- •Price and output determination under the perfect competition. Profit maximization under perfect competition. Firms behavior under perfect competition.

- •Basic characteristics of perfect competition.

- •T otal notions approach to profit max of a firm.

- •A verage and marginal notions approach to profit max of a firm.

- •The behavior of the firm under perfect competition.

- •Equilibrium of the firm in the lr.

- •Profit maximization under monopoly.

- •Monopoly:

- •Dem. And mr of the monopolistic firm.

- •The behavior of the firm under perfect competition.

- •Last week was said!!!

- •Equilibrium of the firm in the lr.

- •Profit maximization under monopoly.

- •Monopoly:

- •Dem. And mr of the monopolistic firm.

- •Oligopoly.

- •The basic characteristics of an oligopoly:

- •Explicit collusions:

- •Rules of thumb models.

- •Kinked d-curve. Assumptions:

- •Maximax strategy (optimistic approach). Ex:

- •Cournot model / duopoly (2 firms in industry) 1830s.

- •Isoprofit curve and the reaction function of firm 2.

- •Isoprofit curve and the reaction function of firm 2.

- •Market equilibrium in different market structures.

- •Algebraic explanation of the Cournot model.

- •Stackelberg model (quantity leadership model).

- •Contestable markets model.

- •Oligopoly and public.

- •Monopolistic competition.

- •Major characteristics:

- •Lr equilibrium

- •Minuses”-”.

- •Derived dem. For ec. Resources.

- •Equilibrium of the firm on the resource market.

- •Sr equilibrium:

- •Lr equilibrium(all factors are variable):

- •Wage determination under Perfect competition.

- •Wage determination under imperfect competition.

- •The theory of distribution of income II. Capital(k) and Land.

- •Concepts of capital.

- •Measuring k.

- •How does the firm invest?

- •Sell bills/bonds to the households.

- •Sr rentals include:

- •Demand and Supply for k purchase.

- •Fairness and effectiveness

- •Inequality in income and wealth distribution

- •Distr. Of income and wealth characteristics:

- •Pareto efficiency and Edgeworth box.

- •Edgeworth box

- •Pareto efficiency allocation:

- •P rinciple possibility of losses compensation.Icks

- •There are positive and negative external effects, divided into 4 groups:

- •Taxes (Pigourian taxes)

- •Sell the right to pollute for example.

- •Public goods –

Derived dem. For ec. Resources.

Dem. for ec. rsources depends upon:

The dem. for good produced with this resource

The price of the good

Productivity of the resource(productivity↑ demand↑)

Prices of other resources(complementary and substitute)

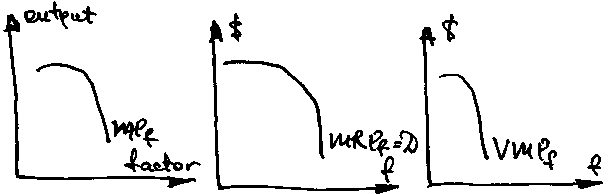

Results of the usage of one additional unit of a factor:

additional product(MPf – marg. product of a factor)

add. revenue((marg. revenue product of a factor)MRPf = MR * MPf)

add. value((value of marg. product of a factor)VMPf = Pgood * MPf)

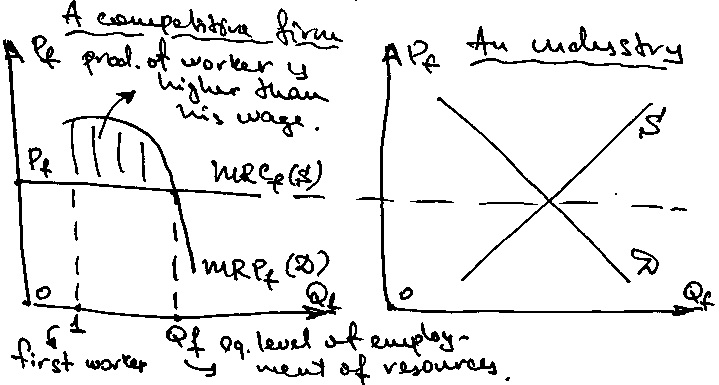

!!! In perf. competition Pgood = MR, so MRPf = VMPf

!!! Under imperfect compet. P > MR, so VMPf > MRPf

Equilibrium of the firm on the resource market.

Sr equilibrium:

In

the SR a firm confronts the law of diminishing marg. productivity

of a variable factor.

In

the SR a firm confronts the law of diminishing marg. productivity

of a variable factor.MRC – marg. revenue cost – the cost of employing on more unit of a var. factor.

MC – marg. cost – cost of producing of one more unit of a product.

The dem. for resources will be realized by the firm until MRPf ≥ MRCf, and equilibrium MRPf = MRCf

If we assume a perf. compet. market structure . MRCf = Pf a firm is a price-tajer price of hiring a new worker will be equal to the av. market wage.

MRCf = Pf – eq. rule for perfectly comp. markets.

!!! (Neo)Classical schools used this theory to conclude that owners of resources are awarded according to the MProductivity of resources.

Lr equilibrium(all factors are variable):

Two or more factors can be used; all the units of labor and cap. are identical

Both factors are substitutes and compliments(used together)

Substitution and output effects of a price change.

Assume(L,K - factors):

Pk↑

Costs↑ Output↓ DL↓ and QDk↓ - output effect

Labour relative costs↓, though DL↑; DK↓ PL=const – substitution effect

!!! Both effects are negative(P↑ Q↓)

!!! Cross-effects work in the opposite direction(разные изменения от одного)

!!! In some cases factors are complement no substitution effect(only output(scale) effect)

![]() -- cost min. rule

-- cost min. rule

![]() -- Profit maximization rule(eq. in LR)

-- Profit maximization rule(eq. in LR)

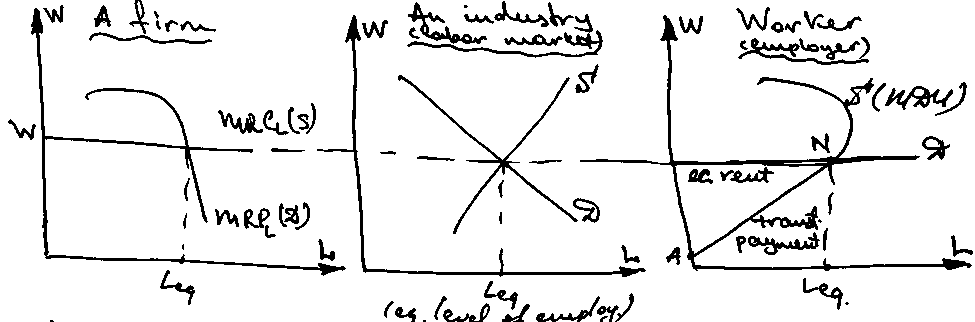

Wage determination under Perfect competition.

Transfer payments – shows at what levels of the wages workers are willing and able to be at the labor market.

MDU↑(marg. disutility of labour) P↑ to compensate disutility

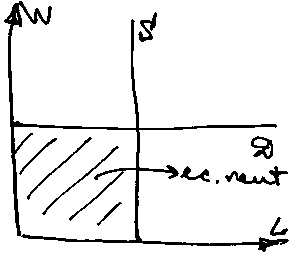

Economic

rent – the difference between the

current market wage rate and the transfer payments.

Economic

rent – the difference between the

current market wage rate and the transfer payments.For absolutely unique worker all the earnings are economic rent.

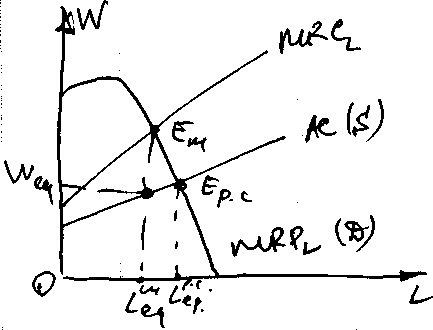

Wage determination under imperfect competition.

Monopsony – monopoly of an employer on the market.

To attract more workers W↑ to all the workers.

!!! As there is no competition between employers W will be as low as possible.

![]()

Conclusion: Monopsony underemployes and underpays to workers.

The theory of distribution of income II. Capital(k) and Land.

Concepts of capital.

Marx: K is the industrial (economic) relation between the worker/owner. This relation can be presented in different forms (equipment, labor force, goods produces, etc).

Classical/Neoclassical: K is identified with manufacture goods used to produce final G/S.

Modern Economists: recognize different forms of K. It can be:

Tangible |

Intangible |

Equipment, residential structures, non-residential structures, inventories of inputs/outputs…. |

Human K (investments in education, training, etc), R/D, goodwill of the firm…. |

K yields valuable productive services over time. It is used to produce final G/S.