SpeakingOilGas

.pdfwhich yield more of the lower value products like fuel oils. Therefore light sweet crude oils, such as Gippsland (Bass Strait, Victoria) and Cossack (offshore Western Australia) which yield lots of transport fuels, are valued higher than the heavier sourer crudes from the Middle East which contain more fuel oil and residues and also more contaminants, such as sulphur and nitrogen.

Oil and condensate can be sold on the spot market (in which cargoes are priced individually at the market rate at the time of sale) or on term contracts (where shipments of a particular crude are contracted and sold to one buyer or group of buyers for a fixed term at a negotiated price set at a differential to the floating price of a bench mark crude).

In fact, crude oil can be priced, bought and sold anywhere along its supply chain from the point of loading, through the transportation period and the refining process to the individual end products stage. The end buyer of crude and condensate is the refiner, but a shipment can be bought and on-sold by oil traders or intermediaries before the physical crude shipment reaches the refinery. Oil producers must be able to sell their crude oil otherwise their storage will fill up (tank tops) and they will be forced to shut in production, which is a very costly process. At times when demand for crude is less than the supply available, producers find themselves in this predicament and therefore oil shipments that are unsold become known as distressed cargoes. To make a sale, the producer or trader must take a loss on the deal.

During the 1980s the practice of forward selling crude and condensate became a significant marketing strategy and established a futures market in the commodity. This involves producers offering crude for sale which they will not produce from their fields for several months or more, giving rise to the term paper crude.

Buyers (refiners or traders) negotiate a price which they believe will be competitive when the physical crude is available. This involves a degree of risk-taking and judgment about future world crude prices. The practice is known as hedging. The price that producers and buyers negotiate may prove

116 |

SPEAKING OIL & GAS |

MARKETING & PRICING TAXATION,

Boiling Point |

-200 |

-10 0 |

|

30 |

|

|

150 200 |

250 |

|

|

|

|

350 380 |

|

520 |

|

|

|

|

|

1000+ |

|

||||||||||||||||||||||||||||||||||||

Range ˚C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General |

|

|

|

Gases |

|

|

|

|

|

|

|

|

|

|

Light |

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

|

|

|

|

|

Heavy |

|

|

|

|

|

Residue |

|

|

|

||||||||||||

Classification |

|

|

|

|

|

|

|

|

|

|

|

|

|

Fraction |

|

|

|

|

|

|

|

|

|

|

|

Fraction |

|

|

|

|

|

|

|

Fraction |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gases |

|

|

|

|

|

|

|

|

|

|

|

|

Gasolines |

|

|

|

|

|

|

|

|

|

|

|

|

|

Fuel |

|

|

|

|

|

Asphaltenes |

|

|

|

|

|||||||||||||||||

|

dry |

|

|

|

wet |

|

|

light |

|

|

|

|

heavy |

|

|

|

|

|

|

|

|

Oils |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Main Components |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gas Oils |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LPG |

|

|

|

|

|

|

|

|

Kerosenes |

|

|

|

|

|

|

|

|

Lubricating Oils |

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Naphthas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hydrocarbon |

|

|

|

C4 and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Range |

|

|

|

lower |

|

Pentane Plus |

|

|

|

|

|

|

|

|

|

|

|

|

Liquid |

|

|

|

|

|

|

|

|

|

|

|

|

Solid |

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

C1 |

|

|

|

|

C4 |

C5 |

|

C8 |

|

|

|

|

C14 |

|

|

C16 |

|

|

|

|

|

|

|

|

C60 |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

US Bureau of Mines |

Paraffinic – Paraffinic |

|

Paraffinic – Naphthenic |

|

Naphthenic – Paraffinic |

|

|

Naphthenic – Naphthenic |

||||||||||||||||||||||||||||||||||||||||||||||||||

Correlation Index |

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Base Classification |

Paraffinic (Light) |

|

|

|

Mixed (Aromatic) |

|

|

|

|

|

|

|

|

|

|

|

|

Naphthenic (Heavy) |

Asphaltic |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Typical API |

|

|

|

38˚–47˚ |

|

|

|

|

|

|

|

|

37˚–30˚ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25˚–15˚ |

|

|

|

||||||||||||||||||||||

Gravity Range |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specific Gravity |

|

|

|

0.835–0.800 |

|

|

|

|

|

|

0.840–0.876 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.900–0.970 |

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: The classifications shown in this table are intended to be representative, and no precise demarcations are implied

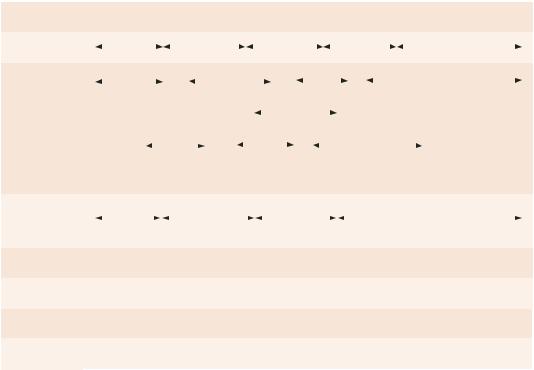

components its and oil crude of cationClassifi

117

to be above or below the world price at the time of physical production of the crude. Either way the hedging deal guarantees sale for some or all of a producer’s production — which is particularly important for small producers who want to safeguard an income stream in times of volatile world prices

— while refiners are guaranteed the most suitable crude for their needs well in advance. Both parties are able to plan their corporate future with a greater degree of certainty.

Natural gas

Natural gas leaving a treatment facility to be sold into the retail market (sales gas) usually has strict specifications in terms of its content that are demanded by the buyer. The gas is virtually 100 per cent methane, but there are traces of other compounds. The specifications set limitations (in parts per million) on the amounts of these other ingredients, such as ethane, propane, butane and inert gases like nitrogen and carbon dioxide. Sometimes higher amounts of ethane, propane and butane are left in the gas if a dedicated industrial customer wants to extract them for their own use.

The price paid for the sales gas by consumers typically comprises four main parts:

•Ex-plant price is the price at which producers sell their gas.

•Transmission cost is the cost of transporting gas to main market centres through high-pressure pipelines, including a return for the pipeline owner.

•Distribution cost is the cost of transporting gas to the end consumer through low-pressure pipelines, including a return for the pipeline owner.

•Retail margin is the margin obtained by the seller of gas.

118 |

SPEAKING OIL & GAS |

Ex-plant price

These prices are set by negotiations between gas producers and gas buyers and are usually controlled by market forces rather than by regulation. Gas buyers may be gas utilities that then on-sell the gas to consumers. Sometimes large gas users buy gas directly from the producers.

Some typical characteristics of gas contracts include:

•Long terms, sometimes 10–20 years.

•Maximum quantity provisions.

•Minimum quantity provisions (‘take or pay’ i.e. buyers contract to take a certain volume and if they don’t, they pay for the contract volume anyway).

•Pricing clauses that enable regular renegotiation of prices between the parties.

•Price arbitration provisions that enable an arbitrator to set a price if buyers and sellers cannot agree at a renegotiation.

Transmission cost

Gas is usually transported from the producing basins to major markets via large diameter, high-pressure pipelines, sometimes referred to as trunk pipelines. In most cases trunk lines represent natural monopolies, i.e. it is not economically efficient to duplicate them and therefore they are often subject to regulation to ensure that monopoly rents are not extracted.

Often there are trunkline access provisions established by regulatory authorities to enable third parties to negotiate access to pipeline transmission systems on fair and reasonable commercial terms. In addition, transmission tariffs are usually approved by the regulator, although the party seeking access is free to accept a set reference tariff or try to negotiate for a lesser transmission fee with the pipeline operator.

TAXATION, PRICING & MARKETING |

119 |

Distribution cost

Typically, gas is transported from the point where the high-pressure line ends (often referred to as the city gate) to individual gas users via a grid of low-pressure pipelines referred to as a distribution system. As with trunk pipelines, distribution systems are usually natural monopolies, although there may be several different distributors serving different sectors of a city or metropolitan area. Again this area is often subject to regulation.

Retail margin

Usually consumers buy gas from a retail company, often privately owned and competing with other gas retailers. (The exception may be a large customer able to buy its gas direct from the producer). Retailers charge a margin which is calculated as a percentage of the sum of the wholesale price of gas plus network charges that include transmission and distribution charges, as well as the cost of metering individual consumers.

Liquefied natural gas (LNG)

Most LNG is produced in countries that have large uncommercialised gas reserves with limited domestic market opportunities. The major buyers and end-users of LNG are electric power and gas utility companies in the so-called Pacific and Atlantic Basins. In most cases LNG is an export commodity. The projects are very large and capital intensive involving dedicated gas fields feeding by pipelines into liquefaction facilities on the coast, and special LNG vessels to carry the product to coastal reception terminals in the importing country, where it is re-gasified and used in the same way as pipelined natural gas.

There are exceptions where LNG plants are quite small and built in isolated, inland locations. An example is the plant at Karratha in Western Australia which is fed by gas from the North West Shelf fields. The LNG is taken by special road trains (trucks) to be used for power generation at remote towns such as Derby and Fitzroy Crossing in the Kimberley region of northern Western Australia. However this type of operation is likely to remain a niche application in the total LNG picture.

120 |

SPEAKING OIL & GAS |

Most LNG projects are developed to supply long-term contracts (15–25 years) hence a large quantity of proven gas reserves is required to secure the supply. For instance, an LNG plant built with two processing trains to produce a total of 8 million tonnes of LNG a year will require about 8 trillion cubic feet of proven gas reserves to support the production and delivery of LNG to buyers over a 20 year contract life.

Market place

Globally, LNG is a rapidly growing market, firstly because of continuing Asian demand and secondly because there is now a marked and steady increase in USA and European demand.

In Asia the Japanese (and Korean) market is already large and growing steadily. However it is the demand for LNG in China that is driving the speed and size of new increases in the overall Asian market. This has come about because of environmental problems surrounding China’s traditional use of coal, plus the high cost and difficult logistics of transporting coal and indigenous gas from the country’s west to industrial centres in the east. Hence importing LNG has become a viable option.

The other big growth area is the Atlantic Basin — particularly the east coast and Gulf coast of the USA, but also Europe and notably the UK.

In general the Pacific Basin market (including the USAwest coast) is catered for by Australian/Asian suppliers, while Middle East/African suppliers cater to the Atlantic Basin and the Mediterranean region. Some exceptions to this are a contract negotiated by Yemen to supply Korea and another for Oman to supply Japan. This trend is expected to continue as the LNG market becomes more global. The increasing need for power generation fuel is a large driver for the growth in demand for LNG, especially in the Asian region.

TAXATION, PRICING & MARKETING |

121 |

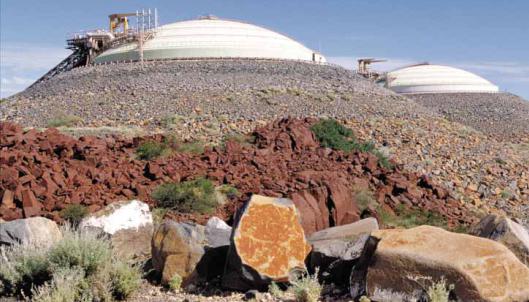

LNG train, North West Shelf Project, Western Australia

Decreasing costs

The real cost of LNG has been falling since the early 1990s. The first LNG carriers had capacities of 125,000 cubic metres and less. Now vessels of 165,000 cubic metres capacity are becoming the norm and some are being built with a capacity up to 220,000 cubic metres. In addition, the capacity of LNG production trains has markedly increased from about 2.7 million tonnes per year in the mid 1980s to 6 million tonnes a year per train today. Overall, the economies of scale that result from these capacity increases have reduced the cost of the LNG product. However, partially offsetting this is the remoteness and/or harshness of the new producing regions such as Sakhalin, a Russian island north of Japan.

Terminals are also becoming cheaper to build because of technological advances, modularisation of components and competition between construction groups. And there is increasing competition on the supply side as more and more players enter the market.

As a consequence LNG can now compete with pipeline gas where the pipeline is more than 1500–2000 kilometres long. For example, in the UK, the Southern North Sea gas fields have depleted to the extent that Britain has become a net importer of gas, but as the country is located at the far end of the European pipeline system, LNG has become a viable competitor for the still growing UK market.

122 |

SPEAKING OIL & GAS |

LNG storage tanks, North West Shelf Project, Western Australia

Another example is the USA. Although there are some pipelines connecting the east and west USA states, the connection is not across the full network. Thus the east and west USA are really two different markets and both can be served, at least in part, by LNG coming in from the Atlantic and Pacific Basins respectively.

Pricing mechanisms

The export price of LNG has historically been linked to the price of crude oil on international markets. In the main north Asian markets, LNG competes with alternative fuels like diesel, naphtha and fuel oil. An oil price marker called the Japan Crude Cocktail (JCC) is used which relates to the average price of crude oil imported into Japan in a particular month. Other factors taken into account in the price formula are the cost of insurance and the freight costs for landing fuels in Japan.

In the USA, UK and Europe the main competitor for LNG is pipeline gas and hence this has become a significant base for LNG price negotiations. There is a need to match the daily market prices of natural gas traded on well known commodity exchanges like the New York Mercantile Exchange (NYMEX).

TAXATION, PRICING & MARKETING |

123 |

‘Northwest Swan’ LNG carrier

LNG price formulae can be fixed for the life of the contract or reviewed periodically by mutual agreement, taking into consideration changing market conditions. There is also a small, but growing spot market in LNG, particularly during periods of peak demand, such as the northern hemisphere winter. The spot market makes up about six per cent of the world LNG trade and some LNG vessels are being built to cater exclusively for it.

LNG can be priced on FOB (free on board) terms where the buyer arranges the shipping, or CIF (cost including freight), sometimes also referred to as ex-ship terms, where the seller provides the transport arrangements. The difference in price between the two arrangements relates to the cost of ocean freight from the loading to the discharge point.

Liquefied Petroleum Gas (LPG)

LPG refers primarily to the two gases, butane and propane. Butane tends to be more associated with oil production while more propane is produced with natural gas. Butane is liquid at a pressure of 4 atmospheres or a temperature of -4 degrees C. Propane is liquid at a pressure of 14 atmospheres or a temperature of -43 degrees C.

124 |

SPEAKING OIL & GAS |

Uses

The primary use of LPG is as an automotive fuel, favoured because it has lower sulphur dioxide and nitrogen oxides than petrol and diesel fuel. Japan is traditionally a large user, although the market there has plateaued in the last few years. Australia is one of the largest users of LPG as an automotive fuel in the world, per head of population. Western Europe is also a major market, largely because of the environmental considerations. Manufacturers are now designing vehicles especially to run on LPG and incorporating the gas cylinders into a fuel tank rather than taking up extra space in the boot.

A secondary use of LPG is as a feedstock for the petrochemical industry and a tertiary use is as an industrial fuel.

There is also domestic use of the commodity in heating and cooking, particularly in regions not served by natural gas. In this sense LPG can be looked upon as a ‘frontier’ commodity that is used in remote areas until the demand becomes high enough to justify construction of natural gas pipelines into the region. In fact, LPG can also be reticulated and, with a few minor adjustments to the hardware (burners etc), the LPG reticulation system can be used when natural gas arrives.

LPG for the leisure market (camping gas) is very strong.

In the USA the LPG mix in a cylinder is generally 90 per cent propane and 10 per cent butane, while in Europe the balance is 80 per cent butane and 20 per cent propane. This preference has to do with the individual properties of the two gases. For instance, propane vapourises at lower temperature than butane and is more suitable for cold weather starts. (As an aside, butane is used for cigarette lighters because it requires very little pressure for the liquid phase.)

In Australia the LPG distributed in cylinders and used for domestic heating and cooling contains a high proportion of propane. Automotive LPG can obtain up to 50 per cent butane with the remainder being predominantly propane under Australian national fuel standard legislation.

TAXATION, PRICING & MARKETING |

125 |