- •Global backdrop: slower growth, monetary policy normalization, strong EUR

- •EMEA growth to slow to 1.6% in 2019, before rebounding to 2.6% in 2020

- •We are more pessimistic than consensus in 2019, but more optimistic in 2020

- •Key EMEA themes and asset calls

- •PIVOTAL QUESTIONS

- •Q: How much of UBS view on growth is shared by consensus?

- •Q: What are the key themes and asset calls to flag?

- •UBS VIEW

- •EVIDENCE

- •WHAT'S PRICED IN?

- •Emerging EMEA Outlook

- •Key global factors for EMEA

- •Emerging EMEA Growth outlook: faltering in 2019, with some rebound in 2020

- •Key regional themes

- •Russia

- •Turkey

- •South Africa

- •Poland

- •Czech Republic

- •Hungary

- •Greece

- •United Arab Emirates

- •Kazakhstan

- •Ukraine

- •Valuation Method and Risk Statement

vk.com/id446425943

Poland

•GDP growth is likely to cool from a red-hot pace to just above potential, as domestic demand remains firm in the face of slowing external demand.

•Inflation slightly below target gives the NBP room to wait until after the ECB starts to lift the depo rate to tighten policy, likely in 2020.

GDP growth again looks on track to outperform our 2018 forecast thanks to a very strong H1 2018. But with the activity data less bubbly in Q3 and manufacturing PMIs signalling falling export demand for the industry, it looks like our expectations of a moderation in growth going forward are getting confirmed. We have revised our 2018 GDP forecast from 4.5% to 4.7%, and forecast GDP to expand by 3.8% in 2019 (unchanged) and 3.6% in 2020. Two important observations: first, the Eurozone has turned from a tailwind to a drag on growth, so this is even more a domestic demand story now. Second, GDP should still be growing at above potential rate until late 2020, implying that the output gap should stay positive.

After picking up rapidly in late 2017, wage growth has stabilised around 7% y/y recently (though the NBP pointed to improvement in non-wage working conditions). The inflow of foreign migration helped to ease the pressure on the labour market (and perhaps offset the impact of lowering the retirement age). With the unemployment rate down to 3.7% in Q2 2018, we expect some further acceleration in wage growth to 8-9% by 2020 as the labour market tightens further and shortages of skilled workers become more evident. The upside is that real wage growth is likely to stay in a 5-6% range, boosting consumption growth even in the absence of further fiscal stimulus. Thus we expect private consumption to cool only slightly to 3.8-3.7% in 2019-20 from 4.3% in 2018.

EU funds inflows have picked up in recent quarters but the bulk of the EU fund inflows under the 2014-2020 is still ahead. On EC data, of the total EUR104.9bn of structural funds (of which EUR 86.1bn is EU funding), only 17% has been actually spent, although 62% has been approved for projects. This non-cyclical factor should provide support for investment and GDP growth, as well as for the balance of payments. Thus we view the slowdown in fixed investment to 4.5% y/y in Q2'18 as temporary (although it will drag down the annual figure) and forecast a pick-up in investment growth closer to 6% in 2019-20.

Despite higher wage growth, core inflation does not yet show convincing signs of a pick-up: at 0.8%y/y in October it is the same as a year ago. As higher wage costs feed through, we expect core inflation to rise above 2.5% in 2020, but have to acknowledge that so far the effect of costlier labour has been mainly restricted to a relatively narrow group of non-regulated service prices. Even then, overall inflation pressures are likely to remain moderate: we forecast headline inflation to average 2.1% in 2019 and 2.3% in 2020. Low inflation in the Eurozone limits the imported inflation pressure. The UBS assumption of flat to slightly declining oil prices and EUR appreciation implies a drag from fuel inflation throughout most of 2019-20, although the contribution from housing energy will likely turn positive. Food inflation will also likely continue to decline until early 2019 on base effects.

Against the backdrop of very moderate inflation pressure, we expect the National Bank of Poland to retain the current accommodative stance until two conditions are met: 1) domestic inflation rises to the 2.5% target (in a sustainable way, as the NBP has in the past overlooked temporary inflation spikes above 2.5%y/y due to

After a stellar H1 2018, weaker Q3 data confirms our expectations of slower growth: we forecast 3.8% in 2019 and 3.6% in 2020

Labour market remains tight, boosting private consumption growth

EU fund inflows should continue to support investment and balance of payments

Inflation to stay in a 2-2.5% range as lower non-core inflation offsets the projected rise in core inflation pressures

NBP likely to wait until after ECB starts lifting rates to tighten policy

EMEA Economic Perspectives 9 November 2018 |

29 |

vk.com/id446425943

fuel prices; and 2) the ECB starts to lift policy rates. In the light of the soft recent data, UBS Eurozone economists pushed out the timing of the first ECB deposit rate hike from September to December 2019. Thus we move our first hike to Q1 2020 from Nov 2019. This is somewhat more dovish then the current market pricing, as FRAs price in almost a full 25 bps hike in 12 months. We expect the NBP to lift the policy rate by a cumulative 50 bps to 2.0% by the end of 2020.

We are mildly constructive on the EURPLN, forecasting it to appreciate to 4.2 by end-2019 (4.1 previously) and to 4.1 by end-2020. Our house view of a stronger EUR in 2019-2020 will likely be supportive for the CE3 currencies. We expect only a very gradual widening of the current account deficit to 1% of GDP by 2020, and the net FDI inflows have rebounded recently. However, as we expect the NBP hikes to lag ECB in 2020, this will likely limit the scope for the PLN appreciation.

With about a year left until general elections, the ruling Law and Justice (PIS) party has maintained a lead in the opinion polls over the main opposition party Civic Platform (PO). In local elections in October 2018 the PIS made gains in regional assemblies, although it has conceded several big city mayoralties, including Warsaw, to the opposition coalition of PO and Nowoczesna. On current polls, the PIS has a high chance to retain its outright majority in the Sejm but will likely fall short of the constitutional 2/3 majority of the seats. The PIS confrontation with the EC on a several fronts (judiciary, migration, EU budget, foreign media ownership) has so far made little impact on the financial markets or real economy. Out of these, the EU 2021-27 budget negotiations (which we expect to stretch beyond the EU Parliament elections next May) are arguably the most important economically. The EC proposals to cut CAP and cohesion policy funds and change the criteria for the latter imply a shift of funding from CEE towards Southern Europe. With Poland being the largest recipient of EU funds in current budget and having a big agricultural sector, the government strongly opposes these plans.

On the fiscal side, the PIS government managed to combine a social welfare agenda with an exceptionally strong fiscal performance, thanks to a robust economy and improved tax collection. The budget is again on track to have a smaller-than-expected deficit of 0.8% of GDP this year. A good fiscal track record prompted a one-notch sovereign credit rating upgrade from S&P to A-, reversing a downgrade made two years ago. As growth slows, co-financing of EU projects picks up, and assuming some fiscal slippage around elections, we expect the deficit to widen to 1.6%-1.9% of GDP in 2019-20, still comfortably below the Excessive Deficit Procedure (EDP) limit. Public debt to GDP has likely fallen below 50% of GDP already in 2018 and we expect solid nominal GDP growth to keep the ratio below 50% in 2019-20 despite some widening in the deficit.

PLN – we are constructive but NBP dovishness will likely limit scope for appreciation vs EUR

Polls suggest PIS will stay in power in 2019 elections; negotiations over EU budget will be in focus

Strong growth helped to bring government deficit to below 1% of GDP and we expect it to stay below 2% despite elections next year

EMEA Economic Perspectives 9 November 2018 |

30 |

vk.com/id446425943

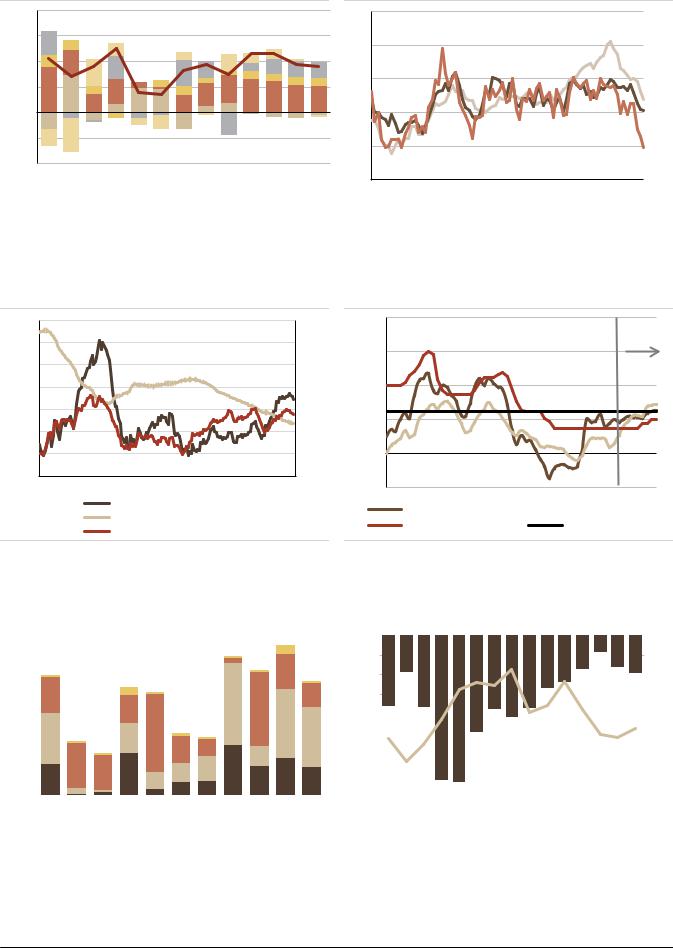

Figure 52: Domestic demand to drive growth in 2019-20 |

Figure 53: Manufacturing PMIs deteriorated recently |

8.0 |

contribution |

|

|

|

|

65 |

Index, sa, |

|

|

|

|

|

|

|

|

Manufacturing PMI |

|||

6.0 |

to GDP |

|

|

|

|

|

|

50+=expans |

|

|

|

|

|

|

60 |

|

|||

|

growth , pp |

|

|

|

|

ion |

|

||

4.0 |

|

|

|

|

|

|

|

|

|

2.0 |

|

|

|

|

|

|

55 |

|

|

|

|

|

|

|

|

|

|

|

|

0.0 |

|

|

|

|

|

|

50 |

|

|

-2.0 |

|

|

|

|

|

|

45 |

|

|

|

|

|

|

|

|

|

|

|

|

-4.0 |

|

|

|

|

|

|

|

|

|

2008 |

2010 |

2012 |

2014 |

2016 |

2018F |

2020F |

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net exports |

|

Private consumption |

|

Jan-12 Jan-13 Jan-14 |

Jan-15 |

Jan-16 Jan-17 Jan-18 |

||||||

|

|

|

|

|||||||||||

|

|

|

|

|||||||||||

|

|

Public consumption |

|

GFCF |

|

|

|

Euro Area |

|

|

PL |

|

PL: New export orders |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Inventories |

|

|

GDP |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: Statistics Poland, Haver, UBS |

|

|

|

Source: IHS Markit, Haver, UBS |

|

|

|

|

||||||

Figure 54: Unemployment rate and wage growth Figure 55: Inflation forecasted to stay in 2-2.5% range

14% |

y/y, 3m MA |

|

|

|

|

|

|

|

|

|

|

20% |

8.0 |

||

12% |

|

|

|

|

|

|

|

|

|

% |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

15% |

6.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

10% |

4.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

5% |

2.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

-5% |

(2.0) |

05 |

06 |

07 |

08 |

09 |

10 |

11 |

12 |

13 |

14 |

15 |

16 |

17 |

18 |

|

|

Nominal wage growth

Unemployment rate, right axis

Real wage growth

%y/y |

|

|

|

|

|

|

|

|

|

|

|

UBS forecast |

||

06 |

07 |

08 |

09 |

10 |

11 |

12 |

13 |

14 |

15 |

16 |

17 |

18 |

19 |

20 |

CPI |

|

CPI ex food and energy |

|

||

Reference rate, % |

|

NBP target |

Source: Eurostat, Haver, UBS Source: Haver, UBS

Figure 56: EU funds inflows pick up in 2018 |

|

|

|

|

|

|

|

Figure 57: Government budget balance and debt |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60 |

|||

EUR bn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

4.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

55 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

3.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of GDP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

|

|

2006 |

2008 |

2010 |

2012 |

2014 |

2016 |

2018F |

2020F |

||||||||||||||||||||||||||||||||||

|

2016 2016 2016 2016 2017 2017 2017 2017 2018 2018 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Budget balance (% of GDP) |

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

Cohesion fund |

|

|

Structural fund |

|

|

|

Agriculture |

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Public debt (% of GDP), r.s. |

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Source: Ministry of Finance, Haver, UBS |

|

|

|

|

|

|

|

|

|

|

|

|

Source: EC, Haver, UBS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

EMEA Economic Perspectives 9 November 2018 |

31 |

vk.com/id446425943

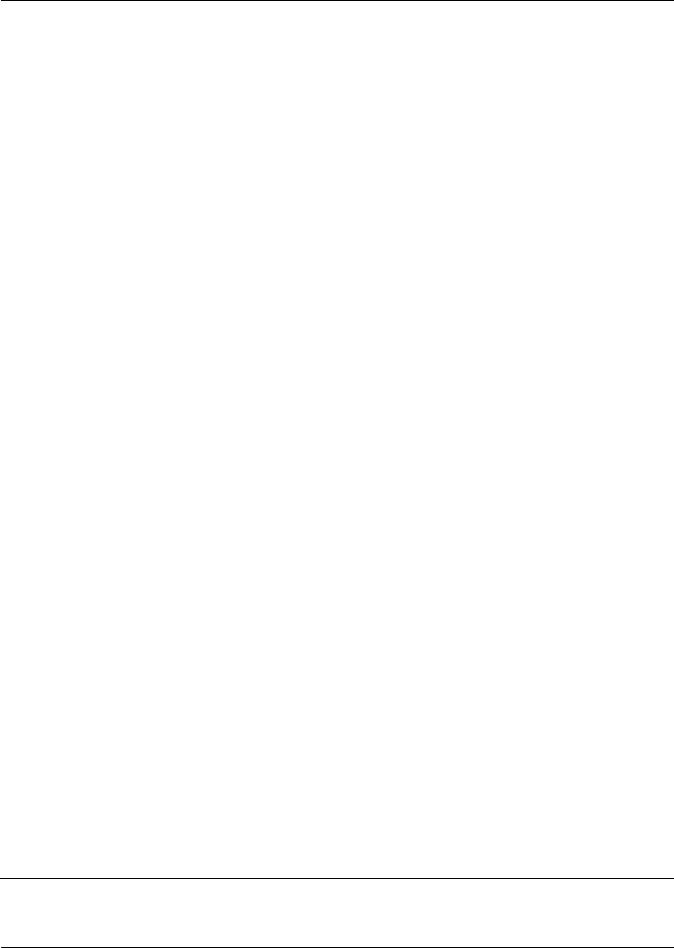

Figure 58: POLAND

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018F |

2019F |

2020F |

|

|

|

|

|

|

|

|

|

Economic Activity and Employment |

|

|

|

|

|

|

|

|

GDP, local currency bn |

1657 |

1720 |

1799 |

1858 |

1982 |

2111 |

2237 |

2372 |

GDP, USD bn |

524 |

545 |

477 |

471 |

525 |

588 |

630 |

724 |

GDP per capita, USD |

13773 |

14343 |

12551 |

12405 |

13815 |

15471 |

16606 |

19083 |

Real GDP growth, % |

1.4 |

3.3 |

3.8 |

3.0 |

4.6 |

4.7 |

3.8 |

3.6 |

Private consumption, % y/y |

0.3 |

2.6 |

3.0 |

3.9 |

4.8 |

4.3 |

3.8 |

3.7 |

Government consumption, % y/y |

2.5 |

4.1 |

2.4 |

1.8 |

3.4 |

3.6 |

3.9 |

3.6 |

Gross Fixed Capital formation, % y/y |

-1.1 |

10.0 |

6.1 |

-8.2 |

3.4 |

6.1 |

6.3 |

5.7 |

Exports, % y/y |

6.1 |

6.7 |

7.7 |

8.8 |

8.2 |

4.6 |

5.0 |

4.6 |

Imports, % y/y |

1.7 |

10.0 |

6.6 |

7.6 |

8.7 |

5.4 |

5.9 |

5.2 |

Unemployment rate, % (avg) |

10.3 |

9.0 |

7.5 |

6.2 |

4.9 |

3.6 |

3.4 |

3.3 |

Industrial Production (%) |

2.3 |

3.4 |

4.8 |

2.9 |

6.5 |

5.4 |

3.9 |

3.5 |

Prices, interest rates and money |

|

|

|

|

|

|

|

|

CPI inflation, % y/y (average) |

0.9 |

0.0 |

-0.9 |

-0.6 |

2.0 |

1.8 |

2.1 |

2.3 |

CPI inflation, % y/y (year-end) |

0.7 |

-1.0 |

-0.5 |

0.8 |

2.1 |

1.8 |

2.1 |

2.5 |

Broad money M2, % y/y (end-year) |

6.7 |

8.8 |

9.6 |

9.7 |

4.5 |

8.0 |

8.0 |

7.0 |

Domestic private credit, % y/y |

3.3 |

5.8 |

7.1 |

5.3 |

3.1 |

5.5 |

5.0 |

5.0 |

Domestic bank credit/GDP |

54.7 |

55.5 |

56.6 |

57.6 |

55.7 |

55.1 |

54.6 |

54.1 |

Reference rate, % (end-year) |

2.50 |

2.00 |

1.50 |

1.50 |

1.50 |

1.50 |

1.50 |

2.00 |

10 year bond yield, % (year-end) |

4.17 |

2.46 |

2.78 |

3.62 |

3.45 |

3.34 |

3.70 |

3.90 |

USD/PLN (year-end) |

3.0 |

3.5 |

3.9 |

4.2 |

3.5 |

3.7 |

3.4 |

3.2 |

EUR/PLN (year-end) |

4.15 |

4.26 |

4.26 |

4.42 |

4.17 |

4.25 |

4.20 |

4.10 |

Fiscal accounts |

|

|

|

|

|

|

|

|

General government budget balance, % GDP |

-4.1 |

-3.6 |

-2.6 |

-2.3 |

-1.7 |

-0.8 |

-1.6 |

-1.9 |

Revenue, % GDP |

38.4 |

38.6 |

38.9 |

38.8 |

39.6 |

40.3 |

40.5 |

40.5 |

Expenditure, % GDP |

42.5 |

42.3 |

41.6 |

41.1 |

41.2 |

41.1 |

42.0 |

42.4 |

of which interest expenditure, % GDP |

2.5 |

1.9 |

1.8 |

1.7 |

1.6 |

1.5 |

1.3 |

1.3 |

Primary balance, % GDP |

-1.6 |

-1.7 |

-0.9 |

-0.6 |

-0.1 |

0.6 |

-0.3 |

-0.6 |

Public sector debt (gross, ESA2010),% GDP |

55.7 |

50.3 |

51.1 |

54.2 |

50.6 |

47.5 |

47.1 |

48.3 |

of which domestic public debt, % GDP |

39.5 |

33.3 |

34.1 |

36.1 |

35.5 |

34.1 |

34.2 |

36.2 |

of which external public debt,% GDP |

16.2 |

17.0 |

17.1 |

18.0 |

15.1 |

13.3 |

12.8 |

12.1 |

% domestic public debt held by non-residents |

33.6 |

39.8 |

39.5 |

32.8 |

32.6 |

29.0 |

28.0 |

27.0 |

Public debt held by the central bank, % GDP |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

Balance of payments |

|

|

|

|

|

|

|

|

Trade balance, USD bn |

-0.4 |

-4.3 |

2.5 |

3.3 |

1.5 |

-3.5 |

-8.0 |

-12.1 |

Exports, USD bn |

198.1 |

210.7 |

191.1 |

196.5 |

228.2 |

250.6 |

265.4 |

296.8 |

Imports, USD bn |

198.5 |

215.0 |

188.6 |

193.2 |

226.6 |

254.1 |

273.4 |

308.9 |

Current account balance, USD bn |

-6.7 |

-11.4 |

-2.7 |

-2.5 |

0.5 |

-1.7 |

-3.8 |

-7.1 |

as % of GDP |

-1.3 |

-2.1 |

-0.6 |

-0.5 |

0.1 |

-0.3 |

-0.6 |

-1.0 |

Foreign direct investment (net), USD bn |

4.1 |

13.1 |

10.2 |

4.7 |

6.3 |

12.0 |

12.0 |

10.0 |

Total FX reserves, USD bn |

106.2 |

100.4 |

94.9 |

114.4 |

113.3 |

112.7 |

123.0 |

130.0 |

Foreign exchange reserves excl gold, USD bn |

102.6 |

95.8 |

89.7 |

108.9 |

109.3 |

108.7 |

119.0 |

126.0 |

Total FX reserves, % GDP |

20.3 |

18.4 |

19.9 |

24.3 |

21.6 |

19.2 |

19.5 |

18.0 |

Total external debt, % GDP |

73.3 |

65.4 |

69.4 |

72.2 |

72.8 |

62.0 |

60.0 |

58.0 |

Net International Investment Position, % GDP |

-68.9 |

-69.1 |

-62.1 |

-61.7 |

-61.2 |

-57.8 |

-55.1 |

-52.9 |

Credit ratings |

|

|

|

|

|

|

|

|

Moody's |

A2 |

A2 |

A2 |

A2 (n) |

A2 (st) |

A2 (st) |

n/a |

n/a |

S&P |

A- |

A- |

A- |

BBB+ (st) |

BBB+ (st) |

A- (st) |

n/a |

n/a |

Fitch |

A- |

A- |

A- |

A- (st) |

A- (st) |

A- (st) |

n/a |

n/a |

Source: NBP, Finance Ministry, GUS, IMF, Haver, Bloomberg, UBS estimates

EMEA Economic Perspectives 9 November 2018 |

32 |