and Poland to follow ECB; and Turkey and Russia policy to be more focused on short-term and external developments.

EMEA Economic Perspectives 9 November 2018 |

7 |

vk.com/id446425943

Our rate call is significantly more dovish than the market pricing in Hungary (first hike only in Q4-19), somewhat dovish in Poland (first hike comes later in Q1 2020) and in Russia (fewer hikes and the re-start of cuts), and in line for the Czech Republic and South Africa.

3.We continue to prefer CE3 currencies, in particular the CZK, and the RUB and thus the KZT — while we assume smaller depreciation (vs the 2018 FX moves) in the ZAR and the TRY. One of the most important consequences of improved imbalances, very significant FX corrections in 2018 and UBS' view that the EUR will rise against the USD in 2019-20, is that any swings in EMEA FX are likely to be way smaller than in 2018. Furthermore we actually see some currencies where there is a possibility of making outright gains against the USD. We are more optimistic than the forwards for all currencies in EMEA (in CE3 vs EUR, the rest versus USD).

Figure 9: FX forecasts

|

|

|

|

Changes vs current, % |

|

|

Current* |

End-19F |

End-20F |

End-19F |

End-20F |

|

|

|

|

|

|

EUR/USD |

1.14 |

1.24 |

1.30 |

-8.77 |

-14.04 |

USD/PLN |

3.78 |

3.41 |

3.15 |

9.62 |

16.52 |

EUR/PLN |

4.31 |

4.20 |

4.10 |

2.48 |

4.80 |

USD/HUF |

282.37 |

246.15 |

242.31 |

12.83 |

14.19 |

EUR/HUF |

321.90 |

320.00 |

315.00 |

0.59 |

2.14 |

USD/CZK |

22.64 |

20.33 |

18.46 |

10.24 |

18.47 |

EUR/CZK |

25.81 |

25.00 |

24.00 |

3.15 |

7.02 |

USD/TRY |

5.46 |

6.25 |

6.50 |

-14.47 |

-19.05 |

EUR/TRY |

6.22 |

7.69 |

8.45 |

-23.51 |

-35.76 |

USD/ZAR |

14.30 |

15.25 |

15.25 |

-6.64 |

-6.64 |

EUR/ZAR |

16.30 |

18.30 |

19.29 |

-12.26 |

-18.34 |

USD/RUB |

65.63 |

61.00 |

63.00 |

7.05 |

4.01 |

EUR/RUB |

74.82 |

75.03 |

81.90 |

-0.28 |

-9.47 |

USD/KZT |

370.97 |

345.00 |

350.00 |

7.00 |

5.65 |

USD/UAH |

28.05 |

30.20 |

30.60 |

-7.66 |

-9.09 |

|

|

|

|

|

|

Source: Bloomberg, UBS. *Close: 2 Nov as per Bloomberg

Our forecasts imply a strong upside in CE3 FX vs the USD – but this is largely dominated by UBS' view that the EUR should appreciate in the coming years. In CE3 the CZK remains our preferred currency, where the CNB's willingness to continue to tighten monetary policy should help to propel the CZK stronger both against the EUR and the USD in the coming two years. With regards to the PLN and HUF our preference is slightly tilted towards the Polish zloty.

We think that the RUB can regain more ground both versus the bicurrency basket and the US$ in H1 2019 but will start depreciating again from mid-2019. Our strategists see the RUB REER as c.10% undervalued on their BEER framework but in an environment of rising US yields and geopolitical risks the undervaluation can persist. Rapidly improving current account surplus will likely peak in Q1 2019 but remain large, assuming oil prices are flat. Non-resident outflows from the government bond market

We like the CE3 currencies and the RUB and thus the KZT, and forecast smaller depreciations (vs the 2018 FX moves) in the ZAR and TRY

EMEA Economic Perspectives 9 November 2018 |

8 |

vk.com/id446425943

have lessened but we would not expect significant inflows in 2019. We expect the CBR to resume market FX purchases for the Finance Ministry in January 2019 but without trying to catch up for the pause in 2018. The sanctions-related newsflow will likely remain the main risk to our RUB forecast. Modalities of the CBR's FX purchases under the fiscal rule are another important unknown but in general this policy will likely continue to curb the appreciation potential of the RUB from higher oil prices.

In Turkey, we continue to expect some TRY depreciation vs the USD, but nothing even close to the magnitude we have seen in 2018. If anything, we recognize the recent very rapid improvement in the external deficit, which in the short run could push TRY stronger than our forecasts. The uncertainty about the exact inflation trajectory and a more difficult global macro backdrop keeps us cautious about getting more optimistic on the Turkish lira.

In South Africa, we project a small currency correction in the coming years. On the positive side, we expect the SARB to hike rates and the commodity environment to remain broadly supportive. However, the growing external deficit and the risks around the CNY/China could weigh on the ZAR outlook.

In Kazakhstan, we expect the current account gap to be under 1% in 2018, gradually widening to 1.5% by 2020 if oil prices are flat. The KZT, however, remains sensitive to RUB volatility and capital outflows; the NBK sold $0.5bn in September to stabilise the exchange rate. Based on UBS's weak-USD view and our expectations of firmer RUB/USD in 2018, we forecast KZT/USD at 345-350 in 2019-20.

Figure 10: EMEA LEIs – 3m changes vs levels |

Figure 11: EMEA LEI and EMEA LEI ex Russia |

LEI level

2.00 |

|

|

|

|

|

|

|

1.0 |

|

|

1.60 |

|

|

|

|

|

|

|

0.5 |

|

|

|

|

|

|

Hungary |

|

|

|

|

||

1.20 |

|

|

|

|

|

|

|

|

||

0.80 |

|

|

|

|

|

|

|

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

0.40 |

|

|

|

Czech |

|

|

|

-0.5 |

|

|

|

|

|

Republic |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

0.00 |

|

Poland |

|

|

|

|

-1.0 |

|

|

|

|

|

Russia |

|

|

|

|

||||

-0.40 |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

-0.80 |

|

|

South Africa |

|

|

-1.5 |

|

|

||

|

Turkey |

|

|

|

|

|

|

|

|

|

-1.20 |

|

|

|

|

|

|

-2.0 |

|

|

|

|

|

|

|

|

|

|

|

|

||

-1.25 |

-1.00 |

-0.75 |

-0.50 |

-0.25 |

0.00 |

0.25 |

0.50 |

Jan-09 Jul-10 Jan-12 |

Jul-13 |

Jan-15 Jul-16 Jan-18 |

|

|

3-month change in LEI |

|

|

EMEA LEI* |

|

EMEA LEI, ex Russia* |

|||

Source: UBS calculations |

Source: UBS calculations |

4.UBS' EMEA Lead indicator (LEI) implies decelerating economic momentum in Q4-2018 and suggests a clear cyclical turning point. Our proprietary EMEA Lead Indicator recorded another drop to -0.28 in September from -0.20 in August. Given the two months' lead time, it suggests that growth in manufacturing (industrial) activity in EMEA is likely to be below the historical average level. Importantly, every single

EMEA Economic Perspectives 9 November 2018 |

9 |

vk.com/id446425943

EMEA country's LEI has declined versus levels held three months ago, while in September, with the exception of South Africa, all countries have printed lower LEIs than in August. This suggests a clear cyclical turning point with industrial growth momentum softening. The uniform drop in CE3 LEIs has been driven by softer confidence indicators and less supportive monetary conditions (real rates, money supply dynamics). In Russia, the drop in the Lead indicator is primarily due to less favourable money supply trends, a further decline of house prices, and reserves coming off a bit; despite oil prices rising further in RUB terms. South Africa was the only country in EMEA where the LEI actually improved slightly in September (-0.77) versus August (-0.86), though the level is rather depressed. The positive change was due to better monetary dynamics (increase in real money supply) and bond market movements, a pick-up in forward-looking sentiment indicators, and less negative car sales.

5.Political calendar: focus on Turkey, South Africa, Greece, Poland and Ukraine. We highlight five important elections in EMEA: the municipal elections in Turkey on 31 March 2019, the parliamentary elections in South Africa (no later than 4 August 2019), the parliamentary elections in Greece (no later than 20 October 2019), the parliamentary elections in Ukraine (no later than 29 October 2019) and the parliamentary elections in Poland (no later than November 2019). In Turkey, though somewhat less important than the parliamentary/ presidential elections, a lot of attention will be paid to the mayoral races in major cities like Istanbul, Ankara, etc. Once this election is out of the way, there are no more elections scheduled until 2023, which should open the government's political space to consider additional economic reform measures. In South Africa, the key question is whether ANC could maintain its one-party rule. If ANC was to score above 60%, it would be an important victory for President Cyril Ramaphosa. Similarly to Turkey, once the election is out of the way there will be more scope for reform, in our view. In Greece, current polls suggest that opposition New Democracy maintains a 10pps lead over incumbent Syriza (36% vs 26%). The polls imply that 5-6 parties/political alliances could make it to the Parliament. The most important macro implication is that the implementation and sequencing of economic reforms could differ if there is a change in government. In Ukraine, Current opinion polls suggest a fragmented political landscape, with 5 to 8 parties potentially making it above the 5% minimum vote threshold. The outcome of the presidential elections seven months prior can influence the vote. Ukraine is a parliamentary-presidential republic, so a good working relationship between the President and the ruling party (or coalition) is usually necessary for the government to function effectively. The most marketfriendly outcome would likely involve a president willing to press on with economic reforms and maintain a working IMF programme, supported by a ruling coalition in the parliament with a sufficiently wide majority. In Poland, opinion polls indicate that the ruling PIS party will likely retain a majority in the parliament. Although the party's anti-EU stance has not dented investor sentiment so far, investors will likely focus on the implications of the ongoing stand-offs with the EC for Poland's allocation of the EU funds in the next EU budget. Finally, for CE3 some attention

Political calendar: focus on Turkey, South Africa, Greece, Poland and Ukraine

EMEA Economic Perspectives 9 November 2018 |

10 |

vk.com/id446425943

should be given to EU parliamentary elections on 23-26 May 2019. The ratification of the new EU budget for 2021-2027, which includes the allocation of EU funds to CE3, is likely to shift into the term of the new EU parliament. The CE3 region should see a drop in EU funds as the region is getting wealthier, but the extent of the drop will be key for the region's growth outlook.

EMEA Economic Perspectives 9 November 2018 |

11 |

vk.com/id446425943

Figure 12: Political calendar in EMEA

Country |

|

Date |

|

Political |

|

Outlook |

|

Macro Implications |

|

|

|

|

Event/Election |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Though somewhat less important than the |

|

|

||

|

|

|

|

|

|

parliamentary elections, a lot of attention will be paid |

Once this election is out of the way, there are no more elections |

|||

|

|

|

|

|

|

to the mayoral races in major cities like Istanbul, |

||||

Turkey |

31-Mar-19 |

Municipalities |

scheduled until 2023 - which should allow the government |

|||||||

Ankara, etc. As always with municipal elections, the |

||||||||||

|

|

|

|

|

|

political space for additional economic measures. |

||||

|

|

|

|

|

|

race is not only decided by party preferences, but by |

||||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

the individual appeal of the mayoral candidates. |

|

|

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

The financial markets are likely to mainly focus on the willingness |

||

|

|

|

|

|

|

Based on opinion polls, the winner will likely be |

of the next President to continue cooperation with the IMF and |

|||

|

|

|

|

|

|

decided in the second round and the outcome is still |

other international creditors, which will likely require |

|||

|

|

|

|

|

|

highly uncertain. Recent opinion polls put former PM |

continuation of reforms and fiscal discipline. Although most |

|||

Ukraine |

31-Mar-19 |

Presidential |

Tymoshenko, leader of the "Fatherland" party, in the |

candidates indicated they plan to work with the IMF (Boyko's |

||||||

elections |

lead with 16-22% of the vote but several other |

Opposition Bloc said it wants to renegotiate on more favourable |

||||||||

|

|

|

|

|||||||

|

|

|

|

|

|

candidates, including current President Poroshenko |

terms), other elements of their programs are unlikely to be |

|||

|

|

|

|

|

|

could make it into the second round and |

approved by the Fund. For instance, Tymoshenko calls for fiscal |

|||

|

|

|

|

|

|

Tymoshenko's disapproval ratings are high. |

stimulus to support "innovative development" and drive GDP |

|||

|

|

|

|

|

|

|

|

growth to 7%. |

||

|

|

May 23-26, |

European |

Election to be followed by the establishment of a new |

A strong election results for populist parties could raise question |

|||||

EU |

Parliament |

European Commission (EC). EC President Jean-Claude |

||||||||

2019 |

|

marks over the future of the EU. |

||||||||

|

|

|

election |

Juncker has said that he will not seek another term. |

||||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

There are no reliable polls by and large in South |

|

|

||

|

|

Not later than 4 |

|

|

Africa. The key question is whether ANC could |

|

|

|||

South Africa |

Parliamentary |

maintain its one party rule. If ANC was to score above |

Option for more policy change after the election. |

|||||||

|

|

Aug 2019 |

|

|

60%, it would be an important victory for President |

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

Cyril Ramaphosa. |

|

|

||

|

|

|

|

|

|

Current polls suggest that opposition New Democracy |

|

|

||

Greece |

Not later than |

Parliamentary |

maintains a 10pps lead over incumbent Syriza (36% |

Implementation and sequencing of economic reforms could differ |

||||||

|

|

20 Oct 2019 |

vs 26%). The polls imply that 5-6 parties/political |

if there is a change in government. |

||||||

|

|

|

|

|||||||

|

|

|

|

|

|

alliances could make it into Parliament. |

|

|

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Ukraine is a parliamentary-presidential republic, so a good |

||

|

|

|

|

|

|

Current opinion polls suggest a fragmented political |

working relationship between the President and the ruling party |

|||

|

|

|

|

Parliamentary |

landscape, with 5 to 8 parties potentially making it |

(or coalition) is usually necessary for the government to function |

||||

Ukraine |

27-Oct-19 |

above the 5% minimum vote threshold. The outcome |

effectively. The most market-friendly outcome would likely |

|||||||

elections |

||||||||||

|

|

|

|

of the presidential elections seven months prior can |

involve a president willing to press on with economic reforms |

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

influence the vote. |

and maintain a working IMF programme, supported by a ruling |

|||

|

|

|

|

|

|

|

|

coalition in the parliament with a sufficiently wide majority. |

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

PIS is a right-wing, Eurosceptic and socially conservative party, |

||

|

|

|

|

|

|

The ruling Law and Justice (PIS) party has an average |

supporting some state intervention in the economy. During the |

|||

|

|

|

|

|

|

lead of c.15pp in the opinion polls over the main |

current term in the Sejm, the party focused on a social welfare |

|||

|

|

|

|

|

|

opposition party Civic Platform (PO), although the gap |

agenda: support for families with children and tax cuts for those |

|||

|

|

|

|

|

|

has narrowed since early 2018. The PIS made gains in |

on lower incomes, as well improving tax collection, and specific |

|||

|

|

No later than |

Parliamentary |

local elections in October 2018, winning 254 out of |

sectoral regulation/taxes. Strong fiscal performance leaves room |

|||||

Poland |

November |

552 seats in regional assemblies but conceded several |

for some pre-election spending increases but we expect the |

|||||||

elections |

||||||||||

|

|

2019 |

|

big city mayoralties, including Warsaw, to the |

government to steer well clear of the 3% EDP deficit limit. PIS |

|||||

|

|

|

|

|

||||||

|

|

|

|

|

|

opposition coalition. As of October 2018, opinion |

continues the stand-off with the EC on a number of issues |

|||

|

|

|

|

|

|

polls suggest PIS has a high chance to retain its |

(judiciary, migration, EU budget). The EC's new proposals for the |

|||

|

|

|

|

|

|

outright majority in the Sejm but short of a |

cohesion funds, if approved, will shift some funding from CEE to |

|||

|

|

|

|

|

|

constitutional 2/3 majority of the seats. |

Southern Europe in the next 7-year EU budget framework; the |

|||

|

|

|

|

|

|

|

|

PIS government strongly opposes these plans. |

||

|

|

|

|

|

|

|

|

|

|

|

EMEA Economic Perspectives 9 November 2018 |

12 |

vk.com/id446425943

|

|

|

Current President Nursultan Nazarbaev (78) has been |

With Nazarbaev dominating Kazakhstan's politics for nearly 30 |

|

|

|

|

in power since 1989, winning the latest election with |

||

|

|

|

years, uncertainty over eventual succession of power has long |

||

|

|

|

almost 98% of votes. Nazarbaev has not indicated his |

||

|

|

|

been highlighted as a risk by rating agencies. Political analysts |

||

|

|

Presidential |

intentions for 2020 yet; in an interview with the BBC |

point to Nazarbaev's steps to ensure a smooth political transition |

|

Kazakhstan |

2020 |

in June, the head of the Senate Tokayev opined that |

|||

elections |

at some point in the future: 2017 changes to the Constitution re- |

||||

|

|

he would not run again. On the other hand, the |

|||

|

|

|

distributed some presidential powers to the government and |

||

|

|

|

recent presidential address on the 5th of October |

||

|

|

|

parliament; and a more recent law allowed Nazarbaev to head |

||

|

|

|

contained a number of social policy commitments, |

||

|

|

|

the Security Council for life. |

||

|

|

|

which could the imply possibility of an early election. |

||

|

|

|

|

||

|

|

|

|

|

|

|

|

|

The term of the current President Andrzej Duda (PIS) |

|

|

|

|

|

expires on 6 August 2020; he is eligible to run for |

Poland is a parliamentary democracy, so while the President is a |

|

|

|

|

another 5-year term and was endorsed by PIS leader |

||

|

|

|

head of state, the post is largely symbolic. The President holds |

||

|

|

|

Mr Kaczynski in July'18. Former Polish PM Donald |

||

|

|

Presidential |

the power to veto legislation, so having a President from an |

||

Poland |

2020 |

Tusk, whose term as President of the EC expires in |

|||

elections |

opposition party would make it more difficult for the ruling party |

||||

|

|

2019, is a potential candidate to run from the |

|||

|

|

|

to push through some of the more controversial parts of its |

||

|

|

|

opposition PO party. Opinion polls put Duda in the |

||

|

|

|

agenda. |

||

|

|

|

lead, suggesting that he would be a likely winner but |

||

|

|

|

|

||

|

|

|

the election would require a second round run-off. |

|

|

|

|

|

|

|

|

Source: UBS |

|

|

|

|

EMEA Economic Perspectives 9 November 2018 |

13 |