- •Price and output determination under the perfect competition. Profit maximization under perfect competition. Firms behavior under perfect competition.

- •Basic characteristics of perfect competition.

- •T otal notions approach to profit max of a firm.

- •A verage and marginal notions approach to profit max of a firm.

- •The behavior of the firm under perfect competition.

- •Equilibrium of the firm in the lr.

- •Profit maximization under monopoly.

- •Monopoly:

- •Dem. And mr of the monopolistic firm.

- •The behavior of the firm under perfect competition.

- •Last week was said!!!

- •Equilibrium of the firm in the lr.

- •Profit maximization under monopoly.

- •Monopoly:

- •Dem. And mr of the monopolistic firm.

- •Oligopoly.

- •The basic characteristics of an oligopoly:

- •Explicit collusions:

- •Rules of thumb models.

- •Kinked d-curve. Assumptions:

- •Maximax strategy (optimistic approach). Ex:

- •Cournot model / duopoly (2 firms in industry) 1830s.

- •Isoprofit curve and the reaction function of firm 2.

- •Isoprofit curve and the reaction function of firm 2.

- •Market equilibrium in different market structures.

- •Algebraic explanation of the Cournot model.

- •Stackelberg model (quantity leadership model).

- •Contestable markets model.

- •Oligopoly and public.

- •Monopolistic competition.

- •Major characteristics:

- •Lr equilibrium

- •Minuses”-”.

- •Derived dem. For ec. Resources.

- •Equilibrium of the firm on the resource market.

- •Sr equilibrium:

- •Lr equilibrium(all factors are variable):

- •Wage determination under Perfect competition.

- •Wage determination under imperfect competition.

- •The theory of distribution of income II. Capital(k) and Land.

- •Concepts of capital.

- •Measuring k.

- •How does the firm invest?

- •Sell bills/bonds to the households.

- •Sr rentals include:

- •Demand and Supply for k purchase.

- •Fairness and effectiveness

- •Inequality in income and wealth distribution

- •Distr. Of income and wealth characteristics:

- •Pareto efficiency and Edgeworth box.

- •Edgeworth box

- •Pareto efficiency allocation:

- •P rinciple possibility of losses compensation.Icks

- •There are positive and negative external effects, divided into 4 groups:

- •Taxes (Pigourian taxes)

- •Sell the right to pollute for example.

- •Public goods –

A maximin strategy (pessimistic approach). Assumes that the expectation will do the worst thing for the person in question. EX:

person A analyses the strategy to confess and sees that if B confesses A will get either 10 or 5 years.

If he expects B not to confess A will have 1 year or be free.

Of 2 bad outcomes A chooses the best – 5 years – to confess

The same for B – the least bad – 5 years.

They are in lower right corner.

Maximax strategy (optimistic approach). Ex:

A expects that B will do the best possible thing for A.

They meet once more in the same corner.

Given the behavior of the rival the person can do no better.

Hash equilibrium (low-right corner).

Cournot model / duopoly (2 firms in industry) 1830s.

We assume that 2 firms are identical and can’t collude.

Initially there is only 1 firm in the market and a new one enters. The new one decreases the price => it sells a certain output.

The existing firm takes these price and output as given and the only thing it can do is to ↓ price and output. The new firm in turn ↓ price again and ↑ output. The old firm again takes it as given and ↓ output.

N ew

firm

aggressive style, old one retreats. Equilibrium

when both firms have equal market share

– Cournot equilibrium.

ew

firm

aggressive style, old one retreats. Equilibrium

when both firms have equal market share

– Cournot equilibrium.

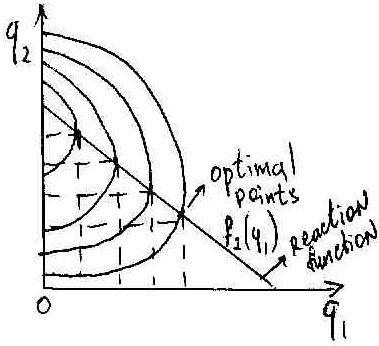

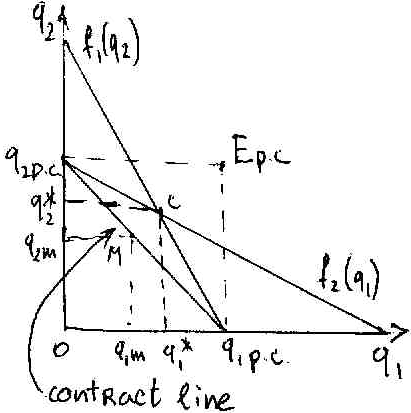

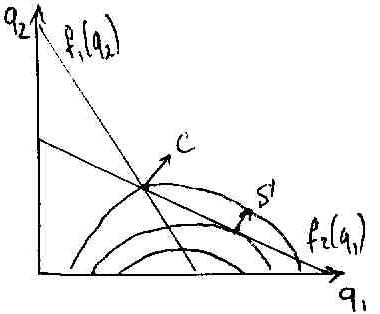

Reaction function – the set of tangent (optimal) points.

Isoprofit curve – shows all the combinations of the 2 firms that yield the same level of profit to one of the firms.

Isoprofit curve and the reaction function of firm 2.

Profit ↑ as we move left.

As we move left output of firm 1 = 0 => firm 2 – monopolist.

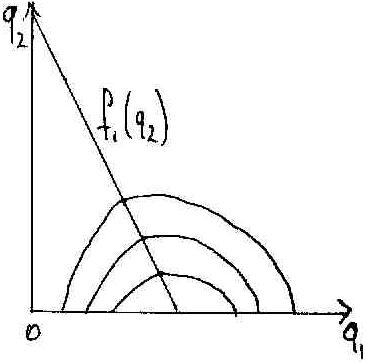

Isoprofit curve and the reaction function of firm 2.

Profit ↑ as we move d

own.

own.As we move down, the firm 2’s output = 0=> firm 1 – monopolist.

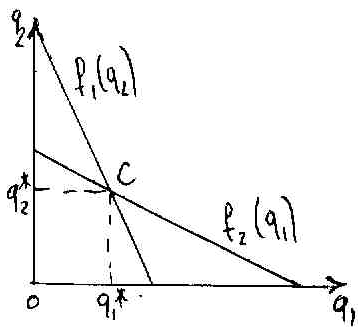

Cournot equilibrium.

Optimum q2 for F2 will be the function of beliefs concerning the output of F1.

C – point when the market is shared – cournot equilibrium.

- optimum choices.

- optimum choices.

Market equilibrium in different market structures.

C

– Cournot equilibrium.

– Cournot equilibrium.Contract line – firms collude and become a monopoly.

Output under monopoly<Output under duopoly<Output under perfect competition.

The final output of the industry and of two firms is now the lowest.

Algebraic explanation of the Cournot model.

![]()

|

![]()

|![]()

If the costs are intro into the analysis the equilibrium quantities and output will be:

Stackelberg model (quantity leadership model).

2 firms are considered, but not identical. Firm1 is a leader, a dominant one, Firm2 – follower, who builds up the strategy according to the behavior of Firm1. Firm2 has a reaction function.

The leader doesn’t react to the steps of the Firm2. But he recognizes that it reacts to his behavior.

![]() For the leader there won’t be a reaction

function:

For the leader there won’t be a reaction

function:

w

e

shall combine reaction function of Firm2 with isoprofit of Firm1.

e

shall combine reaction function of Firm2 with isoprofit of Firm1.Firm1 dominates, Firm2 reacts, at point S both MAX their profits.

In Stackelberg model the market is not equally shared. Dominant produce more and have more power, the second produces less. Firm1 – leader in Q.

Contestable markets model.

If the costs of entry to an industry and exit from industry are very low, then there is always a high possibility of the numerous new firms appearance on the market. The market will lose its oligopolistic structure and will become competitive.