- •Contents

- •Investment summary

- •Reporting schedule

- •Earnings revisions

- •Reporting trends: 2H18E vs 2H17

- •Reporting trends 2H18E vs 1H18

- •Results previews

- •Commodity price and exchange rate forecasts

- •Peer comp charts

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Acron

- •PhosAgro

- •Evraz

- •Disclosures appendix

vk.com/id446425943

NorNickel – BUY

Renaissance Capital

6 February 2019

Metals & Mining

Figure 86: NorNickel, $mn (unless otherwise noted)

NorNickel |

|

GMKN.MM |

|

|

|

Market capitalisation, $mn: |

|

32,778 |

|

|

|

Enterprise value, $mn: |

|

41,310 |

|

|

|

|

|

|

|

|

|

Dec-YE |

2016 |

2017 |

2018E |

2019E |

2020E |

Income statement |

|

|

|

|

|

Revenue |

8,259 |

9,146 |

11,346 |

10,865 |

11,714 |

EBITDA |

3,898 |

3,995 |

5,924 |

5,649 |

6,169 |

EBIT |

3,280 |

3,123 |

5,193 |

4,851 |

5,296 |

Net interest |

-339 |

-458 |

-374 |

-372 |

-461 |

Taxation |

-745 |

-721 |

-957 |

-1,075 |

-1,160 |

Minority interest in profit |

5 |

6 |

-6 |

-103 |

-156 |

Net profit for the year |

2,535 |

2,129 |

3,403 |

3,302 |

3,519 |

Underlying earnings |

2,535 |

2,129 |

3,403 |

3,302 |

3,519 |

Underlying EPS, $ |

1.62 |

1.35 |

2.15 |

2.09 |

2.22 |

Thomson Reuters consensus EPS, $ |

|

|

2.39 |

2.55 |

2.70 |

DPS declared, $ |

1.08 |

1.17 |

2.16 |

2.14 |

2.25 |

Thomson Reuters consensus DPS, $ |

|

######## |

2.08 |

2.17 |

2.50 |

EBIT by division |

|

|

|

|

|

|

|

|

|

|

|

Russia (GMK & KGMK) |

3,524 |

4,299 |

5,904 |

5,451 |

5,706 |

EBIT margin |

55% |

58% |

67% |

65% |

66% |

NN Harjavalta |

17 |

59 |

32 |

-47 |

73 |

EBIT margin |

2% |

7% |

3% |

-5% |

7% |

Other metallurgical |

-11 |

-126 |

68 |

257 |

390 |

EBIT margin |

-157% |

-371% |

24% |

40% |

45% |

Other non-metallurgical |

96 |

91 |

-12 |

5 |

5 |

EBIT margin |

9% |

11% |

-1% |

1% |

1% |

Other |

-285 |

-973 |

-793 |

-815 |

-879 |

Income statement ratios |

|

|

|

|

|

EBITDA margin |

47% |

44% |

52% |

52% |

53% |

EBIT margin |

40% |

34% |

46% |

45% |

45% |

EPS growth |

47% |

-17% |

60% |

-3% |

7% |

Dividend payout ratio |

67% |

87% |

100% |

103% |

101% |

Dividend as % of EBITDA |

44% |

46% |

58% |

60% |

58% |

Input assumptions |

|

|

|

|

|

Nickel, $/t |

9,599 |

10,404 |

13,130 |

11,530 |

14,285 |

Copper, $/t |

4,867 |

6,170 |

6,532 |

6,000 |

6,367 |

Palladium, $/oz |

614 |

871 |

1,030 |

1,216 |

1,088 |

Platinum, $/oz |

988 |

950 |

880 |

870 |

1,070 |

RUB/$ |

67 |

58 |

63 |

67 |

68 |

Unit costs per nickel eq tonne, $ |

6,109 |

8,163 |

7,560 |

7,245 |

7,611 |

Sustaining capex per nickel eq tonne, $ |

814 |

1,187 |

897 |

2,361 |

2,396 |

Production volumes* |

236 |

217 |

219 |

214 |

214 |

Nickel, kt |

|||||

Copper, kt |

360 |

401 |

474 |

481 |

494 |

Palladium, koz |

2,618 |

2,780 |

2,728 |

2,684 |

2,684 |

Platinum, koz |

644 |

670 |

653 |

648 |

648 |

Attributable Cu eq volumes, kt |

1,412 |

1,442 |

1,507 |

1,496 |

1,509 |

Volume growth |

-6% |

2% |

5% |

-1% |

1% |

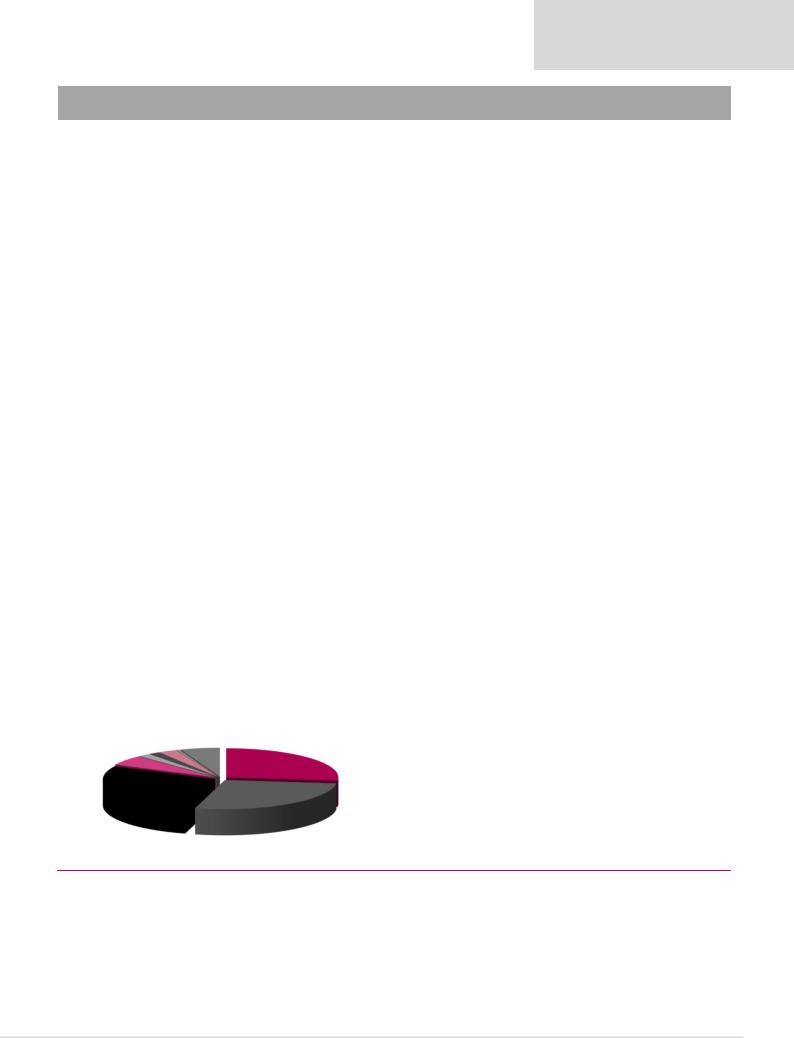

Contribution to 2018E revenue per commodity

|

Target Price, $: |

|

|

24.0 |

|

|

Share price, $: |

|

|

20.8 |

|

|

Potential 12-month return: |

|

26.0% |

||

|

|

|

|

|

|

Dec-YE |

2016 |

2017 |

2018E |

2019E |

2020E |

Balance sheet |

|

|

|

|

|

Net operating assets |

10,299 |

13,581 |

12,337 |

13,836 |

15,431 |

Financial instruments |

198 |

267 |

259 |

259 |

259 |

Equity |

4,986 |

4,333 |

3,876 |

3,794 |

3,758 |

Minority interest |

74 |

331 |

309 |

411 |

567 |

Net debt |

4,530 |

8,201 |

7,466 |

8,896 |

10,323 |

Balance sheet ratios |

|

|

|

|

|

Gearing (net debt/(net debt+equity)) |

47.6% |

65.4% |

65.8% |

70.1% |

73.3% |

Net debt to EBITDA |

1.2x |

2.1x |

1.3x |

1.6x |

1.7x |

RoCE |

37.0% |

28.1% |

40.1% |

37.1% |

36.2% |

RoIC (after tax) |

31.1% |

21.5% |

31.9% |

28.7% |

28.0% |

RoE |

64.0% |

45.7% |

82.9% |

86.1% |

93.2% |

Cash flow statement |

|

|

|

|

|

Operating cash flow |

3,737 |

1,339 |

6,060 |

4,551 |

4,897 |

Capex |

-1,714 |

-2,002 |

-1,650 |

-2,300 |

-2,400 |

Other FCF |

-930 |

431 |

29 |

0 |

0 |

FCF |

1,093 |

-232 |

4,439 |

2,251 |

2,497 |

Equity shareholders' cash |

770 |

-667 |

4,148 |

1,954 |

2,128 |

Dividends and share buy backs |

-1,088 |

-3,004 |

-3,448 |

-3,384 |

-3,555 |

Surplus (deficit) cash |

-318 |

-3,671 |

699 |

-1,430 |

-1,427 |

Cash flow ratios |

|

|

|

|

|

Working capital days |

24 |

96 |

39 |

40 |

40 |

Cash Conversion |

0.3x |

-0.3x |

1.2x |

0.6x |

0.6x |

FCF yield |

4.0% |

-0.7% |

12.2% |

5.3% |

5.7% |

Equity shareholders' yield |

3.4% |

-2.6% |

14.5% |

5.9% |

6.5% |

Capex/EBITDA |

44.0% |

50.1% |

27.9% |

40.7% |

38.9% |

Valuation |

|

|

|

$mn |

$/sh |

SoTP DCF valuation and calculation of target price |

|

|

|||

Russia (GMK & KGMK) |

|

|

|

52,031 |

32.9 |

Finland |

|

|

|

832 |

0.5 |

Other metallurgical |

|

|

|

4,756 |

3.0 |

Other non-metallurgical |

|

|

|

30 |

0.0 |

Other |

|

|

|

-11,140 |

-7.0 |

Total enterprise value |

|

|

|

46,508 |

29.4 |

Net debt as at 31 December 2017 |

|

|

|

-8,201 |

-5.2 |

Cash used in share buy-backs |

|

|

|

- |

- |

Other investments |

|

|

|

267 |

0.2 |

Minority interest |

|

|

|

-331 |

-0.2 |

Equity value as at 4/2/2019 |

|

|

|

38,243 |

24.2 |

Rounded to |

|

|

|

|

24.0 |

Share price on 1/2/2019 |

|

|

|

|

20.8 |

Expected share price return |

|

|

|

|

15.6% |

Plus: expected dividend yield |

|

|

|

|

10.4% |

Total implied one-year return |

|

|

|

|

26.0% |

Share price range, $: |

|

|

|

|

|

12-month high on 26/2/2018 |

21.3 |

12-month low on 10/4/2018 |

14.6 |

||

Price move since high |

-2.7% Price move since low |

|

42.5% |

||

Gold |

|

Cobalt |

Silver |

Semi-products and other |

|

2% |

Rhodium |

0% |

|||

3% |

6% |

||||

|

1% |

|

|||

Platinum |

|

|

|

Nickel |

|

6% |

|

|

|

27% |

Palladium

28%

Copper

27%

Calculation of discount rate |

|

|

|

|

|

|

WACC |

9.4% |

Cost of debt |

|

|

5.0% |

|

Risk-free rate |

4.0% |

Tax rate |

|

|

24% |

|

Equity risk premium |

6.0% |

After-tax cost of debt |

|

3.8% |

||

Beta |

1.30 |

Debt weighting |

|

30% |

||

Cost of equity |

11.8% Terminal growth rate |

|

2.5% |

|||

Valuation ratios |

|

|

|

|

|

|

Dec-YE |

2016 |

2017 |

|

2018E |

2019E |

2020E |

P/E multiple |

8.8x |

12.0x |

|

8.4x |

10.0x |

9.3x |

Dividend yield |

7.6% |

7.2% |

|

12.0% |

10.3% |

10.8% |

EV/EBITDA |

6.9x |

8.6x |

|

6.1x |

7.5x |

7.1x |

P/B |

4.5x |

5.9x |

|

7.4x |

8.7x |

8.7x |

NAV per share, $ |

3.2 |

2.7 |

|

2.4 |

2.4 |

2.4 |

* from Russian own feed

Source: Bloomberg, Thomson Reuters, Company data, Renaissance Capital estimates

53