- •Global backdrop: slower growth, monetary policy normalization, strong EUR

- •EMEA growth to slow to 1.6% in 2019, before rebounding to 2.6% in 2020

- •We are more pessimistic than consensus in 2019, but more optimistic in 2020

- •Key EMEA themes and asset calls

- •PIVOTAL QUESTIONS

- •Q: How much of UBS view on growth is shared by consensus?

- •Q: What are the key themes and asset calls to flag?

- •UBS VIEW

- •EVIDENCE

- •WHAT'S PRICED IN?

- •Emerging EMEA Outlook

- •Key global factors for EMEA

- •Emerging EMEA Growth outlook: faltering in 2019, with some rebound in 2020

- •Key regional themes

- •Russia

- •Turkey

- •South Africa

- •Poland

- •Czech Republic

- •Hungary

- •Greece

- •United Arab Emirates

- •Kazakhstan

- •Ukraine

- •Valuation Method and Risk Statement

vk.com/id446425943

Turkey

•Forecasting the 2019-20 economic outlook has a very high margin of error as the economy is entering a recession driven by the private sector's balance sheet vulnerabilities. In our view, the economy lacks the catalysts for a V-shaped recovery and thus we see -0.8% and 2.3% GDP growth in 2019 and 2020.

•We see the TRYUSD at 6.50 by end-2020 and the CBRT cutting rates from Q3-19 onwards from 24% to 13% by end-2020.

We are in uncharted territory when forecasting the Turkish economy's course for 2019-2020. Due to significant balance of payment pressures, the economy was impacted by a combination of a significant TRY depreciation (the nominal effective TRY rate fell by more than 40% in 2018 — at the weakest point it was more than 75% weaker) and a significant upward move in rates as a result of the Central Bank of Turkey's (CBRT) policy tightening. Interest rates on new consumer and corporate loans are at 34-38% and the CBRT's effective rate is at 24%. Given the 65% of GDP private credit stock (FX loans are 20% of GDP) and the USD -215bn open FX position on the corporate sector's balance sheet (though some of it is hedged), the corporate sector and the banks are likely to be under pressure from the economic slowdown and high debt-service costs. In addition, the spike in inflation is also likely to take its toll on the economy. There is no previous script to hand for how such an adjustment could happen in Turkey – and this is why any forecasts carry a high margin of error. Importantly, the government has a relatively favourable starting point with 28% of GDP debt – unlike in many past EM crises.

Our narrative relies on two premises: a) we expect the banks to try to spread the recognition of loan issues over the coming years and b) no policy (monetary, fiscal, credit) or sector (exports) has the scope to generate a V-shaped recovery. As a consequence we believe that the banks' behaviour should help to put a floor under the depth of the recession in 2019, but we also do not expect the economy to rebound very strongly: we expect GDP growth to slow from 3.6% in 2018 to - 0.8% in 2019, and then to rebound by 2.3% in 2020. The incoming data is consistent with 2.5% y/y GDP growth in Q3-2018, which implies a -2% q/q fall. We forecast a -0.5% q/q decline in GDP in Q4-18 (in line with contraction in credit dynamics and falling sentiment), which translates into the y/y rate falling below zero. We project roughly zero q/q growth rates on average in 2019. Our GDP forecast is more pessimistic than consensus (+0.2%, +2.7% in 2019-20).

Our key macro calls are: we expect CPI to peak around 25-26% y/y in Q1-19 and then to fall to 13.5% y/y by end-2019 and towards 9% by end-2020 — this is based on TRY at 6.25 vs the USD by end-2019 and at 6.50 by end-2020. Correspondingly, we project the CBRT leaving rates on hold at 24% in 2018, and starting to cut rates in Q3-19 to 17% by end-2019 and to 13% by end-2020. On external adjustment, we predict the current account deficit narrowing to cUSD c22bn or 3% of GDP in 2019, before widening again in 2020. The margin of error around these numbers is higher than normal.

We see the weakness mainly affecting the consumer — as evidenced already by a sharp fall in spending on durables (car registrations, consumer goods' imports), home sales and by rising unemployment — and investments, as illustrated by the sharp outright decline in FX-adjusted lending dynamics.

Significant uncertainty about how 2019-2020 will play out in Turkey

– we call for a recession in 2019. Stress is centred on the private sector

Two premises: a) banks to try to spread the recognition of the loan problems over the coming years; and b) no sector could generate a V-shaped recovery

Key macro calls: CPI, TRY, policy rate and external balance

EMEA Economic Perspectives 9 November 2018 |

19 |

vk.com/id446425943

What are the key signposts to see which way the adjustment plays out?

1)External debt roll-overs, in particular for the banks. On remaining maturity Turkish banks had USD 109bn of short-term external debt (in Q2-18), out of which deposits and bank accounts were USD 50bn (for which there is no maturity profile). Private sector banks have an upcoming USD 29.7bn of credit lines and syndicated loans to roll over in November 2018-August 2019, after successfully completing a roll-over of USD 23bn debt in JulyOctober 2018 (though at higher interest rates). Any roll-over problems would deepen the economic contraction.

2)Deposit dollarization. The FX-adjusted dollarization ratio has been coming lower constantly in the last couple of years and there was no change in trend so far this year (current rate is 19%). If deposit dollarization was to rise again, the CBRT would need to hike rates again on financial stability concerns and thus generate more pressure on the economy.

3)Pricing behaviour. Given the recent experience of a very negative turn in pricing behaviour, there is a risk of another significant increase in inflation. In this case, similarly to #2, the erosion of real TRY deposit rates could argue for another CBRT rate hike on financial stability grounds. However, as the government initiated administrative measures to restrict price hikes (and cut taxes on various goods) the risk also exists that inflation will decelerate faster and could allow for a speedier cut in rates.

4)Significant further deterioration in confidence indicators. In October 2018 both economic confidence (67.5) and consumer confidence (57.3) hit levels that are barely over 2009 trough levels. Importantly, the pace of deterioration from September to October slowed notably. Further deterioration could imply more downside to our 2018/19 GDP numbers.

5)Regulatory changes. There is a lot of policy effort going into addressing the problems of different borrowers. This legislation could have a significant impact on the shape of downturn.

6)External adjustment. The 12-m rolling trade deficit and the current account deficit (USD 38bn, 4.9% of GDP) shrank by USD 16bn just in August-October as exports rose by 9.5% y/y and imports fell sharply by 21.5% y/y. We are cautious whether these trends can be extrapolated as such an implosion is likely to reflect a massive inventory drawdown and thus imply a much deeper contraction of activity. However, if the external deficit indeed narrows much faster than our forecast, it will allow the TRY to be stronger than our forecast.

Why do we not believe in a V-shaped recovery (like after 2009)? First, the external environment is not supportive. Both UBS' global base-case and most of the risk scenarios are consistent with global growth slowing to a varying degree and point to EM FX pressures. The growth picture limits the ability of exports to generate a strong economic rebound, while FX pressure constrains the CBRT's ability to help the economy by lowering rates. Second, any fiscal stimulus – such as the announced VAT cuts — will probably slow the external adjustment. Third, we see no room for credit growth to pick up meaningfully either.

How to think of the sequencing of the adjustment? We think that we are going to get clarity first on developments more relevant for FX and rates (such as the inflation path, external adjustment) and only later about growth, the labour market impact and the banks' NPL formation (which are more relevant for equities).

Key signposts to watch: external debt roll-overs; deposit dollarization; pricing behaviour; confidence; regulation and external adjustment

Why we do not believe in a V- shaped recovery?

Sequencing of the adjustment

EMEA Economic Perspectives 9 November 2018 |

20 |

vk.com/id446425943

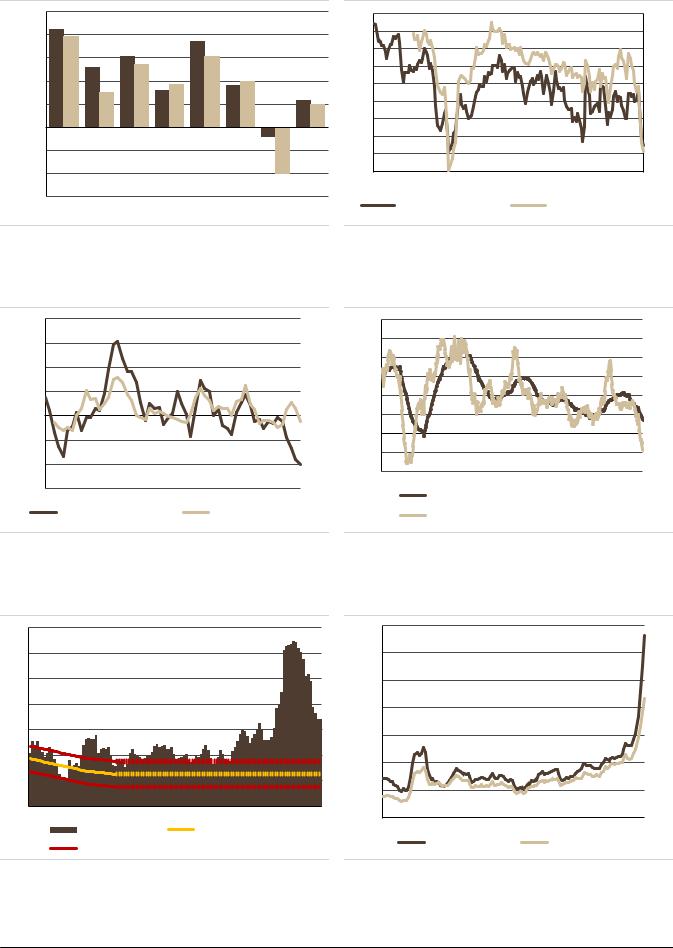

Figure 26: GDP growth and household consumption |

Figure 27: Confidence is back to near 2009 levels |

10.0 |

|

|

|

|

|

|

95 |

|

|

|

|

|

120 |

8.0 |

|

|

|

|

|

|

90 |

|

|

|

|

|

110 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

85 |

|

|

|

|

|

|

6.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80 |

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4.0 |

|

|

|

|

|

|

75 |

|

|

|

|

|

90 |

2.0 |

|

|

|

|

|

|

70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

0.0 |

|

|

|

|

|

|

65 |

|

|

|

|

|

80 |

|

|

|

|

|

|

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

70 |

|

(2.0) |

|

|

|

|

|

|

55 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4.0) |

|

|

|

|

|

|

50 |

|

|

|

|

|

60 |

|

|

|

|

|

|

|

Jan-05 |

Jan-07 |

Jan-09 |

Jan-11 |

Jan-13 |

Jan-15 |

Jan-17 |

(6.0) |

|

|

|

|

|

|

|

Consumer confidence |

|

Business confidence, r.s. |

|||

2013 |

2014 |

2015 |

2016 |

2017F |

2018E |

2019F |

2020F |

|

|||||

|

|

|

|

|

|

||||||||

Source: TurkStat, Haver, UBS |

|

|

|

|

|

Source: CBRT, Haver, UBS |

|

|

|

|

|||

Figure 28: Car and home sales sharply slowing, % y/y

80.0 |

|

|

|

|

60.0 |

|

|

|

|

40.0 |

|

|

|

|

20.0 |

|

|

|

|

0.0 |

|

|

|

|

(20.0) |

|

|

|

|

(40.0) |

|

|

|

|

(60.0) |

|

|

|

|

Jan-14 |

Jan-15 |

Jan-16 |

Jan-17 |

Jan-18 |

Car registration, 3m MA |

Home sales, 3m MA |

|||

Source: TurkStat, Haver, UBS

Figure 29: Credit growth sharply slowing, %

60 |

|

|

|

|

|

50 |

|

|

|

|

|

40 |

|

|

|

|

|

30 |

|

|

|

|

|

20 |

|

|

|

|

|

10 |

|

|

|

|

|

0 |

|

|

|

|

|

(10) |

|

|

|

|

|

(20) |

|

|

|

|

|

Jan-08 |

Jan-10 |

Jan-12 |

Jan-14 |

Jan-16 |

Jan-18 |

|

Domestic credit, % y/y FX adjusted |

|

|||

Domestic credit w/w annualized, 13wk ma

Source: CBRT, Haver, UBS

Figure 30: Inflation outlook, %

28 |

|

|

|

|

24 |

|

|

|

|

20 |

|

|

|

|

16 |

|

|

|

|

12 |

|

|

|

|

8 |

|

|

|

|

4 |

|

|

|

|

0 |

|

|

|

|

Jan-10 |

Jan-12 |

Jan-14 |

Jan-16 |

Jan-18 |

|

CPI (% y/y) |

|

Inflation target |

|

Upper/lower band

Source: TurkStat, CBRT, Haver, UBS

Figure 31: Inflation expectations, %

18.00 |

|

16.00 |

|

14.00 |

|

12.00 |

|

10.00 |

|

8.00 |

|

6.00 |

|

4.00 |

|

Jan-2007 Jan-2009 Jan-2011 Jan-2013 Jan-2015 Jan-2017 |

|

12-month ahead |

24-month ahead |

Source: CBRT, Haver, UBS

EMEA Economic Perspectives 9 November 2018 |

21 |

vk.com/id446425943

Figure 32: External deficit rapidly shrinking, % of GDP |

Figure 33: Private sector external debt maturities*, USD |

|

mn |

4.00 |

12,000 |

|

2.00 |

|

|

0.00 |

10,000 |

|

|

||

(2.00) |

8,000 |

|

(4.00) |

||

|

||

(6.00) |

6,000 |

|

(8.00) |

4,000 |

|

(10.00) |

||

|

||

(12.00) |

2,000 |

|

Jan-2008 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 |

|

Current account balance (ex energy, gold, tourism)

Current account balance (ex energy, gold, tourism)

Tourism

Tourism

Gold trade balance

Gold trade balance  Energy trade balance Current account balance

Energy trade balance Current account balance

Source: CBRT, Haver, UBS

0

Jul-18 Sep-18 Nov-18 Jan-19 Mar-19 May-19 Jul-19  Banks

Banks  Nonbank Financial Corporations

Nonbank Financial Corporations  Nonfinancial sector

Nonfinancial sector

Source: CBRT, Haver, UBS. Based on outstanding loans.

Figure 34: Open FX position of corporate sector, USD mn |

Figure 35: Deposit dollarization, % of total |

200000 |

|

|

|

55.0 |

100000 |

|

|

|

50.0 |

0 |

|

|

|

45.0 |

|

|

|

|

|

(100000) |

|

|

|

40.0 |

|

|

|

|

|

(200000) |

|

|

|

35.0 |

|

|

|

30.0 |

|

|

|

|

|

|

(300000) |

|

|

|

25.0 |

|

|

|

|

|

(400000) |

|

|

|

20.0 |

2004 |

2007 |

2010 |

2013 |

2016 |

|

|

|

FX liabilities - other |

15.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

FX liabilities - foreign banks |

|

05-Feb 07-Feb 09-Feb 11-Feb |

13-Feb 15-Feb 17-Feb |

|||||

|

|

|

|||||||||

|

|

|

|||||||||

|

|

|

FX liabilities - domestic banks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

FX assets |

|

|

|

|

% of total |

|

% of total, FX-adjusted |

|

|

|

|

|

|

|

|

|

||||

|

|

|

Net position |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: CBRT, Haver, UBS |

|

Source: CBRT, Haver, UBS |

|

|

|||||||

Figure 36: Portfolio inflows into bonds & equities* Figure 37: Budget balance* and public debt, % of GDP

12,000 |

|

|

|

0.0 |

10,000 |

|

|

|

-0.5 |

8,000 |

|

|

|

-1.0 |

|

|

|

-1.5 |

|

6,000 |

|

|

|

|

|

|

|

-2.0 |

|

4,000 |

|

|

|

|

|

|

|

-2.5 |

|

|

|

|

|

|

2,000 |

|

|

|

-3.0 |

0 |

|

|

|

-3.5 |

(2,000) |

|

|

|

-4.0 |

|

|

|

-4.5 |

|

(4,000) |

|

|

|

|

|

|

|

-5.0 |

|

(6,000) |

|

|

|

|

|

|

|

|

|

01-Jan- |

13-Jan- |

24-Jan- |

05-Feb- |

16-Feb- |

2010W |

2012W |

2014W |

2016W |

2018W |

|

Government bonds |

|

Equity |

|

25 |

26 |

27 |

28 |

29 |

30 |

31 |

32 |

33 |

2013 |

2015 |

2017F |

2019F |

|

|

|

Budget balance, % of GDP (lhs) |

|

|

|

|

|

||

|

|

|

||

Public sector debt, % of GDP (rhs, inverted)

Source: CBRT, Haver, UBS. *12-week rolling total, USD mn |

Source: IMF, Ministry of Finance, UBS. *Based on IMF-definition. |

EMEA Economic Perspectives 9 November 2018 |

22 |

vk.com/id446425943

Figure 38: TURKEY

|

2013 |

2014 |

2015 |

2016 |

2017F |

2018E |

2019F |

2020F |

|

|

|

|

|

|

|

|

|

|

|

Economic Activity and Employment |

|

|

|

|

|

|

|

|

|

GDP, local currency bn |

1810 |

2044 |

2339 |

2609 |

3107 |

3765 |

4482 |

5049 |

|

GDP, USD bn |

948 |

934 |

857 |

862 |

852 |

762 |

744 |

792 |

|

GDP per capita, USD |

12480 |

12112 |

11019 |

10883 |

10602 |

9311 |

8976 |

9439 |

|

Real GDP growth, % |

8.5 |

5.2 |

6.1 |

3.2 |

7.4 |

3.6 |

-0.8 |

2.3 |

|

Private consumption, % y/y |

7.9 |

3.0 |

5.4 |

3.7 |

6.1 |

4.0 |

-4.0 |

2.0 |

|

Government consumption, % y/y |

8.0 |

3.1 |

3.9 |

9.5 |

5.0 |

7.5 |

0.0 |

2.0 |

|

Gross Fixed Capital formation, % y/y |

13.8 |

5.1 |

9.3 |

2.2 |

7.8 |

3.5 |

-3.5 |

1.0 |

|

Exports, % y/y |

1.1 |

8.2 |

4.3 |

-1.9 |

11.9 |

5.0 |

3.5 |

2.0 |

|

Imports, % y/y |

8.0 |

-0.4 |

1.7 |

3.7 |

10.3 |

-1.5 |

-6.0 |

0.0 |

|

Unemployment rate, % (average) |

9.1 |

10.0 |

10.3 |

10.9 |

10.9 |

10.8 |

12.2 |

12.1 |

|

Industrial Production (%) |

6.6 |

5.9 |

6.1 |

3.4 |

8.9 |

5.0 |

-2.5 |

2.0 |

|

Prices, interest rates and money |

|

|

|

|

|

|

|

|

|

CPI inflation, % y/y (average) |

7.5 |

8.9 |

7.7 |

7.8 |

11.1 |

17.0 |

20.0 |

10.1 |

|

CPI inflation, % y/y (year-end) |

7.4 |

8.2 |

8.8 |

8.5 |

11.9 |

25.4 |

13.5 |

9.0 |

|

Broad money M2, % y/y (end-year) |

22.2 |

11.9 |

17.1 |

18.3 |

15.7 |

25.0 |

5.0 |

8.0 |

|

Domestic private credit, % y/y |

33.8 |

17.5 |

19.4 |

15.8 |

20.7 |

5.0 |

-2.0 |

2.0 |

|

Domestic bank credit/GDP |

54.5 |

56.6 |

59.1 |

61.2 |

62.0 |

69.1 |

63.2 |

61.2 |

|

Policy rate, % (end-year)* |

6.8 |

8.5 |

8.8 |

8.3 |

12.8 |

24.0 |

17.0 |

13.0 |

|

10 year bond yield, % (year-end) |

10.2 |

8.0 |

10.7 |

11.4 |

11.7 |

17.5 |

16.5 |

14.0 |

|

USD/TRY (year-end) |

2.15 |

2.33 |

2.92 |

3.52 |

3.80 |

5.80 |

6.25 |

6.50 |

|

EUR/TRY (year-end) |

2.96 |

2.83 |

3.18 |

3.71 |

4.49 |

6.73 |

7.69 |

8.45 |

|

Fiscal accounts |

|

|

|

|

|

|

|

|

|

General government budget balance, % GDP |

-1.5 |

-1.4 |

-1.3 |

-2.3 |

-2.3 |

-4.0 |

-4.5 |

-4.5 |

|

Revenue, % GDP |

32.8 |

31.9 |

32.2 |

32.8 |

31.2 |

30.3 |

29.9 |

30.0 |

|

Expenditure, % GDP |

34.2 |

33.3 |

33.4 |

35.1 |

33.4 |

34.3 |

34.4 |

34.5 |

|

of which interest expenditure, % GDP |

2.3 |

2.0 |

1.9 |

1.4 |

1.3 |

1.9 |

3.0 |

3.8 |

|

Primary balance, % GDP |

0.8 |

0.5 |

0.6 |

-1.0 |

-0.9 |

-2.1 |

-1.5 |

-0.7 |

|

Public sector debt (gross),% GDP |

32.4 |

30.0 |

29.0 |

29.3 |

28.2 |

30.0 |

27.8 |

27.8 |

|

of which domestic public debt, % GDP |

22.3 |

20.3 |

18.8 |

18.1 |

17.2 |

15.1 |

14.3 |

15.3 |

|

of which external public debt,% GDP |

10.1 |

9.7 |

10.2 |

11.2 |

11.0 |

14.9 |

13.5 |

12.5 |

|

% domestic public debt held by non-residents |

28.1 |

29.1 |

21 |

20.1 |

21.9 |

16.0 |

18.0 |

20.0 |

|

Public debt held by the central bank, % GDP |

0.5 |

0.4 |

0.4 |

0.3 |

0.3 |

0.2 |

0.2 |

0.2 |

|

Balance of payments |

|

|

|

|

|

|

|

|

|

Trade balance, USD bn |

-79.9 |

-63.6 |

-48.1 |

-40.9 |

-59.0 |

-54.5 |

-37.6 |

-42.8 |

|

Exports, USD bn |

161.8 |

168.9 |

152.0 |

150.2 |

166.2 |

172.2 |

176.8 |

179.7 |

|

Imports, USD bn |

241.7 |

232.5 |

200.1 |

191.1 |

225.1 |

226.7 |

214.4 |

222.4 |

|

Current account balance, USD bn |

-63.6 |

-43.6 |

-32.1 |

-33.1 |

-47.5 |

-40.0 |

-22.1 |

-29.3 |

|

as % of GDP |

-6.7 |

-4.7 |

-3.7 |

-3.8 |

-5.6 |

-5.3 |

-3.0 |

-3.7 |

|

Foreign direct investment (net), USD bn |

9.9 |

6.1 |

12.9 |

10.2 |

8.3 |

5.5 |

4.5 |

7.0 |

|

Total FX reserves, USD bn |

131.0 |

127.3 |

110.5 |

106.1 |

107.7 |

80.0 |

75.0 |

75.0 |

|

Foreign exchange reserves excl gold, USD bn |

111.0 |

106.9 |

92.9 |

92.1 |

82.6 |

62.0 |

57.0 |

57.0 |

|

Total FX reserves, % GDP |

13.8 |

13.6 |

12.9 |

12.3 |

12.6 |

10.5 |

10.1 |

9.5 |

|

Total external debt, % GDP |

41.4 |

43.4 |

46.7 |

47.5 |

53.4 |

68.5 |

66.3 |

65.3 |

|

Net International Investment Position, % GDP |

-41.9 |

-47.7 |

-44.9 |

-42.8 |

-54.2 |

-65.7 |

-65.0 |

-64.0 |

|

Credit ratings |

|

|

|

|

|

|

|

|

|

Moody's |

Baa3 |

Baa3 |

Baa3 |

Ba1 |

Ba1 |

Ba3 |

n/a |

n/a |

|

(neg) |

|||||||||

|

|

|

|

|

|

|

|

||

S&P |

BB+ |

BB+ |

BB+ |

BB |

BB |

B+ (sta) |

n/a |

n/a |

|

Fitch |

BBB- |

BBB- |

BBB- |

BBB- |

BB+ |

BB (neg) |

n/a |

n/a |

Source: CBT, TurkStat, IMF, EuroStat, Haver, UBS estimates. *Average cost of funding to banks.

EMEA Economic Perspectives 9 November 2018 |

23 |